Week 35 Weekly Wrap: Retail Centre Trends and Location Analytics Insights

Week 35 Weekly Wrap: Retail Centre Trends and Location Analytics Insights

UK retail centres see a 2.4% annual rise in dwell times, highlighted by enhanced location analytics and evolving customer engagement.

Share on LinkedIn

Retail trends continue to evolve across the UK, and the most recent data on retail centres shows an intricate mix of growth and challenges. In this Weekly Wrap, we delve into key findings from different formats. With location analytics driving insights, the detailed breakdown across formats, regions, and timeframes offers an essential guide to modern consumer behaviours.

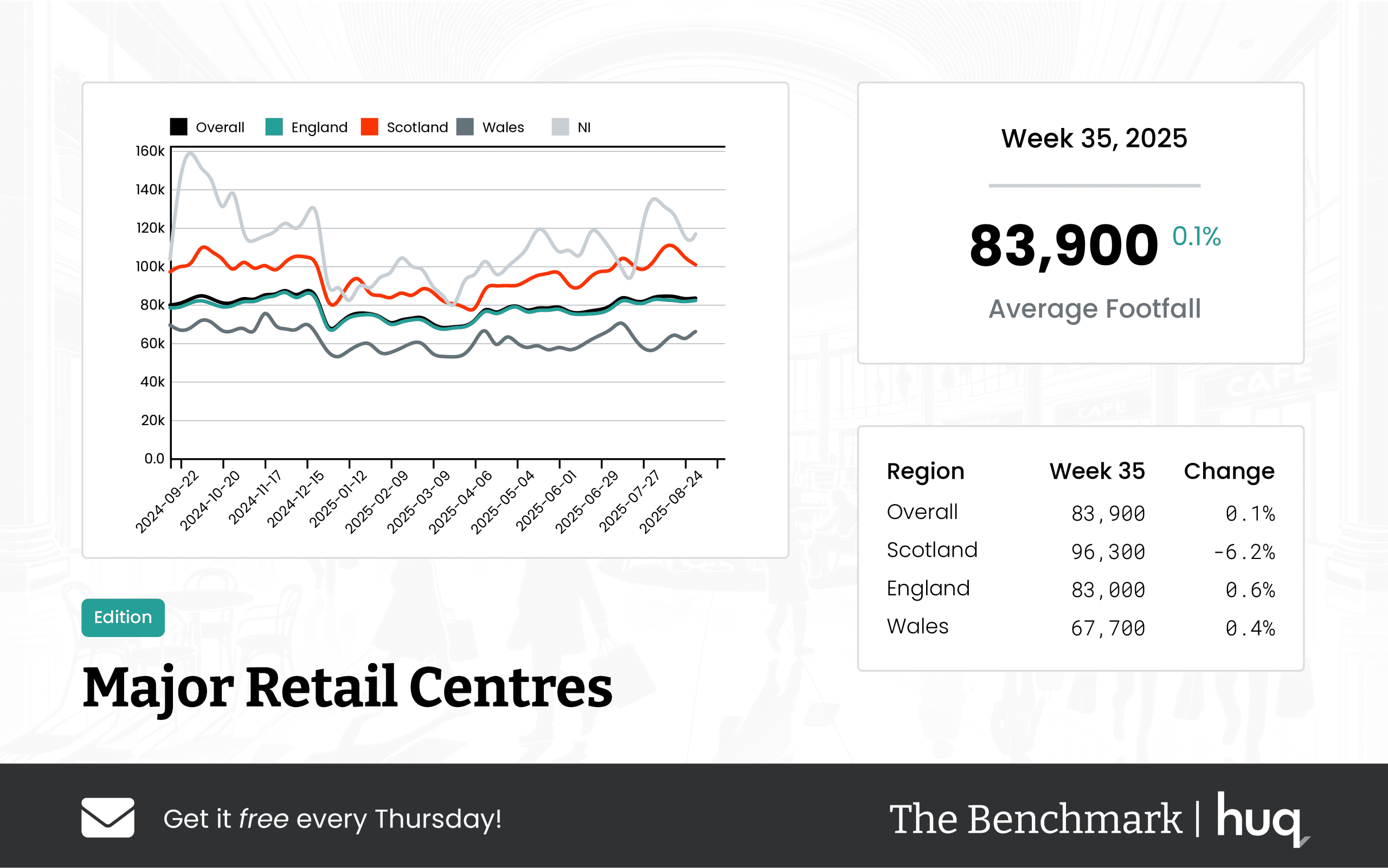

Major Retail Centres

Major retail centres have shown a dynamic performance. In Week 34, these hubs attracted an average of 83,900 daily visitors, with Welsh centres registering a striking 12.4% weekly increase and Scotland achieving high daily numbers despite a slight dip. Another update from Week 34 2025 Major Retail Centres reinforces these trends, while dwell times varied significantly between Scotland, England, and Wales.

Shopping Centres

The latest figures reveal robust performance in UK shopping centres. In the UK Shopping Centres – Week 34 2025, an average of 37,800 daily visits was recorded, with English centres leading at around 40,000 visits each day. Dwell times also differed, as Welsh centres recorded just 52 minutes in contrast to the 105-minute average, underscoring the need for tailored, location intelligence-driven strategies.

