UK Major Retail Centres – Week 26, 2025: Footfall Retail Trends and Performance Update

UK Major Retail Centres – Week 26, 2025: Footfall Retail Trends and Performance Update

UK retail footfall data trends show a 1.3% rise overall with dwell time up 4.2%, indicating evolving consumer engagement in a competitive environment.

Share on LinkedIn

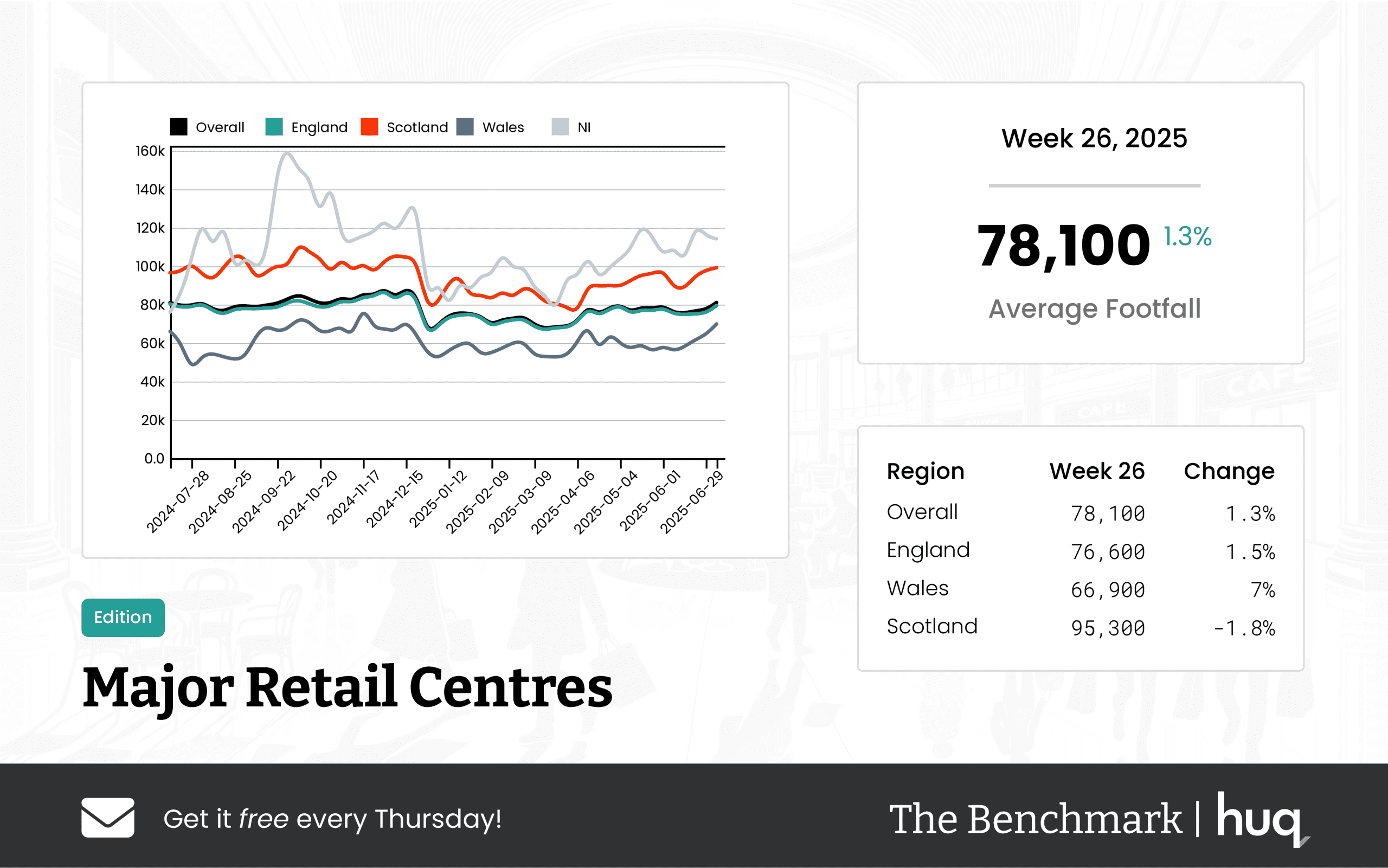

During Week 26, major UK retail centres saw a modest yet positive shift in footfall and visitor engagement. The average daily footfall reached 78,100, marking a 1.3% week-on-week increase, even as year-on-year figures show a slight dip. More notably, visitor dwell time increased by 4.2% to an average of 123 minutes per visit, suggesting that shoppers are spending more time in stores, potentially driven by changing consumer habits and competitive pressures in the retail market.

A closer examination of regional trends presents a varied landscape:

• In England, retail centres welcomed approximately 76,600 visitors daily. Despite a modest decline when compared to the previous year, there was a 1.5% improvement week-on-week, maintaining steady dwell times at 123 minutes and reflecting gradual but positive change.

• Wales outperformed with a robust 7% weekly increase in footfall and an impressive 17.8% year-on-year rise. However, the average visitor spend in Wales decreased to 89 minutes, representing a 19.1% fall week-on-week and 6.3% lower annual figures, indicating that while more shoppers are visiting, they might be spending less time in stores.

• Scotland's centres recorded the highest daily footfall at 95,300 visitors, though they experienced a slight weekly decline of 1.8% and a marginal year-on-year drop. Interestingly, Scottish shoppers are spending more time per visit, with an average dwell time of 137 minutes, supported by a healthy weekly increase.

The shifts in visitor engagement patterns are delivering crucial insights into changing consumer behaviour. Retailers can leverage these dynamics to adjust strategies, optimize in-store experiences, and remain competitive amid evolving market conditions. The detailed analytics underscore that while improvements in footfall and dwell time signal encouraging trends, regional disparities necessitate targeted approaches tailored to local market needs.

Joe Capocci, spokesperson for Huq Industries, remarked, "The sharp increase in Welsh footfall, as observed with its robust weekly performance, aligns with trends noted in recent retail news such as the Foot Locker flagship launch." His comments highlight how broader industry movements influence local retail performance and provide further impetus for retailers to adapt and innovate.

Overall, the data from Week 26 paints an optimistic picture for UK retail centres, marking small yet significant gains in visitor numbers and engagement, and offering actionable insights for businesses aiming to capture the evolving dynamics of consumer behaviour.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 26 2025 Retail Parks Performance Update: Location Analytics Insights

Week 26 2025 Retail Parks Performance Update: Location Analytics Insights

UK retail parks recorded a modest 0.9% increase in daily visits with a 2.8% drop in dwell time. Updated location analytics reveals robust footfall trends.

Share on LinkedIn

Leveraging cutting-edge location analytics, the latest update provides a comprehensive deep dive into the performance of UK retail parks. The insights drawn from The Benchmark reveal intriguing trends across footfall, dwell time, and regional performance, offering a valuable resource for industry stakeholders.

