Week 31, 2025 Local Retail Centres Performance Update: Location Analytics Insights

Week 31, 2025 Local Retail Centres Performance Update: Location Analytics Insights

UK local retail centres show overall modest declines with a −0.3% weekly and −0.6% yearly shift, reflecting evolving footfall trends and steady visitor engagement using location analytics.

Share on LinkedIn

Performance Overview

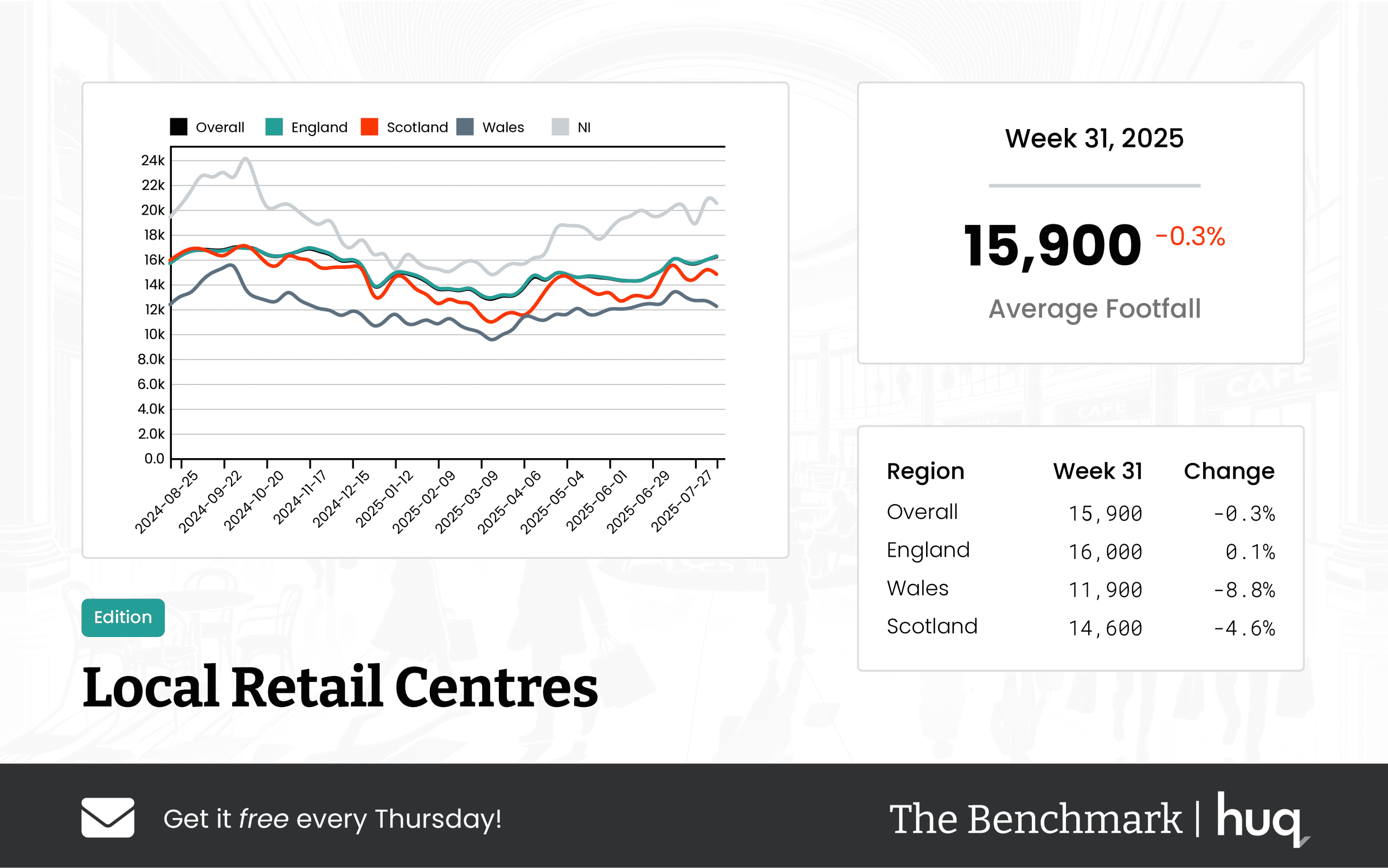

The latest figures for UK Local Retail Centres indicate an overall average daily footfall of 15,900, reflecting a slight weekly softening of −0.3% and a modest year‐on‐year decrease of −0.6%; these insights were derived using location analytics. Alongside the primary footfall data, the average visit duration was recorded at 94 minutes, with a weekly softening of 6.9% and a year‐on‐year increase of 10.6%, highlighting evolving visitor engagement and notable footfall trends. These results suggest steady overall visitation while urging a closer look at regional performance and shifts in the retail industry.

Regional Analysis

In England, centres recorded a resilient performance with an average daily footfall of 16,000, showing a slight increase of 0.1% week‐on‐week and nearly flat year‐on‐year change at −0.1%. Conversely, centres in Wales experienced lower activity with average daily visits of 11,900 and a noticeable weekly decline of −8.8% as well as a year‐on‐year drop of −6.3%. Scottish centres also fell behind with an average of 14,600 daily visits, as they witnessed decreases of −4.6% on a weekly basis and −9.9% over the past year, further emphasising regional performance differences within the retail industry.

Visitor Engagement

Dwell time remains an important secondary metric. Centres in England mirrored the overall average with visitors staying 94 minutes, albeit with a weekly drop of 6% balanced by an annual increase of 9.3%. In Wales, the average duration was higher at 118 minutes, even though it experienced a weekly decline of 9.2%; year‐on‐year figures point to a strong upward trend in visitor engagement, while Scottish centres reported an average visit length of 83 minutes, with the weekly softening reinforced by a modest annual increase.

Joe Capocci, Huq Industries Spokesperson, said: “The most striking change in footfall, especially the notable decline in Wales, is reflected in our data and supported by recent retail industry news reporting a major store closure.”

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

UK Shopping Centres – Week 31, 2025 Performance Update: Location Analytics Insights

UK Shopping Centres – Week 31, 2025 Performance Update: Location Analytics Insights

UK shopping centres experienced a 0.9% overall decline in footfall last week while dwell time rose by 5.8%. Discover key insights in location analytics and emerging retail trends.