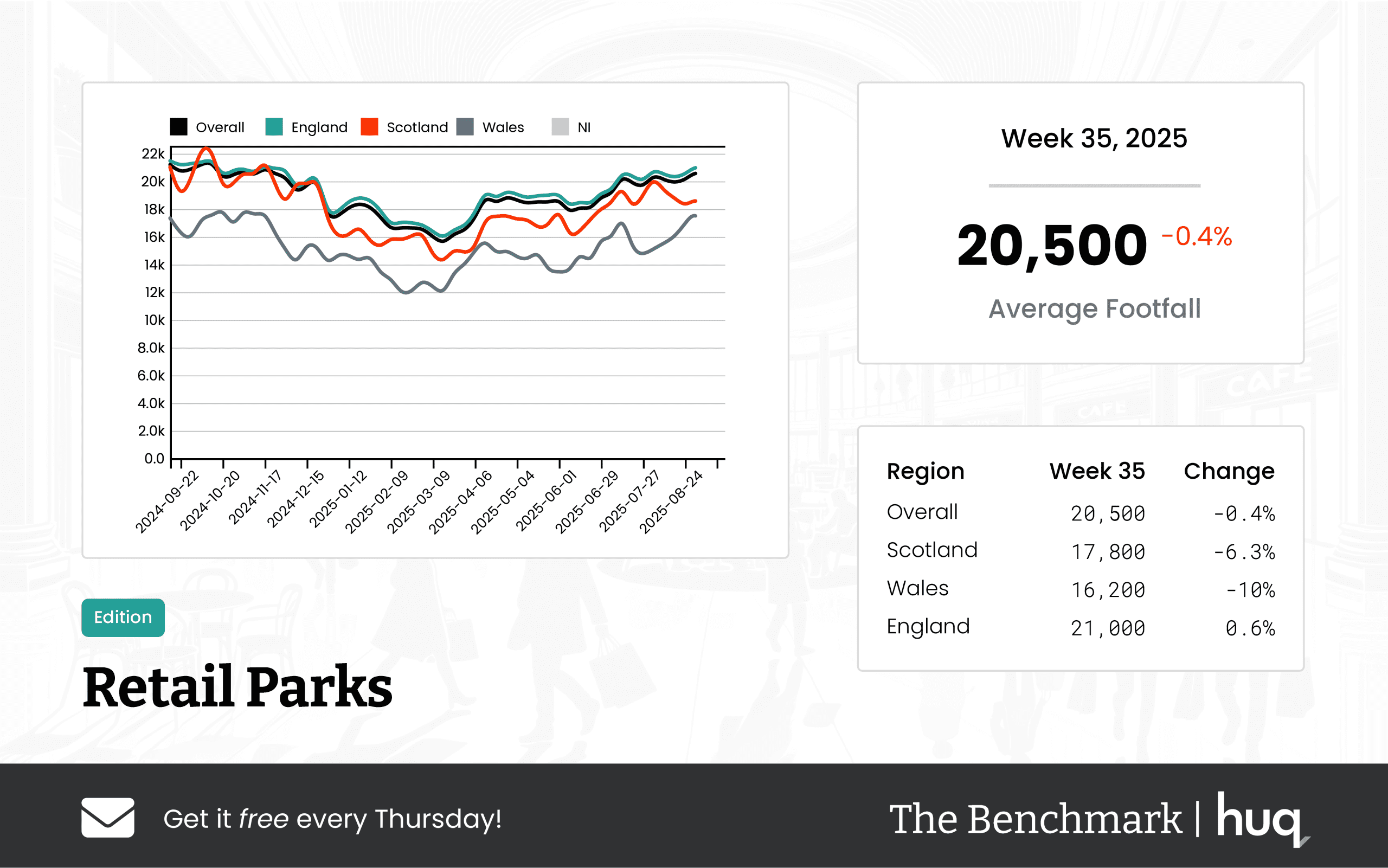

Retail Parks

Retail parks experienced a slightly different trajectory over the past week. Data from Retail Parks – Week 35 2025 indicates a minor decline of 0.4%, with an overall daily footfall of 20,500, though dwell times increased modestly overall. England benefited from an increase in visitor engagement while Scottish and Welsh parks saw declines in numbers. These trends signal that local recovery strategies, informed by precise location analytics, are essential for sustaining growth in this format.

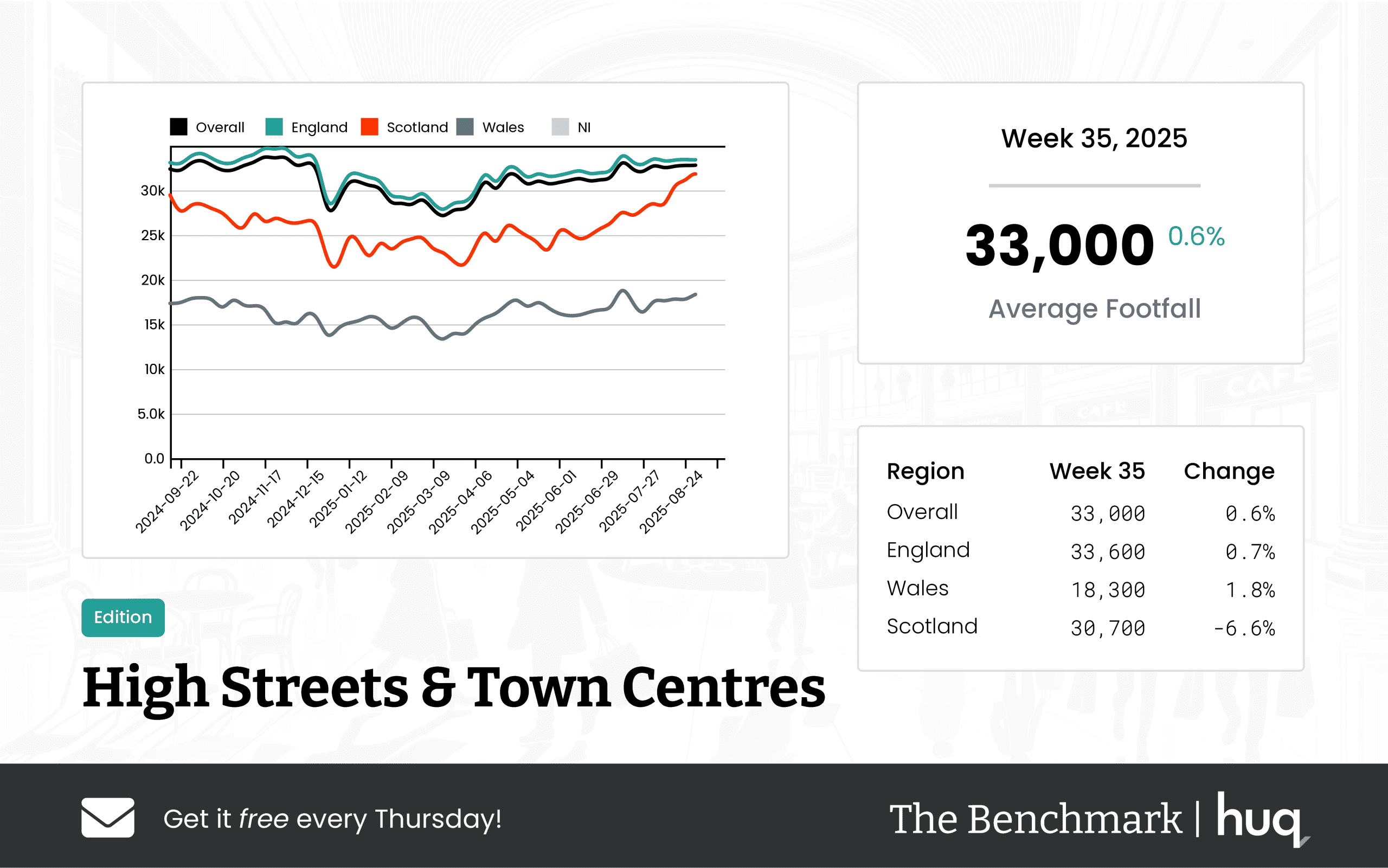

High Streets and Town Centres

Traditional retail hubs are making a steady comeback. In the Week 35 2025 High Streets & Town Centres Update, these areas recorded an average of 33,000 daily visitors, reflecting a 0.6% increase week-on-week and a 2.4% annual rise. English high streets marginally outperformed, while Welsh centres experienced notable weekly gains and Scotland's numbers held steady. Enhanced dwell times averaging 103 minutes suggest that customers are spending more time shopping and engaging in these traditional settings.

