How to leverage footfall and boost instore Black Friday sales

From a term first coined in the 1960s in the United States, Black Friday continues to be an ever-exceeding growth date for the retail industry, with in-store and online retailers one-upping each other; beginning the so-called sales period earlier and stretching discounts out for far longer than its one-day origin story. The worst kept secret for consumers is that Black Friday prices aren’t necessarily the optimum time to get the best deals, but the period does undoubtedly drive purchases – and physical footfall – into a frenzy.

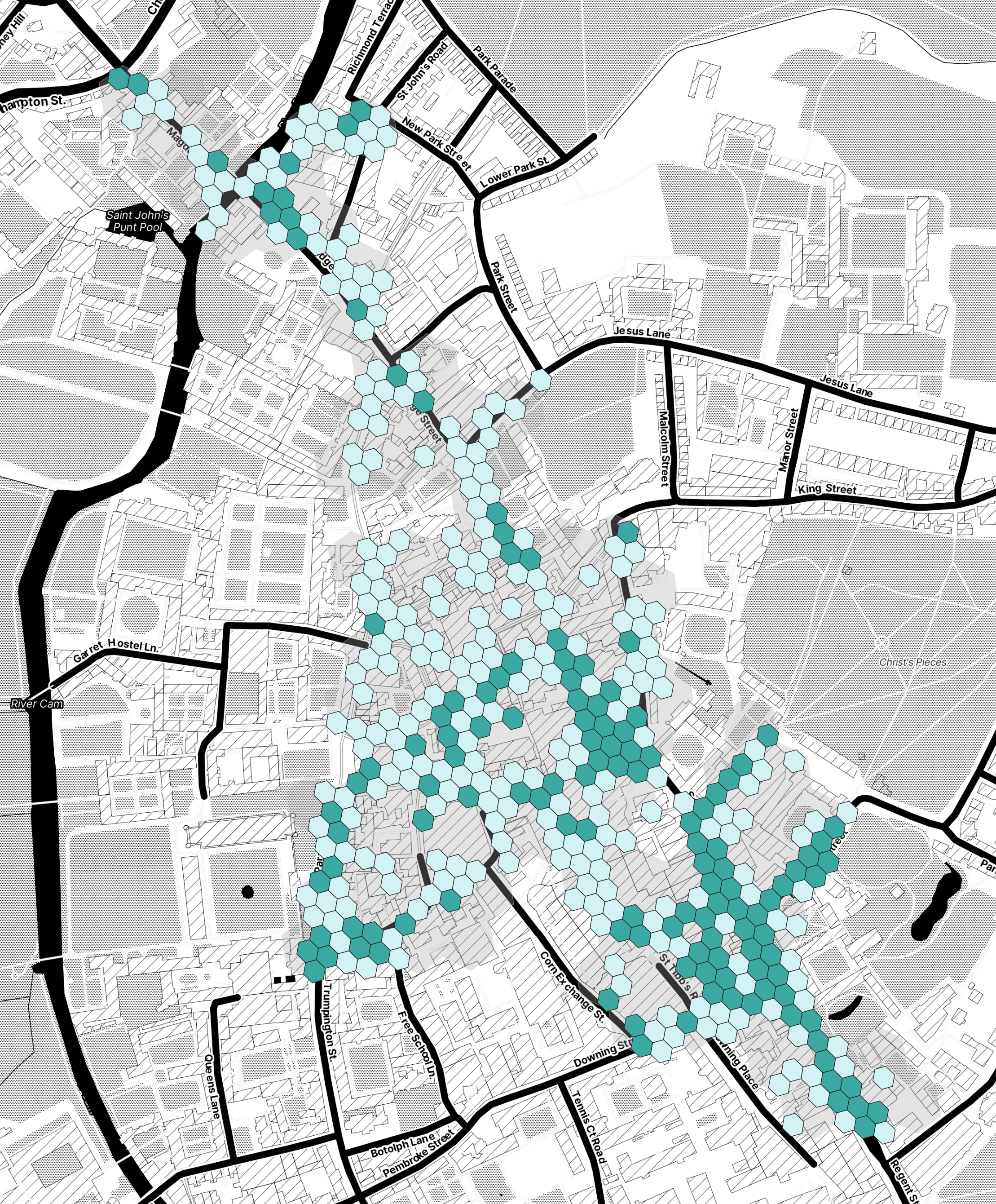

It’s the latter point that we’re interested in here at Huq, because it makes us consider what we can learn about footfall traffic trends, and therefore how we can help retailers and the real estate sector innovate to encourage consumers to yield their purchasing power across towns, retail parks, and high streets.

