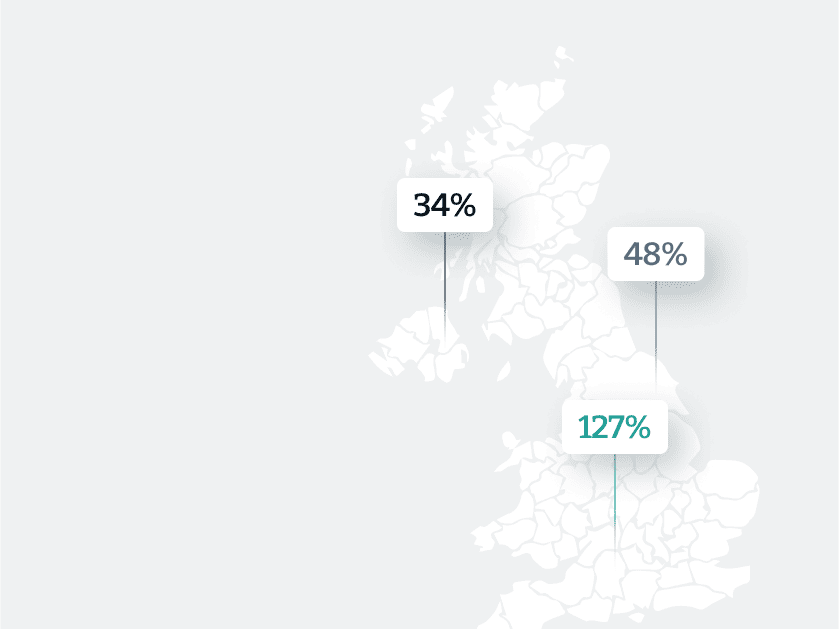

Understand transport and travel patterns

Precise transport planning

How can I optimise local transport routes?

What data can I use to help reduce congestion?

How can we change networks to improve sustainability?

Targeted infrastructure investment

Optimise infrastructure development, such as transportation hubs and public amenities, to support economic growth in those areas.