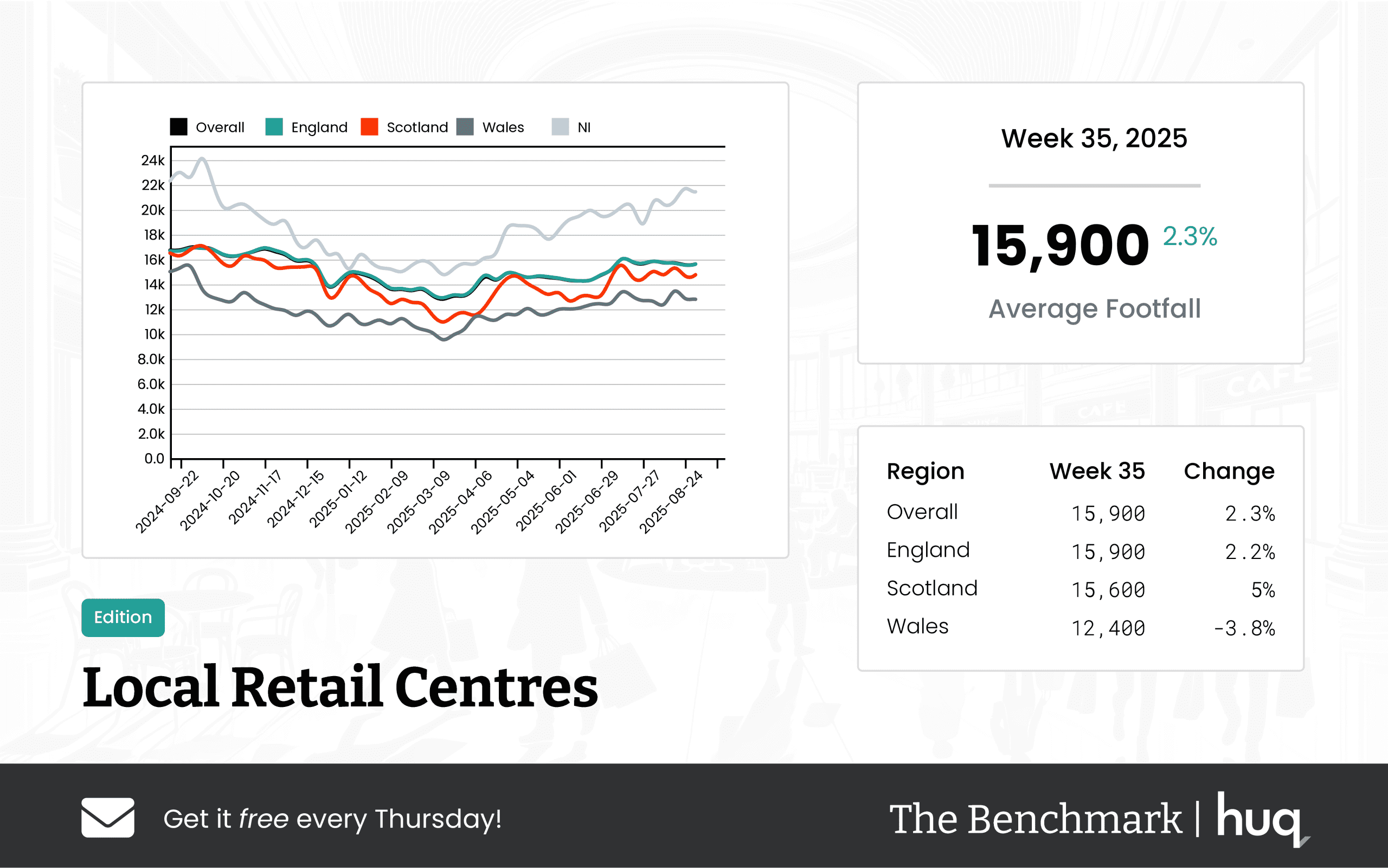

Local Retail Centres

Local retail centres present a mixed picture with short-term rebounds amid longer-term challenges. The Week 35 2025 Local Retail Centres Update recorded an average of 15,900 daily visits, a 2.3% increase over the previous week, though year-on-year numbers remain 5.1% lower. Dwell times improved, reaching an average of 98 minutes, with Welsh centres particularly standing out by posting engagement times of 126 minutes compared to around 99 minutes in England. A further recap in UK Local Retail Centres highlighted these regional disparities once again.

Broader Trends and Context

When viewed collectively, these snapshots illustrate that while footfall may see modest changes, deeper customer engagement is on the rise. The interplay between increased dwell times and static or declining visitor numbers in some areas suggests that shoppers are making more considered choices. Factors such as economic conditions, seasonal weather, and local events continue to shape the retail landscape, and location analytics is proving indispensable for real-time strategy adjustments.

Expert Insights

Joe Capocci, Huq Industries Spokesperson, noted, "The current data highlights how location analytics and location intelligence can drive meaningful insights into consumer behaviour. Despite modest week-on-week footfall changes, the rise in dwell times underlines a robust depth in customer engagement across diverse retail formats." His remarks reinforce the growing reliance on advanced analytics to tailor and optimise retail strategies across the UK.

Strategic Recommendations

Retail managers must adopt a flexible approach based on data-driven insights. With regional differences clearly evident, adapting strategies using both location analytics and location intelligence will be crucial. Retailers can leverage improved dwell times by enhancing in-store experiences, promotions, and comforts that incentivise longer visits, thereby turning challenges into opportunities.

Looking Ahead

This robust data set offers essential clues for retail recovery and growth in changing market conditions. As trends continue to shift, adopting adaptive, location intelligence-driven strategies will enable retailers to counter seasonal slowdowns and capitalise on emerging opportunities. Continuous monitoring will be vital to staying ahead amidst this dynamic backdrop.

Conclusion

The latest weekly data brings mixed yet promising signals across retail centre formats. Enhanced customer engagement, as indicated by increased dwell times, points to a potential shift in consumer behaviour that retailers must harness effectively. Through integrations of location analytics into operational strategies, UK retailers can prepare to meet the challenges and reap the benefits of an evolving market landscape.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 35 2025 Footfall Performance: UK Local Retail Centres Update

Week 35 2025 Footfall Performance: UK Local Retail Centres Update

UK Local Retail Centres experienced a modest 2.3% week-on-week increase in footfall, even as overall visitor numbers show a 5.1% year-on-year decline. Regional variations and dwell time improvements add further complexity to the current retail landscape.

Share on LinkedIn

The latest footfall performance data for UK Local Retail Centres paints a mixed picture. Over Week 35 of 2025, centres recorded an average daily footfall of 15,900—a 2.3% increase on a week-on-week basis—something that could be interpreted as a short-term rebound. However, when compared to the same period last year, there is a 5.1% decline, reflecting ongoing shifts in visitor behaviour and seasonal fluctuations.

