Visitor Levy in England: What a Tourist Charge Could Mean for Town Centres and Local Growth

Visitor Levy in England

What a Tourist Charge Could Mean for Town Centres and Local Growth

The Visitor Levy: Why This Conversation Matters Now

A new government consultation proposes giving English mayors the power to introduce a visitor levy — a small charge on overnight accommodation, with revenue retained locally. The Visitor Levy in England consultation, published by the Department for Levelling Up, Housing and Communities, is currently seeking views on how such a levy might work in practice.

At first glance, this may appear to be a narrow tourism policy issue. In reality, it represents something much rarer in local government finance: the potential creation of a new, locally controlled revenue stream, rather than the redistribution or rebranding of existing funding.

For town centres and high streets — particularly in places with strong visitor economies — the implications could be significant.

What Is Being Proposed?

Under the consultation, mayoral areas would be given the power to introduce a modest per-night charge on overnight stays. This would typically be collected via hotels, guesthouses and short-term accommodation providers.

It is important to be clear about how this would work in practice.

The levy would be paid by visitors, not by businesses. Accommodation providers would act as collection agents, passing the charge on as part of the cost of an overnight stay and remitting it to the relevant authority. In effect, the levy would function as a small increase in the price of accommodation for tourists, rather than a direct contribution from local businesses.

Revenue raised would be retained locally and intended to support the visitor economy and the impacts associated with it.

Versions of visitor levies already exist, or are being introduced, in parts of Scotland and Wales, where revenue is also intended to support local services and place quality. What is distinctive in the English context is the way the proposal is being positioned alongside wider devolution and local fiscal reform — framing the levy not just as a tourism mechanism, but as a locally controlled tool that could support town centre management, public realm and broader place-based outcomes.

Why Visitor Levies Matter for Town Centres

Visitors play a critical role in the health of many town and city centres. They drive footfall, spend and evening-economy activity, supporting retail, hospitality and cultural venues.

At the same time, visitor growth places additional pressure on local infrastructure and services. This includes cleaning and waste management, transport and wayfinding, public toilets, public realm maintenance, safety and night-time management.

These costs are often absorbed by councils without any direct mechanism to recoup them, particularly in places with seasonal tourism or high concentrations of short-term lets.

A locally retained visitor levy offers a way to more directly connect visitor spend with place quality, funding the everyday interventions that help town centres function well for residents and visitors alike.

This Is About Place Management, Not Just Tourism

Although framed as a tourism policy, the visitor levy has wider implications for economic development and regeneration.

If designed and implemented well, levy revenue could support the kinds of interventions that are difficult to fund through traditional capital-led regeneration programmes. This includes ongoing town centre management, public realm maintenance, safety initiatives, wayfinding, events, markets and cultural programming.

These interventions may not always be high-profile, but they have a disproportionate impact on how places feel and perform. In that sense, the levy has the potential to become a revenue backbone for place management, supporting the fundamentals that underpin footfall, confidence and investment.

Trust, Design and Visibility Will Determine Success

Because the levy is paid by visitors rather than businesses, the central challenge is less about cost burden and more about legitimacy, transparency and delivery.

Experience from BIDs and other place-based mechanisms shows that stakeholders are often supportive of contributions when the purpose is clear, governance feels local, and benefits are visible. While the visitor levy is not a business contribution in the same way a BID levy is, the comparison is still useful: acceptance depends on clarity of purpose and confidence that funds are being reinvested into improving the places people experience.

For accommodation providers, the key considerations are likely to be simplicity of administration and confidence that the levy will not undermine competitiveness. For visitors, the test will be whether the charge feels proportionate and justified by the quality of place they encounter.

Where schemes are transparent, simple and clearly reinvested, they are more likely to be understood as a practical tool rather than an imposition.

Governance and Geography Still Matter

One of the most important questions raised by the consultation is how levy revenue would be governed and allocated.

This includes how decisions are made about spend, how outcomes are reported, and how closely revenue raised in specific towns or city centres is reinvested locally, rather than being diluted across wider administrative areas.

As devolution and local government reorganisation continue to evolve, these questions remain unresolved. Ensuring that any future levy remains visibly connected to the places generating it will be critical to maintaining confidence and support, regardless of the final governance structure.

What This Consultation Phase Is Useful For

At this stage, the visitor levy remains a proposal rather than a confirmed policy. Most councils will not — and should not — commit significant resource until there is greater clarity from government.

However, the consultation phase still provides a valuable opportunity to feed delivery-focused insight into the design of any future scheme.

For regeneration, place and economic development teams, this may include reflecting on where visitor pressure is already felt in town centres, what types of investment are hardest to fund through existing mechanisms, and what principles would matter most if a levy were ever introduced.

This is less about preparing for implementation, and more about ensuring that if new local fiscal tools do emerge, they are shaped by delivery reality rather than theory.

A Measured Opportunity

The visitor levy is not a silver bullet for town centre funding. It will not replace national regeneration programmes or solve structural challenges overnight.

But it represents a rare opportunity: a potential locally controlled, recurring revenue source tied directly to place quality and visitor experience.

Handled carefully, it could quietly fund the basics that make town centres work — the things that rarely attract capital grants, but matter most to confidence, footfall and long-term vitality.

The consultation phase is the moment when councils and combined authorities still have influence over how — and whether — that opportunity is realised.

Related reading

👉 Business Rates 2026: What the Revaluation Means for High Streets — and What Councils Should Do Now

Business Rates 2026: What the Revaluation Means for High Streets

Business Rates 2026: Why This Matters Now

From April 2026, business rates bills across England will change following a national revaluation and a revised package of reliefs confirmed at the Autumn Budget 2025

While business rates reform is often discussed as a technical or finance-led issue, the 2026 revaluation will have very real consequences for town centres. For many high street businesses, rates remain one of the largest fixed costs they face, often higher than rent.

The impact will not be uniform. Some businesses will see reductions or manageable changes. Others may face sharp increases that threaten viability.

For councils, the key issue is not whether the policy is “good” or “bad”, but how disruptive the transition becomes locally.

What Is Actually Changing in 2026?

From April 2026, England’s business rates system will undergo a national revaluation, updating rateable values to reflect changes in the commercial property market since the last valuation.

In simple terms, revaluation is meant to reset the system so that businesses pay rates based on current rental values rather than outdated assumptions. In practice, however, it often creates uncertainty, particularly for high street businesses operating on tight margins.

Alongside the revaluation, the government has confirmed a package of accompanying measures, including:

- Lower multipliers for retail, hospitality and leisure properties

- Transitional relief to cap sudden increases in bills

- Higher contributions from some large, high-value commercial properties

The Valuation Office Agency (VOA) is responsible for setting rateable values, using evidence such as rental data, location, property size and use. Its published guidance explains the methodology in detail here -> Rating System.

