Week 39 2025 Retail Parks Footfall Update – Location Analytics Insights

Week 39 2025 Retail Parks Footfall Update – Location Analytics Insights

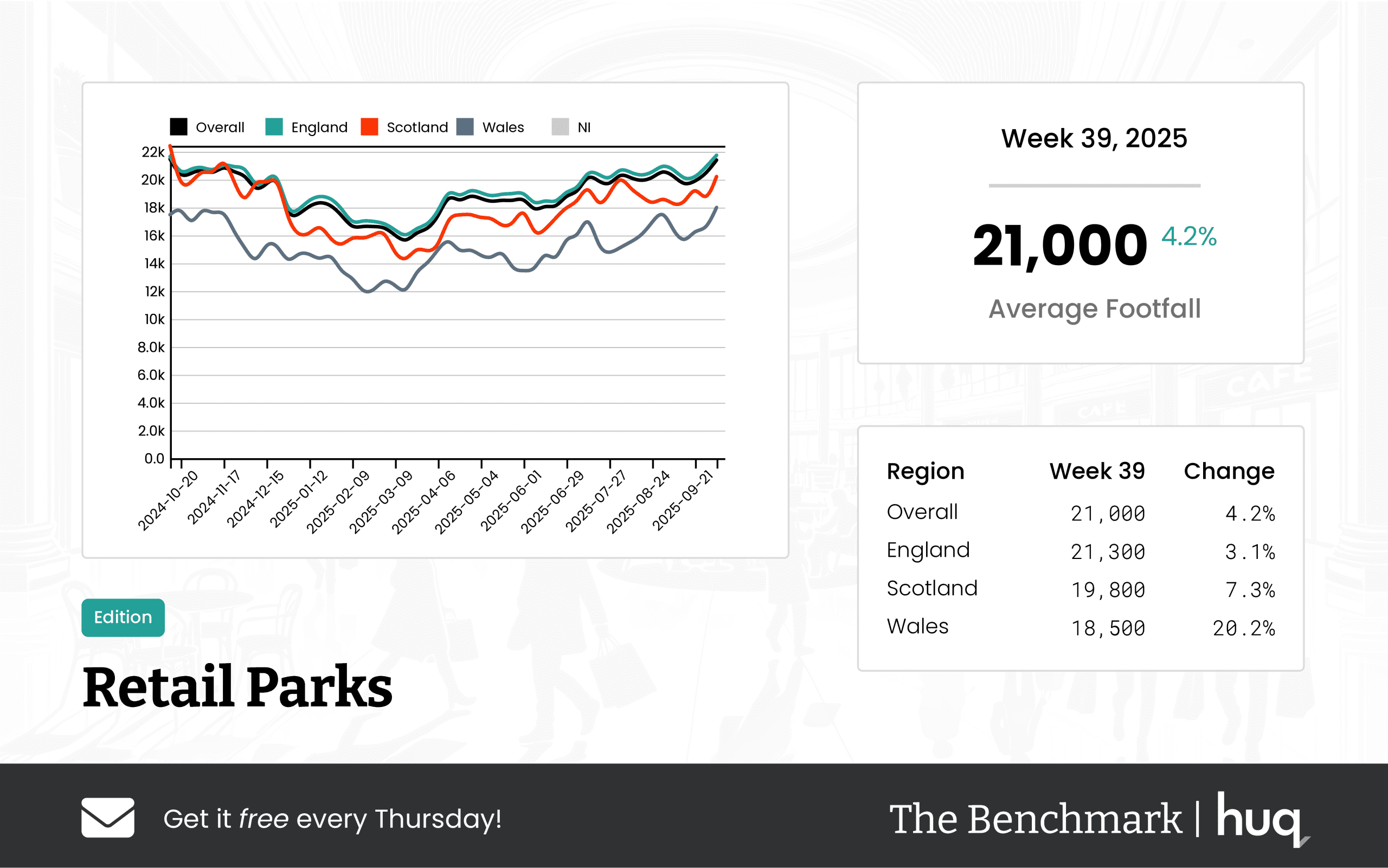

UK Retail Parks saw modest gains with a 4.2% weekly rise in footfall and 8.6% annual uplift in dwell time. Location analytics and location intelligence reveal encouraging retail trends.

Share on LinkedIn

UK Retail Parks have experienced positive trends during Week 39, with overall footfall figures showing encouraging improvements. The average daily visits have risen to 21,000, marking a 4.2% week-on-week increase and a 1.2% rise compared to the same period last year. Although current visit duration averaged 76 minutes—a slight decline of 2.6% from the prior week—annual performance shows an 8.6% uplift in dwell time. These trends underscore enhanced consumer engagement and the positive dynamics of the retail environment.

In England, the largest market by footfall, consumer activity remained steady with an average of 21,300 daily visits. The region recorded a modest improvement of 3.1% week on week and a 1.5% year-on-year rise in visits. While dwell time in England measured at 79 minutes, there was a slight weekly drop of 2.5%. However, when comparing year-on-year data, dwell time impressively increased by 12.9%, reflecting more sustained consumer engagement in the English retail parks.

Scotland's retail parks enjoyed a robust week with an impressive 7.3% week-on-week increase, reaching an average of 19,800 daily visits. Despite this rise in footfall, visitor engagement was less pronounced, with an average visit duration of just 51 minutes—a significant decline of 16.4% over the week, indicative of a softening trend in consumer dwell times compared to previous periods.

Wales presented an interesting scenario. While the average daily footfall was slightly lower at 18,500, the region experienced a sharp increase in weekly visits along with buoyant year-on-year performance. However, the average dwell time of 60 minutes showed modest weekly improvements but suffered a notable decline when viewed on an annual basis.

Joe Capocci, spokesperson for Huq Industries, commented on the trends: "The sharp increase in footfall observed in Wales, which mirrors recent retail industry news, highlights an evolving consumer landscape that is both dynamic and responsive." This insight from industry experts reinforces the notion that evolving consumer behaviors and enhanced location analytics are key to understanding and leveraging retail trends in the UK.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 39 2025 Major Retail Centres – Footfall Retail Performance Update

