Perform detailed market analysis

What data can we use to uncover opportunities?

What data can we use to more effectively mitigate risks?

How can our team gain a competitive edge in the market?

Estimate demand

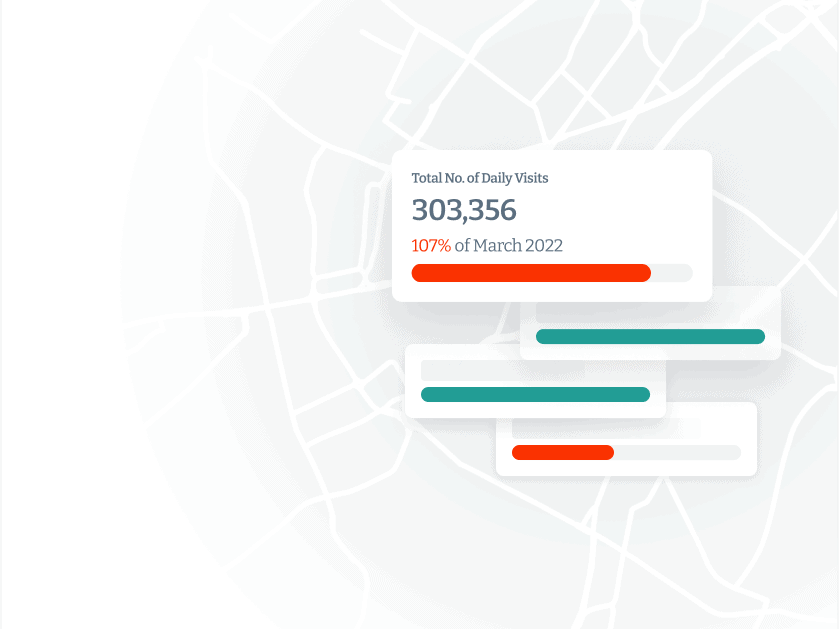

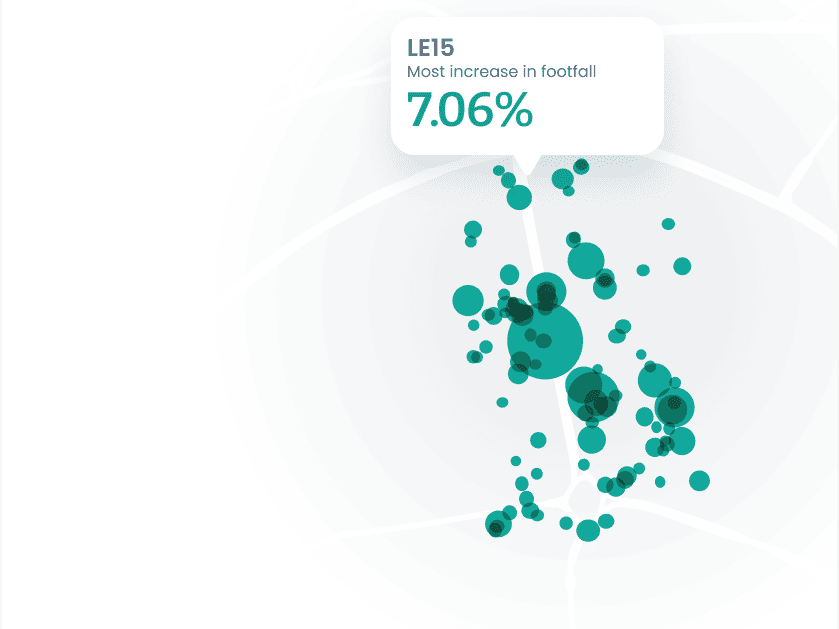

Tap into new opportunities and estimate the demand for specific products or services in different areas with foot traffic patterns and customer behaviour insights.

Surface seasonal trends

Stay ahead of how foot traffic and customer behaviour change seasonally to optimise marketing campaigns and offerings that align with seasonal trends.

