Week 37 Weekly Wrap: Location Analytics and Retail Centre Trends

Week 37 Weekly Wrap: Location Analytics and Retail Centre Trends

Discover a 5.5% weekly rise in shopping centre footfall as location analytics and location intelligence reveal key retail trends.

Share on LinkedIn

The latest Week 37 Weekly Wrap offers a comprehensive analysis of the performance across diverse UK retail centres. In this update, robust location analytics help uncover dynamic customer behaviour and evolving retail trends. The figures presented shed light on the intricate balance between footfall, dwell times, and regional performance, helping stakeholders make informed decisions.

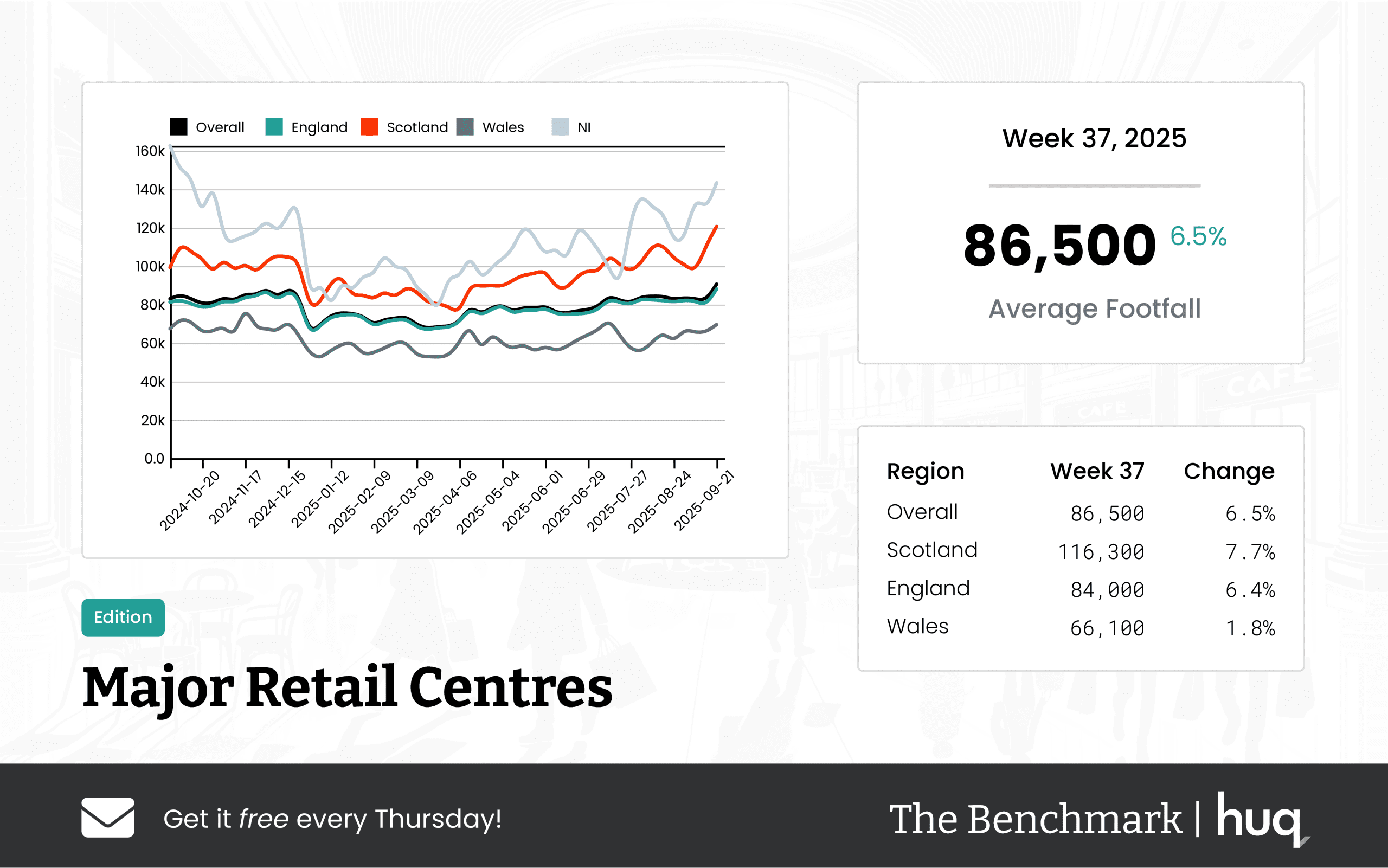

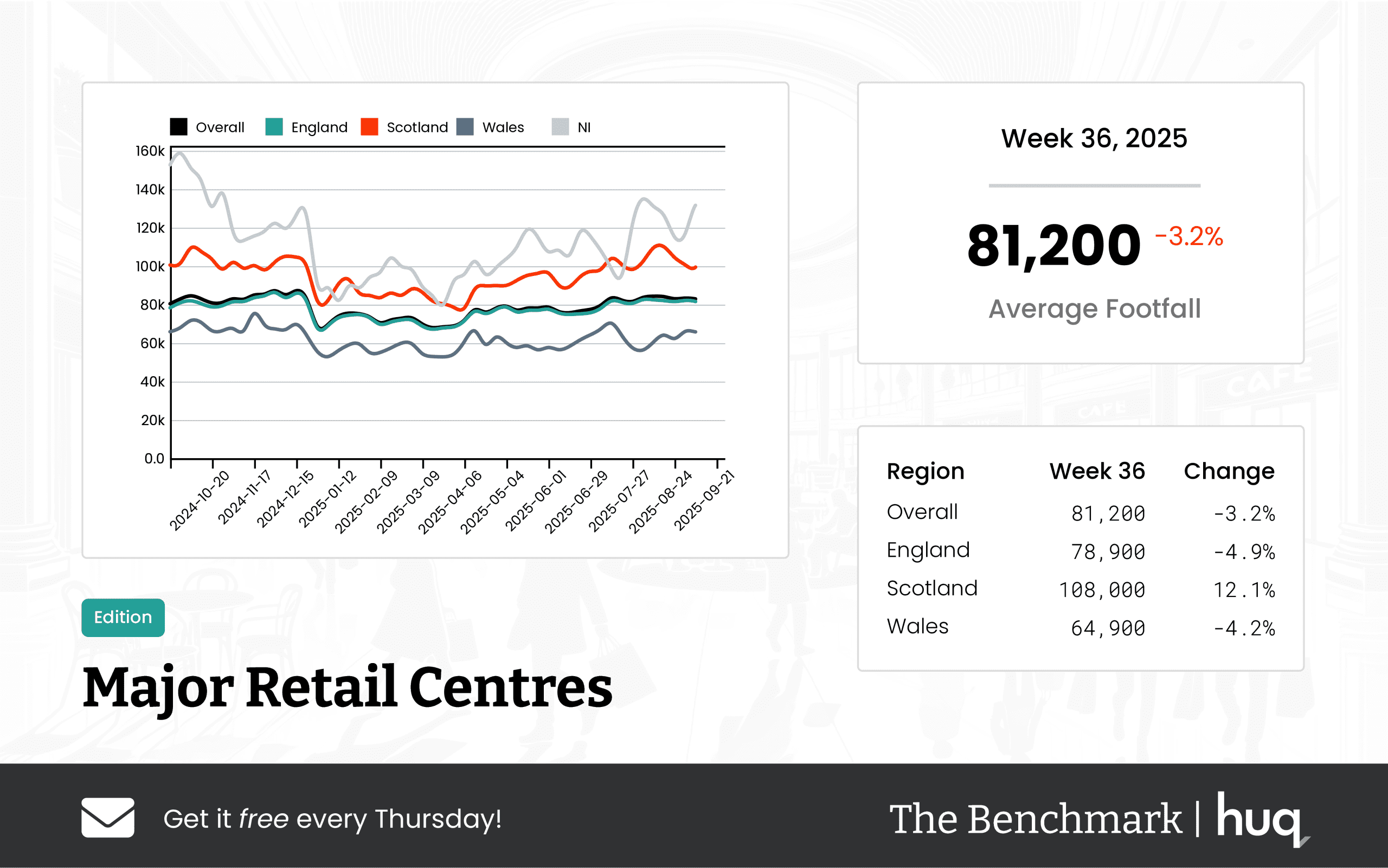

Major Retail Centres

