Week 9 2025 Major Retail Centres Performance Update: Location Analytics Insights

Overall footfall data reveal steady retail performance with a 6.2% drop week-on-week amid long-term growth. Discover location analytics insights.

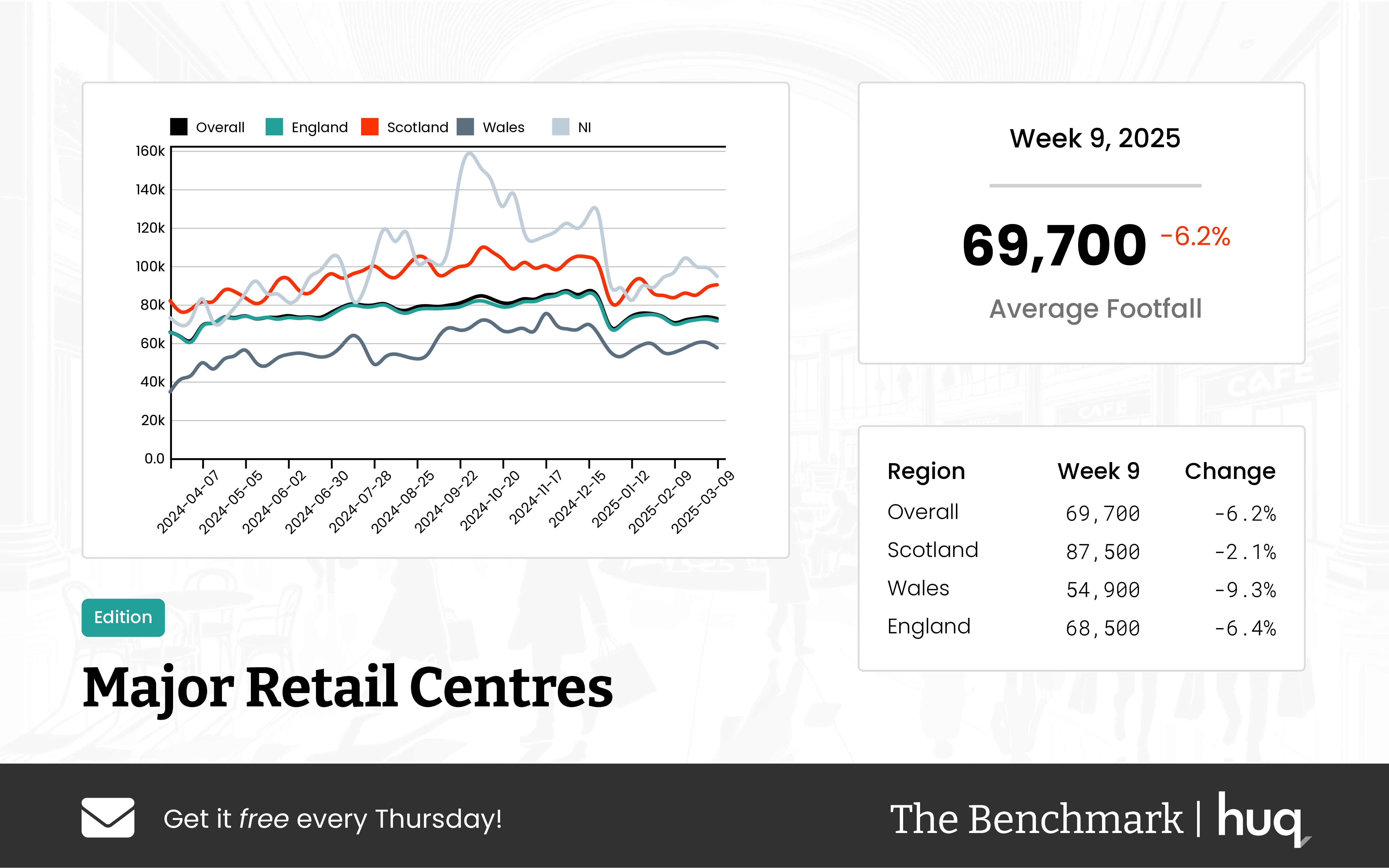

The latest review from The Benchmark Tracker for week 9 shows mixed performance across the UK’s Major Retail Centres. Leveraging advanced location analytics, retail experts have uncovered trends that paint a picture of steady footfall and robust visitor metrics, despite a slight recent dip.

Overall Performance

Across all centres, the average daily footfall reached 69,700. Although this marks a moderate week-on-week decline of 6.2%, the long-term trend remains positive with a strong annual increase of 9.8%. This suggests that while current activity has softened somewhat, longer-term growth is continuing at a healthy pace.

Regional Breakdown

• In Scotland, centres welcomed an average of 87,500 visitors per day. Despite a small week-on-week decline of 2.1%, the region boasts an impressive annual growth of 13.8%, reflecting a resilient and engaged visitor base.

• In England, the average daily footfall was slightly lower at 68,500, with a week-on-week drop of 6.4%. However, there is an encouraging annual increase of 8.3%, signaling that recovery is underway.

• In Wales, retail centres experienced more significant short-term challenges, with a 9.3% decline bringing the daily average to 54,900 visitors. Nevertheless, long-term trends remain positive with clear growth observed over the year.

Dwell Time Metrics

Complementing the visitation figures, dwell time — the duration consumers spend in these retail environments — underscores the quality of these visits. Overall, consumers are now spending an average of 116 minutes per visit, marking an increase of 4.5% from the previous week and a 16% improvement compared to last year.

Scotland leads again with an impressive average of 129 minutes per visit, while centres in England and Wales recorded averages of 115 and 100 minutes respectively, demonstrating varied consumer engagement across regions.

Joe Capocci, a spokesperson for Huq Industries, commented on the dynamic nature of the current market: “The contrast between Scotland’s modest decline and the sharper dip observed in Wales underscores the disparity in footfall performance across UK regions.”

These insights from location analytics provide a clear snapshot of retail performance across the UK’s major centres. While short-term dips are evident, persistent long-term growth, coupled with sustained consumer engagement, signal a robust outlook for the retail sector.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.