However, while the mechanics matter to advisers and finance teams, most businesses experience revaluation in a far simpler way: through a new bill landing on the doormat. What makes the 2026 revaluation particularly sensitive is its timing. It comes after several years of economic disruption, rising operating costs, and structural change on the high street. Even where reliefs apply, any increase or perceived increase can undermine confidence.

For councils, this means that revaluation should not be treated as a routine administrative update. It is a material change to the local business environment that requires active management.

However, for most businesses the practical question is simple: “Is my bill going up, and can I afford it?”

Why Business Rates Still Matter So Much for High Streets

Despite repeated calls for reform, business rates remain one of the most significant fixed costs for town centre businesses — and one of the least flexible.

Unlike rent, rates do not respond to trading performance. A business can have a poor year and still face the same bill. For high street operators dealing with fluctuating footfall, seasonal trade and rising staffing costs, this rigidity matters.

Even modest increases can:

- Push marginal businesses into closure

- Reduce opening hours or staffing levels

- Delay investment in fit-outs, refurbishment or marketing

- Accelerate decisions to downsize or relocate

Importantly, revaluations don’t only affect struggling businesses. In some locations, increased footfall, new residential development or public realm improvements can lead to higher rateable values — meaning successful streets may see higher bills.

This creates a paradox for regeneration: improvements designed to revitalise town centres can, over time, increase cost pressures for the very businesses that made them successful.

The Local Government Association has consistently warned that without careful local handling, revaluations risk destabilising fragile high streets. For councils, this reinforces a critical point: business rates policy may be national, but its consequences are local.

This Is a Place Management Issue, Not Just a Finance One

Although councils don’t control business rates policy, they play a critical role in how the revaluation lands locally.

The most effective authorities treat business rates changes as a place management challenge, not simply an administrative task.

That means recognising that:

- Business closures affect footfall, perception and safety

- Vacancies undermine wider regeneration investment

- Poor communication increases anxiety and distrust among businesses

In contrast, proactive councils use revaluation periods to:

- Build trust with businesses

- Align rates messaging with business support

- Strengthen town centre relationships

What Councils and BIDs Should Be Doing Now

April 2026 may feel distant, but by the time bills are issued, options for intervention are limited.

The most important work happens before the revaluation takes effect.

Practical actions include:

1. Identify exposure early

Use local intelligence to identify businesses likely to face large increases — particularly independents, hospitality operators and long-established tenants.

2. Communicate clearly and early

Businesses don’t expect councils to fix the system, but they do expect clarity. Simple explanations of what’s changing, what relief exists and where to get help can significantly reduce shock.

3. Create a single support route

Avoid fragmented messaging. A single webpage, contact point or briefing session can prevent confusion and build confidence.

4. Align with wider business support

Use the revaluation as a trigger to connect businesses with:

- Cashflow and resilience support

- Productivity and digital tools

- Local grants or discretionary relief where available

5. Use reliefs strategically

Where retail, hospitality and leisure relief applies, this should feature in inward investment and letting conversations. Improved rates affordability can be a genuine selling point for town centres.

Policy doesn’t close shops. Poor transitions do.

The Risk of Doing Nothing

Councils that take a passive approach to the 2026 business rates revaluation risk entering a period of disruption that is both foreseeable and largely avoidable.

When changes to business rates are allowed to land without preparation or communication, the impacts tend to be sudden and concentrated. Businesses that have been operating on tight margins may find themselves unable to absorb higher bills, leading to closures or rapid downsizing in the weeks following the issue of new demands. At the same time, councils often experience a sharp rise in appeals, complaints and requests for clarification, placing additional pressure on revenues teams and customer services at exactly the moment when clarity is most needed.

These effects rarely remain contained. Business closures contribute to increased vacancy rates, which in turn undermine footfall, perception and confidence in the town centre. For traders who remain, a poorly managed revaluation can damage trust in the local authority, particularly if businesses feel they were not warned, supported or listened to. Once confidence is lost, it can take years to rebuild, and regeneration programmes operating in parallel often suffer as a result.

Crucially, these outcomes are difficult and costly to reverse once they take hold. Filling vacant units requires time, incentives and renewed investment. Repairing relationships with local businesses demands sustained engagement. The opportunity to soften the immediate shock of revaluation, however, exists only before April 2026.

By contrast, councils that plan early and communicate clearly tend to experience a very different trajectory. Businesses are better prepared for change, even when the outcome is challenging. Rates conversations become part of a wider dialogue about viability, support and the future of the town centre, rather than a flashpoint for frustration. Relationships with BIDs, traders and landlords are often strengthened, and regeneration teams are able to maintain momentum rather than diverting energy into crisis management.

In these places, revaluation does not disappear as an issue, but it becomes manageable. The focus remains on retaining businesses, supporting occupancy and delivering longer-term regeneration objectives, rather than reacting to avoidable shocks.

The revaluation itself will happen regardless. What varies, and what councils still have agency over, is the local experience of it.

Business Rates as Part of a Bigger Picture

Business rates don’t operate in isolation.

Their impact in 2026 will interact with:

- Rising wage costs

- Changing consumer behaviour

- Ongoing regeneration programmes

- The wider council funding environment

Understanding these interactions is essential if high streets are to remain viable and investable.

A Moment to Act, Not React

The 2026 revaluation is not a surprise. The policy direction is clear, and the timetable is known.

For councils, BIDs and regeneration teams, the question is not whether change is coming — it is how prepared local places are to manage it.

Those that act early will absorb the change. Those that wait will spend 2026 firefighting.

Related reading

The Local Government Finance Settlement 2026–29: Why It Matters for Regeneration & Economic Development

The Local Government Finance Settlement 2026–29: Why It Matters

The Local Government Finance Settlement 2026–29 marks a significant shift for councils across England. For the first time in more than a decade, local authorities have been given multi-year funding certainty, replacing annual settlements and short-term fixes.

Full details of the settlement are available via the government’s official announcement.

From Annual Uncertainty to Medium-Term Planning

For much of the past decade, councils have been operating in a state of financial uncertainty. Annual settlements, late announcements and reliance on competitive funding bids have made it difficult to plan beyond a single financial year.

This has had a direct impact on town centre regeneration.

High street programmes typically depend on:

- Multi-year capital investment

- Ongoing revenue funding (management, safety, animation)

- Coordination across planning, transport, culture and community safety

Short-term funding cycles have often resulted in fragmented delivery or stalled programmes.

The move to a multi-year settlement doesn’t remove financial pressure, but it reduces volatility. As the Local Government Association has highlighted, it allows councils to align budgets with medium-term priorities rather than operating in constant crisis mode.

For regeneration teams, this shift is structural rather than financial, and that distinction is critical.

