Week 24 2025 High Streets & Town Centres: Footfall Analytics Update

Week 24 2025 High Streets & Town Centres: Footfall Analytics Update

Recent footfall data shows a slight weekly drop (–0.2%) alongside a modest 4.4% year-on-year rise, reflecting evolving footfall retail trends.

Share on LinkedIn

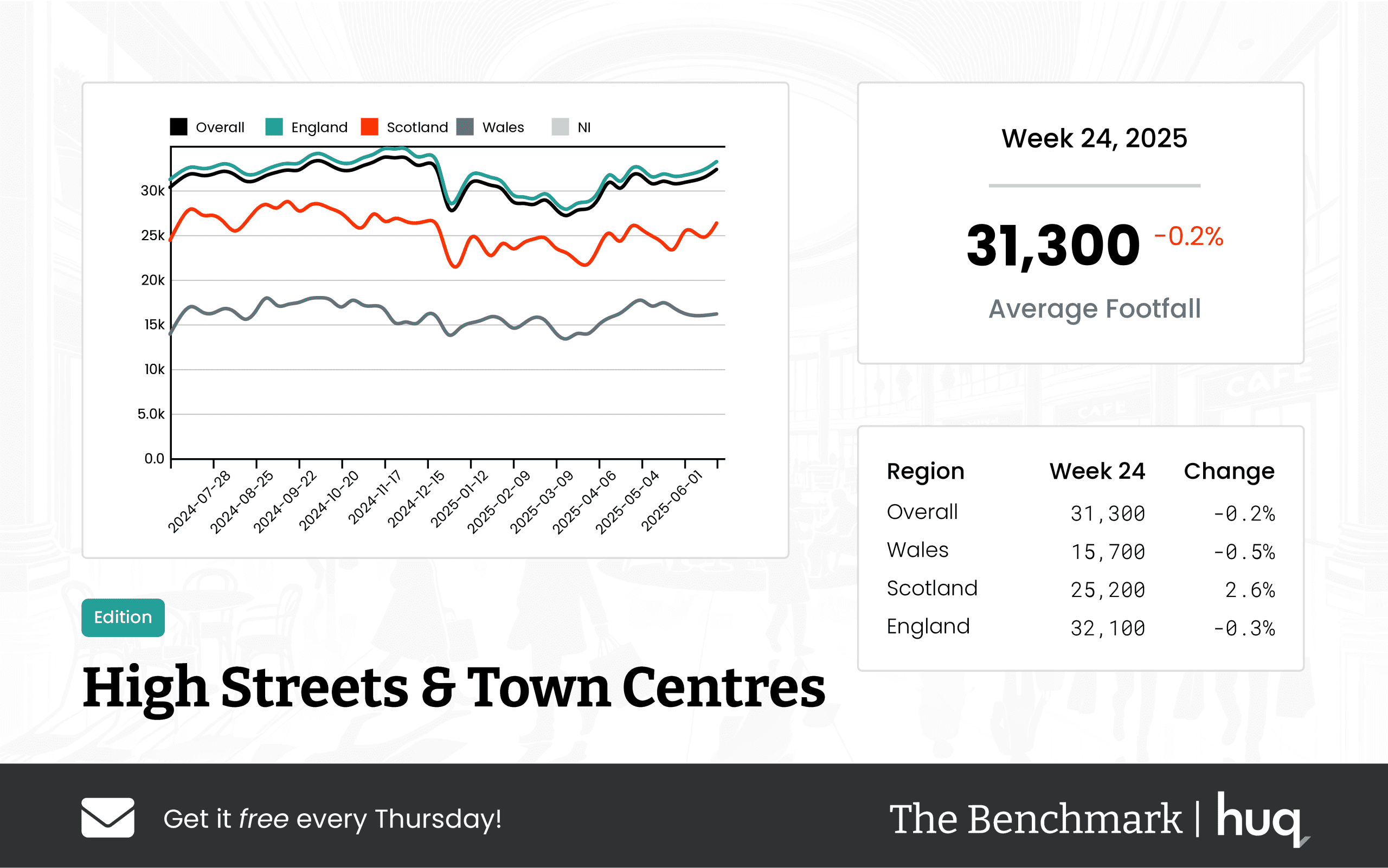

The Benchmark's latest figures for UK High Streets and Town Centres reveal a dynamic landscape of visitor patterns as we analyze the week ending June 22, 2025.

Overall performance indicates that the average daily footfall across these areas reached 31,300. Despite a marginal week-on-week decline of –0.2%, comparisons with the same period last year show a modest increase of 4.4%. This suggests that while short-term numbers dipped slightly, longer-term trends continue on an upward trajectory.

The regional breakdown further emphasizes varying local dynamics. In England, locations averaged 32,100 daily visitors, reflecting a minor weekly decline (-0.3%) yet a healthy 4.4% increase compared to last year. Wales, with a lower average of 15,700, experienced a similar slight weekly dip (-0.5%), but impressively, there was a significant year-on-year rise of 9.7%, marking a strong upward trend. Scotland offers a contrasting picture with 25,200 daily visitors, showing a positive week-on-week increase of 2.6% and a steady year-on-year improvement of 2.1%.

Visitor engagement metrics provide additional insights. On average, visitors now spend about 100 minutes per visit across the analysed locations. Although the week-on-week dwell time figures remain consistent, there is a notable year-on-year improvement of 13.6%. In England and Scotland, dwell times have either plateaued or increased moderately. Meanwhile, despite a minor year-on-year reduction overall in Wales, the recent spike in visit duration points to a deepening engagement with these spaces.

Industry expert Joe Capocci of Huq Industries commented on these trends, stating, "The sharp improvement in Wales’ year-on-year footfall, alongside the sentiment reflected in recent retail industry news, underscores the evolving landscape of visitor engagement across UK High Streets and Town Centres."

This detailed footfall report not only captures the current statistics but also illuminates the shifting retail trends through comprehensive analytics. As the market continues to adapt and evolve, such insights are proving invaluable for strategizing future improvements in high street environments across the UK.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 24 2025: Local Retail Centres Footfall Retail Performance Update

Week 24 2025: Local Retail Centres Footfall Retail Performance Update

During week 24 2025, UK local retail centres maintained a balanced trend with a mean daily footfall of 14,400. Footfall retail and footfall analytics point to steady performance across regions, with varying patterns of consumer engagement.