Overall Performance

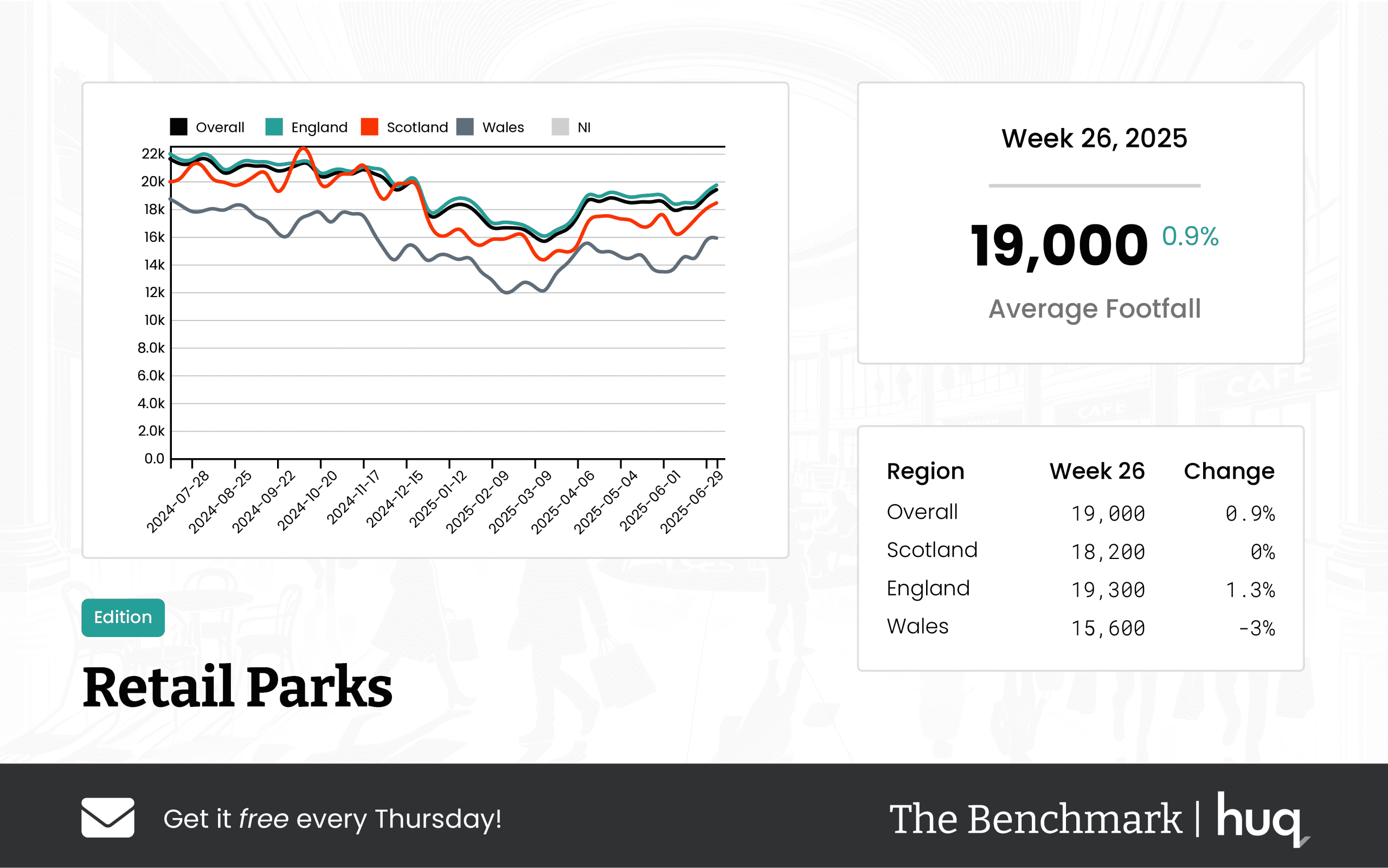

UK retail parks have seen a slight uplift in footfall, with the average daily visits reaching 19,000 – a modest increase of 0.9% week-on-week. However, compared to the corresponding period last year, this figure is 10.4% lower. The dwell time metric tells a more nuanced story: despite a 2.8% drop during the recent week, the year-on-year figure shows a healthy 7.7% increase, indicating longer, more engaged visits over the long term.

Regional Breakdown

Detailed regional insights show that England is leading with an average of 19,300 daily visitors, marking a 1.3% increase on the week but still reflecting a 10.3% decrease when compared to last year. Welsh retail parks, drawing an average of 15,600 daily visitors, experienced a 3% decline over the past week along with a significant 12.2% year-on-year drop. Scotland maintained a steady weekly performance with 18,200 daily visits, though it experienced an 11.2% annual decline.

Engagement Metrics

In terms of customer engagement, the data paints a mixed picture. England’s retail parks have succeeded in maintaining a robust average visit duration of 73 minutes, with only minor weekly changes and a notable 14.1% improvement year-on-year. In contrast, both Scotland and Wales have seen shorter dwell times. Welsh parks average 62 minutes, and Scotland has experienced a downturn in visit duration, suggesting softer engagement trends in these regions.

Industry Comment

Joe Capocci, a spokesperson for Huq Industries, remarked, "The modest weekly recovery in English footfall, bolstered by recent images showing progress at Wynyard Retail Park, confirms that our data continues to offer essential insights despite an annual softness." His comments underscore the importance of nuanced location analytics in understanding market dynamics, even amid broader industry challenges.

This update reinforces the role of location intelligence in tracking performance metrics and highlights the need for stakeholders to continually adapt to evolving consumer behavior across different regions of the UK.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 26, 2025 High Streets & Town Centres: Footfall Performance Insights

Week 26, 2025 High Streets & Town Centres: Footfall Performance Insights

Week 26 footfall data reveals a modest softening in UK High Streets & Town Centres with an average of 31,100 daily visitors. Mixed regional trends underline evolving consumer behaviour.