Share on LinkedIn

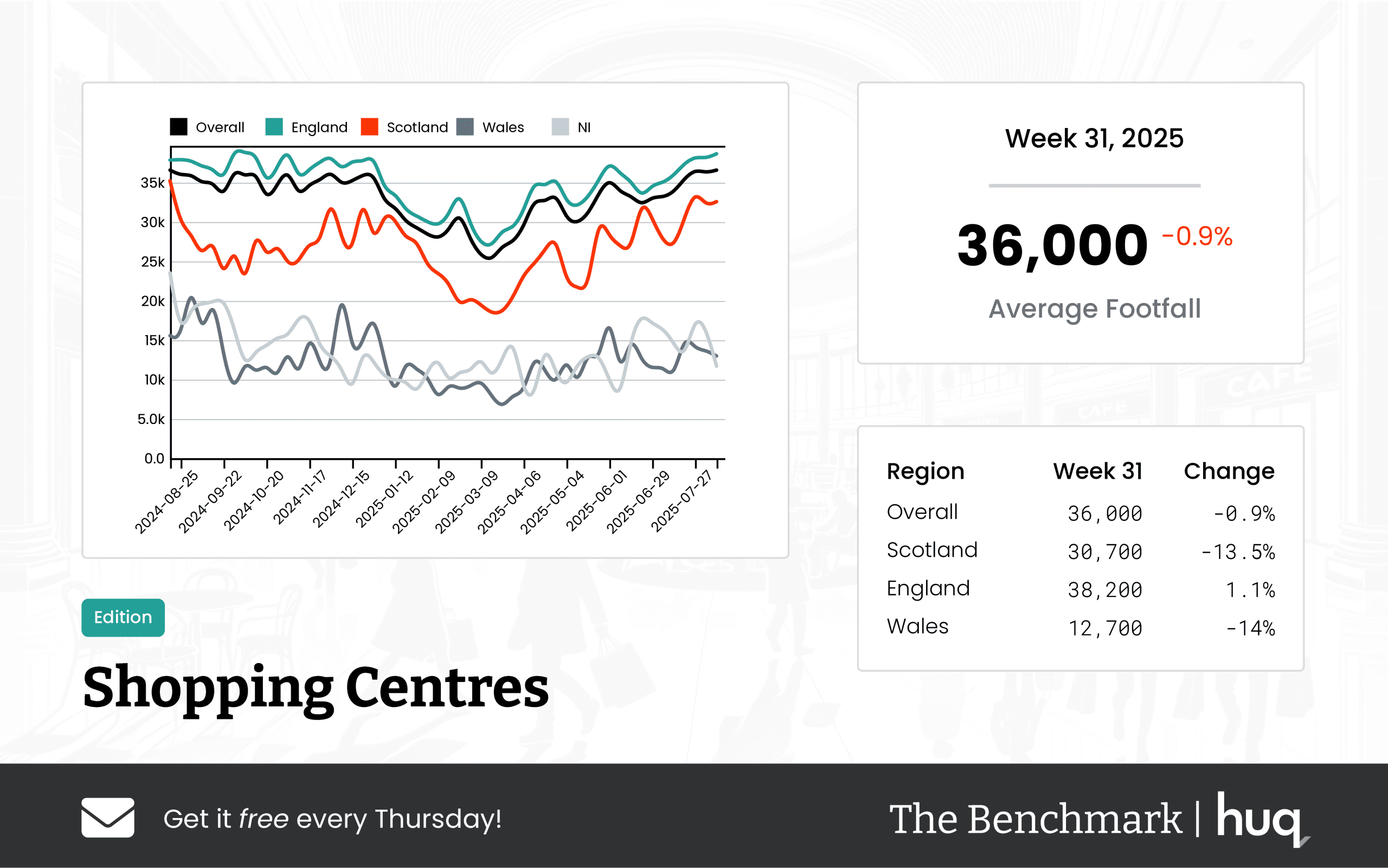

UK shopping centres are facing subtle shifts in consumer behavior as revealed by the latest location analytics for Week 31. The overall average daily footfall across the UK reached 36,000 visitors, reflecting a 0.9% decline from the previous week and remaining 2% below the figures from the same period last year. This modest contraction is indicative of broader market trends and evolving shopping habits.

Overview:

The Benchmark data demonstrates that even though visitor numbers are slightly down, the retail environment is adapting. The increased dwell time seen across the board suggests shoppers are spending more time per visit, perhaps scrutinizing in-store offerings more closely or enjoying a more leisurely shopping experience.

Regional Performance:

- In England, centres reported an encouraging average of 38,200 visits per day. Despite a minor 1% dip compared to last year, a 1.1% week-on-week increase suggests a steady resilience, possibly bolstered by advanced location intelligence providing local centres with targeted insights.

- Scottish centres, on the other hand, faced a steeper challenge, averaging 30,700 daily visits and experiencing a significant 13.5% decrease week-on-week. However, the year-on-year comparison shows only a 0.3% change, hinting at a relatively stable long-term performance despite recent setbacks.

- Welsh centres are under particular pressure, with daily averages at 12,700 visits and a sharp 14% decline from the previous week. Historical trends also indicate a downturn compared to the previous year, reflecting deeper issues within the regional retail sector.

Shopper Dwell Time:

One of the key positives noted in the report is the rise in shopper engagement, as evidenced by dwell time. Overall, the average visit now lasts 109 minutes, marking an increase of 1.9% over the previous week and a notable 5.8% improvement compared to the previous year. The endurance of visitor engagement is further underscored by regional figures:

- England’s centres show an average stay of 111 minutes, aligning with the general upward trend.

- Scottish centres have also improved with an average of 94 minutes per visit, showcasing a 9.3% year-on-year improvement.

- Although Welsh centres have seen a considerable week-on-week increase in dwell time, the overall annual performance remains subdued, highlighting regional disparities.

Industry Commentary:

Joe Capocci, the spokesperson for Huq Industries, commented on the figures by saying, "The marked decline in Welsh footfall alongside recent industry restructuring, such as the Rivergate centre closure, underscores the varied market pressures we are witnessing." His remarks echo the broader narrative of a retail landscape in flux, with regional markets experiencing distinct challenges and opportunities.

Conclusion:

The latest insights from Week 31 reveal that while UK shopping centres face declining footfall figures, increased dwell times indicate a shift towards deeper shopper engagement. The divergence in performance between regions, particularly the contrasting trends seen in England, Scotland, and Wales, points to a nuanced landscape where localized strategies and branding efforts become increasingly crucial. As the retail market continues to evolve, the reliance on precise location analytics will be essential in managing these challenges and leveraging emerging trends.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 31, 2025 Major Retail Centres: Location Analytics Performance Update

Week 31, 2025 Major Retail Centres: Location Analytics Performance Update

Week 31 shows a steady rise in UK retail centres, with overall daily footfall up by 1% and year-on-year growth of 7%. Location analytics and location intelligence data signal strong consumer engagement.

