UK Shopping Centres – Week 41 2025 Performance Update with Location Analytics

UK Shopping Centres – Week 41 2025 Performance Update with Location Analytics

UK shopping centres experienced a 2% weekly decline and a 4.7% annual dip, while evolving consumer trends and location intelligence highlight shifting dynamics across regions.

Share on LinkedIn

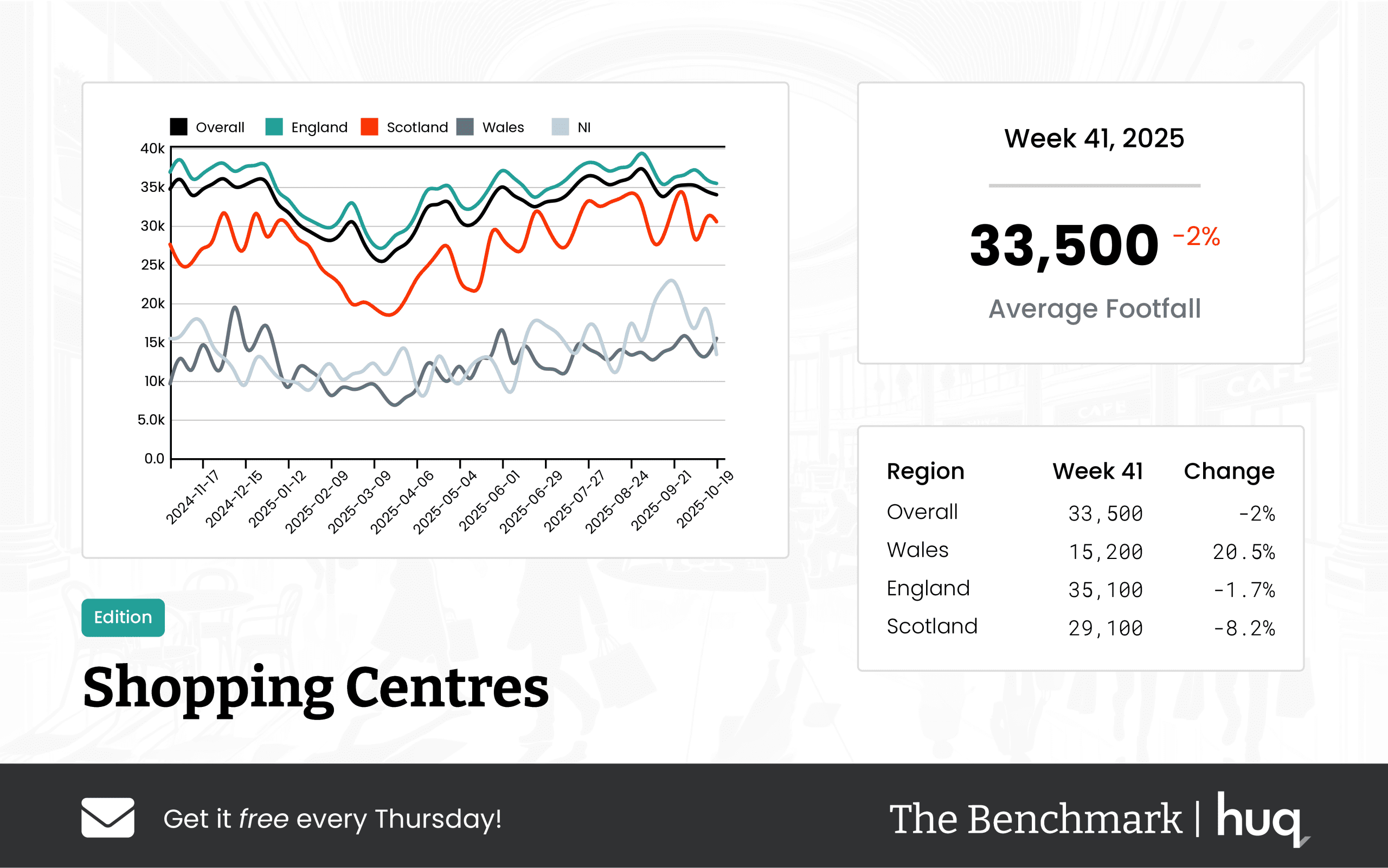

UK shopping centres are experiencing a period of modest softness, as the latest weekly data from The Benchmark indicates an average daily visitor count of 33,500 during Week 41. Overall, the centres saw a weekly decline of 2% and a year-on-year decline of 4.7%, signalling evolving consumer behaviours amid changing retail conditions.

Overview:

The most recent figures reveal that despite the overall decrease in footfall, regional performance varies significantly. Location analytics and location intelligence are playing critical roles in interpreting these trends and understanding market dynamics.

Regional Performance:

In England, shopping centres recorded an average of 35,100 daily visitors. Although there was a slight week-on-week decline of 1.7%, the annual figures showed a more significant decrease of 7%. In Scotland, centres counted an average of 29,100 visitors each day, with a sharper weekly decline of 8.2% but an impressive year-on-year increase of 15.6%, suggesting that the market may be poised for gradual recovery. Wales, meanwhile, continues to differentiate itself with 15,200 daily visitors, alongside a noticeable bounce in both weekly and annual performance compared to previous trends.

Dwell Time:

The average visit duration across the UK stood at 105 minutes, marking a modest weekly increase of 4%, even as the annual figures slipped by 3.7%. English centres reported an average dwell time of 106 minutes per visit, reflecting a weekly gain of 3.9% even though there was a 5.4% decline over the year. Scottish centres maintained an average duration of 101 minutes, bolstered by an impressive 17.4% year-on-year improvement, indicative of stronger consumer engagement. Conversely, Welsh centres experienced shorter visits, with an average dwell time of only 20 minutes, registering significant declines in both weekly and annual metrics.

Spokesperson Comment:

Joe Capocci, the spokesperson for Huq Industries, remarked, "The sharp increase in Welsh footfall, alongside notable retail industry headlines such as the recognition of a Scottish shopping centre, underlines evolving consumer dynamics across regions. This shifting landscape emphasizes the importance of leveraging location analytics and intelligence to adapt to consumer needs and regional particularities."

This update provides a snapshot of the steering influences in the UK retail market, highlighting the importance of regional variations and the role of data-driven insights in navigating the modern shopping experience.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

UK Local Retail Centres – Week 41, 2025 Footfall Data Report

UK Local Retail Centres – Week 41, 2025 Footfall Data Report

UK Local Retail Centres recorded 16,900 visitors daily in week 41, with footfall data showing a slight 0.9% dip yet steady growth. Robust footfall retail trends illustrate gradual progress.

