UK Local Retail Centres – Week 34, 2025 Performance Update: location analytics Insights

UK Local Retail Centres – Week 34, 2025 Performance Update: location analytics Insights

Modest recovery: a 1.1% rise in dwell time versus a 5.8% overall decline. Strong location analytics and retail performance drive UK Local Retail Centres’ update.

Share on LinkedIn

Share on LinkedIn

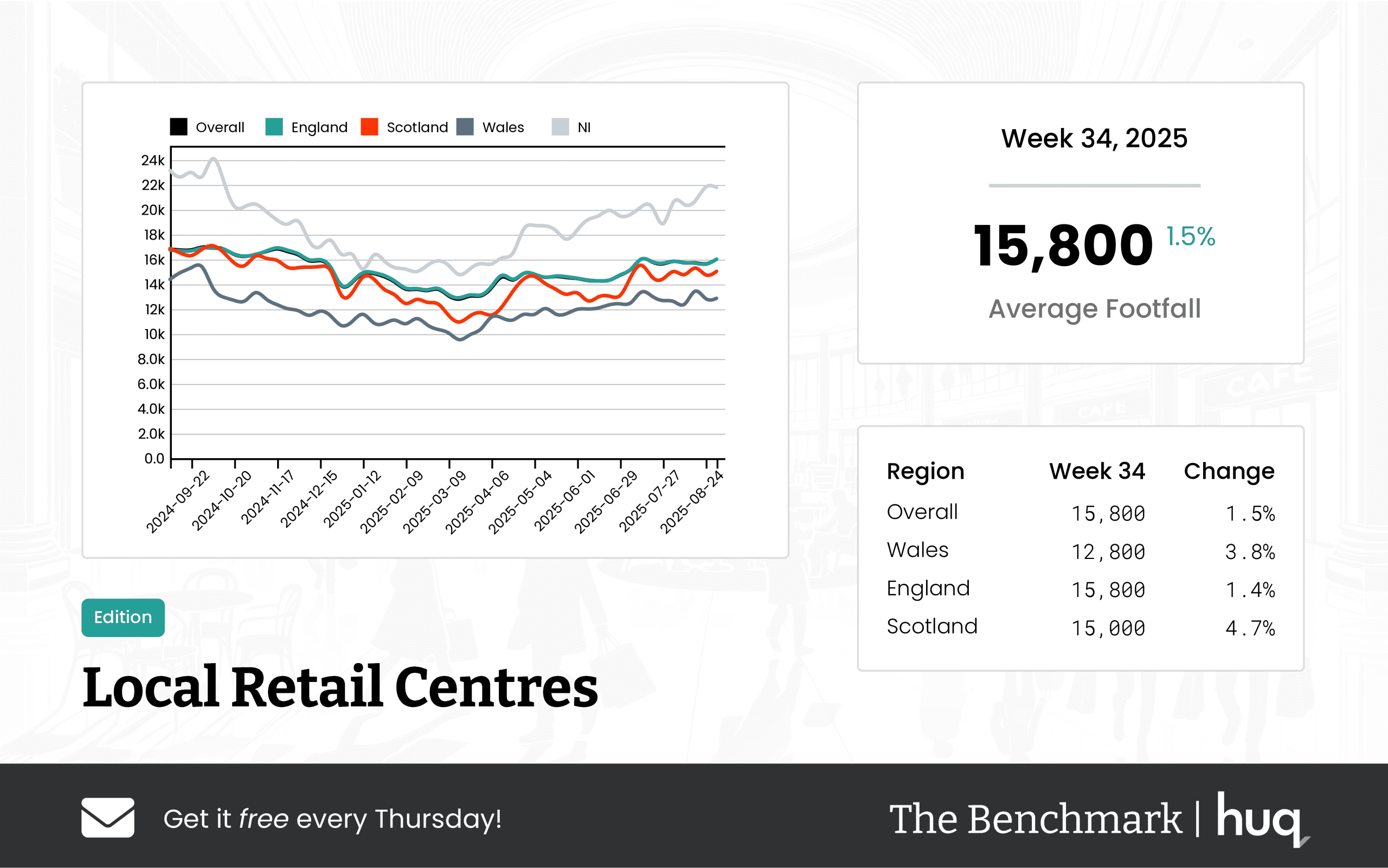

During the week ending 2025-08-31, UK Local Retail Centres recorded an overall average daily footfall of 15,800. Compared with the previous week, this represents a modest increase, while the year on year performance indicated a decline of approximately 5.8%. Dwell time across the UK also showed modest improvement, with an overall average visit length of 95 minutes, rising slightly by 1.1% on a weekly basis and improving by 4.4% compared with the previous year.

Across England, footfall performance remained consistent with an average daily figure of 15,800, accompanied by a week-on-week change of 1.4% and a year-on-year dip of 5.6%. In Scotland, the average daily footfall was slightly lower at 15,000, demonstrating a weekly boost of 4.7%, while the year-on-year figure declined by 9.4%.

Wales exhibited a different trend with an average daily footfall of 12,800. Although Wales experienced a weekly increase of 3.8%, the region faced a notable year-on-year decline of 14.7%. This decline contrasts with dwell time measurements, where visitors in Wales spent considerably longer, with an average visit duration of 146 minutes.

While overall dwell time saw slight improvements, regional variations are evident. Scotland reported lower average visit times of 84 minutes, showing only minor weekly improvements. The increased dwell time in Wales highlights a regional trend of customers spending more time during their visits, despite the lower overall footfall numbers.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 32 Weekly Wrap: In-Depth Footfall Data Trends Across UK Retail

Week 32 Weekly Wrap: In-Depth Footfall Data Trends Across UK Retail

Discover how footfall surged by 12.4% in Welsh centres, with expert insights from Huq Industries and detailed footfall analytics.

Share on LinkedIn

Share on LinkedIn

Overview of the Week

This week’s analysis offers a comprehensive look at recent footfall metrics across the UK retail sector as derived from robust footfall analytics. Both Week 31 and Week 32 updates call attention to nuanced changes in footfall trends that are critical for retailers. The unique insights based on footfall data reveal subtle shifts and regional variations that set the tone for strategic planning.

Insights from Major Retail Centres

Major retail centres witnessed slight but important shifts in their daily performance. The UK Major Retail Centres Performance Update reported a modest 1% increase in daily footfall with visitors spending 117 minutes on site. Regional disparities were evident with Scottish centres reaching an impressive 109,500 daily visitors while Welsh centres recorded a robust 12.4% weekly improvement.

Update on Shopping Centres

The latest figures for shopping centres show a minor contraction in overall daily visitor numbers while dwell times improved noticeably. The UK Shopping Centres Week 31, 2025 Performance Update reported an average of 36,000 visitors per day alongside a 5.8% increase in visit duration, which suggests a shift towards longer engagement despite reduced footfall. This balance between moderate visitor decreases and increased dwell time underlines the resilience within the shopping centre format, an important element of footfall retail strategies.