Why the Finance Settlement Still Matters for Town Centres

Regeneration and economic development activity usually sits within discretionary budgets. When statutory services come under pressure, those budgets are often the first to be cut.

By stabilising the wider system, the 2026–29 settlement indirectly:

- Reduces the risk of in-year cuts to regeneration programmes

- Makes it easier to commit to multi-year town centre strategies

- Protects delivery capacity that is often lost during budget crises

- Improves confidence among private sector and third-sector partners

Town centre recovery rarely comes from a single intervention. It depends on sequenced investment, improving safety and cleanliness, activating space, supporting businesses, and only then moving into longer-term redevelopment.

Multi-year funding certainty allows councils to treat regeneration as a programme, not a series of disconnected projects.

Funding Distribution vs Regeneration Delivery

The settlement also rebalances funding towards areas of higher need. This is significant for towns that have experienced long-term disinvestment.

However, increased funding alone does not guarantee successful regeneration.

Delivery still depends on:

- Clear prioritisation of places and projects

- Sufficient internal capacity

- Alignment between finance, regeneration, planning and transport

- Realistic delivery timescales

What This Finance Settlement Is — and Isn’t

This settlement is not:

- A new regeneration fund

- A replacement for capital programmes such as the Levelling Up Fund, Towns Fund or UK Shared Prosperity Fund

- Money councils can freely redirect to high streets

This settlement is:

- Greater funding certainty over a three-year period

- Reduced pressure on discretionary budgets

- Increased confidence to commit to multi-year place programmes

A stabilising factor that makes regeneration delivery more realistic.

A Quiet but Consequential Shift for High Streets

This finance settlement is unlikely to generate headlines or ribbon-cutting moments. It does not promise quick wins or large new regeneration pots.

What it does provide is arguably more important: the ability to plan with confidence.

For regeneration teams that have spent years operating in survival mode, this shift could quietly define what gets delivered on high streets between now and 2029.

Related reading

👉 Business Rates 2026: Who Wins, Who Loses, and What Councils Should Do Now

https://huq.io/blog/business-rates-2026-high-street

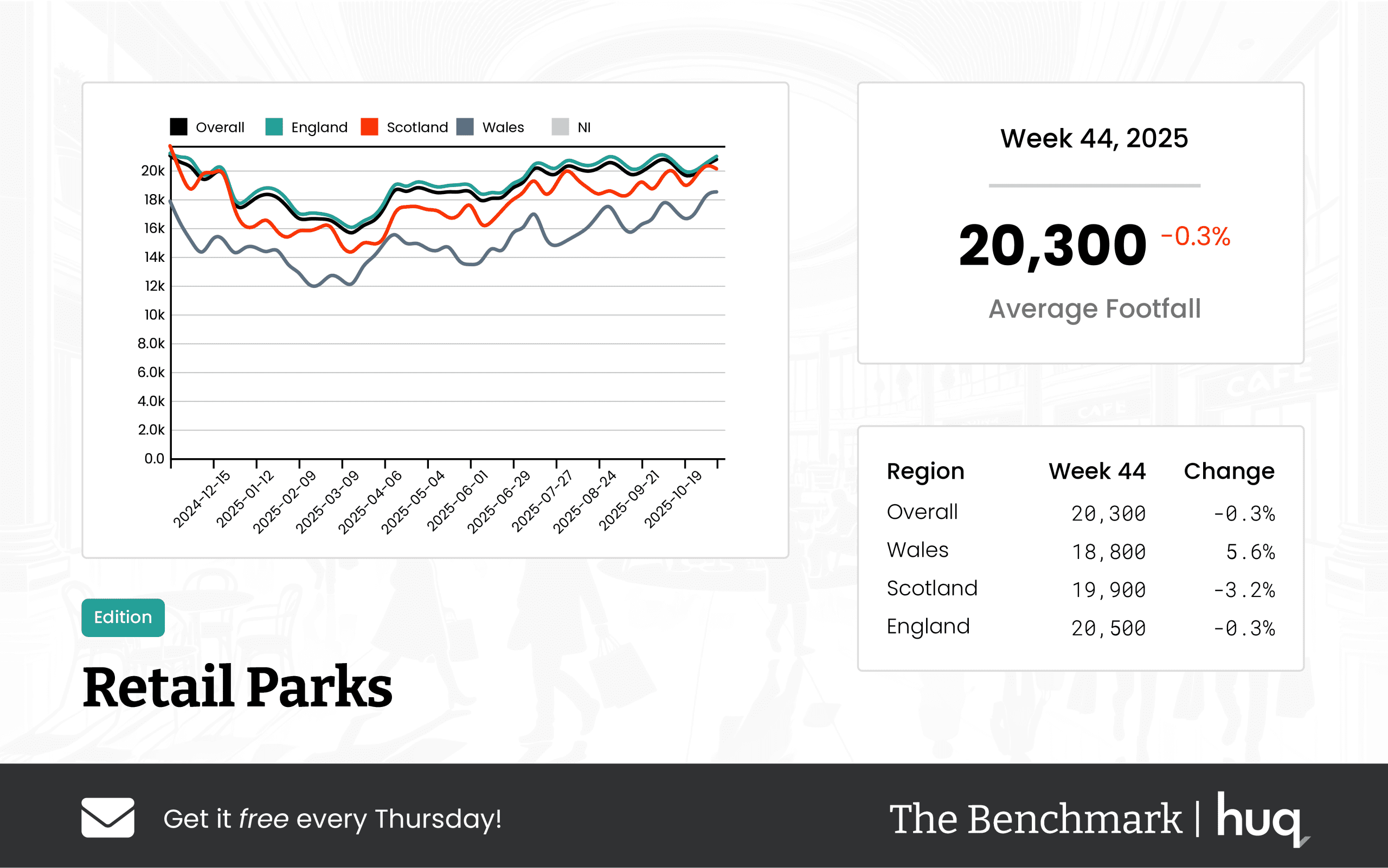

Week 44 2025 Retail Parks Performance Update – Leveraging location analytics

Week 44 2025 Retail Parks Performance Update – Leveraging location analytics

UK Retail Parks maintained steady footfall with around 20,300 daily visits and longer visit durations. location analytics insights and location intelligence reveal an overall stable trend amid slight fluctuations.

Share on LinkedIn

The latest figures from The Benchmark reveal that UK Retail Parks maintained relatively stable visitation overall during the week, with an average daily footfall of 20,300 visits. Although this represents only a slight drop compared to the previous week and a modest fall relative to the same period last year, the data indicates that consumers are responding well, as the average duration of each visit increased to 75 minutes.

Regional insights show that performance varies across the UK. In Wales, daily visits averaged 18,800 with an encouraging upward trend in footfall. England led with the highest regional performance at 20,500 daily visits, though there was a slight decline compared to previous figures. In contrast, Scotland recorded an average of 19,900 daily visits alongside the shortest visit duration, pointing to a potential area for further location intelligence review.