Overall Performance

The Benchmark's data highlights the interplay of short-term gains and long-term challenges. While there is evidence of a modest recovery from week-to-week increases, the comparative decline on an annual basis suggests that the retail sector is adjusting to broader market trends and evolving consumer preferences.

Regional Overview

England closely mirrors the national performance with an average of 15,900 visitors per day, a steady week-on-week increase of 2.2%, and a year-on-year decline of 4.9%. Scotland, though slightly lower with an average of 15,600 daily visitors, shows a robust week-on-week rise of 5% despite a comparable annual drop of 5.7%. In contrast, Wales is facing notable challenges. With an average daily footfall of 12,400, the region experienced a 3.8% drop in a single week coupled with a significant 17.8% fall year-over-year. These disparities underline how varied regional economic factors and market dynamics continue to influence retail centre performance.

Dwell Time Performance

The data on visitor dwell time reveals encouraging signs for retailer engagement. Across all centres, visitors now spend an average of 98 minutes on-site—up 3.2% from the previous week and showing a promising 7.7% rise compared to last year. In England, this metric improves further to 99 minutes, with a weekly surge of 4.2% and an 8.8% annual increase. Scotland mirrors this positive movement with a sharp weekly increase of 16.7% and a 12.6% year-on-year gain. Interestingly, although Wales boasts the longest dwell time at 126 minutes, it saw a weekly decrease of 13.7%, even though the annual increase is at 16.7%. This suggests that while visitor engagement remains high in certain regions, short-term factors are influencing time spent within these centres.

Industry Comment

Joe Capocci, Spokesperson for Huq Industries, noted that "the notable decline in Wales’ footfall coupled with the recent retail industry news on fashion-focused events underscores how local dynamics continue to challenge and shape visitor behaviour across the UK." His remarks emphasize that while the data indicate some positive trends in terms of dwell time and short-term footfall gains, localised events and regional economic conditions are playing a critical role in shaping retail centre performance.

Conclusion

Week 35’s footfall performance data reveals both encouraging improvements and significant regional disparities. As local retail centres navigate a complex and evolving market landscape, ongoing analysis of these trends will be crucial for strategic planning and operational adjustments across the UK.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

UK High Streets & Town Centres – Week 35, 2025: A Location Analytics Update

UK High Streets & Town Centres – Week 35, 2025: A Location Analytics Update

Week 35 data shows modest gains on UK high streets & town centres with a 0.6% week-on-week and 2.4% year-on-year rise. Trending location analytics and location intelligence highlight the gradual recovery.

Share on LinkedIn

Overview:

The latest Benchmark report for the week ending September 7, 2025, has revealed a modest uptick in visitor numbers across UK high streets and town centres. The overall average daily footfall reached 33,000—a 0.6% increase from the previous week and a 2.4% boost compared to the same period last year—further underlining the gradual recovery in consumer engagement. Additionally, the average visit duration climbed to 103 minutes, marking a 4% increase over the previous week and a 13.2% rise on a year-on-year basis. The data provides vital insights into evolving consumer trends, showcasing the role of location analytics and location intelligence in this recovery phase.

Regional Analysis:

In England, the daily footfall averaged 33,600, reflecting a 0.7% week-on-week increase and a 1.9% year-on-year uplift, which is indicative of a steady rebound in consumer activity. Wales experienced a pronounced week-on-week rise of 1.8% in daily average footfall, reaching 18,300, with an impressive annual increase of 6.2%—although the average visit duration was slightly lower at 87 minutes. In contrast, while Scotland’s annual footfall surged by 10.4% to average 30,700 visitors, it faced a sharp weekly decline of 6.6% and an average visit duration of 90 minutes. These regional insights highlight how location intelligence provides businesses with key actionable information to understand shifting consumer dynamics.

Industry Comment:

The report has sparked commentary from industry experts, who note the growing importance of location intelligence in tracking consumer patterns and refining operational strategies. Joe Capocci from Huq Industries remarked, "The sharp weekly decline in Scotland’s footfall alongside a modest recovery in Wales, as reflected in recent Retail Industry News, highlights the need for retailers to adapt to evolving visitor behaviours." The findings underscore the continued reliance on location analytics to decipher nuanced trends that can shape future strategies in the retail sector.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

UK Major Retail Centres – Week 35, 2025 Performance Update: Location Analytics in Focus

UK Major Retail Centres – Week 35, 2025 Performance Update: Location Analytics in Focus

UK Major Retail Centres continue steady performance with visitor numbers up by 0.1% and dwell times rising by 5.4%. Discover how location analytics and footfall trends reveal stronger visitor engagement.

Share on LinkedIn

Overall Performance

The Benchmark Tracker data indicates a stable performance across UK Major Retail Centres. The week ending 7 September 2025 saw an average daily footfall of 83,900, reflecting a slight week-on-week rise of 0.1% and a robust year-on-year growth of 5.4%.

In addition to improved visitor numbers, location analytics highlights an enhancement in visit quality. The average duration per visit increased to 118 minutes, representing a 1.7% week-on-week improvement and an 8.3% increase compared to last year. This suggests that shoppers are engaging more deeply with the retail environments.

Regional Highlights

Breaking down the data by region reveals varied dynamics. In Scotland, the average daily footfall amounted to 96,300. Despite a 6.2% decrease from the previous week and a slight year-on-year dip of 0.1%, Scottish visitors recorded an average visit duration of 138 minutes. This significant dwell time improvement reflects a positive shift in shopper behavior.

In England, an average of 83,000 daily visitors was observed along with a modest week-on-week increase of 0.6% and a 6.2% improvement compared to last year. The average visit duration in England was 116 minutes, with week and year-on-year increases of 1.8% and 6.4% respectively. These statistics underline steady regional growth and engagement.

Wales demonstrated an average footfall of 67,700, enjoying a slight week-on-week uptick of 0.4% and a 2.4% year-on-year rise. Although the average dwell time here was recorded at 107 minutes per visit and saw a slight decline from the previous week, the overall trends remain positive.

Industry Commentary

Industry leaders and analysts are paying close attention to these trends. Joe Capocci, spokesperson for Huq Industries, noted that the notable decline in Scottish footfall coincided with fashion-oriented events at Liverpool One, emphasizing the importance of data-driven insights in understanding consumer behavior. Such real-time location analytics are proving crucial for optimizing retail strategies in an evolving market.

Collectively, these findings not only showcase the resilience of UK Major Retail Centres but also shed light on how advanced analytics is enhancing our understanding of consumer engagement across different regions.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

UK Retail Parks – Week 35, 2025 Performance Update: location analytics Insights

UK Retail Parks – Week 35, 2025 Performance Update: location analytics Insights

UK retail parks experienced a slight –0.4% decline in footfall with enhanced dwell times. location analytics and location intelligence highlight overall modest trends and improved customer engagement.