Share on LinkedIn

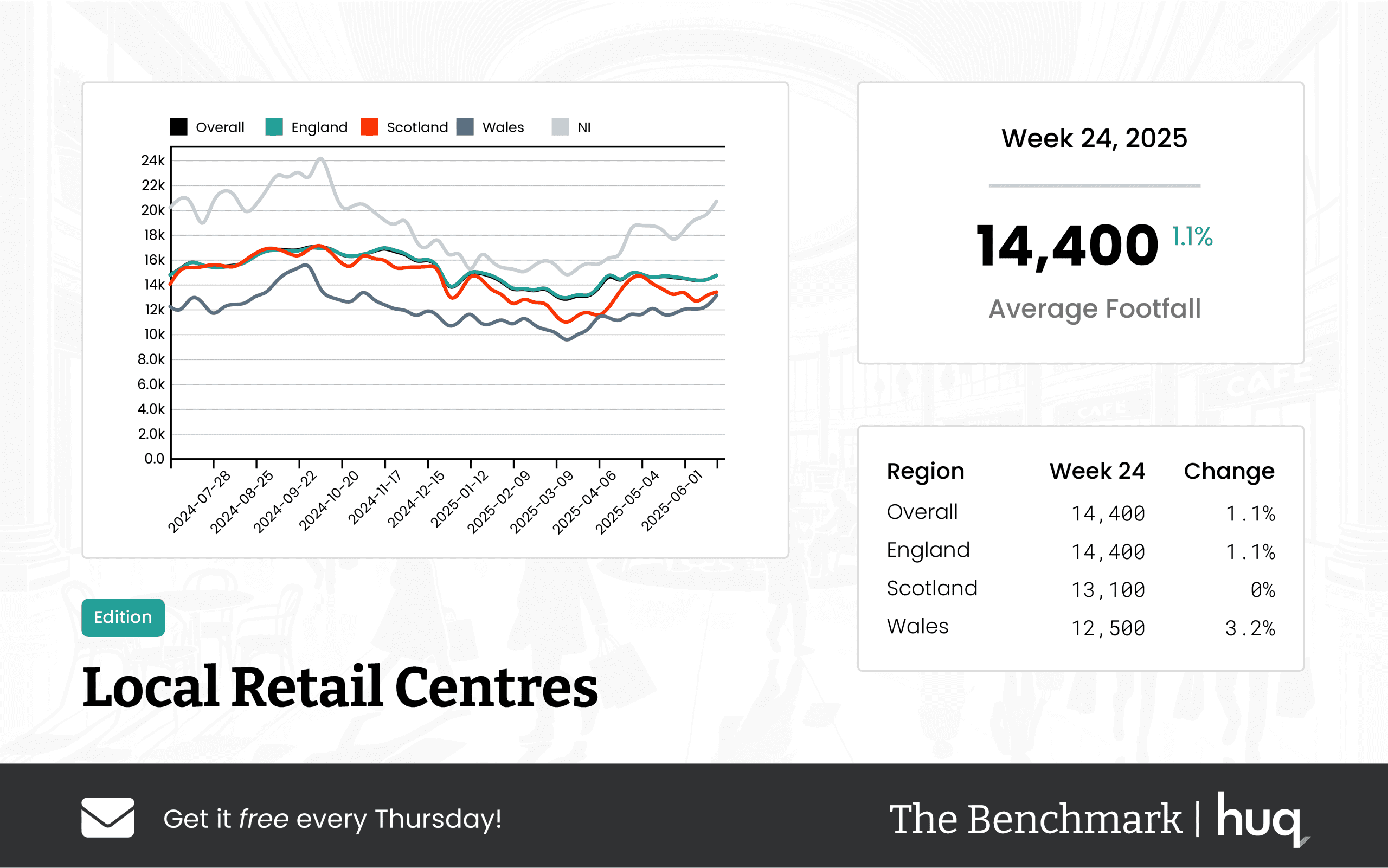

In the week ending 2025‑06‑22, aggregate visitation trends across UK local retail centres exhibited a steady pattern, with key indicators showing a mean daily footfall of 14,400. This reflects a modest week‑on‑week increase alongside a slight year‑on‑year reduction. Notably, consumer engagement, as evidenced by an average dwell time of 96 minutes, remained robust, even though a minor decline was observed in the recent period.

When examined regionally, England closely mirrored the overall figures, maintaining an average daily footfall of 14,400 and a slightly higher dwell time of 97 minutes, thanks to a modest uplift both week‑on‑week and annually. Conversely, Scotland recorded an average of 13,100 daily visitors, with no recent change compared to the previous week and a modest annual drop, while dwell time held firm at 97 minutes despite a recent dip, ultimately showing an annual uplift in engagement.

Wales, although registering the lowest daily footfall at 12,500, experienced a week‑on‑week increase and a positive annual change. Dwell time in Wales averaged 96 minutes, and while the most recent week saw a downturn in this metric, annual numbers indicate a modest decline. These nuanced regional trends underscore varying consumer behavior patterns, highlighting the overall resilience of local retail.

Complementary footfall counting measures further confirm these observed trends, bolstering the narrative of steady performance in local retail centres.

Joe Capocci, spokesperson for Huq Industries, commented on the performance trends: "The noticeable week‑on‑week uplift in Wales, combined with constructive retail industry news, supports our observation of steady performance in local retail centres."

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

UK Major Retail Centres – Week 24 2025 Performance Update: Location Analytics Insights

UK Major Retail Centres – Week 24 2025 Performance Update: Location Analytics Insights

UK Major Retail Centres experienced a modest week-on-week increase of 0.8% and a year-on-year rise of 2.4%. This performance update highlights significant location analytics insights across the UK, with detailed regional breakdowns and dwell time trends that reveal evolving market dynamics.