Visitor engagement remains a crucial measure across these retail hubs. In England, consumers spent an average of 77 minutes per visit, indicating improved engagement. Wales followed closely with an average visit duration of 74 minutes. Meanwhile, Scotland’s visitors averaged only 58 minutes per visit, suggesting a less engaging consumer experience.

Industry insights further contextualize these findings. According to Joe Capocci, a spokesperson for Huq Industries, "Observed changes include a particularly notable increase in Welsh footfall alongside the decline in Scotland, which aligns with the broader trends noted in recent retail industry news such as developments at Wynyard Retail and Trade Park." This commentary underscores the role of nuanced location analytics in understanding regional differences and guiding strategic improvements in the retail parks sector.

By leveraging location intelligence, retail parks can continue to optimize visitor experiences, direct targeted improvements, and sustain steady engagement even as industry dynamics shift.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

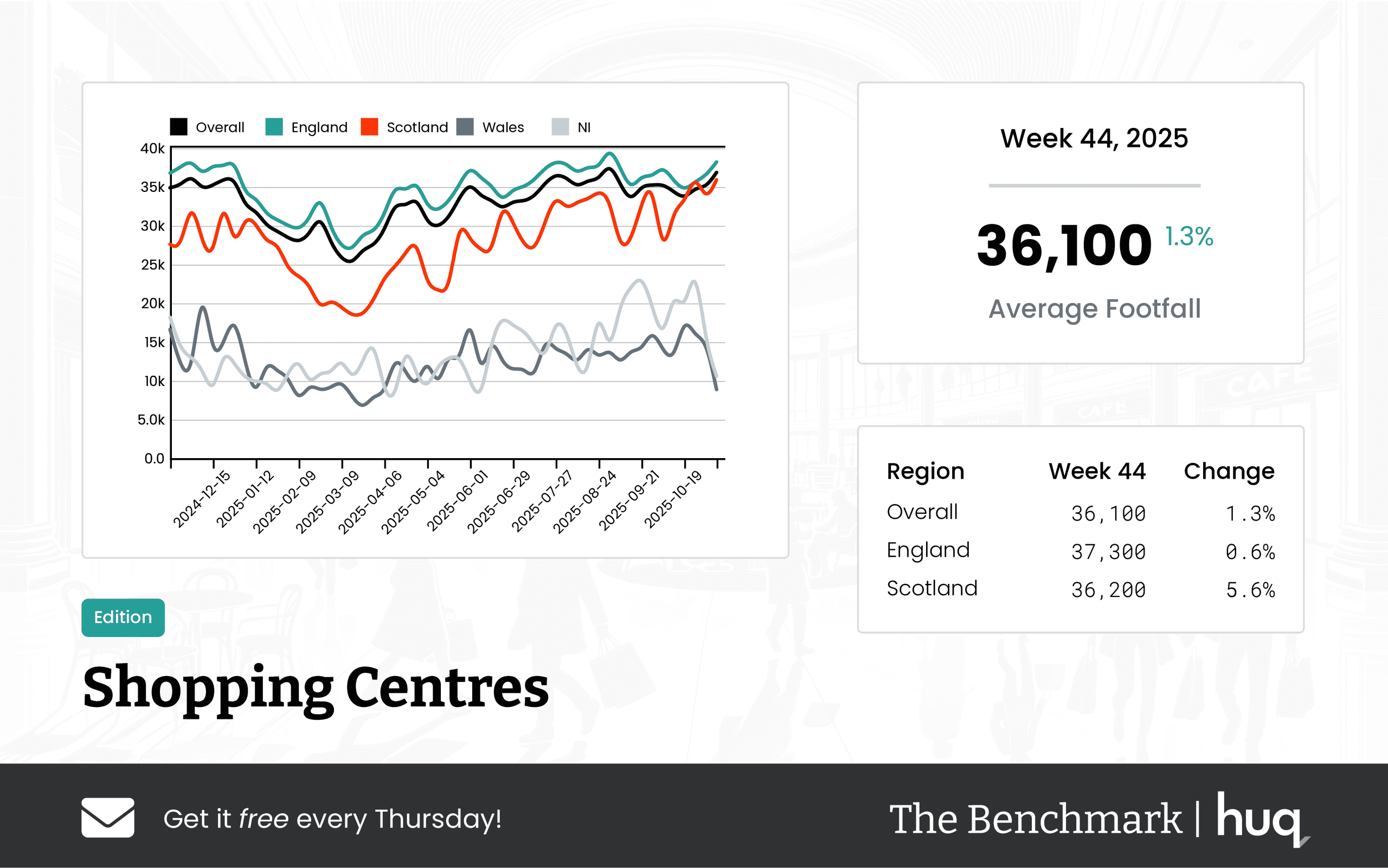

UK Shopping Centres – Week 44 2025: Footfall Retail Updates

UK Shopping Centres – Week 44 2025: Footfall Retail Updates

UK shopping centres show a modest rise in average daily footfall retail numbers, with footfall data indicating steady week-on-week improvements.

Share on LinkedIn

Recent observations for week 44 reveal that UK shopping centres are experiencing modest improvements in visitor numbers and footfall retail performance. Across the network, centres are registering an average daily footfall in the low 36,000s—an encouraging sign of a gentle upward trend on both weekly and annual bases.

On a regional level, the performance varies. In England, regional centres report a slightly higher average daily footfall than the overall network. They have witnessed a gradual increase week-on-week, although annual figures suggest that visitor numbers have experienced a minor softening. In contrast, shopping centres in Scotland have enjoyed a significant weekly surge and an exceptionally strong annual performance, confirming a robust consumer engagement in that region.

Visitor dwell time analysis further supports the overall trend. Shoppers across the network are spending nearly two hours per visit, with improvements observed on both weekly and annual metrics. In England, the increased visit duration aligns with the modest footfall gains. However, in Scotland, the average visit duration is notably shorter, indicating a brisk pace of customer interaction despite exceptionally strong footfall numbers.

Joe Capocci, spokesperson for Huq Industries, commented: "The clear surge in Scotland, supported by recent retail news on major new store openings, marks the most striking change this week and underlines our ability to track evolving consumer habits, as observed in footfall counting."