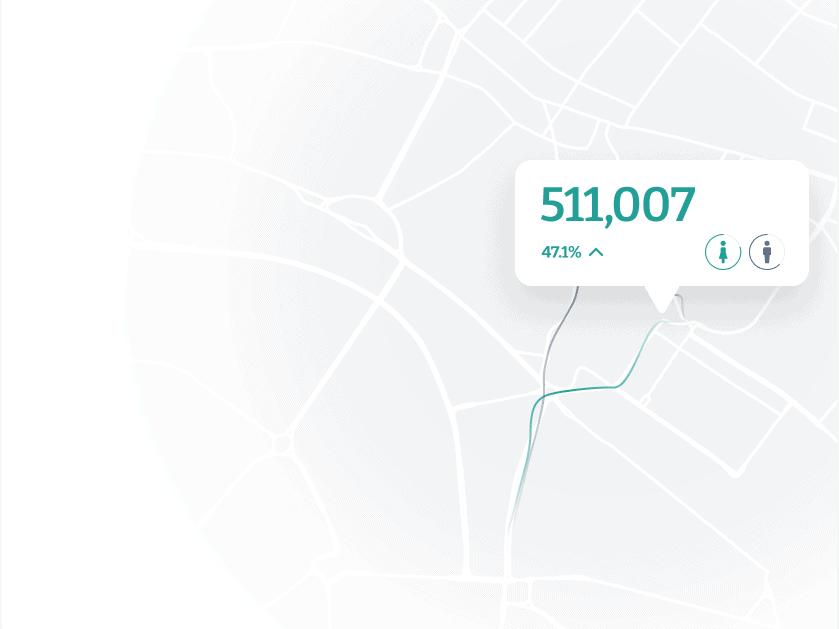

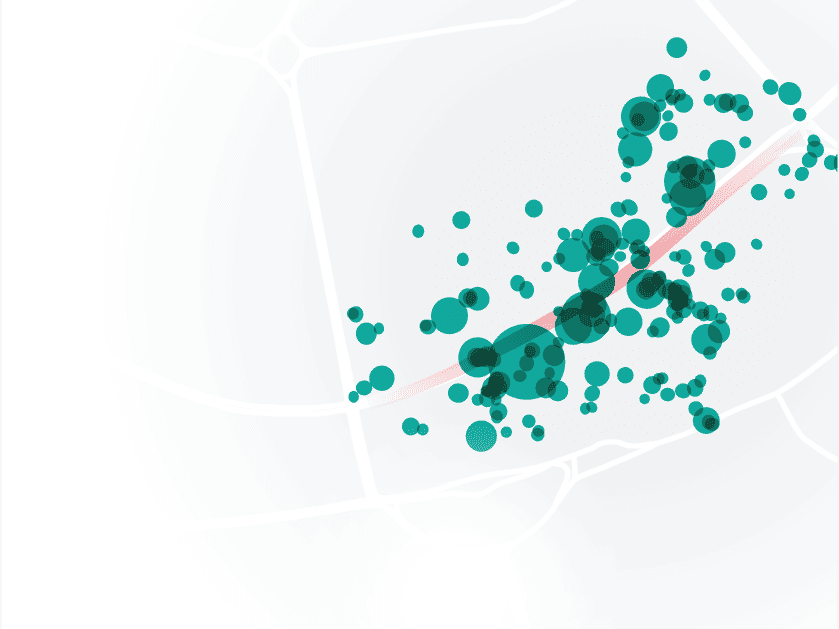

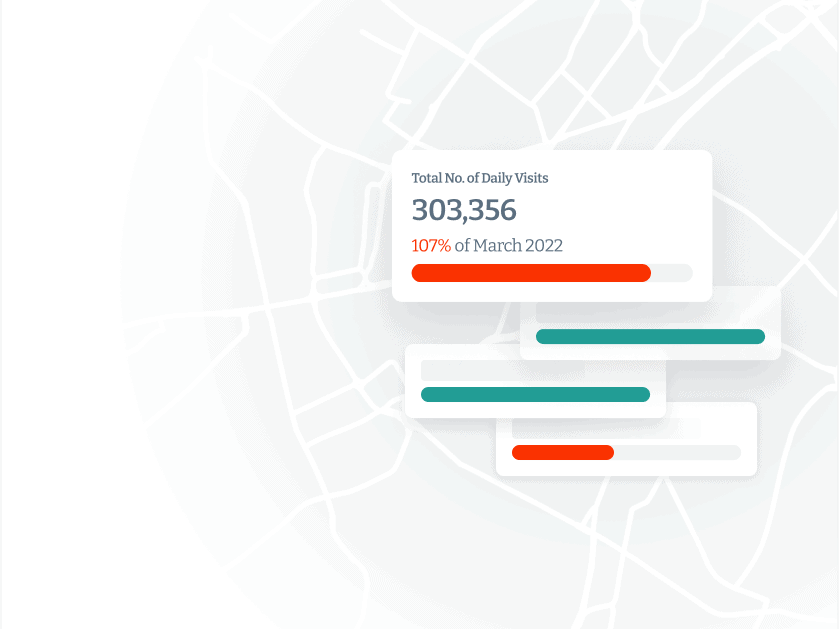

Monitor routes and transport methods

Surface patterns in popular destinations, peak travel times, and recurring travel routes to gain insights into typical travel behaviours with common travel routes, modes of transportation used, and frequency of travel.