Week 39 2025 Major Retail Centres – Footfall Retail Performance Update

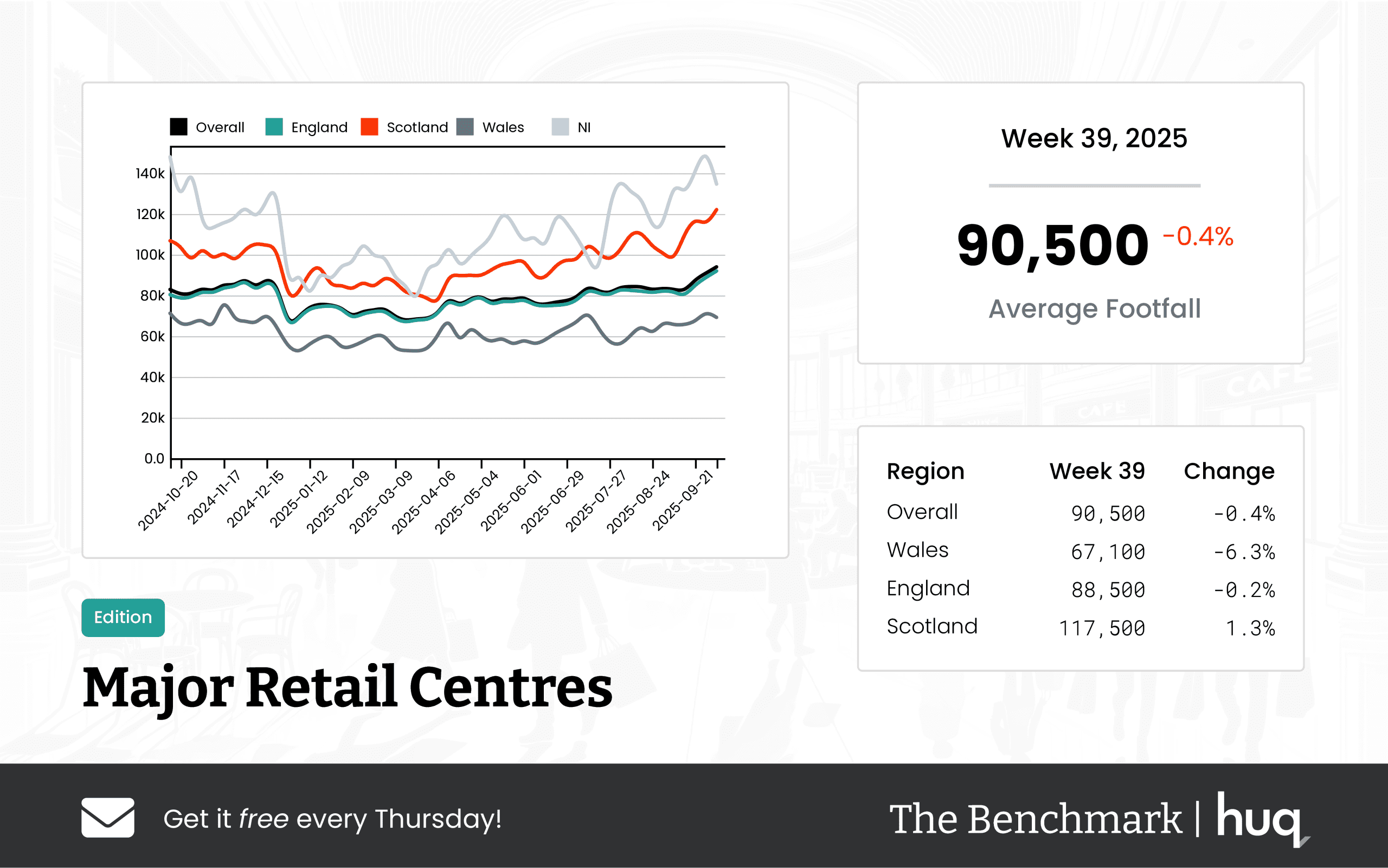

UK major retail centres show a moderate overall improvement in footfall retail despite a slight weekly dip. Footfall data reveal annual rises around 10% amid steady long‐term trends.

Share on LinkedIn

Overall Performance

Overall performance across UK Major Retail Centres during the week ending 2025‑10‑05 shows an average daily footfall of 90,500. While there has been a slight drop in week-on-week figures, the year‑on‑year outlook indicates a moderate improvement in visitor numbers. This overall result, derived from The Benchmark weekly monitor, confirms that long‑term trends remain positive even when recent performance is mixed. Robust footfall retail trends continue to underpin the sector.

Regional Analysis

Regional analysis reveals divergent trends across the UK. In England, centres experienced an average of 88,500 daily visitors. The week saw negligible change, while the year‑on‑year growth of 10% demonstrates steady performance in the region. Scotland’s retail centres outperformed with an average of 117,500 daily visitors, recording a modest week-on‑week increase and an annual rise of 11.3%. These figures underline the strong consumer engagement in Scotland. In contrast, retail centres in Wales attracted an average of 67,100 daily visits; week‑on‑week, the region experienced a sharper drop, and the annual figure shows a slight softness.

Analytical Insights

Key insights were derived using footfall data, footfall analytics, footfall statistics and footfall counting techniques, providing a holistic perspective on visitor trends.

Consumer Behaviour

Dwell time metrics provide further insights into consumer behaviour. In England, the average visit duration was 128 minutes, reflecting a healthy progression over both the recent week and year‑on‑year comparisons. Scotland again leads with an average duration of 136 minutes, where the recent data not only recorded a marked improvement in visit duration but also exhibited a sharp increase on a year‑on‑year basis. Conversely, dwell times in Wales appear less robust, with an average duration of 97 minutes accompanied by weakening weekly and annual figures.

Comment

Commenting on these results, Joe Capocci, Huq Industries spokesperson, stated: “The most striking change is the marked improvement in footfall in Scotland, which is further supported by recent Retail Industry News observations about Glasgow’s performance.”

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

UK High Streets & Town Centres – Week 39, 2025 Performance Update: Insights from Location Analytics

UK High Streets & Town Centres – Week 39, 2025 Performance Update: Insights from Location Analytics