Share on LinkedIn

Overview

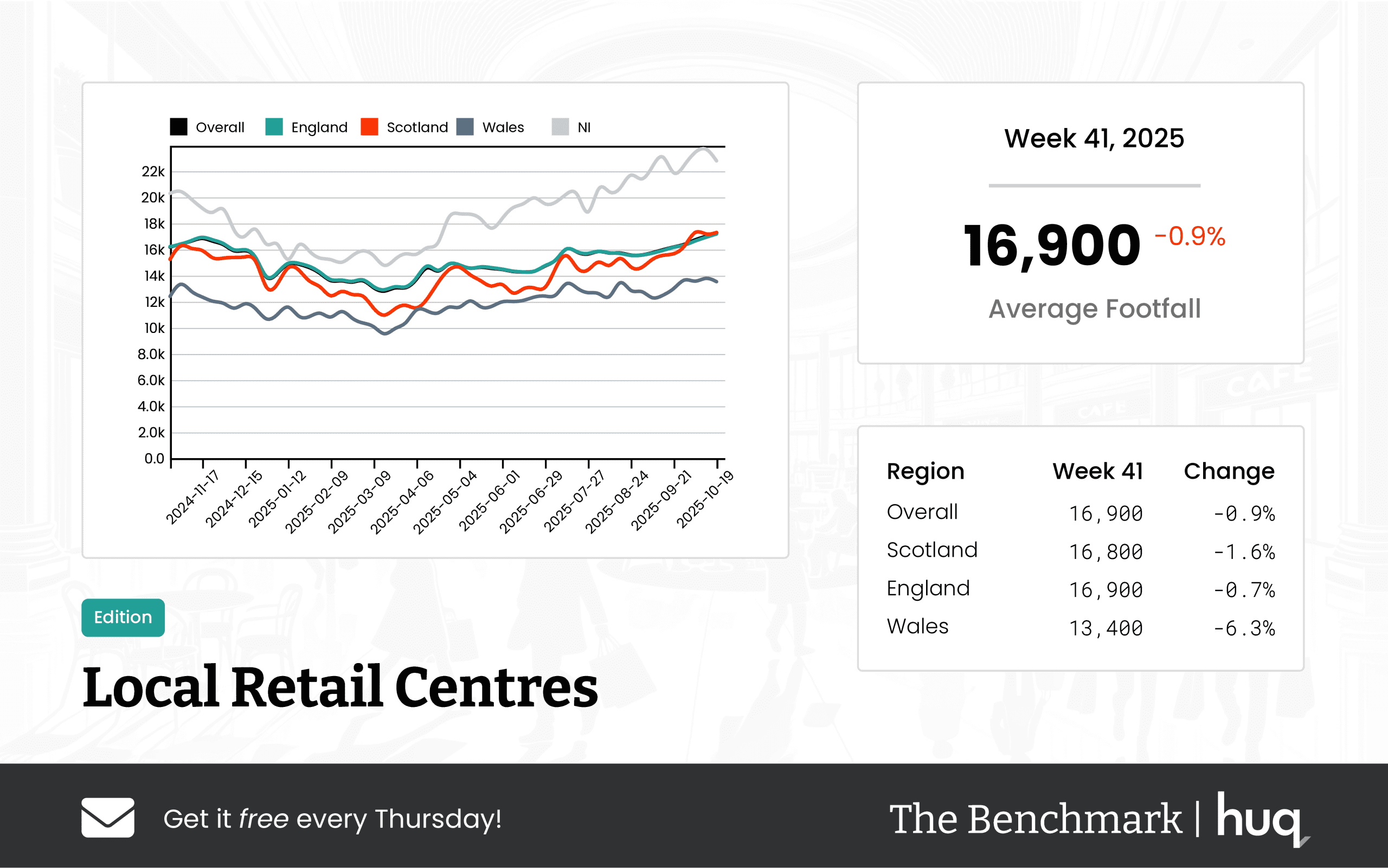

The latest footfall data figures from The Benchmark reveal that UK Local Retail Centres recorded an overall mean footfall of 16,900 visitors per day for week 41. The data shows a modest week‐on‐week decline of 0.9% while maintaining a positive longer‐term perspective, with an increase of 2.1% compared to the same week a year ago. These figures indicate that despite a slight recent dip, the overall trend remains on course for gradual growth.

Regional Performance

In examining regional performance, centres in England closely follow the overall trend with an average daily footfall of 16,900 visitors, experiencing a small week‐on‐week drop of 0.7% and a year‐on‐year improvement of 1.9%. Centres in Scotland recorded an average of 16,800 visitors per day with a sharper week‐on‐week decline of 1.6%, offset by a healthy year‐on‐year increase of 4%. Welsh centres registered a lower daily average of 13,400 visitors, with footfall softening by 6.3% over the week while still showing a year‐on‐year rise of 4%.

Secondary Metrics

Secondary metrics further enhance the story. Overall, visitors spent an average of 106 minutes on site, recording a week‐on‐week uplift of 5% and a year‐on‐year increase of 16.5%. In England, the average visit duration was 108 minutes with a week‐on‐week increase of 5.9%. Scotland’s centres saw visitors spending 102 minutes per visit, reflecting a slight decline in the recent week yet benefitting from an 18.6% improvement compared to last year, while Welsh centres experienced an average of 92 minutes per visit with a small softening of 4.2% on a weekly basis alongside a 4.5% year‐on‐year rise.

Methodology Insights

Leveraging footfall retail insights, the report utilises advanced footfall analytics to interpret robust footfall statistics and applies precise footfall counting methods.

Spokesperson Comment

Joe Capocci, Huq Industries spokesperson, stated: "The notable downturn in Welsh footfall, when contrasted with stable trends in England and concurrent industry moves like the new upsized store in south Essex, emphasises evolving consumer behaviour."

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 41, 2025 Retail Parks Performance Update: Footfall Trends

Week 41, 2025 Retail Parks Performance Update: Footfall Trends

UK retail parks' footfall dipped modestly by 2.5%, yet longer dwell times suggest steady visitor engagement. Footfall analytics confirm consistent performance in Week 41.

