Week 15 Weekly Wrap: Leveraging Location Analytics for UK Retail Trends

Week 15 Weekly Wrap: Leveraging Location Analytics for UK Retail Trends

Explore UK retail performance with location analytics insights as a 2.6% uplift in footfall shows strong consumer engagement.

Share on LinkedIn

UK retail outlets have been experiencing dynamic shifts this week, and the latest reports demonstrate the power of location analytics in providing a detailed view of evolving consumer behaviours. The data presented on major retail centres, shopping centres, retail parks, high streets, and local retail centres shows that not only is footfall a key measure but that dwell times are gaining importance in understanding customer engagement. This comprehensive outlook underscores that even modest changes can yield significant insights for brands and retailers.

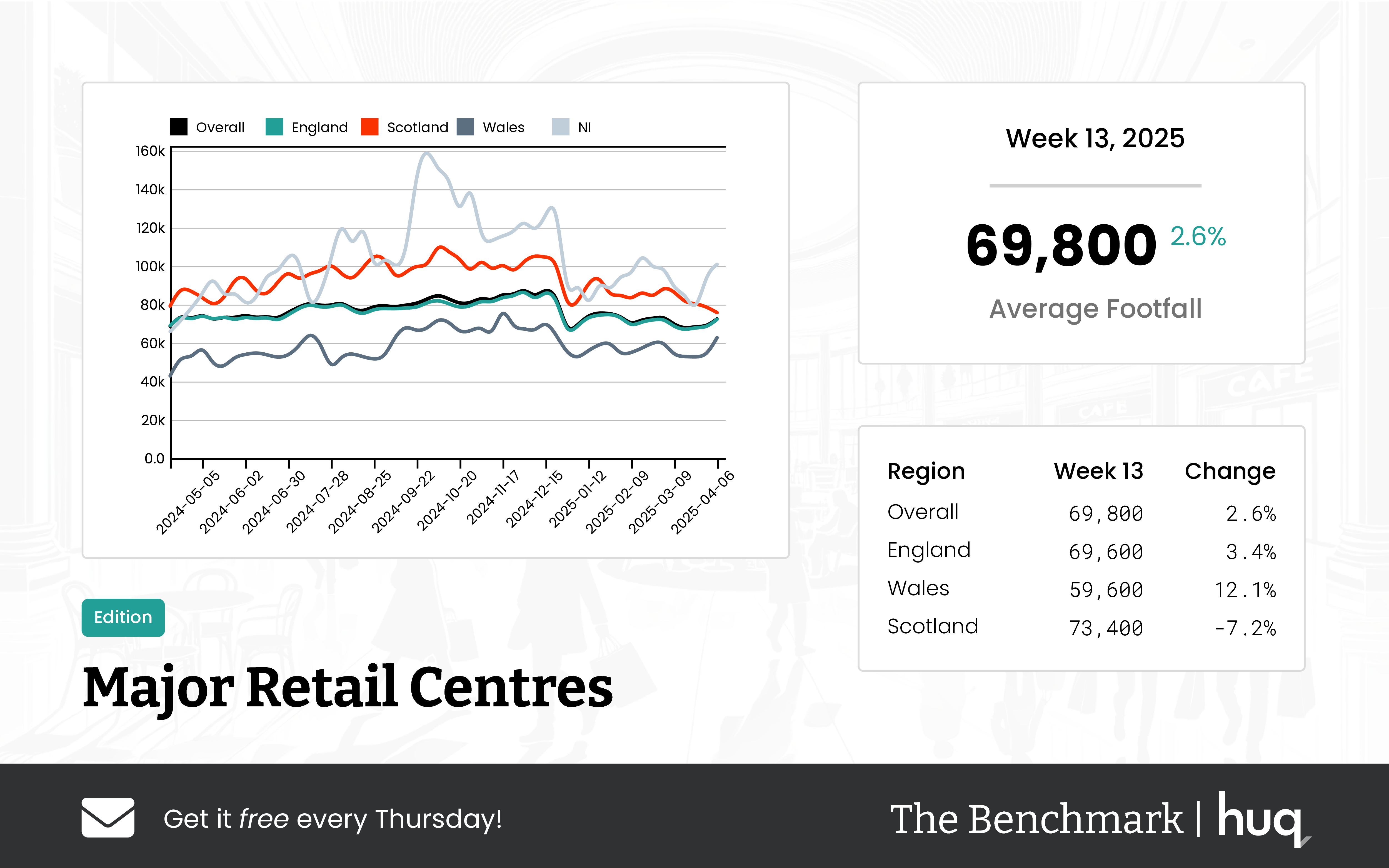

Major Retail Centres Remain Resilient

Major retail centres continue to be the stalwarts of UK retail performance. The Week 13 report highlighted an average daily footfall of 69,800 with shoppers spending 115 minutes per visit as detailed in the Week 13 2025 Major Retail Centres – Leveraging location analytics article. Regional variations, such as sharper declines in Scotland and rebounding numbers in Wales, emphasise that each market has distinct trends, making location intelligence indispensable for effective decision-making.