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

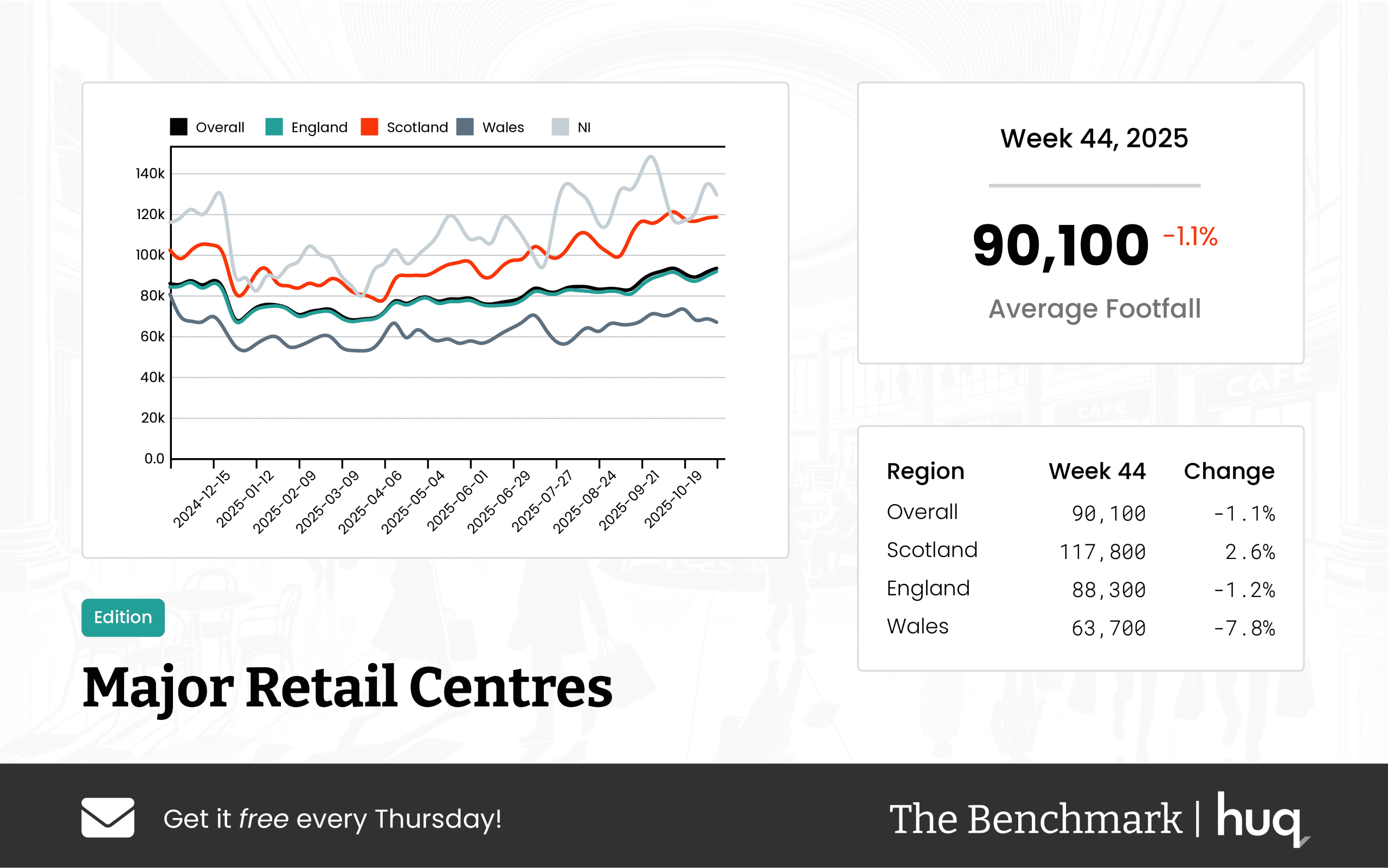

UK Major Retail Centres – Week 44 2025: footfall Retail Update

UK Major Retail Centres – Week 44 2025: footfall Retail Update

Overall performance shows a steady trend with modest footfall increases and enhanced visitor engagement, despite a slight dip in daily numbers. Average visit durations reached 129 minutes, based on footfall data.

Share on LinkedIn

UK Major Retail Centres continue to demonstrate resilience and steady performance amid evolving retail dynamics. The latest update for week 44 of 2025 highlights a subtle dip in daily footfall alongside an increase in visitor engagement, with shoppers spending an average of 129 minutes per visit.

In terms of overall performance, the centres recorded an average daily footfall of 90,100 visitors. While this number is slightly lower than the previous week, year-on-year trends reveal a modest improvement, signifying healthy long-term growth. Enhanced engagement metrics, as evidenced by the increasing visit durations, suggest that shoppers are taking advantage of the diverse offerings and experiences available within these retail hubs.

The regional breakdown provides additional insights. Scottish centres, in particular, stood out with a robust average of 117,800 visitors per day. Despite a slight dip in weekly dwell time to 146 minutes, the region benefits from a strong upward year-on-year trend, pointing to a dynamic recovery and strengthened shopper loyalty. In England, daily footfall averaged 88,300 visitors, showing a small decrease; however, improvements in dwell time on both weekly and annual bases indicate that engagement remains a priority among visitors.

Welsh centres presented a more mixed performance. Although there was a notable decline in daily visitor numbers, averaging 63,700 per day, the increased dwell time of 117 minutes suggests that those who do visit are spending more time exploring and engaging with the offerings.

Industry commentary further illuminates these trends. Joe Capocci, spokesperson for Huq Industries, remarked, "The sharp increase in Scottish footfall, complemented by developments such as the new Trafford Centre store reported in recent retail industry news, underscores evolving shopper engagement patterns across the UK Centres." This focus on regional differences and evolving engagement strategies is crucial for understanding broader retail trends in the UK marketplace.

Overall, while footfall numbers may fluctuate on a weekly basis, the consistent improvement in visitor engagement and the historical upward trends underscore the resilience and adaptability of the UK retail sector. Retail centres are clearly evolving to meet consumer demands, ensuring a vibrant and dynamic shopping environment across the nation.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