Share on LinkedIn

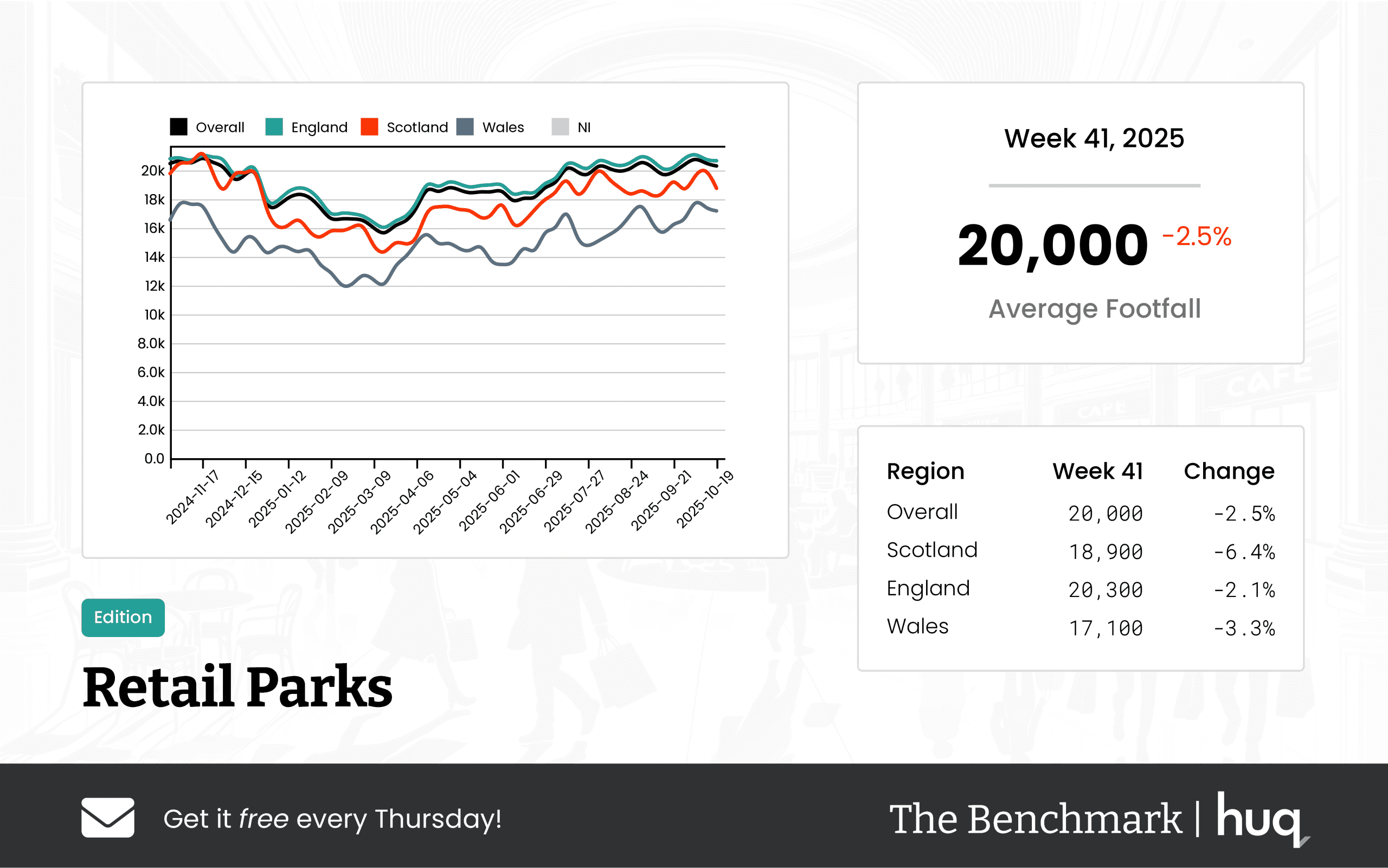

The latest weekly data from Huq Industries' Benchmark monitor reveals that UK retail parks have experienced a modest decline in footfall during Week 41 of 2025. With an average of 20,000 visitors per day across the nation, footfall numbers have dipped by 2.5% on a week-on-week basis and 3.7% compared to the same period last year.

Despite this slight softening, longer dwell times suggest that visitor engagement remains robust. Across the board, retail park visitors are spending more time on site with an average dwell time of 74 minutes, a 5.7% increase from the previous year. This trend highlights that while fewer people may be visiting, those who do are engaging more deeply with the retail experience.

Regional breakdown shows varied performance across the UK. In England, daily averages sit at 20,300 visitors, in line with national trends. However, Scotland's retail parks have seen a steeper decline, averaging 18,900 visitors per day, whereas Welsh locations recorded 17,100 daily visitors. Notably, dwell time also varied regionally: England led with an average visit lasting 77 minutes, Scotland experienced a unique pattern of weekly increases despite overall annual dips, and Wales reported the shortest visits, averaging just 51 minutes.

Industry experts are taking a measured view amid these mixed signals. Joe Capocci from Huq Industries observed that the marked softening in Scotland’s footfall, in conjunction with recent developments in retail park openings, underscores shifts in consumer behaviour as well as an encouraging trend of increased engagement through longer visits. Overall, even as footfall numbers see a slight dip, enhanced visitor interaction could point to a more engaged consumer base, offering interesting insights for retail operators navigating the changing landscape.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 40 Weekly Wrap: A Deep Dive into UK Retail Centre Performance with Location Analytics

Week 40 Weekly Wrap: A Deep Dive into UK Retail Centre Performance with Location Analytics

Explore the week’s retail trends with detailed location analytics and insights, including a 4.2% annual rise in footfall at shopping centres.

Share on LinkedIn

The latest UK retail centre performance data has revealed intriguing trends across various formats. Location analytics continues to offer invaluable location intelligence insights into consumer behaviour and engagement patterns. This weekly wrap combines detailed analyses and regional nuances to help retail professionals adapt to an ever-evolving landscape.

Shopping Centres Performance

The shopping centre segment experienced mixed outcomes over the week. One update, the Week 39 Weekly Wrap: UK Retail Trends Through Location Analytics, noted a modest rise in both footfall and attendee frequency. In England, centres recorded approximately 38,400 daily visitors with a 7.1% week‑on‑week boost, while visit durations compressed slightly to about 104 minutes.

