Week 17, 2025 Retail Parks Performance Update: Location Analytics Insights

Week 17, 2025 Retail Parks Performance Update: Location Analytics Insights

UK Retail Parks show a stable trend with a slight footfall increase averaging 18,700 daily visitors. Location analytics and location intelligence indicate modest shifts in consumer behaviour.

Share on LinkedIn

Overview

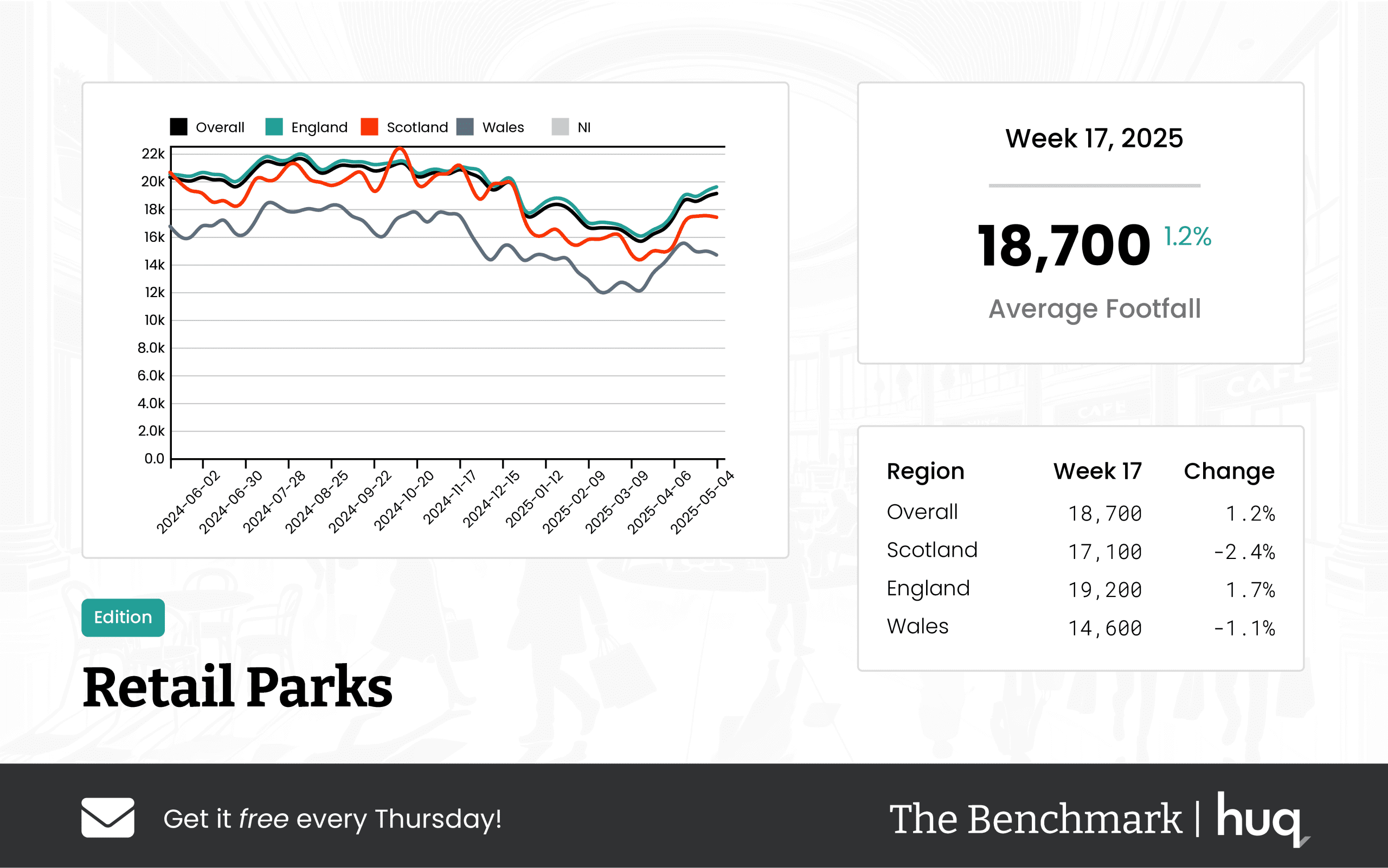

For the week ending 4 May 2025, UK Retail Parks recorded an average daily footfall of 18,700. Overall figures indicate a slight increase compared with the previous week, though a modest decline relative to the same week last year. This overall trend demonstrates stability amid ongoing adjustments in consumer behavior, as supported by insightful location analytics and footfall data.

Regional Performance

A deeper regional look reveals notable differences across the UK. In England, retail parks saw an average of 19,200 daily visitors, which is a modest improvement from the previous week. Conversely, Scotland experienced a decline to 17,100 daily visitors, with a notable decrease over the week and a more pronounced decline on a year on year basis, underscoring regional variations in consumer trends.

Visitor Engagement

The analysis of dwell time data brings further nuance to the visitor experience. Across UK Retail Parks, the average duration of visits has increased to 73 minutes. In England, visitors also averaged 73 minutes, while in Scotland, shoppers engaged for a longer duration of 83 minutes. Wales, however, showed a lower average dwell time, with visitors spending 62 minutes in retail parks. These metrics highlight unique regional preferences and shopping behaviors.

Industry Comment

Joe Capocci, spokesperson for Huq Industries, noted: "The most striking change in footfall is the increase seen in England, an observation that is well supported by recent developments in the UK retail industry." His comment reflects broader shifts in consumer behavior as captured through detailed location analytics and industry performance metrics.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

UK Shopping Centres – Week 17 Performance Update 2025: footfall Insights

UK Shopping Centres – Week 17 Performance Update 2025: footfall Insights

UK Shopping Centres showed a slight decline with a 9% drop, yet steady visitor engagement. Notably, footfall analytics highlight resilient performance.

