Black Friday 2024: Insights and footfall trends from Huq

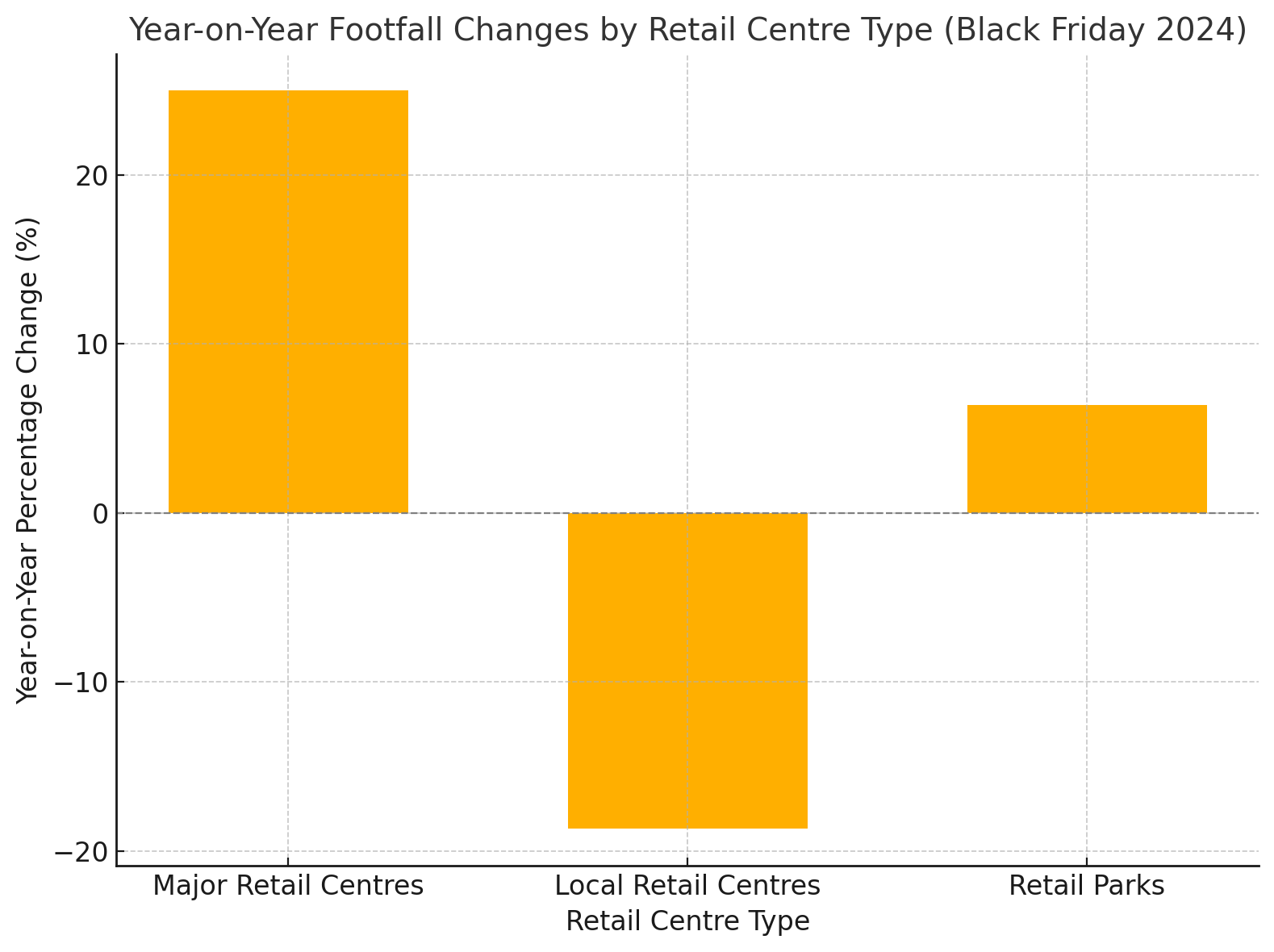

Black Friday remains a key event in the UK retail calendar, but its impact has evolved significantly over the years. While some retailers saw footfall spikes during the week ending 30th November 2024, others struggled to attract shoppers, particularly in local retail centres and retail parks. Using Huq’s location footfall data, we explore how this year’s Black Friday performed and what it means for the retail sector.