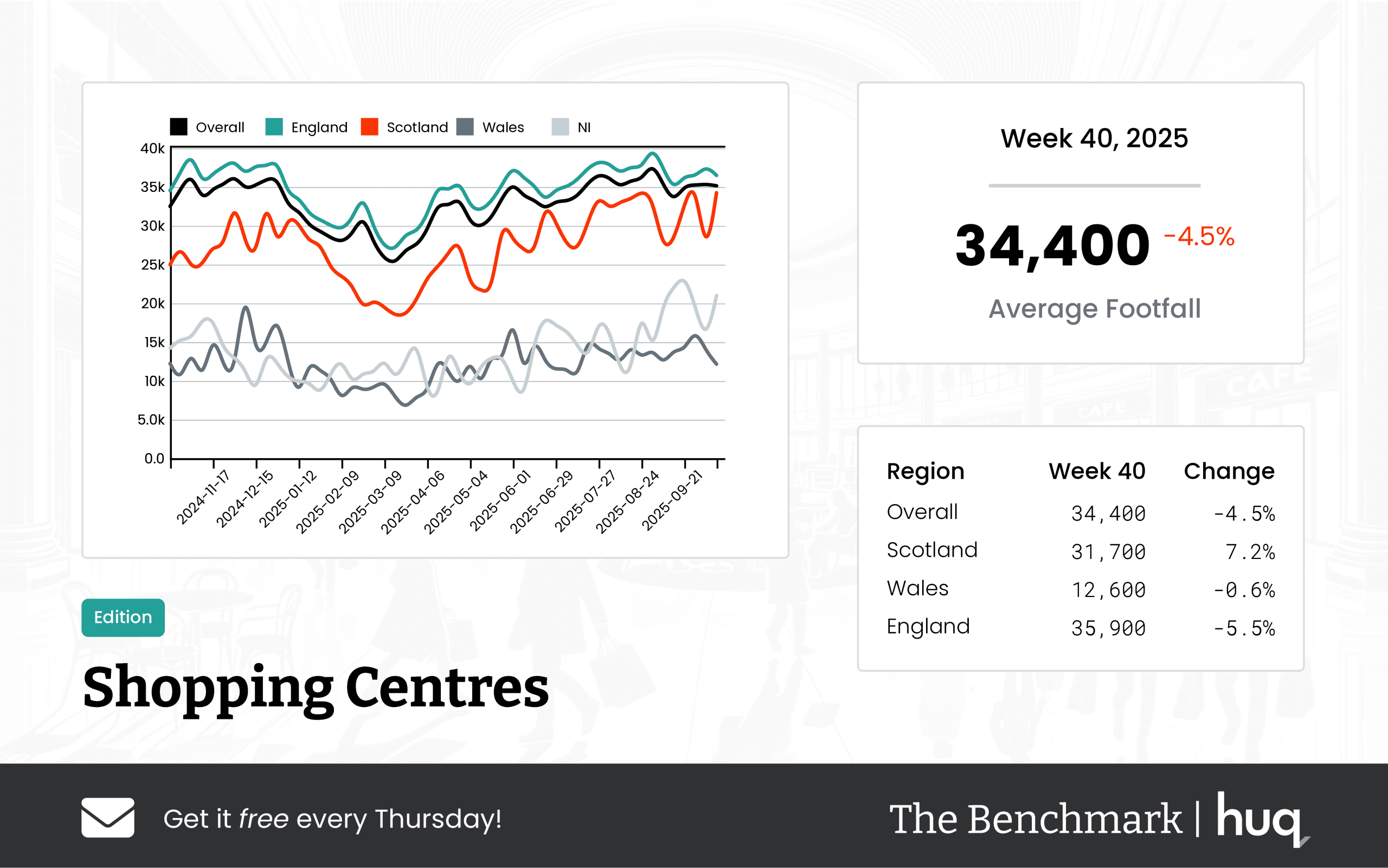

A subsequent analysis, UK Shopping Centres – Week 40 (2025) Footfall Retail Update, showed contrasting statistics with a 4.5% weekly decline and a year‑on‑year drop of 2.2%. Such variations underline the significance of granular regional data and emphasise the need to monitor consumer engagement carefully with each passing week.

Retail Parks and High Streets

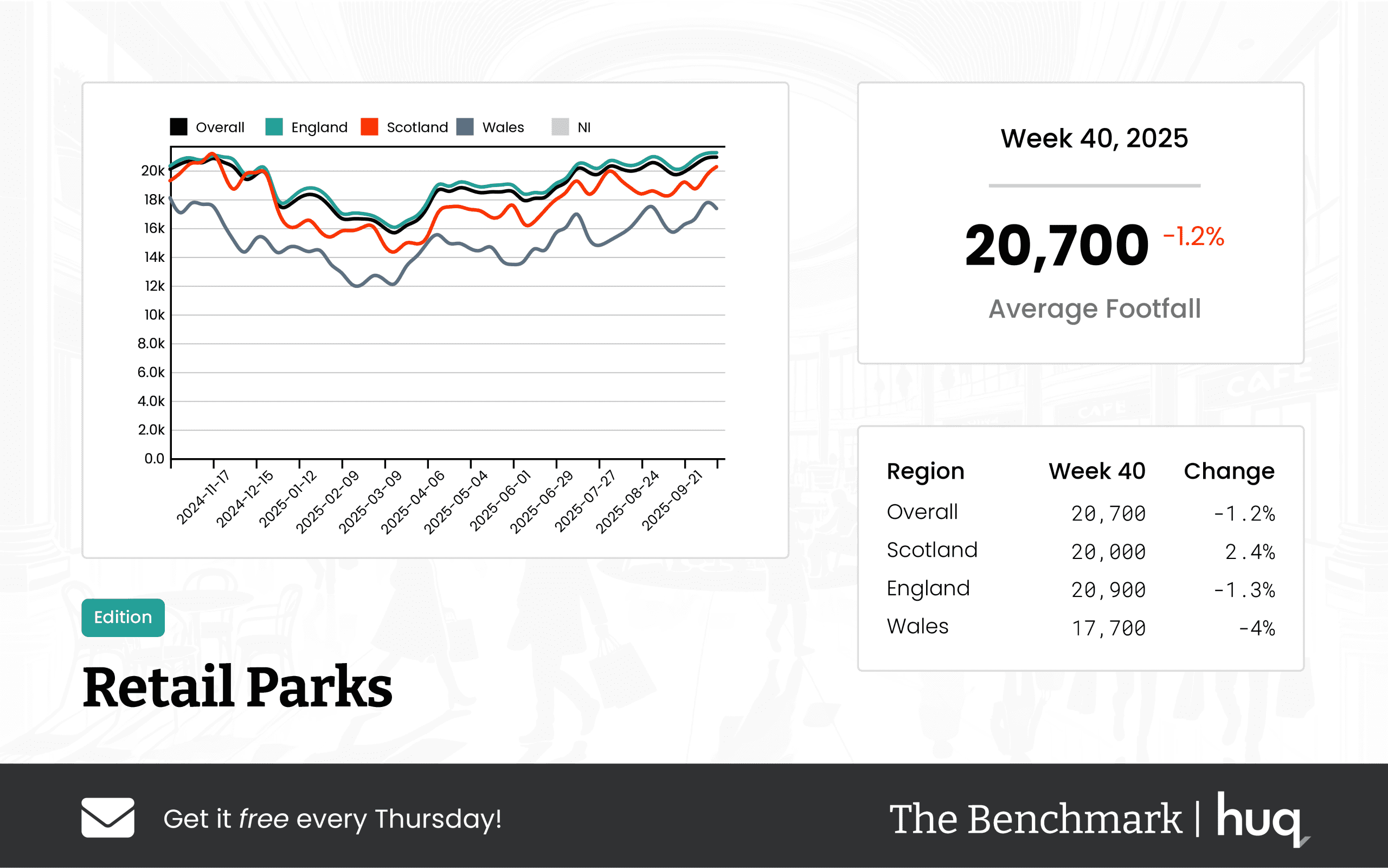

UK retail parks have exhibited subtle shifts despite a slight weekly dip. The UK Retail Parks – Week 40, 2025 Performance Update detailed that retail parks averaged about 20,700 daily visitors, with England showing marginally higher numbers. Secondary indicators such as footfall trends, dwell times, and regional disparities are critical for understanding market dynamics for retail parks.