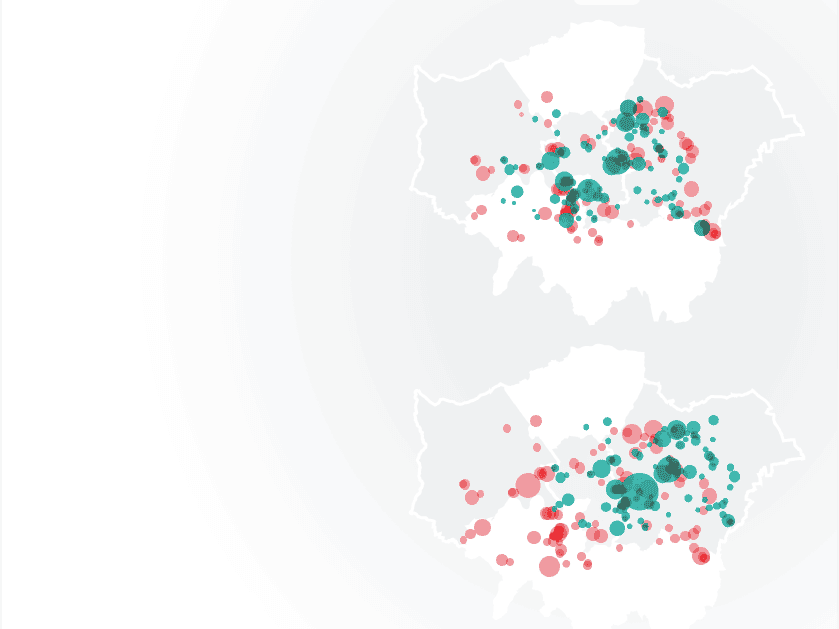

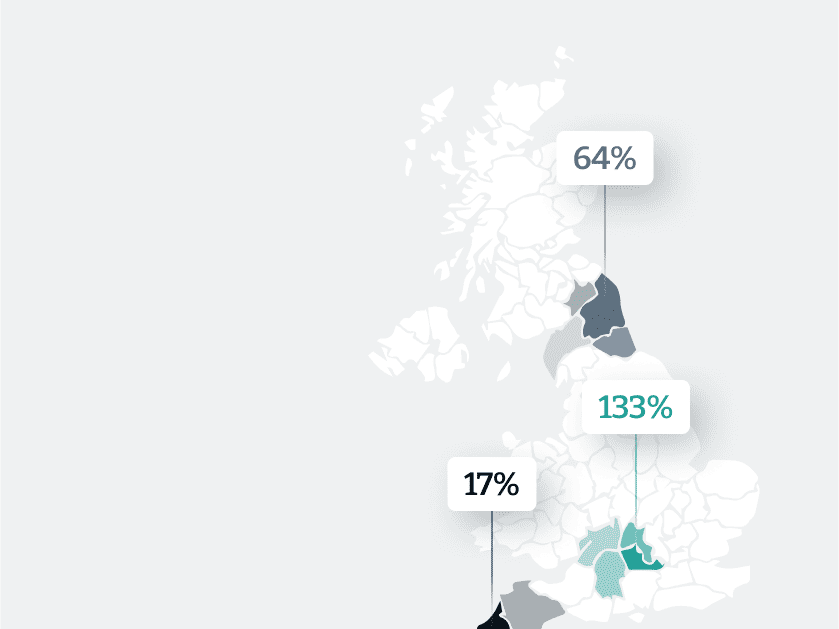

See origins and destinations

Study origin-destination pairs to understand where people begin their journeys and where they end up to identify commuting patterns, popular travel corridors, and the interconnectivity of different regions.

Identify core behaviours

Uncover unique travel behaviours and preferences for different traveler profiles, such as commuters, tourists, or business traveler, enabling you to tailor services and offerings more effectively.

Identify new workforce trends

Leverage mobility data to pinpoint evolving commute patterns and understand where and when residents travel for work.

Business attraction and support

Attract businesses that align with local customer behaviours and provide support to industries that drive foot traffic.

4.8Bn

GBP Influence

3

Gov Departments

8

Uni partners

Huq’s data is real-time and that makes 3DI’s data even stronger and more valuable. Both local and central government bodies will be able to use it to get a clearer picture of the real economic impacts of Covid-19 across the country