Share on LinkedIn

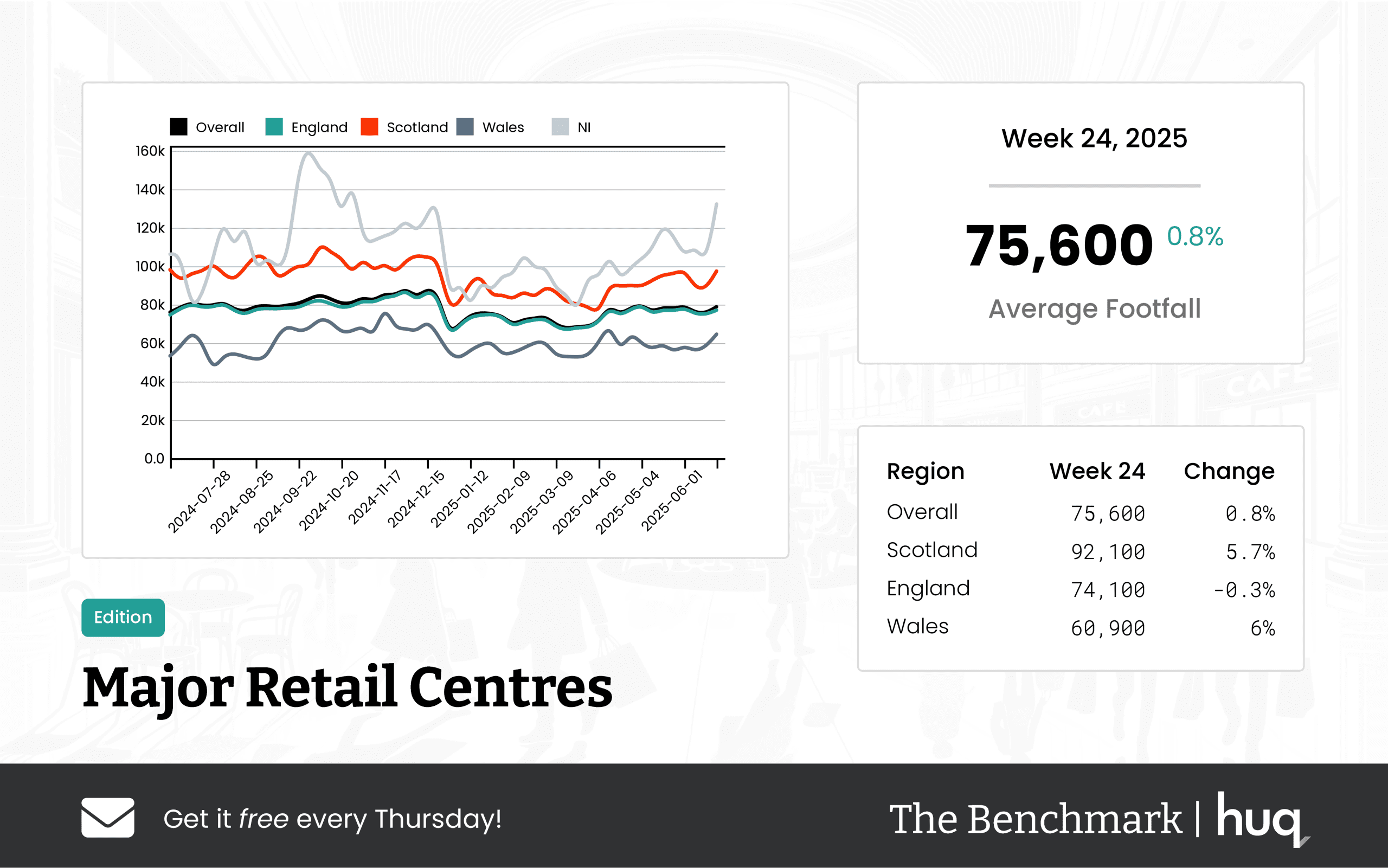

UK Major Retail Centres continued to demonstrate resilient performance during the week ending 22 June 2025, recording an average of 75,600 daily visits. The overall figures represent a modest week-on-week increase of 0.8%, paired with a year-on-year growth of 2.4%. These results underline a stable retail environment, underpinned by comprehensive location analytics and location intelligence that offer deeper insights into market trends.

The regional breakdown indicates interesting variations across the UK. Scotland led the market with an impressive average daily footfall of 92,100, showing a robust week-on-week rise of 5.7%, while mirroring the overall yearly stability at 2.4%. In contrast, England experienced a slight dip to 74,100 daily visits, with a marginal week-on-week decline of 0.3%, albeit with a modest year-on-year growth of 1.6%. Wales had a standout performance, with 60,900 daily visitors marking a strong recovery by showing a 6% week-on-week increase and a significant 13.9% year-on-year improvement.

Visitor engagement, as measured by dwell time, provides an additional layer of insight. Across the board, shoppers spent an average of 114 minutes per visit. Although there was a slight week-on-week reduction of 2.6%, the year-on-year dwell time saw a healthy increase of 7.5%, indicating a gradual yet positive trend in shopper engagement. Regional nuances in dwell time were also observed: in Scotland, the average visit duration was 109 minutes (down 10.7% over the week but up 13.5% year-on-year), in England the mean duration was 115 minutes (a slight 1.7% decrease over the week, rising by 7.5% year-on-year), and in Wales the 98-minute average had a 6% week-on-week improvement but a decline year-on-year.

Industry commentary highlights these evolving dynamics. Joe Capocci, spokesperson for Huq Industries, noted that the most striking change was seen in Scotland’s rebound, an observation reinforced by recent developments such as the opening of a US retailer in Glasgow. This comment supports the view that both traditional metrics and advanced location intelligence are crucial in understanding the market’s evolution.

The integration of location analytics with location intelligence continues to validate market performance and provides retail centres with a robust framework to navigate future trends in consumer behaviour and market dynamics.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 23 Weekly Wrap: Footfall Trends Revealed

Week 23 Weekly Wrap: Footfall Trends Revealed

UK retail footfall data shows a notable 1.5% uplift in major centres alongside improved engagement.

Share on LinkedIn

UK retail performance continues to evolve this week, with recent footfall statistics highlighting nuanced shifts across a range of retail centres. Early in the period, footfall data revealed a consistent recovery, with increasing engagement on every front. The latest figures from retail reports underscore that while visitor numbers fluctuate, dwell times are on a steady upward trajectory. In this Weekly Wrap, we uncover critical insights tied to footfall and explore the performance across diverse retail categories.