Trends in Local Retail Centres

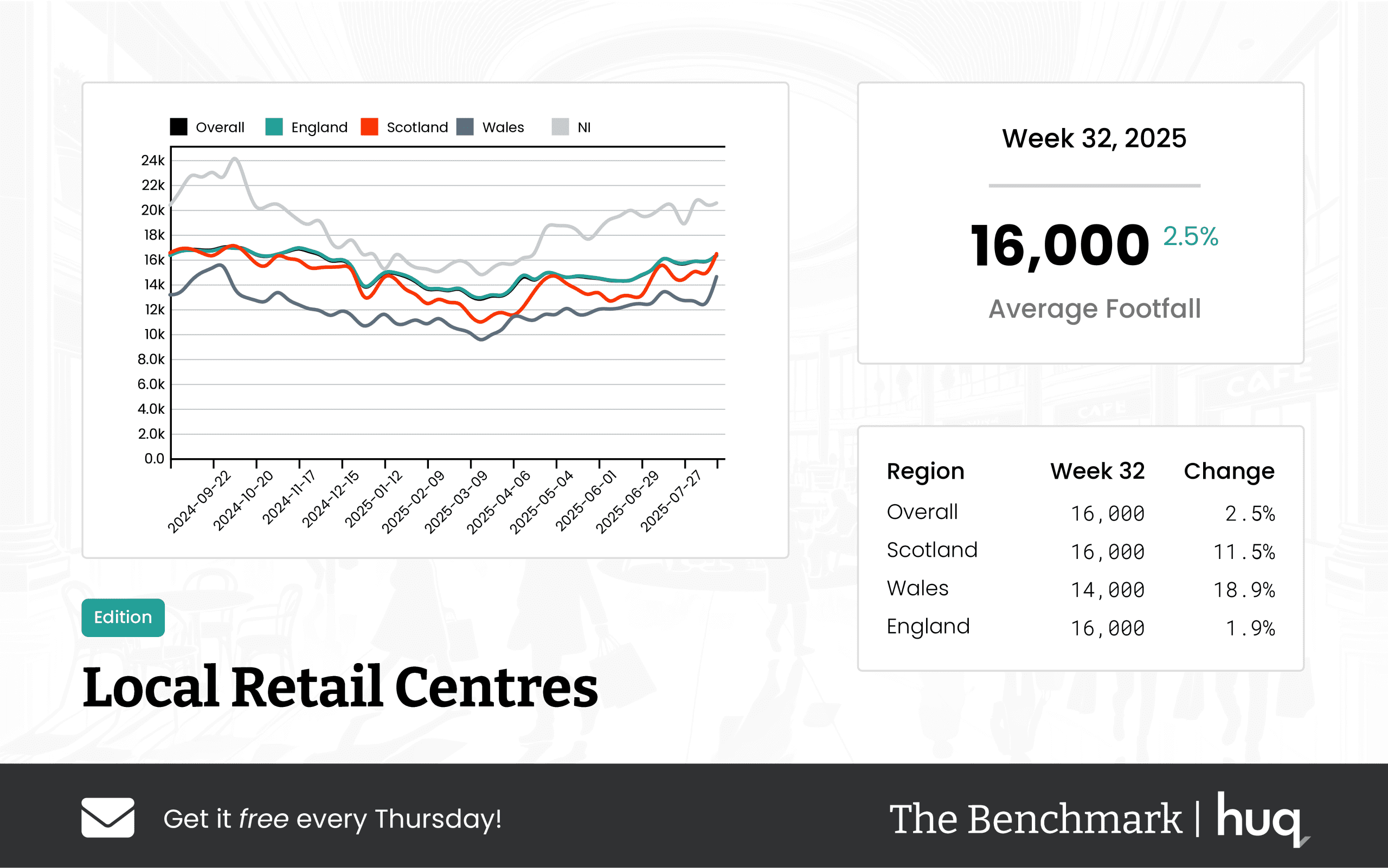

Local retail centres have displayed mixed performance metrics that require retailers to be adaptive. The Week 32 Local Retail Centres Footfall Update highlighted a 2.5% rise in daily visitor numbers, though annual changes have been marginal. Notably, Welsh centres turned heads with an 12.4% weekly rise and an average dwell time of 119 minutes, while the Local Retail Centres Performance Update pointed to a slight contraction, underscoring the variance in local footfall statistics.