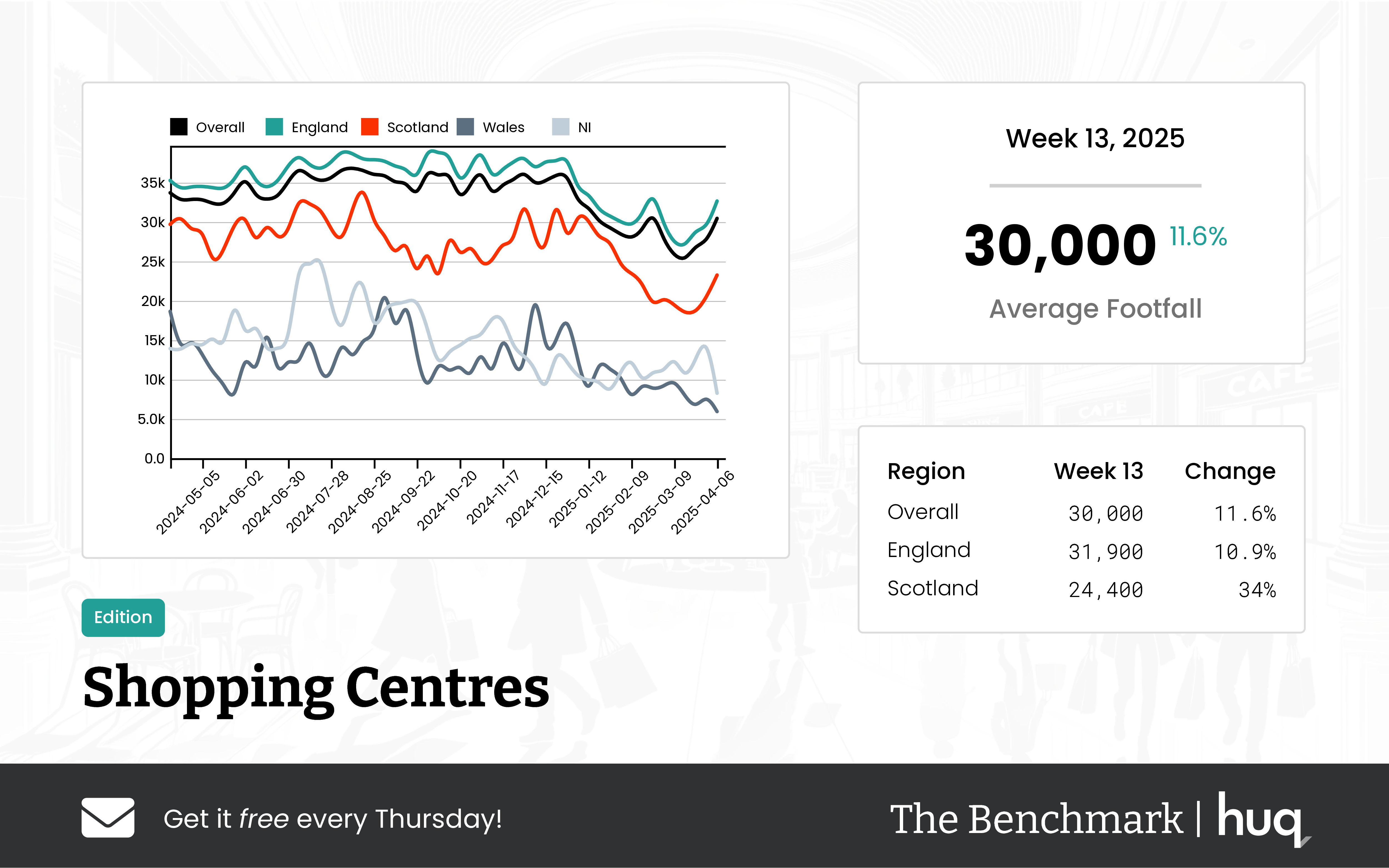

Shopping Centres Witness Varied Trends

Shopping centres are experiencing mixed performance across regions and weeks. An earlier update recorded an impressive 11.6% weekly increase with centres receiving around 30,000 visitors daily, while the Week 15 update showed a modest decline in overall visitor numbers. The comparison between England’s stable figures at approximately 34,400 visitors and lower counts in Scotland and Wales clearly indicates that retail footfall is highly variable, reinforcing the importance of location analytics and regional trend assessment.

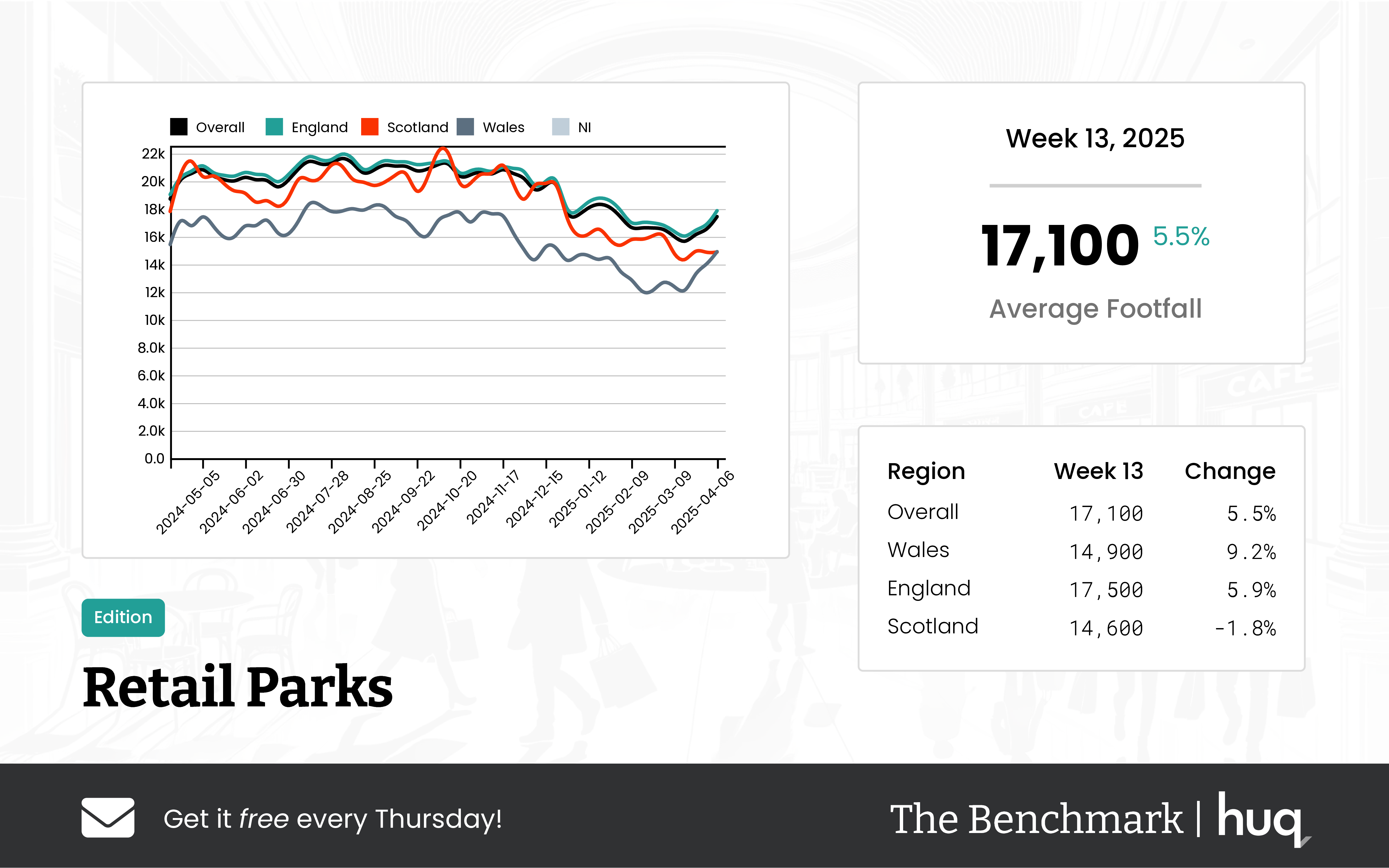

Retail Parks and Their Evolving Narrative

Retail parks are evolving in a multifaceted manner. Week 13 data reported 17,100 daily visitors—a 5.5% weekly improvement—but these figures still fell 15.1% on a year‐on‐year basis, as described in the Week 13 2025 Retail Parks Performance Update: Harnessing Location Analytics. Week 15 figures indicate a slight decline to 18,600 visitors overall, although engagement remains positive in regions with increased dwell times. Such trends underline the need for detailed footfall analysis and strategic adjustments tailored on location intelligence insights.