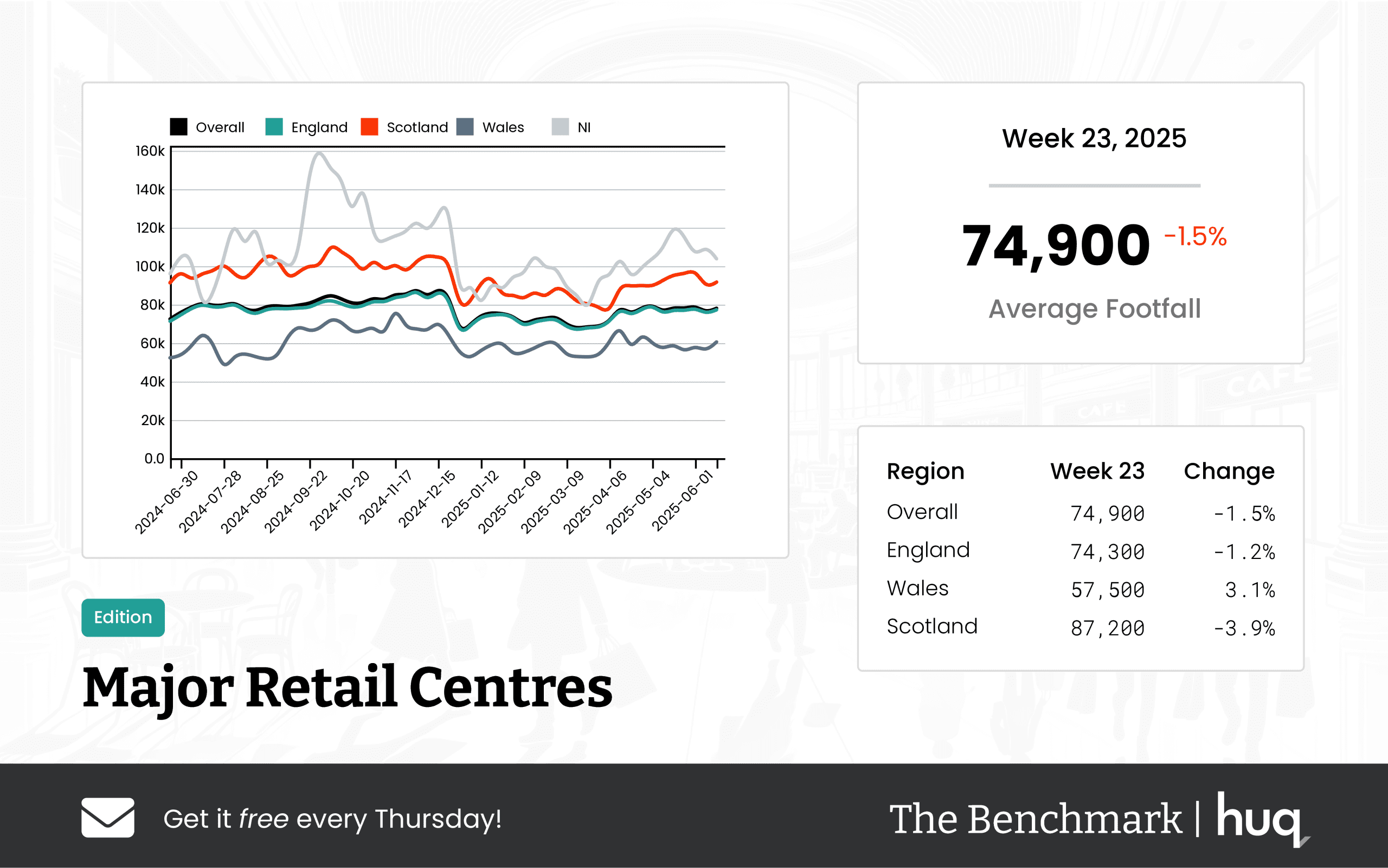

Major Retail Centres Trends

Major retail centres continue to register reliable activity. In Week 23, these centres reached an average daily count of 74,900 visitors, modestly up by 1.5% year‑on‑year, supported by an average dwell time of 117 minutes. Detailed insights are available in the Week 23 Major Retail Centres Footfall Data Update, which helps us analyse the steady improvement in footfall retail performance.

Local Retail Centres and Dwell Time Improvements

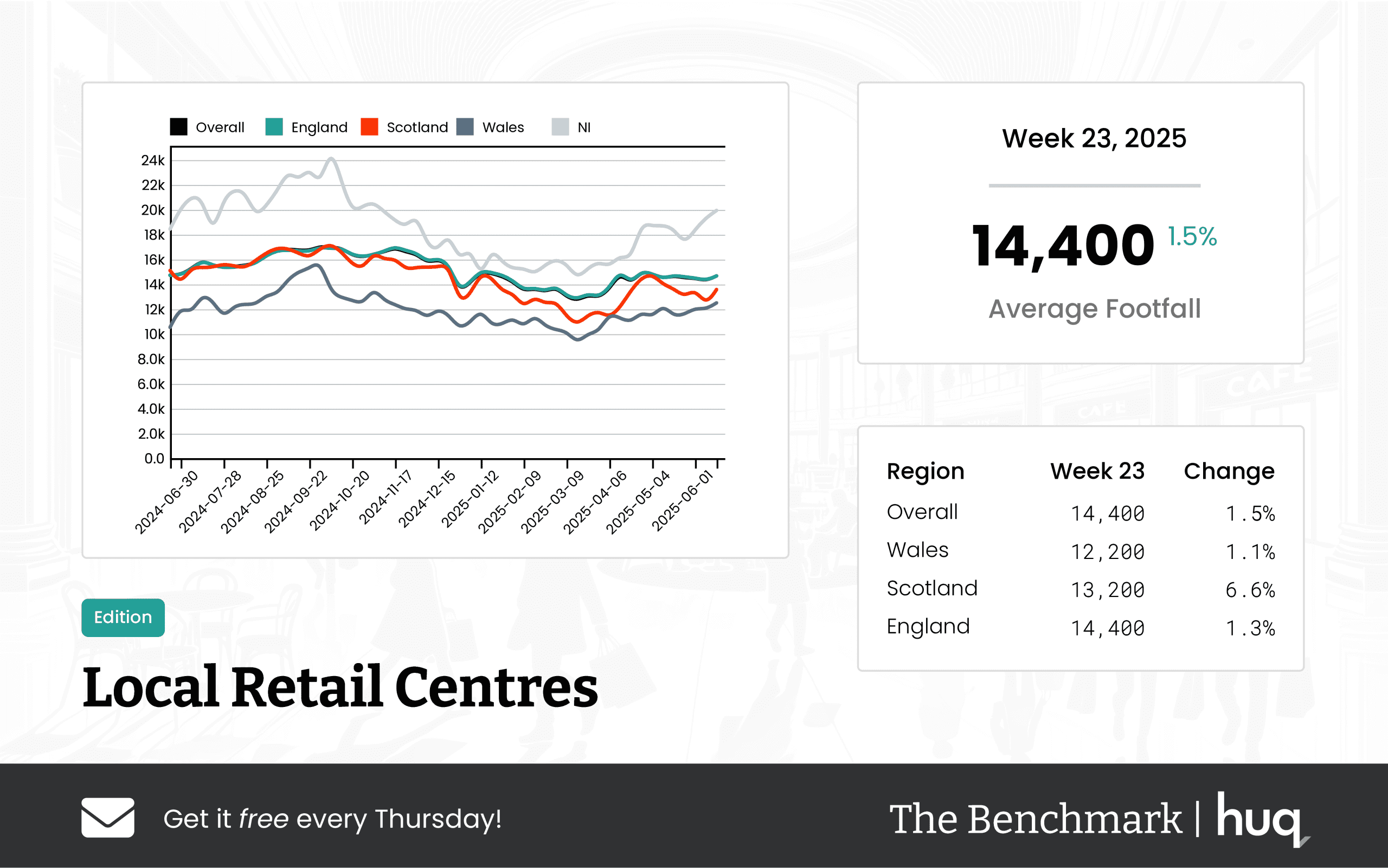

Local retail centres have shown a subtle yet encouraging trend. Week 23 figures reveal 14,400 daily visitors—a slight weekly rise of 1.5%—coupled with an 18.3% year‑on‑year gain in dwell time, now averaging 97 minutes. More details can be found in the Week 23 Footfall Analytics Update for UK Local Retail Centres, indicating that even modest increases in visitor counts can lead to richer in-store engagement.