Share on LinkedIn

Overall Performance

The latest figures from The Benchmark indicate that UK retail parks recorded an overall average daily footfall of 20,500 during the week ending 2025-09-07. The data reveals a modest week-on-week decline of –0.4% and a year-on-year decline of –1.8%. Dwell time, a key measure of customer engagement, improved significantly to an average of 72 minutes per visit, rising 2.9% in the current week and 5.9% compared to last year.

Regional Overview

A detailed regional analysis uncovers varied trends across the UK:

• In England, retail parks saw an average daily footfall of 21,000. There was a week-on-week increase of 0.6%, although the year-on-year figure shows a small decline of –0.7%. Notably, dwell times improved to 74 minutes on average—a weekly increase of 1.4% and a remarkable 10.4% year-on-year rise, highlighting robust customer engagement.

• Scotland experienced a notable decline, with average daily footfall dropping to 17,800. This represents a steep decline of 6.3% for the week and a year-on-year fall of –12.1%. Despite a weekly increase in dwell time by 5.2%, the average remains at 61 minutes, trailing behind England's figures.

• In Wales, retail parks recorded an average daily footfall of 16,200. This figure dropped by 10% compared to the previous week and declined by –2.6% compared to last year, indicating mixed performance in the region.

Industry Comment

Joe Capocci, spokesperson for Huq Industries, commented on the trends: "Overall, the data highlights a sharp decline in Scotland’s footfall alongside modest gains in England, aligning with recent retail industry updates." This insight reinforces the importance of location analytics in understanding shifts in customer behavior and adapting to changing market dynamics.

These performance metrics underscore the crucial role of data-driven strategies in nurturing improved customer engagement across the diverse landscapes of UK retail parks.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 34 Weekly Wrap: UK Retail Insights with Location Analytics

Week 34 Weekly Wrap: UK Retail Insights with Location Analytics

Location analytics reveal Welsh retail centres boosted footfall by 12.4% this week, signalling strong UK retail customer engagement.

Share on LinkedIn

This week’s wrap brings together comprehensive data from recent updates that have been monitored using advanced location analytics and location intelligence techniques. Retailers and analysts alike are drawing insights from granular footfall trends and dwell times across the UK. The analysis paints a picture of an evolving market that is both challenging and promising for the UK retail sector.

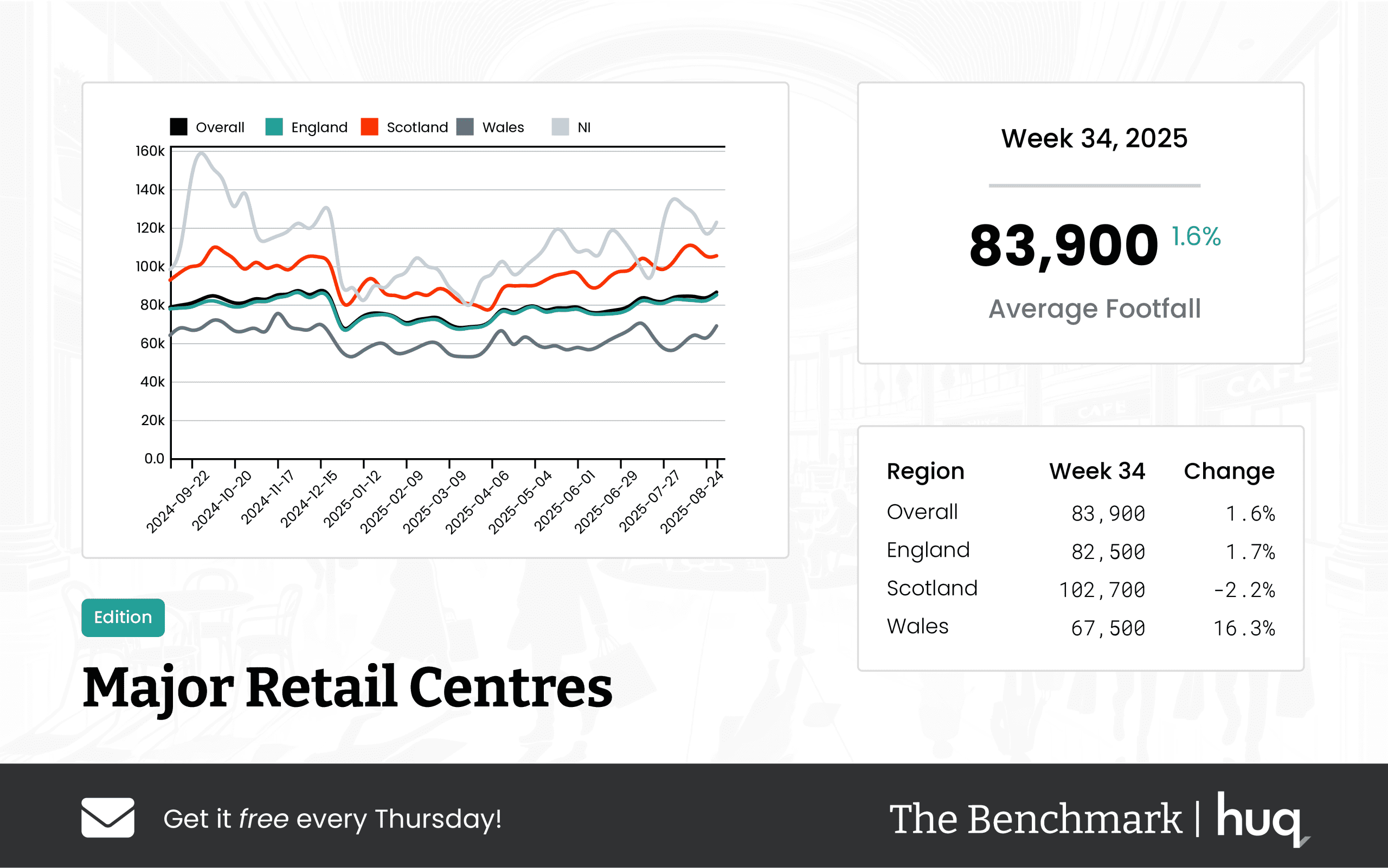

Major Retail Centres

Major retail centres are showing resilient performance with varied regional trends. The latest Week 34 update reported an average of 83,900 daily visitors. In England, centres recorded 82,500 visitors followed by Scottish centres with 102,700 visitors despite a slight decline in week-on-week figures, and Welsh centres boosted footfall by 12.4%, showcasing remarkable growth and higher dwell times.