Share on LinkedIn

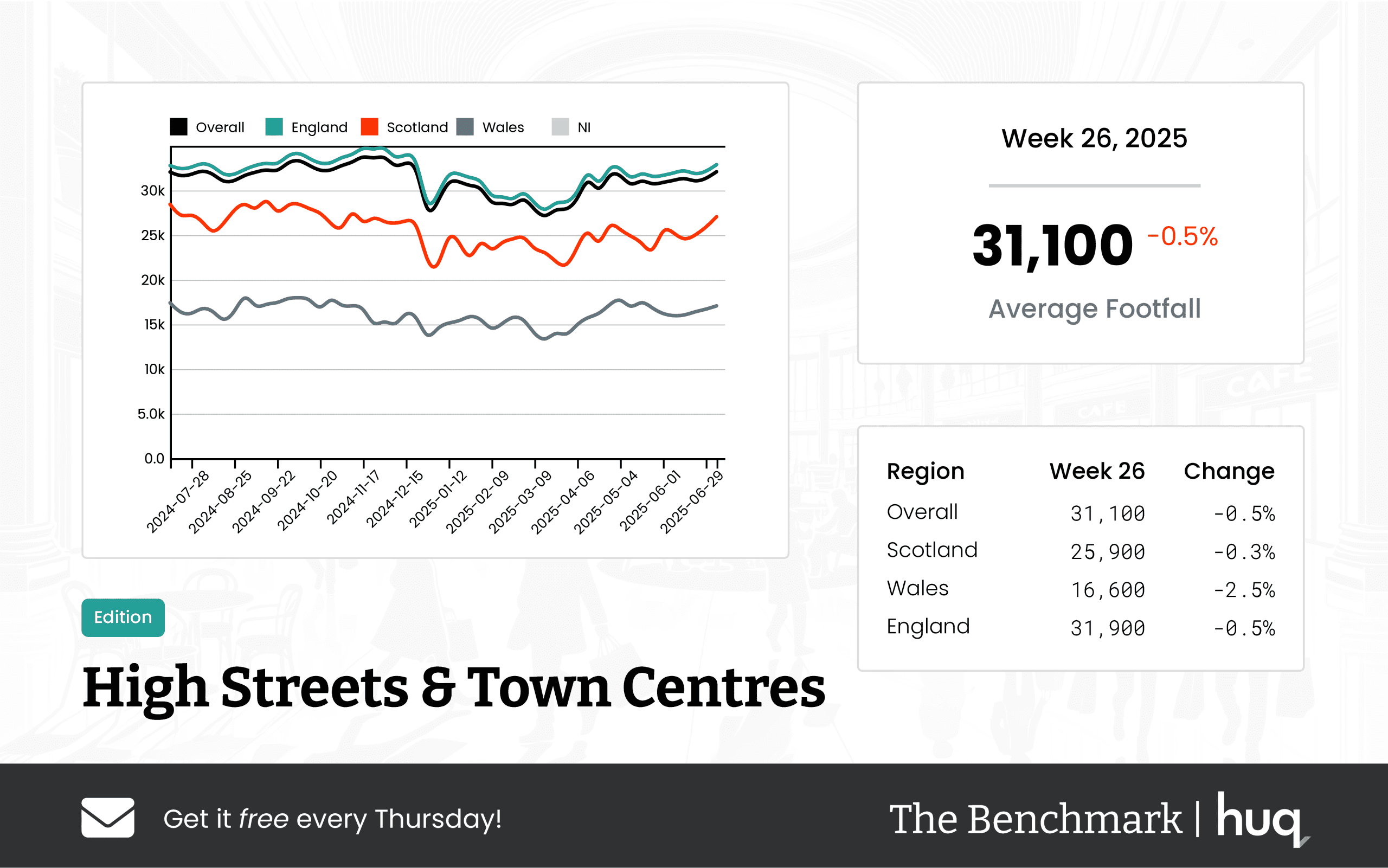

The latest Week 26 data for UK High Streets and Town Centres highlights a modest softening in overall footfall, with an average of 31,100 daily visitors across the UK. In England, footfall slightly edged higher at 31,900 visitors per day, while Scotland trailed with 25,900. Interestingly, Wales bucked the overall trend, registering year-on-year improvements in visitor numbers.

A breakdown of regional trends reveals that England and Scotland experienced a softening in footfall at key retail locations, aligning with the broader national picture of a slight decline. The resilience of Wales, however, suggests regional factors or targeted local strategies could be at play to boost visitor numbers amid a challenging landscape.

In addition to mere visitor counts, the analysis also shed light on dwell time, an important measure of consumer engagement, which averaged 101 minutes per visit across the UK. Not only did England and Scotland witness an increase in the duration of visits — pointing to enhanced engagement — but Scotland mirrored this upward trend. In contrast, Wales, despite welcoming more visitors, experienced a dip in dwell time, possibly indicating a shift in shopping behaviours.

Joe Capocci, spokesperson for Huq Industries, stated: "The modest softening in footfall on the UK High Streets, particularly on Scotland and England’s key locations, is underscored by recent retail industry news and highlights the need for constant strategic adjustments." His comments suggest that both local and broader retailers need to adapt dynamically to evolving consumer patterns.

As advanced footfall analytics continue to play a pivotal role in understanding shopper behaviour, stakeholders across regions are urged to examine these nuanced trends carefully. Strategic responses that factor in both visitor numbers and engagement depth will be crucial for the sustained vitality of High Streets and Town Centres in a rapidly changing retail environment.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 25 Weekly Wrap: Retail Trends Revealed Through Location Analytics

Week 25 Weekly Wrap: Retail Trends Revealed Through Location Analytics

Retail footfall up 3.5% and dwell time rising. Discover UK retail trends through location analytics and location intelligence insights.

Share on LinkedIn

The latest UK retail updates for Week 25 show dynamic shifts in consumer behaviour that are reshaping the landscape. Early analyses using location analytics reveal subtle yet significant changes in footfall and dwell times across several retail centre types. These detailed insights underline trends in UK retail and offer consumer insights that benefit businesses and urban planners alike.