Key takeaways

Major Retail Centres Dominate

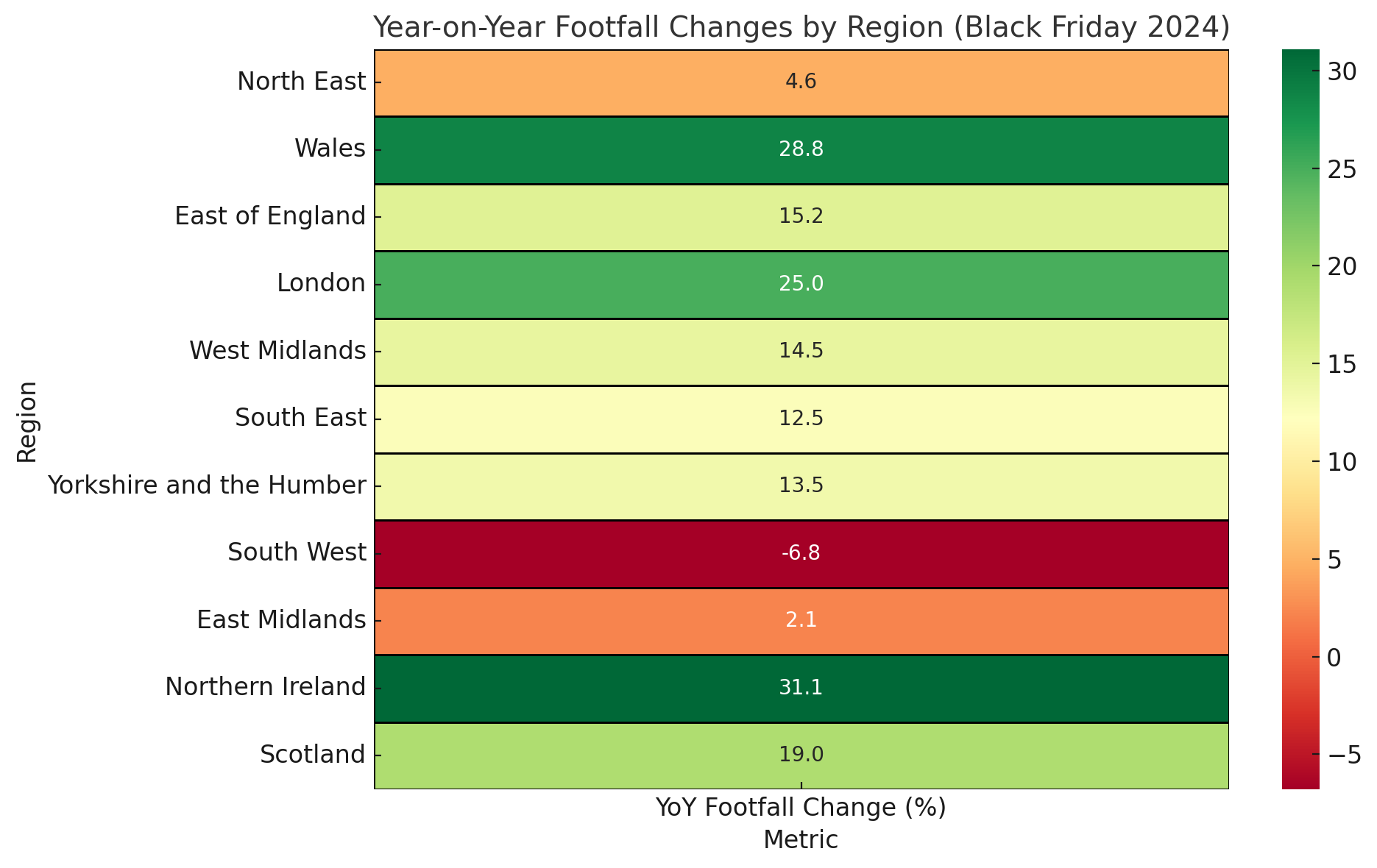

London, East of England and Wales all saw significant footfall growth (25%, 29% and 15%).

Retail Parks & Local Centres Lag

Local centres struggled to keep pace while retail parks showed mixed results. Wales experienced a footfall drop across both retail centres.

Changing Shopping Patterns

Despite overall gains in some regions, several retail centres saw limited growth or declines, hinting at a growing preference for online shopping or consolidating trips to larger hubs.

Analysis of the Data

Winners of Black Friday 2024

Major retail centres clearly outperformed, suggesting that shoppers are still drawn to flagship locations for Black Friday deals. In London, Kingston upon Thames recorded one of the highest week-on-week (WoW) increases at 2.2%.

Retail parks, although mixed overall, had standout performers like Mannington Retail Park in Swindon and Battery Retail Park in Birmingham, both reporting 14.3% WoW growth.

Shoppers hunt for the best deals during Black Friday 2024, a day that brought mixed fortunes for UK retailers.

Challenges in Smaller Locations

Local retail centres and some high streets faced challenges. Harlow and Basingstoke were among the worst hit, with WoW declines of 13.3% and 13.2%, respectively. Retail parks like Heathfield Retail Park (Scotland) also saw footfall drop by 16.6% WoW.

Shoppers in these areas may have shifted online or opted for larger destinations, highlighting a potential gap in Black Friday marketing and promotions for smaller locations.

The Role of Dwell Time and Visitation Trends

Interestingly, average dwell times in major retail centres remained steady or grew in regions like London (104 minutes, up 3% WoW) and the East of England (123 minutes, up 0.8% WoW). This suggests that while footfall trends varied, those who did visit spent more time shopping.

Recommendations for Retailers

Double Down on Flagship Locations

Retailers in major centres should continue to capitalise on Black Friday momentum by optimising staffing, inventory, and promotions.

Reimagine Strategies for Local Centres

Local retail centres must explore personalised marketing campaigns, events, or partnerships to attract shoppers during key retail events.

Leverage Footfall Data

Retailers can use location intelligence, such as Huq’s data, to better understand shopper trends and tailor their strategies for future events.

Conclusion

Black Friday 2024 showcased a polarised retail landscape. While major hubs like London excelled, smaller locations struggled to maintain relevance where Black Friday failed to generate the universal footfall surge retailers might have hoped for. The mixed results could reflect changing consumer behaviours, with many shoppers favouring online deals over in-person visits. Additionally, economic pressures such as inflation may have dampened discretionary spending, further diluting the impact of in-store promotions. While Black Friday delivered isolated successes, the broader picture indicates that it did not achieve a consistent boost to UK retail footfall. This suggests the need for retailers to rethink their strategies, blending online and offline offerings to fully capture consumer interest during major sales events.

“This year’s Black Friday highlights the continued draw of major retail centres and the shifting preferences of consumers. Our data reveals that while flagship locations thrive, smaller retail hubs must adapt to compete effectively in a changing landscape.”

Is your business facing similar challenges?

Our experienced team can demonstrate how to use location intelligence and analytics to augment a wide range of use cases, including:

- Identifying locations for new stores

- Optimising your existing store portfolio

- Informing your pricing strategy

- Improving the effectiveness of marketing

- Benchmarking performance across locations

- Understanding competitor landscape

- Optimising opening hours