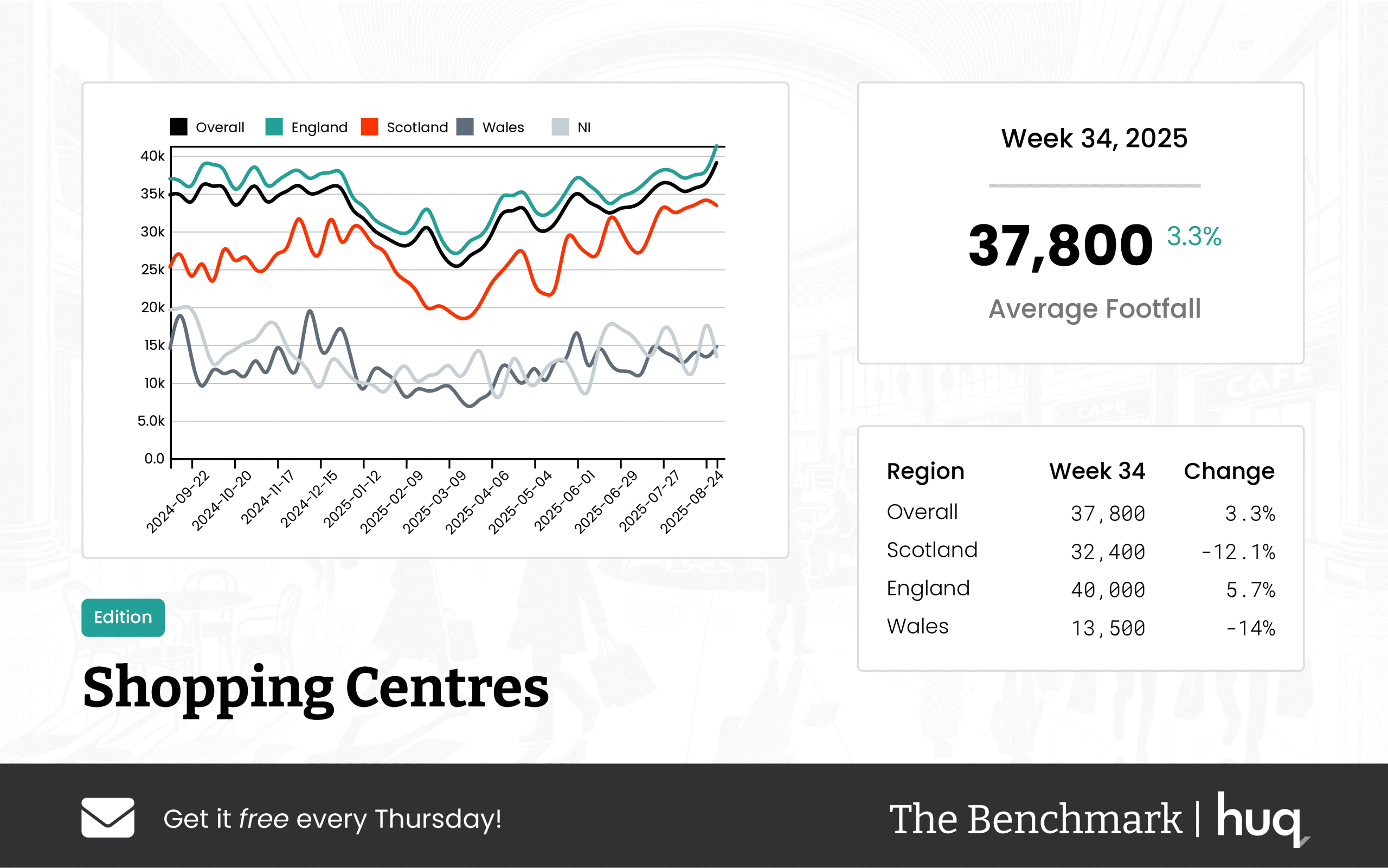

Shopping Centres

UK shopping centres continue to deliver solid performance. The Shopping Centres update for Week 34 recorded an average of 37,800 daily visits and a prolonged dwell time of 105 minutes. English centres led the way with approximately 40,000 visitors while venues in Wales trailed with 13,500 daily visits, demonstrating important differences in customer engagement across regions.

Local Retail Centres

Local retail centres offer a contrasting picture with steady yet regionally distinct trends. In the Week 34 Performance Update, figures showed England averaging 15,800 visits daily, Scotland at 15,000, and Wales with 12,800 visitors, albeit with an overall slight decline. Notably, Welsh centres delivered the highest dwell times at 146 minutes, while other regions showed more modest figures, highlighting evolving patterns of customer behaviour at the local level.