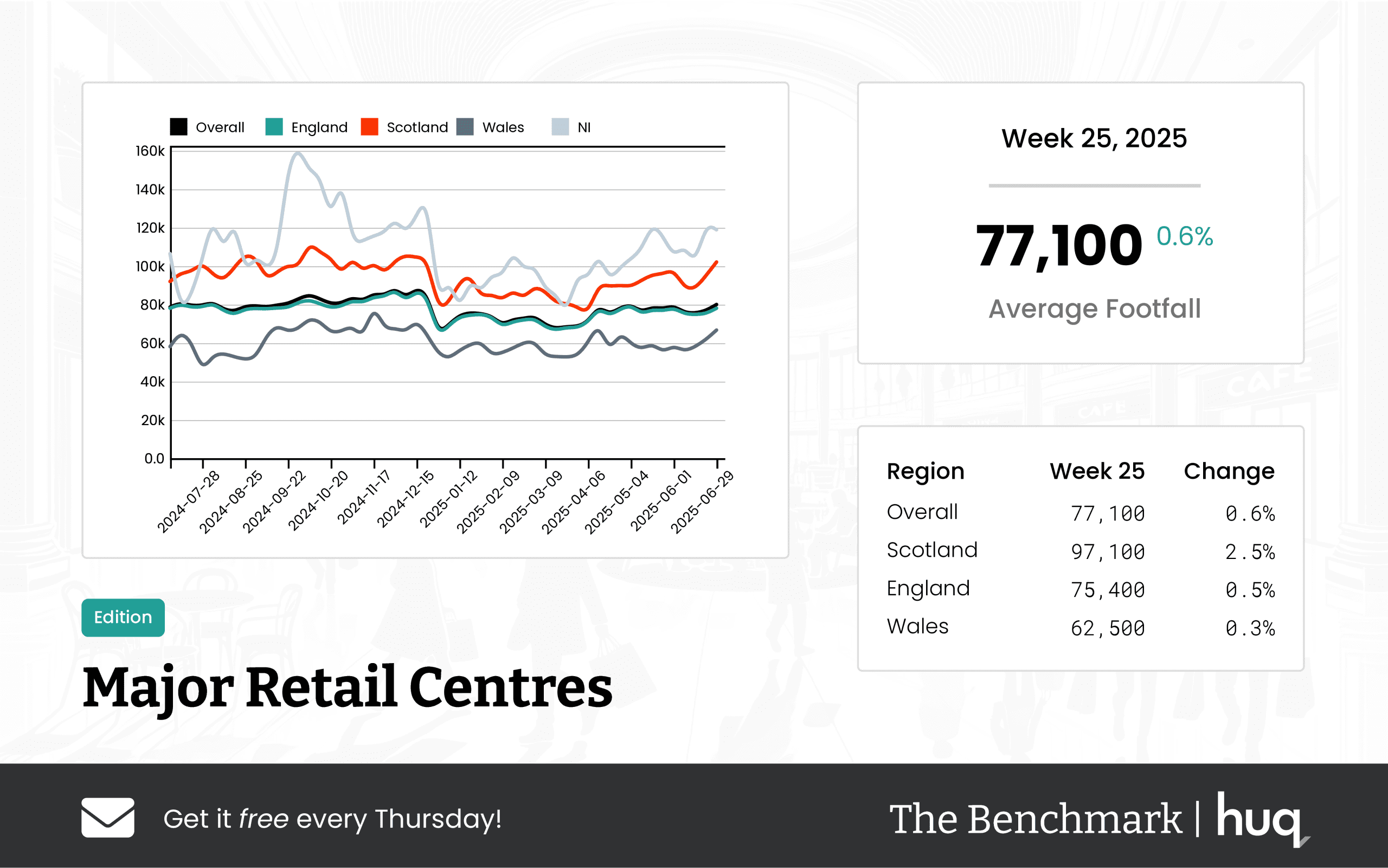

Major Retail Centres Insight

Major retail centres continue to hold steady with modest gains that drive confidence in the market. In Week 23, centres saw an average of 74,900 visitors daily; Week 24 improved to 75,600 daily visits with Scotland topping the charts at 92,100 visitors [UK Major Retail Centres – Week 24 2025 Performance Update: Location Analytics Insights]. By Week 25, overall footfall increased by 0.6% and dwell times rose by 3.5%, with Scottish centres recording dwell times up to 129 minutes. This steady performance reflects the resilience found in many UK retail spaces.

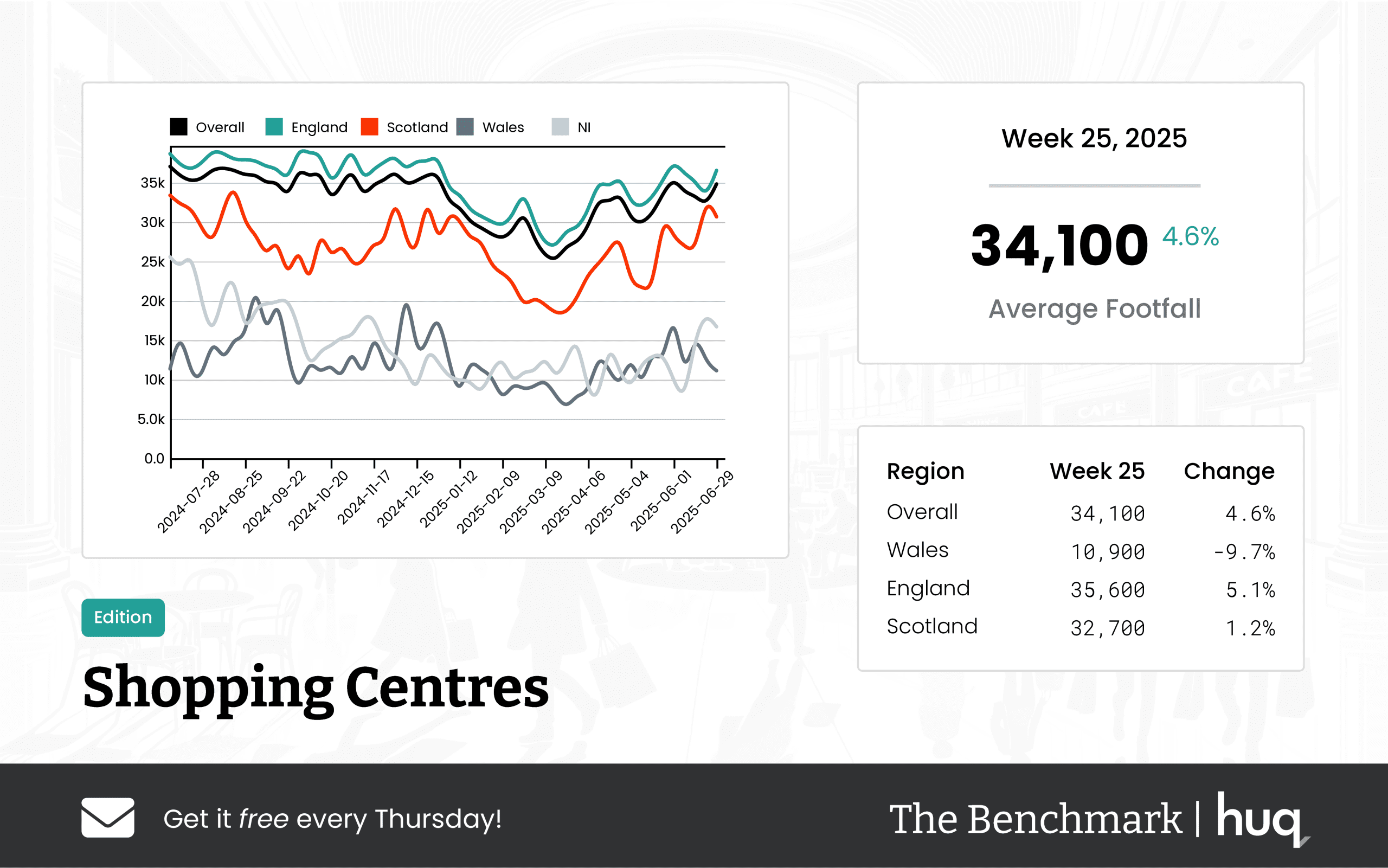

Trends in Shopping Centres

Shopping centres also exhibit robust performance levels despite regional variances. Week 25 data recorded an average daily footfall of 34,100, marking a 4.6% week-on-week uplift even though the averages fell 4.2% compared to the previous year [Week 25, 2025 Shopping Centres: Robust Footfall Trends]. English centres performed strongly with 35,600 daily visitors and an average visit duration of about 101 minutes, while Welsh centres showed declines. This divergence illustrates how local economic factors and consumer preferences are playing important roles in retail dynamics.