Major retail hubs continue to demonstrate strong resilience despite experiencing slight short‐term dips. Recent data from the Week 36 Weekly Wrap indicates 81,200 daily visitors, a minor drop from Week 35, while dwell times have improved notably. Further insights from the Week 37 2025 Major Retail Centres Update reveal nearly 87,000 visitors daily, with Scotland outperforming other regions, showcasing the importance of detailed footfall data in understanding retail trends.

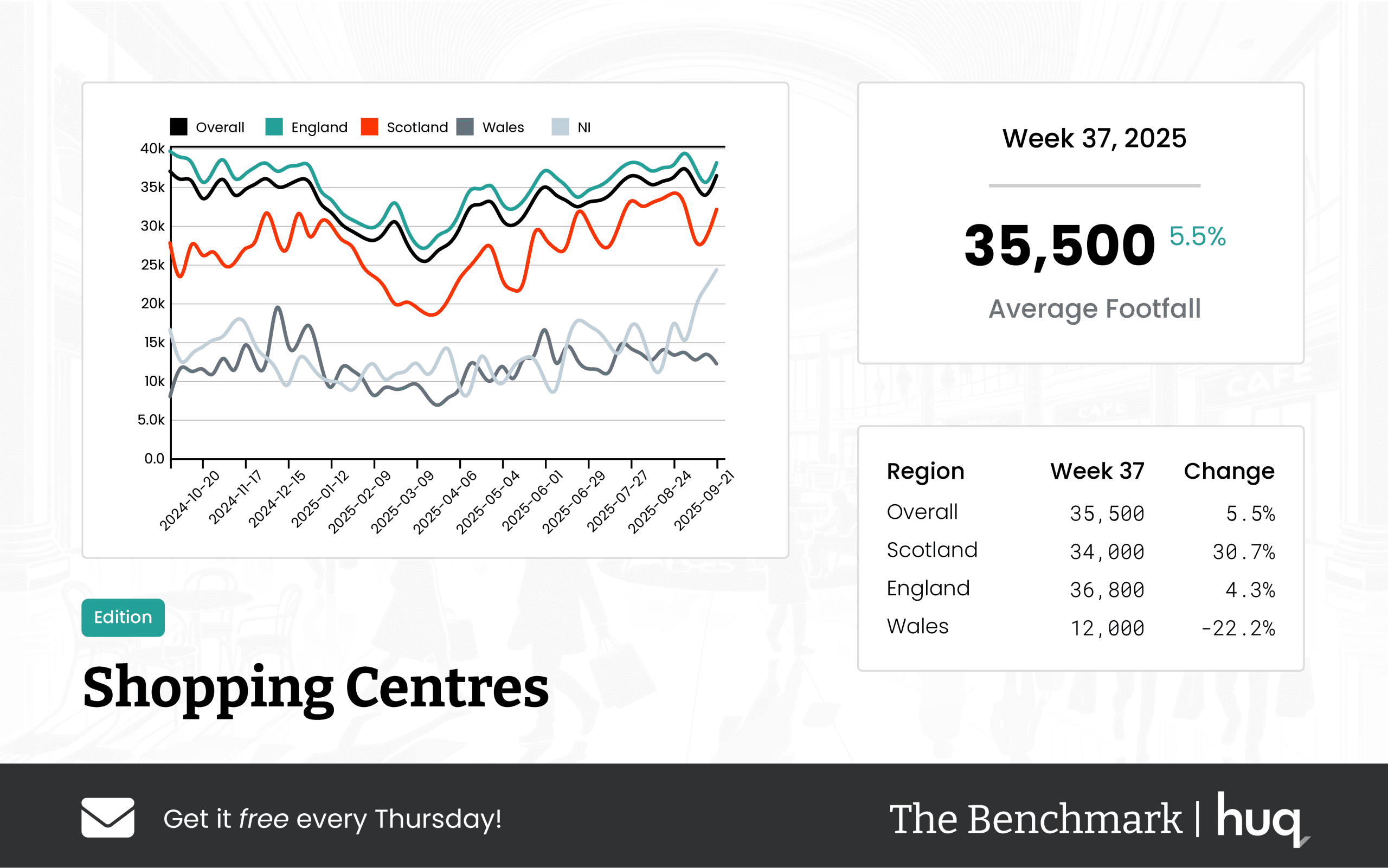

Shopping Centres

The UK shopping centres are slowly recovering, as reflected by a steady rise in visitor numbers and engagement. According to the Week 37 2025 Shopping Centres Footfall Update, centres achieved an average of 35,500 daily visitors, marking a 5.5% weekly uplift along with a 2.1% year-on-year increase. This data is central to modern location intelligence, providing valuable indications that customer engagement is paying dividends in improved dwell times and overall retail performance.