Benjamin Lucas (PhD, FHEA), Managing Director at 3DI

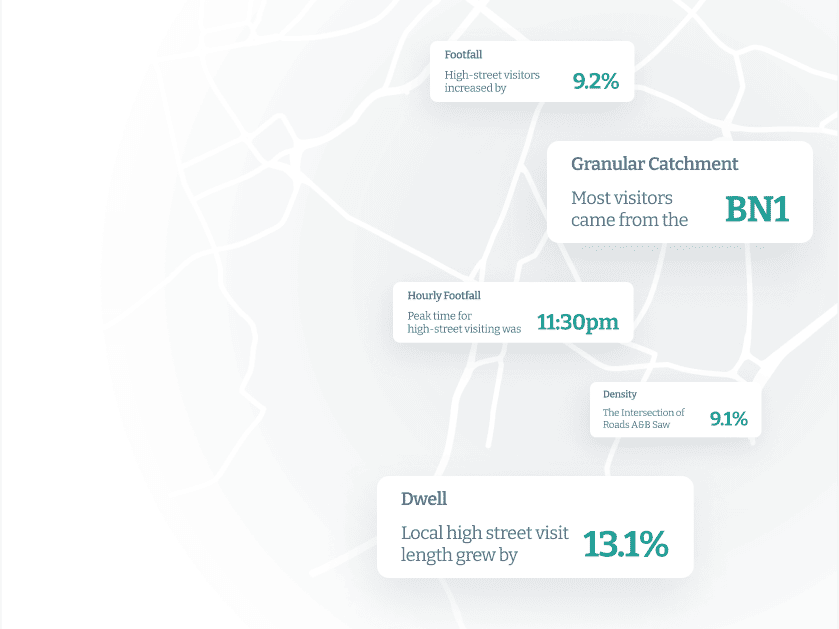

Successful store planning

Successful store planning

How can I select sites for maximum yield?

What data can I use to better understand and evaluate the market?

How can we reduce risk and cannibalisation in our investment?

Understand your market

Leverage foot traffic, movement patterns, or visit durations of specific demographics to create a comprehensive understanding that covers the time period and locations of interest.

Pinpoint your audience

Understand the demographics, behaviours, and preferences of the visitors in the identified areas.

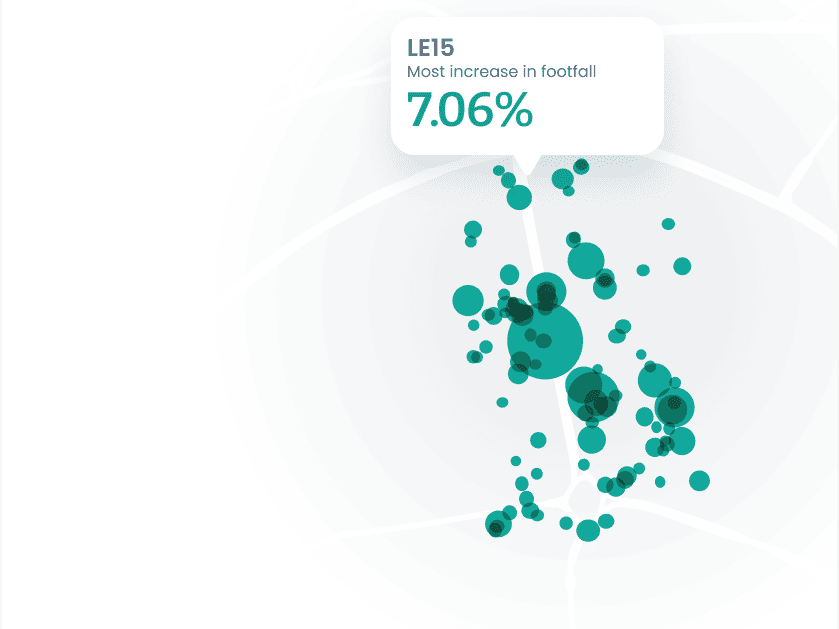

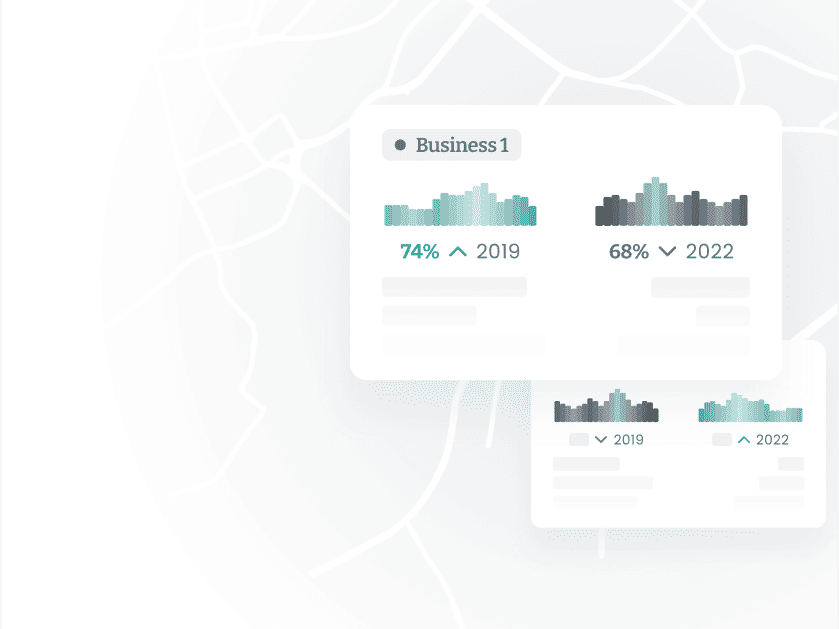

Monitor behaviour shifts

Identify changes in foot traffic patterns, peak visit times, and customer preferences to align your strategies with evolving market dynamics.