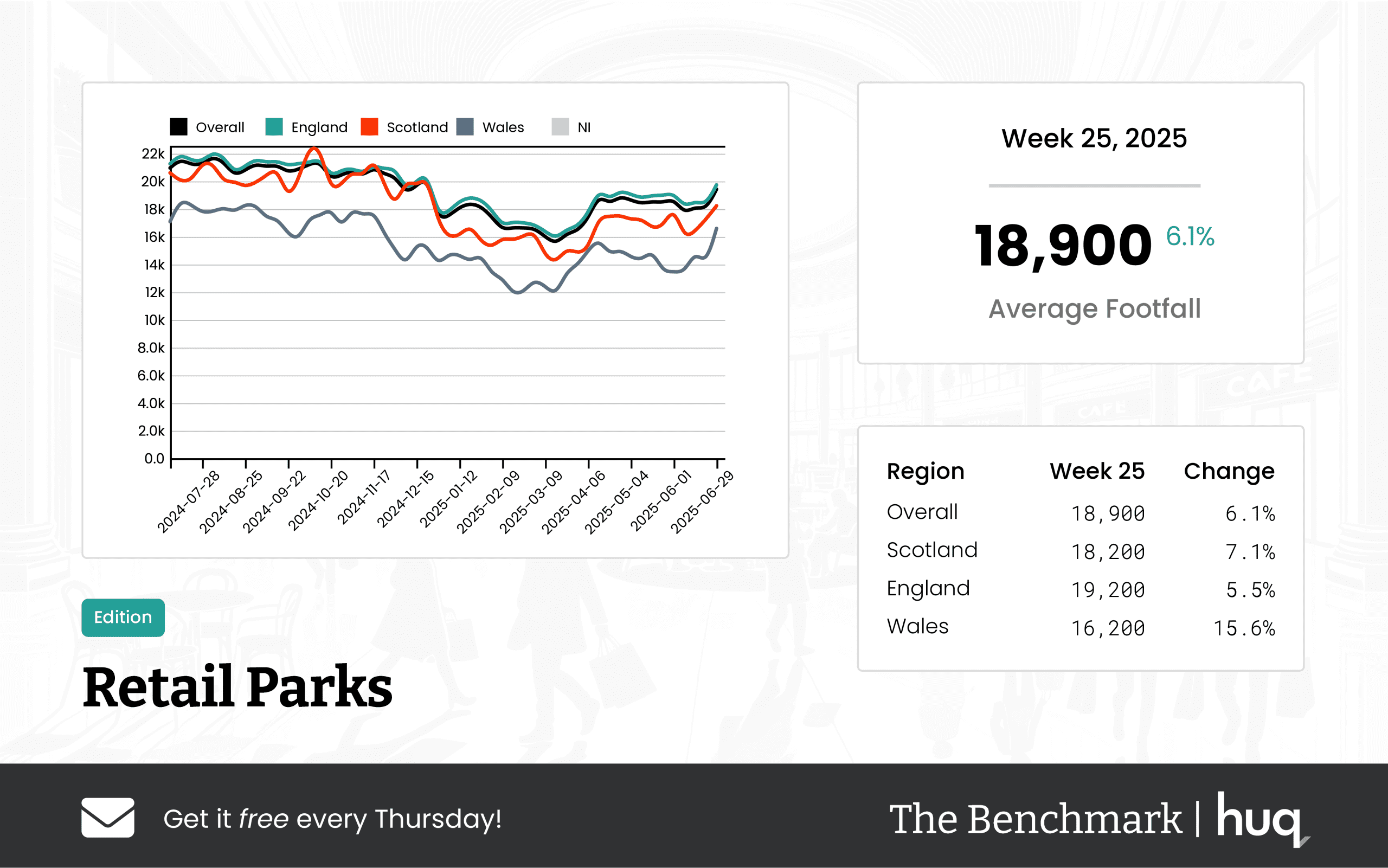

Insights from Retail Parks

Retail parks offer yet another perspective on evolving customer journeys across the nation. Week 23 figures indicated an average daily count of 18,400, with modest improvements by Week 25 reaching 18,900 visitors [UK Retail Parks – Week 25 2025: location analytics performance update]. Regional data paint a nuanced picture, with England’s parks leading at 19,200 visitors, while Scottish and Welsh parks recorded slightly lower numbers. Longer dwell times in England compared to Wales, where durations were approximately 66 minutes, offer additional insight into regional consumer intelligence trends.

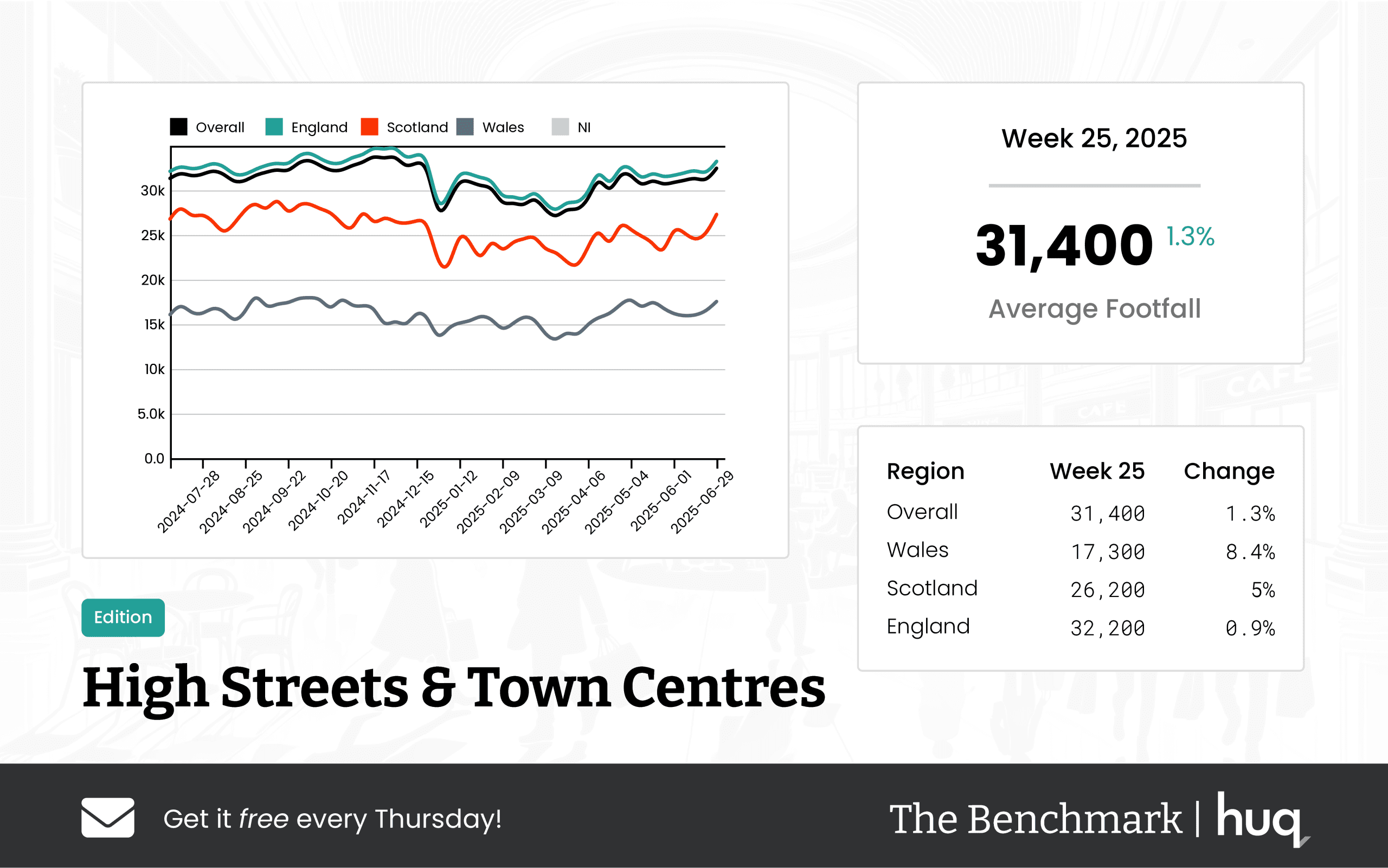

High Streets, Town Centres and Local Retail

High streets and town centres have seen modest but reassuring improvements with a 1.3% week-on-week rise in footfall. Week 25 data highlighted an average of 31,400 visitors daily and a mean dwell time of 96 minutes [UK High Streets & Town Centres – Week 25 2025 Footfall Performance Update]. Notably, Welsh high streets registered an 8.4% boost in weekly performance and a minor annual increase. In the realm of local retail centres, averages held steady around 14,400 visitors with consistent dwell times of approximately 96 to 97 minutes, depicting a balanced but evolving local consumer engagement [Week 24 2025: Local Retail Centres Footfall Retail Performance Update] and [Week 25, 2025 Local Retail Centres Performance Update: Location Analytics Trends].