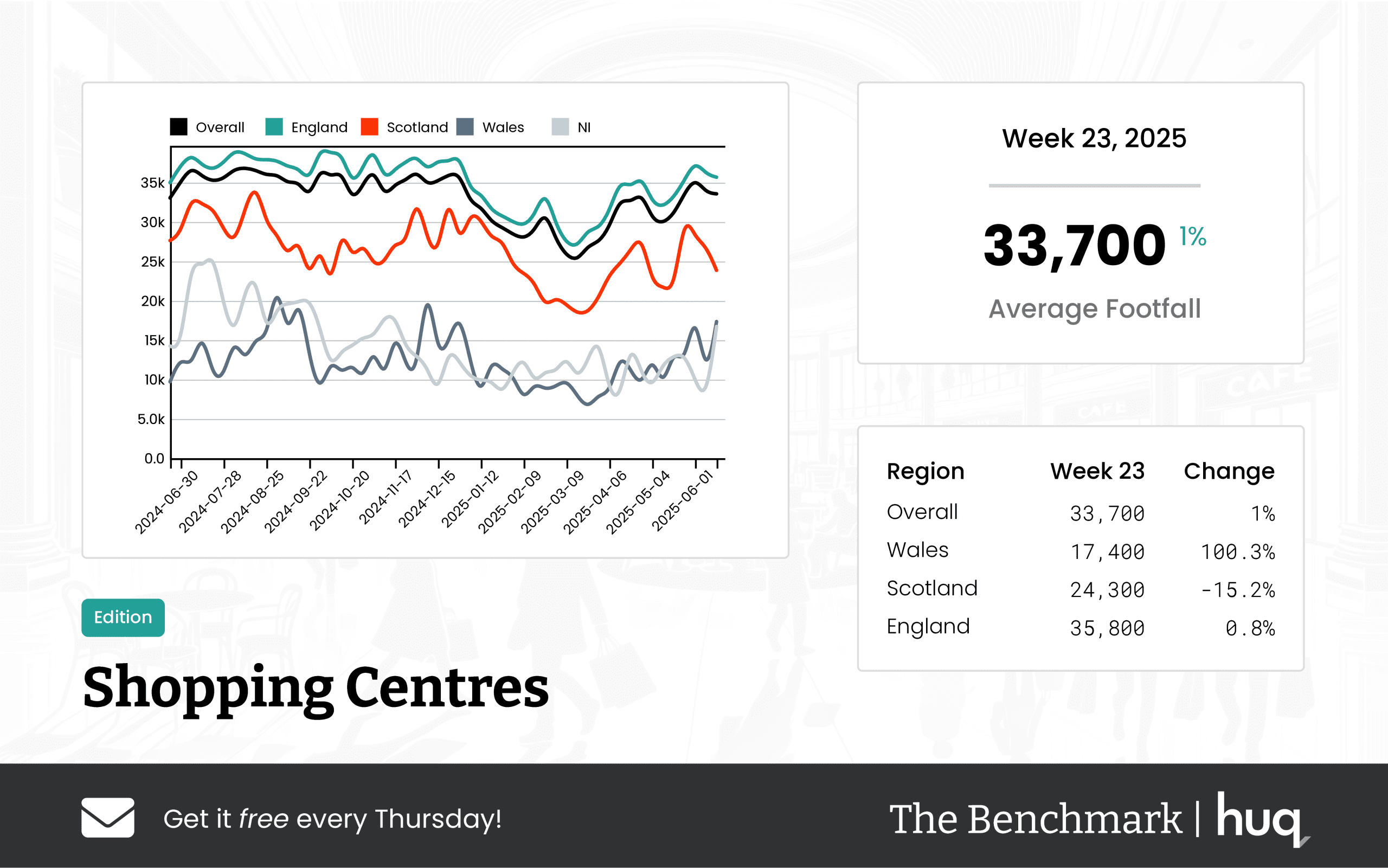

Shopping Centres Performance Insights

Shopping centres have maintained strong performance amid evolving consumer habits. In Week 23, these venues witnessed an average of 33,700 daily visitors and dwell times around 116 minutes. In regional splits, England leads with 35,800 visitors at 124 minutes, while performance discrepancies across Scotland and Wales are visible. For further discussion on footfall statistics, see the UK Shopping Centres – Week 23 Performance Update.

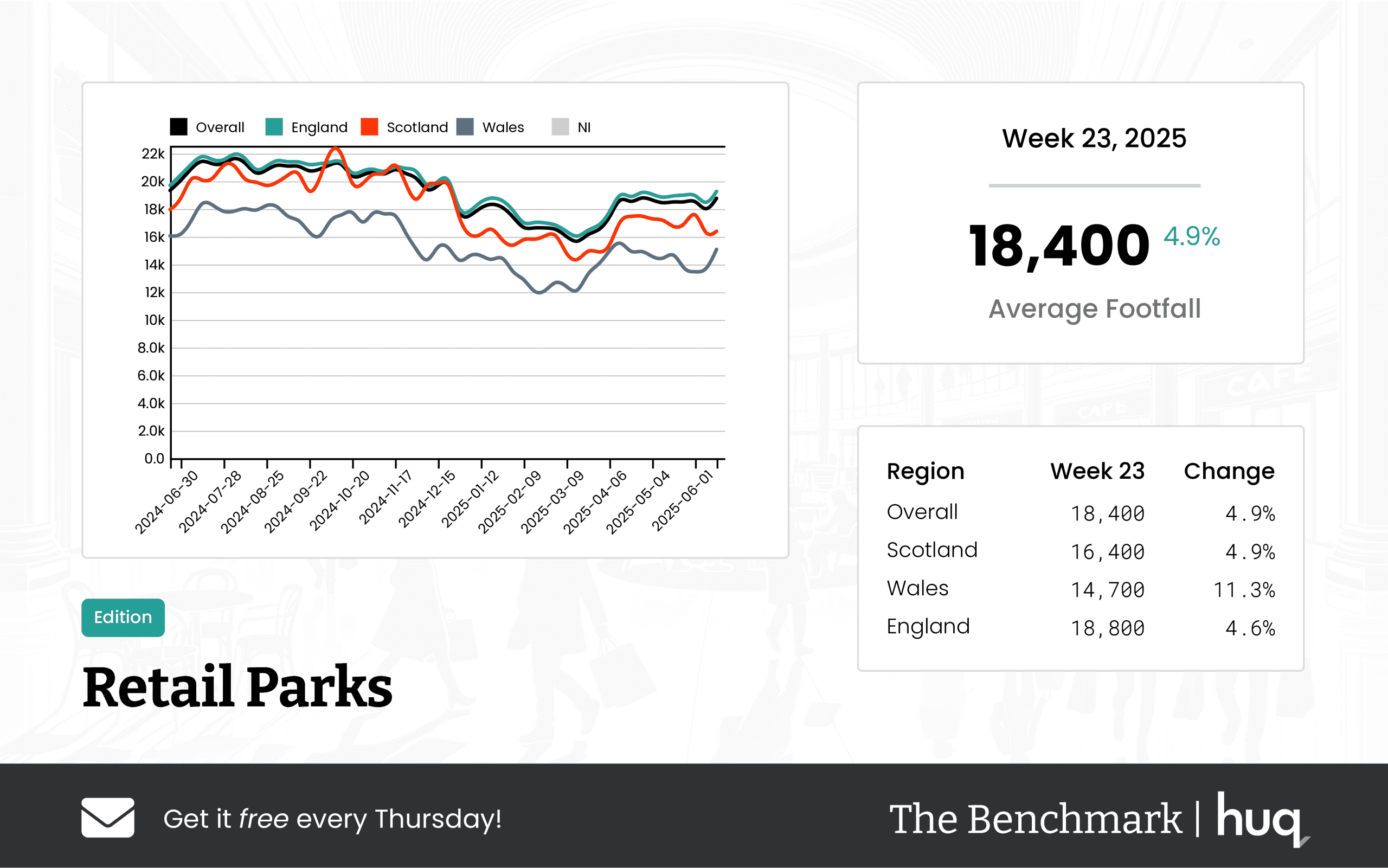

Retail Parks: Weekly Growth and Challenges

UK Retail Parks experienced a notable weekly uplift with an average of 18,400 visitors—a 4.9% increase compared to previous weeks. However, year‑on‑year figures indicate a persistent decline of 7.8%. These contrasting trends echo challenges captured in earlier reports, such as the Week 21 update, emphasising that sustained footfall counting remains critical despite short-term gains. More information is offered in the Week 23 Retail Parks Performance Update.