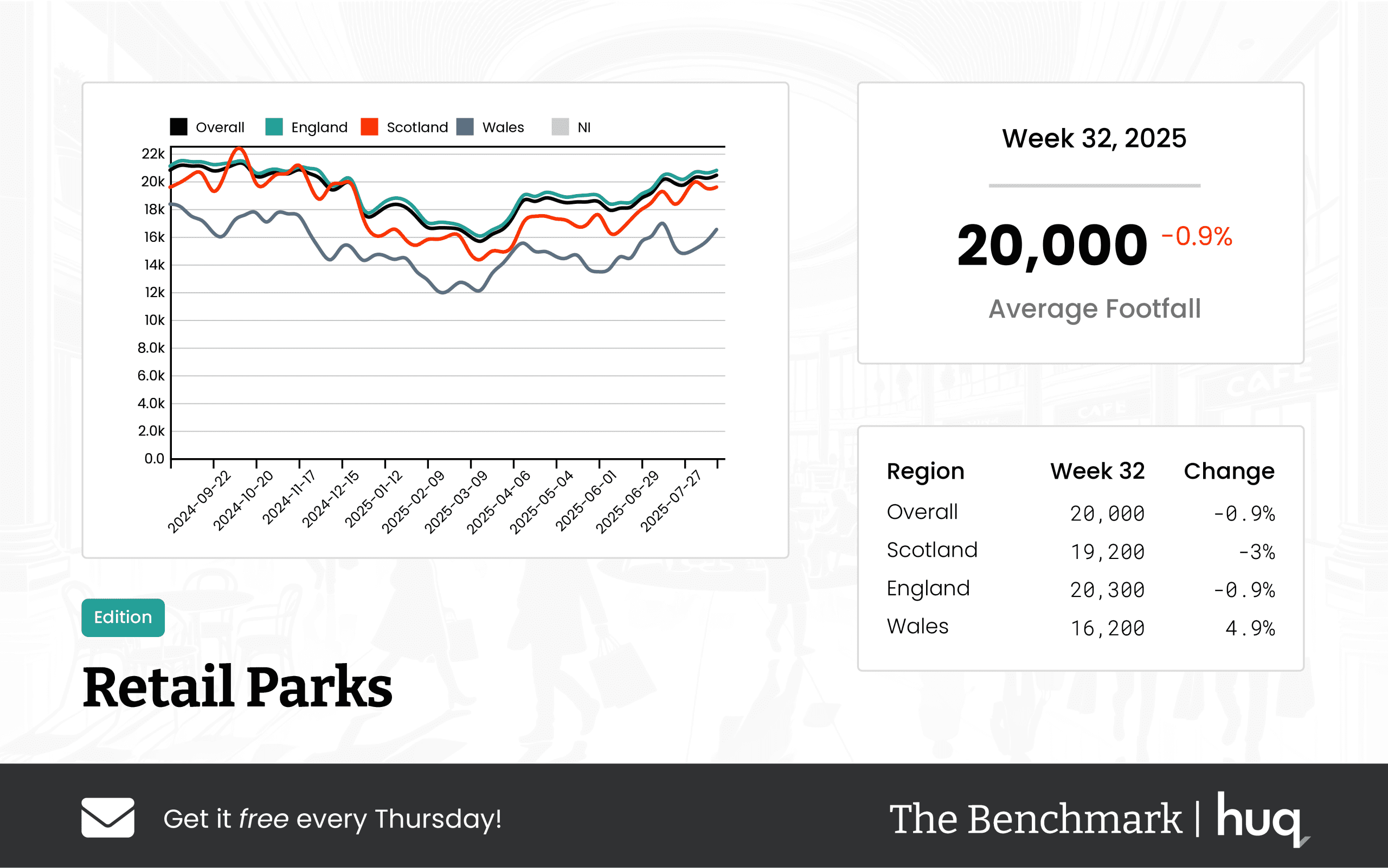

Examination of Retail Parks

Retail parks are experiencing modest adjustments in both visitation figures and duration. According to the Retail Parks Performance Update, Week 31 saw a small 0.4% dip in footfall, while visit durations improved by 2.8%, reaching 73 minutes on average. Regional differences further illustrate this dynamic, with English parks posting the highest dwell times of 75 minutes and Scottish parks showing consistent engagement, emphasising the importance of detailed footfall counting in retail park performance.

Emerging Market Trends

Beyond individual centre performance, broader market dynamics are in play alongside smaller percentage changes that shape the retail landscape. The Weekly Wrap from Weeks 25–27 revealed that even a 4.2% rise in overall footfall data can influence strategic decisions. Economic shifts, warmer weather, and local developments are all factors steering seated and transient behaviours, making this a key moment for retailers who rely on precise footfall statistics and retail insights.

Expert Commentary

Joe Capocci, Huq Industries spokesperson, explained, “The current trends in footfall data underscore the need for agility in retail strategies. Regional nuances and even slight weekly variations can have significant impacts on consumer engagement. Retailers must decode these numbers with thorough footfall analytics to stay ahead in a competitive market.”

Final Reflections

In summary, this week’s updates provide a detailed snapshot of evolving footfall trends that signal a changing retail environment. While major retail centres have seen an overall positive shift, shopping centres, local retail centres, and retail parks each exhibit unique patterns that require tailored responses. The recent data offers invaluable insights for retailers; continuous monitoring and strategic use of footfall data are essential for future success.

Looking Ahead

Retailers should take away the importance of understanding detailed footfall trends when planning for seasonal peaks or potential downturns. As highlighted by the recent reports, the interplay between footfall retail metrics and consumer behaviour continues to be a critical factor influencing overall performance. With robust data, refined strategies, and clear regional insights, businesses are better equipped to respond to market changes and capitalise on emerging opportunities.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 32, 2025 Shopping Centres: Footfall Retail Update

Week 32, 2025 Shopping Centres: Footfall Retail Update

UK shopping centres' overall footfall shows a slight dip with average daily figures of 35,100 and visits lasting 104 minutes, as revealed by footfall analytics.

Share on LinkedIn

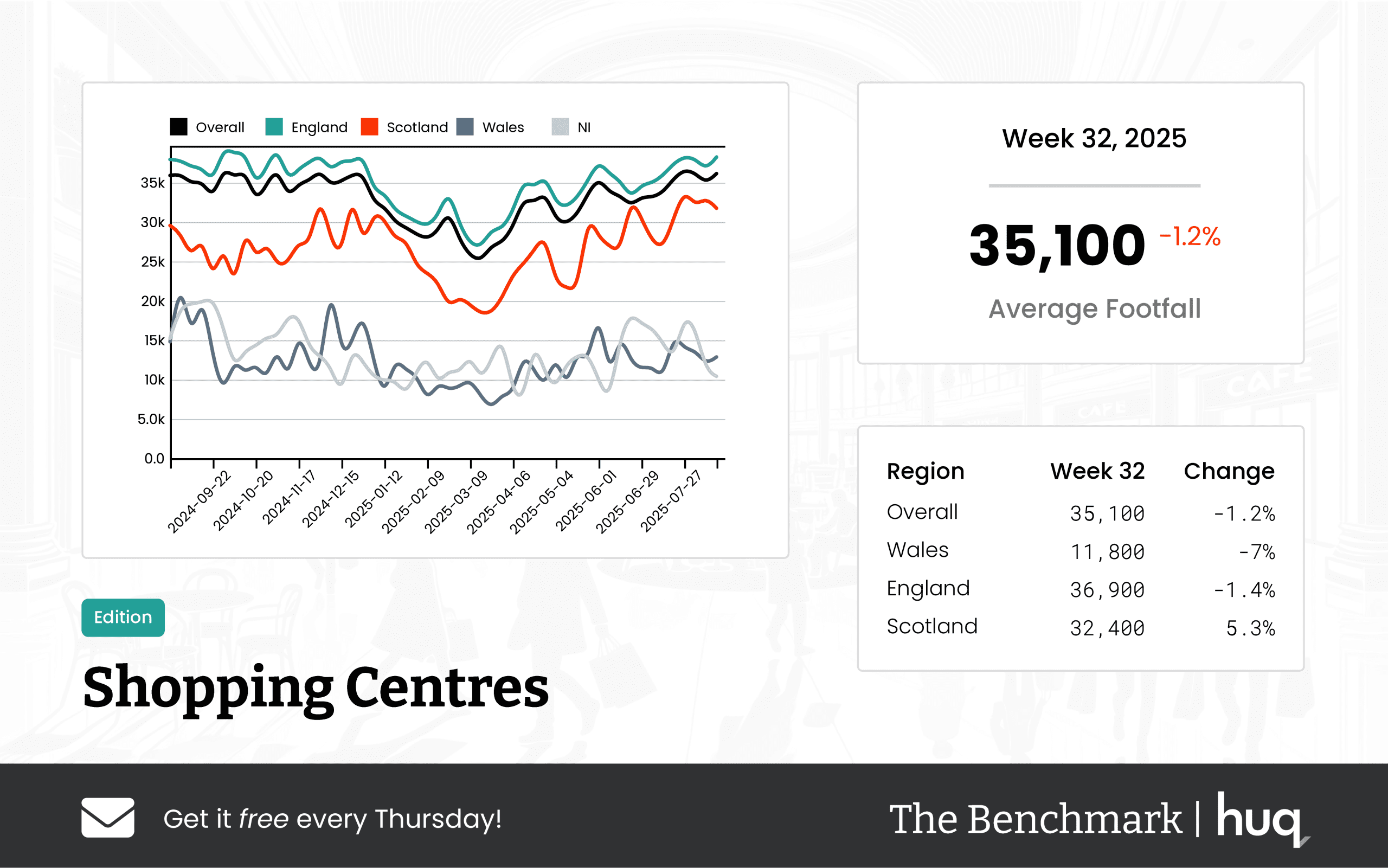

The latest figures for week 32 indicate that UK shopping centres are experiencing a modest softening in overall activity. According to recent footfall data, average daily footfall across centres stood at 35,100, a slight drop compared with the previous week. Visitors spent an average of 104 minutes per trip, implying that while engagement has softened somewhat, shoppers continue to enjoy a comfortable retail experience, thereby supporting steady footfall trends.