Economic Factors and Weather Impact

Economic conditions and evolving weather patterns have been instrumental in shaping these retail patterns. Warmer spells have coincided with higher visitor engagement, while ongoing infrastructure investments appear to support sustained footfall increases. Analysts using location intelligence have flagged that such external factors play a significant role in the subtle oscillations observed across all retail categories.

Expert Commentary and Future Outlook

Joe Capocci, Huq Industries Spokesperson, stated, "The consistent rise in dwell times and footfall across diverse retail settings reinscribes the importance of adapting business strategies to the dynamic market. Our data-driven approach using location analytics helps retailers capitalise on customer insights and emerging trends." His remarks reinforce the narrative that integrating consumer insights and location analytics can enhance performance across all sectors.

Looking Ahead

The week’s performance updates indicate that adaptability and keen market evaluation are the keys to success in UK retail. The analyses further suggest that using integrated metrics like footfall statistics and dwell times can enable retailers to preempt market changes and tailor their approaches accordingly. Future reporting is expected to focus even more on detailed regional trends, allowing businesses to harness the power of precise location intelligence.

Final Reflections

Retail environments continue to beat a steady drum of change, with each retail centre type displaying its own unique set of challenges and opportunities. Emerging trends in major centres, shopping centres, retail parks, high streets and local retail sites illustrate a comprehensive picture of the current retail zeitgeist. This Weekly Wrap serves as a clear resource for those relying on advanced location analytics to drive strategic decisions in today’s competitive retail market.

Additional text: As we move forward, it remains clear that the utilisation of robust metrics like footfall and dwell time can yield invaluable consumer insights. Retailers and analysts alike will benefit from closely tracking these trends and responding with agile, data-informed strategies. The evolving landscape promises continued growth in consumer engagement, paving the way for transformative retail experiences.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 25, 2025 Local Retail Centres Performance Update: Location Analytics Trends

Week 25, 2025 Local Retail Centres Performance Update: Location Analytics Trends

UK local retail centres recorded a modest 5.1% weekly footfall increase and a 3.4% annual decline, signalling resilience. Location analytics and footfall data indicate a gradual recovery.

A new analysis using location analytics reveals evolving shopping trends, insightful footfall data, robust retail performance and dynamic consumer behaviour. This additional perspective offers a clear indication of the market recovery and complements the metrics reported in the press release below.

Overview

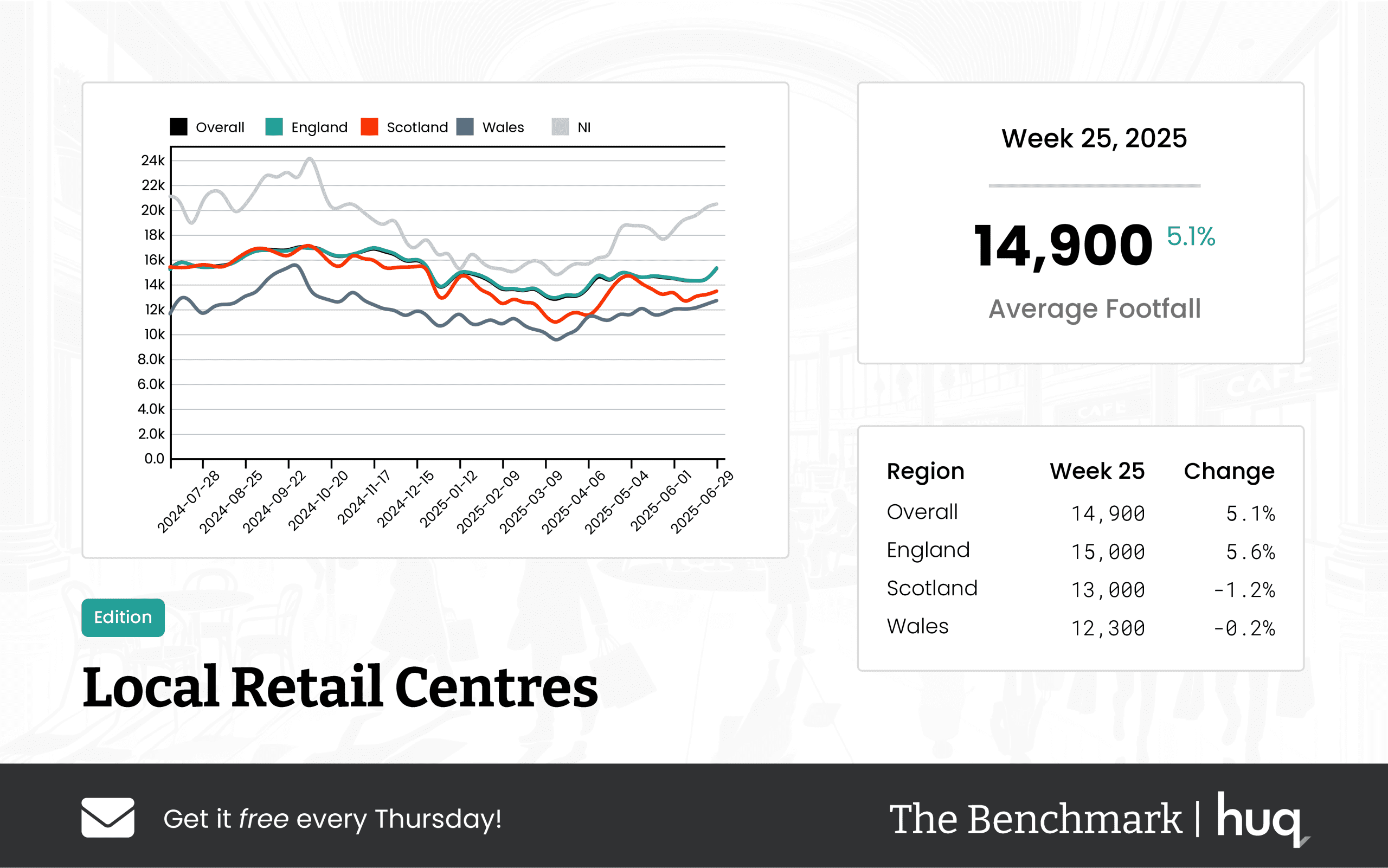

The Benchmark’s latest update on UK Local Retail Centres for Week 25 has revealed a mixed performance across the nation. Overall, the centres recorded an average daily footfall of 14,900, marking a moderate week-on-week increase of 5.1% while showing a slight annual decline of 3.4%. These figures indicate a recent recovery over the past week, despite a softer performance compared to the same period last year.