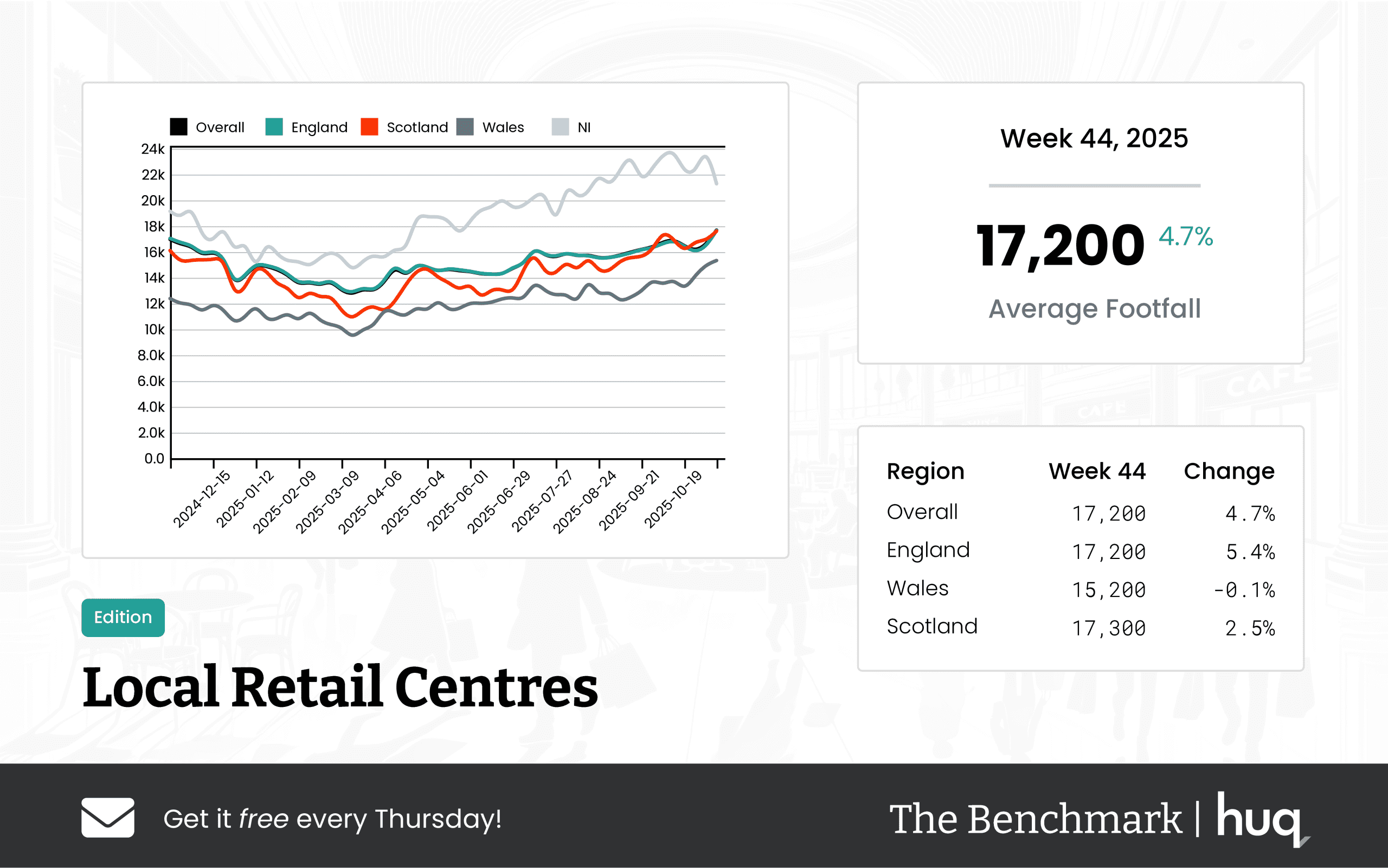

UK Local Retail Centres – Week 44, 2025 Performance Update with Location Analytics Insights

UK Local Retail Centres – Week 44, 2025 Performance Update with Location Analytics Insights

Week 44 shows a steady recovery with a 4.7% weekly increase. Advanced location analytics and refined location intelligence drive growing consumer interest.

Share on LinkedIn

Overall Footfall Performance

This update leverages cutting-edge location analytics to provide deeper insights. The latest data from The Benchmark reveals encouraging trends across UK Local Retail Centres. Overall, the average daily footfall reached 17,200, representing a 4.7% increase compared to the previous week.

These figures indicate steady recovery and growing consumer interest as centres continue to draw increasing numbers of visitors. Data records run up to [object Object], providing a robust snapshot of current visitor dynamics.

Regional Insights

A closer look at regional performance shows differences in visitor trends across the UK. In England, local retail centres maintained an overall daily average of 17,200 with a 5.4% week-on-week improvement and a modest 2.4% gain year-on-year.

Welsh centres experienced a lower footfall averaging 15,200; while there was almost no change compared to the previous week, the year-on-year performance is described as a sharp increase. In Scottish retail areas, centres reached the highest average of 17,300 visitors with moderate weekly growth of 2.5% and a notable year-on-year rise of 9.4%.

The figures underscore the vital role of location intelligence in understanding visitor dynamics. The regional variations highlight the potential gains from utilising refined location intelligence insights.

Visitor Engagement

Turning to visit quality, the average dwell time for visitors across the UK centres was 105 minutes, showing a 2.9% uplift week-on-week and an 18% improvement on a yearly basis. English centres marginally outperformed with an average visit duration of 107 minutes, mirroring the overall weekly uplift and achieving an 18.9% year-on-year gain.

Welsh centres recorded an impressive weekly rise of 15.6% in the time spent per visit, although figures indicate a notable decline over the longer term. Scottish centres consistently delivered strong engagement with an average visit duration of 106 minutes and both moderate weekly growth and a sharp increase when comparing year-on-year data.

These engagement metrics are further enhanced by robust location intelligence analysis.

Industry Comment

Industry experts suggest that local retail centres can benefit greatly from refined location intelligence strategies. "Among the most notable observations, Welsh centres recorded a sharp increase in visitor numbers, which aligns with recent industry developments at major retail locations," said Joe Capocci, Huq Industries spokesperson.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 41 Weekly Wrap: Footfall Trends and Footfall Analytics Insights

Week 41 Weekly Wrap: Footfall Trends and Footfall Analytics Insights

A detailed review reveals a 7.1% rise in footfall retail at shopping centres alongside intriguing footfall data trends.

Share on LinkedIn

Introduction to UK Retail Trends

UK retail is evolving with contrasting trends in footfall, as recent updates shed light on shifting visitor behaviours. Emerging footfall data and footfall analytics trends across shopping centres, retail parks, and local as well as major retail centres offer a comprehensive picture. This Weekly Wrap examines these patterns and provides fresh insights into consumer engagement across England, Wales, Scotland, and beyond.

UK Shopping Centres Performance

Recent reports on shopping centres show mixed progress. In Week 39, centres in England attracted roughly 38,400 daily visitors – an encouraging 7.1% rise with a dwell time of 104 minutes. However, in Week 40, the UK Shopping Centres – Week 40 Footfall Retail Update noted a 4.5% drop, and by Week 41 the average dipped to 33,500 visitors daily, highlighting how regional disparities such as those in Welsh centres can influence footfall statistics.

Retail Parks Update

Retail parks show a steadier performance despite subtle shifts. Data from Week 41 presented by the UK Retail Parks Performance Update: Footfall Trends reveals a 2.5% dip in visitors with an average of 20,000 per day, and average visitor durations of 74 minutes. The consistent patterns across English and Scottish parks underline the importance of robust footfall counting measures even when minor fluctuations can impact overall footfall data.