Regional performance varied across the UK.

• In England, centres recorded an average daily footfall of 36,900, with a minimal week-on-week decline, and visitors lingered for an average of 108 minutes per visit.

• In Wales, shopping centres attracted an average of 11,800 visitors each day, though dwell times softened compared with previous periods, reflecting slight adjustments in shopper engagement.

• In Scotland, centres welcomed a robust average of 32,400 visitors per day. More notably, both footfall figures and engagement improved, with the average visit duration rising to 103 minutes.

Industry feedback further highlights these trends. Joe Capocci, spokesperson for Huq Industries, noted that the sharp increase in Scottish footfall, along with enhanced dwell times and the recent arrival of a major Spanish fashion brand, signals a promising shift in regional retail performance. These developments suggest that while overall activity in UK shopping centres remains steady, certain regions are experiencing dynamic growth fueled by new retail initiatives.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 32 2025 High Streets & Town Centres: Insights from Footfall Retail

Week 32 2025 High Streets & Town Centres: Insights from Footfall Retail

UK high streets & town centres record a modest week-on-week increase of 1.3% in footfall retail with a 3.6% year-on-year rise, reflecting robust footfall analytics across the market.

Share on LinkedIn

Share on LinkedIn

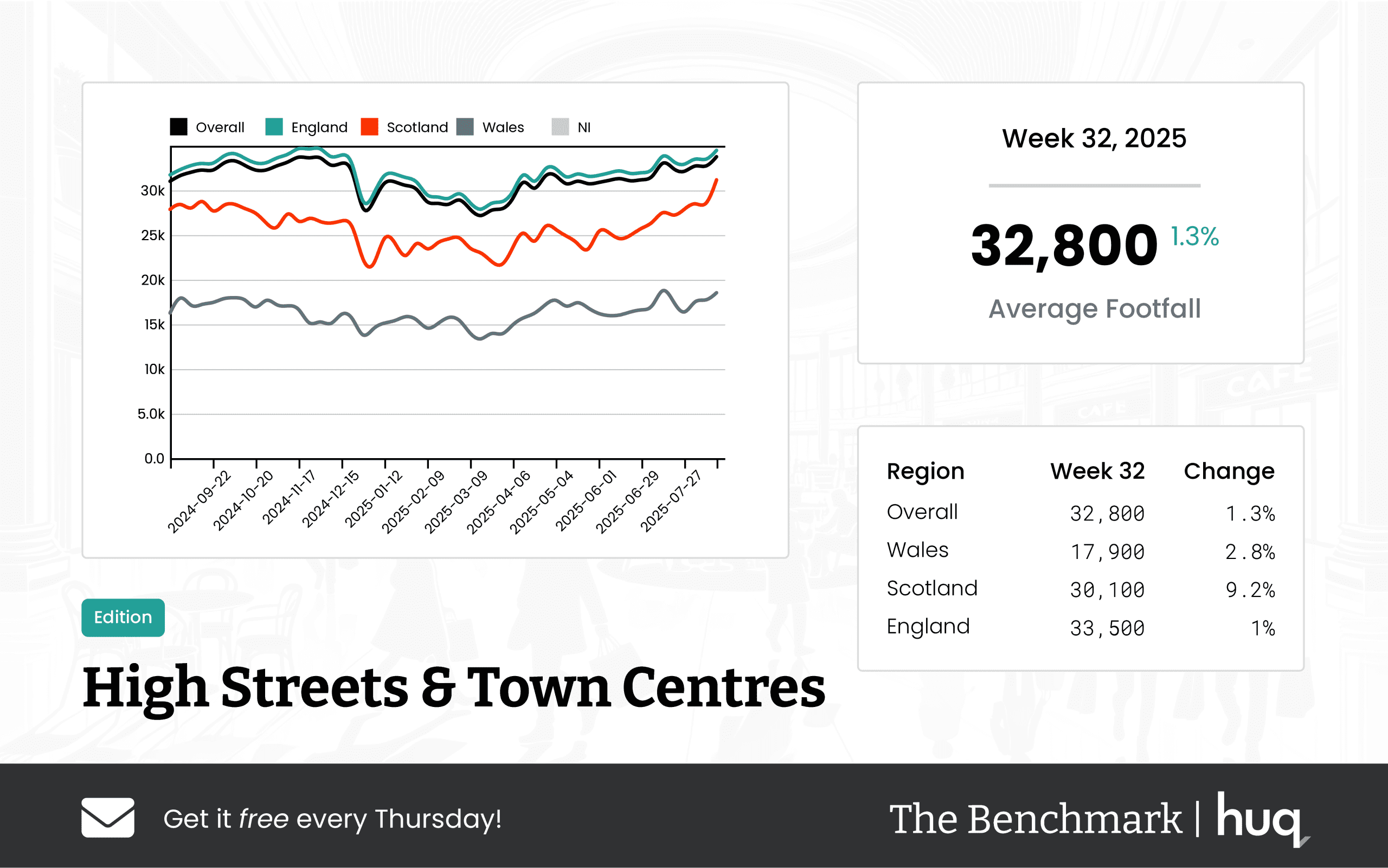

Recent data for the week ending 17 August 2025 underscores a steady growth trajectory across UK High Streets and Town Centres. The overall average daily footfall reached 32,800, signifying a week-on-week increase of 1.3% and a year-on-year rise of 3.6%. Visitors are not only frequenting these retail hubs more often, but they are also spending additional time during each visit.

The average visit duration now stands at 99 minutes, a figure that has increased by 1% on a weekly basis and improved by 12.5% compared to the same period last year. These figures, derived from detailed footfall data and robust analytics, offer valuable insights into evolving customer engagement patterns.

Regional performance across the UK reveals some interesting trends:

• In Wales, average daily footfall hit 17,900 visitors, showing a week-on-week lift of 2.8% and a robust annual increase of 6.4%.

• Scotland exhibited particularly strong dynamics with an average of 30,100 daily visitors, accompanied by significant increases of 9.2% on a weekly basis and 11.3% over the past year. Despite this high activity, Scotland recorded a slightly lower average visit duration of 81 minutes, with both weekly and yearly decreases suggesting shorter engagement periods compared to other regions.