Share on LinkedIn

Overall Performance

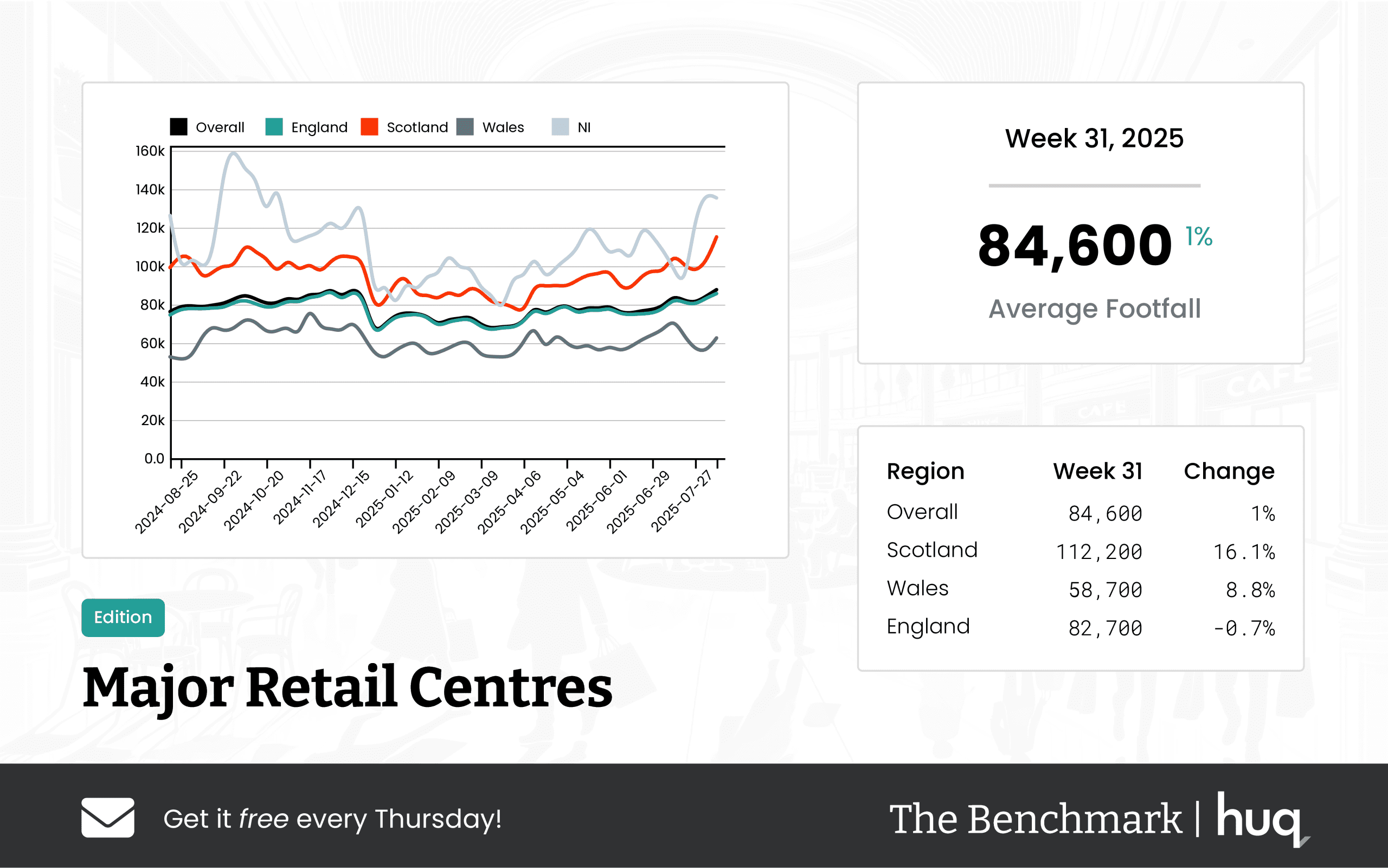

The latest figures from The Benchmark reveal that UK Major Retail Centres recorded an average daily footfall of 84,600 during Week 31, representing a modest 1% increase from the previous week and a 7% improvement on a year-on-year basis. Using cutting-edge location analytics, these centres are showing encouraging footfall trends. Visitors exhibited an overall average dwell time of 117 minutes per visit. Despite a small 3.3% softening in visit duration compared to last week, the year-on-year growth of 10.4% in dwell time underscores enduring consumer engagement.

Regional Insights

Scotland led performance with an impressive average daily footfall of 112,200, buoyed by a strong week-on-week boost of 16.1% and a 10.2% annual increase. Scottish retail centres also recorded the longest on-site visit duration at an average of 129 minutes, although this figure saw a minor decline of 4.4% from the preceding week. In Wales, retail centres welcomed an average of 58,700 daily visitors, experiencing an 8.8% weekly increase and a 10.3% rise on a year-on-year basis. This positive performance in both Wales and Scotland highlights significant consumer engagement through the lens of location intelligence and footfall data.

In contrast, centres in England recorded an average of 82,700 daily visitors. While England experienced a slight 0.7% softening in footfall week-on-week, the year-on-year performance remained strong with a 6.3% increase. The average visit duration in England was 115 minutes, showing a small short-term decline of 4.2% but an 8.5% growth over the year, reinforcing the sustained consumer interest.

Industry Comment

Joe Capocci, spokesperson for Huq Industries, commented on the evolving retail dynamics: "The sharp increase in Scottish footfall paired with the recent industry developments strongly supports our view on the evolving retail dynamics now evident in key UK regions." His remarks further stimulate confidence in the sector as location analytics continue to shed light on emerging consumer trends and regional performance disparities.

The continuous improvements in footfall and visitor engagement across UK retail centres signal resilience in the retail market, with location analytics playing a pivotal role in capturing these evolving trends.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 25-27 Weekly Wrap: Retail Trends Unfold with Location Analytics

Week 25-27 Weekly Wrap: Retail Trends Unfold with Location Analytics

A modest 4.2% rise in footfall impresses in this week’s UK retail trends; discover how location analytics is steering consumer insights.

Share on LinkedIn

The latest UK retail reports have offered a deep dive into evolving consumer behaviour and market performance, using advanced location analytics to illuminate trends. Recent updates have shown that even a modest uplift in key figures can have a significant ripple effect across the retail landscape. This week, UK retail and consumer engagement were in focus as location intelligence tools highlighted subtle shifts in footfall and dwell time across a variety of formats.

General Overview

The reports present a broad picture of the retail sector, with data-driven insights revealing that gradual improvements in visitor numbers are shaping strategic decisions. For instance, Week 26 Weekly Wrap: Footfall Trends in UK Retail detailed a 4.2% change that has already started to pivot retailer responses. This analysis underlines how even small percentage gains in footfall can transform overall UK retail performance.