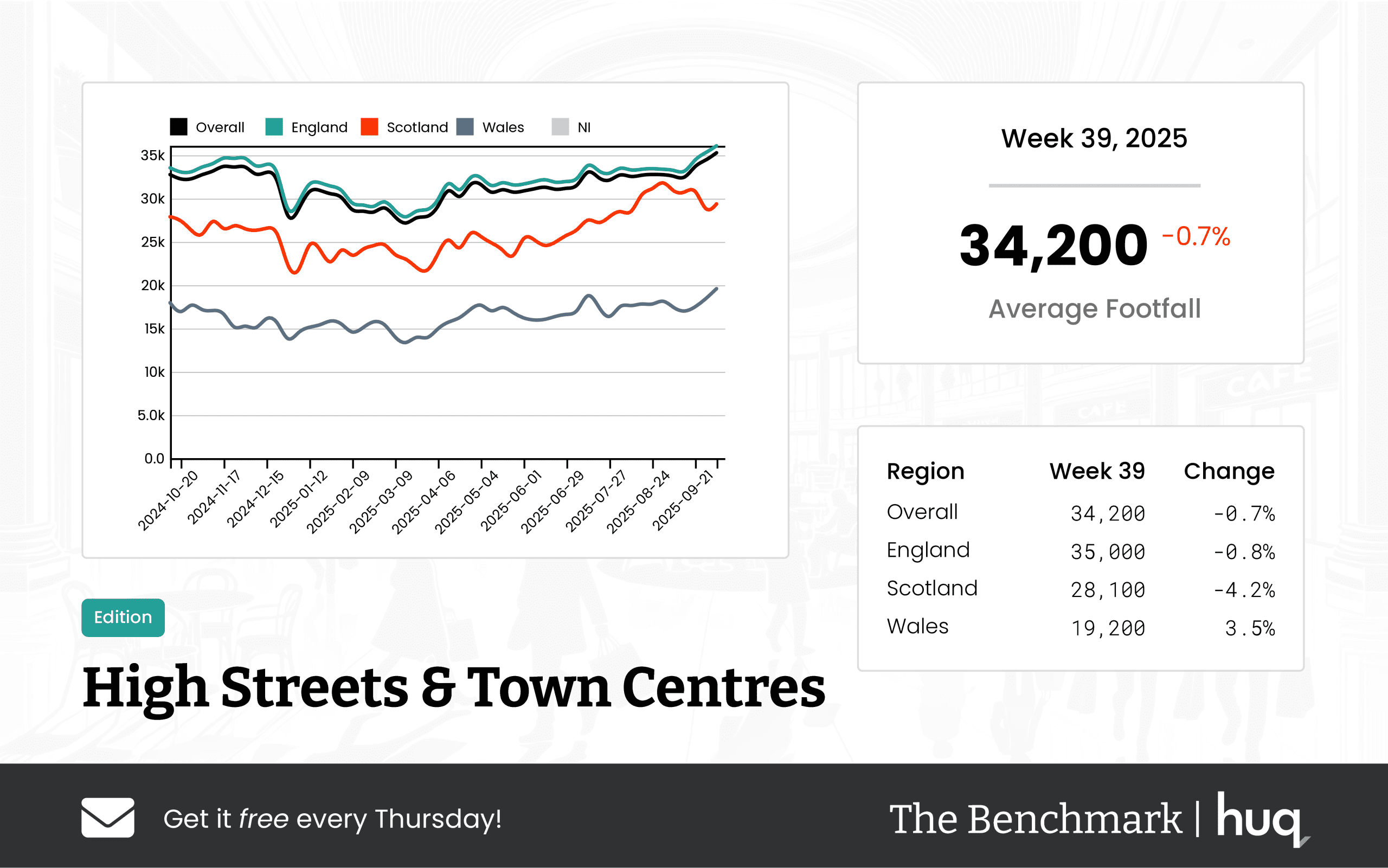

UK High Streets & Town Centres saw a 4.6% annual rise and a 0.7% week-on-week drop, highlighting resilience through strong location analytics and insightful location intelligence.

Share on LinkedIn

The latest Benchmark data for Week 39 reveals a complex yet optimistic picture for UK High Streets and Town Centres. Powered by advanced location analytics, the overall average daily footfall stands at 34,200 – a slight 0.7% decline from the previous week yet buoyed by a 4.6% increase compared to the same period last year. This nuanced performance signals that, while short-term challenges remain, the retail landscape is generally robust and resilient.

Breaking down the figures by region offers further clarity. In England, High Streets recorded an average of 35,000 visitors each day. Despite a small weekly dip of 0.8%, there is comforting annual growth of 4.4%, affirming the steady pace of recovery and consumer confidence. Scotland, on the other hand, experienced a more notable 4.2% week-on-week drop with 28,100 daily visitors, though the year-on-year gain of 2.4% suggests some underlying positive trends. Wales emerges as a standout region – footfall not only increased by 3.5% on a weekly basis, but the annual growth reached an impressive 9.7%, backed by emerging insights from location intelligence.

Visitor dwell time is another important metric complementing footfall data. Overall, visitors are spending an average of 108 minutes per visit – a modest week-on-week boost of 0.9% and an annual lift of 18.7%, indicative of deeper customer engagement and satisfaction. Regionally, England's dwell time remains consistent at 108 minutes. Scotland shows a slightly lower average of 104 minutes, though recent weeks have witnessed an encouraging spike likely driven by an improved in-store experience influenced by location intelligence data. Conversely, Wales sees a drop to 102 minutes, suggesting shorter but more frequent visits as footfall continues to rise.

Industry commentary from Joe Capocci, Spokesperson for Huq Industries, underscores the significance of these findings. "Wales’ footfall sharp increase and its positive weekly momentum, as echoed in recent industry headlines, underline the nuanced changes across regions," Capocci stated. This insight epitomizes how detailed, data-driven location intelligence is providing the clarity needed to navigate challenging market dynamics.

In summary, while Week 39 reflects a slight short-term contraction in footfall, the broader annual trends and deeper insights into dwell time demonstrate that UK High Streets and Town Centres are adapting well through informed, location-based strategies. Retailers and regional planners alike are encouraged by the resilience highlighted through these robust analytics, anticipating that continued adjustments will drive further recovery and growth in the months to come.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 39, 2025 Shopping Centres Performance Update – Insights from Location Analytics

Week 39, 2025 Shopping Centres Performance Update – Insights from Location Analytics

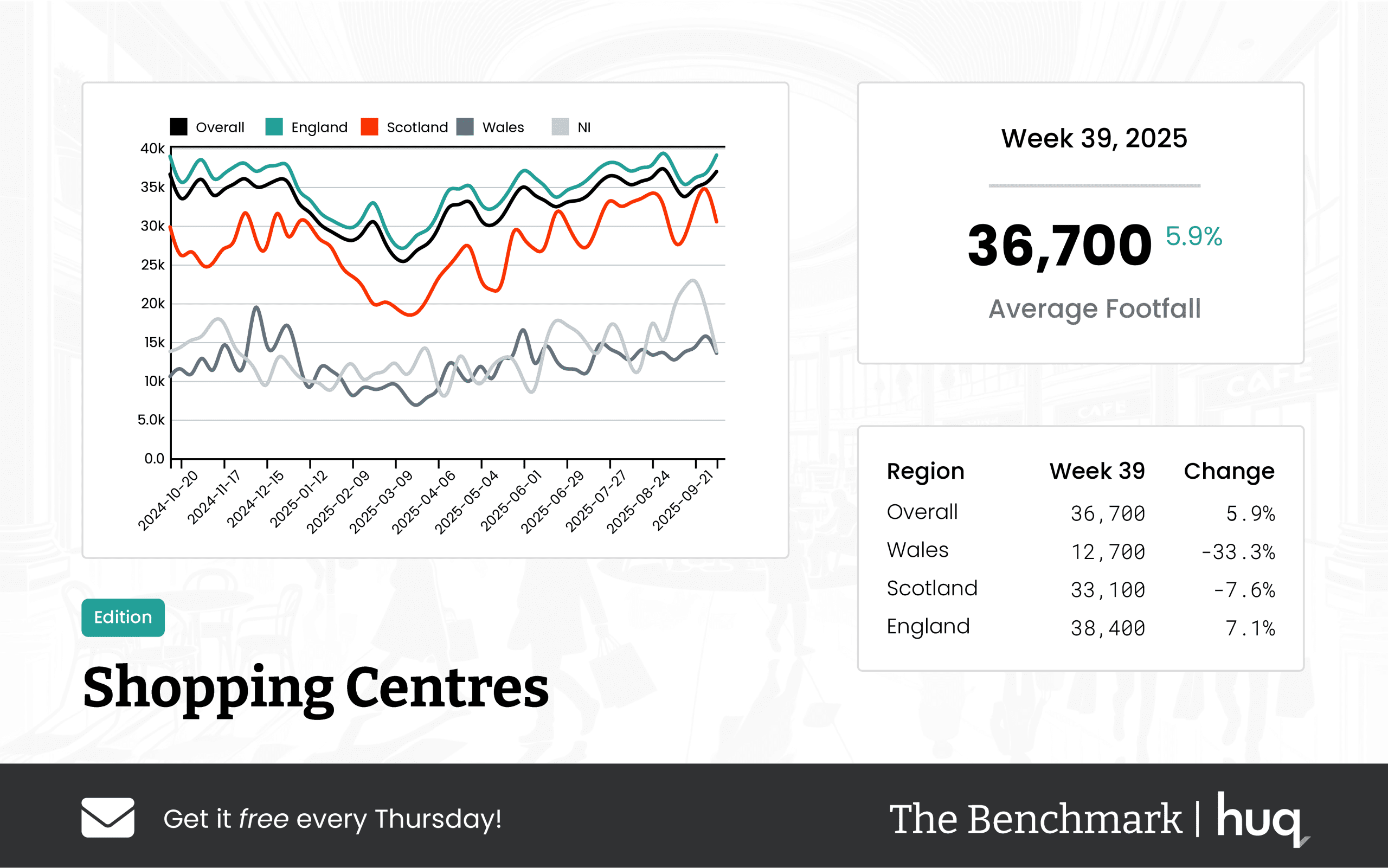

UK shopping centres saw a modest rise in visits (up 5.9% week-on-week and 4.2% year-on-year) despite shorter visit times, offering key insights from location analytics and strong footfall performance.

