How can our team understand metrics for successful capital transactions?

How can data help us minimise transaction risks?

How can I increase the success rate of investments?

Identify market demand

Understand the demand for specific types of properties or services in different locations for targeted offerings that lead to successful transactions.

Intelligent investment decisions

Make informed decisions about property acquisitions or divestitures using level of activity in the area and customer behaviour analyses around potential investment properties.

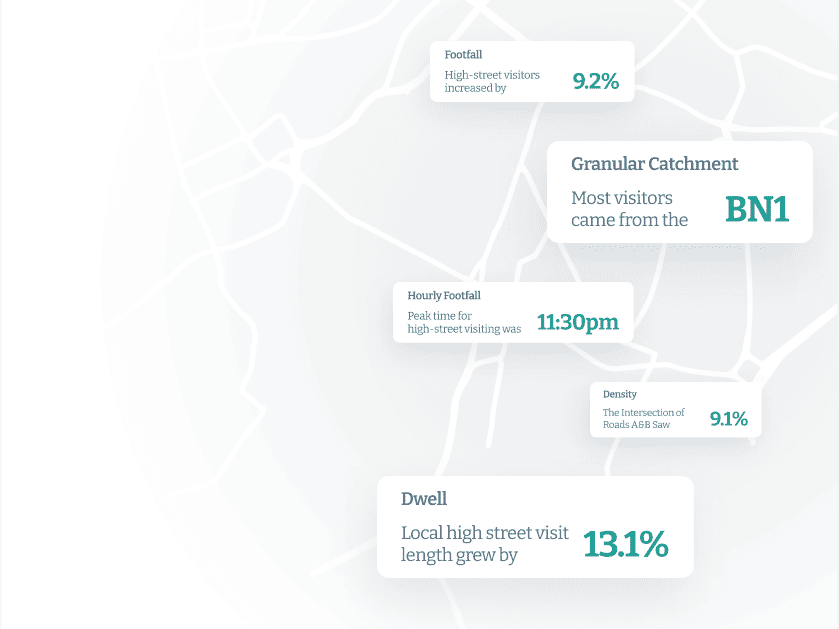

Monitor tenant and occupancy

Gauge tenant satisfaction and identify opportunities for optimising lease agreements or attracting new tenants with foot traffic, dwell times, and visit pattern insights.

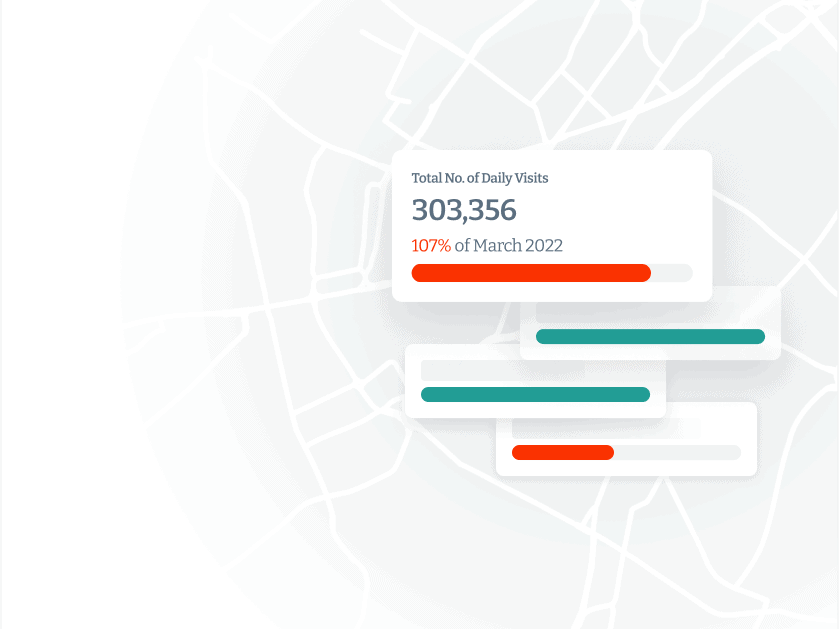

Foresee and mitigate risk

Monitor the performance of properties or financial assets with historical foot traffic trends and comparing them to market benchmarks.

Optimise negotiation and pricing

Showcase the value of a property's location when negotiating leases or property prices with demand-based insights.

223Bn

£GBP AUM

900+

Employees

12

Countries

Huq’s mobility data helps us to make better investment decisions and allows us to appropriately manage risk on behalf of our investor clients

Huq’s mobility data helps us to make better investment decisions and allows us to appropriately manage risk on behalf of our investor clients

Jonathan Bayfield, Head of UK Real Estate Research at Aviva Investors