What can I do do help minimise loss?

What can we do to minimise disruption?

How can we plan to optimise revenue retention?

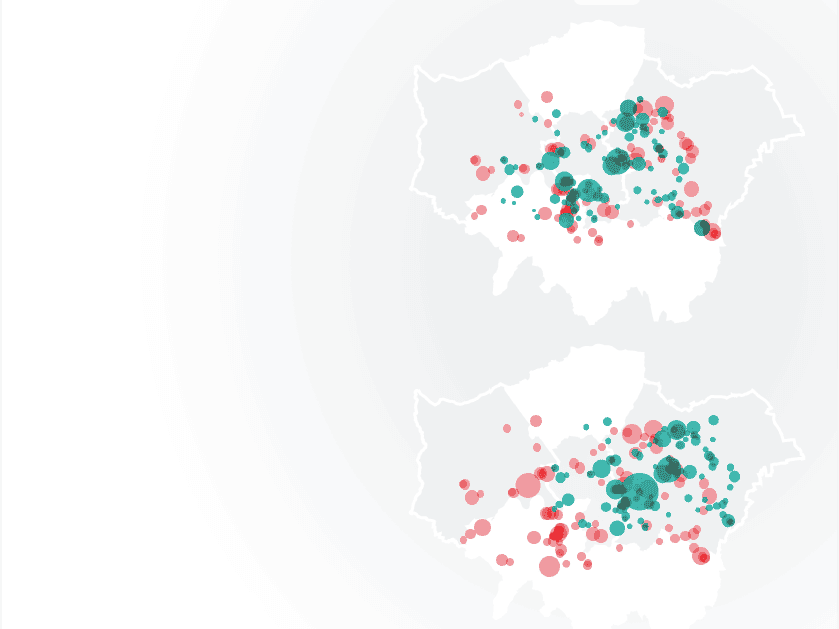

Understand your market

Identify stores with low or declining metrics that show underperformance with segmented store locations that are based on their performance metrics, such as foot traffic trends, visit durations, and customer engagement.

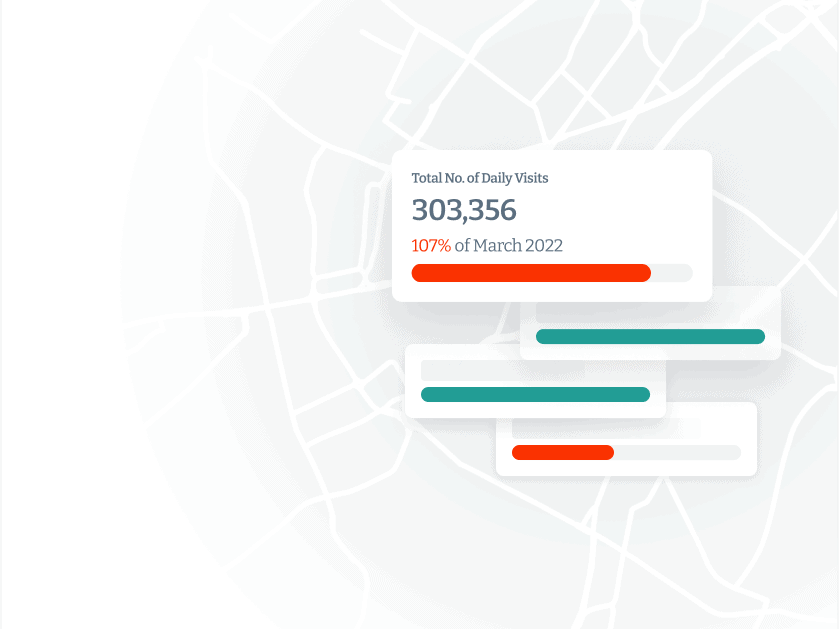

Pinpoint customer trends

Uncover patterns and insights that contribute to a store's lack of success with a complete picture of the demographics, behaviours, and preferences of customers who frequent the underperforming stores.

Competition assessment

Evaluate the mobility data of your locations in comparison to your competitors' store locations to identify underperforming stores resulting from changes in local competition or other external factors.

Uncover market potential

Explore the market potential of the areas surrounding the underperforming stores for trends in foot traffic, population growth, and economic indicators to surface signs of recovery or potential for future success.

Optimise closure plan

Maximise cost saving and minimise loss and disruption with insights gained from the mobility data, create a phased closure plan.

3400

Stores

38

Countries

$12.5Bn

Annual sales

Huq’s catchment insights allows JD to more accurately assess the impact of the wider retail catchment on the sales potential of new store opportunities

Alastair Browne, JD Group Head of Site Research & Strategic Insight