Share on LinkedIn

Overview

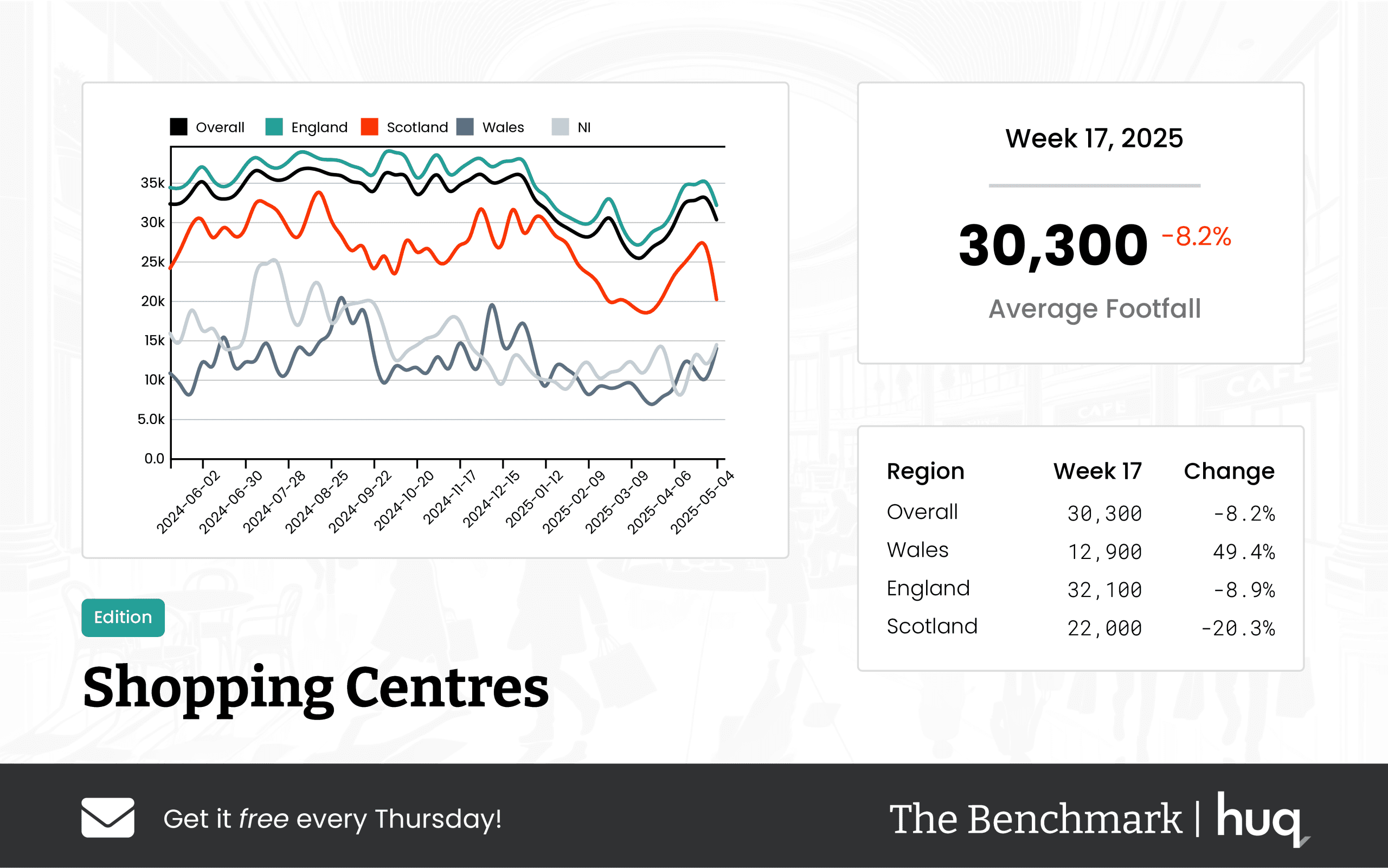

The latest update from The Benchmark reveals a mixed performance across UK Shopping Centres for the week ending 4 May 2025. Overall, the average daily footfall decreased moderately to 30,300 visitors, reflecting subdued performance on both a weekly and yearly basis. Dwell time remained robust at 119 minutes across centres, providing key footfall statistics for the period.

Wales

In Wales, centres reported an average daily footfall of 12,900 visitors. This sharp increase in both weekly and year-on-year comparisons shows strong footfall retail performance. The average visit duration reached 130 minutes, with both weekly and yearly figures indicating robust improvements.

England

In England, shopping centres attracted an average of 32,100 daily visitors. Data indicated modest declines of 8.9% week on week and 9.1% year on year, and footfall data reveal slight variations in visitor engagement. Dwell time in England was marginally lower at 120 minutes, with only slight slippage on a weekly basis despite modest yearly gains.

Scotland

In Scotland, the average number of daily visitors was recorded at 22,000, with a notable decline in footfall. However, visit durations improved, with an average dwell time of 99 minutes. Footfall analytics point to both weekly improvements and a sharp increase compared with last year.

Joe Capocci, Huq Industries spokesperson, stated, “The sharp increase in footfall and dwell time in Wales, alongside recent Retail Industry News noting significant developments, underlines the dynamic yet regional nature of our market.”

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 17, 2025 High Streets & Town Centres Update: Insights from Location Analytics

Week 17, 2025 High Streets & Town Centres Update: Insights from Location Analytics

A moderate recovery is underway with footfall rising by 1.9% week on week and 5.7% year on year, reflecting trends in location analytics and location intelligence.

Share on LinkedIn

Our recent analysis via location analytics confirms the figures and sets the scene for the detailed update ahead.

