UK Shopping Centres – Week 31, 2025 Performance Update: Location Analytics Insights

UK shopping centres experienced a 0.9% overall decline in footfall last week while dwell time rose by 5.8%. Discover key insights in location analytics and emerging retail trends.

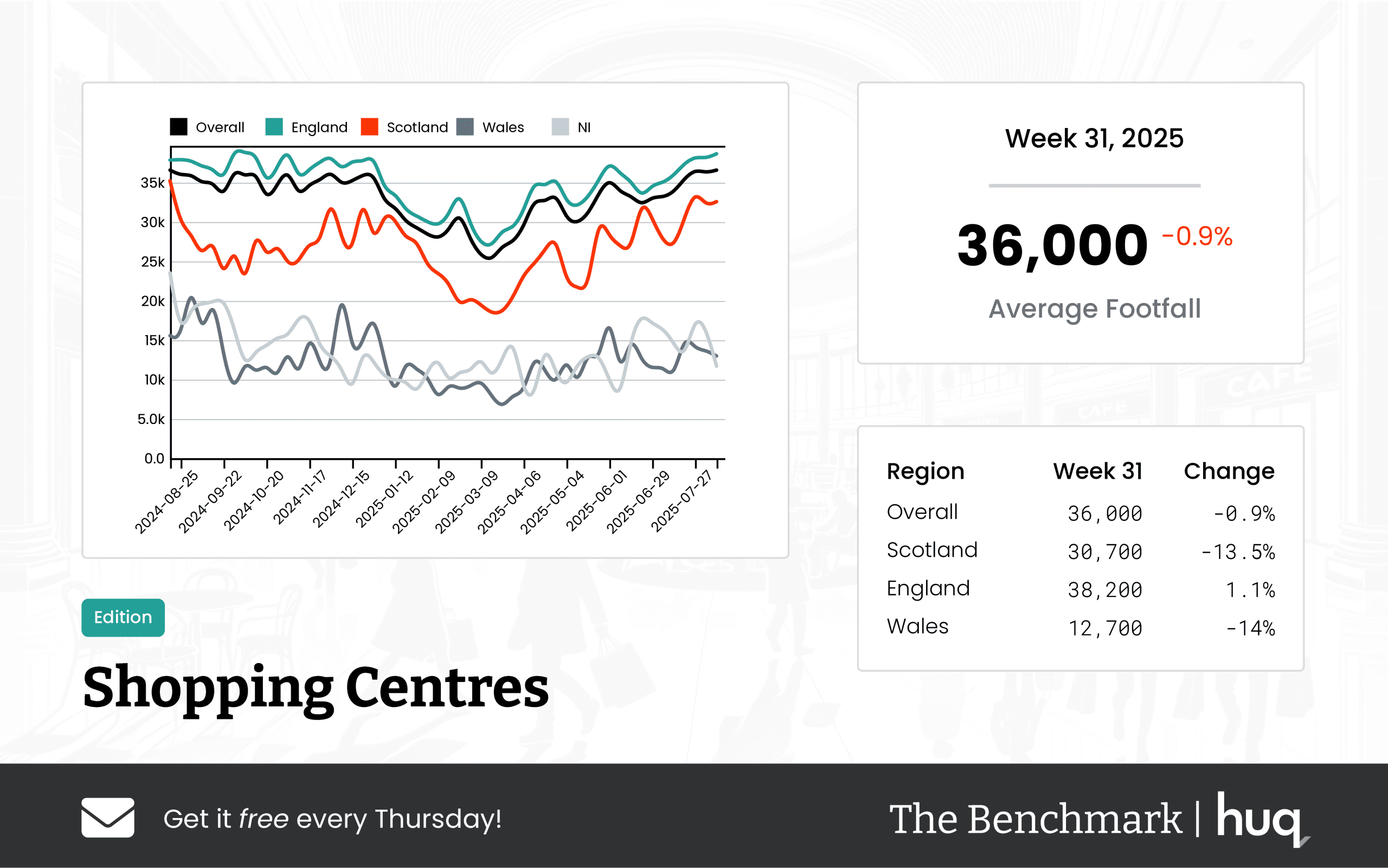

UK shopping centres are facing subtle shifts in consumer behavior as revealed by the latest location analytics for Week 31. The overall average daily footfall across the UK reached 36,000 visitors, reflecting a 0.9% decline from the previous week and remaining 2% below the figures from the same period last year. This modest contraction is indicative of broader market trends and evolving shopping habits.

Overview:

The Benchmark data demonstrates that even though visitor numbers are slightly down, the retail environment is adapting. The increased dwell time seen across the board suggests shoppers are spending more time per visit, perhaps scrutinizing in-store offerings more closely or enjoying a more leisurely shopping experience.

Regional Performance:

- In England, centres reported an encouraging average of 38,200 visits per day. Despite a minor 1% dip compared to last year, a 1.1% week-on-week increase suggests a steady resilience, possibly bolstered by advanced location intelligence providing local centres with targeted insights.

- Scottish centres, on the other hand, faced a steeper challenge, averaging 30,700 daily visits and experiencing a significant 13.5% decrease week-on-week. However, the year-on-year comparison shows only a 0.3% change, hinting at a relatively stable long-term performance despite recent setbacks.

- Welsh centres are under particular pressure, with daily averages at 12,700 visits and a sharp 14% decline from the previous week. Historical trends also indicate a downturn compared to the previous year, reflecting deeper issues within the regional retail sector.

Shopper Dwell Time:

One of the key positives noted in the report is the rise in shopper engagement, as evidenced by dwell time. Overall, the average visit now lasts 109 minutes, marking an increase of 1.9% over the previous week and a notable 5.8% improvement compared to the previous year. The endurance of visitor engagement is further underscored by regional figures:

- England’s centres show an average stay of 111 minutes, aligning with the general upward trend.

- Scottish centres have also improved with an average of 94 minutes per visit, showcasing a 9.3% year-on-year improvement.

- Although Welsh centres have seen a considerable week-on-week increase in dwell time, the overall annual performance remains subdued, highlighting regional disparities.

Industry Commentary:

Joe Capocci, the spokesperson for Huq Industries, commented on the figures by saying, “The marked decline in Welsh footfall alongside recent industry restructuring, such as the Rivergate centre closure, underscores the varied market pressures we are witnessing.” His remarks echo the broader narrative of a retail landscape in flux, with regional markets experiencing distinct challenges and opportunities.

Conclusion:

The latest insights from Week 31 reveal that while UK shopping centres face declining footfall figures, increased dwell times indicate a shift towards deeper shopper engagement. The divergence in performance between regions, particularly the contrasting trends seen in England, Scotland, and Wales, points to a nuanced landscape where localized strategies and branding efforts become increasingly crucial. As the retail market continues to evolve, the reliance on precise location analytics will be essential in managing these challenges and leveraging emerging trends.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.