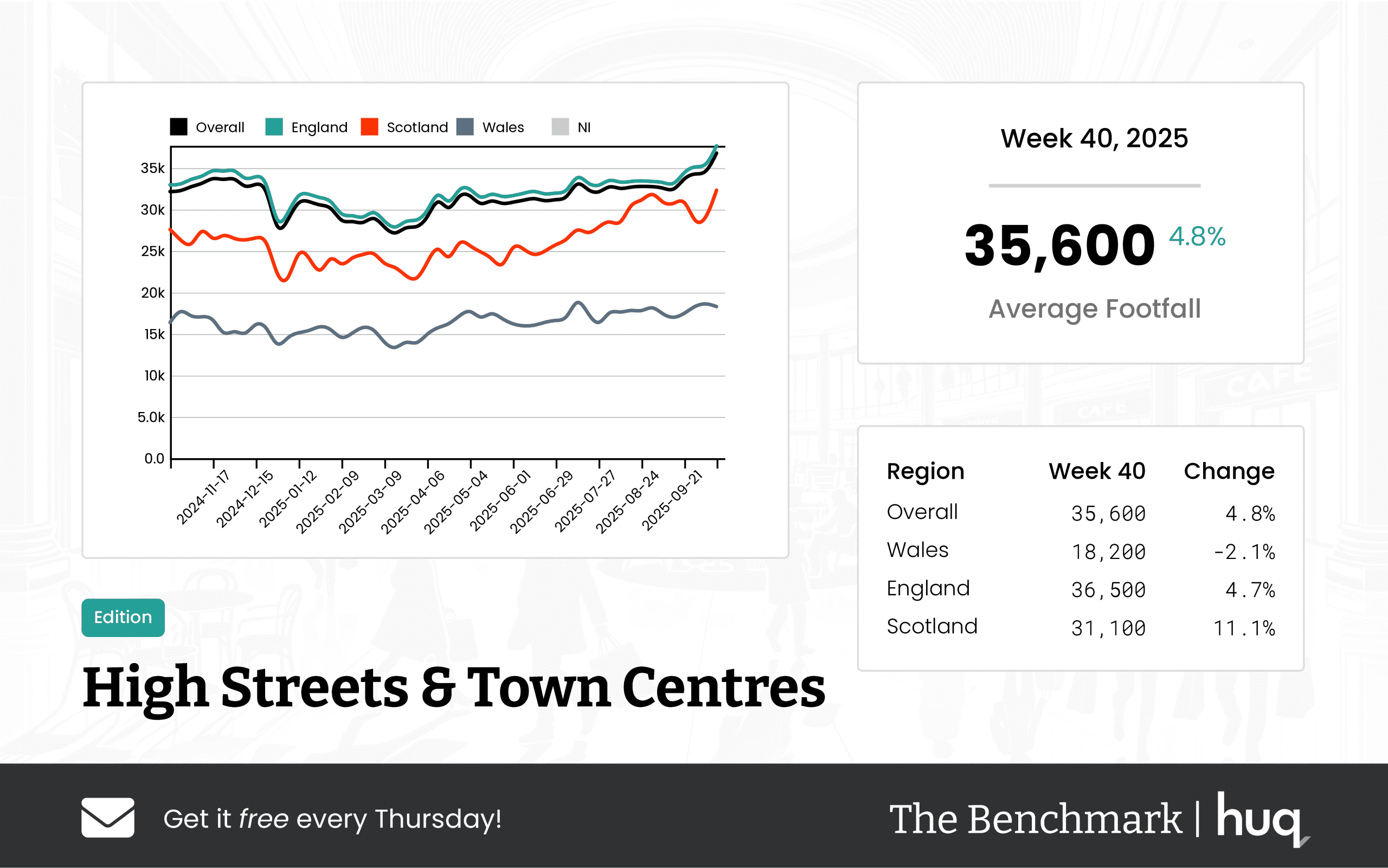

High streets and town centres remain vibrant with consumer activity. The Week 40, 2025 High Streets & Town Centres Footfall Report highlighted a 4.8% weekly rise, reaching an average of 35,600 visitors per day. The rise in average dwell time to 107 minutes, particularly in Wales where visitors spent up to 113 minutes, reflects strong consumer engagement and a resilient high-street culture that bolsters secondary trends such as footfall and dwell time.