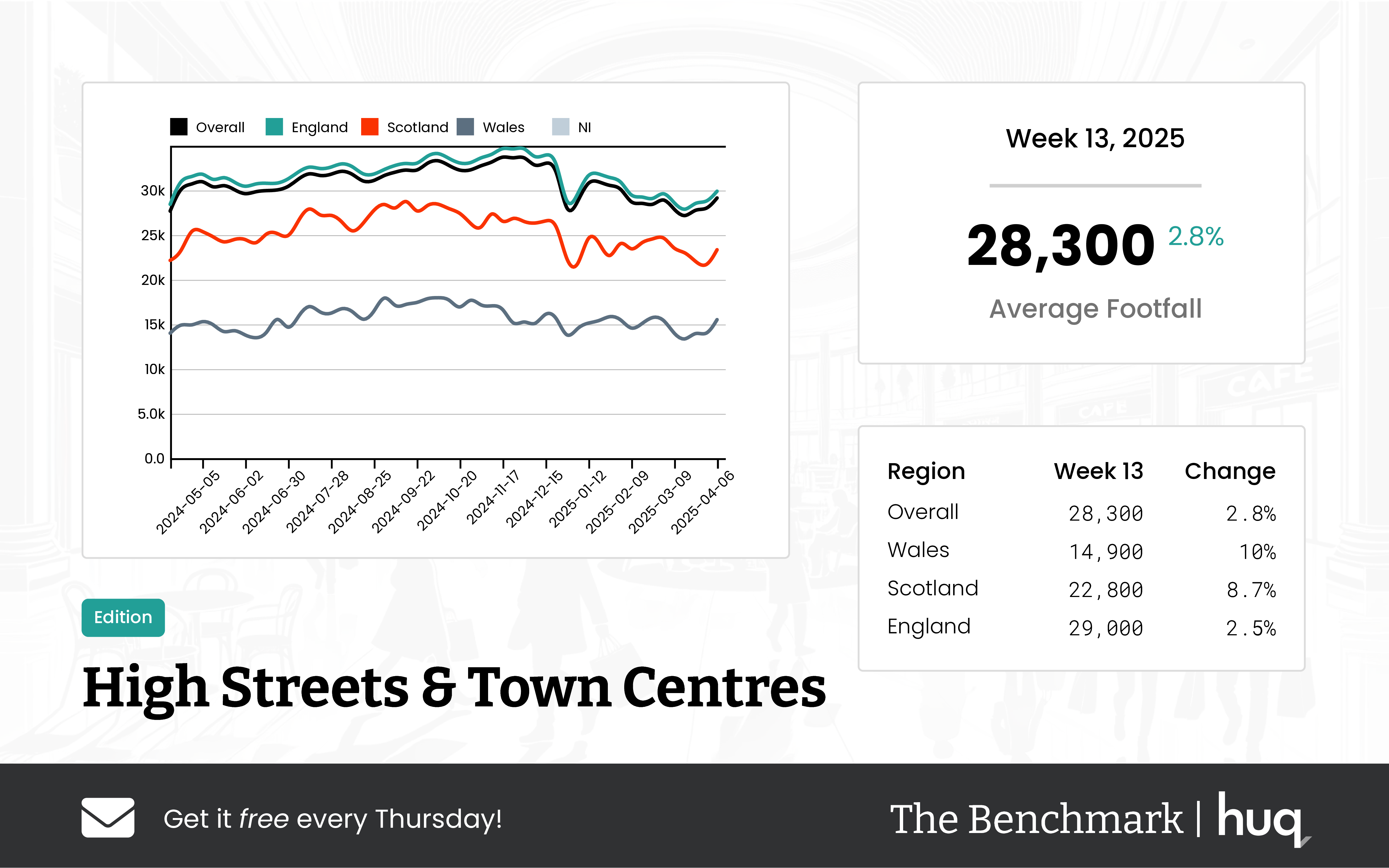

Distinct Trends on High Streets and Town Centres

High streets and town centres continue to display mixed trends that are worth watching. Reports indicate a daily average of 28,300 visitors with a 2.8% weekly uplift and a dwell time of 99 minutes, as noted in the Week 13 2025 High Streets & Town Centres: Footfall Data Update article. Variations are noted with Welsh centres showing a significant 10% increase while Scottish centres are facing sharper declines, thereby requiring refined location analytics to fully harness regional insights.

Adapting Strategies in Local Retail Centres

Local retail centres have also adopted innovative measures in response to challenging conditions. Week 13 data shows an average of 13,500 daily visitors—a 5% weekly rise despite a year‐on‐year decrease of 6.6%—which confirms that consumers are spending longer times in these centres, with dwell times increasing by 5.4%. This discrepancy between visitor numbers and engagement provides a unique case study in using location intelligence to convert lower footfall into quality interactions.

Industry Perspective and Forward Look

Joe Capocci, Huq Industries Spokesperson, commented that "the subtle shifts in dwell time and regional footfall numbers reinforce how critical location analytics are for tailoring effective retail strategies." His statement reflects the industry’s confidence in leveraging precise data to manage both quantity and quality metrics efficiently. The focus on engaging consumer experiences underlines a broader trend where even small percentage changes in footfall can translate into meaningful actions for retailers.

Conclusion: Navigating Future Trends with Data

In summary, weekly data shows that while certain retail segments confront challenges, overall trends indicate that consumers are engaging more deeply with their shopping environments. With a modest 2.6% increase in footfall observed in some areas, the insights provided by location analytics and location intelligence are proving essential. As market variations continue to develop, businesses must rely on detailed analytics to inform adaptable and effective retail strategies for future growth.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 15, 2025 Major Retail Centres Performance Update: Location Analytics Insights

Week 15, 2025 Major Retail Centres Performance Update: Location Analytics Insights

UK Major Retail Centres show overall trends with a 6.9% weekly decline and a 3.9% year on year increase in footfall. The latest report highlights promising retail performance and footfall trends, supporting robust location analytics.