• England maintained a steady performance with healthy footfall figures of 33,500 daily visitors. The region saw a modest weekly uptick of 1%, with a comfortable year-on-year rise of 3.3%. Notably, England leads with an impressive average visit duration of 100 minutes—a standout improvement of 14.9% year-over-year.

The data presents a story of resilience and dynamic change in the UK retail landscape. Understanding these shifts can help retail planners and high street managers better tailor their strategies in a market that’s rapidly evolving. With continuous monitoring and analysis, local governments and industry stakeholders are well-positioned to adapt to consumer behaviors, ensuring high streets and town centres remain vibrant hubs for commerce and community activities.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

UK Major Retail Centres – Week 32 2025: Footfall Retail Trends

UK Major Retail Centres – Week 32 2025: Footfall Retail Trends

UK Major Retail Centres recorded steady footfall trends in Week 32 2025 with an average daily footfall of 83,400, a 1.5% week-on-week decline and modest annual growth. Robust footfall data underpins balanced consumer sentiment.

Share on LinkedIn

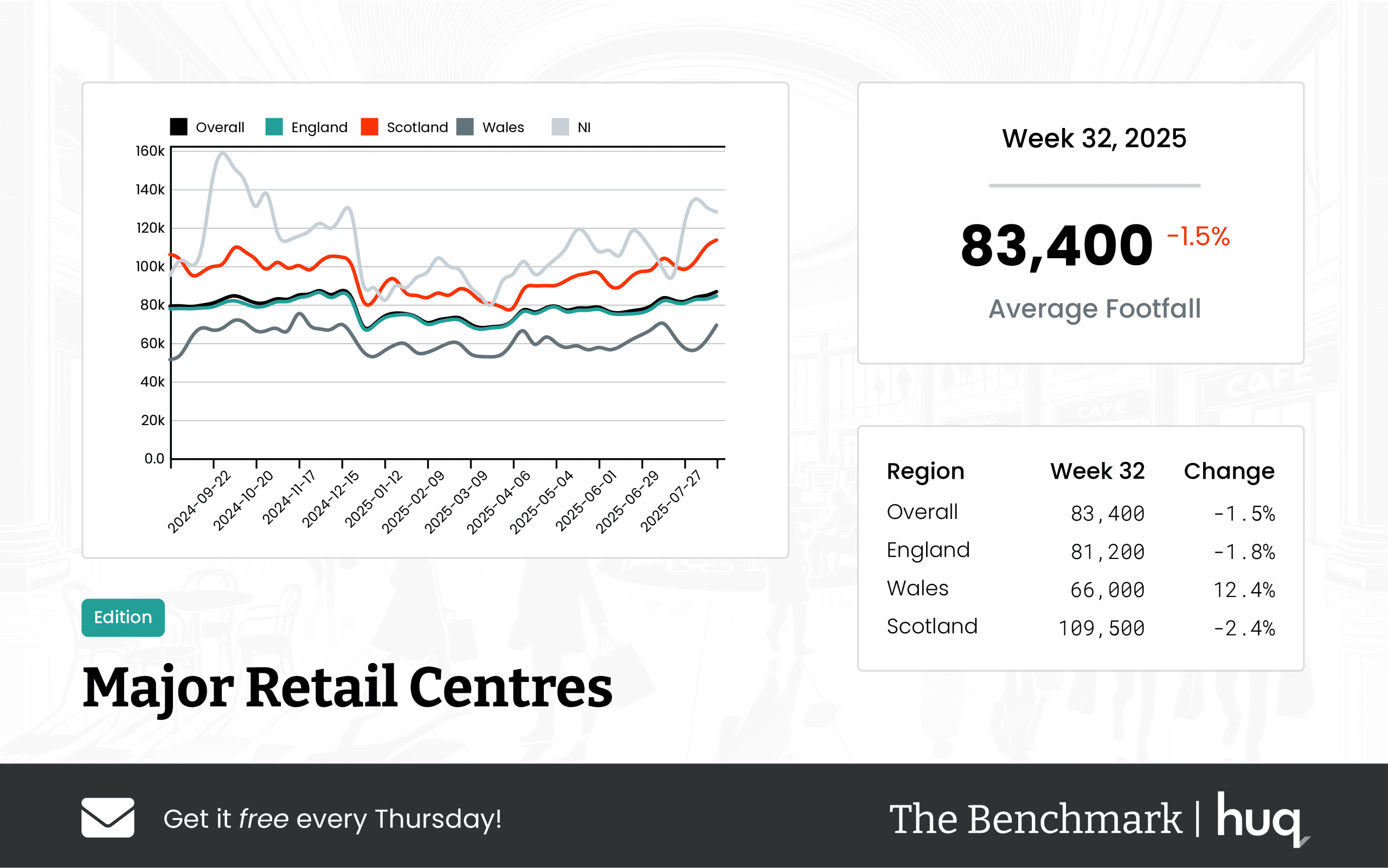

UK Major Retail Centres have displayed a balanced trend in Week 32 2025 with robust yet stable consumer activity noted throughout the week. The overall performance shows an average daily footfall of 83,400, marking a slight week-on-week decline of 1.5% while still recording a modest annual increase when compared to the same period last year. This performance reinforces a consistent market sentiment, even as some local variations come to light.

In terms of regional insights, there are significant differences across England, Scotland, and Wales. Retail centres in England averaged 81,200 daily visitors, experiencing a minor weekly drop of 1.8%, yet the year-on-year figures indicate a modest uplift of 4.4%. In Scotland, centres averaged a higher figure of 109,500 visitors per day; despite a small weekly softness of 2.4%, the annual numbers improved by a notable 7.5%, suggesting a steady recovery in the region. Wales, on the other hand, showed particularly strong performance with an average of 66,000 daily visitors and a robust week-on-week increase of 12.4%, accompanied by a sharp annual improvement. These regional variations are prominently supported by detailed footfall analytics and comparative studies.

The story does not end with just visitor numbers. An important aspect is the visitor dwell time, which has also recorded positive shifts. Across the retail centres, the average visit duration stood at 118 minutes—a slight week-on-week rise of 0.9% and an impressive 11.3% year-on-year increase. Specifically, visitors in England spent around 117 minutes with a weekly lift of 1.7%, while Scottish centres recorded a longer average stay of 131 minutes, showing steady weekly performance and strong annual improvement. Though Welsh centres recorded an average dwell time of 102 minutes, the overall trend remains positive with ongoing consumer engagement.

Industry experts are noting these changes with optimism. Joe Capocci, spokesperson for Huq Industries, commented on the evolving consumer habits, highlighting the surge in Welsh footfall alongside the steady engagement metrics. Capocci referenced current retail headlines, including significant events like the Biggest Bershka opening at Trafford Centre, which further emphasizes changing retail dynamics and consumer preferences. This industry commentary not only sheds light on the current metrics but also provides context for the evolving landscape of UK retail.