Latest Footfall Data

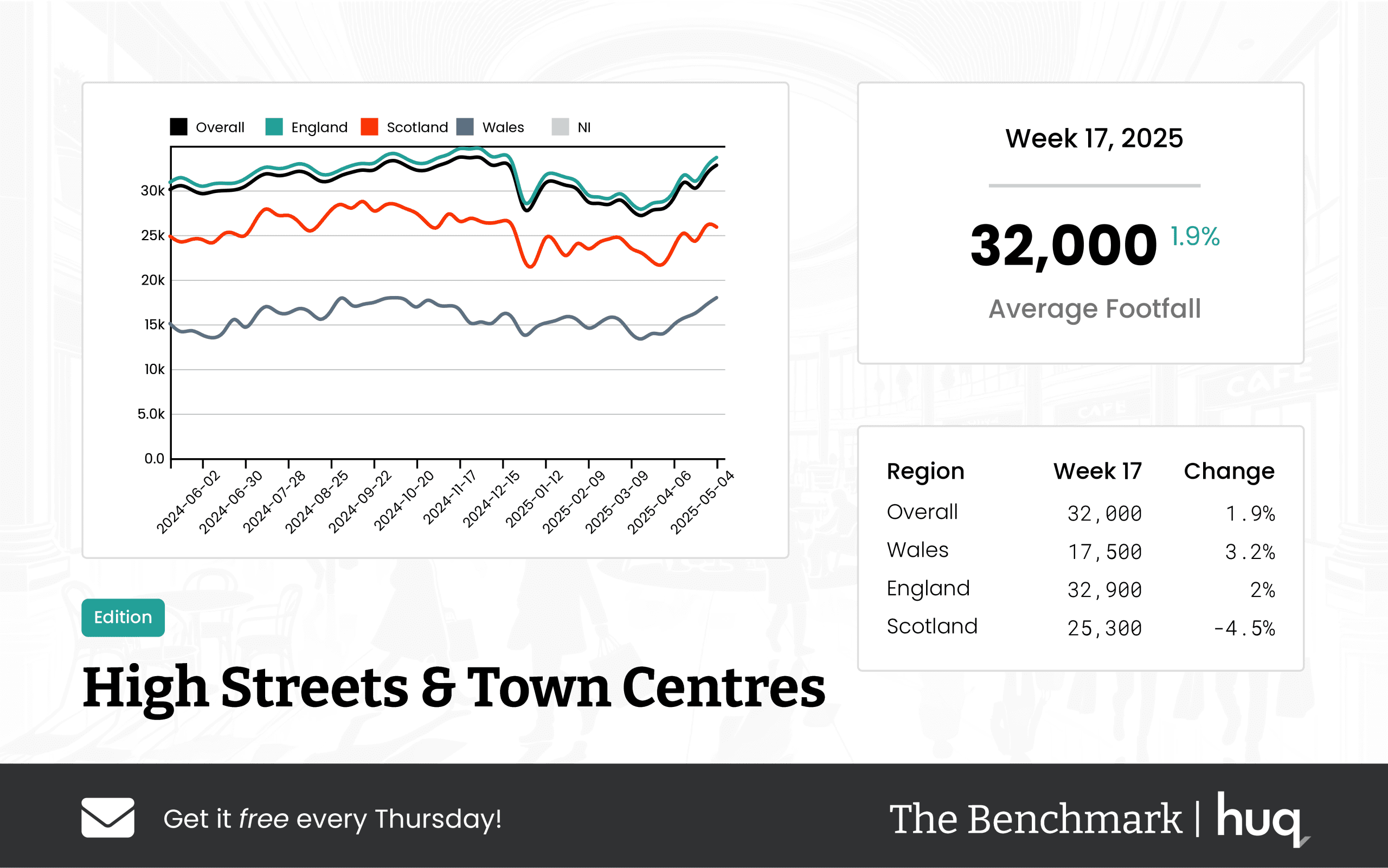

The latest figures for UK High Streets and Town Centres indicate a moderate recovery in customer visits with the overall average daily footfall reaching 32,000. This reflects a week on week gain of 1.9% and a year on year increase of 5.7%, demonstrating steady progress in retail visitation across the country. These numbers are a clear indication of evolving consumer behaviour and the gradual return of consistent market activity over the past week.

Regional Breakdown

A closer look at regional performance reveals a nuanced pattern. In England, the average daily footfall of 32,900 came with a modest week on week increase of 2% and an annual rise of 5.5%, suggesting that city centres and retail zones are steadily welcoming more visitors. Wales, meanwhile, recorded an average of 17,500 daily visitors, with a week on week improvement of 3.2% and a sharp increase in year on year footfall, underlining a strong longer term uplift in customer numbers. In contrast, Scotland saw an average daily footfall of 25,300. Despite a modest annual gain of 2.7%, some town hubs experienced a week on week drop of 4.5%, signalling a short-term softening in performance.

Dwell Time Analysis

Complementary to the visitor numbers, dwell time offers further insights into the quality of visits. Overall, the average visit duration remains at 100 minutes, reflecting continuity in customer engagement, with England mirroring this performance. In Wales, the average dwell time of 98 minutes has shown improvement, while Scotland experienced a decline to 94 minutes, suggesting more fleeting visits in that region.

Industry Comment

Joe Capocci, spokesperson for Huq Industries, said: "The notable week on week decline in Scotland's footfall, alongside a sharp increase in Wales and corroborated by recent retail industry developments such as Ikea’s Oxford Street store launch, highlights evolving consumer dynamics in UK town centres." Additional insights from location intelligence have enriched our understanding of these trends.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 17 2025 Footfall Update: UK Local Retail Centres

Week 17 2025 Footfall Update: UK Local Retail Centres

UK Local Retail Centres saw steady footfall with a 1.6% year-on-year increase, averaging 15,000 daily visitors. Recent footfall data confirms centre stability across the network.

Share on LinkedIn

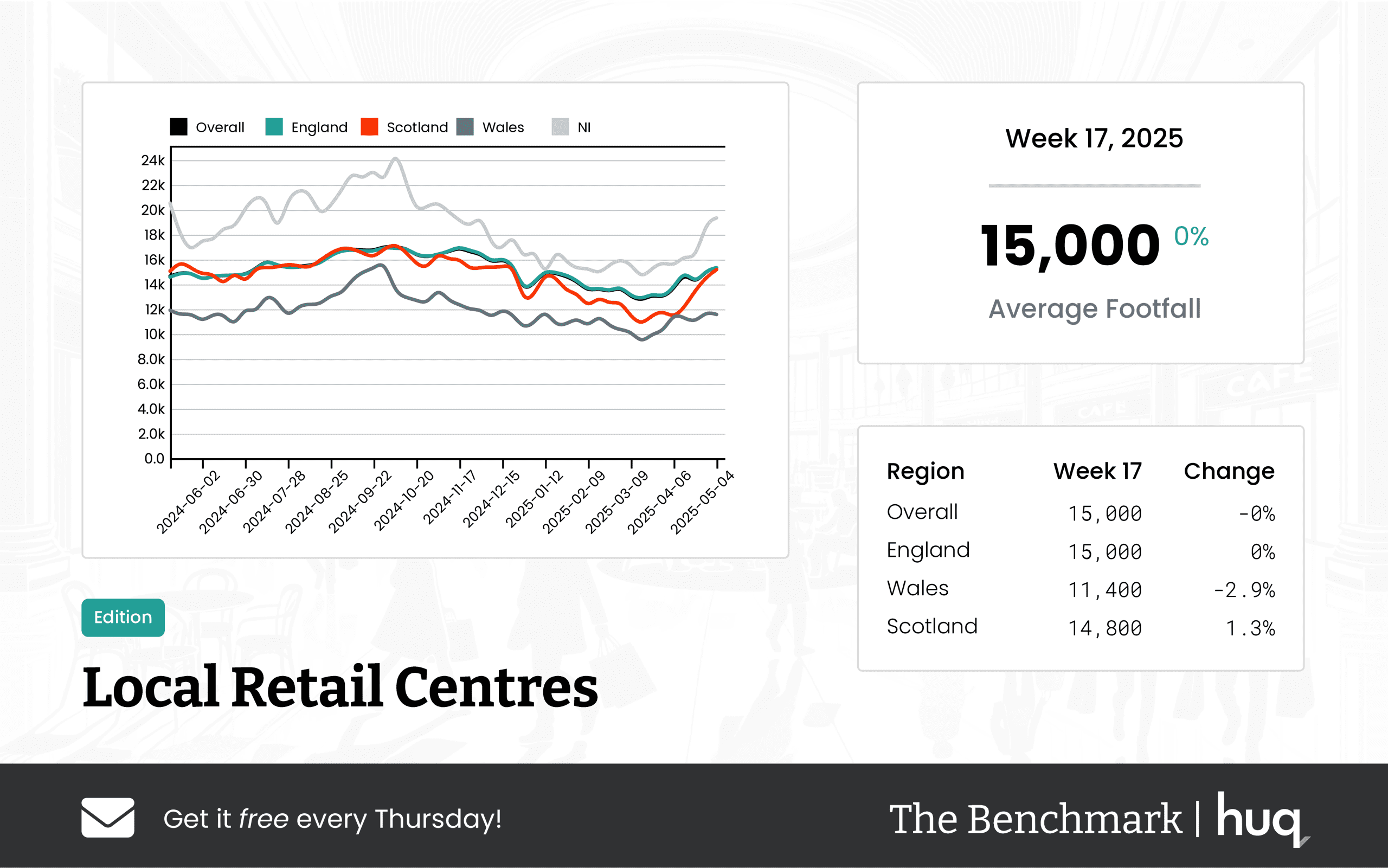

The latest Benchmark data for Week 17 shows that UK Local Retail Centres continue to deliver consistent performance with resilience across the network. Averaging 15,000 daily visitors, the centres recorded a modest year-on-year increase of 1.6%, maintaining stable week on week figures.