Benchmark location performance

Stay on top of foot traffic trends across different locations and identify areas with growth potential with actionable location insights.

Optimise market entry

Enter a new market with confidence with strategic insights on foot traffic trends and customer engagement.

Mitigate economic uncertainty

Stay ahead of economic movement local economic conditions on customer behaviours.

3400

Stores

38

Countries

$12.5Bn

Annual sales

Huq’s catchment insights allows JD to more accurately assess the impact of the wider retail catchment on the sales potential of new store opportunities

Alastair Browne, JD Group Head of Site Research & Strategic Insight

360 location visibility

How can we place new locations more strategically?

What can I do to improve the appeal of local places?

How can we react faster to changing environments?

Make accurate customer profiles

Easily tailor your offerings to match the characteristics of the local customer base using insights into demographics, behaviours, and preferences of visitors in a specific location.

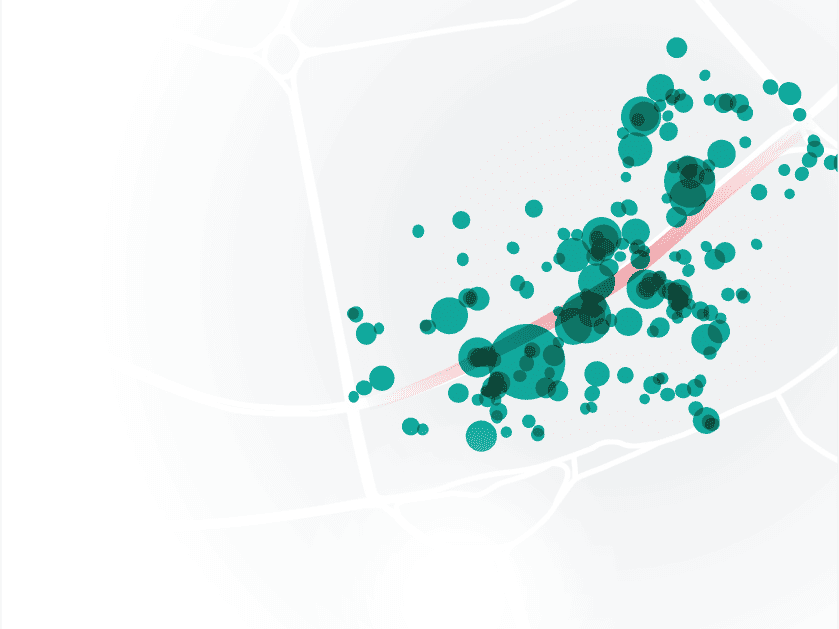

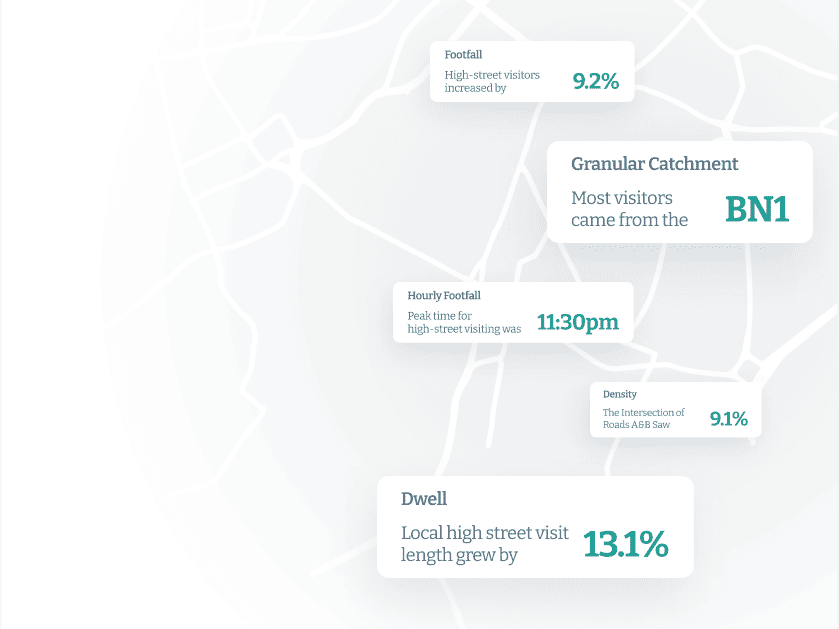

Improve foot traffic management

Make informed decisions about placement and marketing with insights into peak visit times, popular routes, and areas of interest to make informed decisions about placement, marketing, and amenities.