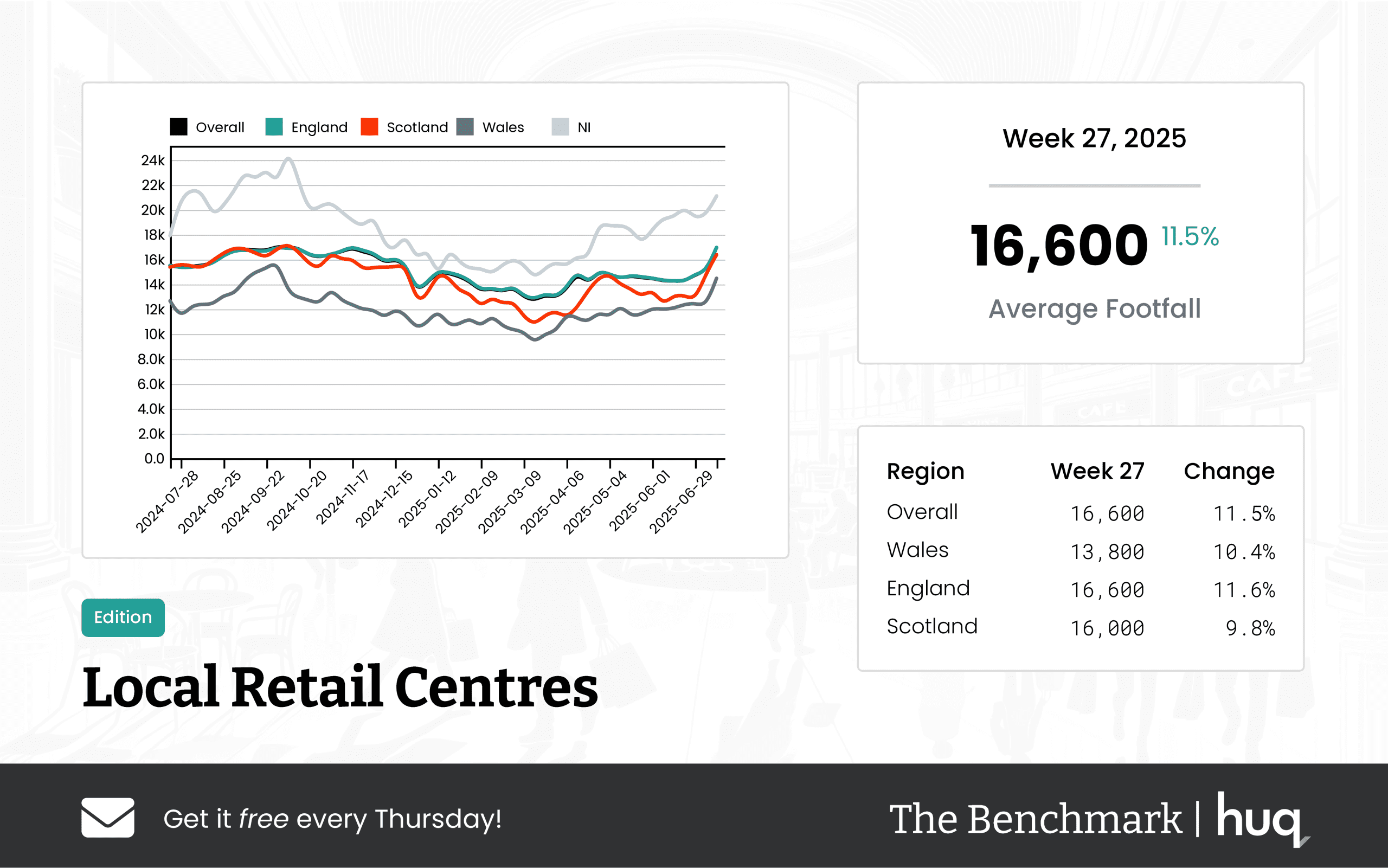

Local Retail Centres

Local retail centres have emerged as strong performers this week. The UK Local Retail Centres – Week 27 2025 Performance Update reported an 11.5% surge in daily footfall, with visitors spending an average of 100 minutes on site. The sustained year-on-year growth in these centres highlights renewed consumer interest, bolstering confidence in local markets and igniting discussions on future urban planning.

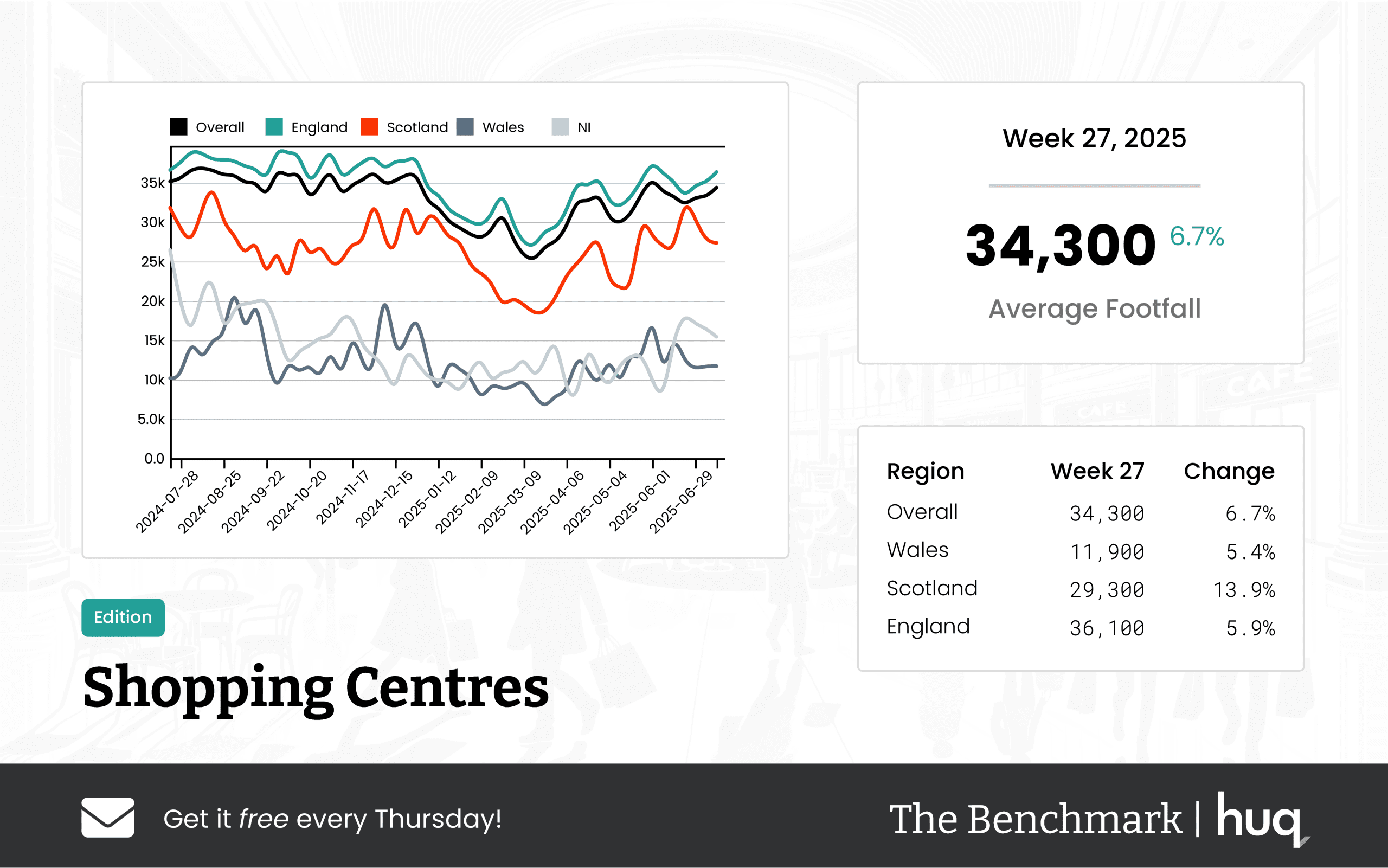

Shopping Centres Performance

Shoppers have responded robustly to improvements, as evidenced in shopping centres. According to the Week 27 2025 Shopping Centres: Robust Footfall Performance, there was a notable 6.7% weekly increase in visitor numbers, with English centres leading the charge at 36,100 daily visitors. Retailers in these spaces are now keenly tracking dwell time gains, making UK retail a key area where location analytics and footfall metrics intersect.