In a closer look, regional variations paint a nuanced picture. In England, daily averages stood at 15,000 visitors with an impressive 1.9% rise year on year, reinforcing the strength of these local hubs. Conversely, Welsh centres experienced challenges with an 11,400 daily visitor count, marked by a 2.9% drop week on week and a 3.7% decline year on year. Scotland’s centres offered a mixed story—averaging 14,800 daily visitors with a slight 1.3% improvement week on week, although the year on year figures fell modestly by 2.3%.

Dwell time data adds further insight to consumer behavior. Across all centres, visitors spent an average of 98 minutes per visit, reflecting a minor 1% decrease week on week but benefiting from a strong 16.7% increase over the year. In England, not only did visitors enjoy 99 minutes on average with a small weekly gain of 1%, but the year-on-year dwell time surged by 17.9%. Welsh centres, however, lagged with an average visit of 86 minutes, seeing significant declines of 17.3% weekly and 13.1% year on year. Scotland’s centres fared better with a 96-minute average visit, featuring a 5% weekly drop but an encouraging 20% year on year increase.

Industry perspectives, such as those shared by Joe Capocci from Huq Industries, underline the regional contrasts. The lower footfall in Welsh local centres echoes broader retail trends, adding another layer to the narrative of evolving consumer behaviors in the UK retail landscape.

Overall, Week 17 benchmarks illustrate that while stability dominates the sector, regional disparities and varying dwell times suggest a dynamic environment that retailers must navigate carefully.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 16 Weekly Wrap: Footfall Trends Across UK Retail

Week 16 Weekly Wrap: Footfall Trends Across UK Retail

UK retail shows a solid 7.6% annual rise with intriguing footfall analytics and footfall retail insights that are capturing attention.

Share on LinkedIn

The UK retail sector is under the spotlight with fresh footfall data revealing significant weekly trends. In these latest reports, footfall figures have been closely monitored across various centre types using comprehensive footfall analytics. As we explore the developments over weeks 13 to 16, notable changes in visitor numbers and engagement have been uncovered that are reshaping retail strategies.

Overview of Weekly Trends

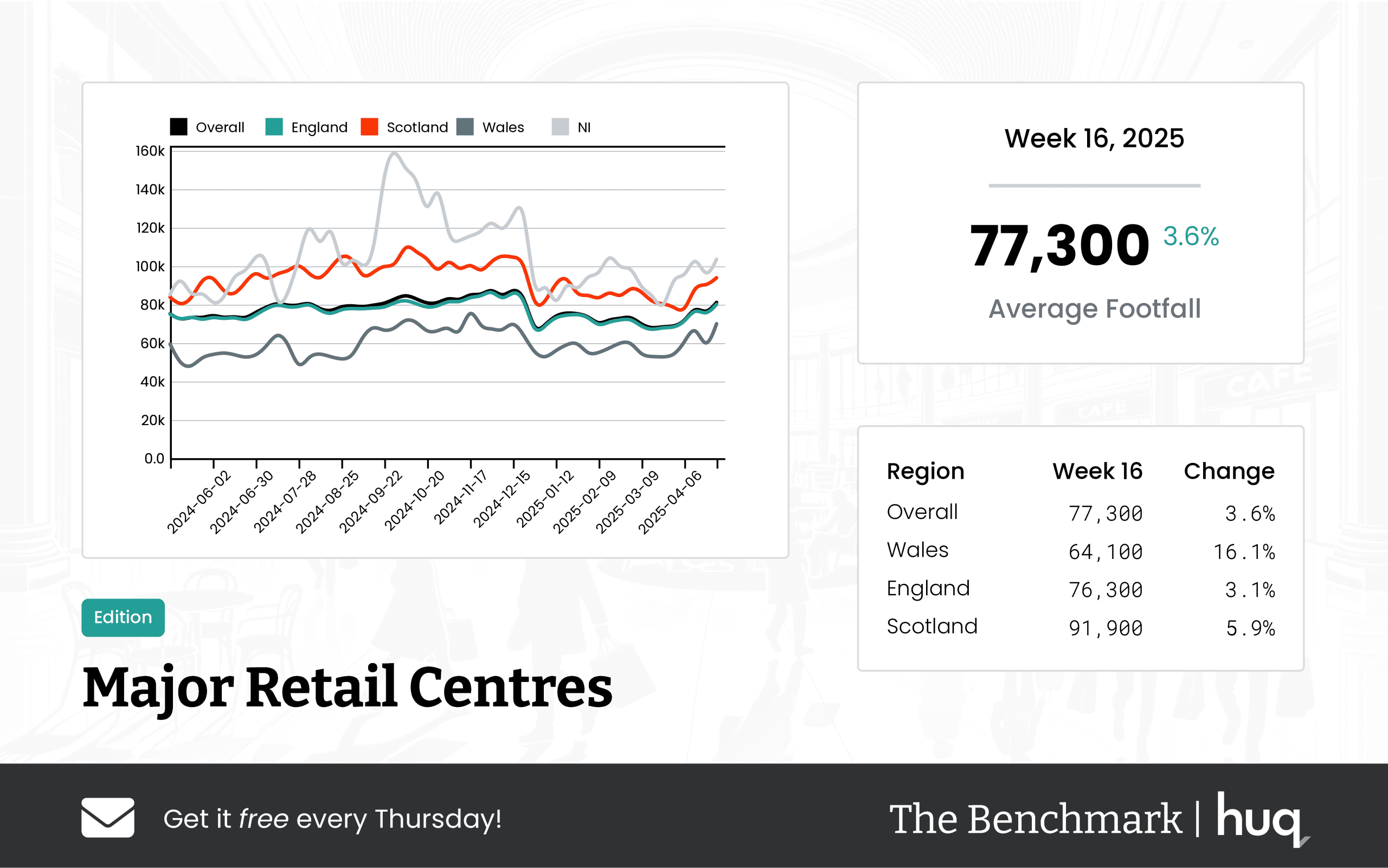

Emerging from recent data, the week has showcased diverse performance trends across multiple retail segments. Major Retail Centres experienced gradual improvements with a 7.6% annual increase, while High Streets and Local Retail Centres show cautious improvement. These insights, drawn from detailed footfall statistics and footfall data, set the stage for a deeper dive into the week’s evolving retail landscape.