Major and Local Retail Centres

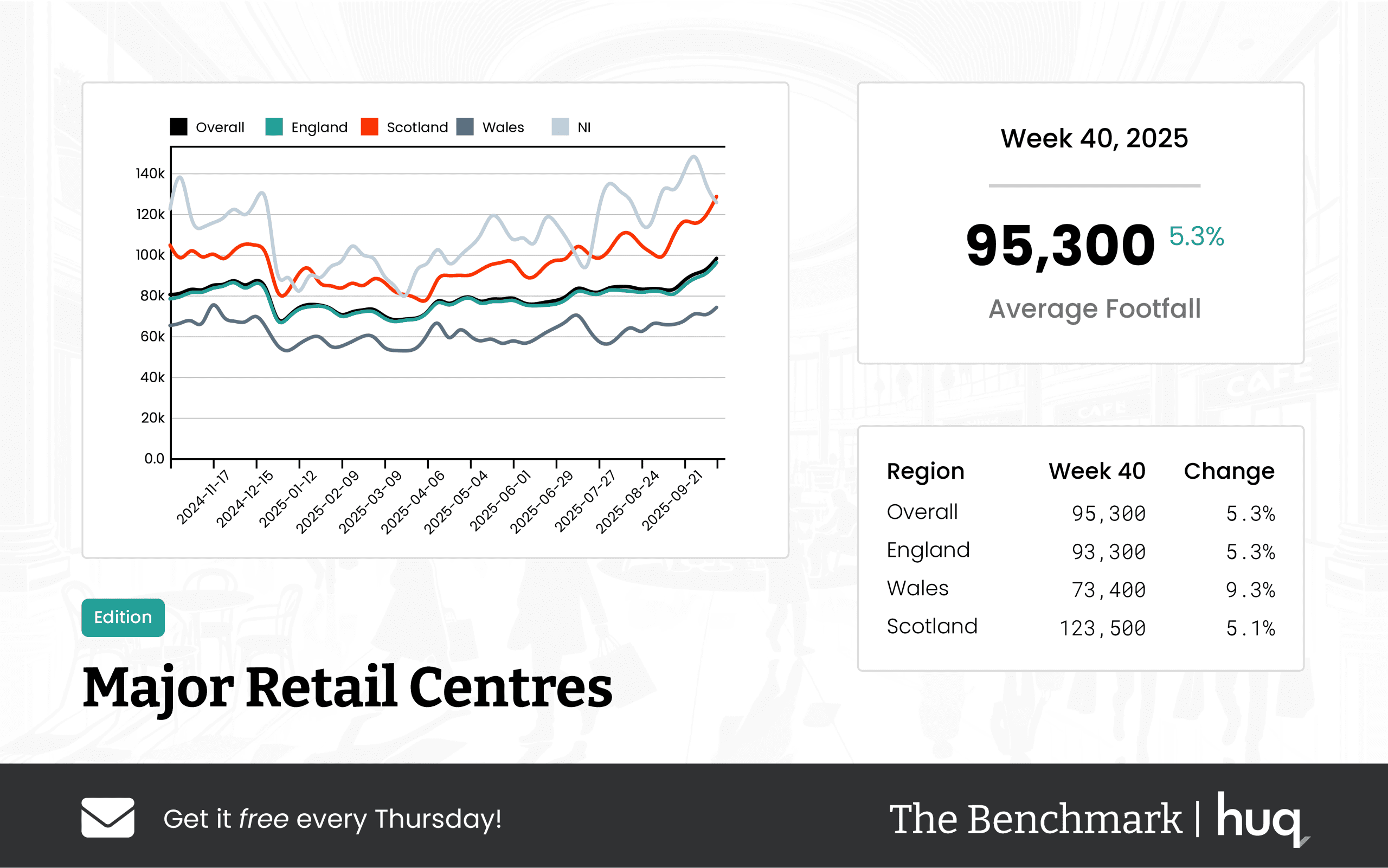

Major retail centres continue to display robust performance. Data from the Week 40 2025 Major Retail Centres: A Location Analytics Performance Update reported a 5.3% weekly upturn with an average of 95,300 daily visitors. Although there was a minor dip in dwell time, falling 3.1% to 124 minutes, the 15.1% annual boost in footfall points to a positive long-term trend in consumer behaviour.

Local retail centres also reveal encouraging signs of recovery and growth. The UK Local Retail Centres – Week 40 Performance Update indicated a 4.4% weekly increase and a 5.2% annual development in footfall. Regional spikes such as Wales’ impressive weekly boost of 12.9%, alongside steady numbers in England and Scotland, underscore the importance of location intelligence in real-time retail planning.

Regional Variations at a Glance

Subtle regional nuances have emerged from these reports. While shopping centres in Scotland outperformed English figures in certain comparisons, some Welsh centres recorded shorter average dwell times, with reports indicating periods as low as 52 minutes. These secondary observations, alongside metrics such as footfall and dwell time variations, highlight the evolving nature of consumer behaviour impacted by local factors.

Expert Insights

Joe Capocci, Huq Industries Spokesperson, remarked, "The mixed week-on-week trends across retail centres underscore the need for a sophisticated approach to location intelligence. Retailers must focus on precise data to adapt their strategies and optimise customer engagement." His comment encapsulates the dual importance of short-term adjustments and long-term planning amid shifting consumer dynamics.

Looking Forward

Retail professionals should heed the nuanced shifts in metrics presented by location analytics and secondary trends like footfall, dwell times, and regional performance. The emerging patterns suggest that markets are responding variably, and even small percentage changes can forecast broader shifts in consumer behaviour. Navigating these trends with agility and insight may prove vital in ensuring retail resilience moving forward.

Concluding Thoughts

The comprehensive data this week demonstrates that UK retail centres are experiencing a blend of rising and falling trends in engagement. The thorough reports from diverse retail formats and regions emphasise that location analytics is indispensable for crafting responsive retail strategies. With insights into primary measures such as footfall and dwell times, retailers are empowered to make informed decisions that reflect both short-term volatility and long-term market strength.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

UK Local Retail Centres – Week 40 Performance Update: Footfall Data Trends in 2025

UK Local Retail Centres – Week 40 Performance Update: Footfall Data Trends in 2025

Week 40 saw a 4.4% weekly rise and 5.2% year‐on‐year growth in footfall data at UK Local Retail Centres. Improved footfall counting signals promising overall trends.