In conclusion, while Week 32 showed a slight week-on-week dip in overall numbers, the steady annual growth, regional strengths, and improving visitor engagement metrics suggest that UK Major Retail Centres continue to be resilient and adaptive in a changing retail environment.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

UK Local Retail Centres – Week 32 (2025) Footfall Retail Update

UK Local Retail Centres – Week 32 (2025) Footfall Retail Update

UK Local Retail Centres saw steady growth in week 32, 2025 with a 2.5% rise in average daily footfall of 16,000. Recent footfall data confirms the overall positive trend.

Share on LinkedIn

UK Local Retail Centres delivered strong performance during week 32 of 2025. The centres reached an average daily footfall of 16,000, marking a 2.5% increase from the previous week. Although the year-on-year growth remained marginal at 0.1%, the figures indicate a stable and consistent visitor trend across the sector.

Overall Footfall Performance

The recent data for the week ending 17 August 2025 showed that, despite only minor annual changes, there is a clear indication of gradual growth in visitor numbers. The continued stability and slight uplift in weekly footfall reaffirm the positive outlook for local retail centres.

Regional Comparisons

Differences in performance across regions were notable. In Wales, centres reported an average daily footfall of 14,000, accompanied by an impressive 18.9% week-on-week rise and a 10.3% annual increase. Scotland's centres, however, maintained the overall average of 16,000 with an 11.5% week-on-week boost, but experienced a slight year-on-year decline of 1.1%, suggesting that while the immediate results are strong, longer-term growth may be more challenging.

Visitor Engagement

Dwell time remains a critical metric for assessing visitor engagement. Across all centres, the average visit duration was 93 minutes. Although this represented a small 1.1% decline from the previous week, there was a notable annual improvement of 9.4%. Wales again outperformed, with visitors spending an average of 119 minutes per visit, compared to 89 minutes in Scotland and 94 minutes in England. These trends underscore a quality visitor experience despite varying regional metrics.

Industry Comment

Joe Capocci, a spokesperson for Huq Industries, remarked on the latest trends: "The sharp increase in Wales and recent retail developments such as the new IKEA Brighton opening underline the evolving consumer trends seen in our latest results." His comment highlights how emerging retail developments are contributing to dynamic shifts in consumer behavior across different regions.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 32, 2025 Retail Parks Update: Insights with Location Analytics

Week 32, 2025 Retail Parks Update: Insights with Location Analytics

The latest report reveals UK retail parks saw a modest 0.9% weekly dip in daily footfall. Location analytics highlights compelling footfall trends driving market insights.

Share on LinkedIn

The latest figures from Week 32, 2025 indicate that UK retail parks are experiencing mixed trends as they navigate evolving consumer behaviors. Overall, the parks recorded an average daily footfall of 20,000, marking a slight weekly decline of 0.9% and a more pronounced year-on-year drop of 5.7%. Despite fewer visitors, an in-depth look at dwell times suggests that visit quality remains an important measure of engagement.

Utilising advanced location analytics, industry experts are able to capture subtle shifts in footfall along with visitor dynamics. These insights are vital as retail centres and shopping parks continually adjust to economic climates and shifts in consumer preferences. Regional breakdowns offer a deeper understanding of these trends:

• In Scotland, retail parks observed around 19,200 daily visitors, representing a 3% weekly contraction and a 4.1% annual decline. However, the increased dwell time—averaging 76 minutes—signals that while visitor numbers dipped, the engagement quality improved notably.

• England’s figures align closely with the national average, with 20,300 daily visitors. The region experienced the same 0.9% weekly drop and a 5.5% year-on-year decline in footfall. The average dwell time here stayed constant at 70 minutes, indicating a balance between slight short-term and long-term fluctuations.

• Wales presents an interesting case where a 4.9% weekly increase in the average of 16,200 visitors contrasts with an annual decline of 11.7%. Although visitor numbers bounced back in the short term, the dwell time of 60 minutes—rising modestly by 3.4% this week while falling 15.5% year-on-year—raises questions about long-term visitor engagement.

Industry experts are closely monitoring these nuances. Joe Capocci, of Huq Industries, commented on the trends saying, "These figures reveal the most striking change in regional footfall trends with Wales showing a positive weekly recovery, and echo the sentiment in recent retail industry news regarding innovative entry trials at retail parks."

This blend of quantitative footfall data and qualitative dwell measurements highlights the evolving landscape of the UK retail market. As retail parks continue to adapt and innovate, location analytics remains a key tool in understanding where the market is headed and in fine-tuning strategies to enhance visitor engagement and overall performance.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 31 Weekly Wrap: UK Retail Footfall Insights with location analytics

Week 31 Weekly Wrap: UK Retail Footfall Insights with location analytics

UK retail centres improved by 7% as advanced location analytics and location intelligence drive shopper engagement.

Share on LinkedIn

UK retailers are watching visitor patterns change as even subtle shifts in retail footfall make a big impact. Recent findings reveal that improvements in visitor duration and numbers are reshaping strategies across retail centres. By using advanced location analytics, industry experts have a clearer picture of evolving shopper behaviour.

A Closer Look at Major Retail Centres

Major retail centres continue to show resilience with a weekly rise in visitor numbers. In Week 31, centres recorded an average daily footfall of 84,600, marking a 1% increase from the previous week and a 7% year‐on‐year growth. More detailed insights are available in the Week 31 Major Retail Centres update, which highlights how even small percentage gains matter in a competitive market.

Shopping Centres and Changing Dynamics

Shopping centres have experienced minor contractions in footfall, with a 0.9% decrease to an average of 36,000 daily visitors in Week 31. Despite this, the average visit length has improved by 5.8%, suggesting that customer engagement is still healthy. The report for the retail sector in shopping centres provides further details in the UK Shopping Centres Week 31 update, noting that location intelligence is playing a critical role in understanding these trends.

Divergent Trends Across Local Retail Centres

Local retail centres are showing mixed performance with regional differences that underline the complexity of the current retail environment. One report shows an 11.5% increase in footfall, while another highlights a slight 0.3% drop on a weekly basis. These contrasting trends reveal that local retail centres face unique challenges, as further discussed in the UK Local Retail Centres Week 27 update and the Week 31 Local Retail Centres update.