Deep Dive into Major Retail Centres

Major Retail Centres have demonstrated resilience with average daily footfall moving from 69,800 in Week 13 to 77,300 in Week 16, reflecting a robust 7.6% annual rise. Footfall retail performance in key regions like Scotland and Wales also echoed this upward trend. For further details on these developments, refer to the Major Retail Centres Performance Update.

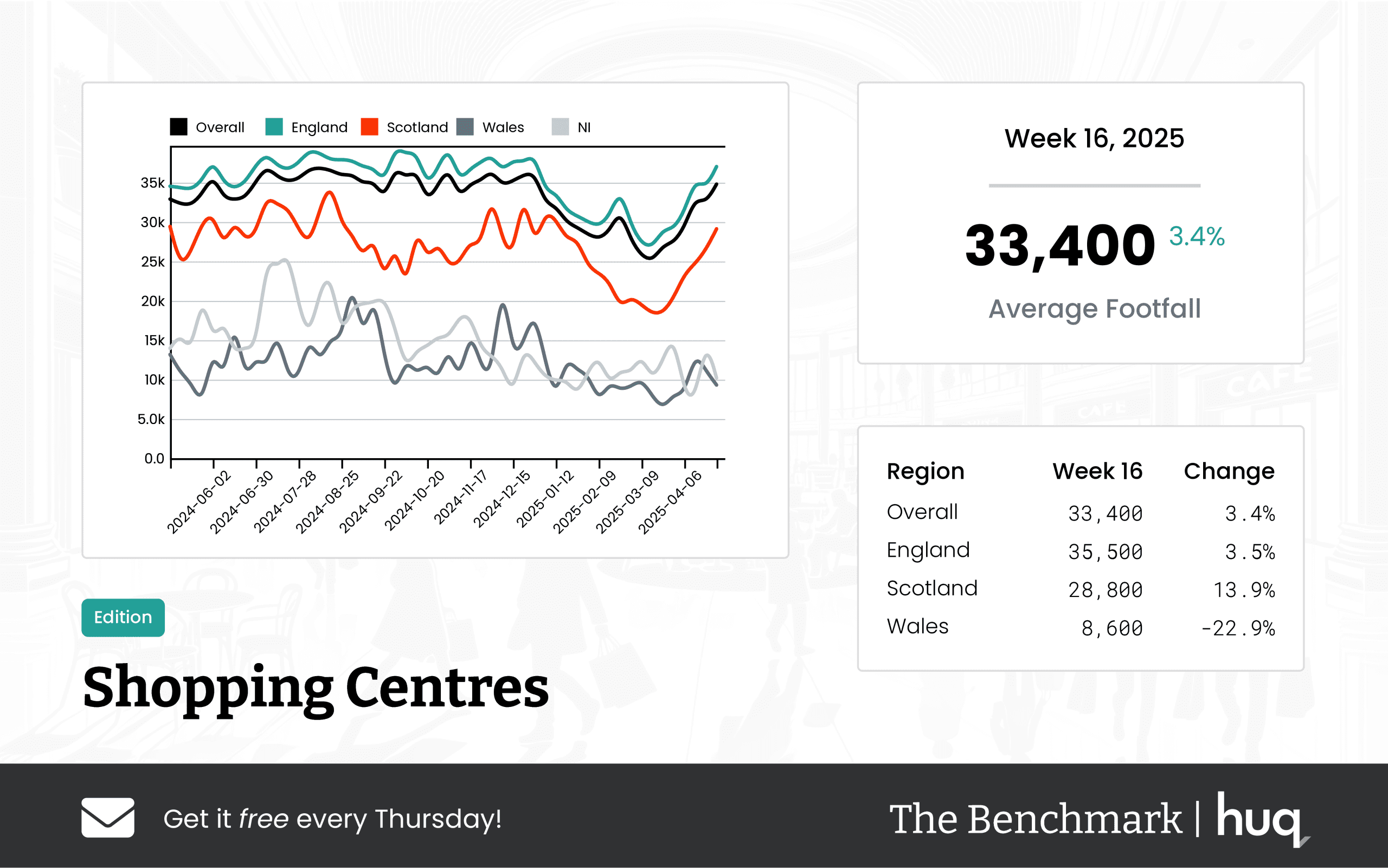

Insights from Shopping Centres

Shopping Centres have reported slight fluctuations, with Week 16 recording 33,400 daily visitors compared to a modest dip in Week 15. This variation indicates a shifting consumer mindset, and extended visit durations suggest that shoppers are spending more time per visit. These nuances in footfall counting and footfall statistics highlight the need for retailers to adapt strategies, as detailed further in the Shopping Centres Footfall Data Insights and the UK Shopping Centres Week 15 Update.