Retail Parks

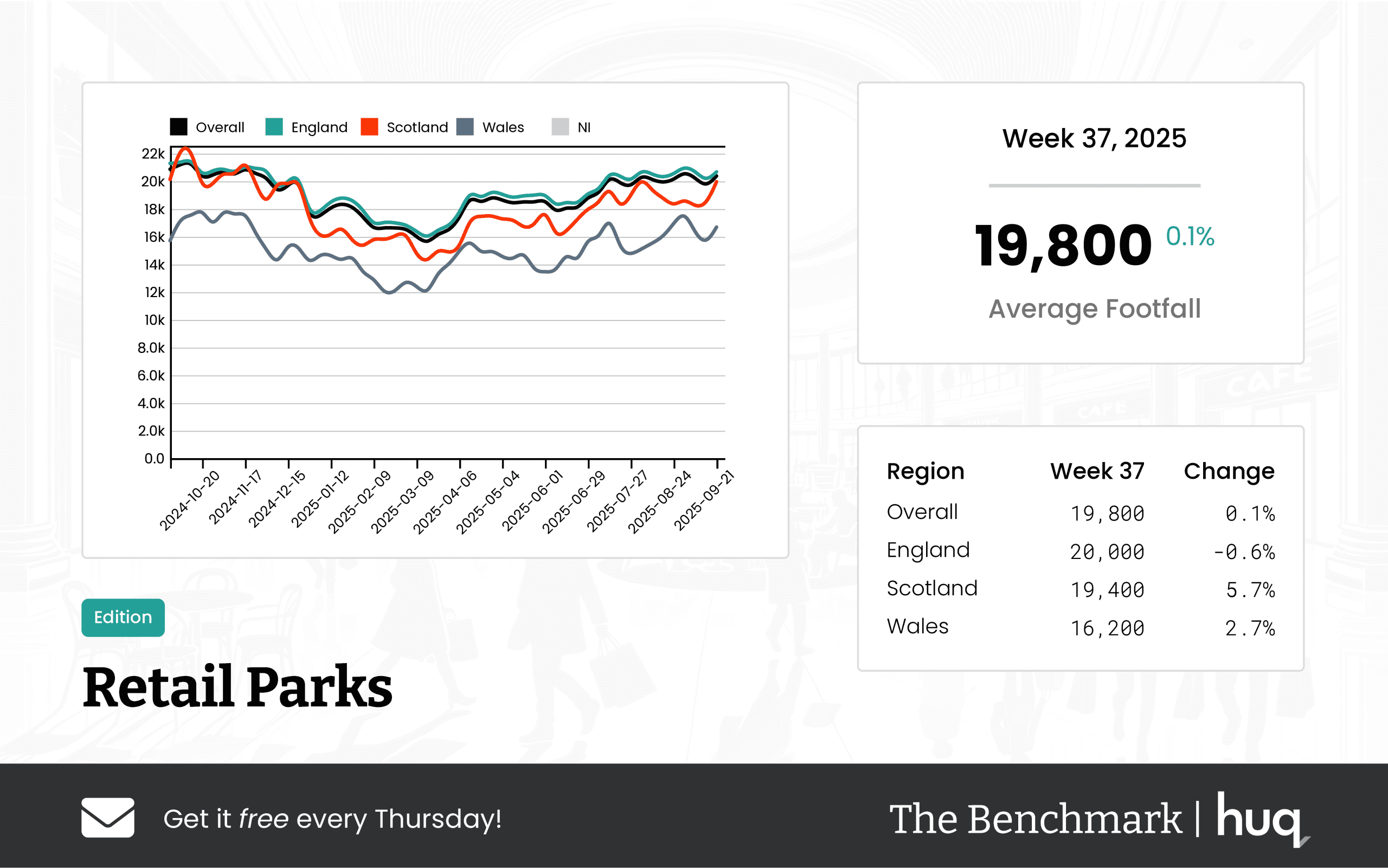

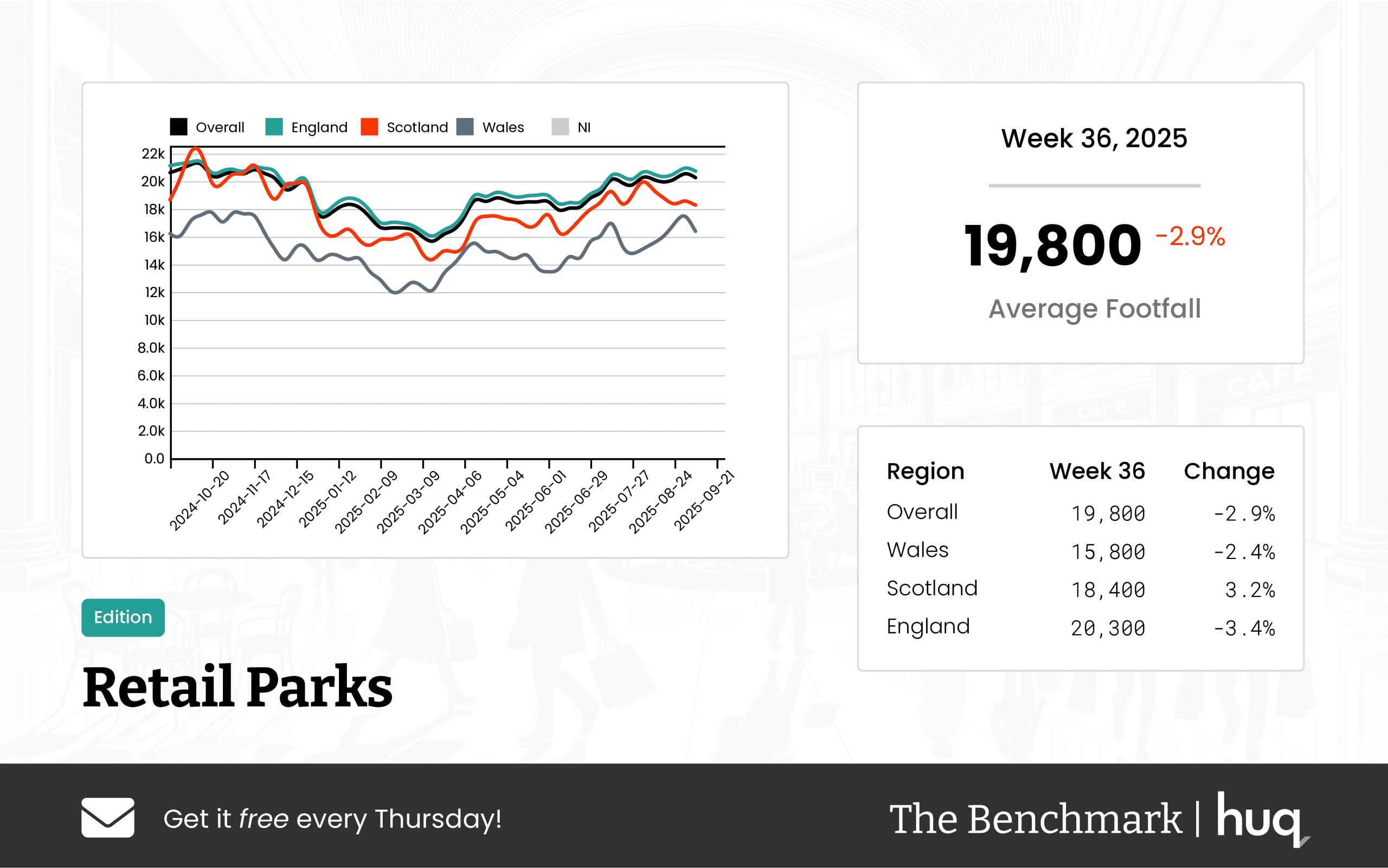

Next, retail parks present a more nuanced picture with relatively stable footfall figures and marked regional variations. The Week 37 2025 Retail Parks Update reports an average of 19,800 daily visitors, showing a slight weekly increase despite a 5.1% annual decline. Regional differences are significant with Scotland exhibiting a 5.7% weekly increase, while England and Wales experience moderate fluctuations, highlighting the importance of regular footfall data evaluations across regions.