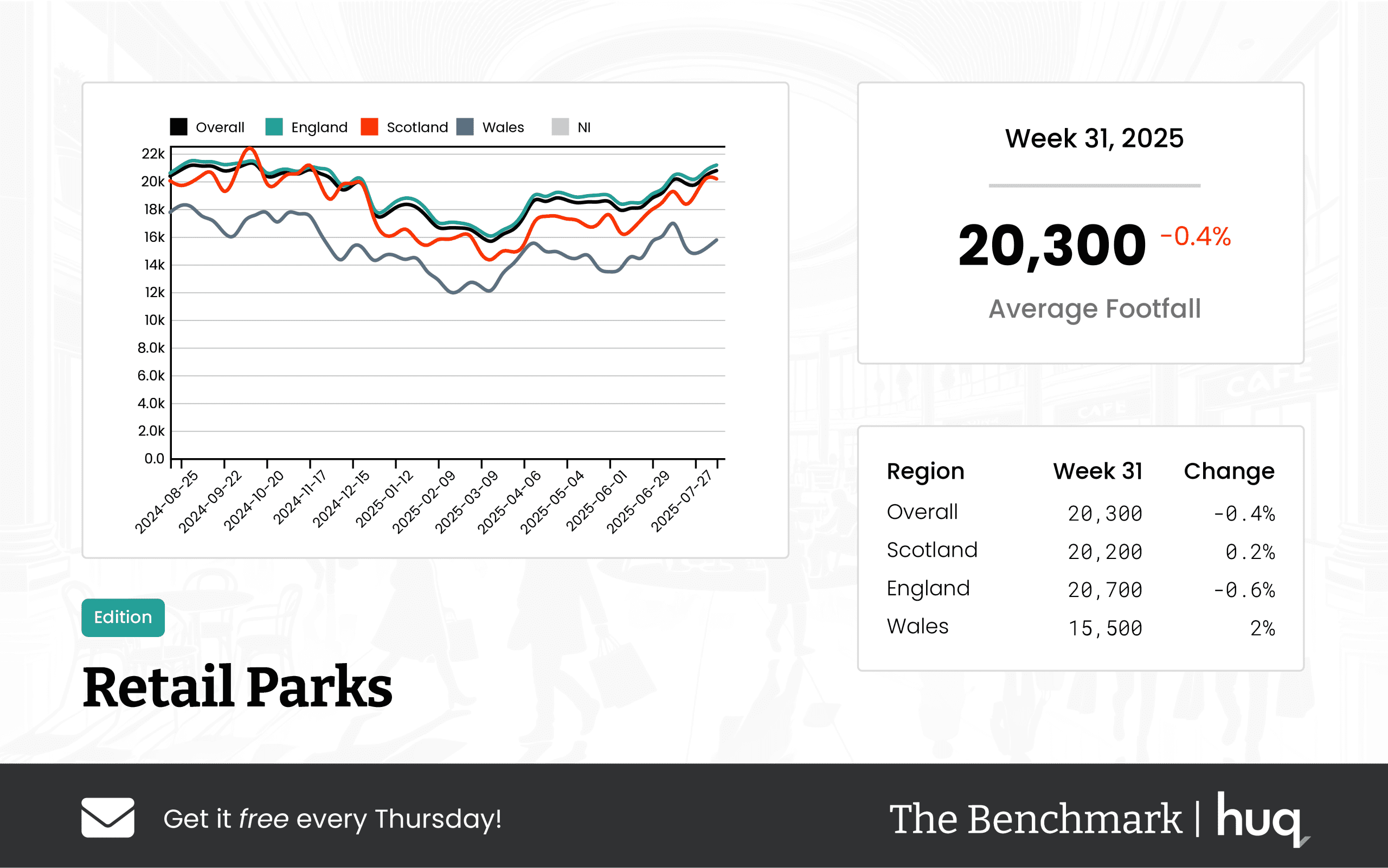

Retail Parks: Small Declines and Renewed Engagement

Retail parks have experienced a small decline of 0.4% in overall footfall during Week 31, with an average of 20,300 daily visitors. However, the increase in dwell time by 2.8% to 73 minutes demonstrates growing customer engagement. Further analysis on this evolving trend can be found in the UK Retail Parks Week 31 update and the Week 27 Retail Parks review.

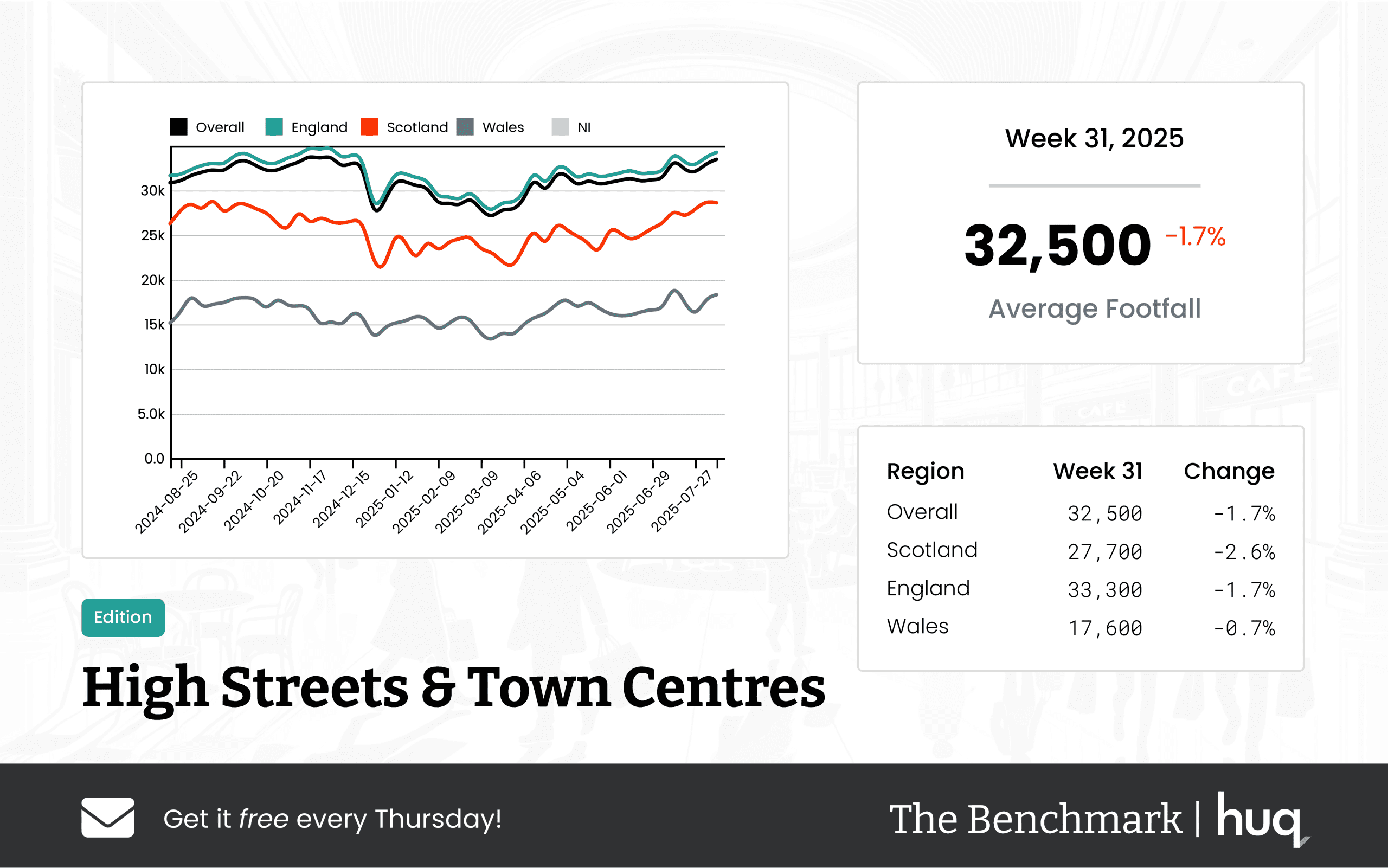

High Streets and Town Centres on the Mend

High streets and town centres are beginning to show signs of recovery as they record promising annual increases. Week 31 data reveals an average of 32,500 daily visitors and a 2.8% annual growth in footfall, with dwell time averaging 98 minutes per visit. More detailed figures are discussed in the UK High Streets & Town Centres Week 31 update, emphasising that location analytics is essential for planning future recovery strategies.