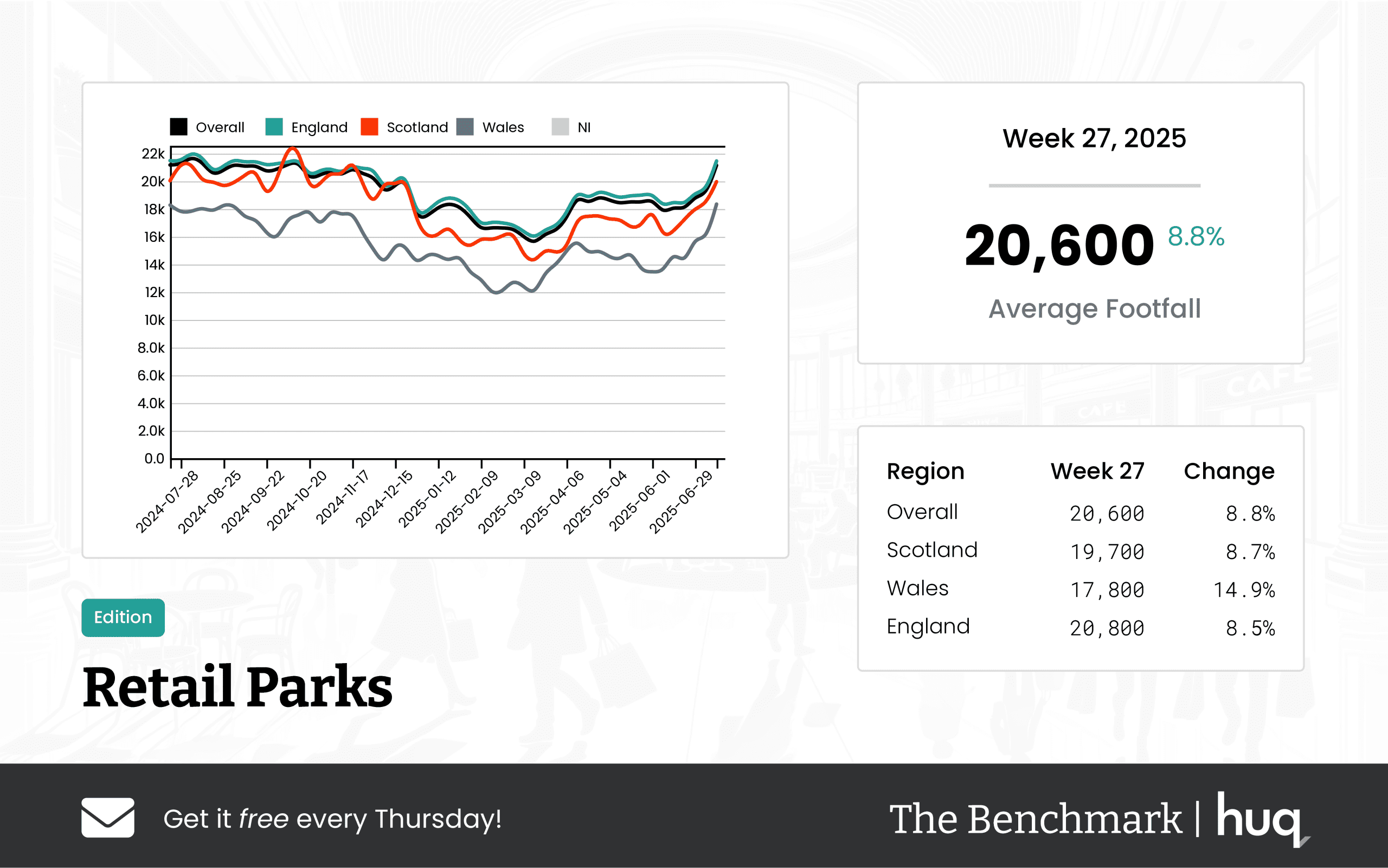

Mixed Results from Retail Parks

Retail parks have shown a more nuanced picture this week. The UK Retail Parks Week 27, 2025 Performance Update indicated that weekly footfall climbed 8.8% to 20,600 visitors, with dwell times modestly increasing. In contrast, the Week 26 2025 Retail Parks Performance Update reflected only a 0.9% increase in footfall and a slight 2.8% drop in dwell time. These differences underscore the importance of ongoing analysis in refining location intelligence strategies for varied retail environments.

