A new way to evaluate real estate potential

Inform strategic decisions, optimise investment decisions, and maximise portfolio value with new location-based real estate data.

Succeed with the leading location intelligence platform

Optimise your locations

See trends across footfall, geographic origin, audience, and cross-visitation to identify gaps, avoid cannibalisation, and maximise the performance of your properties.

Reveal the true performance of your space

Uncover peaks and troughs in annual, monthly, weekly, daily, and hourly footfall across any global site.

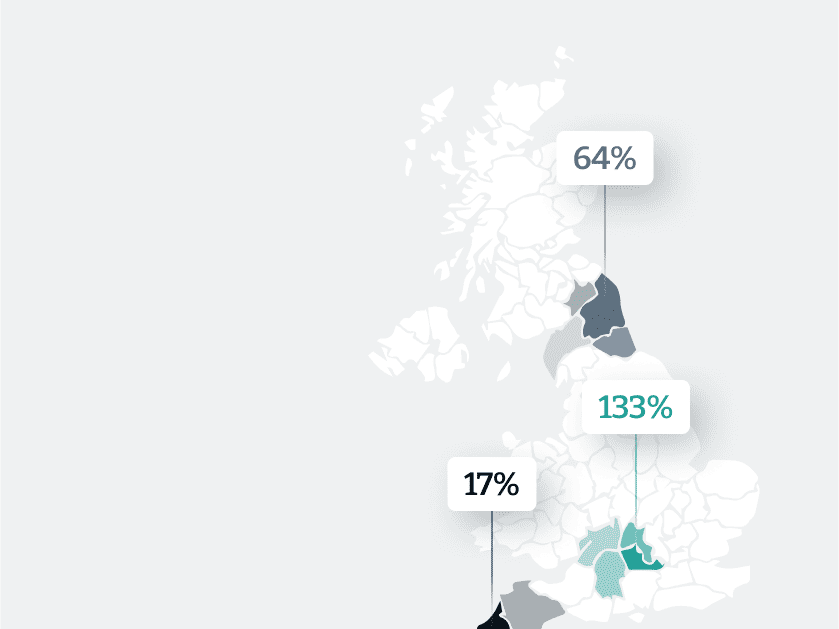

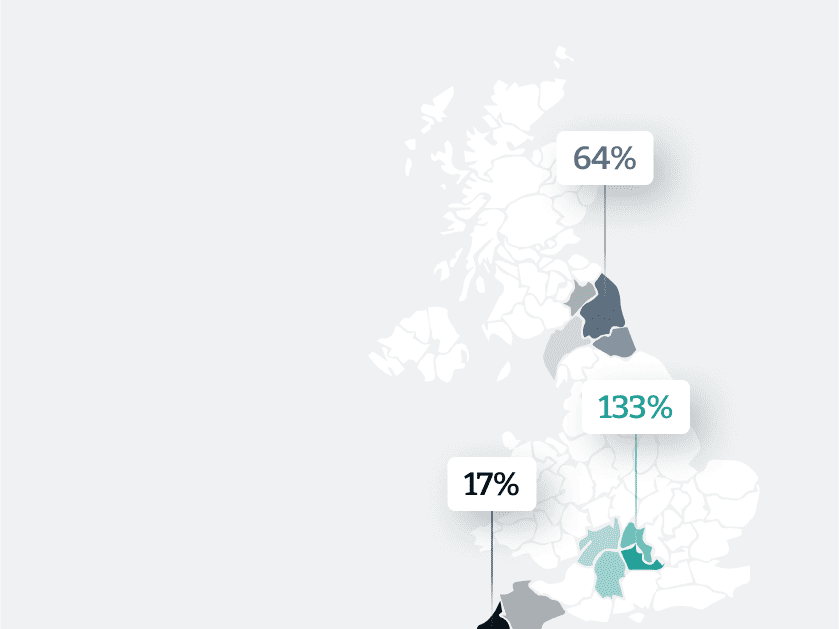

Identify expansion potential

Be the first to uncover popular new areas. Identify and monitor high quality sites for potential expansion.

Improve investment strategies

Mitigate risk while diversifying your investments across locations with early indicators such as the stability of foot traffic, competition in the area, and economic indicators.

Expert benchmarks

Ensure that your projects are making an impact with expert prepared insights and benchmarks that are catered towards your goals.

See trends across footfall, geographic origin, audience, and cross-visitation to identify gaps, avoid cannibalisation, and maximise the performance of your properties.

Uncover peaks and troughs in annual, monthly, weekly, daily, and hourly footfall across any global site.

Be the first to uncover popular new areas. Identify and monitor high quality sites for potential expansion in real-time.

Mitigate risk while diversifying your investments across locations with early indicators such as the stability of foot traffic, competition in the area, and economic indicators.

Ensure that your projects are making an impact with expert prepared insights and benchmarks that are catered towards your goals.

Succeed in real estate with location intelligence

"Huq's mobility data allows us to measure footfall, almost in real-time, by submarket and by region. The data helps us to make better investment decisions and allows us to appropriately manage risk on behalf of our investor clients”

Jonathan Bayfield

Head of UK Real Estate Research, Aviva Investors