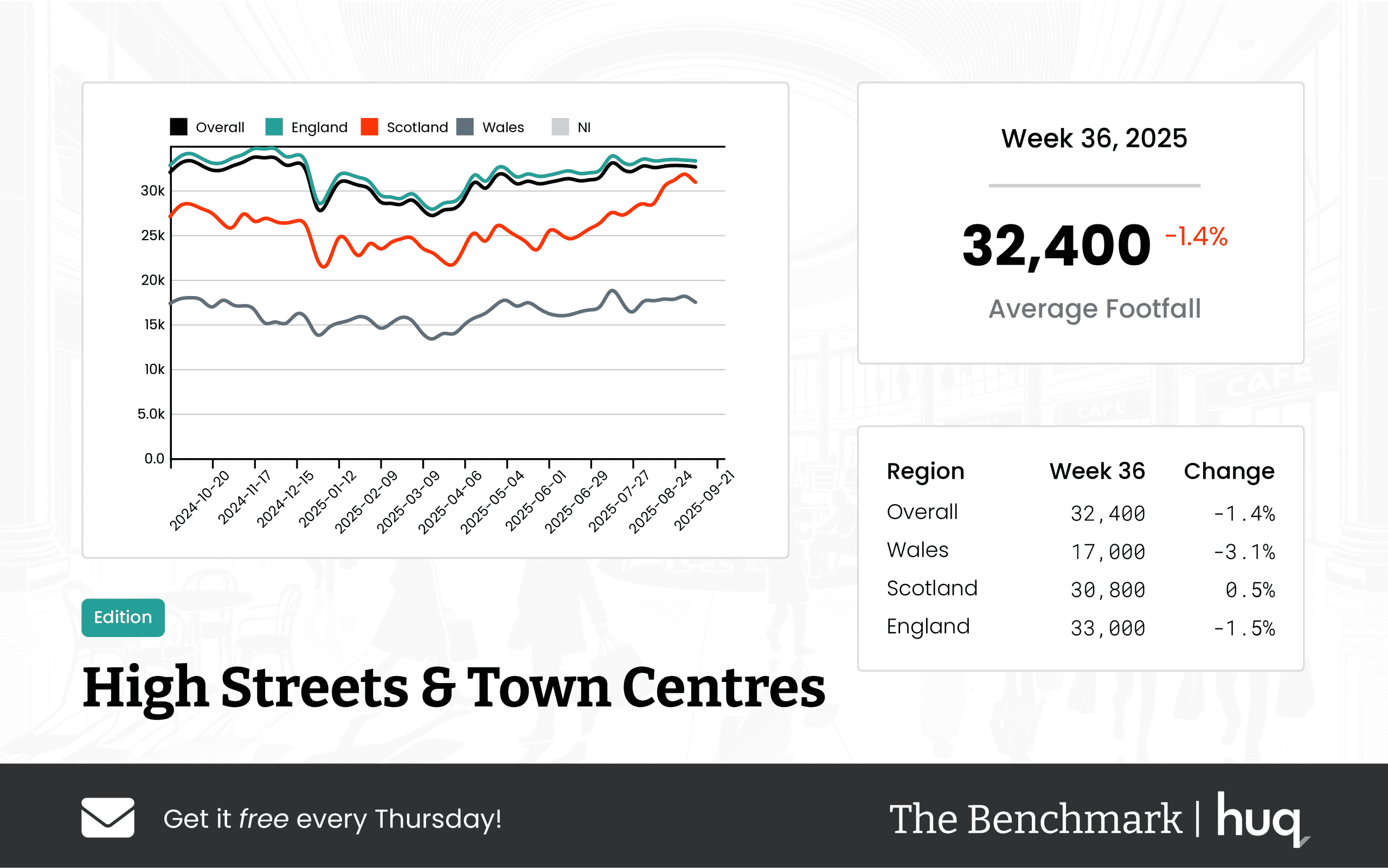

High Streets and Town Centres

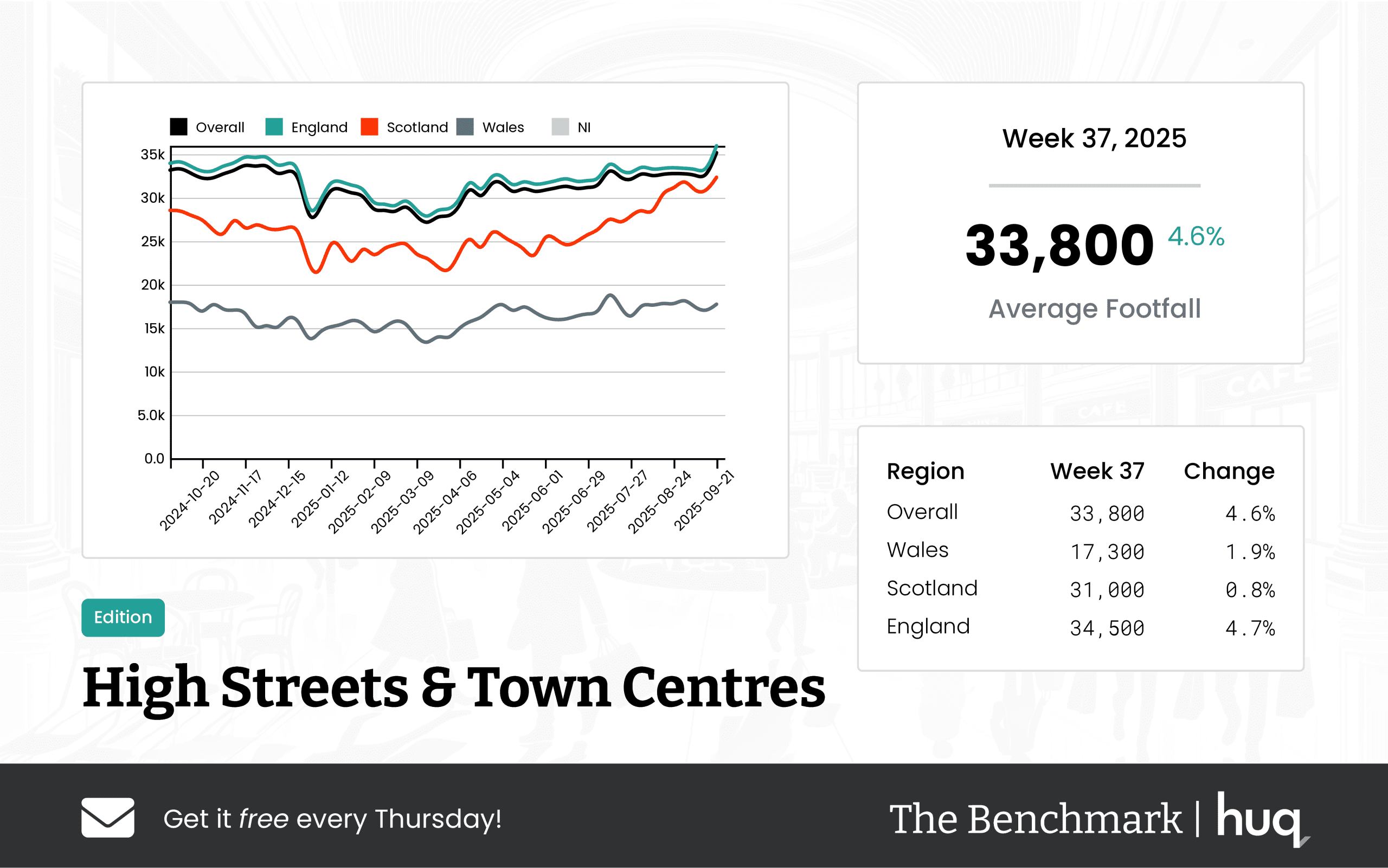

High streets and town centres are slowly regaining momentum with a healthy mix of increases in both footfall and dwell time. The Week 37 2025 High Streets & Town Centres Update notes an average of 33,800 visitors daily and a 4.6% weekly growth, though slight regional disparities persist. Detailed observations in this format underscore how location intelligence combined with traditional retail trends can guide future improvements in visitor engagement.

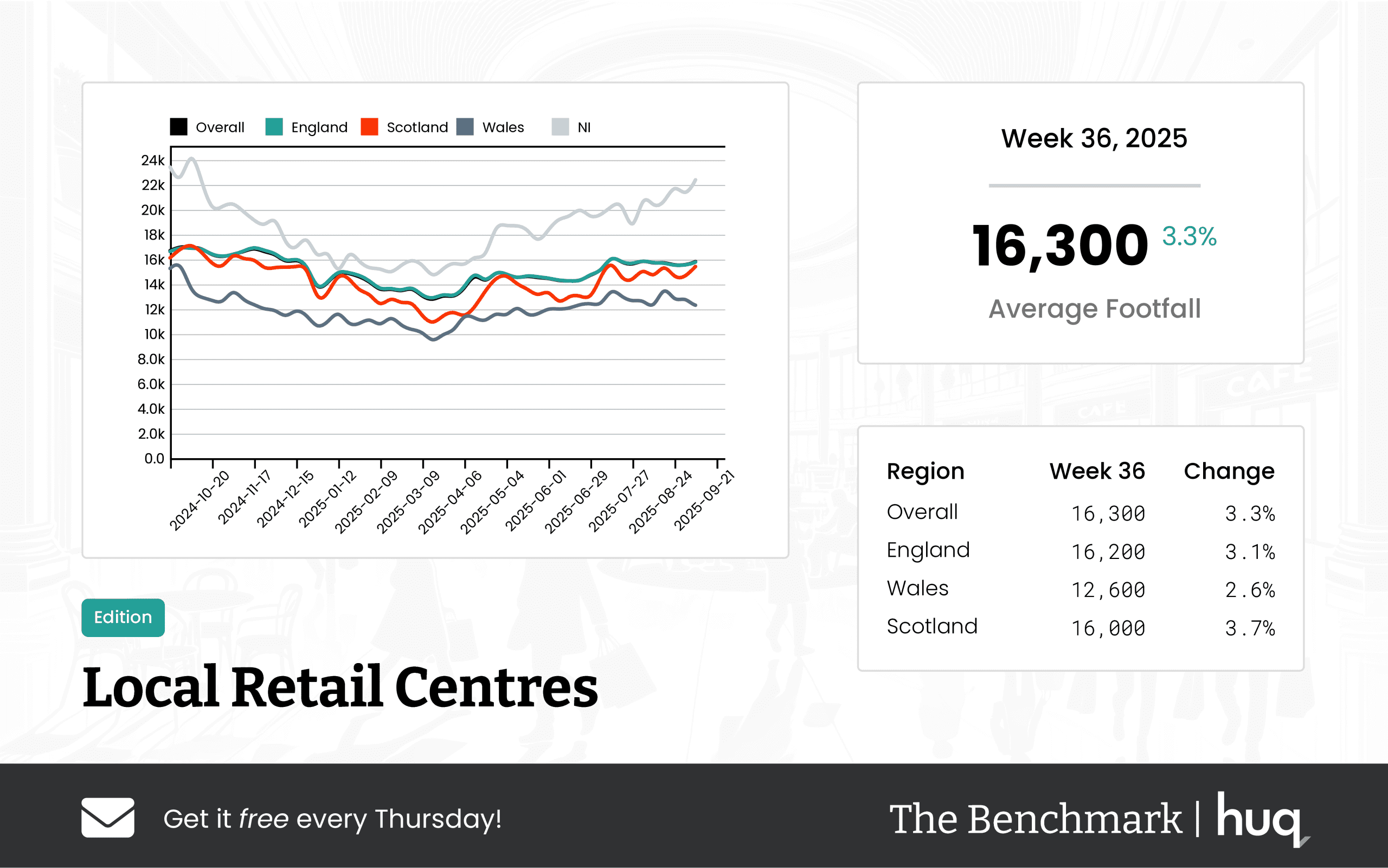

Local Retail Centres

Local retail centres continue to show mixed performance across regions. The Week 36 2025 Local Retail Centres Update reported an average of 16,300 daily visitors and dwell times around 101 minutes, with England and Scotland faring better than Wales. This format exemplifies the challenges and opportunities in smaller retail environments, and refined location analytics plays a crucial role in optimising these spaces to respond to customer needs better.

Industry Insight and Expert Comment

Joe Capocci, Huq Industries Spokesperson, noted, "The varied performance across retail formats demonstrates the critical role that location analytics plays in understanding customer behaviour. Continuous monitoring with sophisticated location intelligence enables retailers to adapt their strategies in real-time." His perspective reinforces the value of integrating detailed data across major, shopping, park, high street, and local retail formats in fostering regional tailored approaches. This sentiment is echoed by industry experts who emphasise the benefits of granular footfall data and enhanced visitor engagement metrics.

Looking Ahead

Retail trends indicate that while major squares experience high footfall, different formats are at various stages of recovery. Consistent improvements in dwell times across several regions offer a hopeful outlook, with an emphasis on optimising strategies using refined location analytics and location intelligence. As the market adapts to new consumer patterns, UK retail centres continue to balance digital innovations with on-ground experiences in a competitive environment.

The analysis provides clear guidance for retailers aiming to refine their practices. As detailed performance metrics become more accessible, adapting to regional differences is increasingly necessary in challenging market conditions. Readers should note that even minor percentage shifts, such as the 5.5% weekly rise at shopping centres, can have substantial implications for future planning.