Stay ahead of competitors

Surface your strengths and weaknesses with comparisons of foot traffic and customer behaviour at your location with those of competitors nearby.

Optimise placemaking strategies

Enhance the overall customer experience with insights that help identify high-traffic zones within a location.

Intelligent predictive modelling

Leverage historical mobility data to build predictive models that can forecast future foot traffic trends, allowing you to anticipate changes and optimise strategies proactively.

3400

Stores

38

Countries

$12.5Bn

Annual sales

Huq’s catchment insights allows JD to more accurately assess the impact of the wider retail catchment on the sales potential of new store opportunities

Alastair Browne, JD Group Head of Site Research & Strategic Insight

Accurate risk assessments

How can location data help enhance our decision-making?

How can I better potential strategic vulnerabilities in my portfolio?

How can I proactively forecast risk?

Understand a location's risk

Understand the risk associated with a specific property or location with foot traffic trends, visit frequencies, and customer engagement to gauge the level of activity.

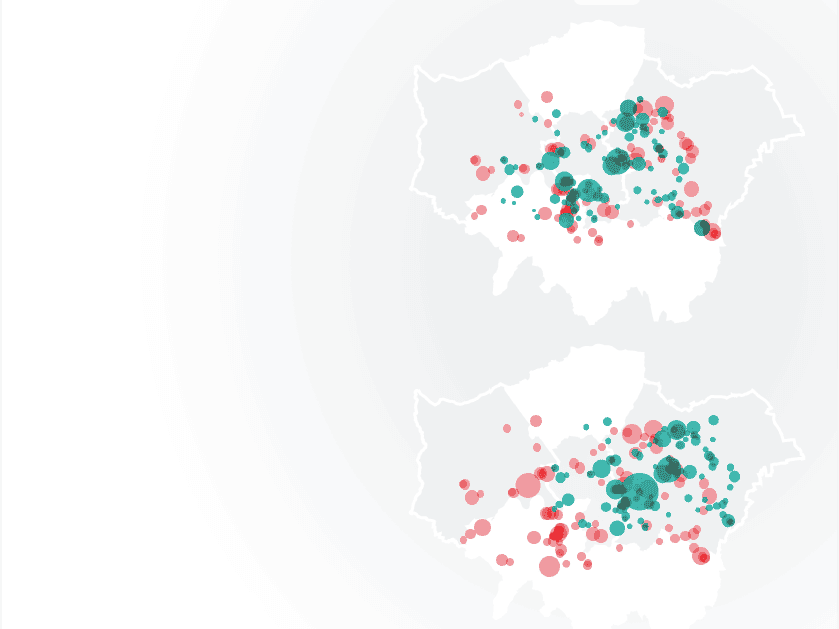

Uncover competitors' strategy

Benchmark how your property is performing against others with property to property comparison of foot traffic patterns and customer behaviours.

Stay ahead of economic trends

Identify potential risk factors that could impact property performance or market demand by overlaying mobility data with relevant economic indicators such as GDP growth, unemployment rates, or consumer sentiment.

Predict seasonal impact

Surface unanticipated seasonal impacts with on foot traffic, customer behaviour, and performance changes during peak and off-peak periods.

Uncover historic trends

Easily Identify long-term trends and potential future risks in foot traffic and customer engagement with historic insights into patterns of stability, growth, or decline.