As we’ve mentioned in our previous 101 Guide to location intelligence, there are limitations to traditional approaches to estimating footfall traffic at stores and shopping centres; data which provides an incomplete picture of the scale of traffic, density and dwell time, and the potential for making data-driven retail decisions.

Huq’s unique first-hand and third-party authoritative data, presents a near exhaustive intersectional array of geospatial intelligence, which – in turn – can help retailers and real estate investors to forecast, plan, and deliver.

So how did Black Friday perform in 2023?

Paul Martin, UK Head of Retail at KPMG summarised this week, that Black Friday saw retail sales “grow by over 4% in November [which gave] a much-needed boost both [to] the high street and online.” But he warns that while “household appliances, footwear and furniture” saw sales growth – toys, computing and baby equipment products are still in negative sales figures.

Helen Dickinson OBE, CEO of the British Retail Consortium concurred that growth overall “remained far below current inflation” – suggesting volumes are down. The turn in the weather fuelled purchases of coats, hooded blankets and hot water bottles for sure, but consumers appear to be pivoting to cosy nights in rather than big nights out on the whole.

Meanwhile Huq’s proprietary data suggests that the intensity of average physical footfall across our 20 defined top-performing shopping areas, jumped from 180.6k to 250.5k in the same period from 2022 to 2023. The overall total change in footfall from 2022 to 2023 across our top performing retail environments was +27.9% during the Black Friday period. Within this, of course, hides a wealth of hugely rich demographic data that we can break down according to individual hot spots and our clients’ requirements – but this snapshot would indicate that footfall at least was greater this year’s Black Friday.

We carry our own caveats of course, in so far as our measurement for purposes here is comparing apples and avocados, as some retail centres are much larger than others. Our general assessment however is that our footfall, density and dwell data is likely greater because retailers have decided to use Black Friday for much longer sales periods, therefore attracting consumers throughout the entire week (and sometimes further). Moreover, when we explore our own historic data capture, we see that 2019 – across our same 20 shopping destinations – carried as high an average of footfall traffic as 396.5k over the same time period.

We deduce from our geospatial data that the ‘great decentralisation’ that has spread across the UK post-Covid, means that consumers simply aren’t physically shopping in the same areas and in the same numbers as they were before the pandemic. But the boost from 2022 to 2023 shows promise for the future.

Let’s look at what our location intelligence – which can be pinpointed to an individual store location with incredible accuracy – can support, when it comes to helping retail brands and real estate developers. When we get as narrow as possible in terms of which brands and product themes are attracting and retaining consumers, we can help strategic planners, communicators and marketers possess confidence in retail growth planning, location selection, and even influence inventory management tactics.

How Huq can unleash Black Friday’s potential

For global and multi-location retailers, it’s vital to explore the data to uncover your customer behaviours, and troubleshoot which strategies succeeded and what may have fallen short. Which stores thrived, which merely survived, and what could you reposition ahead of 2024’s Black Friday period to attract and retain consumers? Only by looking at the data and conducting the right evaluation can we set the future up for success.

For outlets and areas which didn’t perform so well during 2023’s Black Friday period, or experienced inconsistent patterns across different locations, our location data will give a strong indication of customer trends, and what drives them to visit, spend, shop and socialise. We improve when we kick the weakest tyres after all.

Retail store performance metrics will indicate whether less-dense footfall areas need to be repurposed or may similarly support the development of enhanced shopper experiences, targeted promotions, and individualised marketing. Benchmark, adjust, and improve – that’s a mantra that retailers will appreciate.

And because Huq provides granular understanding of customer base and catchment areas, for real estate developers, this location intelligence can support property purchases and portfolio decisions.

Finally, we would suggest you watch your rivals. Insights are truly valuable when contextualised. By examining how your competitors performed you can reverse engineer the strategies that contributed to their successes – or failures.

To round up then, we have the broad analysis of retail performance for Black Friday 2022, and by twinning these trends insights with Huq’s unrivalled location data, we can begin to make highly informed and strategic decisions in retail growth and contraction planning, and investment strategies.

The transformative potential of geospatial intelligence for retailers and real estate stakeholders is only just being untapped. We would encourage industry leaders to embrace these technologies to stay ahead, maximise the post-Black Friday momentum, and grow consumer retention and loyalty, in an ever-evolving retail landscape – and a challenging spending environment.

3400

Stores

38

Countries

$12.5Bn

Annual sales

Huq’s catchment insights allows JD to more accurately assess the impact of the wider retail catchment on the sales potential of new store opportunities

Alastair Browne, JD Group Head of Site Research & Strategic Insight