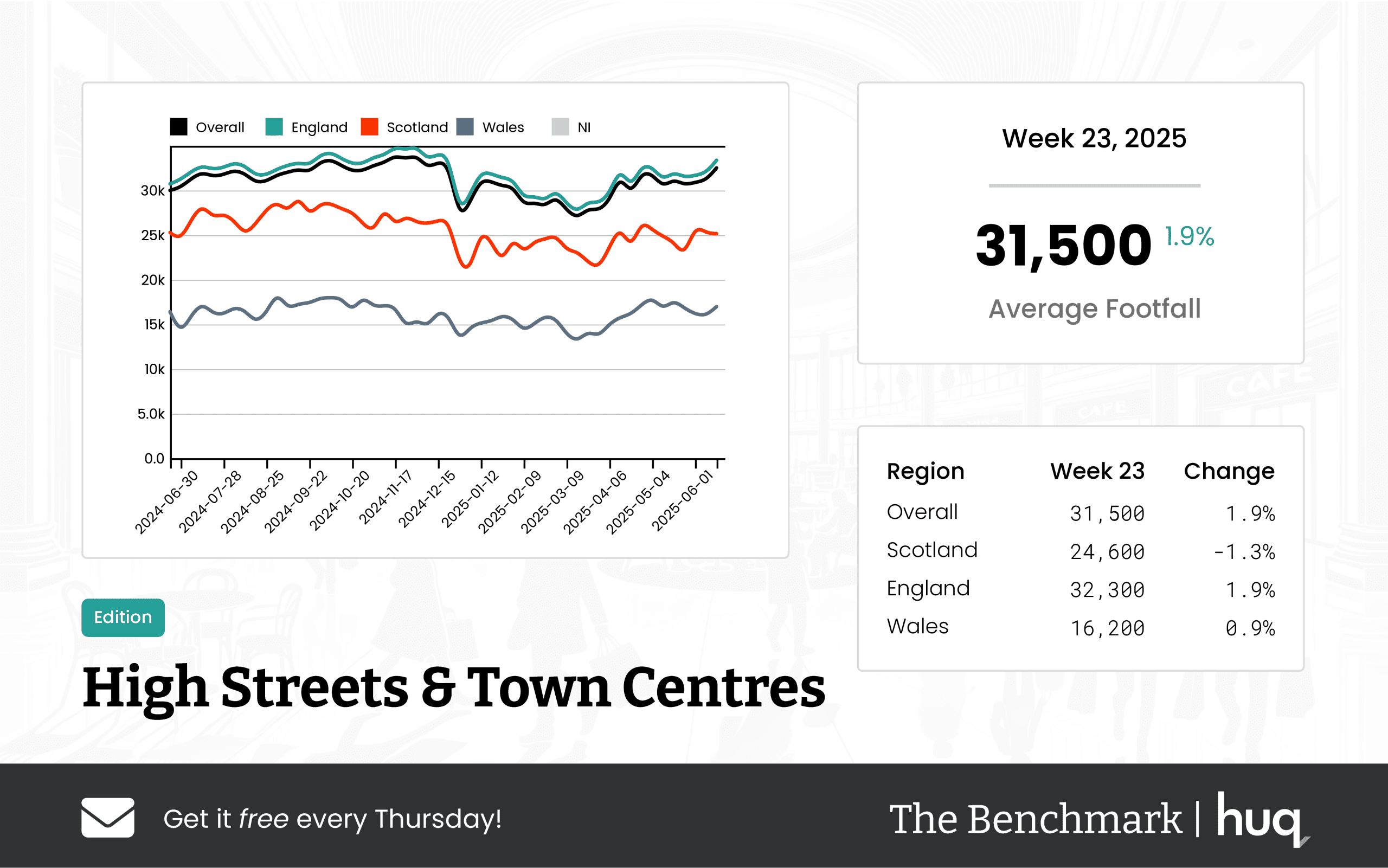

High Streets and Town Centres Steady Performance

High streets and town centres have remained resilient with consistent, if unspectacular, numbers. The Week 23 report shows an overall average of 31,500 visitors and dwell times near 100 minutes, with England emerging as the strongest performer. This continuity reflects robust consumer attendance, detailed further in the Week 23 High Streets & Town Centres Update.

Analysis and Expert Insights

Joe Capocci, Huq Industries Spokesperson, remarked, "The evolving retail landscape demonstrates that while footfall trading is experiencing modest gains, increased engagement across centres points to a resilient market that is adapting well to consumer preferences." His comment highlights the importance of combining footfall analytics with strategic customer experience enhancements. Retailers across sectors are now focusing on in-store experiences, contributing to longer dwell times and bolstering overall performance.

Looking Forward

The data from major, local, shopping centres, retail parks and high streets presents a multi-faceted perspective on consumer behaviour. While percentages may vary, stronger dwell times confirm that shoppers are spending more quality time at these venues. This trend will be key to how brands adapt, whether by improving the footfall retail experience or by making targeted enhancements driven by detailed footfall data. The insights gleaned from these reports are essential for forecasting future trends in the competitive UK retail market.

Concluding Thoughts

This week’s analysis points to a cautious yet ongoing recovery within the retail sector. With mixed results across different retail centre types, increased engagement and longer visits appear to counterbalance slight declines in visitor numbers. Retailers that align their in-store experiences with these new trends may well see continued improvements in footfall analytics and overall market confidence.

Looking ahead, continuous monitoring and adaptation will be crucial. The detailed weekly evaluations serve as a benchmark for performance and offer retail professionals a solid foundation for strategic adjustments moving forward.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 23 2025 Footfall Analytics Update: UK Local Retail Centres

Week 23 2025 Footfall Analytics Update: UK Local Retail Centres

UK local retail centres saw a modest 1.5% weekly rise in footfall analytics, despite a slight yearly drop. Overall, improved quality visits and steady footfall data highlight the trend.

Share on LinkedIn

The latest footfall data for UK local retail centres has revealed a mixed yet generally upbeat performance for Week 23. Overall, the average daily footfall recorded was 14,400, representing a slight increase of 1.5% over the past week. Although this figure shows a year-on-year decline of 1.8%, there is a silver lining: the average dwell time has remained steady at 97 minutes per visit, accompanied by an impressive year-on-year boost of 18.3%. This suggests that while the number of visitors dipped slightly compared to last year, the quality and duration of visits significantly improved.

A closer look at regional performance introduces some interesting contrasts. Wales achieved an average daily footfall of 12,200, with figures rising by 1.1% on a weekly basis and surging by 7.6% year-on-year. The average dwell time in Wales was an impressive 141 minutes, marking an 8.5% rise over the week along with strong annual gains, underscoring the increasing visitor engagement.