Share on LinkedIn

UK shopping centres recorded a modest overall improvement in footfall during the latest full week, as revealed by detailed location analytics. With an average daily visitor count of 36,700, centres experienced a week-on-week increase of 5.9% and a year-on-year jump of 4.2%. However, the average visit duration fell to 104 minutes, indicating that while more people are visiting, they are spending less time in the centres.

A regional breakdown of performance highlights notable differences. In Wales, centres attracted an average of 12,700 visitors daily, showing an 8.4% year-on-year rise although the previous week noted a marked drop, with engagement waning as indicated by a shorter average dwell time of just 52 minutes. Scotland’s centres, on the other hand, saw an average daily footfall of 33,100 despite a 7.6% week-on-week decline; however, there was a robust annual increase, and visitors spent about 106 minutes on average – longer than last year, even though weekly engagement dropped.

England’s shopping centres demonstrated a steadier performance, with 38,400 daily visitors on average. Here, footfall increased by 7.1% week-on-week and by 1.7% year-on-year, while the average visit duration held at 106 minutes, although experiencing a slight decline of 5.4% on both a weekly and annual basis.

Industry commentary from Joe Capocci, spokesperson for Huq Industries, underscored the broader retail dynamics: "Observing the sharp annual increase in footfall in regions like Scotland, alongside industry developments in major centre sales, underscores the evolving dynamics of our retail landscape." This update reflects the complex mix of growing visitor numbers against a backdrop of diminished visit durations, highlighting the challenges faced by shopping centres in engaging modern consumers.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 38 Weekly Wrap: Footfall Dynamics in UK Retail Centres

Week 38 Weekly Wrap: Footfall Dynamics in UK Retail Centres

UK retail centres witness 11.5% weekly uplift amid steady footfall retail trends and evolving footfall data.

Share on LinkedIn

The latest week in UK retail has revealed intriguing shifts in footfall patterns that are reshaping the competitive landscape. Recent footfall data shows varied performance across multiple centre types, with subtle yet significant differences found in local retail centres, shopping centres, retail parks, major retail hubs, and high streets or town centres. Although the changes are modest in percentage terms, they are driving operational strategies and consumer engagement measures across the industry.

Overview of Weekly Performance

Overall trends indicate that footfall analytics continue to play a vital role in shaping strategies in the retail space. For some centre types, even small percentage changes in footfall statistics suggest a cautious yet determined quest for improvement. Retail operators are deploying enhanced footfall counting techniques to better understand weekly variations and to support smarter decision-making across all retail categories.

Detailed Look at Local Retail Centres

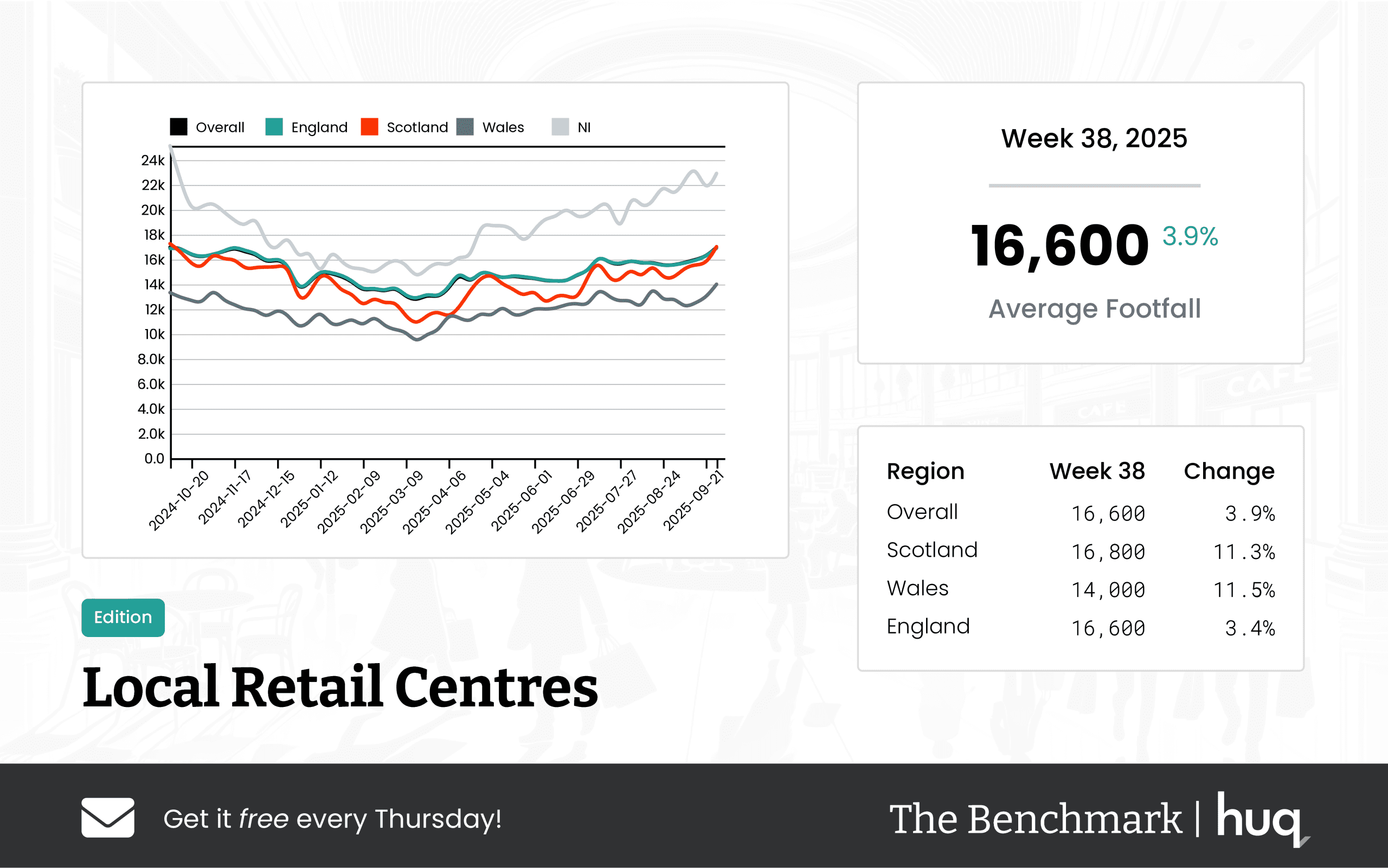

Local retail centres have experienced mixed performance during this period. One report, Week 38, 2025 Local Retail Centres: Footfall Retail Insights, highlighted an average of 16,600 daily visitors with a modest uplift of 3.9% and regional variations that reveal a complex picture. In Scotland, for example, there was an 11.3% weekly boost in footfall but a slight decline in averaged dwell times, showcasing how diverse regional data can alter the retail narrative.