3400

Stores

38

Countries

$12.5Bn

Annual sales

Huq’s catchment insights allows JD to more accurately assess the impact of the wider retail catchment on the sales potential of new store opportunities

Alastair Browne, JD Group Head of Site Research & Strategic Insight

Re-strategising store placement

How can I improve capture while decreasing cannibalisation?

How can location data help us benchmark success?

How can we gain a competitive market edge?

Understand your existing markets

Leverage Mobility data to create a robust picture of the market that covers movement patterns, foot traffic, and visit durations across various locations.

Monitor placement performance

Evaluate the performance of your current placements with insights on which areas experience high foot traffic, peak visit times, and strong customer engagement to pinpoint underperforming locations.

Prevent customer cannibalisation

Pinpoint the demographics, preferences, and behaviours of visitors in different areas to tailor your new placement strategies.

Find high potential areas

Leverage the mobility data to identify areas with high foot traffic and optimal trends, aligning with your target audience's preferences.

Monitor and test in real time

Monitor the impact of your changes and new placement strategies using insights on foot traffic, customer engagement, and other relevant metrics to assess the effectiveness of the re-strategised placements.

Huq’s mobility data helps us to make better investment decisions and allows us to appropriately manage risk on behalf of our investor clients.

Jonathan Bayfield, Head of UK Real Estate Research at Aviva Investors

Breaking decision paralysis

How can I make better-informed choices?

What can we do to mitigate market uncertainties?

How can we be confident in our decision-making?

Accurate view of your market

Look for trends, patterns, and insights that directly relate to the decision you're facing. Identify key performance indicators, such as foot traffic trends, customer behaviour, or location popularity, that provide a clear picture of the situation.

Data-driven prioritisation

Leverage actionable insights to pinpoint areas of greater need and break down your decision into key options or scenarios.

Monitor and test in real time

Test the waters, learn from real-world outcomes, and adjust your strategy based on before and after impact and the data-driven insights you gather.

Uncover new investment risks

Mitigate risk while diversifying your investments across locations with insights into the stability of foot traffic, competition in the area, and economic indicators.

223Bn

£GBP AUM

900+

Employees

12

Countries

Huq’s mobility data helps us to make better investment decisions and allows us to appropriately manage risk on behalf of our investor clients

Huq’s mobility data helps us to make better investment decisions and allows us to appropriately manage risk on behalf of our investor clients

Jonathan Bayfield, Head of UK Real Estate Research at Aviva Investors

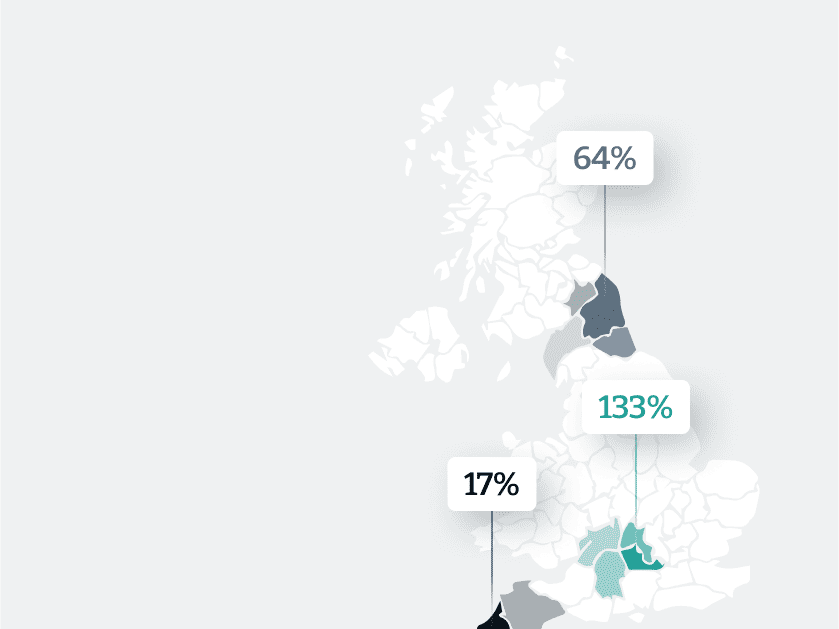

Validating government funding

How can we maximise the impact of our funding spend?