Share on LinkedIn

Overview

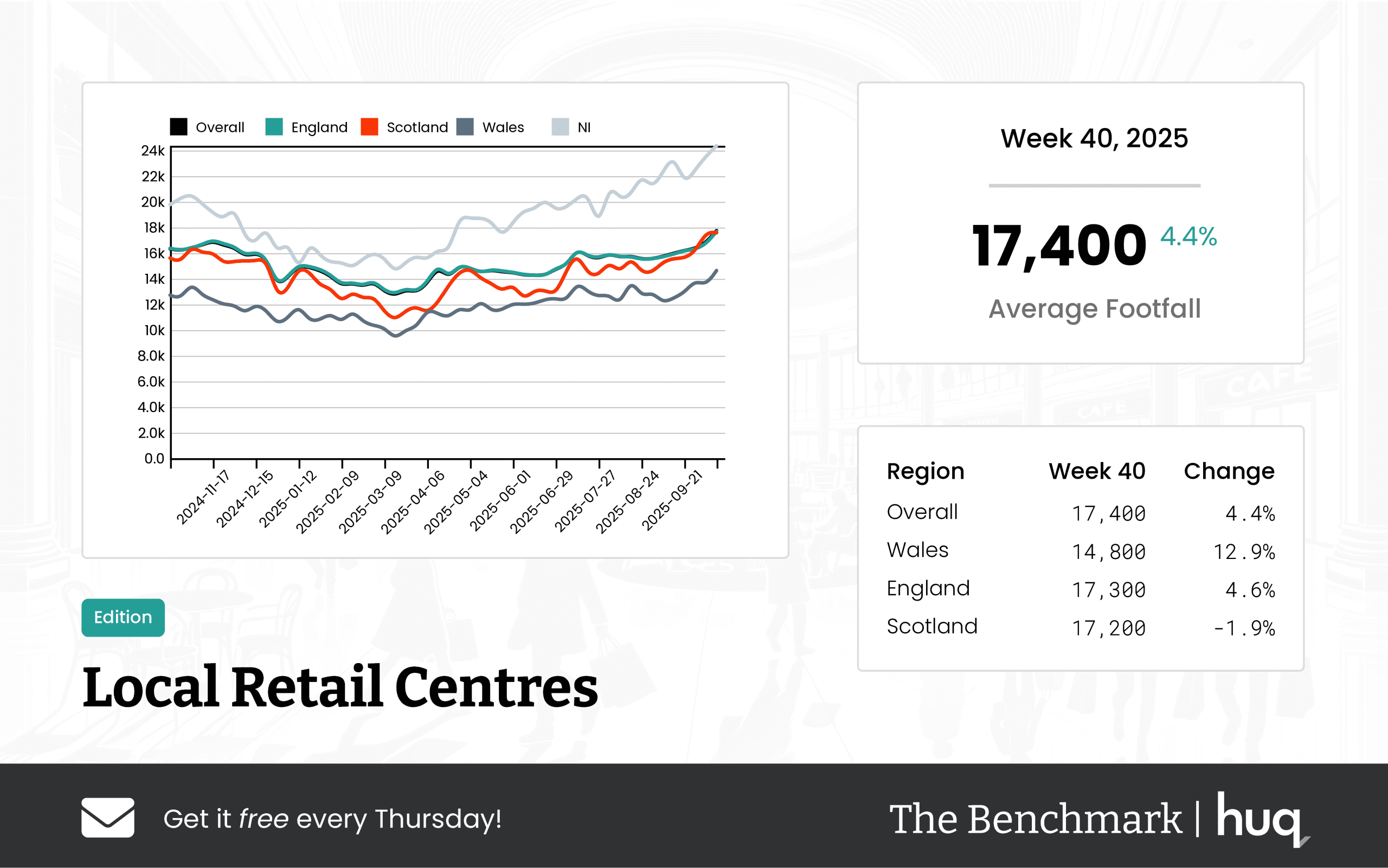

Huq Industries’ latest update on footfall data and dwell time provides a comprehensive view of visitor trends across UK Local Retail Centres for the week ending 12 October 2025. Overall, the centres achieved an average of 17,400 daily visitors – a noticeable increase compared to the previous year – with a weekly 4.4% improvement and a 5.2% rise year‐on‐year. Advanced footfall analytics are being integrated to enhance retail strategies and ensure the accuracy of these statistics.

Regional Breakdown

In Wales, centres recorded an average of 14,800 daily visitors, demonstrating a robust recovery with a week-on-week growth of 12.9% and a year‐on‐year increase of 14.7%. England’s centres followed with an average of 17,300 daily visitors, reflecting steady growth of 4.6% weekly and 4.8% on a year‐on‐year basis.

Scotland Insights

Scotland’s centres, with an average of 17,200 daily visitors, experienced a minor downturn during the week; however, the year‐on‐year performance improved by 6%. Additionally, Scottish centres recorded an average dwell time of 105 minutes per visit with a 5% improvement on a weekly basis, underlining efforts to boost shopper engagement. These positive indicators are supported by robust, advanced footfall counting measures that provide detailed local insights.

Spokesperson Comment

Joe Capocci, spokesperson for Huq Industries, stated: "The sharp increase in Wales’ footfall, in conjunction with recent observations in Retail Industry News, underscores the dynamic changes taking place across our local retail centres. We are encouraged by these trends and will continue harnessing advanced data analytics to drive further growth and operational improvements."

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 40 2025 Major Retail Centres: A Location Analytics Performance Update

Week 40 2025 Major Retail Centres: A Location Analytics Performance Update

Robust overall footfall advanced 15.1% YoY with a 5.3% weekly rise at UK major retail centres. Advanced location analytics underline steady trends in retail performance.

Share on LinkedIn

Overall Footfall Results

Utilising advanced location analytics, the Benchmark data for week 40 shows robust visitor activity across UK Major Retail Centres. Centres recorded an average daily footfall of 95,300 visitors, reflecting a modest week on week improvement of 5.3% and a healthy year on year advance of 15.1%. While visitor numbers continue to rise, the average duration of visits experienced a slight weekly decline of 3.1%, settling at 124 minutes; however, the year on year data shows an encouraging 12.7% increase in dwell time, highlighting improved visitor engagement overall.

Further analysis employing location intelligence reveals not only notable footfall trends but also retail performance gains and enhanced consumer engagement across the board.

Regional Performance

A closer look at the regional breakdown reveals variations in consumer behavior. In England, retail centres experienced an average daily footfall of 93,300, with a week on week growth of 5.3% and a year on year increase of 15.8%. The average visit duration was 123 minutes, marking a weekly softening of 3.9% yet reflecting an annual improvement of 11.8%.

Wales reported an average daily count of 73,400, registering a higher weekly uplift of 9.3%, despite a comparatively lower year on year increase of 6.9%. Notably, the dwell time in Wales—averaging 123 minutes—experienced a sharp weekly increase, suggesting enhanced quality in visitor engagements for select centres.

Scotland leads with the highest overall daily footfall of 123,500, recording a week on week growth of 5.1% and a year on year increase of 17%. Visitors in Scotland enjoyed the longest average visit duration at 128 minutes. Although there was a slight weekly softening of 5.9%, the annual figure shows a solid improvement of 17.4%, reinforcing Scotland’s robust performance.

Industry Comment

Joe Capocci, Huq Industries Spokesperson, commented, "The sharp increase in Scotland’s footfall, supported by recent Retail Industry News, highlights a key shift in consumer activity across our major centres."

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 40, 2025 High Streets & Town Centres Footfall Report: A Look at Location Analytics

Week 40, 2025 High Streets & Town Centres Footfall Report: A Look at Location Analytics

UK high streets and town centres saw steady footfall and longer visits in week 40, 2025. A modest 4.8% increase overall reveals solid location analytics and clear footfall trends.

Share on LinkedIn

The latest data from The Benchmark highlights a steady performance across UK high streets and town centres during Week 40, 2025. With an average daily footfall of 35,600, the area recorded a modest week-on-week increase of 4.8% and an impressive year-on-year boost of 9%. Visitors maintained a healthy average dwell time of 107 minutes, despite a slight week-on-week decrease of 0.9%, and a dramatic year-on-year improvement of 17.6%, indicating stronger visitor engagement.

Regional performance varied across the country. In England, centres averaged 36,500 visitors daily, with dwell time improvements over the year, highlighting a robust recovery trend. Scotland showcased a standout performance with 31,100 visitors on average per day, experiencing a remarkable 11.1% week-on-week increase and a 13.6% uplift compared to the previous year. While Wales saw a dip with 18,200 daily visitors and a 2.1% decline in footfall, the average visit length rose by 10.8% to 113 minutes, suggesting that shoppers are spending more quality time in these centres.