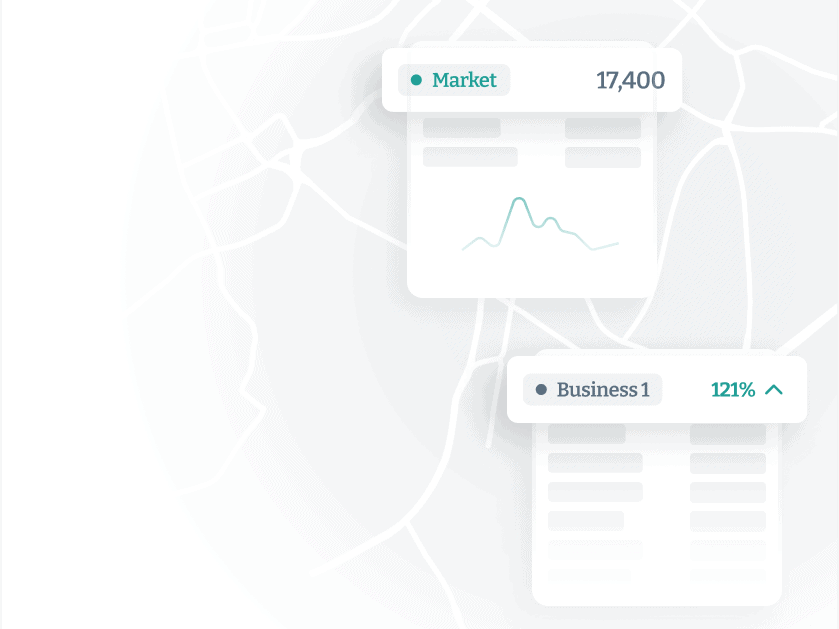

Forecast sales

Develop detailed store forecasting based on current and past visitor behaviours and profiles and competitive insights on footfall, dwell, catchment, and travel insights.

Drive informed decisions

Leverage foot traffic data and customer behaviours to validate the effectiveness of your new store strategy and make adjustments as needed.

3400

Stores

38

Countries

$12.5Bn

Annual sales

Huq’s catchment insights allows JD to more accurately assess the impact of the wider retail catchment on the sales potential of new store opportunities

Alastair Browne, JD Group Head of Site Research & Strategic Insight

Successful franchising

Successful franchise strategies

How can we ensure that we are choosing the right areas?

How can we mitigate risk and decrease waste?

How can insights help us to grow our business?

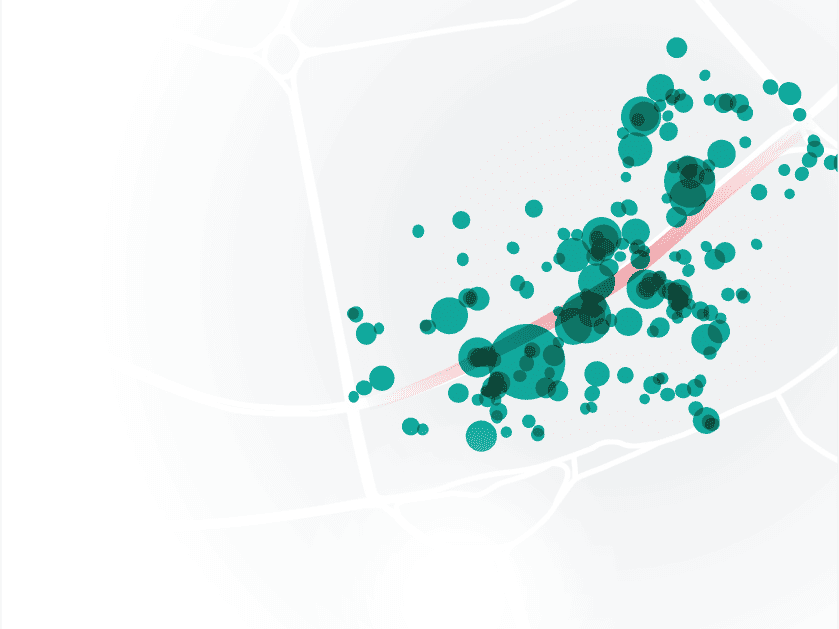

Monitor ideal locations

Identify areas with high foot traffic, aligning with your target customer demographics and business model and pinpoint ideal franchise locations.