Local and Major Retail Centres Trends

Local retail centres continue to register progress as seen in the UK Local Retail Centres – Week 41 Footfall Data Report. With 16,900 daily visitors and a modest week-on-week dip of 0.9%, local centres still recorded an annual growth of 2.1% and average visitor engagement of 106 minutes. In contrast, major retail centres are more resilient, with Week 41 Major Retail Centres Footfall Update reporting around 91,000 daily visitors and significant annual gains of 10%, despite a short-term drop that underscores evolving shopping patterns.

High Streets and Town Centres Insights

High streets and town centres present a nuanced perspective on modern retail. Week 41 data from the UK High Streets & Town Centres Footfall Update indicate an overall daily footfall of 34,200, with averages slightly lower compared to Week 40 when increases were recorded. Distinct regional trends, such as lower visitor counts but higher dwell times in some Welsh centres, further enrich these footfall statistics and illustrate the diverse consumer behaviours across the UK.

Expert Perspective

Expert insights help clarify these trends. Joe Capocci, Huq Industries Spokesperson, remarked, "The holistic analysis of footfall retail data is instrumental for understanding nuanced shopping behaviours which are evolving due to economic shifts and regional preferences." His comment underscores the importance of detailed footfall analytics in guiding strategic decisions in the competitive retail landscape. The expert view reinforces the value of in-depth data for tailoring future initiatives and overcoming short-term declines.

Reflecting on Overall Retail Patterns

Analyzing the spectrum of retail sectors highlights critical patterns in footfall and visitor dwell times. Footfall counting across different types offers a layered understanding of market shifts, and subtle declines in one segment may be offset by robust performance in another. The contrast between short-term fluctuations and long-term growth trends emphasises the need for ongoing, precise footfall data to inform effective retail strategies.

The Role of Advanced Analytics

Advanced analytics remain pivotal in deciphering these insights. The integration of footfall analytics methods provides a granular view of visitor movement that is essential for successful retail centre management. Enhanced tracking has enabled operators to make informed decisions, adapt to market dynamics, and foster improvements in visitor engagement even when short-term numbers experience modest changes.

Looking Ahead

The future of UK retail appears intricately linked to the effective use of footfall data. Stakeholders are increasingly realising that detailed analysis can help counter isolated declines and strengthen overall performance by pinpointing opportunities across regions. As consumer trends continue to evolve, robust data collection and analytics will serve as the bedrock of adaptive, resilient retail strategies.

Conclusion

This Weekly Wrap for Week 41 synthesises diverse retail insights across the UK. The varied performances across shopping centres, retail parks, and both local and major retail centres reflect the dynamic environment of UK retail. With expert perspectives and comprehensive footfall statistics driving forward strategic decisions, the sector remains poised to embrace future challenges while capitalising on persisting strengths.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

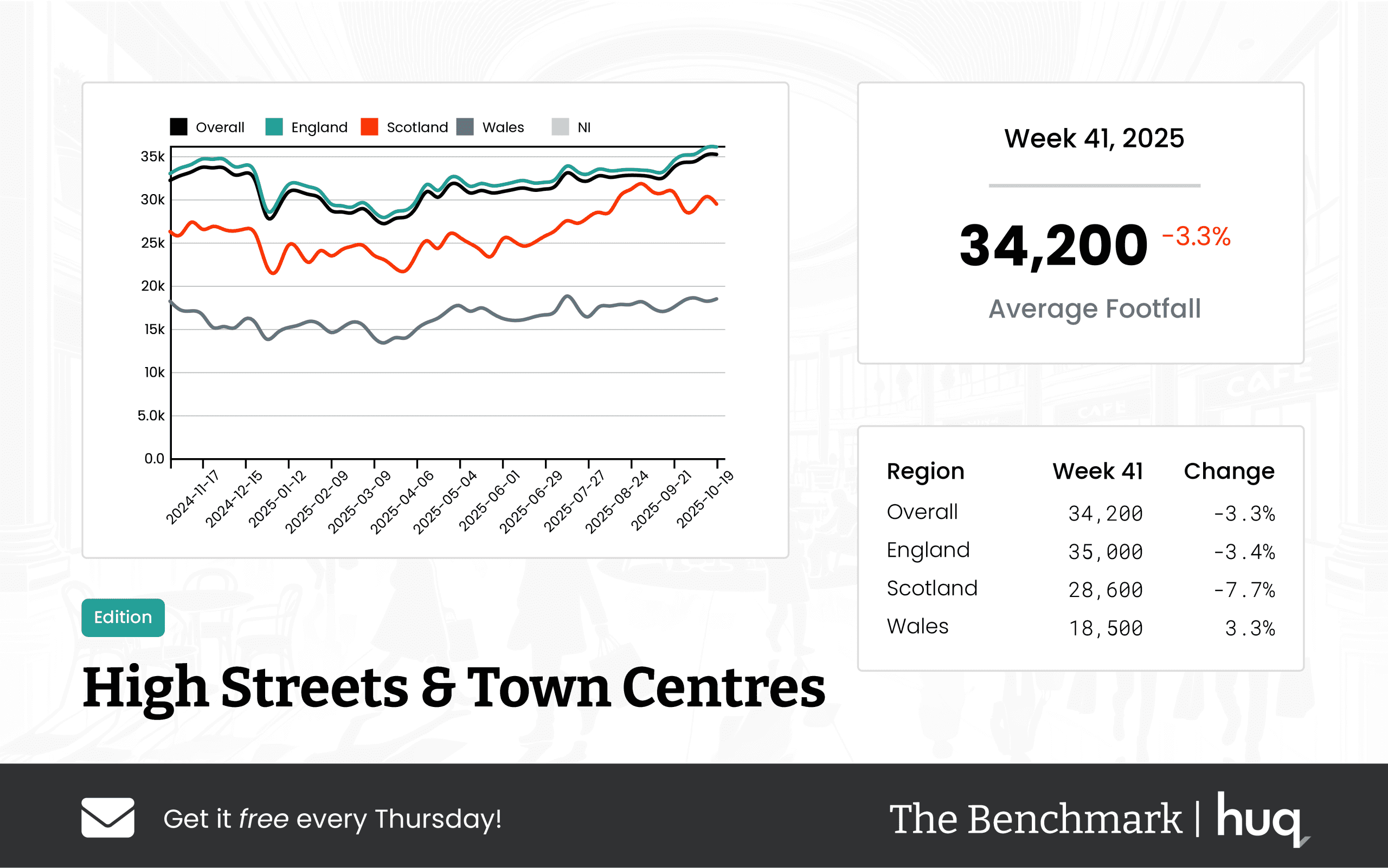

UK High Streets & Town Centres – Week 41 2025: Footfall Update

UK High Streets & Town Centres – Week 41 2025: Footfall Update

Overall week-on-week footfall dropped 3.3% while year-on-year improvements persist. Recent footfall analytics show a positive annual trend amid modest declines.