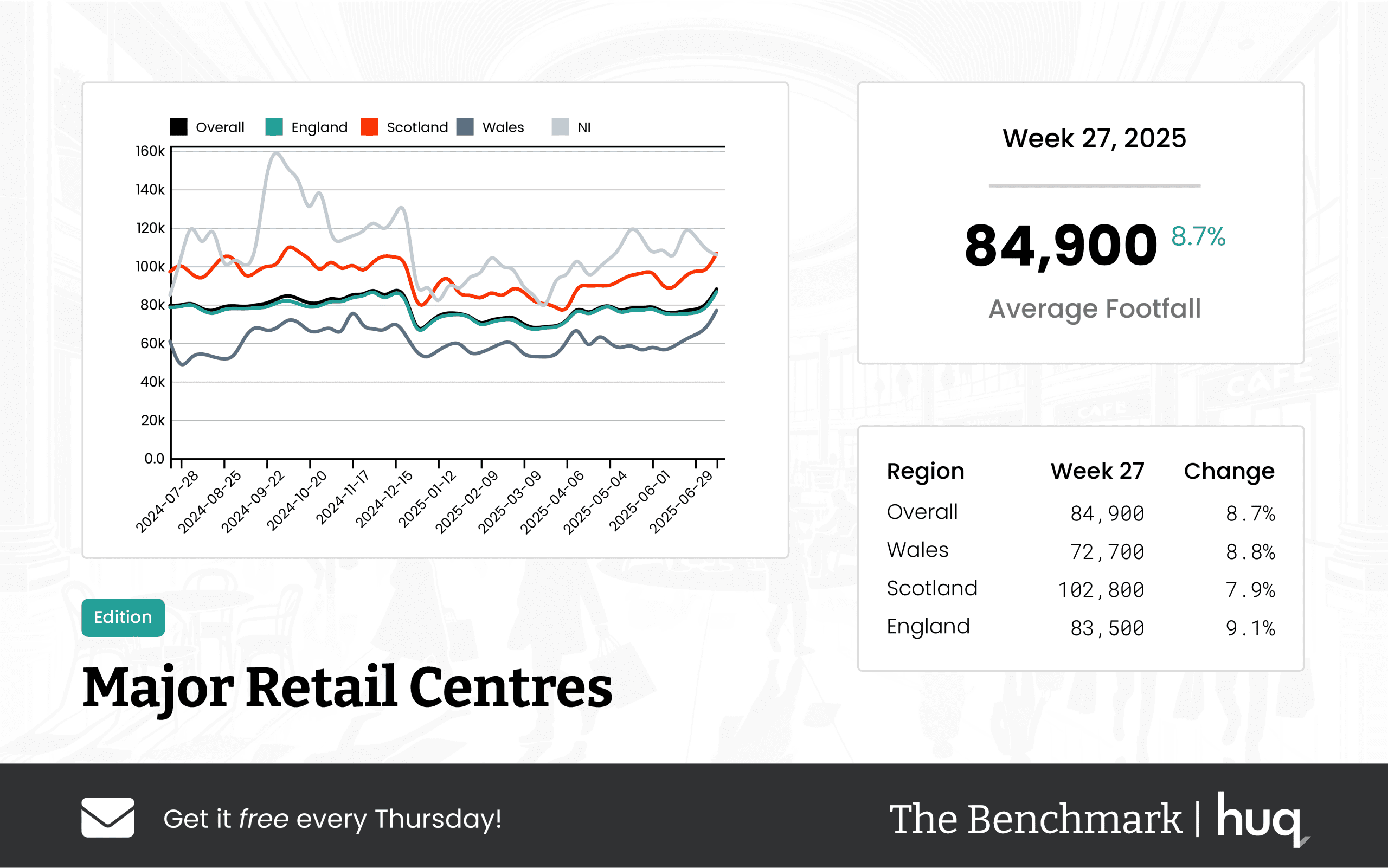

Insights into Major Retail Centres

Major retail centres continue to capture attention through their high visitor volumes and extended dwell times. The Week 27 2025 – Major Retail Centres Footfall Retail Update recorded an impressive 8.7% weekly gain, reaching an average of 84,900 daily visitors. Comparably, the UK Major Retail Centres – Week 26, 2025: Footfall Retail Trends and Performance Update documented subtler increases, with regional distinctions highlighting Scotland’s peak performance. Here, high footfall and dwell time metrics align, reinforcing the resilience of major urban centres.

High Streets and Town Centres in Focus

High streets and town centres are also under the lens this week. The Week 27, 2025 High Streets & Town Centres Performance Update – Leveraging Location Analytics showcased an 8.9% boost in weekly visits, averaging 33,700 daily visitors. Meanwhile, the Week 26, 2025 High Streets & Town Centres: Footfall Performance Insights presented a scenario with slightly lower initial figures, highlighting varying regional dwell times. This variance invites further exploration into how location intelligence is adapting strategies at local levels.

Expert Insights and Future Direction

Joe Capocci, Huq Industries Spokesperson, remarked, "Retail performance is evolving rapidly, and data from location analytics clearly shows how minute changes in visitor behaviour can influence broader market trends." His observations highlight the need for retailers and urban planners to lean on robust data insights to stay ahead. The consistent monitoring of footfall and dwell time metrics is essential in adapting to today’s competitive landscape.

Concluding Thoughts

This weekly analysis paints a comprehensive picture of the dynamic changes taking shape across the UK retail environment. Retail centres from local shops to major complexes are leveraging location analytics to refine their strategies and respond to evolving consumer trends. The interplay between footfall, dwell time, and regional variations underscores the importance of a data-driven approach for sustainable growth.

Looking Ahead

As we move forward, continued investment in location intelligence will be critical for understanding consumer habits and driving competitive advantage in UK retail. The insights from these reports provide a strong foundation for future decisions in urban retail planning. With the momentum of small yet significant improvements, retail stakeholders are better equipped to navigate market shifts and capitalise on emerging opportunities.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 27, 2025 High Streets & Town Centres Performance Update – Leveraging Location Analytics

Week 27, 2025 High Streets & Town Centres Performance Update – Leveraging Location Analytics

UK High Streets & Town Centres demonstrate a robust recovery with an 8.9% weekly rise and 6.3% annual boost. Increasing location analytics and consumer confidence underpin the overall trend.

Share on LinkedIn

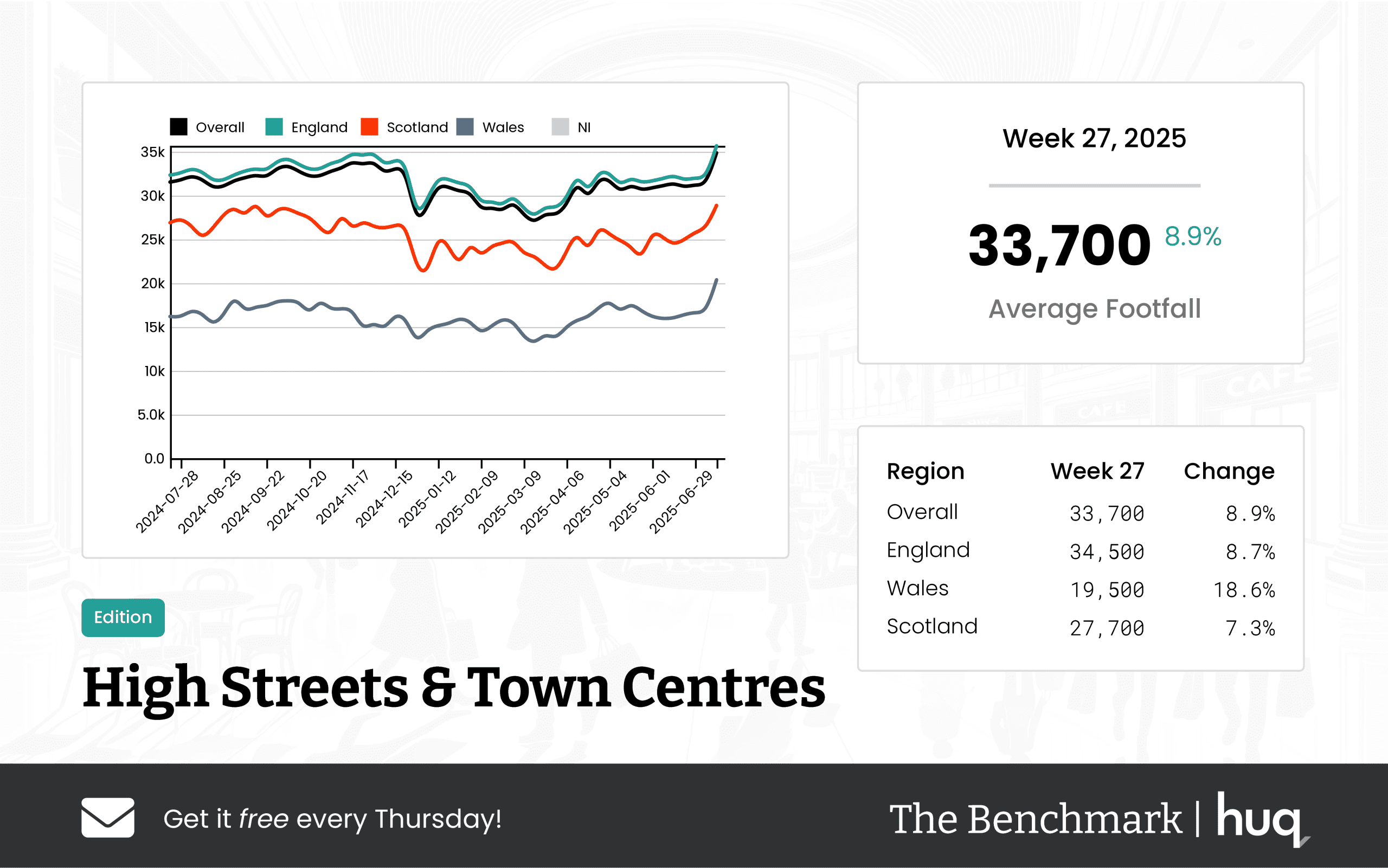

Across the United Kingdom, High Streets and Town Centres recorded healthy gains during Week 27 with an overall average daily footfall of 33,700. This 8.9% week-on-week and 6.3% year-on-year improvement highlights robust retail resilience, fueled by enhanced location analytics and growing consumer confidence.