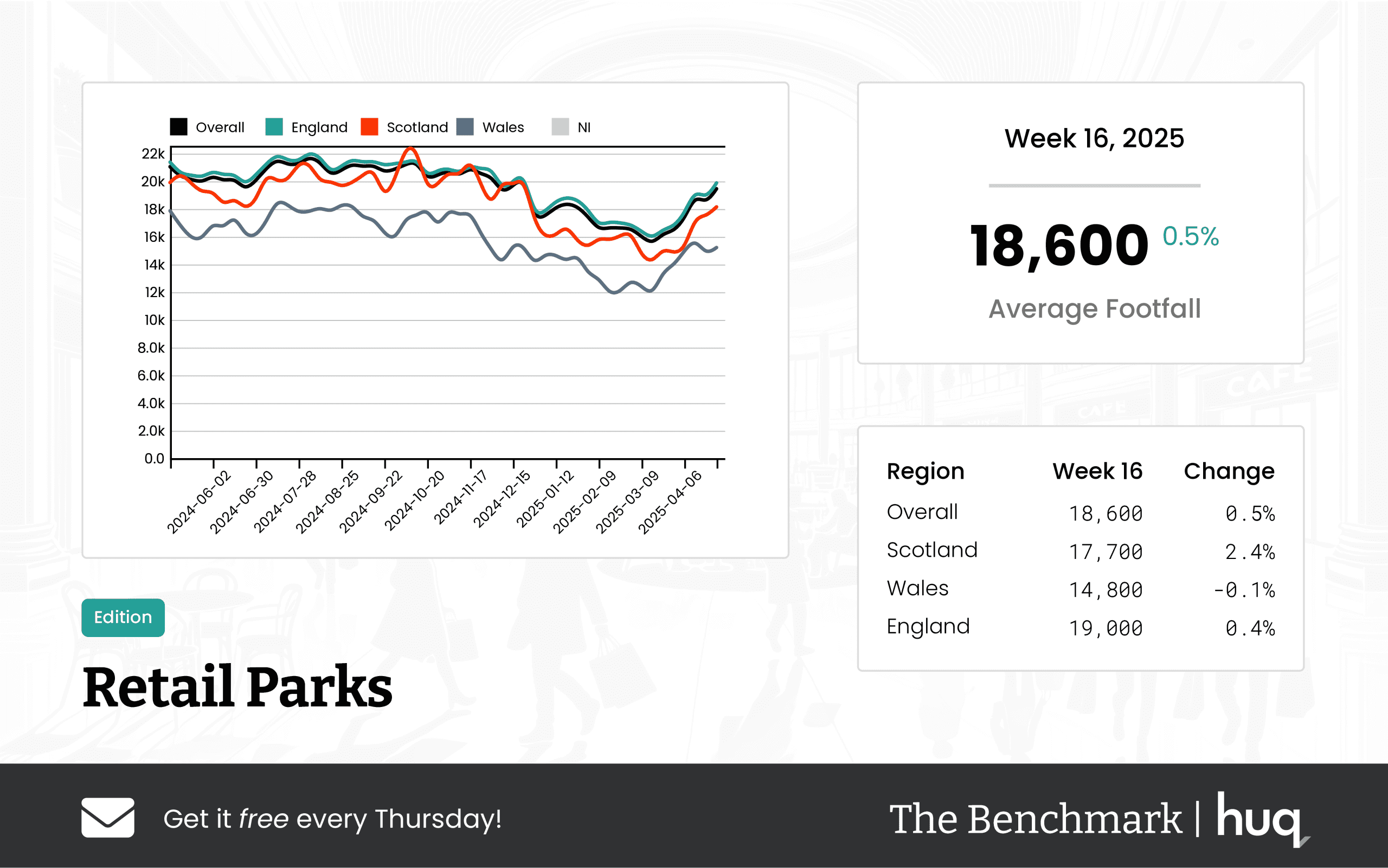

Retail Parks Performance

Retail Parks have faced their own challenges with an average daily footfall of 18,600 in Week 16, marking a modest 0.5% weekly increase despite a 7.4% annual decline. Regional variations further illustrate these challenges, with England modestly rebounding and Scotland showing higher weekly gains despite falling annually. This segment’s struggles emphasise the importance of utilising detailed footfall data and footfall analytics for refining retail operations, as noted in the Retail Parks Performance Update – Week 16 and the Week 15 Retail Parks Insights.

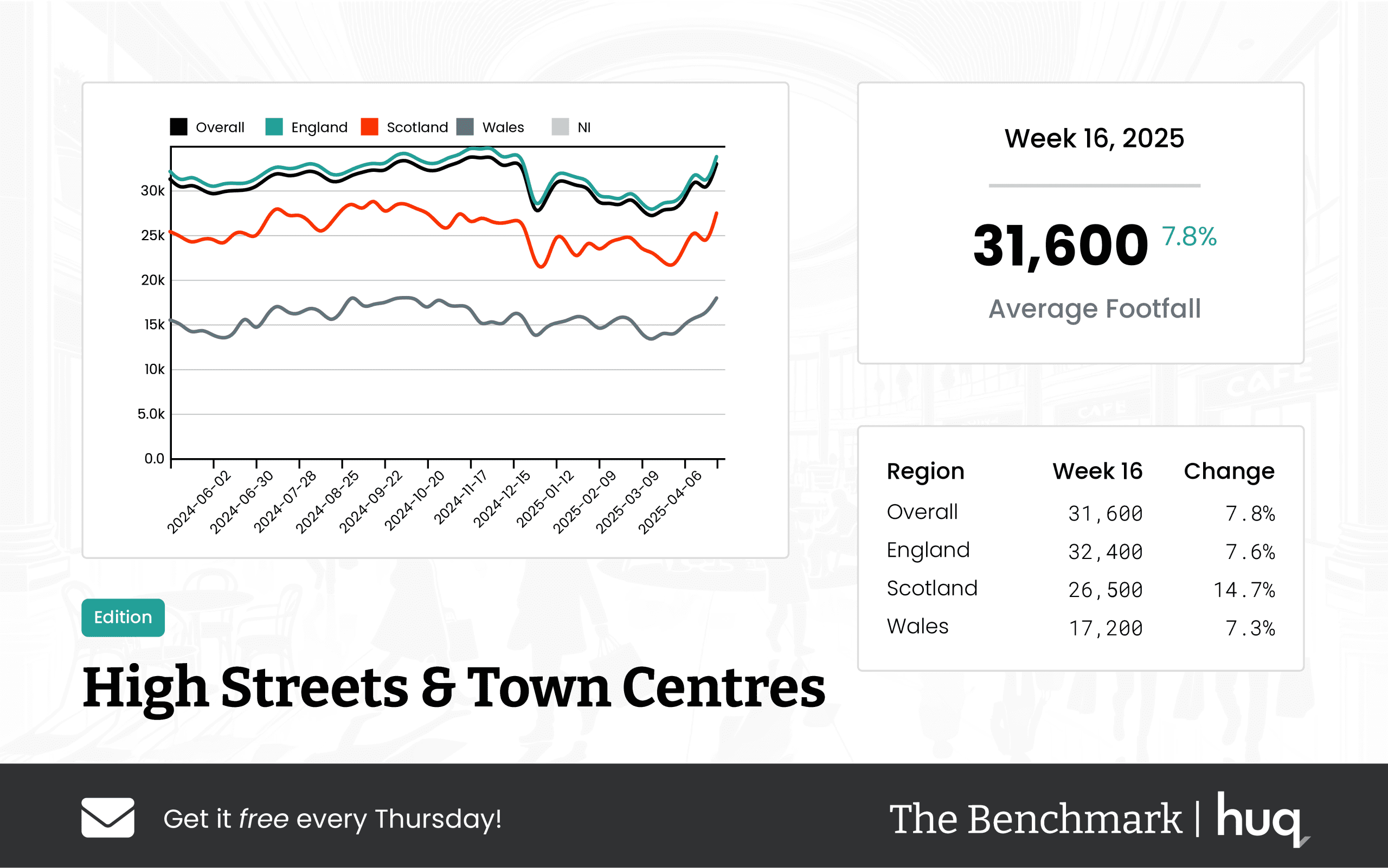

High Streets & Town Centres Observations

High Streets and Town Centres have shown a steady performance with an average daily footfall rising from 29,400 in Week 15 to 31,600 in Week 16. The dwell time also improved slightly, with regions like Scotland seeing marginal boosts that indicate deeper customer engagement. This consistent performance, as captured by robust footfall statistics, underscores the potential of urban centres to revitalise and adapt in changing market conditions, a topic explored further in the High Streets & Town Centres Week 16 Report and the Week 15 Performance Update.

Local Retail Centre Shifts

Local Retail Centres have been adapting well to changing consumer behaviours, with a 9.8% week-on-week improvement in footfall leading to an overall 5.4% annual increase in visitor numbers. The consistent use of footfall data in tracking these shifts has allowed these smaller centres to optimise dwell time and in-store engagement. More detailed insights into these evolving trends can be found in the Local Retail Centres Report – Week 16 and the Week 13 Weekly Wrap.

Expert Insights and Future Outlook

Joe Capocci, Huq Industries Spokesperson, stated, "The dynamic shifts we’re witnessing through rigorous footfall counting and footfall retail analyses provide invaluable insights into evolving shopper behaviours. Understanding these subtle changes helps retailers enhance engagement and tailor in-store experiences accordingly." His comments underline the power of detailed data and the evolving retail landscape. Looking forward, mastering footfall analytics will be crucial for retailers aiming to capitalise on emerging trends and drive resilient growth.