Share on LinkedIn

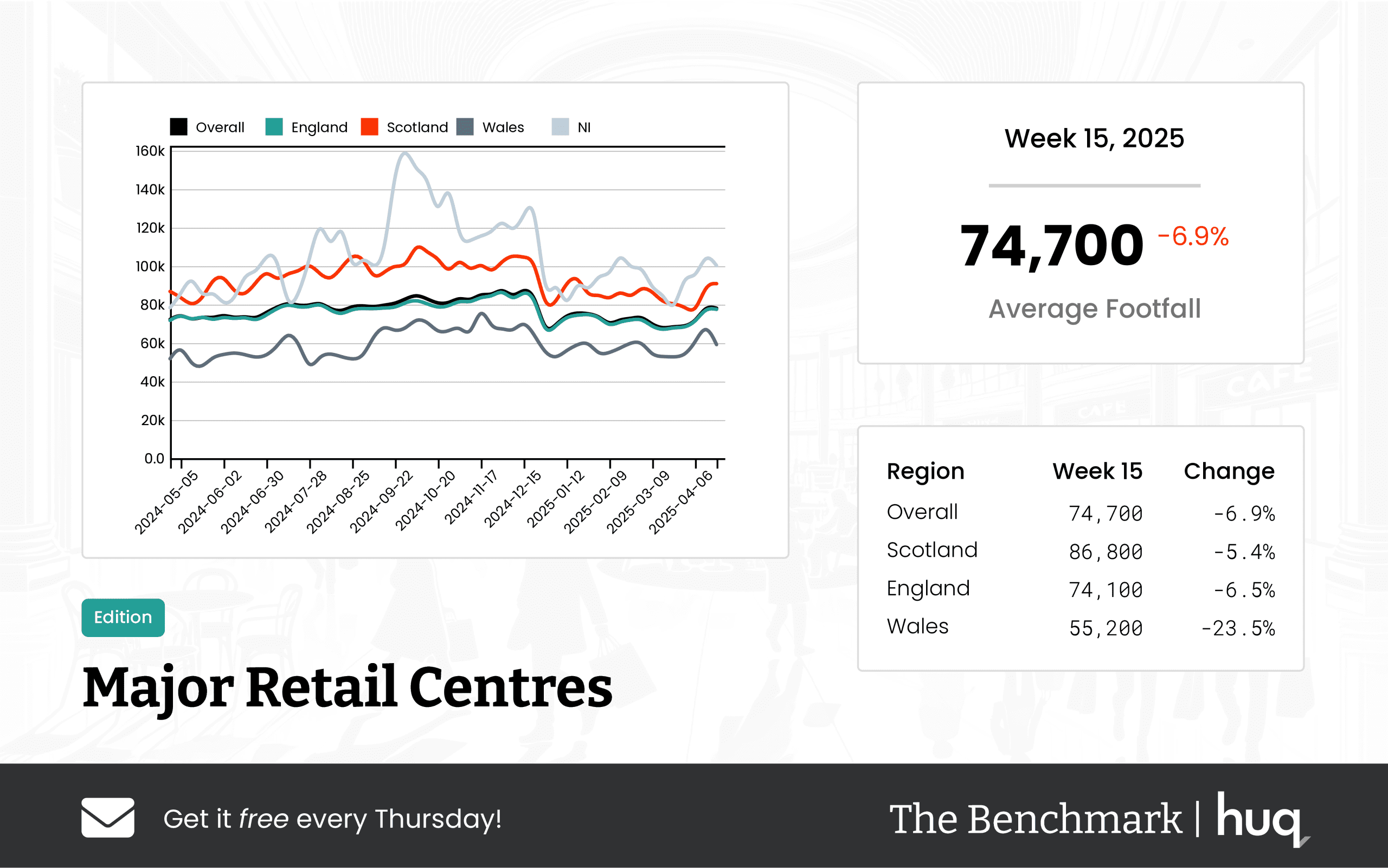

The latest update from The Benchmark offers an in-depth insight into the current performance of the UK's major retail centres. Focusing on detailed location analytics, the report reveals an average daily footfall of 74,700 for the week ending 20 April 2025, marking a 6.9% week-on-week decline. However, a more encouraging long-term picture emerges with a 3.9% increase year on year, demonstrating the resilience of the retail landscape amidst evolving consumer patterns.

A breakdown of the data by region uncovers important performance nuances. Scotland tops the metrics with an average daily footfall of 86,800, showing a smaller week-on-week decline of 5.4% alongside a modest yearly rise of 3.2%. In contrast, retail centres in England recorded an average of 74,100 visitors daily, with a 6.5% week-on-week dip and a year-on-year improvement of 3.5%. Wales, however, trails with the lowest average daily footfall at 55,200, experiencing a significant week-on-week drop even as annual trends hold relatively steady.

Visitor dwell time further enriches this data narrative. Across all centres, the average visitor spent 112 minutes per visit, reflecting a 5.9% week-on-week decrease, although the year on year change was a modest 0.9% increase. Scotland again distinguishes itself with an average visit lasting 115 minutes—a period boosted by a substantial 13.9% week-on-week increase and an 8.5% annual uplift. Meanwhile, centres in England averaged 113 minutes, with a 7.4% decline over the week but a slight year-on-year gain of 2.7%. Wales, with an average dwell time of 94 minutes, recorded a more notable annual decline in visitor engagement.

Joe Capocci, spokesperson for Huq Industries, commented on these trends, saying, "The most striking change in footfall was seen in Wales with a notable decline, which is supported by the latest Retail Industry News." This insight underscores the shifting dynamics in retail performance across the UK, prompting further exploration of the factors driving these trends.

Overall, while weekly fluctuations depict some challenges, the year-on-year growth trend and rising dwell times in key regions highlight a cautiously optimistic outlook for the UK retail sector as it navigates a period of transformation and digitalization.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 15, 2025 – High Streets & Town Centres: footfall retail Performance Update

Week 15, 2025 – High Streets & Town Centres: footfall retail Performance Update

Latest performance shows a steady overall trend with moderately lower visits and an average 97-minute dwell time. Recent footfall analytics indicate resilience in UK retail centres.