How can data help us better demonstrate accountability?

How can I help gather evidence needed for further funding?

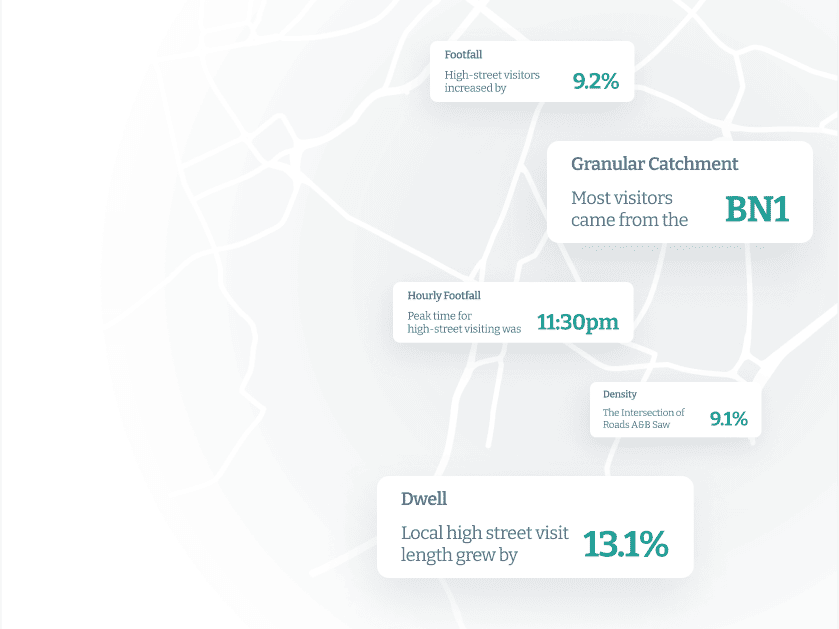

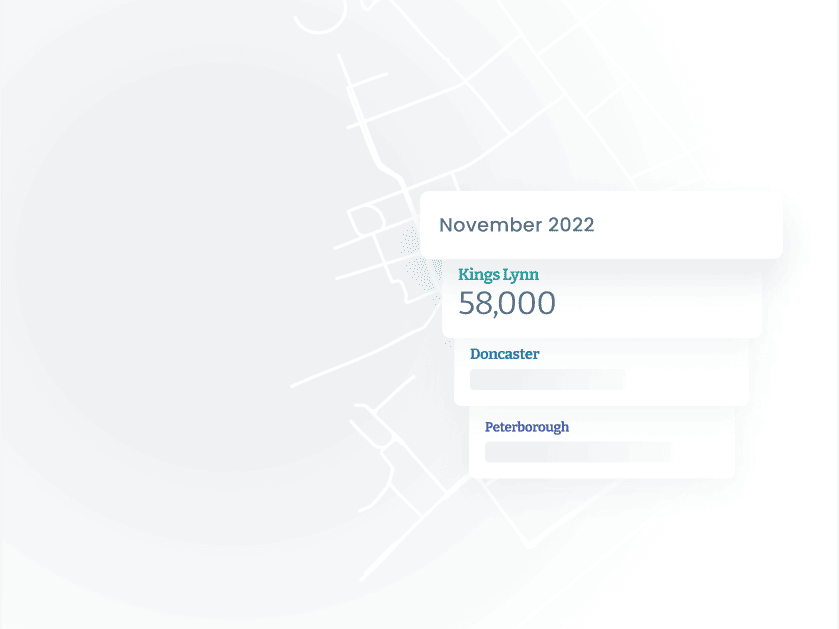

Improve your reporting

Validate the effectiveness of funding allocation with measurements of success such as increased foot traffic, extended dwell times, or improved visit frequency.