Economic and Weather Influences

Weather and economic conditions continue to play a role in shaping consumer behaviour and retail dynamics. Warmer weather and shifts in consumer sentiment are prompting businesses to rethink their strategies using both location analytics and location intelligence. The report notes that retailers are now more focused than ever on using detailed location intelligence to adapt to regional variances and enhance customer experiences.

Industry Insight and Expert Commentary

Joe Capocci, Huq Industries Spokesperson, commented, "The detailed figures from our location analytics reports are a vital tool for understanding shifting consumer patterns. Even minimal gains in footfall can signify the need to adapt marketing strategies and infrastructure investments. Our approach is to use these insights to target improvements across every retail channel." His statement underscores the importance of data in driving positive change in the retail environment.

Strategic Implications for Retailers

Retailers must now balance short-term footfall variations with long-term improvements in dwell time. The combination of location analytics and emerging location intelligence is providing key insights into area-specific trends. This means adapting strategies for major retail centres, shopping centres, local retail centres, and retail parks to harness subtle yet impactful trends.

Summing Up the Trends

The interplay of minor weekly and annual shifts in UK retail footfall indicates evolving market conditions. Small changes in the numbers, such as the 1% increase in major centres or the slight dip in shopping centre visits, have significant strategic implications. Retailers are advised to continue focusing on detailed data to understand the shifts in retail centres and optimise their operations.

Looking Ahead

As consumer behaviour gradually shifts, detailed data from location analytics is becoming indispensable. Retailers are encouraged to deploy tailored strategies for each segment – from high streets and town centres to local retail centres. Future trends will undoubtedly require further application of location intelligence to ensure enduring engagement and success.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

UK High Streets & Town Centres – Week 31, 2025 Performance Update with Location Analytics

UK High Streets & Town Centres – Week 31, 2025 Performance Update with Location Analytics

UK high streets and town centres show a gradual recovery with 2.8% year‐on‐year gains. Robust location analytics and footfall data highlight resilience in visitor engagement.

Share on LinkedIn

UK high streets and town centres are on a steady path to recovery. In week 31, location analytics recorded an average of 32,500 visitors per day, pointing to a gradual resurgence in foot traffic despite a modest week‐on‐week dip. Compared to the same week last year, there’s been a promising 2.8% year‐on‐year increase in visitor numbers.

A deeper regional analysis reveals varied performance across the UK. In England, the average daily footfall reached 33,300 visitors with sustained annual gains, despite experiencing a similar slight decline over the past week. Scotland, while observing a somewhat steeper weekly decline with 27,700 visitors per day, still managed to register a healthy 2.4% increase compared to last year. Wales, on the other hand, saw an average of 17,600 visitors daily, alongside a modest weekly decrease, yet distinguished itself with an impressive 4.8% improvement on an annual basis.

Visitor engagement metrics add further insight into the narrative of recovery. The average visit duration across the UK was recorded at 98 minutes, with England’s figures showing a slight dip on a weekly basis but a robust annual increase of 13.8%. In Scotland, visitor engagement improved week-on-week with a solid 96 minutes average stay, underscoring a resilient visitor experience. Wales experienced a notable weekly increase in dwell time, reflecting the unique challenges and improvements witnessed within the region over the year.

Adding to these insights, industry spokesperson Joe Capocci from Huq Industries remarked, "The most striking change in footfall is the robust year‐on‐year recovery, which is underscored by current industry news on high street closures." His comments underline an underlying market confidence, even as high street closures make headlines, illustrating that resilient consumer behavior and dedicated visitor engagement remain pivotal in the recovery process.

Overall, the detailed performance analysis underscores the evolving dynamics of the UK’s high streets and town centres. With adaptive strategies and continuous monitoring of visitor patterns, local economies are poised to benefit from this gradual resurgence, reinforcing the importance of location analytics in navigating the post-pandemic landscape.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

UK Retail Parks – Week 31, 2025 Performance Update: Insights from Location Analytics

UK Retail Parks – Week 31, 2025 Performance Update: Insights from Location Analytics

UK Retail Parks Week 31, 2025 shows a 0.4% drop in footfall and a 2.8% rise in visit duration, signalling a shift in visitor engagement. Highlights reveal robust location analytics and evolving consumer trends in retail park dynamics.

Share on LinkedIn

The recent performance update for UK retail parks in Week 31, 2025 reveals a mixed bag in visitor numbers and engagement metrics based on comprehensive location analytics. The benchmark data indicates that while the average daily footfall across these retail parks slightly decreased by 0.4% to 20,300, there was a notable increase in average visit duration, which climbed by 2.8% weekly to 73 minutes – up by a substantial 10.6% on an annual basis.

A closer look at regional performance uncovers several fascinating trends:

• In Scotland, retail parks averaged 20,200 daily visitors. Although modest, there was a 0.2% weekly increase, which coupled with a 1.3% annual rise, reflects steady local engagement.

• England, on the other hand, experienced a higher daily count of 20,700 visitors. However, it registered a 0.6% decline week-on-week and a 3.8% fall compared to the previous year. Despite this dip in footfall, England boasted the highest average dwell time at 75 minutes, showing a strong weekly increase of 4.2% and a 15.4% annual gain, suggesting enhanced consumer interaction.

• Wales showed a contrasting trend with a lower average of 15,500 daily visitors. Despite this, there was a healthy weekly increase of 2% in footfall; however, the region saw a significant 15.6% decline when compared to the previous year, and it recorded the shortest average visit duration at 58 minutes.

Visitor engagement metrics, as indicated by dwell time, further accentuate the disparity in regional performance and underline the importance of tailored marketing and operational strategies. The UK market continues to grapple with various challenges, yet the increasing dwell time suggests that when visitors do come, they are spending more time exploring and engaging with the retail environment.

Industry expert Joe Capocci of Huq Industries noted, “The most striking change in footfall was observed in Wales with a notable annual decline, which is underscored by recent retail industry news on new park developments, and this indicates a shift in consumer engagement patterns.”

As the landscape of retail parks evolves, these insights emphasize the need for stakeholders to continue leveraging robust location analytics to adapt and innovate in response to changing consumer behaviors.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.