As retail continues to reinvent itself, the weekly wrap illustrates that no single sector is immune to change. Leveraging precise footfall data and smart analytics remains integral to sustaining growth. This week’s performance across diverse retail segments provides a glimpse into the strategic adjustments that lie ahead for the UK retail market.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

UK Retail Parks – Week 16, 2025 Performance Update with Location Analytics

UK Retail Parks – Week 16, 2025 Performance Update with Location Analytics

UK retail parks see a 0.5% weekly increase, yet overall declines persist. Notable insights from location analytics and growing location intelligence inform footfall performance analysis.

Share on LinkedIn

Overview

UK retail parks recorded an average daily footfall of 18,600 during Week 16, reflecting a modest 0.5% weekly increase alongside a 7.4% year-on-year decline. This data, sourced from The Benchmark, provides valuable location analytics insights for retail operators across the nation. The findings underscore that while there are encouraging short-term gains, significant longer-term challenges continue to affect the sector’s recovery.

Regional Performance

A detailed look at regional trends reveals distinct performance patterns:

• Scotland: An average daily visitor count of 17,700 marks a 2.4% weekly rise, although a 12.8% year-on-year decline is present.

• England: Retail parks in England saw an average of 19,000 daily visitors, enjoying a steady 0.4% weekly increase paired with a 6.6% annual drop in footfall.

• Wales: A slight weekly dip, with an average of 14,800 visitors and a 12.3% year-on-year decline, was noted in Wales.

Dwell Time & Additional Insights

Dwell time stands out as a key secondary metric, with visitors averaging 71 minutes per visit. This represents a weekly increase of 2.9% and an annual rise of 12.7%. Regional specifics include Scotland with a higher average visit duration of 74 minutes, while England and Wales both maintained an average of 71 minutes. England’s continuous week-on-week improvement and a short-term uplift in Wales further enhance the robust location intelligence framework needed for performance analysis.

Spokesperson’s Comment

Joe Capocci, spokesperson for Huq Industries, noted, "The most striking change this week was the sharp increase in Scotland’s weekly footfall, along with supportive indications from recent retail industry news." Despite the current uptick, the ongoing annual declines underscore the need for retailers to leverage insightful analytics as part of their recovery strategies.

Conclusion

In summary, while Week 16 highlighted incremental improvements, the underlying trends call for continued vigilance and innovative strategies to address the broader challenges faced by UK retail parks.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 16 2025 Shopping Centres: Footfall Data Insights

Week 16 2025 Shopping Centres: Footfall Data Insights

UK shopping centres show resilient footfall data with a modest weekly rise. Overall visitor numbers highlight evolving market dynamics and steady footfall retail trends.

Share on LinkedIn

The Week 16 2025 analysis of UK shopping centres reveals an overall stable yet evolving performance framework in the retail landscape. With an average daily footfall standing at 33,400 across the country, the data reflects a modest week on week increase, even as annual figures have softened relative to the previous year.

Regional performance indicates a mixed picture. In England, shopping centres have seen a positive uptick with an average of 35,500 daily visitors and a slight annual increase. Conversely, Scotland experienced an average of 28,800 daily visitors, showing a robust week on week improvement but facing a modest annual decline. Wales, however, recorded an average daily footfall of 8,600, encountering a noticeable drop both in recent week comparisons and on an annual basis.

Dwell time further accentuates these regional disparities. Across all centres, visitors are spending an average of 119 minutes per visit—a figure that has seen a moderate week on week rise and a substantial annual increase, reflecting deeper engagement within centres. In England, the average dwell time is 122 minutes, while Scotland’s centres report 89 minutes per visit, and Welsh centres see a slightly reduced engagement at 75 minutes per visit.

Joe Capocci, spokesperson for Huq Industries, commented on the trends: "We have seen a striking drop in Welsh visitor numbers along with emerging shifts in customer engagement, as echoed by recent industry headlines, reinforcing the need for continued adaptation in our retail strategy."

This detailed week on week and annual insight into footfall and dwell time not only underscores the resilience of UK shopping centres but also highlights evolving consumer behaviors that could shape future retail strategies.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 16 2025 High Streets & Town Centres Report: Insights from Footfall Retail Data

Week 16 2025 High Streets & Town Centres Report: Insights from Footfall Retail Data

UK High Streets & Town Centres continue to attract visitors with steady engagement, as data shows modest week‑on‑week improvement and gradually rising footfall, backed by modern analytics and evolving regional trends.

Share on LinkedIn

In the latest week of footfall retail data, UK High Streets and Town Centres recorded an average daily footfall of 31,600, representing a modest week‑on‑week improvement and a steady year‑on‑year increase. Visitors are also staying longer, with an average dwell time of 100 minutes per visit, following a modest weekly boost and maintaining a long‑term upward trend.

Robust footfall analytics underpinned these observations, and the reliability of modern footfall counting techniques has further validated the consistency in visitor numbers across UK centres.

Regional analysis reveals distinct performance variations. England's high streets achieved an average daily footfall of 32,400, with dwell time remaining consistent at 100 minutes per visit. In Scotland, despite a lower overall footfall of 26,500, there was a sharper weekly increase in visitor numbers combined with a slight rise in dwell time to 102 minutes, indicating stronger visitor engagement. Conversely, Welsh high streets recorded an average of 17,200 daily visitors, with a slightly lower average dwell time of 92 minutes. While visitor numbers in Wales are growing gradually both weekly and annually, the reduction in dwell time suggests differing engagement dynamics compared to other regions.

Industry observations add further insight. Joe Capocci, spokesperson for Huq Industries, commented, "The most striking change in footfall is seen in Scotland with a sharp increase in weekly numbers, and recent retail industry news regarding high street closures supports our observation of varied performance across the UK."

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 16 2025 Major Retail Centres Performance Update – Location Analytics Insight

Week 16 2025 Major Retail Centres Performance Update – Location Analytics Insight

UK Major Retail Centres saw modest increases in footfall (3.6%) and dwell time (2.7%), indicating steady engagement. Our location analytics data and location intelligence evidence rising trends.

Share on LinkedIn

Overview:

The latest figures from The Benchmark provide a clear view into the performance of UK Major Retail Centres for the week ending 27 April 2025. Centres across the UK registered an overall average daily footfall of 77,300, marking modest progress with a 3.6% increase week on week and a 7.6% rise compared to the same week last year.

Complementing these visitor numbers, the average dwell time per visit held at 115 minutes, with slight week on week and year on year increases of 2.7% and 3.6% respectively. These figures indicate consistent visitor engagement with the retail environments. These insights, underpinned by location intelligence, guide industry strategies.