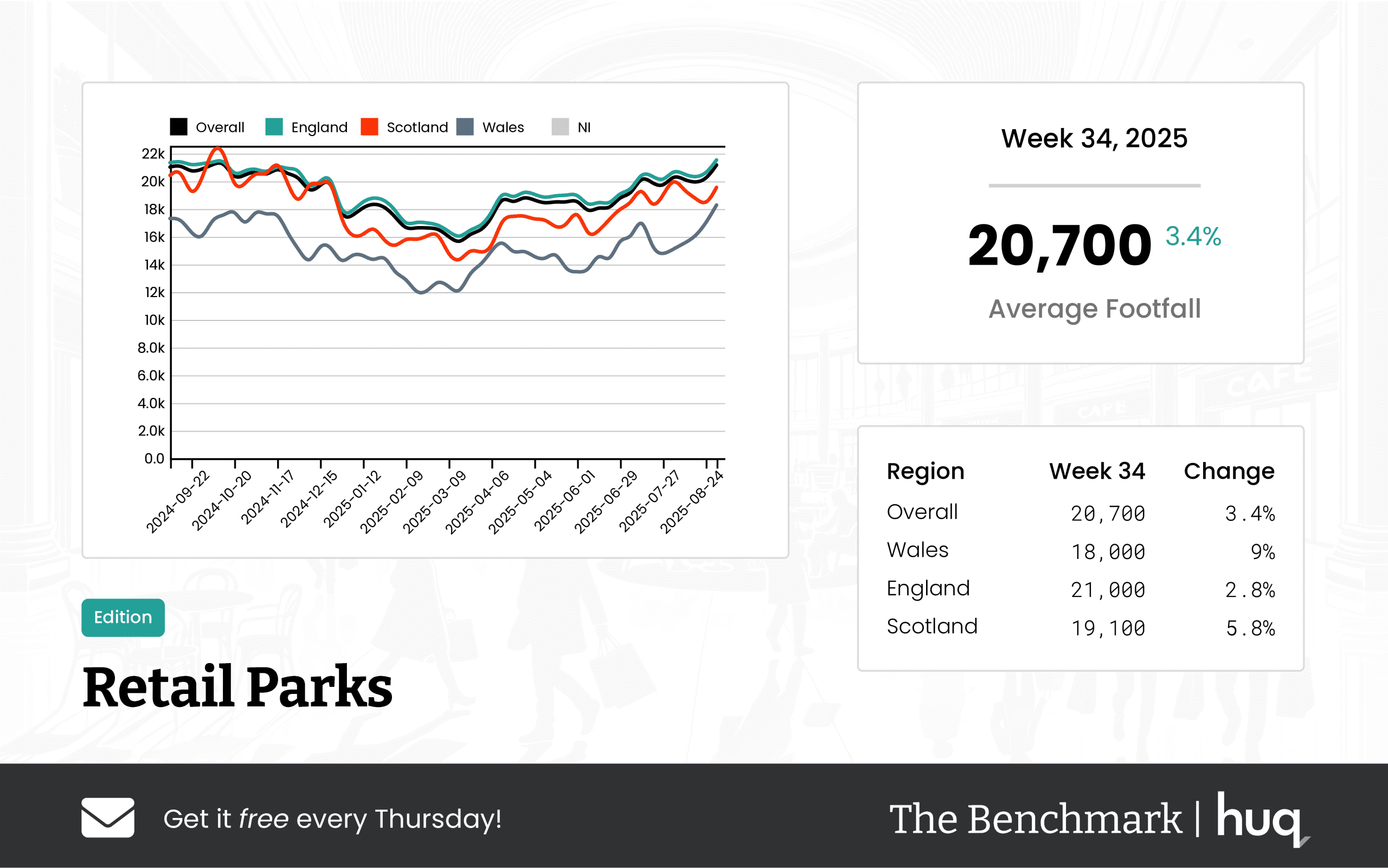

Retail Parks

Retail parks have experienced modest fluctuation in visitor numbers. Detailed findings from the Week 34 update on Retail Parks pointed to an average of around 20,700 daily visitors. Regional breakdown revealed England with 21,000, Scotland with 19,100, and Wales close behind with 18,000 visitors; dwell times varied, underscoring the importance of adapting strategies to maintain customer engagement in different settings.

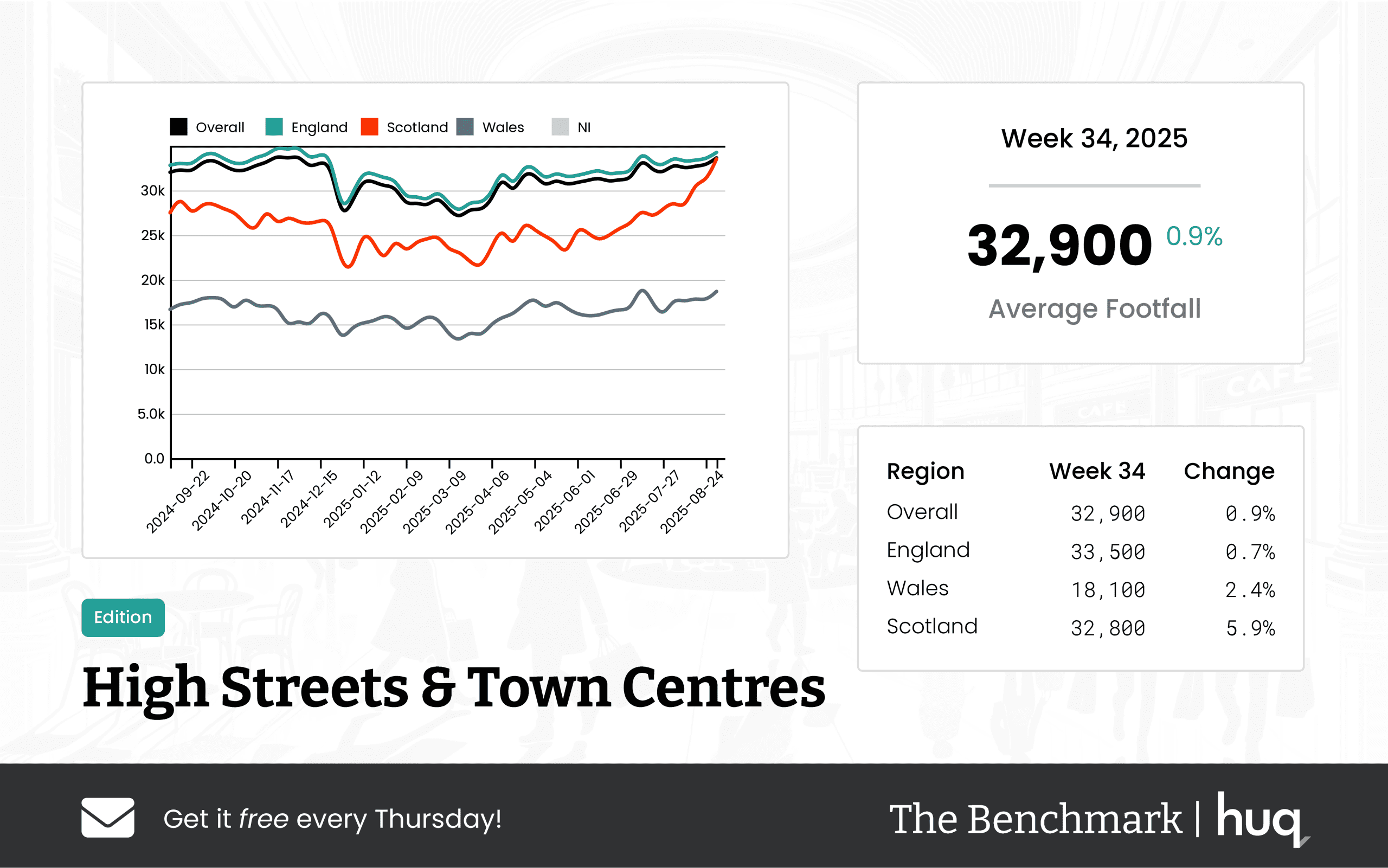

High Streets & Town Centres

High streets and town centres continue to attract a healthy mix of visitors and maintain engaging dwell times. The Week 34 update reported an average daily footfall of 32,900 with English centres recording up to 33,500 visitors. Even though Welsh centres recorded lower figures at 18,100, the overall hover time of around 99 minutes speaks to steady customer engagement in these traditional retail hubs.

Broader Economic and Retail Trends

A close look at these updates suggests that broader economic factors, seasonal weather and emerging retail initiatives such as new store openings play a significant role in shaping outcomes. Joe Capocci, Huq Industries Spokesperson, noted, "Our location analytics tools are proving invaluable in adapting UK retail strategies to meet evolving customer needs, and the subtle shifts in dwell times and footfall serve as a clear signal for future market trends." These trends also underscore the importance of leveraging location intelligence to identify opportunities and mitigate risks in a competitive market.

Strategic Implications and Next Steps

The data collected points to the need for a dynamic approach that tailors retail strategies to both regional characteristics and overall market shifts. Retailers are increasingly using location analytics to pinpoint emerging trends and adjust their tactics in response to changes in consumer engagement and economic factors. Emphasising customer engagement through improved dwell times appears to be key to navigating the current retail landscape.