Mixed Developments in Shopping Centres

UK shopping centres report a mix of trends with both slight declines and increases evolving in parallel. According to the UK Shopping Centres – Week 38, 2025 Performance Update, there was a national average footfall decrease of 0.2%, yet dwell times showed a 7.4% weekly rise. Another update from Week 37 2025 Shopping Centres Footfall Update revealed a 5.5% weekly increase in visitor numbers, pointing to dynamic footfall retail responses in different regions.

Nuances in Retail Parks Performance

Retail parks demonstrated a varied performance profile throughout the week. The UK Retail Parks – Week 38 Performance Update 2025 showed an average of 20,400 daily visitors with English parks achieving slightly higher numbers compared to their Welsh counterparts. A similar trend was noted in the Week 37 (2025) Retail Parks Footfall Retail Performance Update, where England saw minor declines while Scotland enjoyed a 5.7% feedback, emphasising the importance of regional performance differences as captured by robust footfall counting systems.

Major Retail Centres Continue Strength

Major retail centres remain a beacon of strength, exhibiting rising engagement and improved visitor metrics. The UK Major Retail Centres – Week 38, 2025 Performance Update reported a 5.1% weekly increase in daily footfall, with average dwell times showing a slight drop yet positive annual growth. Regional data also suggests that centres in Scotland are outperforming others when monitoring footfall statistics, which proves essential in navigating the challenges of an evolving retail environment.

High Streets & Town Centres Rebound

High streets and town centres are demonstrating a promising recovery with steady weekly improvements in visitor numbers and extended dwell times. As highlighted in the UK High Streets & Town Centres – Week 38 Performance Update 2025, these areas are slowly regaining traction by nurturing customer engagement. The reported enhancements in footfall retail experiences underscore the resilience of these community hubs, bolstering confidence as the retail sector continues to adapt to changing consumer habits.

Joe Capocci, Huq Industries Spokesperson, remarked, "The dynamic shifts in footfall and visitor dwell time we're observing underline the critical need for retailers to remain agile. Our focus is on leveraging detailed footfall analytics to refine in-store experiences and support strategic growth across regions." His comments reflect the broader industry trend of integrating precise footfall counting methodologies to drive operational improvements and enhance the overall shopping experience.

In conclusion, the week’s retail performance data conveys a story of nuanced recovery and challenging diversity. While major retail centres chart a course of robust strength, local centres and retail parks show that even minor improvements in footfall can have substantial operational impacts. This analysis, enriched by detailed footfall retail insights, highlights the adaptive strategies retailers are embracing to counter regional variations and drive greater customer engagement.

This article provides a comprehensive look at weekly retail trends, demonstrating that measured changes in footfall are critically shaping the industry. The evolution of customer engagement will continue to define competitive edges as retailers harness precise footfall analytics to forecast and prepare for future market shifts.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

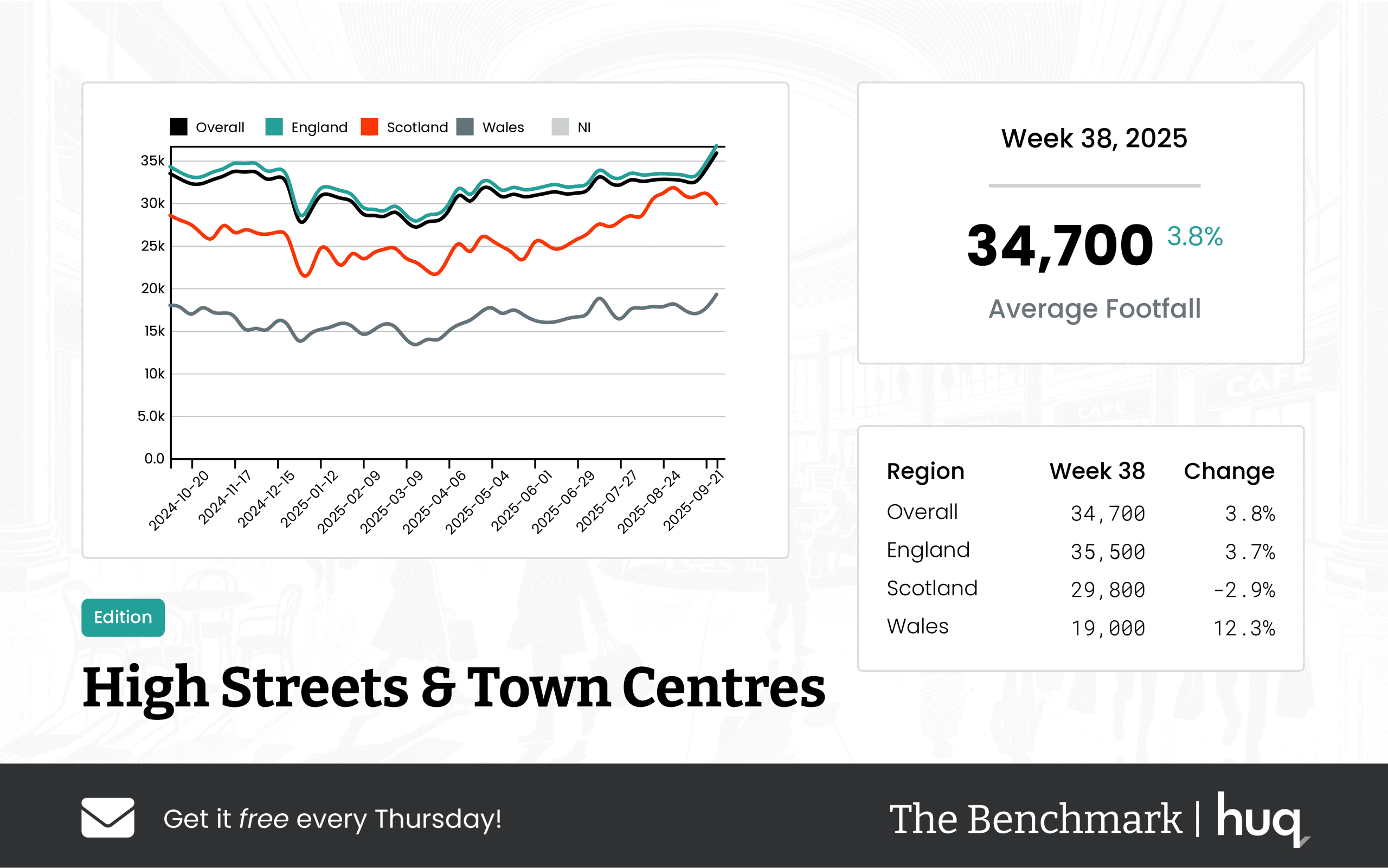

UK High Streets & Town Centres – Week 38 Performance Update 2025: Location Analytics Insights

UK High Streets & Town Centres – Week 38 Performance Update 2025: Location Analytics Insights

Latest UK High Streets & Town Centres data show modest weekly growth and a moderate year-on-year increase in footfall. Location analytics reveal steady footfall trends and overall robust visitor activity.