Understand your impact

Easily identify any significant positive shifts that can be attributed to the funding spend with insights into before and after the implementation of funding initiatives. Analyse the changes in foot traffic, customer engagement, and overall economic activity in the targeted areas.

Location-specific insights

Validate the impact of initiatives on attracting visitors and driving economic activity benefiting via footfall and catchment trends, preferences, and travel patterns.

Drive informed decisions

Track the progress of funding initiatives and make timely strategies based on emerging insights to optimise their impact. Ensure that funding is being allocated to areas that consistently show positive results with data-driven adjustments.

Get rapid feedback

Leverage foot traffic data and customer behaviours to validate the effectiveness of your new store strategy and make adjustments as needed.

985k

Population

23.8Bn

£GDP

187

Stations & hubs

Colleagues in local government now use outputs from Huq’s data for travel insights across the Glasgow City region. Uses include origin-destination analyses, and learning what draws people to local neighbourhoods

Dr Andrew McHugh, Senior Data Science Manager, UBDC / University of Glasgow

Competitive benchmarking

How can I make instant, informed decisions?

How can data help us refine our competitive strategies?

How can we gain a competitive market edge?

Understand your target market

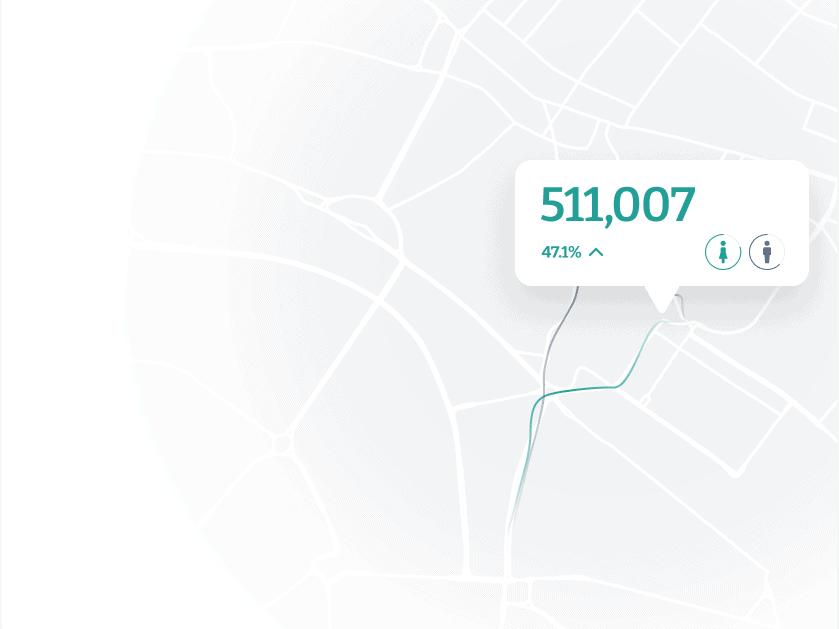

Create a robust picture of the market that covers movement patterns, foot traffic, and visit durations across various locations. Identify complete customer profiles and unique insights by laying in existing data.

Uncover competitors' strategies

Pinpoint your key competitors' locations and areas of operation and leverage mobility data to understand their foot traffic patterns, peak visit times, and customer engagement at each location.

Benchmark your performance

See how you compare to your competitors and identify areas where you excel and areas that require improvement with foot traffic trends, visit durations, and customer behaviour at both your locations and your competitors' locations.

Create deeper analysis

Compare the performance of specific location types, such as urban centres or malls, between your business and competitors. Break down the data by demographics to understand which customer groups are more drawn to your offerings versus your competitors'.

Speed up strategic adaptation

Utilise the insights gained from the mobility data to optimise your offerings, marketing, and placement strategies based on the data-driven insights you uncover.