Share on LinkedIn

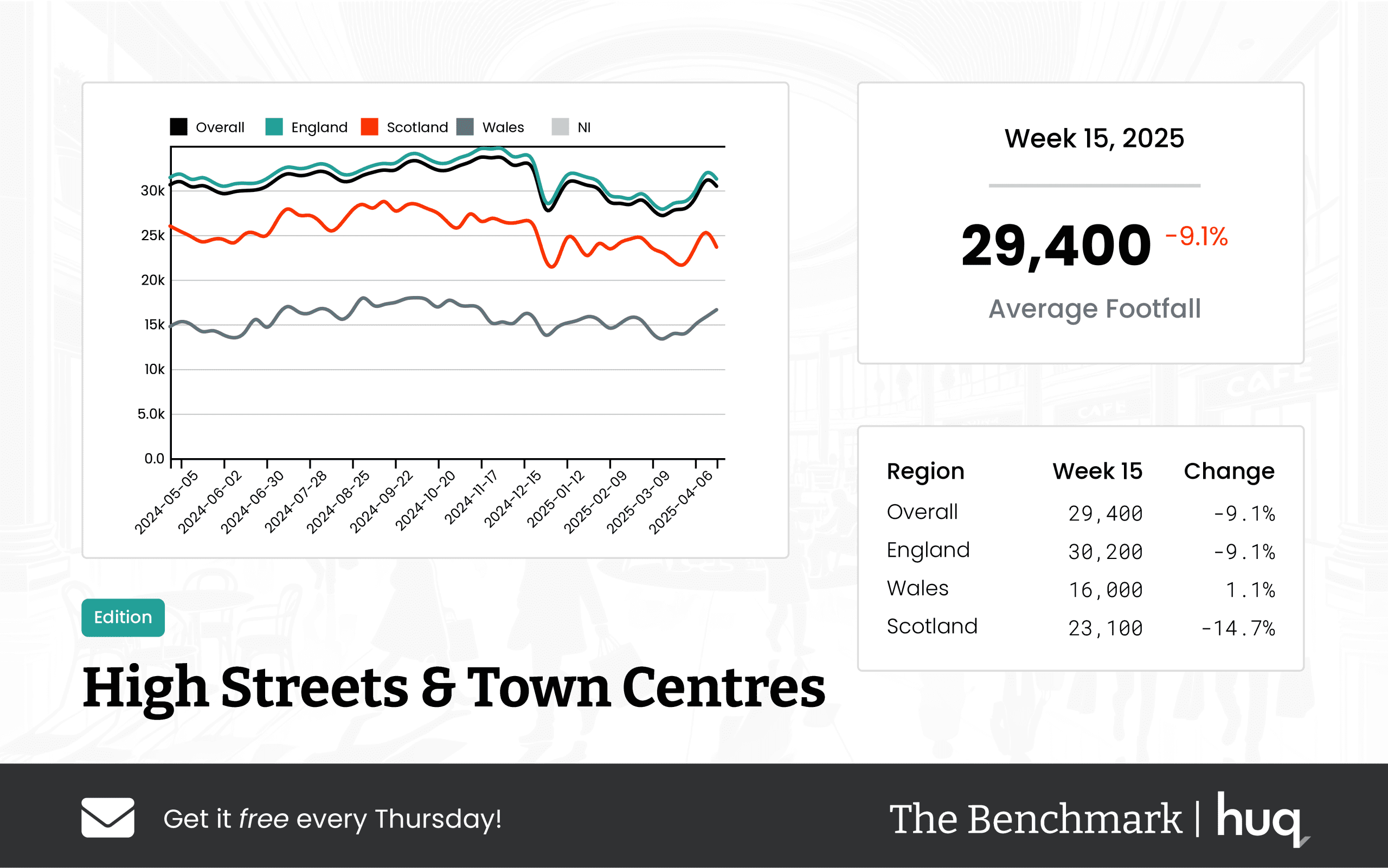

The latest figures reveal that UK High Streets and Town Centres recorded an average daily footfall of 29,400 in Week 15, with a moderate decline in visits compared to the previous week. Despite this slight setback, the year-on-year data remains almost flat, signaling that retail locations are adapting to ongoing challenges.

Regional performance shows intriguing contrasts across the UK. In England, numbers have dipped modestly both on a weekly and yearly basis, echoing the overall trend. Wales, however, shines with a modest weekly increase and higher average daily counts, showcasing robust performance. Scotland, in contrast, faces steeper declines both in footfall and visitor numbers when compared to the same period last year.

Visitor engagement metrics add another layer to the narrative. Across England, dwell time holds steady with a slight uplift over previous years at 97 minutes per visit. Welsh high streets lead with an impressive 117 minutes per visit, indicating deeper customer engagement. In Scotland, a marked drop in engagement is evident with visitors averaging only 72 minutes per visit.

Joe Capocci, spokesperson for Huq Industries, remarked, "The sharp contrast seen in footfall trends, particularly the uplift in Wales against ongoing challenges elsewhere, is mirrored by recent industry news highlighting adjustments in retail operations." This insight underscores the varied economic landscape and evolving consumer behaviors across different regions, prompting a focus on strategic adjustments in retail operations to maintain resilience during leaner periods.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 15, 2025 Retail Parks Performance: Insights from Location Analytics

Week 15, 2025 Retail Parks Performance: Insights from Location Analytics

UK retail parks show a modest dip in footfall (-3.4%) with increased dwell time (+9.5% YoY). Location analytics data and location intelligence trends underscore nuanced shopper engagement.

Share on LinkedIn

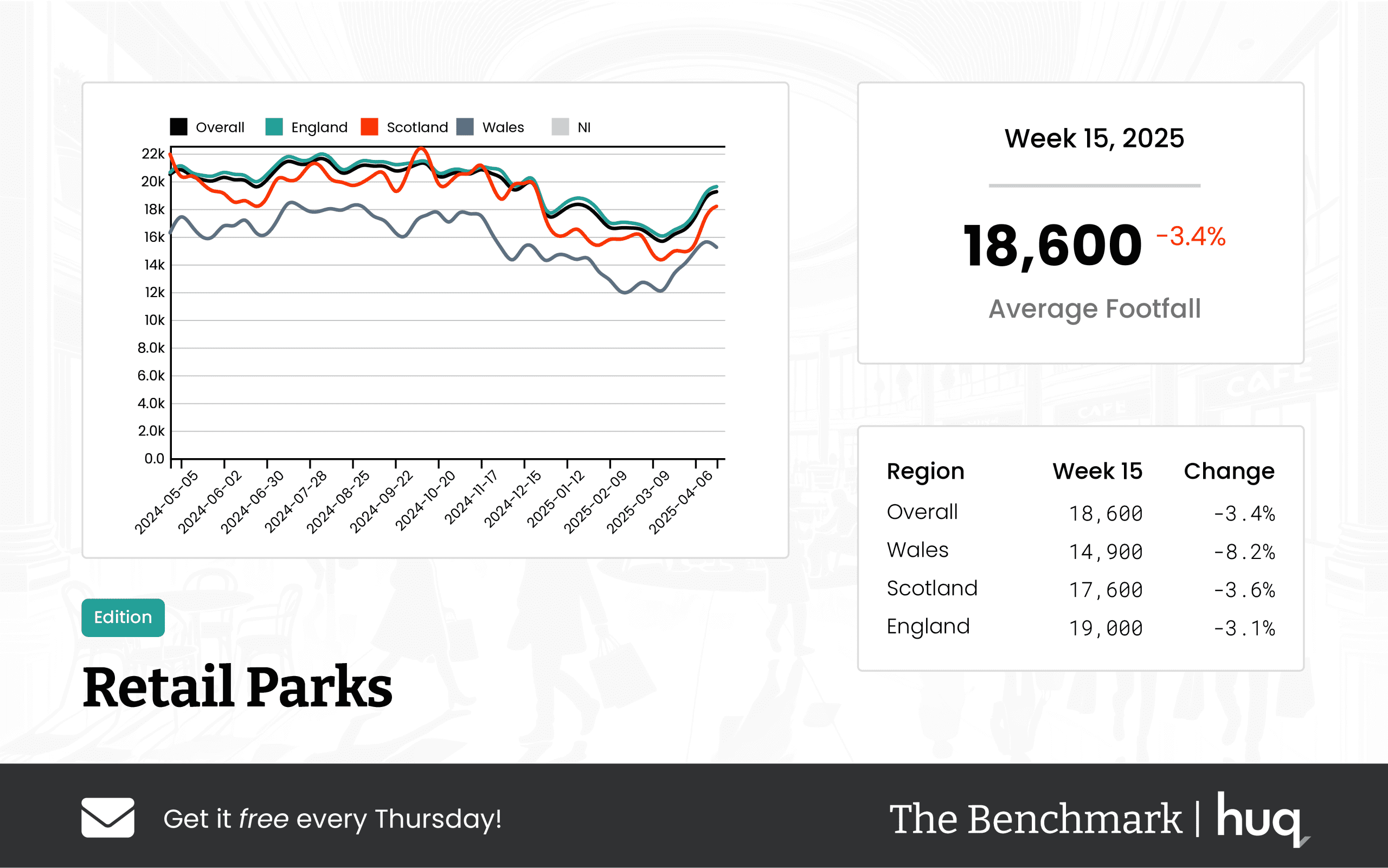

Overview

The latest figures from The Benchmark, as reported by location analytics, indicate that UK Retail Parks recorded an average daily footfall of 18,600 in Week 15, marking a decline of 3.4% from the previous week and 7.4% year on year. Although overall visitor numbers have moderated, the average visit duration of 69 minutes suggests a more nuanced picture, with a week-on-week dwell time decrease of 5.5% contrasting against a 9.5% year-on-year increase. This dynamic offers valuable insights into location intelligence trends.

Regional Performance – England and Scotland

In England, retail parks experienced a strong average daily footfall of 19,000, enduring only a slight week-on-week decline of 3.1% and a 6.6% year-on-year reduction. Dwell time persisted at 69 minutes with an 11.3% improvement YoY, underlining stable shopper engagement and reinforcing location intelligence observations.

