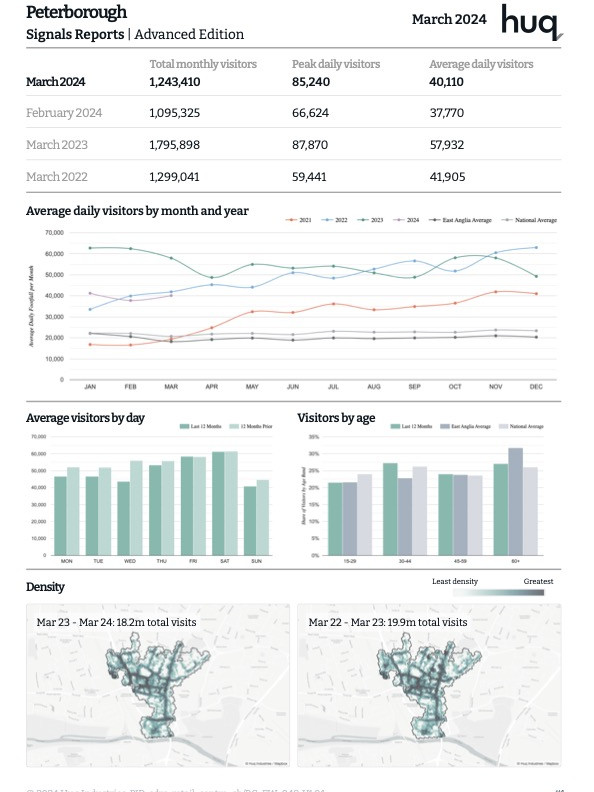

A snapshot into any location

Unveil opportunity and value in any location with our Footfall Analysis Benchmark Report – a comprehensive guide to understand, optimise, and elevate your business’s physical presence.

Get my report

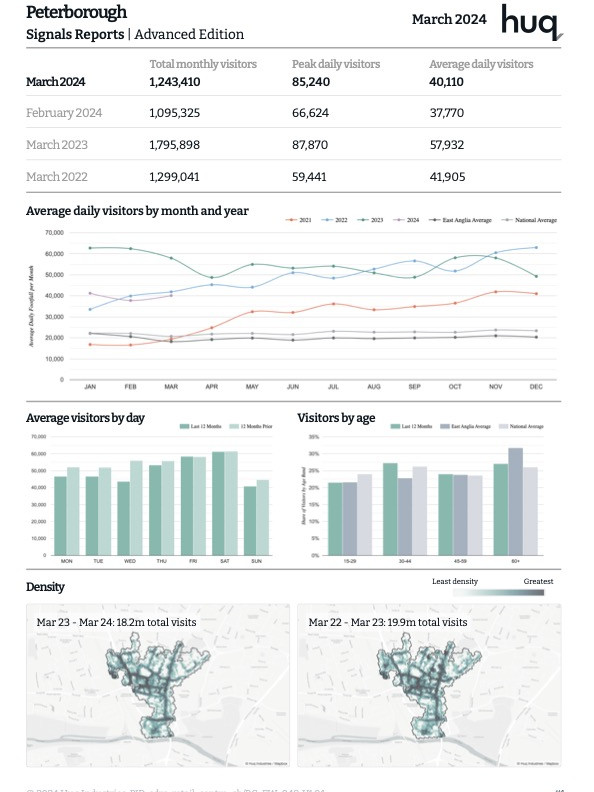

- Footfall trends and patterns

- Spacial hotspots

- Origin and destination

- Visitor profiles

- Side-by-side comparisons

Market-moving trends, competitive KPIs and spacial benchmarks -- delivered directly to you:

Need instant access to insights in any location? Capture snapshots into:

10x

Cost savings

100%

On-time delivery

110%

Increase in ARPU

"Huq provides the best way to identify lucrative visitor behaviours and maximise your investment"

– Aviva Investors

The volume of data available has never been greater. The challenge has become finding value.

Instant access

Seamlessly access reports to make informed location decisions faster than ever.

Unique insights

Leverage diverse data for insights on asset performance.

Trusted partner

Widely cited in academia and news and trusted by 300+ companies for informed decisions.

Global solutions

Worldwide support for your monitoring needs.