Regional Performance

In England, the average daily footfall reached 15,000 with a pleasing week-on-week increase of 5.6%, complemented by a minor year-on-year decline of 3.0%. This trend suggests that many English local centres are beginning to rebound, likely due to good weather conditions.

In contrast, Scottish centres have reported a daily average of 13,000 visitors, with a modest week-on-week decrease of 1.2% and a notable year-on-year decline of 15.2%. Meanwhile, retail locations in Wales achieved a daily peak of 12,300 visitors; although there was a marginal week-on-week dip of 0.2%, the annual data shows a slight improvement, with an increase of 0.8%.

Dwell Time Trends

Visitor engagement, as measured by dwell time, also provided a deeper insight into consumer behaviour. Overall, the average time spent per visit was 97 minutes.

Specifically, English centres maintained an average dwell time of 97 minutes, reflecting stability, while visitors in Wales spent a longer duration of 104 minutes per visit. Scottish centres led in engagement with an average dwell time of 108 minutes, a figure that was supported by a week-on-week increase of 11.3%, suggesting that shoppers in Scotland are engaging more thoroughly during their visits.

Joe Capocci, spokesperson for Huq Industries, stated: "We have observed a sharp rebound in weekly footfall in certain regions which is well aligned with the recent warm weather."

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

UK Major Retail Centres – Week 25 Performance Update 2025: Location Analytics Insights

UK Major Retail Centres – Week 25 Performance Update 2025: Location Analytics Insights

Week 25 saw overall footfall rise by 0.6% and dwell time up by 3.5%, signalling a steady recovery. Location analytics and location intelligence reveal evolving consumer trends.

Share on LinkedIn

The latest update from The Benchmark reveals mixed performance across UK Major Retail Centres for week 25, with overall average daily footfall standing at 77,100 as analyzed through advanced location analytics. Notably, visitor engagement improved as the average dwell time climbed to 118 minutes—a 3.5% weekly increase and a 10.3% uplift year-on-year—reflections of both robust retail performance and evolving consumer trends in the market.

Regional Performance:

The data paints a varied picture across the UK. Scotland emerged as the leader, recording a high daily footfall of 97,100 with a 2.5% weekly growth and a 1.5% year-on-year increase. England, meanwhile, registered 75,400 visitors daily, with modest week-on-week growth of 0.5% but facing a 4.4% decline year-on-year. Wales, although marking the lowest daily figure at 62,500, saw a week-on-week rise of 0.3% and an impressive year-on-year increase of 10.1%, underpinned by deep insights from location intelligence.

Visitor Engagement:

In terms of visitor engagement, regional trends continue to morph. Scottish shoppers enjoyed the highest average dwell time of 129 minutes, followed by England at 117 minutes, and Wales at 110 minutes. These consistent improvements across regions underscore the positive trajectory of shopper engagement and robust footfall metrics.

Industry Commentary:

Joe Capocci, spokesperson for Huq Industries, noted the impressive turnaround in Scotland, stating, "Scotland’s sharp footfall rebound is most striking, echoing the retail resilience reflected in recent Metrocentre and M&S investment news." His comments emphasize the broader narrative of retail robustness and evolving trends as captured through detailed location analytics.

Overall, the week 25 performance update provides critical insights into consumer behavior and retail dynamics, showcasing how data-driven location intelligence can reveal the underlying trends influencing the UK’s major retail centres.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

UK High Streets & Town Centres – Week 25 2025 Footfall Performance Update

UK High Streets & Town Centres – Week 25 2025 Footfall Performance Update

Weekly footfall performance shows a modest 1.3% rise overall, while footfall analytics reveal subtle shifts in consumer visits at high streets & town centres.

Share on LinkedIn

Overall Footfall Performance

The latest weekly data reveals that UK High Streets and Town Centres attracted an average daily footfall of 31,400. This represents a modest week-on-week increase of 1.3%, although there was a slight year-on-year decline of 0.8%. These figures point to steady, if marginal, shifts in consumer visits across the region.

Regional Variation

Examining the regions individually, Wales exhibited a notably strong performance with an 8.4% weekly increase and a year-on-year rise of 5.8%, suggesting that local centres are experiencing revived visitor numbers. In England, an average of 32,200 daily visitors was recorded with a modest weekly improvement of 0.9%, balanced by a subtle annual decline of 0.9%, mirroring the overall trend. Meanwhile, Scotland saw a daily average of 26,200 visitors, with a healthy weekly increase of 5% although its year-on-year figures reflected a 4.2% decline.

Dwell Time Insights

The average dwell time across the UK was 96 minutes. Although the most recent week recorded a 4% reduction, year-on-year performance improved by 7.9%, suggesting that visitors are generally spending longer than they did last year despite recent shorter visits.

In Wales, visitors spent an average of 115 minutes on-site, with a weekly increase of 6.5% even as annual figures saw a small decline. In contrast, Scotland experienced a considerable drop in dwell time by 15.3% over the latest week, and an overall year-on-year decline of 7.8%. England maintained a consistent average visit duration of 96 minutes, with a gentle week-on-week decline and a supportive year-on-year improvement of 9.1%.

For further insight, footfall data and footfall statistics continue to inform footfall retail trends, while our footfall analytics and footfall counting methods provide robust measures of consumer engagement.

Commenting on the findings, Joe Capocci, spokesperson for Huq Industries, stated, "The notable increase in Welsh footfall, in line with recent trends observed in the retail industry news, underlines evolving consumer behaviour across the high streets."

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 25, 2025 Shopping Centres: Robust Footfall Trends

Week 25, 2025 Shopping Centres: Robust Footfall Trends

UK Shopping Centres show steady footfall with modest weekly gains and minor yearly softness. Recent footfall data reveals consistent visitor trends.

Share on LinkedIn

The latest data from The Benchmark reveals that UK Shopping Centres recorded an average daily footfall of 34,100 for the week ending June 29, 2025. With a week on week increase of 4.6% yet a slight 4.2% drop compared to the previous year, these figures underscore a generally steady level of visitor interest across the country.

In England, centres saw a robust performance with an average daily footfall reaching 35,600. A week on week rise of 5.1% was observed, contributing to a modest softness on a yearly basis. In contrast, Welsh centres experienced challenges, registering only 10,900 daily visitors alongside significant declines of 9.7% on a week on week basis and 7.3% year on year. Scottish centres, handling an average of 32,700 visitors daily, maintain stability with a slight week on week climb of 1.2% and modest yearly gains.

Delving into dwell time, shoppers across all centres spent an average of 100 minutes per visit. However, a week on week softening of 9.9% was noted even though the yearly figures remained largely stable. In England, the average visit stretched to 101 minutes despite a notable 13.7% decrease in the week on week metric, while Welsh centres lagged with a shorter average of 35 minutes and more significant footfall and dwell declines. Scottish centres led the pace by not only boasting the longest average visit duration of 103 minutes but also witnessing a positive 10.8% week on week change coupled with a sharp improvement over the year.