Turning to Scotland, retail parks reported an average footfall of 17,600. They witnessed a 3.6% decrease on a week-on-week basis and a more marked 13.4% decline year on year. However, visitor engagement appeared higher with dwell times at 76 minutes, registering a week-on-week gain of 4.1% and an 8.6% year-on-year uplift.

Regional Performance – Wales

Wales, in contrast, showed a softer performance. Its retail parks recorded an average footfall of 14,900, down by 8.2% compared to the previous week and 11.6% year on year. The average visit duration in Wales also contracted, dropping to 63 minutes with a significant week-on-week decline of 14.9% and a year-on-year drop of 12.5%. This performance underlines distinct location intelligence trends in the region.

Industry Insight

Joe Capocci, a spokesperson for Huq Industries, commented, 'The most striking change in footfall was the notable decline observed in Wales, which is reinforced by industry news regarding the upcoming closure at Craigleith Retail Park. This further underscores the evolving trends in shopper engagement.'

The data demonstrated through location analytics and intelligence is pivotal for understanding evolving consumer behavior amidst varying regional dynamics.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

UK Shopping Centres – Week 15, 2025 Performance Update: Footfall Retail

UK Shopping Centres – Week 15, 2025 Performance Update: Footfall Retail

UK shopping centres experienced a slight dip in visitor numbers in week 15, 2025, with footfall retail trends and footfall data signalling a cautious consumer environment.

Share on LinkedIn

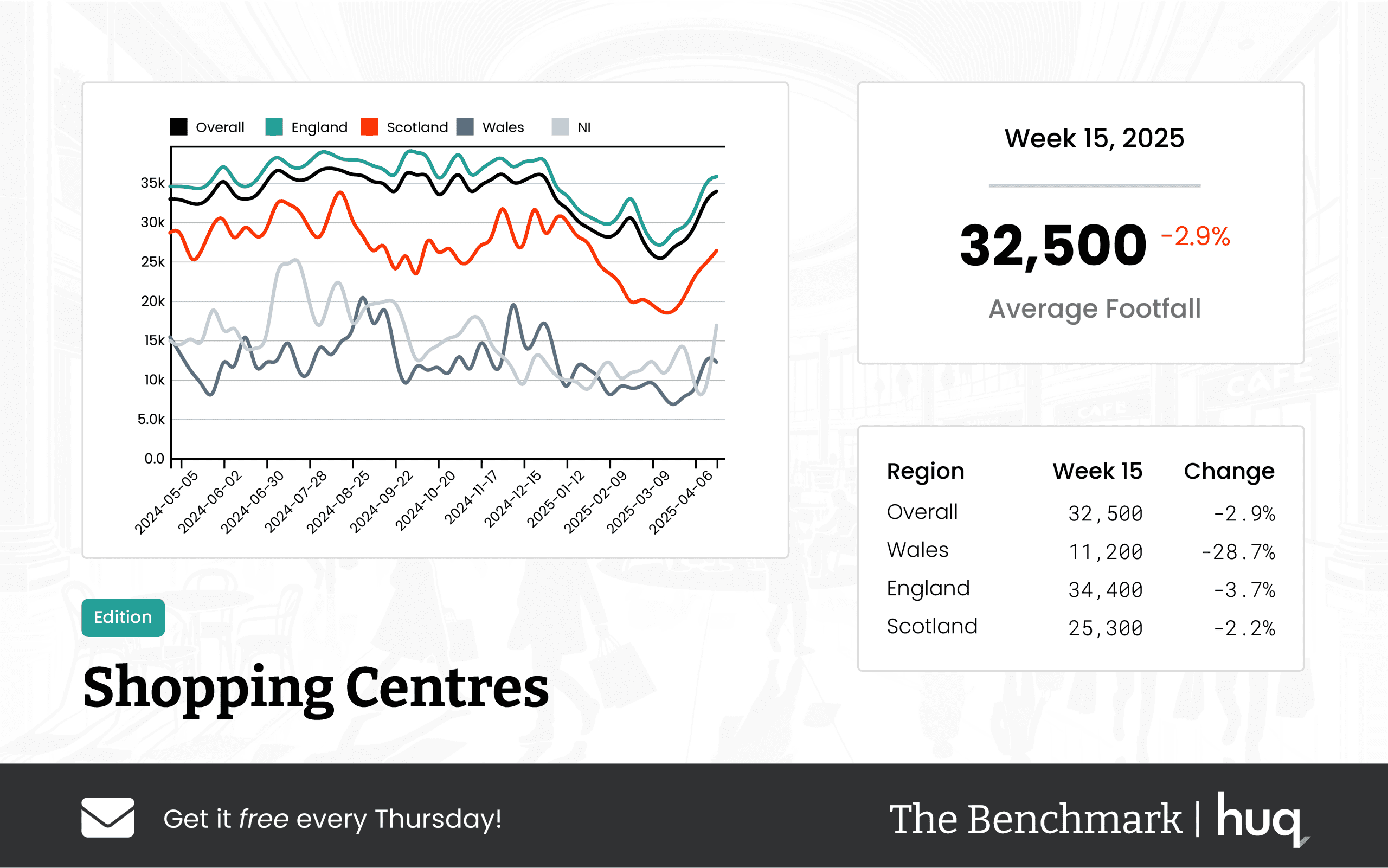

Overall Performance

The latest footfall retail figures and data from The Benchmark report that UK shopping centres recorded an overall average daily footfall of 32,500 during week 15, 2025. Compared to previous periods, this signifies a modest decline, reflecting a cautious consumer environment amid recent headwinds, with the primary key performance indicator signaling a degree of stability.

Additional Insights

Additional footfall analytics and statistics further underscore the reported trends, suggesting that while the overall performance remains relatively stable, slight regional variations are evident.

Regional Breakdown

A closer look at regional data highlights notable differences. In England, centres recorded an average daily footfall of 34,400, maintaining a relatively steady flow of visitors despite a modest decline compared to earlier performance. In contrast, Scotland's centres attracted an average of 25,300 daily visitors with moderate week-on-week changes. However, the situation in Wales was more challenging, with centres observing an average of only 11,200 daily visitors accompanied by a sharp decline in footfall. This calls for tailored local strategies to address the unique challenges each region faces.

Visitor Engagement

Footfall numbers alone do not tell the full story. Dwell time data provides critical insights into visitor engagement. Across the UK, shoppers spent an average of 109 minutes per visit during week 15. In England, the average visit duration increased slightly to 113 minutes. However, Scotland’s centres saw a decrease in visit duration, averaging 82 minutes per visit, while in Wales, despite the decline in footfall, shoppers spent an average of 74 minutes per visit. These findings highlight the need to balance visitor quantity with quality engagement.

Industry Comment

Joe Capocci, a spokesperson for Huq Industries, remarked, "The sharp decline in Welsh centres, in contrast to the resilience observed in English locations, and recent retail industry news underscore the evolving landscape of UK shopping environments." His comments underline the importance of regional adaptation and strategic initiatives in addressing the ongoing changes in the market.