Share on LinkedIn

The recently released data for UK High Streets and Town Centres, covering the period ending 28 September 2025, reflects a resilient performance in the face of an increasingly competitive retail landscape. National averages reveal a mean daily footfall of 34,700, underpinning a mix of modest weekly growth alongside a positive year-on-year comparison.

Regional breakdowns add nuance to the overall picture. In England, the story is one of steady improvement with an average of 35,500 visitors a day, indicating both week-to-week and annual increments in footfall. Scotland, while still recording positive annual trends with an average of 29,800, saw a small dip in weekly visitor numbers. Notably, Wales emerged as a bright spot with 19,000 daily visitors and a significant weekly leap, pointing to dynamic retail activity at its high streets and town centres.

Additional insights on visitor engagement were gleaned from dwell time data. Nationally, shoppers spent an average of 107 minutes per visit. England’s figures paralleled this trend while Wales exceeded it, recording an average visit duration of 113 minutes – a testament to the region’s engaging retail environments. In contrast, Scotland reported a lower average visit duration of 84 minutes, suggesting a temporary softening in customer engagement compared to previous periods.

Industry leaders, such as Joe Capocci of Huq Industries, emphasize the importance of these insights, particularly in Wales where the weekly rise in footfall is pronounced. Capocci commented, "The pronounced weekly rise in Wales is the most striking change in footfall this week, and it aligns with retail industry news that underscores the need for dynamic approaches in high street environments."

Overall, the data paints a picture of resilience and gradual growth, offering valuable insights for stakeholders aiming to navigate the evolving retail landscape on UK high streets and town centres in 2025.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

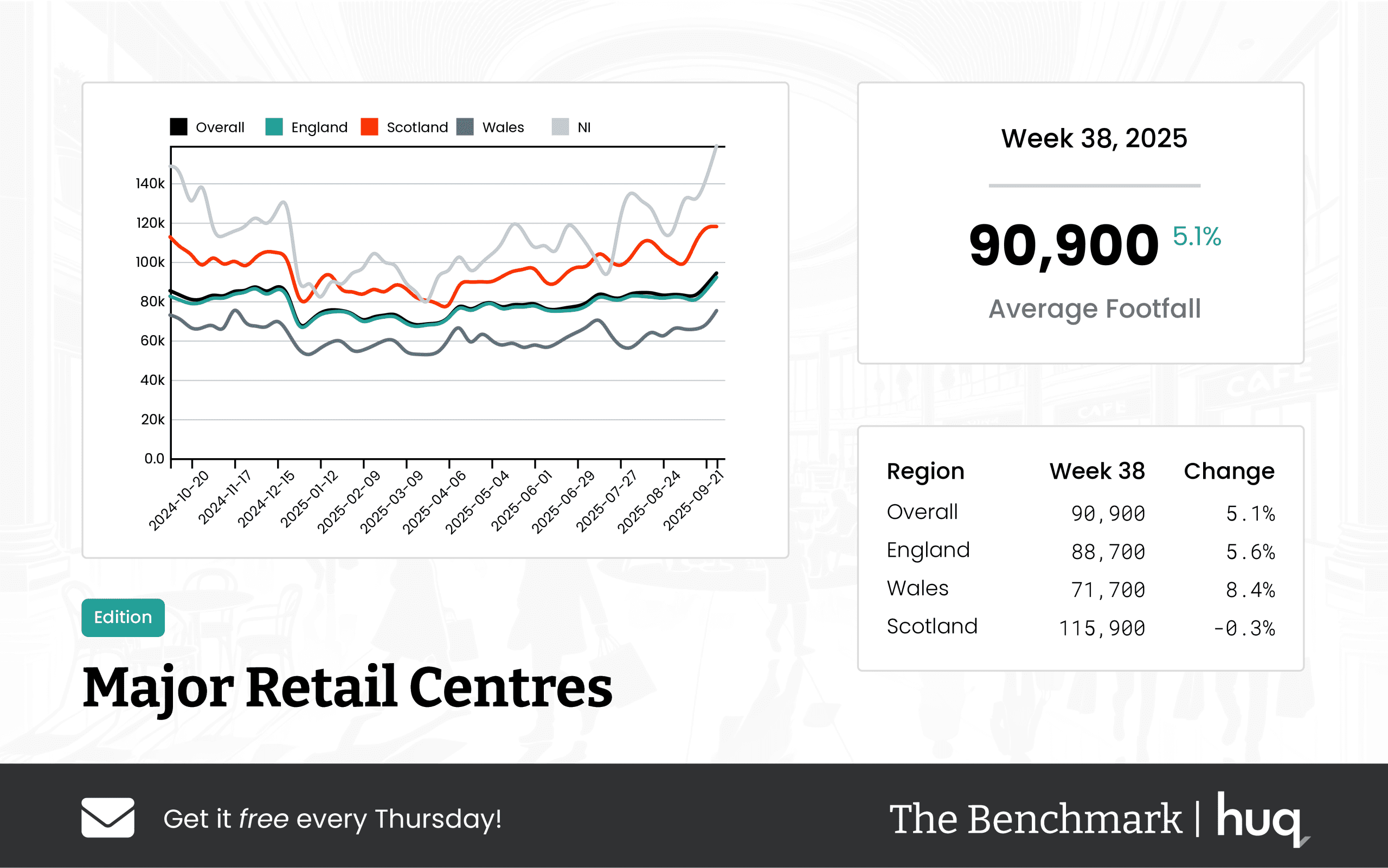

UK Major Retail Centres – Week 38, 2025 Performance Update with Location Analytics

UK Major Retail Centres – Week 38, 2025 Performance Update with Location Analytics

Overall, UK Major Retail Centres have seen moderate growth with a 5.1% week-on-week and 9.9% year-on-year increase in footfall, reflecting robust location analytics and strong footfall trends.

Share on LinkedIn

Overall Performance:

The latest data from The Benchmark, underpinned by location analytics and reflecting strong annual retail growth, highlights a period of moderate growth across UK Major Retail Centres. Average daily footfall reached 90,900, marking a week-on-week increase of 5.1% and a year-on-year rise of 9.9%, underpinning resilient footfall trends. Meanwhile, average dwell time registered at 119 minutes per visit, with an 8.2% year-on-year increase despite a slight week-on-week drop of 2.5%, indicating that while more visitors are returning, the length of each visit has moderated slightly in the short term.

Regional Analysis:

In England, centres recorded an average daily footfall of 88,700 with steady week-on-week improvements of 5.6% and an average visit duration of 118 minutes, despite a modest decline in dwell times relative to overall performance. Scotland’s centres, which recorded the highest average daily footfall at 115,900 and a robust 9.8% year-on-year increase in visitor numbers coupled with a 12.8% uplift in dwell time, showed a slight week-on-week drop of 0.3% in footfall while dwell time remained stable. Welsh centres posted 71,700 daily visitors with an 8.4% week-on-week rise and an average dwell time of 103 minutes, reflecting overall location intelligence insights.