In England, an average daily footfall of 34,500 was observed, up by 8.7% week-on-week and 6.2% year-on-year. These figures underscore steady urban investment and rejuvenating consumer sentiment, demonstrating the effectiveness of location intelligence in reinforcing a thriving market.

Wales showed a particularly striking performance, with an average daily footfall of 19,500 and impressive weekly and annual gains of 18.6% and 19% respectively. The average dwell time in Wales reached 91 minutes, with a slight week-on-week improvement. However, a softer year-on-year dwell time suggests that visitor behavior is evolving amidst growing consumer engagement and retail resilience.

Scotland recorded an average daily footfall of 27,700, with modest growth rates of 7.3% for the week and 1.6% on an annual basis. The average visit duration here is 87 minutes, with small declines in dwell time, possibly in response to emerging market trends and shifting consumer habits.

Joe Capocci, spokesperson for Huq Industries, emphasized the unique trends by stating, "The sharp increase in footfall witnessed in Wales is particularly striking alongside the Retail Industry News, reflecting evolving consumer habits."

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 27 2025 – Major Retail Centres Footfall Retail Update

Week 27 2025 – Major Retail Centres Footfall Retail Update

UK major retail centres saw an 8.7% weekly footfall uplift alongside a 6.8% annual rise, signalling robust consumer interest according to fresh footfall analytics.

Share on LinkedIn

Overall Footfall Performance

The latest figures from The Benchmark Tracker for week 27 show that UK Major Retail Centres welcomed an average of 84,900 visitors daily. This represents an 8.7% improvement compared to the previous week and a 6.8% increase relative to the same week last year. These statistics indicate a consistent growth trajectory across the retail landscape.

Regional Footfall Analysis

A breakdown by region shows varying performance across the UK. Scotland registered the highest average daily footfall at 102,800, while England recorded 83,500. Wales, though attracting fewer visitors at 72,700 on average, demonstrated an encouraging week on week gain of 8.8%, with year on year performance described as a sharp increase. These results, derived from comprehensive footfall data, offer insights via advanced footfall analytics. The figures provide reliable footfall statistics and support accurate footfall counting.

Visitor Dwell Time Performance

Complementing the footfall data, overall dwell time stood at an average of 121 minutes per visit. While this represents a minor week on week decrease of 1.6%, the year on year improvement of 13.1% points to a more engaged shopper profile.

In Scotland, visitors spent an average of 134 minutes each visit, despite a slight weekly softening of 2.2%, while in England, the average visit lasted 120 minutes, with a modest weekly dip of 2.4% counterbalanced by an 11.1% uplift over the past year. In Wales, visitors showed a notable shift in behaviour with both weekly and annual trends indicating enhanced engagement.

Industry Insights

“Recent results indicate that the sharp increase in footfall seen in Wales, alongside developments such as JD’s upsizing at Braehead, reflects evolving consumer dynamics,” said Joe Capocci, Huq Industries Spokesperson.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

UK Retail Parks Week 27, 2025 Performance Update with Location Analytics

UK Retail Parks Week 27, 2025 Performance Update with Location Analytics

UK Retail Parks data shows an 8.8% weekly increase in footfall. Robust location analytics and improved consumer engagement highlight a short-term boost in performance.

Share on LinkedIn

The latest performance update for UK Retail Parks, drawing insights from advanced location analytics, reveals a pivotal week ending July 13, 2025. Overall, retail parks averaged 20,600 visitors each day during this period, marking an 8.8% increase over the previous week. However, when compared with the same week last year, there was a slight decline of 3.1%, indicating that while short-term trends are positive, broader yearly comparisons show softer performance.

Regional performance was varied. Scotland's retail parks welcomed approximately 19,700 visitors daily, displaying an 8.7% weekly increase, although visitor numbers were down by 4% when compared to the previous year. Wales experienced a strong recovery by recording 17,800 daily visitors—a remarkable 14.9% week-on-week surge and a modest 0.4% year-on-year gain. In England, the sector recorded the highest footfall with 20,800 daily visitors, maintaining solid growth with an 8.5% increase over the week, albeit dropping by 3.2% from last year’s figures.

Further examination of consumer engagement shows that the average duration of visits increased to 71 minutes, reflecting a 1.4% week-on-week rise and an impressive 9.2% increase from the previous year. England again led in this area, with visitors spending an average of 73 minutes at the parks, while Scotland and Wales trailed at 59 and 63 minutes respectively. These differences underscore varying levels of consumer engagement across regions.

Joe Capocci, spokesperson for Huq Industries, highlighted the significance of the current trends, noting, "Overall, the sharp increase in visitor numbers, particularly the notable surge in Wales alongside industry developments such as the upcoming IKEA small store in Essex, highlights the evolving dynamics of the retail park sector." Indeed, these insights not only point to a short-term boost in performance but also underline the importance of targeted regional strategies and the role of innovative retail formats in keeping pace with changing consumer behaviors.

As retail parks continue to adapt in an evolving market, stakeholders are keenly watching these trends. The integration of refined location analytics is crucial for understanding consumer patterns and fine-tuning operational strategies, ensuring that retail parks remain competitive in a dynamic landscape.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 27 2025 Shopping Centres: Robust Footfall Performance

Week 27 2025 Shopping Centres: Robust Footfall Performance

UK shopping centres saw a positive footfall trend with a 6.7% weekly rise, underscoring resilient footfall retail dynamics despite slight year-on-year declines.

Share on LinkedIn

UK shopping centres have reported robust footfall performance for Week 27 2025 with an overall average daily visitor count of 34,300. This marks a significant 6.7% increase on a weekly basis, even though the figures reflect a slight year-on-year decline.

In an in-depth regional breakdown, centres in England recorded the highest average daily footfall at 36,100 accompanied by a steady weekly growth of 5.9%, despite a 3.2% year-on-year dip. Meanwhile, Scotland reported a commendable weekly surge of 13.9% in footfall to reach an average of 29,300 daily visitors, even as the year-on-year figures show a 5.9% decline. Conversely, Wales posted the lowest overall daily footfall at 11,900, though it registered a modest weekly gain of 5.4% and a unique year-on-year increase of 1.3%, underlining dynamic trends in this region.