Regional Analysis:

A closer examination of regional performance reveals some interesting contrasts. In England, the average daily footfall reached 76,300 with moderate improvements both on a week on week basis (3.1%) and when compared to last year (6.6%), while visitors maintained an average duration of 115 minutes. In-depth location intelligence further clarifies these developments.

Scotland’s retail centres outperformed the overall benchmark with an impressive average daily footfall of 91,900, alongside week on week and year on year gains of 5.9% and 9.2% respectively; however, there was a slight softening in visit duration week on week, even though the year on year uplift reached 7.5%. Conversely, Wales, with an overall lower average daily footfall of 64,100, experienced a particularly strong week on week rebound of 16.1% and recorded an average visit duration of 103 minutes, which saw a robust week on week increase of 9.6% despite a notable decline in the comparison with the previous year. Supplementary location intelligence data reinforces these performance contrasts.

Industry Comment:

“Both the marked week on week uplift we observed in Wales and the recent retail industry news highlighting major developments, such as new store openings and redevelopments, underscore the continued resilience within our retail sector,” said Joe Capocci, Huq Industries spokesperson.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

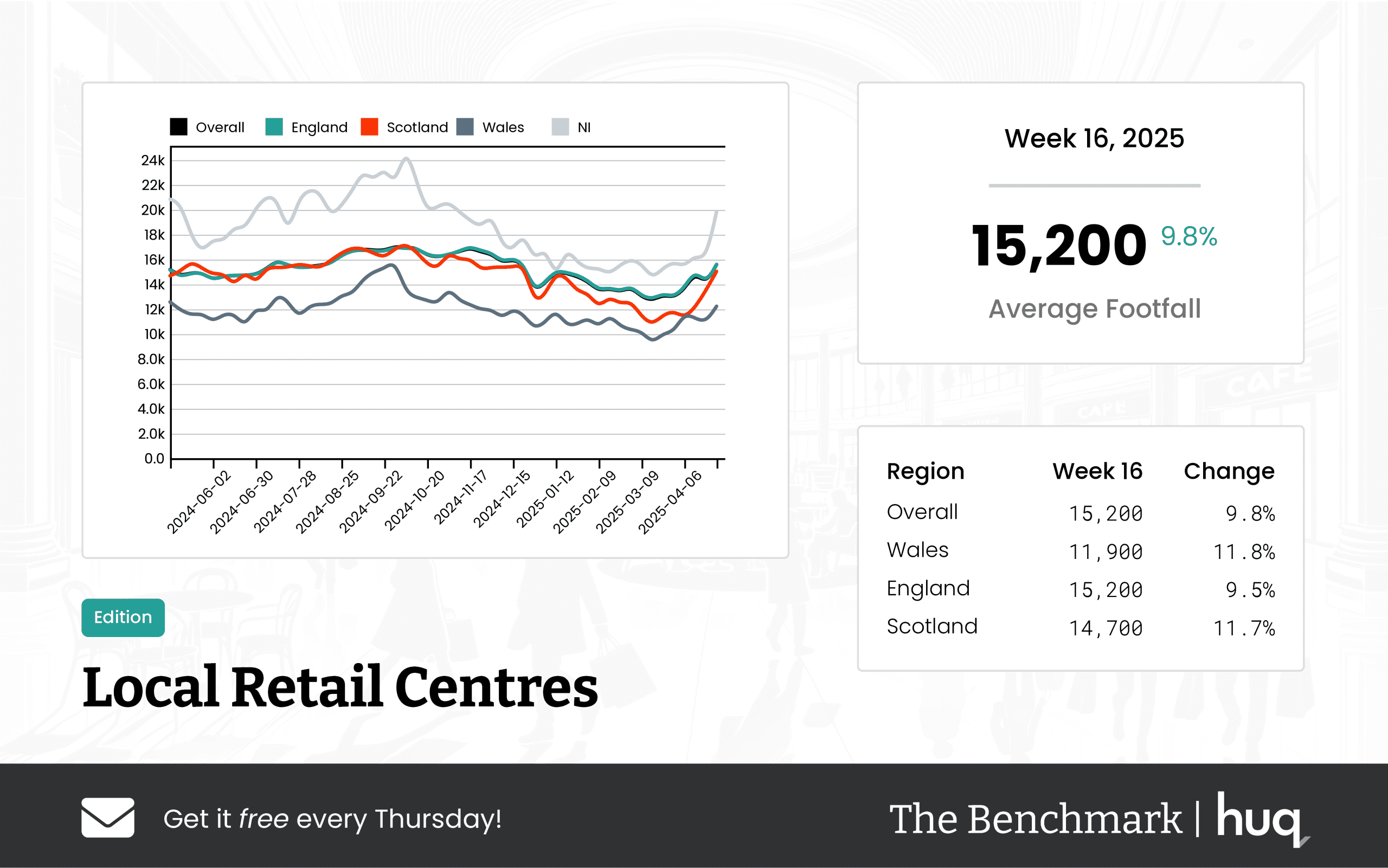

Week 16, 2025 Local Retail Centres Report: UK Location Analytics Insights

Week 16, 2025 Local Retail Centres Report: UK Location Analytics Insights

UK local retail centres saw footfall rise by 9.8% and a 5.4% annual increase, highlighting robust consumer engagement via location analytics and location intelligence.

Share on LinkedIn

UK Retail Centres continue to demonstrate resilience in a competitive market. The latest benchmark report by Huq Industries offers a detailed look into the performance of local retail centres across the UK. During the week ending April 27, 2025, retail centres recorded an average daily footfall of 15,200 visitors. This marks a 9.8% increase over the previous week and a 5.4% growth when compared annually.

The rise in footfall is accompanied by consumers spending an average of 99 minutes per visit. Dwell times have also seen a positive shift, with a 2.1% week-on-week increase and a notable improvement over the same week last year. These statistics are a testament to the effectiveness of utilising location analytics and location intelligence to gain deeper insights into consumer behaviour and retail performance.

A breakdown of regional data provides an interesting insight into local variations. Centres in England have maintained robust numbers with an average of 15,200 daily visitors, a 9.5% week-on-week improvement and a strong annual increase of 6.3%. The average dwell time here was recorded at 98 minutes per visit. In contrast, retail centres in Wales, while observing an 11.8% weekly uplift with 11,900 daily visitors, experienced an annual decline in footfall. However, Welsh centres recorded the longest visit durations at an average of 104 minutes per customer and a significant weekly improvement in dwell time of 18.2%.

Scottish centres have managed an average daily footfall of 14,700, showing an 11.7% increase during the week, although annual figures suggest a slight decline. Visitors in Scotland spent an average of 101 minutes per visit, highlighting steady consumer interest despite a tough retail environment.

Industry experts are optimistic about these trends. Joe Capocci, a spokesperson for Huq Industries, commented, "The sharp increase in footfall in key regions, alongside developments such as the retail centre revamp highlighted in recent industry news, confirms our belief in the market’s resilience." This industry sentiment, combined with positive footfall and dwell time data, underscores the ongoing consumer engagement and the critical role of location analytics in driving retail success across the UK.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.