Share on LinkedIn

The latest analysis of UK High Streets and Town Centres has revealed a mixed picture for the week ending 19 October 2025. Average daily footfall across these key locations stands at 34,200, marking a week-on-week decline of 3.3%, even as annual comparisons point to a steady upward trajectory.

In England, High Streets and Town Centres reported an average daily footfall of 35,000 with a modest weekly slowdown of 3.4%, while still registering improvements on an annual basis. Scotland's High Streets and Town Centres saw an average of 28,600 visitors per day, experiencing a more pronounced weekly decline, yet the long-term annual trend remains positive. Contrastingly, Wales experienced a slight week-on-week gain with an average daily footfall of 18,500.

Dwell time data further deepens the analysis. On average, visitors spent 106 minutes in these locations, though regional variances emerged. England maintained the overall average, Scotland’s visitors spent 78 minutes, and those in Wales lingered for 117 minutes, indicating a higher level of engagement.

Joe Capocci, spokesperson for Huq Industries, summed up the results: "The data clearly shows Scotland’s more pronounced week-on-week decline in footfall alongside a modest uplift in Wales, which is consistent with recent retail industry observations in Time Out and The Herald."

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

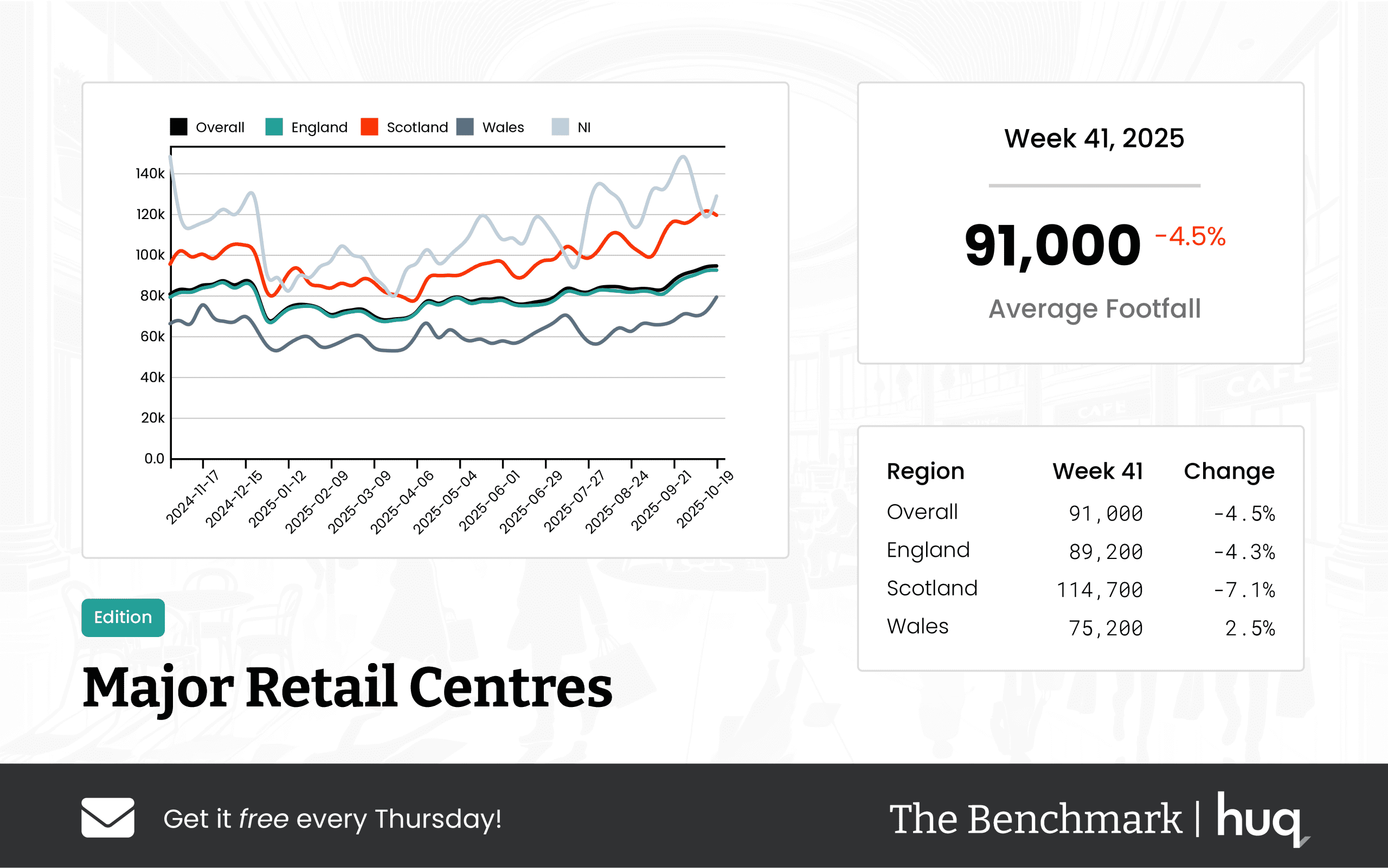

Week 41 2025 Major Retail Centres: Footfall Data Update

Week 41 2025 Major Retail Centres: Footfall Data Update

Week 41 footfall data shows a 4.5% weekly decline contrasted by a 10% yearly rise, supporting steady footfall retail trends across UK major centres.

Share on LinkedIn

Overall Performance

The latest figures from The Benchmark reveal that UK Major Retail Centres have seen an average of 91,000 daily visitors during Week 41. Although this represents a 4.5% decline from the previous week, it is important to note that the same period last year saw a 10% increase, indicating a robust long-term upward trend. Additionally, the average dwell time has improved to 124 minutes, marking a year-on-year increase of 12.7% even as weekly figures remain stable.

Regional Breakdown

In England, retail centres recorded an average of 89,200 visitors per day with a 4.3% weekly decline, but a healthy year-on-year growth of 10.8%, and an average visit duration of 122 minutes. Scotland’s centres reported higher daily footfall at 114,700 visitors, despite a 7.1% drop on a week‑on‑week basis; the year-on‑year increase here stands at 8.6%, complemented by an encouraging 14.1% weekly rise in dwell time, reaching 146 minutes. Meanwhile, centres in Wales welcomed an average of 75,200 visitors daily, with a modest weekly uptick and a solid 9.6% increase over the same period last year, and an average dwell of 105 minutes.

Industry Comment

Joe Capocci, spokesperson for Huq Industries, commented on the data, stating, “The Benchmark data reveal that the most striking change is the notable decline in footfall observed in Scotland, which is fully supported by the recent retail industry news from sources such as the Manchester Evening News and Wales Online.”

The consolidated data reflects a dynamic retail environment where even with minor weekly declines, the overall long-term growth in footfall remains promising across UK major retail centres.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.