Industry Comment:

Joe Capocci, Huq Industries spokesperson, stated, "The pronounced week on week increase in Wales, coupled with the contrasting softening in Scotland, resonates with recent retail industry news and underlines shifting visitor dynamics across the country."

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

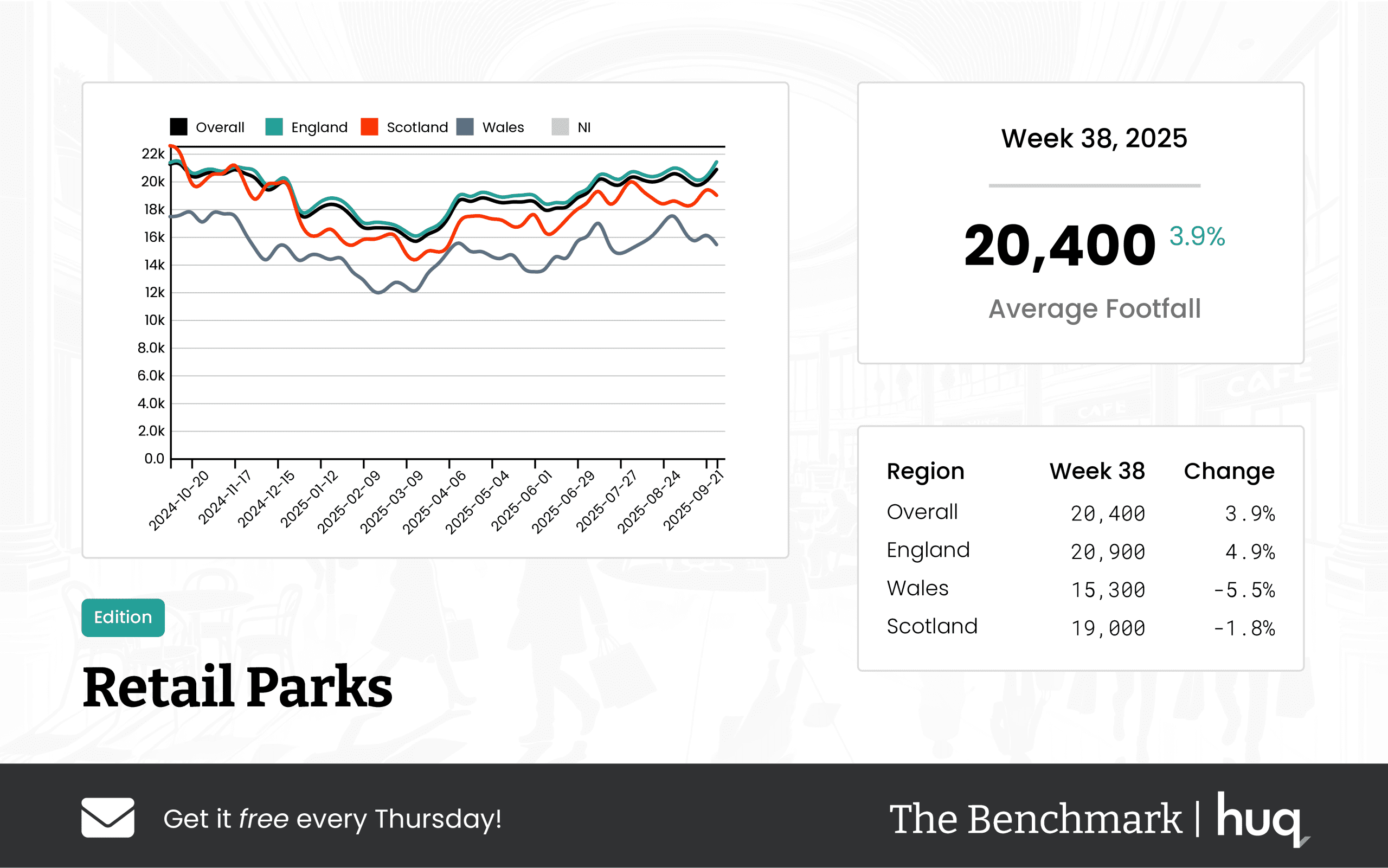

UK Retail Parks – Week 38 Performance Update 2025: Footfall Data Trends

UK Retail Parks – Week 38 Performance Update 2025: Footfall Data Trends

The latest UK Retail Parks footfall data shows a moderate uplift with 20,400 daily visitors, while robust trends in footfall analytics hint at steady overall performance.

Share on LinkedIn

The most recent data from The Benchmark reveals that UK Retail Parks achieved an average daily footfall of 20,400 for the week ending September 28, 2025. Although this is a modest week‑on‑week increase, it comes with a slight softness when benchmarked against the same period last year. The data underscores the continued relevance of footfall analytics in understanding retail performance, highlighting steady momentum alongside longer‑term growth challenges.

Key regional insights include:

• England leads the pack with Retail Parks drawing an average of 20,900 daily visitors. Despite only slight softening versus historical data, the steady increase across the week indicates robust market performance.

• Wales, on the other hand, recorded a daily average of 15,300 visitors and experienced a weekly drop. Year‑on‑year comparisons suggest that many Welsh Retail Parks are struggling to sustain visitor numbers.

• Scotland's Retail Parks recorded an average of 19,000 daily visitors, with a slight downturn on a weekly basis and softer visitation figures in comparison to the previous year.

Visitor engagement metrics also provide noteworthy insight. Across the UK, average dwell time was recorded at 78 minutes per visit. While there was a slight decrease in dwell time over the week, the encouraging year‑on‑year improvement indicates that, despite fewer overall visitors, the duration of visits is increasing. England, in particular, leads in visitor engagement with an average dwell time of 81 minutes, whereas both Wales and Scotland have seen declines in this metric, further emphasizing regional disparities.

Joe Capocci, spokesperson for Huq Industries, observed, "The most striking change in our data is the pronounced drop in Welsh footfall, a trend subtly supported by recent Retail Industry News regarding new store openings."