Scotland, meanwhile, experienced a standout week with its average daily footfall rising to 13,200—up by 6.6% in one week, despite an 8.6% annual decline. The dwell time in Scotland improved significantly, clocking in at 109 minutes per visit and recording a robust 19.8% weekly uptick, suggesting that shoppers are spending considerably more time at these centres.

In England, the performance figures mirrored the overall trend. With an average daily footfall of 14,400, England saw a 1.3% weekly increase paired with a 1.8% dip year-on-year. The regional dwell time stood at 95 minutes, with a slight weekly decrease of 1% but a noteworthy year-on-year improvement of 17.3%. This data underscores a resilient retail market where customer engagement continues to improve even amid minor demographic shifts.

Joe Capocci, spokesperson for Huq Industries, commented on the fresh data: "The most striking change in footfall is Scotland’s 6.6% weekly increase, and the recent retail news—such as observations from the Whitgift Centre—supports the view that market dynamics are evolving steadily." His remarks reinforce the overall narrative: while raw numbers may fluctuate, the quality of visitor engagement and the strategic importance of evolving market dynamics remain strong indicators of robust retail performance in the UK.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 23, 2025 Major Retail Centres: Footfall Data Update

Week 23, 2025 Major Retail Centres: Footfall Data Update

UK major retail centres show a cautious recovery with an average daily footfall of 74,900 and a modest 1.5% YoY increase. Analysis of footfall retail reveals subtle yet ongoing shifts in visitor engagement.

The Benchmark Tracker's data for the last full week of June 2025 shows that UK major retail centres are witnessing a cautious yet persistent recovery. The reported average daily footfall stands at 74,900, representing a modest 1.5% year‑on‑year improvement despite a slight week‑on‑week decline of the same percentage.

Visitor engagement remains a key focus, with the average dwell time now at 117 minutes. Although this figure experienced a 1.7% week‑on‑week reduction, it still marks a significant 10.4% increase compared to the same period last year, indicating a strengthening long-term trend in customer behavior.

Regional disparities paint an intriguing picture. In England, average daily footfall is very close to the national performance at 74,300, showing a 1.2% drop over the week but a healthy 1.9% increase year‑on‑year. Wales presents a brighter outlook with an average of 57,500 visitors daily, boosted by a 3.1% rise from the previous week and a notable 7.5% year‑on‑year surge. The average dwell time in Wales is 92 minutes, which experienced a significant week‑on‑week increase despite a softer comparative year‑on‑year performance.

Scotland continues to lead in visitor numbers with an impressive average of 87,200 daily visitors, even though it faced a 3.9% drop week‑on‑week and a 3.1% year‑on‑year decrease. Scottish centres also noted an average visit duration of 122 minutes; while experiencing a slight week‑on‑week decline, the duration marks a strong year‑on‑year improvement.

The comprehensive analysis of these figures highlights not just the resilience but also the nuanced changes in footfall retail trends, emphasising the importance of regional performance variations in shaping the future of retail centres.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

UK High Streets & Town Centres – Week 23 2025 Footfall Retail Performance Update

UK High Streets & Town Centres – Week 23 2025 Footfall Retail Performance Update

UK High Streets & Town Centres maintained strong performance in week 23, 2025 with steady footfall retail activity. Overall footfall data reveals modest weekly improvements and increasing visit durations.

Overall Performance

The latest figures from The Benchmark reveal that UK High Streets and Town Centres maintained steady visitation levels during the period under review, underpinned by robust footfall retail performance. The overall average daily footfall reached 31,500, according to recent footfall data, demonstrating modest weekly improvements alongside a favourable year-on-year increase.

The quality of visits remained strong, with an average duration of 100 minutes. This figure also saw a slight weekly increment and a healthy improvement from the same period last year, indicating that shoppers remain engaged in the retail environment and are actively contributing to local economic activity.

Regional Trends

In England, the performance was in line with the overall trends. The region recorded an average daily footfall of 32,300, experiencing an upward shift on a weekly basis and positive year-on-year growth. Additionally, average visit duration in England climbed to 101 minutes, reflecting steady engagement among customers.

In contrast, Scotland's High Streets and Town Centres reported an average daily footfall of 24,600. The region experienced a slight weekly decrease and a minor year-on-year decline, highlighting some challenges that might need further attention.

Wales, however, presents a different scenario. With an average daily footfall of 16,200, the region demonstrated steady weekly improvement coupled with a decent overall gain in numbers. While the average visit duration in Wales reached 82 minutes with a notable weekly uplift, there was a decline in year-on-year dwell time trends. These variations emphasize the differing dynamics experiencing along the nation’s retail corridors.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 23, 2025 Retail Parks Performance Update: Insights from Location Analytics

Week 23, 2025 Retail Parks Performance Update: Insights from Location Analytics

UK Retail Parks enjoyed a modest 4.9% weekly rise in footfall, reflecting short-term improvements despite long‑term declines. Dive into our update for key insights on retail park performance drawn from advanced location analytics and location intelligence data.

This week’s update on UK Retail Parks performance leverages detailed location analytics to provide a clear picture of evolving market trends. The report highlights crucial data on footfall, dwell time, and regional differences, offering a comprehensive view of where the industry stands and where it’s headed.

Overall Performance:

For the week ending June 15, 2025, UK Retail Parks recorded an average of 18,400 visitors per day. This represents a 4.9% week‑on‑week increase, despite a 7.8% decline when compared to the same period last year. The short‑term uptick suggests a modest recovery, while the year‑on‑year figures underscore persistent challenges in attracting visitors over the longer term.

Regional Breakdown:

• England: With an average of 18,800 visitors per day, England leads the regional performance. Its 4.6% weekly improvement is tempered by a slight 7.3% decline over the year, indicating steady activity amid ongoing market pressures.

• Scotland: The Nation experienced an average daily footfall of 16,400 visitors, registering a 4.9% weekly rise. However, the year‑on‑year trend is less encouraging, with an 11.1% decline observed, signalling a need for strategic interventions to boost sustained footfall.

• Wales: Notably, Wales observed the strongest weekly surge with a significant 11.3% rise, boosting its daily average to 14,700 visitors. Despite this encouraging week‑on‑week performance, the region still faces historic challenges with an 11.5% reduction over the past year.

Dwell Time Insights:

Visitor engagement, as measured by dwell time, reveals that UK Retail Parks maintained an average visit duration of 76 minutes—a slight decrease of 1.3% from the previous week. England’s visitors spent about 77 minutes per visit, whereas Scotland trailed with an average of 59 minutes. Interestingly, Welsh retail parks stood out by recording the longest visit durations at 88 minutes, accompanied by a robust weekly increase of 14.3%. Over the longer term, while England has seen a sharp increase in dwell times, Scotland’s metrics have shown only marginal changes.

This update highlights the diverse performance metrics across regions and emphasises the importance of integrating location analytics into retail strategies. By understanding both short-term fluctuations and longer-term trends, stakeholders can better navigate the complexities of the retail landscape.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

UK Shopping Centres – Week 23, 2025 Performance Update: Location Analytics Insights

UK Shopping Centres – Week 23, 2025 Performance Update: Location Analytics Insights

UK shopping centres maintained stable performance with modest footfall increases and consistent dwell times, reflecting robust footfall performance and location analytics insights.