Additional observations suggest that UK retail centres remain dynamic and responsive to shifting consumer expectations. Retail operators are encouraged to monitor emerging trends closely and utilise comprehensive location analytics to better understand footfall data. This strategy is essential for maintaining competitive advantage in an evolving retail landscape.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

UK High Streets & Town Centres – Week 37 Update 2025: Insights from location analytics

UK High Streets & Town Centres – Week 37 Update 2025: Insights from location analytics

Week 37 shows overall footfall up about 5% with visitors spending 106 minutes. Strengthened consumer confidence and a robust retail strategy, paired with location analytics insights, drive positive trends.

Share on LinkedIn

Overall Footfall Performance

The Benchmark’s latest results reveal an upward trend across UK High Streets and Town Centres during Week 37. Analysis using location analytics confirms these emerging patterns and strengthens footfall performance insights. The overall average daily footfall reached 33,800, reflecting a 4.6% increase from last week and a 4.9% uplift compared to the corresponding period last year.

Regional Breakdown

A closer look across regions shows varying performance. In England, daily footfall averaged 34,500, demonstrating consistent progress with both week-on-week and year-on-year changes of 4.7%.

Scotland recorded an average of 31,000 daily visitors, with modest week-on-week progress at 0.8% and a notably sharp annual increase of 11.7%. Conversely, Wales experienced milder gains, recording an average of 17,300 visitors with week-on-week improvements of 1.9% while its year-on-year change remained at 0.2%.

Dwell Time Trends

Dwell time metrics reinforce the overall upward trajectory in visitor engagement. Overall, visitors are spending an average of 106 minutes per visit, marking a 5% rise from the previous week and a 16.5% gain over the last year. In England, the average dwell time remains at 106 minutes, mirroring the national improvements.

In Scotland, visitors are spending 98 minutes on site, bolstered by a week-on-week increase of 14% and a 12.6% uplift from last year. In contrast, Wales shows a weakening trend, with the average duration falling to 98 minutes accompanied by declines of 2% week-on-week and 13.3% year-on-year.

Industry Comment

Joe Capocci, Huq Industries Spokesperson, commented: “The sharp increase in Scotland’s annual footfall and the supportive retail industry news underline today's encouraging trends in consumer engagement.”

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 37 2025 Major Retail Centres Update: Robust Footfall and location analytics Insights

Week 37 2025 Major Retail Centres Update: Robust Footfall and location analytics Insights

UK Major Retail Centres recorded nearly 87,000 daily visitors with a 122-minute average visit. Robust trends, bolstered by location analytics and location intelligence, underscore overall gains.

Share on LinkedIn

UK Major Retail Centres continue to demonstrate strong performance in Week 37, with nearly 87,000 visitors recorded on an average day. Advanced location analytics and intelligence are confirming a steady upward trend, as evidenced by this week’s figures which show substantial week‐on‐week and annual gains in consumer engagement. The average visit duration has also increased to 122 minutes, signaling that shoppers are spending more time at these key locations.

Regional performance reveals nuanced consumer behaviors across the UK. In Scotland, the average daily footfall is around 116,300, driven by both a clear week‐on‐week rise and a significant year‐on‐year improvement. Although the average visit duration in Scotland has softened slightly on a weekly basis, it still remains higher than the levels recorded last year, underscoring robust performance.

In contrast, England's Major Retail Centres have maintained solid performance with approximately 84,000 daily visitors. Both short-term and annual figures suggest consistent gains, highlighting steady consumer engagement.

The situation in Wales is more challenging. With a daily average of around 66,100 visitors, the region has seen only marginal weekly change and virtually no annual growth. The lower average dwell time of 97 minutes, coupled with a notable annual decline, suggests that maintaining prolonged visitor engagement could be an ongoing challenge for Welsh retail centres.

Industry commentary from Joe Capocci, spokesperson for Huq Industries, underlines the diverse consumer behaviors across regions. He noted, "Scotland’s sharp increase in overall footfall, especially in the context of recent retail industry news, underscores the dynamic yet varied consumer behaviours currently shaping the UK retail landscape." This comment captures the essence of an evolving retail environment where data-driven insights are increasingly vital to understanding market trends and consumer patterns.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 37 2025 Shopping Centres Footfall Update

Week 37 2025 Shopping Centres Footfall Update

UK shopping centres show a steady recovery with a modest 5.5% weekly rise in footfall and robust footfall analytics that reflect gradual improvements.

Share on LinkedIn

UK shopping centres are displaying encouraging signs of recovery as evidenced by the latest data from The Benchmark Tracker. The centres have recorded an average daily footfall of 35,500 visitors, marking a modest 5.5% weekly increase and a year-on-year rise of 2.1%. This steady progress underlines a cautiously optimistic retail climate with traders and analysts noting that consumer activity is gradually picking up.

A close look at regional performance further highlights the nuances of this recovery. In England, shopping centres enjoyed an average of 36,800 visitors per day. The region experienced a modest week-on-week growth of 4.3%, while year-on-year changes remain almost flat at -0.1%. Notably, visitor engagement in England is on the upswing with an increased average dwell time of 112 minutes, showing a weekly improvement of 19.1% and a robust annual gain.

Scotland, on the other hand, is witnessing a sharp surge in footfall, with centres attracting an average of 34,000 visitors daily. However, a slight decline in average visit duration suggests that while more people are visiting, the time spent per visit has decreased. Conversely, shopping centres in Wales continue to face headwinds. With an average daily footfall of just 12,000 and a significant year-on-year decline of 16.2%, Welsh centres recorded a shorter visitor dwell time of 58 minutes, compounded by further weekly and annual reductions.

In industry commentary, Joe Capocci, spokesperson for Huq Industries, remarked, "The sharp increase in Scottish footfall, as reflected in our latest results alongside retail moves such as Jo Malone’s upcoming opening at Silverburn, confirms evolving consumer engagement across key markets." This statement underscores the role of both consumer trends and strategic retail initiatives in shaping the current market landscape.

Overall, these updates provide critical insights to retailers, urban planners, and investors alike, affirming that while the recovery is steady, regional variations necessitate tailored strategies. The importance of detailed footfall analytics in directing these strategies cannot be overstated as centres adjust to evolving consumer behaviours and market conditions.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

UK Retail Parks – Week 37 (2025) Footfall Retail Performance Update

UK Retail Parks – Week 37 (2025) Footfall Retail Performance Update

Week 37 retail data shows overall stable footfall with a modest week-on-week increase of 0.1%, despite a small year-on-year decline. Recent footfall analytics reflect consistent visitor patterns in UK retail parks.

Share on LinkedIn

In the latest weekly update, UK retail parks have maintained a broadly stable trend in footfall, with the overall average daily visitation for the week recording 19,800. This comes alongside a modest week-on-week boost of 0.1%, even though comparisons with the same week last year indicate a decline of 5.1%. Such detailed analytics enable retailers to fine-tune operations and marketing strategies to meet evolving visitor patterns.