The overall visitor engagement in these centres is also highlighted by dwell time metrics. Across the board, visitors spent an average of 117 minutes in shopping centres, which represents a 4.5% increase over the week and a robust 17% uplift over the previous year. This upward trend was particularly pronounced in England, where dwell time averaged 122 minutes, enjoying a weekly increment of 8.9% and an 18.4% improvement over last year's figures. In contrast, Scottish centres experienced a decline in dwell time averaging 91 minutes, and Welsh centres were notably lower, with an average dwell time dropping dramatically to just 16 minutes.

Joe Capocci, a spokesperson for Huq Industries, commented on the developments, noting, 'The sharp increase in Scottish centre footfall this week supports observations seen in recent retail industry news, underscoring key regional shifts.' This statement aligns with recent trends and forecasts that suggest regional variations in consumer behaviour and the overall vibrancy of retail footfall in various parts of the UK.

Despite some year-on-year declines, the overall positive weekly trend in footfall and dwell time suggests that UK shopping centres continue to be resilient and adaptive in a rapidly evolving retail environment. The mixed regional performance, especially the marked differences between Wales and other regions, points to the need for tailored strategies to engage with local consumer demographics effectively.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

UK Local Retail Centres – Week 27 2025 Performance Update: Footfall Data Insights

UK Local Retail Centres – Week 27 2025 Performance Update: Footfall Data Insights

UK Local Retail Centres saw an 11.5% rise in daily footfall, with strong week-on-week and year-on-year gains fueling confidence in local retail spaces.

Share on LinkedIn

Recent figures from The Benchmark indicate that UK Local Retail Centres experienced a significant uptick in footfall performance during the week ending July 13, 2025. The centres recorded an overall daily average of 16,600 visitors, showing an 11.5% increase compared to the previous week alongside a 7% rise on a year-on-year basis. These robust numbers, captured using the latest footfall counting techniques, underline a thriving trend in local retail engagement.

Regional performance paints a nuanced picture. In England, centres not only achieved the national average of 16,600 daily visitors but also enjoyed an 11.6% rise week-on-week and a 7.2% increase over the year. Meanwhile, Welsh retail centres, with a slightly lower daily average of 13,800 visitors, demonstrated remarkable resilience by registering a 10.4% weekly lift and an impressive 12.8% annual increase. Scotland’s local centres, with a daily average of 16,000 visitors, recorded a 9.8% improvement over the previous week, coupled with modest gains over the year.

Beyond mere visitor counts, dwell time metrics have also seen positive momentum. On average, visitors spent 100 minutes per visit across the UK, representing stable week-on-week figures and an encouraging 19% uplift on an annual basis. Breaking this down further, England noted an average visit duration of 99 minutes, Wales slightly outpaced with 101 minutes, and Scotland led the group with an impressive 119 minutes per visit. Although weekly figures from Scotland hinted at minor softening, the overall annual performance emphasises strong growth and increased consumer engagement.

Industry experts remain optimistic. Joe Capocci, spokesperson for Huq Industries, commented, "The 11.5% overall footfall increase is a striking change that mirrors the momentum seen in recent retail developments reported by sources such as the BBC and Southend Echo." With these insights, local retail centres continue to adapt and thrive, leveraging detailed analytics to drive future growth.

These evolving trends in footfall and dwell time not only signal a vibrant retail environment but also highlight the importance of continuous monitoring and adaptation. As UK Local Retail Centres harness these insights, they reinforce their role as essential components of the community's economic and social landscape.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 26 Weekly Wrap: Footfall Trends in UK Retail

Week 26 Weekly Wrap: Footfall Trends in UK Retail

Delve into week 26's weekly wrap with footfall data insights showing a 4.2% change that is quietly reshaping UK retail strategies.

Share on LinkedIn

A Fresh Look at Footfall in UK Retail

UK retail continues to harness the power of advanced footfall analytics to gauge the nation’s shopping habits. Recent updates in footfall data highlight subtle yet important changes in customer engagement across several retail formats. In these reports, small percentage improvements in footfall statistics have been influential in informing retail strategies.

Major Retail Centres on the Rise

Major retail centres have shown steady progress in both visitor numbers and dwell time. In Week 25, data indicated that footfall increased by 0.6% alongside a 3.5% rise in average dwell time. Details can be found in the Week 25 Major Retail Centres Performance Update and the Week 26 UK Major Retail Centres update.

Insights from Shopping Centres

Shopping centres have reported a robust footfall retail performance with a 4.6% uplift in Week 25. The data reveals that centres in England performed notably strong, with average daily visitors reaching 35,600 and visitors spending about 101 minutes on site. More on these trends is available in the Week 25 Shopping Centres: Robust Footfall Trends.

Mixed Signals from Retail Parks

Retail parks across the UK present a mix of gains and challenges. In Week 26, retail parks saw a modest 0.9% increase in daily visits, reaching around 19,000 visitors, although dwell time dropped by 2.8%. In-depth reports, such as the Week 25 update and the Week 26 update, offer a comprehensive picture of these trends.

High Streets and Town Centres Dynamics

High Streets and Town Centres remain vital for drawing footfall, with Week 25 figures showing an average of 31,400 visitors daily. Although some regions, like Scotland, experienced lower numbers, Welsh centres marked notable improvements. More detailed insight can be seen in the Week 25 update and the Week 26 update.

Local Retail Centres and Their Unique Story

Local retail centres have observed a 5.1% weekly increase in footfall, although they face a slight 3.4% year-on-year decline. English centres recorded around 15,000 daily visitors, compared to 13,000 in Scotland and 12,300 in Wales, with varying average stay durations that hint at evolving customer behaviour. You can explore these nuances further in the Week 25 Local Retail Centres Performance Update.

Economic and Weather Influences

The role of economic shifts and warmer weather cannot be underestimated in shaping footfall statistics. Retailers have leveraged these changes by adjusting strategies based on footfall analytics, which are crucial for planning infrastructure investments and economic forecasts. This combination of temperature and economic resilience continues to redefine market approaches.

Industry Voices and Future Directions

Joe Capocci, Huq Industries Spokesperson, remarked, "The recent increments in footfall, though modest, underscore a resilient market adapting smartly to both economic and climatic changes." His statement reinforces the importance of using detailed footfall analytics to drive smart, evidence-based decisions. The industry's future will undoubtedly rely on precise footfall counting and strategic planning.

Adapting to Regional Variability

Regional differences have emerged as a significant factor in interpreting footfall data trends. While England often shows slightly higher performance metrics, areas like Scotland and Wales offer unique insights into dwell time variations and on-ground customer behaviour. Armed with this footfall retail intelligence, local businesses and urban planners are better positioned to tailor their operational strategies.

Concluding Thoughts

The evolving landscape of UK retail is marked by nuanced changes across major centres, shopping areas, retail parks, and high streets. Each segment presents distinct challenges and opportunities, with key drivers being economic conditions and weather patterns. Continuous analysis of footfall data helps shape smarter decision-making and competitive strategies in the retail sector.

Additional analysis reveals that even small percentage improvements in customer engagement can yield significant benefits for retailers. This detailed week-by-week review highlights the role of footfall analytics in modern retail and confirms that adaptable, data-led approaches are key to navigating an ever-changing market. Future trends will likely see retailers further harnessing this data to create more engaging, efficient shopping experiences without compromising on the insights that have so far driven steady progress.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.