223Bn

£GBP AUM

900+

Employees

12

Countries

Huq’s mobility data helps us to make better investment decisions and allows us to appropriately manage risk on behalf of our investor clients

Huq’s mobility data helps us to make better investment decisions and allows us to appropriately manage risk on behalf of our investor clients

Jonathan Bayfield, Head of UK Real Estate Research at Aviva Investors

Site selection

How can I make targeted placement decisions?

How can we better understand customer behaviours?

How can data help us capture customer preferences?

Optimise your current portfolio

Ensure your locations align with your target audience and maximise business objectives by identifying areas with high foot traffic, frequent visits, and customer engagement.

Pinpoint your audience

Understand the demographics, behaviours, and preferences of the visitors in the identified areas.

Identify new markets

Find market potential in trends on foot traffic, visit frequency, and economic indicators. Determine if the area has room for growth and if there's a strong demand for your offerings.

Gain a competitive edge

Identify any gaps or opportunities in a competitor's locations where you can offer unique value to customers that competitors may be missing.

Drive informed decisions

Leverage foot traffic data and customer behaviours to validate the effectiveness of your new store strategy and make adjustments as needed.

3400

Stores

38

Countries

$12.5Bn

Annual sales

Huq’s catchment insights allows JD to more accurately assess the impact of the wider retail catchment on the sales potential of new store opportunities

Alastair Browne, JD Group Head of Site Research & Strategic Insight

Placemaking and leasing

How can we enhance retail customer experiences?

How can data help increase tenant satisfaction?

How can I drive engagement and revenue?

Pinpoint high traffic zones

Identify high-traffic areas within your properties or retail spaces through foot traffic patterns and visit frequencies. Pinpoint prime locations for placemaking initiatives or high-demand spaces for leasing to maximise visibility and engagement.

Surface customer patterns

Understand customer behaviour and preferences within your properties with popular routes, dwell times, and points of interest. Strategically position amenities, retail offerings, and gathering spaces in areas that align with customer movement.

See routes and movements

Find patterns in popular destinations, peak travel times, and recurring origin and destination movement to gain insights into typical travel behaviours with common travel routes, modes of transportation used, and frequency of travel.

Improve planning

Identify seasonal trends that attract visitors with targeted placemaking activities or lease spaces to align with these trends and optimise your offerings and promotions.

Drive engagement

Monitor how placemaking initiatives or newly leased spaces impact customer behaviour and leverage location insights to make adjustments to your strategies.

223Bn

£GBP AUM

900+

Employees

12

Countries

Huq’s mobility data helps us to make better investment decisions and allows us to appropriately manage risk on behalf of our investor clients

Huq’s mobility data helps us to make better investment decisions and allows us to appropriately manage risk on behalf of our investor clients

Jonathan Bayfield, Head of UK Real Estate Research at Aviva Investors

Improve capital transactions

How can our team understand metrics for successful capital transactions?

How can data help us minimise transaction risks?

How can I increase the success rate of investments?

Identify market demand

Understand the demand for specific types of properties or services in different locations for targeted offerings that lead to successful transactions.

Intelligent investment decisions

Make informed decisions about property acquisitions or divestitures using level of activity in the area and customer behaviour analyses around potential investment properties.

Monitor tenant and occupancy

Gauge tenant satisfaction and identify opportunities for optimising lease agreements or attracting new tenants with foot traffic, dwell times, and visit pattern insights.

Foresee and mitigate risk

Monitor the performance of properties or financial assets with historical foot traffic trends and comparing them to market benchmarks.

Optimise negotiation and pricing

Showcase the value of a property's location when negotiating leases or property prices with demand-based insights.

223Bn

£GBP AUM

900+

Employees

12

Countries

Huq’s mobility data helps us to make better investment decisions and allows us to appropriately manage risk on behalf of our investor clients

Huq’s mobility data helps us to make better investment decisions and allows us to appropriately manage risk on behalf of our investor clients

Jonathan Bayfield, Head of UK Real Estate Research at Aviva Investors