Identify market potential

Find market potential in trends on foot traffic, visit frequency, and economic indicators. Determine if the area has room for growth to avoid over-saturation, ensuring each franchise has the best chance of success.

Understand your selected stores

Leverage foot traffic, movement patterns, or visit durations of specific demographics to create a comprehensive understanding that covers the time period and locations of interest.

Pinpoint your audience

Understand the demographics, behaviours, and preferences of the visitors in the identified areas.

Drive informed decisions

Leverage foot traffic data and customer behaviours to validate the effectiveness of your new store strategy and make adjustments as needed.

3400

Stores

38

Countries

$12.5Bn

Annual sales

Huq’s catchment insights allows JD to more accurately assess the impact of the wider retail catchment on the sales potential of new store opportunities

Alastair Browne, JD Group Head of Site Research & Strategic Insight

Maximise operational efficiency

How can we drive better resource optimisation?

How can we increase returns?

How can we stay ahead of the market and competitors?

Estimate demand

Tap into new opportunities and estimate the demand for specific products or services in different areas with foot traffic patterns and customer behaviour insights.

Stay ahead of economic trends

Identify potential risk factors that could impact property performance or market demand by overlaying mobility data with relevant economic indicators such as GDP growth, unemployment rates, or consumer sentiment.

Optimise staffing and resourcing

Optimise staffing schedules to ensure adequate customer service during high-demand periods with catered foot traffic trends.

Maximise marketing impact

Create campaigns and projects that coincide with peak visit times for maximum reach and engagement.

Empower predictive modelling

Leverage predictive models on historical mobility data to forecast changes in foot traffic and customer behaviour for proactive risk management.

Huq’s mobility data helps us to make better investment decisions and allows us to appropriately manage risk on behalf of our investor clients.

Jonathan Bayfield, Head of UK Real Estate Research at Aviva Investors

Surface and mitigate risk

How can we prevent unplanned risk?

How can we create bulletproof strategies?

How can we accurately forecast sales?

Understand your risk profile

Understand the risk associated with a specific property or location with foot traffic trends, visit frequencies, and customer engagement to gauge the level of activity.

Stay ahead of economic trends

Identify potential risk factors that could impact property performance or market demand by overlaying mobility data with relevant economic indicators such as GDP growth, unemployment rates, or consumer sentiment.

Monitor location performances

Identify underperforming areas to implement corrective actions that mitigate risks associated with declining foot traffic.

Improve customer retention

Identify factors that impact customer retention and engagement, enabling the implementation of strategies to mitigate customer attrition risks and increase loyalty.

Empower predictive sales modelling

Leverage predictive models on historical mobility data to forecast changes in foot traffic and customer behaviour for proactive risk management.

$611Bn

Annual revenue

2.3m

Employees

10.5k

Locations

Observations are summarised as input signal for sales prediction models, frequently surpassing 0.7+ against sales results in correlation backtesting

Isambard Poulson, CTO, Huq Industries

Accurately identify emerging trends

How can we develop more adaptive strategies?

How can data help us gain a competitive advantage?

How can we be proactive with negative trends?

Foot traffic patterns

Identify recurring patterns such as peak visit times, seasonal trends, and changes in customer behaviour over time with historical location and movement data.

Seasonal trends

Capitalise on increased foot traffic with insights into trends related to seasons, holidays or local festivities.

New visitor trends

Leverage insights into projects and time periods of increase unique visits to attract and retain new visitors.

Preferred routes and areas

Uncover preferred routes and areas within a location with visibility over where visitors tend to congregate and dwell.

Comparative analysis

Identify consistent trends and variations across multiple locations to understand what drives success in certain areas and adapt your strategies.