Breaking the data down regionally reveals nuanced performance trends. England leads the pack with the highest daily footfall at 20,000. However, this region experienced a slight week-on-week decrease of 0.6% and a year-on-year drop of 5.4%. Meanwhile, Scotland’s retail parks have shown promising signals with a robust week-on-week gain of 5.7%. Although Scotland's year-on-year figures have fallen by 3.9%, the recent uptick points to emerging positive trends in the market. Similarly, Wales posted a healthy week-on-week increase of 2.7%, reaching an average daily footfall of 16,200, despite a 2.5% fall over the same period last year.

Dwell time metrics further enrich the insights from this data set. Overall, visitors spent an average of 82 minutes per visit, supported by a significant week-on-week increase of 13.9%. In England, visitor engagement appears slightly higher, with average visit durations clocking in at 84 minutes and an impressive 18.3% bump over the previous week. In contrast, Scotland saw its average duration at 74 minutes, experiencing a minor decline from the week before, while Wales registered 71 minutes with a modest week-on-week gain.

Retail professionals can take a proactive approach by leveraging these detailed footfall analytics alongside improved counting technologies. Insights derived from both overall and regional statistics offer a refined perspective on visitor behavior, helping stakeholders adapt to both short-term fluctuations and long-term trends.

Commenting on the findings, Joe Capocci, spokesperson for Huq Industries, noted, "Scotland’s sharp increase in week-on-week footfall, alongside retail industry developments such as The Range creating jobs ahead of the Enniskillen store opening, highlights significant emerging trends that could shape future strategies." This optimistic outlook is driving further investments and operational adjustments across the UK retail landscape.

As retail parks continue to evolve in response to dynamic consumer behaviors, industry insiders will be closely monitoring these trends to optimize performance and better cater to the needs of modern shoppers.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 36 Weekly Wrap: Footfall Retail Trends Uncovered

Week 36 Weekly Wrap: Footfall Retail Trends Uncovered

Discover UK footfall trends with footfall data insights, including a modest 5.4% annual rise. Dive into the Weekly Wrap.

Share on LinkedIn

Introduction to UK Footfall Trends

UK retail spaces are witnessing dynamic changes with footfall consistently shaping customer engagement. Recent reports highlight intriguing shifts in footfall, footfall data and footfall retail patterns across various centre types. With subtle yet promising changes reported in annual and weekly figures, retailers continue to monitor footfall analytics closely to decode consumer behaviour.

Major Retail Centres Performance

Major Retail Centres are recording mixed outcomes this week. As seen in the Week 35 update, the average visitor count reached 83,900 with a modest 0.1% week-on-week rise and an annual increase of 5.4%, while dwell times improved notably. The Week 36 update further reported 81,200 visitors; a slight dip compared to last week but still enjoying improved customer engagement, suggesting that regional dynamics are influencing footfall statistics in significant ways.

Insights from Shopping Centres

Shopping Centres continue to impress with consistent performance. Data from the Week 34 Weekly Wrap recorded an average of 37,800 daily visits and prolonged engagement of 105 minutes. This steady stream solidifies the importance of real-time footfall counting and offers clear insights into customer loyalty and in-store experiences across various regional markets.

Retail Parks Developments

Retail Parks are experiencing varied performance, reflecting both caution and opportunity. The Week 35 update on Retail Parks reported 20,500 daily visitors with a minor weekly decline, while the dwell time rose to 72 minutes. The Week 36 update presented a slight further drop in visitor numbers yet maintained increased engagement levels, highlighting that footfall analytics continue to be central in gauging retail performance.

High Streets & Town Centres Revival

High Streets and Town Centres are showing a promising recovery with modest increments in both footfall and dwell times. As detailed in the Week 35 update, the average daily visitor count reached 33,000 with dwell time climbing to 103 minutes. In the Week 36 update, a slight dip in numbers was accompanied by a balance in engagement metrics, underpinning the role of consistent footfall retail monitoring in these vibrant areas.

Local Retail Centres at a Crossroads

Local Retail Centres are displaying mixed signals in terms of visitor counts and engagement. According to the Week 35 update, daily footfall averaged 15,900 and dwell time slightly improved, despite a year-on-year drop. The follow-up Week 36 update confirms these trends with marginal improvements, suggesting that local centres may need enhanced in-store experiences to better leverage footfall statistics and footfall data trends.

Expert Commentary and Regional Nuances

Joe Capocci, Huq Industries Spokesperson, stated, "Our latest data shows that while some retail sectors experience modest changes in footfall, increased dwell times are indicative of deeper customer engagement." His insights highlight the need for retailers to adapt strategies based on real-time footfall analytics and regional economic conditions. These findings underline that a balanced focus on footfall data and engaging in personalised experiences could pave the way for sustained growth in the competitive UK market.

Looking Ahead

As UK retailers continue to adapt to changing consumer behaviours, the emphasis on recording and analysing footfall statistics remains critical. The data suggests that even a slight percentage increase or decrease can inform strategic decisions that enhance shopper engagement and drive in-store activity. Retailers are advised to use these insights to tailor their marketing efforts and promotional campaigns, reinforcing the importance of footfall retail as a key performance metric.

Conclusion

In summary, the collected updates from various centre types point to a complex yet promising retail environment. From major centres achieving subtle growth to shopping centres maintaining steady performance, the scene is set for continued refinement of in-store experiences. These insights affirm that robust footfall counting and footfall analytics are instrumental to realising market potential.

This comprehensive review offers a thorough perspective on the current landscape, encouraging retailers to consider all facets of footfall statistics as they navigate an evolving market.

Additional analysis shows that adaptative strategies based on detailed regional data can drive competitive advantages and enrich customer interactions, ensuring that each retail format remains responsive to consumer preferences over time.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

UK Local Retail Centres – Week 36, 2025 Update: Location Analytics Reveals Trends

UK Local Retail Centres – Week 36, 2025 Update: Location Analytics Reveals Trends

UK Local Retail Centres show a moderate recovery with a daily footfall of 16,300. Analysis across England, Scotland, and Wales reveals regional nuances in footfall and dwell time, highlighting both short-term uplifting trends and ongoing year‑on‑year declines.

Share on LinkedIn

The latest weekly update on UK Local Retail Centres paints a picture of a cautious yet promising recovery as location analytics report an overall average daily footfall of 16,300. Although year‑on‑year figures show a decline, week‑on‑week improvements suggest that certain markets are beginning to bounce back.

A closer inspection reveals distinct regional dynamics. In England, retail centres achieved an average daily footfall of 16,200. Despite a modest increase in recent footfall, long‑term trends indicate a slight decline, underscoring the delicate balance between short-term recovery and persistent challenges.

Scotland shows an interesting trend with an average daily footfall of 16,000 – coupled with a sharper week‑on‑week increase. Yet, the annual figures indicate that Scotland is not immune to the broader retail challenges, showing a more noticeable long-term decline compared to its transient weekly gains.

Wales reflects a divergent scenario with a lower average daily footfall of just 12,600. Even though the week‑on‑week trend is positive, the year‑on‑year data displays a more significant decline. This drop in footfall points toward tougher conditions in Wales, sparking a call for tailored strategies to revitalize the retail environment.