These figures come at a time when retail analytics emphasize the importance of precise footfall statistics and counting strategies in shaping agile, data‐driven responses. As retail investment initiatives continue to evolve, industry experts, including Joe Capocci, a spokesperson for Huq Industries, underscore the need for active and responsive management – particularly in regions like Wales where sharp declines suggest emerging challenges.

Overall, the report paints a picture of a diverse retail landscape, with each region presenting unique visitor trends that call for tailored strategies as the industry adapts to continually shifting market dynamics.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

UK Retail Parks – Week 25 2025: location analytics performance update

UK Retail Parks – Week 25 2025: location analytics performance update

UK retail parks saw a moderate uplift with roughly a 10% boost in daily visitors and dwell times, signalling encouraging location analytics trends alongside solid footfall performance.

Share on LinkedIn

The Benchmark’s latest analysis of UK Retail Parks reveals an overall average daily footfall of 18,900 for the week ending 29 June 2025. This moderate increase compared with the previous week comes amid a year‐on‐year decrease, highlighting a shifting landscape in visitor patterns. Despite a decline in the number of visits compared to previous years, dwell time analysis indicates that when visitors do come, they stay longer — an average visit now lasts 72 minutes.

A closer look at the regional breakdown uncovers varied insights. Scotland’s Retail Parks recorded an average of 18,200 daily visitors, showing a week-on-week recovery despite softer year‐on‐year numbers. England’s retail parks fare slightly better, with an average of 19,200 daily visitors alongside extended dwell times averaging 74 minutes per visit. Wales, meanwhile, demonstrated resilience by registering a notable weekly increase, with an average of 16,200 daily visitors and a 66-minute average dwell time, even as its engagement lags slightly behind in dwell duration.

The emerging location analytics trends capture the evolving scene where visitor engagement is proving more robust even as overall footfall declines compared to previous years. A spokesperson from Huq Industries, Joe Capocci, remarked, "Recent data, particularly the standout increase in Wales, combined with supportive industry developments such as significant retail transactions and infrastructure investments, underline the evolving retail visitor landscape."

The report not only provides a snapshot of current trends but also emphasizes the importance of regional differentiation and consumer behavior insights for the future of retail park strategies in the UK.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 24 Weekly Wrap: Comprehensive Footfall Retail Update

Week 24 Weekly Wrap: Comprehensive Footfall Retail Update

UK retail update reveals Scotland's major footfall (5.7% rise) and evolving footfall data trends across centres.

Share on LinkedIn

UK retail trends continue to paint a multifaceted picture as the latest updates showcase steady but varied performance across all centre types. Within the first 100 words, the analysis highlights essential footfall insights that are crucial for retailers. The robust footfall data across regions indicates resilience in a challenging market. The detailed reports incorporate exclusive footfall analytics and footfall statistics that help businesses recalibrate their strategies.

Major Retail Centres

Major retail centres remain at the forefront of consumer activity. Week 23 recorded an average 74,900 daily visitors with a 1.5% year‑on‑year increase and a dwell time of 117 minutes. In Week 24, these centres improved to 75,600 daily visits. Regional comparisons reveal Scotland leading with 92,100 visitors, a 5.7% weekly rise, while England and Wales saw mixed results. Detailed insights are available in the Week 23 Major Retail Centres Footfall Data Update and the UK Major Retail Centres – Week 24 2025 Performance Update: Location Analytics Insights.

Local Retail Centres

Local retail centres continue to show balanced performance. Week 23 and Week 24 data report an average of around 14,400 visitors daily. Although there was a marginal negative year‑on‑year change in Week 23, dwell times were robust with a peak of 109 minutes recorded in Scotland. These figures underscore steady footfall counting trends and reinforce the need to monitor regional variations closely. Readers can explore further analysis in the Week 23 2025 Footfall Analytics Update: UK Local Retail Centres and the Week 24 2025: Local Retail Centres Footfall Retail Performance Update.

Shopping Centres

UK shopping centres have shown a steady performance pattern amid shifting economic climates. In Week 23, these centres garnered an average of 33,700 visitors with consistent dwell times of 116 minutes. England’s centres fared notably well with 35,800 daily visitors and longer engagement of 124 minutes. In contrast, Wales experienced an increased visitor count but a stark drop in dwell time, while Scotland saw a nearly 15% decline in footfall. Such contrasting trends emphasise the importance of accurate footfall analytics to track performance. More regional details are provided in the UK Shopping Centres – Week 23, 2025 Performance Update: Location Analytics Insights.

Retail Parks

Retail parks have displayed a mix of growth and decline in recent reports. In Week 23, these centres experienced a 4.9% weekly increase, reaching an average of 18,400 visitors, despite a year‑on‑year decline of 7.8%. England’s parks recorded 18,800 visitors, while Scotland and Wales reported 16,400 and 14,700 visitors respectively. Dwell time varied significantly across regions, ranging from 59 minutes to 88 minutes. This variation strengthens the case for comprehensive footfall statistics to capture true consumer behaviour. Find more insights in the Week 23, 2025 Retail Parks Performance Update: Insights from Location Analytics.

High Streets & Town Centres

High Streets and Town Centres have maintained a steady pace despite minor dips. Both Week 23 and Week 24 updates recorded average daily footfall figures between 31,300 and 31,500. Dwell times ranged from 98 to 100 minutes, with some reports noting up to a 13.6% year‑on‑year increase in dwell time. England boasted stronger figures compared to slight declines in Scotland, while Wales achieved noticeable improvements. These trends confirm that footfall retail strategies must remain agile. Detailed reports can be found at the Week 24 2025 High Streets & Town Centres: Footfall Analytics Update and the UK High Streets & Town Centres – Week 23 2025 Footfall Retail Performance Update.

Industry Insights and Expert Quote

A previous Week 22 update highlighted that major centres had around 80,100 daily visitors and dwell times nearing 119 minutes. Even as shopping centres pursued recovery, the interplay of economic and consumer behaviour remained intricate. Joe Capocci, Huq Industries Spokesperson, remarked, "These statistics reflect both the challenges and opportunities within the UK retail landscape. Sustained footfall analytics and precise footfall data are vital for realigning retail strategies in diverse markets." His words underscore the value of this detailed analysis.

Conclusion

The latest weekly data provides clear signals regarding the shifting retail landscape. The collected footfall statistics across major, local, shopping centres, retail parks, and high streets reflect a dynamic consumer base. Retailers can draw valuable lessons from these weekly figures and adjust strategies according to regional performance and footfall retail trends. Consistent monitoring of these aspects helps retail operators understand market demands and consumer behaviour better.

The ongoing commitment to accurate footfall counting and analysis is crucial for the industry. The evolving trends offer actionable insights that both large chains and independent retailers can utilise. With detailed reports and regional breakdowns now available, businesses can adopt a more informed approach and stay ahead in a competitive market. Overall, the updates on footfall data represent a significant benchmark for operational improvements and future planning.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.