985k

Population

23.8Bn

£GDP

187

Stations & hubs

Colleagues in local government now use outputs from Huq’s data for travel insights across the Glasgow City region. Uses include origin-destination analyses, and learning what draws people to local neighbourhoods

Dr Andrew McHugh, Senior Data Science Manager, UBDC / University of Glasgow

Understand visitor demographics

How can I make better investment decisions?

How can data help us optimise our properties?

What can we do to drive better tenant selection?

Understand your visitors

Create tailored real estate offering with in depth visitor profiles based on movement patterns and ideal demographics.

Pinpoint demographic preferences

Improve investment effectiveness and optimise property development strategies with insights into movement and demographic preferences.

Cater to residential preferences

Reveal insights into the preferred local amenities, transportation choices, and leisure activities of your residents.

Optimise commercial property

Ensure business mixes that cater to the preferences of local demographics with insights into the types of businesses or services that attract different demographic groups.

Data-driven investments

Leverage insights into the movement patterns of target demographics and their preferences for nearby amenities, influencing decisions about property types and amenities.

985k

Population

23.8Bn

£GDP

187

Stations & hubs

Colleagues in local government now use outputs from Huq’s data for travel insights across the Glasgow City region. Uses include origin-destination analyses, and learning what draws people to local neighbourhoods

Dr Andrew McHugh, Senior Data Science Manager, UBDC / University of Glasgow

Accurate tenant insights

How can data help us better understand our tenants?

How can we better align with customer preferences?

What can I do to enhance the success of property?

Understand your visitors

Identifying businesses that align with the footfall and visitor trends of your area with movement patterns, visit frequency, and dwell times of potential tenants.

Identify peak trends

Leverage insights into peak visit times and days to potential tenants' operating hours and services to optimise resource allocation.

Optimise tenant experience

Leverage insights into business patronage to strategically place offerings that curate a diverse and tenant experience and give feedback back to businesses.

Identify market gaps

Leverage location insights to surface gaps in the market and underrepresented businesses and unmet visitor, worker and customer needs.

985k

Population

23.8Bn

£GDP

187

Stations & hubs

Colleagues in local government now use outputs from Huq’s data for travel insights across the Glasgow City region. Uses include origin-destination analyses, and learning what draws people to local neighbourhoods

Dr Andrew McHugh, Senior Data Science Manager, UBDC / University of Glasgow

Optimising place performance

How can data help us produce desired place behaviours?

What steps can we take to improve customer experience?

How can we maximise revenue generation?

Optimise resource allocation

Optimise resources and inventory with insights from foot traffic patterns and peak visit times, ensuring excellent customer experiences while minimising excess stock.

Data-driven marketing campaigns

Leverage mobility insights to time and place marketing campaigns effectively, targeting customers during peak foot traffic hours to maximise campaign reach and impact.

Maximise placement planning

Drive success with strategic store placement that capture the right audiences with mobility insights.

Understand your audience

Identify your customers and their behavioural patterns and preferences for a more targeted and relevant marketing campaign.

$611Bn

Annual revenue

2.3m

Employees

10.5k

Locations

Observations are summarised as input signal for sales prediction models, frequently surpassing 0.7+ against sales results in correlation backtesting

Isambard Poulson, CTO, Huq Industries

Improving urban planning

What can we do to design spaces for the better?

What steps can we take to optimise our infrastructure?

How can data help us enhance quality of life for individuals?

Sustainable growth strategies

Tailor urban planning for sustainable, future-ready communities with insights on foot traffic, visit durations, and popular routes.

Efficient infrastructure

Optimise road networks, public transportation routes, and pedestrian pathways for smoother traffic flow with data-driven urban development.

Livability enhancement

Craft environments that promote well-being and satisfaction with data on space usage.

Resilient cities

Plan for adaptability in the face of evolving urban challenges such as leveraging insights on high-traffic areas to allocate resources efficiently, such as adding or upgrading public amenities and transportation hubs.

985k

Population

23.8Bn

£GDP

187

Stations & hubs

Colleagues in local government now use outputs from Huq’s data for travel insights across the Glasgow City region. Uses include origin-destination analyses, and learning what draws people to local neighbourhoods

Dr Andrew McHugh, Senior Data Science Manager, UBDC / University of Glasgow