Share on LinkedIn

UK shopping centres have continued to perform steadily, with overall visitor numbers and dwell times reflecting a stable retail environment, even as regional variations offer deeper insights into local consumer behavior.

Overview

During the latest full week, total performance across the UK shopping centres has held nearly constant with an average daily footfall of 33,700 – a modest improvement compared to the previous week while remaining consistent with figures from the same period last year. Visitors spent an average of 116 minutes per visit. Although there was a slight weekly decline in dwell time, the yearly analysis shows that consumer engagement remains resilient.

Regional Breakdown

Wales: Exhibiting the most dramatic shifts, Welsh centres recorded an impressive average daily footfall of 17,400. This increase is significant when compared not only to the previous week but also to last year. However, this surge in visitor numbers has been accompanied by a decline in the average visit duration, which dropped to 45 minutes. The week-on-week and year-on-year falls in dwell time suggest that while more people are visiting, their engagement levels per visit are decreasing.

Scotland: Scottish shopping centres experienced a decrease in visitor activity, with an average daily footfall falling to 24,300 – a roughly 15% drop relative to the previous week. Although dwell time also dropped proportionally to 70 minutes, year-over-year metrics show more moderate fluctuations, indicating a steady yet challenged consumer engagement landscape in the region.

England: In contrast, England’s centres remained strong, achieving the highest average daily visitors at 35,800. A modest increase in weekly figures and a notable annual rise underscore improved consumer confidence and engagement. The average dwell time in England was recorded at 124 minutes, buttressed by strong location analytics data and targeted engagement strategies.

Industry Comment

Joe Capocci, spokesperson for Huq Industries, noted: "The striking increase in Welsh footfall, which aligns with recent retail industry news, highlights the evolving consumer landscape that necessitates tailored strategies to maintain engagement." This comment reflects a broader industry attention shift towards dynamic location analytics to effectively navigate and strategize in a changing retail environment.

Overall, the steady performance of UK shopping centres, despite regional disparities, reaffirms the importance of local insights in shaping consumer engagement strategies across the sector.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 22 Weekly Wrap: UK Footfall Data Trends

Week 22 Weekly Wrap: UK Footfall Data Trends

Discover this week's UK retail landscape as local centres display a modest 9.1% increase in footfall, with key insights via footfall analytics.

Share on LinkedIn

Introduction: A Dynamic Retail Landscape

UK retail continues to evolve with shifting patterns in footfall and consumer engagement. Recent updates reveal that footfall data across several retail centre types have begun showing noticeable improvements alongside mixed performance trends. With a blend of modest gains and cautious declines, the story this week is one of resilience and adaptation, as tracked by cutting-edge footfall analytics.

Major Retail Centres – Steady Growth

Major retail centres remain a cornerstone for the UK retail sector. In Week 21, these hubs reported an average daily footfall of roughly 80,100 and an average dwell time of 119 minutes, reflecting a steady year‑on‑year gain. Detailed breakdowns are available in the Week 21 Weekly Wrap: UK Retail Trends and Insights Through Location Analytics. This consistency underlines the sector’s ability to maintain momentum in an ever-changing market.

Local Retail Centres – Mixed Yet Promising Insights

Local retail centres display a more nuanced picture with modest improvements and targeted growth. Week 21 figures indicated an average daily footfall of 14,800, up by 2.2% week‑on‑week, and a modest annual growth of 0.6%. Regional data shows England with stable numbers, Scotland with slightly lower figures but longer average visit durations at 109 minutes, and Welsh centres offering the longest dwell times of 119 minutes. More details can be found in the UK Local Retail Centres – Week 21 2025 Footfall Analytics Performance Update.

Shopping Centres – Signs of Recovery

Shopping centres are signalling a recovery in a challenging economic climate. One Week 21 update reported an encouraging 9.1% increase in footfall, reaching 35,700 visitors daily, with dwell times remaining robust at 118 minutes. A subsequent update in Week 22 noted slightly lower overall footfall at 33,600 but maintained strong engagement levels. For a deeper insight into these trends, explore the updates on UK Shopping Centres – Week 22 Performance Update 2025: Footfall Retail Trends and UK Shopping Centres – Week 21, 2025 Performance Update featuring Location Analytics.

Retail Parks – Challenges Amid Extended Visits

The outlook for retail parks appears more challenging as weekly comparisons reveal a decline in visitor numbers. In Week 19, retail parks recorded 18,700 daily visitors, but by Week 22 this average dropped to 17,600, showing an 11.5% annual decrease. However, dwell times increased by 8.5% to an average of 77 minutes, which could hint at a more engaged customer base despite lower footfall. Regional variations are stark, with England’s centres showing slight improvements, Welsh parks remaining steady, and Scotland facing sharper declines. More comprehensive figures are presented in the UK Retail Parks – Week 22 Performance Update 2025: location analytics Insights.

High Streets and Town Centres – Stability In Focus

High streets and town centres continue to exude stability in a fluctuating market. For Week 22, overall daily footfall hovered around 31,000 with a minute weekly dip of 0.4%, while annual growth touched 3.6% and dwell times increased to 98 minutes. England’s centres reported a robust annual performance, Scotland experienced a sharper weekly drop of 4.6%, and Welsh centres demonstrated impressive year‑on‑year gains. These trends not only underscore the significance of footfall statistics but also reveal consumer reliance on familiar high street experiences, as highlighted in the UK High Streets & Town Centres – Week 22, 2025 Performance Update: Insights from Location Analytics.

Retail Trends and Expert Perspectives

Across all retail formats, recent data reveals that while footfall figures may show minor setbacks, dwell time trends remain promising. A growing focus on footfall counting and footfall retail analysis is enabling operators to fine-tune strategies on a regional basis. Joe Capocci, Huq Industries Spokesperson, remarked, "The evolving nature of consumer behaviour demands that retailers adapt through sophisticated footfall analytics. Although some regions face challenges, the overall increase in engagement underscores a positive turn in customer experience." This statement further cements the role of innovative analytical tools in planning for the future.

Regional and Sectoral Insights: A Balanced View

When assessing the performance of retail centres, it is clear that regional disparities play a significant role. In England, both major centres and shopping areas continue to gain momentum. Conversely, Welsh and Scottish regions face differing challenges, with some centres demonstrating prolonged dwell times that could balance out lower visitor numbers. These varied outcomes highlight the importance of targeted strategies in footfall retail environments and suggest that a one-size-fits-all model may not be effective. Retail professionals are encouraged to consider these subtleties when making operational decisions.

Conclusion: Navigating the Future of Retail

This weekly analysis encapsulates the dynamic nature of UK retail, where improved engagement and strategic data use are key themes. As retailers harness detailed footfall analytics to understand complex market trends, both consumer behaviour shifts and regional nuances are driving business adaptations. In summary, while footfall numbers provide the initial insight into store performance, enhanced dwell times and the strategic use of footfall data are proving essential for long-term success in today’s competitive retail landscape.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.