The insights drawn from these footfall statistics underline both the strengths and challenges faced by the retail park sector, as operators continue to navigate a complex landscape marked by localized shifts and broader economic trends.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

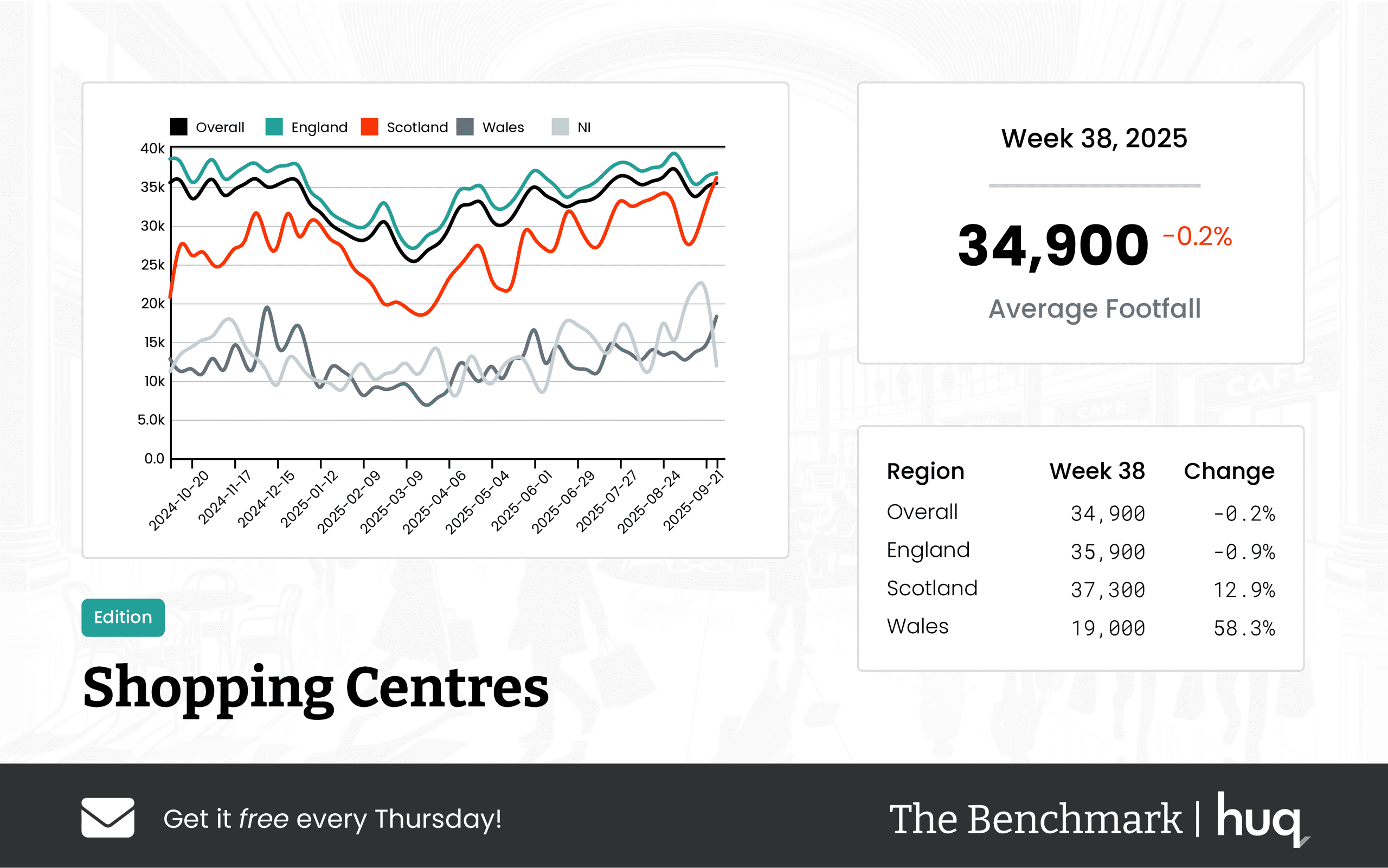

UK Shopping Centres – Week 38, 2025 Performance Update: Location Analytics

UK Shopping Centres – Week 38, 2025 Performance Update: Location Analytics

UK shopping centres show modest contraction with footfall down by 0.2% weekly while dwell time rises. Location analytics reveal improved engagement and notable retail trends.

Share on LinkedIn

The latest Benchmark data utilizing location analytics unveils a modest overall contraction in UK shopping centre footfall, alongside an increase in consumer engagement per visit. Despite a slight 0.2% weekly dip, with an average daily national footfall of 34,900, the data reveals an encouraging rise in dwell time across centres.

National Overview:

• Average Daily Footfall: 34,900 visitors (down 0.2% compared to last week and 0.9% year-on-year).

• Average Dwell Time: 116 minutes, marking a weekly rise of 7.4% and a 6.4% increase over the past year.

Regional Insights:

• England: With an average daily footfall of 35,900, there has been a marginal decline of 0.9% weekly and a 4.7% decrease annually. Dwell time remains stable at 112 minutes.

• Scotland: Enjoying an average daily footfall of 37,300, Scotland experienced an impressive weekly increase of 12.9%. Dwell time has also significantly risen to 169 minutes, highlighting higher consumer engagement.

• Wales: Welsh centres saw substantial improvements with an average of 19,000 daily visitors. Both footfall and dwell time (rising to 139 minutes) recorded notable gains, reinforcing dynamic regional retail trends.

Additional Insights:

The analysis underscores evolving retail trends, refined engagement metrics, and the resilience of the market. Although overall footfall has contracted slightly, the increase in dwell time suggests that shoppers are spending more time in the centres, engaging with retail offerings more deeply.

Industry Commentary:

Joe Capocci, spokesperson for Huq Industries, commented, "The sharp increase in Welsh centre footfall, highlighted alongside dynamic events such as the major free event at Braehead Shopping Centre, reinforces our view of an evolving retail landscape that continues to adjust consumer engagement strategies."

This week’s performance update is a testament to the adaptability of UK shopping centres, as they continue to navigate a changing retail environment with innovative engagement approaches, ensuring that even with fewer visitors, the customer experience remains robust and compelling.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 38, 2025 Local Retail Centres: Footfall Retail Insights

Week 38, 2025 Local Retail Centres: Footfall Retail Insights

UK Local Retail Centres saw a 3.9% weekly rise in footfall retail, with footfall analytics revealing a 15.4% uplift in engagement year-on-year.

Share on LinkedIn

Overview:

For the week ending 28 September 2025, UK Local Retail Centres reported an average daily footfall of 16,600. The overall performance displayed a moderate week-on-week increase of 3.9% and a slight year-on-year gain of 0.5%. Visitor engagement remained robust with an average dwell time of 105 minutes, although this represented a week-on-week drop of 2.8%, counterbalanced by a strong year-on-year engagement boost of 15.4%.

Regional Breakdown:

- Scotland: Retail centres recorded an average of 16,800 daily visitors, marking a significant week-on-week rise of 11.3% and a year-on-year improvement of 3.9%. However, the average dwell time in Scotland was 95 minutes, down by 13.6% on a weekly basis, even as it improved by 10.5% year-on-year.

- Wales: Centres attracted approximately 14,000 daily visitors, with an impressive week-on-week increase of 11.5% and an 8.3% rise year-on-year. The average visit in Wales lasted 90 minutes, reflecting a 10% weekly reduction and a modest change of 2.3% on a year-on-year basis.

- England: Here, retail centres maintained a daily footfall of 16,600 with a week-on-week increase of 3.4% and a nearly unchanged year-on-year performance (0.2%). Visitors in England experienced the longest average dwell time at 107 minutes, despite a slight weekly decrease of 2.7% and a year-on-year increase of 16.3%.

Industry Comment:

Joe Capocci from Huq Industries highlighted the uplift in footfall trends, noting that the strong weekly performance in Wales, with an 11.5% surge, underscores current market trends as also seen in the latest Retail Industry News.

Data Insights:

The detailed footfall statistics and analytics provide a comprehensive view of the varying performance across regions, with noticeable impacts on visitor frequency and engagement quality. These figures offer retailers critical insights for strategic planning and operational adjustments in response to dynamic consumer behavior.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.