Visitor dwell time provides further insights into consumer behavior. Across all centres, visitors are spending an average of 101 minutes per visit, a duration that has benefited from a week‑on‑week uplift and an encouraging annual increase. England’s visitors clock in slightly above average at 102 minutes, experiencing both recent gains and healthy annual improvements.

Scotland remains a standout, boasting an impressive average visit time of 109 minutes, reflective of a striking week‑on‑week boost and positive momentum over the longer term. In contrast, Welsh retail centres see visitors spending only 94 minutes on average, with recent figures showing a noticeable decline that echoes the broader annual softness.

Industry experts are keeping a close watch on these trends. Joe Capocci, a spokesperson for Huq Industries, remarked, "These figures, highlighted by a sharp increase in Scotland's footfall and supported by recent retail industry news, provide a clear insight into the nuanced recovery trends across our markets." His comments underscore the importance of adapting strategies to the varied regional dynamics in the UK's retail landscape.

As the market evolves, the careful interpretation of both short‑term and long‑term data remains crucial. The trends indicate that while there are signs of recovery, challenges persist across the board, calling for a measured and regionally tailored approach to revitalize local retail centres.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

UK Retail Parks – Week 36 (2025) Footfall Data Performance Update

UK Retail Parks – Week 36 (2025) Footfall Data Performance Update

UK Retail Parks saw a modest dip in footfall, with daily averages falling by 3%, while footfall analytics highlight regional variations and improved dwell time.

Share on LinkedIn

Overview

The latest update from The Benchmark for UK Retail Parks paints a picture of measured performance in week 36. Visitor numbers averaged 19,800 per day, reflecting a modest decline of 2.9% compared to the previous week and a 4.8% decrease relative to the same period last year. Though these overall figures indicate a slight contraction in footfall, regional differences offer additional insights.

Enhanced Insights

Detailed footfall analytics provide a deeper understanding of the performance dynamics, with advanced counting methodologies helping to validate the observed trends across regions.

Regional Performance

• England leads the pack with an average daily footfall of 20,300, despite showing a softening trend in visitor numbers compared to previous periods.

• Wales records an average of 15,800 daily visitors, observing a gentle decline when set against historical figures.

• Scotland, however, stands out with a 3.2% week-on-week increase, reaching an average of 18,400 visitors, underlining a positive shift in regional dynamics.

Visitor Engagement

Alongside the footfall data, dwell time metrics offer vital insights into visitor engagement. Across the board, visitors spent an average of 73 minutes per visit—up 1.4% from the previous week and marking a 7.4% improvement year-on-year. In detail:

• England averages a 72-minute stay.

• Wales records a 68-minute visit, showing a weekly uplift, though slightly lower year-on-year.

• Scotland leads with the highest engagement, boasting an average dwell time of 82 minutes.

Industry Comment

Joe Capocci, spokesperson for Huq Industries, remarked, "These figures, particularly Scotland’s sharp increase in footfall, underscore evolving consumer dynamics. This is further affirmed by recent industry developments at longwaterretailpark and greenockwaterfrontretail_park." His comment highlights both the regional variations and the broader shifts in consumer behavior currently influencing the market.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 36 2025 High Streets & Town Centres Performance Update: Footfall Data Insights

Week 36 2025 High Streets & Town Centres Performance Update: Footfall Data Insights

Week 36 2025 update: UK High Streets & Town Centres report a slight decline in average daily footfall with modest year-on-year improvements, while footfall analytics confirm balanced visitor engagement.

Share on LinkedIn

Recent footfall data for week 36, ending September 14, 2025, reveal mixed performance across UK High Streets and Town Centres. Overall, the average daily footfall was recorded at 32,400, a slight decline from the previous week, yet showing modest improvement compared to the same period last year. Meanwhile, the average visit duration was 100 minutes, indicating that while slightly shorter on a weekly basis, the year-on-year figures reflect improved visitor engagement.

Regional insights further underscore these nuanced dynamics. In Scotland, the daily visitors numbered around 30,800 – marking a small weekly increase and a significant year-on-year recovery. However, the dwell time was lower at 86 minutes, suggesting that while footfall volume improved, engagement quality lagged slightly behind. Welsh centres, attracting an average of 17,000 daily visitors, maintained a 100-minute average visit duration. Here, the increased dwell time on a week-on-week basis hints at more engaged visitors, even as overall numbers were lower. England's High Streets and Town Centres observed an average of 33,000 daily visitors with a steady visit duration of 101 minutes, pointing to a balance between visitor numbers and engagement quality.

Comprehensive analytics, including footfall retail performance reviews and various counting methods, underpin these trends, offering a detailed look at the evolving landscape of UK retail environments. Joe Capocci, spokesperson for Huq Industries, commented, "Scotland’s modest increase in footfall, alongside shifts in visitor engagement, reinforces the retail industry news reporting a revival in UK high streets."

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 36 2025 Major Retail Centres Performance Update: Footfall Insights

Week 36 2025 Major Retail Centres Performance Update: Footfall Insights

UK major retail centres see a slight 3.2% dip in daily footfall, while engagement climbs with a 0.8% rise in dwell time. Robust footfall analytics highlight resilient performance.

Share on LinkedIn

Recent footfall trends show evolving patterns in retail. Key metrics from footfall data, footfall retail, footfall analytics and footfall statistics contribute to robust insights.

Overall Performance

In the week ending 14 September 2025, the latest figures from The Benchmark indicate modest shifts in UK Major Retail Centres. Centres across the UK recorded an average of 81,200 daily visitors – a 3.2% decrease compared to the previous week, while marking a 2% improvement from the same period last year.

Visitor engagement also strengthened, with the average dwell time rising by 0.8% on a weekly basis to 119 minutes and showing an annual improvement of 9.2%. These overall trends reflect a retail environment where, despite a slight fall in visitor numbers, engagement remains solid.

Regional Analysis

England’s retail centres posted an average of 78,900 daily visitors, experiencing a week-on-week decline of 4.9% alongside a modest year-on-year growth of 1.1%. The average dwell time in these centres was 117 minutes per visit, with small weekly and annual gains of 0.9% and 7.3% respectively.

In contrast, Scottish retail centres achieved an impressive average of 108,000 daily visitors, with a week-on-week increase of 12.1% and a consistent annual improvement. Scottish visitors spent an average of 135 minutes per visit, although there was a minor weekly dip in dwell time; the overall annual increase was notably strong.

Welsh locations, with an average of 64,900 daily visitors, experienced a 4.2% week-on-week dip and a slight year-on-year decline. Despite this, dwell time in Wales improved on a weekly basis by 4.7% to an average of 112 minutes, even as the annual figure fell modestly.

Industry Comment

"Our data shows a striking week-on-week increase in Scottish footfall alongside stronger engagement, as subtly echoed by recent Retail Industry News," said Joe Capocci, Huq Industries Spokesperson.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.