Conclusion

Week 15 of 2025 presents a nuanced picture of the UK shopping centre landscape, where overall stability is challenged by regional disparities and shifting consumer behaviors. Retailers and shopping centre operators must heed these insights, leveraging comprehensive footfall analytics and engagement data to navigate the evolving market dynamics effectively.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 13 Weekly Wrap: Retail Trends and Location Analytics Insights

Week 13 Weekly Wrap: Retail Trends and Location Analytics Insights

Discover a modest 2.6% rise in Major Retail Centres amid robust location analytics and footfall performance trends.

Share on LinkedIn

The latest weekly insights highlight significant retail trends in the UK. Emerging data shows that location analytics is central to understanding evolving consumer behaviour. Retail centres continue adapting to changing customer dynamics, and this analysis provides valuable clues for stakeholders.

Retail Parks Overview

UK Retail Parks welcomed an average of 17,100 daily visitors in Week 13, marking a 5.5% rise despite a 15.1% year-on-year decline. Dwell times increased by 9.9% to 78 minutes, signalling stronger engagement. Regional differences are notable, with parks in Wales attracting about 14,900 visitors, as detailed in the Week 13 2025 Retail Parks Performance Update.

Local Retail Centres Update

Local Retail Centres experienced a 5% increase in daily footfall with an average of 13,500 visitors, while dwell times climbed by 5.4%. The Week 12 data had shown a slight decline, making this recovery an encouraging sign. More insights can be found in the UK Local Retail Centres – Week 13 Update and the Week 12 Local Retail Centres Update.

Major Retail Centres Performance

Major Retail Centres averaged 69,800 daily visitors in Week 13, a modest improvement of 2.6%, with average visit durations rising to 115 minutes. While English centres maintained robust performance, Scottish centres saw a 7.2% dip in footfall and a decline in dwell time. For an in-depth look, view the UK Major Retail Centres – Week 13 Update.

Shopping Centres Trends

Shopping Centres recorded an 11.6% weekly increase with an average of 30,000 daily visitors, though overall numbers remain 10.5% lower than last year. Dwell times improved to 114 minutes, with a slight week-on-week dip of 0.9% rounding off the story. Further details are available in both the Week 13 Shopping Centres Performance Update and the Shopping Centres Week 12 Update.

High Streets and Town Centres Developments

High Streets and Town Centres reflected mixed performance, with Week 13 averages reaching 28,300 daily visitors and dwell times at 99 minutes. In contrast, the Week 12 figures were slightly lower with 27,600 visitors and 95 minutes average stay. Specific trends vary by region; for instance, Welsh centres saw a notable uplift, while Scottish centres exhibited distinct patterns, as outlined in the Week 13 Footfall Data Update and the Week 12 Performance Update.

Emerging Retail Trends

Recent data underscores that while footfall numbers face annual pressures, increased dwell times signal deeper consumer engagement. This trend, complemented by sharp regional variations, highlights the nuanced role of location intelligence in shaping retail strategies. Retailers are advised to consider these retail trends and the impact of evolving customer dynamics when planning upcoming strategies.

Industry Insights and Expert Commentary

Notably, enhanced dwell times across centres suggest that consumers are spending more time in-store, even if visitor numbers do not fully reflect this engagement. Retail trends remain in constant flux, and regional differences continue to influence performance metrics. The nuanced analysis of dwell times versus footfall reaffirms the need for refined operational strategies using insights from location analytics.

Insights from Leadership

"We are encouraged by the steady rise in dwell times, which indicates that shoppers are engaging more deeply with our retail environments," said Joe Capocci, Huq Industries Spokesperson. "The data, enriched by robust location analytics, offers a clear pathway for retailers to adapt and thrive in challenging market conditions." His remarks highlight the practical application of these insights across various retail formats.

Looking Ahead

The weekly trends reinforce the critical role of location analytics as retailers navigate diverse challenges in the current market. As data continues to evolve, stakeholders should remain agile, utilising location intelligence to drive marketing and operational decisions. With continued focus on these emerging trends, the future of retail centres looks set for sustained recovery and innovation.

Further analysis will be published in subsequent updates as new data emerges, ensuring that retailers and analysts have the insights needed to capitalise on evolving consumer behaviours and market opportunities.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 13 2025 Shopping Centres Performance: location analytics update

Week 13 2025 Shopping Centres Performance: location analytics update

UK shopping centres reported an 11.6% weekly rise and an 18.8% year-on-year improvement, highlighting strong location analytics trends in shopping centres performance and robust visitor engagement.

The latest figures from The Benchmark Tracker showcase notable improvements in UK shopping centres performance. Across the country, shopping centres reported an average daily footfall of 30,000 in the most recent week. This figure marks an 11.6% increase from the previous week, though it remains 10.5% lower than levels recorded a year ago. The data, derived from detailed location analytics, not only highlights increased footfall but also indicates long-term visitor engagement trends.

Visitors are spending an average of 114 minutes per visit. While there is a slight week-on-week dip of 0.9%, the average visit duration has grown by 18.8% compared to the same week last year. This juxtaposition of short-term declines against year-on-year growth suggests that while overall visitation is improving, the weekly momentum in visit duration may be experiencing a temporary slowdown.

Regionally, there are distinct trends. In England, the performance is robust with an average daily footfall of 31,900, showing a 10.9% increase from the previous week. However, this figure is still 8.9% lower than the level a year ago. Despite this, engagement metrics remain strong with an average dwell time of 116 minutes – an increase of 2.7% on a week-on-week basis and 17.2% on a year-on-year basis.

In contrast, stats from Scotland present a mixed picture. Although Scottish centres recorded a lower average footfall of 24,400, they benefited from a sharp week-on-week rise. However, this increase is overshadowed by a significant 19.9% decline compared to the same period last year. Visitors in Scotland are spending an average of 79 minutes per visit. The weekly numbers show a downturn, though the annual decline remains modest in comparison.

Wales provides a less comprehensive snapshot with only dwell time data available. In the region, visitors are spending an average of 28 minutes per visit – a 7.7% increase from the previous week, yet this is set against a notable year-on-year decline.

Industry expert Joe Capocci from Huq Industries commented on the trends: "The sharp increase in weekly footfall seen in Scotland – as highlighted alongside industry news such as the recent expansion initiatives – underscores an important shift in visitor behaviour." His observations stress the relevance of location analytics in understanding and adapting to evolving consumer patterns across the UK shopping scene.

In summary, while short-term performance metrics in some areas are subdued, the year-on-year improvements in visit duration and overall footfall highlight a positive trajectory for UK shopping centres. The insights derived from sophisticated location analytics continue to play a pivotal role in guiding strategies to further enhance shopper engagement and adapt to changing market dynamics.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of physical commerce with our flagship lighthouse platform.

Looking for intelligence on specific locations? Explore the lighthouse platform.

Week 13 2025 High Streets & Town Centres: Footfall Data Update

Week 13 2025 High Streets & Town Centres: Footfall Data Update

Overall footfall displayed a 2.8% weekly uplift against a 4.3% annual decline. The insights reveal resilient footfall retail trends amid evolving challenges.