The insights gathered over these weeks reinforce that maintaining an agile strategy is essential for retailers hoping to capitalise on every opportunity. The detailed location analytics and location intelligence insights are setting the stage for a more adaptive and responsive retail strategy. With granular data becoming ever more critical, UK retail sectors across all formats are well positioned to respond to future shifts in footfall trends and consumer behaviour.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

UK Retail Parks – Week 34 Performance Update, 2025: Location Analytics Insights

UK Retail Parks – Week 34 Performance Update, 2025: Location Analytics Insights

In Week 34 2025, UK retail parks experienced a modest rise in daily footfall with location analytics revealing roughly 20,700 visitors on average and evolving footfall trends amidst softer year‐on‐year performance.

Share on LinkedIn

Share on LinkedIn

The latest figures from The Benchmark show that UK retail parks recorded an average daily footfall of 20,700 during Week 34 of 2025. While these numbers indicate a modest week-on-week increase in the volume of visitors, a deeper dive into the data reveals softer year‐on‐year performance and some shifts in shopper behavior.

Across the country, the main indicator has been the increased visitor numbers. However, market analysts note that while the footfall is up, engagement as measured by dwell time has not kept pace, suggesting that a higher stream of visitors does not necessarily translate into more prolonged visits or deeper engagement with retail offerings.

Regional insights further highlight how performance varies across the UK:

• England: Retail parks here saw an average of 21,000 visitors per day. Although the weekly figures are slightly higher, the subtle decline year‐on‐year points to a stability in visitor flow despite broader challenges in the retail sector.

• Scotland: With an average of 19,100 daily visitors, Scottish retail parks recorded a relatively stronger week‐on‐week improvement. However, the historical context indicates reduced visitor dwell time, meaning shoppers are spending less time on-site.

• Wales: A notable trend in Wales is the significant 18,000 daily visitor count, which represents a sharp weekly rise. The year‐on‐year figures are on an upward trend, though the average visit duration remains at 51 minutes, suggesting a disconnection between footfall growth and prolonged visitor engagement.

Overall, the Week 34 performance update offers a nuanced view of the UK retail park sector. While footfall numbers are seeing a positive bump, the softer dwell time and varied regional performance underline the importance of adapting strategies to sustain both visitor numbers and engagement in a competitive retail landscape.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 34 2025 UK High Streets & Town Centres: Footfall Retail Trends

Week 34 2025 UK High Streets & Town Centres: Footfall Retail Trends

UK High Streets & Town Centres saw modest increases in footfall retail with a steady 32,900 average daily visits. Footfall analytics reveal improvements below 20%, reflecting ongoing consumer engagement.

Share on LinkedIn

Share on LinkedIn

UK High Streets and Town Centres ended the week of 31 August 2025 with consistent visitor numbers and a steady average daily footfall of 32,900. This modest improvement, in line with both week-on-week and year-on-year comparisons, highlights ongoing consumer engagement in an otherwise challenging retail environment.

Regional data underscores diverse trends across the UK. In England, the numbers peaked at an average daily footfall of 33,500, with gradual gains indicating a stable patronage base. Wales, though registering a lower average of 18,100 daily visitors, still showcased a strong recent week-on-week uptick. Scotland, with a daily average of 32,800, emerged as a notable performer, exhibiting both significant week-on-week gains and a robust annual trend.

Visitor engagement remains a key highlight across all regions, with shoppers spending an average of 99 minutes on high streets and town centres. While England consistently holds this engagement time, Wales experienced a dynamic rise to 94 minutes in recent weeks, despite a year-long softening effect. Similarly, Scotland’s average dwell time of 92 minutes, though slightly dipped week-on-week, still reflects an overall modest year-on-year improvement, signaling reliable and evolving footfall patterns.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 34 2025 Major Retail Centres – Location Analytics Performance Update

Week 34 2025 Major Retail Centres – Location Analytics Performance Update

UK Major Retail Centres registered steady week 34 performance with a 1.6% rise in footfall. Robust trends in location analytics and retail trends underpin strong consumer engagement.

Share on LinkedIn

Share on LinkedIn

Overall Footfall Performance

Data from the latest full week monitoring programme shows a strong performance across UK Major Retail Centres. The centres recorded an average daily footfall of 83,900, marking a week‐on‐week increase of 1.6% and a year‐on‐year rise of 5.3%. Such consistent footfall levels highlight enduring consumer engagement, even as niche trends in various regions evolve under the influence of location analytics.

Regional Breakdown

In England, the centres achieved an average daily footfall of 82,500, growing by 1.7% from the previous week and 5.6% compared to last year. However, visit duration in England saw a slight weekly dip of 2.6%, settling at an average of 114 minutes per visit, which nonetheless represents a 4.6% improvement on annual figures.

Scotland’s performance presents an interesting contrast, with centres recording a higher average daily footfall of 102,700. Although there was a modest weekly decline of 2.2%, visitor engagement improved as reflected by an impressive week‐on‐week dwell time gain of 16.2%, with an average visit lasting 136 minutes. Additionally, annual performance figures show a healthy growth of 6.5%.

Welsh retail centres, on the other hand, experienced robust momentum with an average daily footfall of 67,500 and a striking weekly increase of 16.3%, despite an annual growth of only 2.1%. Further, dwell time in Wales rose by 17.4% over the week to an average of 108 minutes, even as the annual figure noted a decline of 15%.

Dwell Time Analysis

Dwell time continues to serve as a valuable indicator of consumer engagement. While England experienced a marginal drop in visitor duration over the week, the increases observed in Scotland and Wales signal a shift in consumer behaviour—spending more time in the retail environment. These emerging patterns reflect the impact of location analytics on understanding and predicting retail consumer trends.

Looking Ahead

The steady performance across these key retail centres suggests that adopting advanced location intelligence tools is paying dividends. As consumer habits continue to shift, retailers and analytics experts must leverage these insights to optimize their strategies for enhanced customer engagement and improved footfall performance across the board.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

UK Shopping Centres – Week 34, 2025 Performance Update with Location Analytics

UK Shopping Centres – Week 34, 2025 Performance Update with Location Analytics

UK shopping centres displayed robust footfall trends in week 34, 2025. Location analytics reveals a 12% rise and demonstrates improved retail industry engagement.

Share on LinkedIn

Share on LinkedIn

For the week ending 2025‑08‑31, Huq Industries’ Benchmark report, based on comprehensive location analytics, indicates that UK shopping centres recorded an average of 37,800 daily visits. This not only marks a modest increase from the previous week but also shows a significant improvement over the same period last year. The data highlights that along with increasing visitation, the average visit duration has extended to 105 minutes, suggesting that consumers are spending more time within the retail spaces, engaging more deeply, and reflecting evolving consumer behavior across the retail landscape.

Examining the regional performance reveals varied trends across the UK. In England, shopping centres have recorded a robust average of 40,000 daily visits paired with increased dwell time, signifying strong visitor sentiment and effective market dynamics. Conversely, centres in Scotland, despite a strong year‑on‑year increase in footfall, showed a decline in the current week’s figures and a slight reduction in visit duration compared to the previous week. Wales, on the other hand, lagged behind with centres averaging just 13,500 daily visits and visitors spending only 52 minutes on average.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.