Overview

The latest weekly data for UK High Streets and Town Centres indicate an overall average daily footfall of 28,300 – reflecting a modest week-on-week increase of 2.8% yet counterbalanced by a 4.3% year-on-year decline. These statistics highlight the resilience of retail footfall in the face of continual challenges and serve as a benchmark in footfall analytics.

Regional Breakdown

Disaggregating the data by region, substantial variations are evident. Wales reported an average of 14,900 daily visitors, benefitting from a significant week-on-week lift of 10%, despite an annual decline of 2.1%. Scotland’s centres experienced an average footfall of 22,800 per day, enjoying an 8.7% weekly increase that partly offsets a year-on-year decline of 6.7%. England leads with the highest average daily footfall of 29,000, showing a steady weekly increase of 2.5% and matching the overall annual decline of 4.3%.

Dwell Time

Visitor engagement remains strong with an average dwell time of 99 minutes per visit across all monitored centres. This figure represents a 4.2% boost on a week-on-week basis and an impressive 11.2% jump from the previous year. A closer look reveals that England holds at 99 minutes per visit, Scotland is marginally behind at 98 minutes, while Wales, even at a slightly lower 95 minutes, has seen a sharp week-on-week increase in stay duration—despite the annual downturn in this metric. Notably, Scotland's year-on-year performance boasts a significant increase in visit duration, underlining evolving consumer engagement.

Industry Comment

"Observing the 10% uplift in Wales amid recent retail industry news on evolving store formats has reinforced our view of shifting consumer patterns," stated Joe Capocci, spokesperson for Huq Industries. This comment accentuates the impact of emerging retail practices and suggests potential future adjustments in the strategies adopted across high streets and town centres.

Conclusion

The latest data encapsulates both the challenges and opportunities inherent in today’s retail environment. Despite the ongoing annual decline in footfall, regional variations and improvements in dwell time highlight a dynamic adjustment within the sector. Retailers and industry stakeholders are closely monitoring these trends to better align with the evolving demands of consumers.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of physical commerce with our flagship lighthouse platform.

Looking for intelligence on specific locations? Explore the lighthouse platform.

UK Major Retail Centres – Week 13, 2025: Leveraging location analytics

UK Major Retail Centres – Week 13, 2025: Leveraging location analytics

Week 13 data shows overall growth in UK major retail centres with a 2.6% rise in footfall and a 4.5% increase in visit duration. This location analytics report meets location intelligence trends.

The latest location analytics report for UK major retail centres reveals both encouraging footfall and engaging visit durations. Throughout Week 13, the overall daily footfall averaged 69,800, reflecting a modest week‑on‑week increase of 2.6% despite a slight annual contraction of 2.9%. More notably, shoppers are spending a longer time in these centres, with the average visit duration climbing to 115 minutes – a week‑on‑week uptick of 4.5% and an annual improvement of 3.6%. These figures highlight an improvement in the quality of mall visits, indicating prolonged engagement among consumers.

Regional performance provides deeper insights into these trends. In England, the daily average footfall reached 69,600, marking a 3.4% increase week‑on‑week though witnessing a mild annual decline of 2.8%. England also enjoyed improved dwell time, with shoppers spending an average of 116 minutes per visit – a significant leap of 5.5% over both the recent week and the previous year.

Scotland presents a contrasting picture. Despite a reported footfall of 73,400, the region experienced a noticeable drop with a week‑on‑week decline of 7.2% and a year‑on‑year fall of 12.8%. In Scotland, the average dwell time fell to 110 minutes – a week decline of 9.1%, even as the annual performance improved modestly by 3.8%. This divergence suggests potential challenges within the Scottish market, calling for closer monitoring of consumer behavior and market conditions.

Wales, on the other hand, demonstrated robust performance with a daily average footfall of 59,600. This mark was bolstered by a 12.1% increase from the previous week and an impressive annual growth of 17.8%, indicating a strong rebound. The average dwell time in Wales was 98 minutes, with a notable week‑on‑week increase of 12.6%. However, it is worth noting that the longer-term dwell time performance in Wales has shown signs of softening.

Additional analysis underscores the critical role of location intelligence in capturing and understanding the evolving dynamics of retail centres. By focusing on footfall and dwell time metrics, retailers and analysts can better gauge consumer engagement and adapt strategies to leverage these insights.

Industry commentary from Joe Capocci, spokesperson for Huq Industries, further highlights the relevance of these trends. "The striking rebound in Wales, coupled with supportive news of retail expansion, underscores gradual shifts in consumer behaviour across UK major retail centres," Capocci commented, emphasising that these figures point towards an evolving retail landscape driven by strategic location analytics.

With these insights, stakeholders are better equipped to understand the nuanced performance across regions and leverage location-driven data in shaping future strategies for retail growth and consumer engagement.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of physical commerce with our flagship lighthouse platform.

Looking for intelligence on specific locations? Explore the lighthouse platform.

Week 13 2025 Retail Parks Performance Update: Harnessing Location Analytics

Week 13 2025 Retail Parks Performance Update: Harnessing Location Analytics

UK Retail Parks showed a 5.5% footfall rise and a 9.9% increase in dwell time. Harnessing location analytics and robust footfall trends, weekly performance reflects changing visitor engagement.

This week’s update provides an in-depth look at the latest performance metrics of UK Retail Parks amid evolving visitor engagement patterns. Leveraging cutting-edge location intelligence data from The Benchmark, the report highlights both weekly improvements and ongoing challenges compared with previous benchmarks.

Overall Performance:

The analysis reveals that UK Retail Parks recorded an average daily footfall of 17,100 in Week 13, marking a weekly increase of 5.5% compared to the previous week. However, this improvement is tempered by a significant 15.1% decline from the same period last year. Meanwhile, visitors spent an average of 78 minutes at these parks, with dwell time increasing by a healthy 9.9% over the week, underscoring a trend of enhanced visitor engagement.

Regional Analysis:

The performance metrics vary considerably across different regions of the UK:

• In Wales, retail parks experienced an average daily footfall of 14,900, recording a 9.2% increase on a weekly basis. These parks, however, saw an 11.6% decline compared to the previous year, with average dwell times holding steady at 63 minutes despite the yearly decrease.

• In England, figures were slightly higher with an average daily footfall of 17,500 and a weekly growth of 5.9%. Although there was a 14% drop annually, the data shows improvement with an increasing dwell time averaging 78 minutes and a weekly growth of 9.9%.

• Scottish retail parks presented a different picture with an average footfall of 14,600, recording a modest weekly decline of 1.8% alongside a significant year‐on‐year downturn. Despite lower footfall, Scottish visitors’ engagement appears strong, as indicated by a longer average dwell time of 86 minutes and a weekly increase of 6.2%, accompanied by a sharp annual rise in visit duration.

Industry Comment:

Industry experts, including Joe Capocci, spokesperson for Huq Industries, noted that the contrasting trends between regions are noteworthy. "The most striking change in our data is the notable decline in footfall in Scotland contrasted with robust gains in other regions," said Capocci. This sentiment was mirrored by recent retail industry news, which underlined various expansion initiatives by major retailers that could be influencing these regional differences.

The insights presented in this update underscore the importance of harnessing location analytics to drive footfall and improve visitor engagement, providing valuable guidance for retailers navigating an evolving market landscape.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.