Commenting on the performance, Joe Capocci from Huq Industries noted the strong rebound in locations such as Scotland, where a significant week-on-week increase occurred despite news of high street store closures, emphasizing the evolving dynamics in visitor behaviour and the overall resilience of the retail sector. This report underscores the importance of location analytics in understanding consumer patterns and signals gradual retail recovery despite ongoing challenges in the market.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

UK Retail Parks – Week 40, 2025 Performance Update: Insights from Footfall Analytics

UK Retail Parks – Week 40, 2025 Performance Update: Insights from Footfall Analytics

UK Retail Parks saw modest shifts in overall footfall analytics with a slight weekly decline. Data shows about 20,700 daily visitors and 74-minute average visits; footfall counting remains key.

Share on LinkedIn

Overall Performance

The latest update from The Benchmark reveals modest shifts in visitor patterns across UK Retail Parks with footfall data indicating steady trends. Overall, the average daily footfall reached 20,700, reflecting a slight weekly decline and a modest softening in performance when compared with the same period last year.

In addition, the overall average visit duration for the week was 74 minutes. Although there was a small decrease in dwell time during the week, this figure remains higher on an annual basis, suggesting that while fewer visitors are making the journey, those who do are spending more time at the parks than they did the previous year, highlighting continued strength in footfall retail engagement.

Regional Breakdown

In Scotland, retail parks recorded an average daily footfall of 20,000. Here, weekly visitor numbers experienced an increase, even though the annual performance shows a softer trend. Nevertheless, the average visit duration stood at 54 minutes, with a short-term boost in dwell time that does not offset a longer-term decline.

In England, retail parks enjoyed slightly higher average daily numbers at 20,900, even as they experienced a slight weekly decline with modest softening on an annual basis; footfall analytics also point towards sustained engagement. Notably, the average visit duration in England was the highest at 77 minutes, which indicates a deeper level of engagement relative to previous periods.

Wales presented a more mixed picture; its parks averaged 17,700 visitors per day during the week. Despite a drop in footfall during the week, year-on-year data suggest some recovery, while the average visit duration reached 66 minutes with improved dwell time over the short term, even as the annual trend indicates a slight weakening; footfall statistics and trends are closely monitored.

Industry Comment

Analysis of current trends continues to utilise footfall counting to assess consumer engagement.

Joe Capocci, spokesperson for Huq Industries, stated: "The noticeable drop in daily footfall in Wales, supported by recent retail industry news, highlights a subtle yet significant shift in consumer engagement."

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

UK Shopping Centres – Week 40 (2025) Footfall Retail Update

UK Shopping Centres – Week 40 (2025) Footfall Retail Update

UK Shopping Centres saw a 4.5% drop in footfall this week with overall footfall data indicating a 2.2% annual decline. Footfall analytics suggest evolving consumer habits.

Share on LinkedIn

The latest UK Shopping Centres report for Week 40 (2025) highlights notable trends in footfall and consumer behavior. The overall average daily footfall reached 34,400 during the week ending 12 October 2025, reflecting a 4.5% decline on a week-on-week basis and marking a 2.2% drop compared to the previous year. Alongside these figures, the average visit duration has decreased to 101 minutes, showing a recent decline of 2.9% and a 7.3% drop year-on-year.

Regional differences are evident in the data. In Scotland, an average daily footfall of 31,700 was recorded, with a 7.2% increase from the previous week and significant annual gains. This contrasts with England, where footfall averaged 35,900, experiencing both a week-on-week drop of 5.5% and a 4.8% annual decline. In Wales, footfall held at an average daily count of 12,600, with a minimal week-on-week decrease of 0.6% but showing slight positive movement on an annual basis.

Consumer engagement remains a key focus. Visitors in Scotland continued to average 101 minutes per visit, even as recent trends showed a slight softening, while the annual figures suggest a moderate increase in engagement time. England mirrored this pattern with an average visit duration of 102 minutes, experiencing only slight week-on-week fluctuations but a more pronounced annual decrease. Conversely, visitors in Wales, with an average duration of 82 minutes, displayed sharper increases in their engagement time.

Industry reactions have been mixed. Joe Capocci, the spokesperson for Huq Industries, commented, "The latest figures show Scotland’s robust footfall growth alongside subdued trends in England, as supported by retail news of new store openings at Glasgow Silverburn and Manchester Arndale." These developments indicate that while overall trends suggest a cautious market, regional variations continue to drive strategic retail initiatives.

The evolving consumer habits reflected in both footfall and dwell time metrics point to an ongoing transition in retail engagement, with UK shopping centres adapting to new market dynamics amid both challenges and opportunities.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 39 Weekly Wrap: UK Retail Trends Through Location Analytics

Week 39 Weekly Wrap: UK Retail Trends Through Location Analytics

Explore UK retail trends with location analytics and location intelligence, including a notable 4.2% rise in shopping centre footfall.

Share on LinkedIn

Introduction to UK Retail Trends

UK retail environments are undergoing subtle shifts, as revealed by the latest footfall data. Early insights from detailed location analytics indicate a mixed performance across retail centres that include shopping centres, retail parks, high streets and town centres, major retail centres, and local retail centres. This weekly wrap delves into how these trends signal changes in consumer engagement and lay out the evolving dynamics in the UK retail sector.

Dynamic Performance in Shopping Centres

Shopping centres recorded a modest overall improvement in footfall, with a recent week showing a 5.9% week-on-week increase and a 4.2% rise compared to the previous year. Despite a slight reduction in average visit duration to 104 minutes, regional differences point towards evolving shopper behaviour. In England, for instance, centres saw 38,400 daily visitors with a 7.1% increase, while Scotland and Wales experienced contrasting trends. For more insight, please refer to the Week 39, 2025 Shopping Centres Performance Update and UK Shopping Centres – Week 38 Performance Update: Location Analytics.

Steady Growth in Retail Parks

Retail parks continue their positive trajectory with modest gains in footfall and shifting dwell time trends. The national daily average reached 21,000 visitors last week, with England noticing a yearly dwell time increase of 12.9%. Scotland reported a 7.3% week-on-week gain in visitors despite experiencing a 16.4% dip in dwell time. This nuanced performance highlights the importance of location intelligence in deciphering consumer movement. Additional details can be found in the Week 39 2025 Retail Parks Footfall Update – Location Analytics Insights and the UK Retail Parks – Week 38 Performance Update 2025: Footfall Data Trends.

Shifting Patterns in High Streets and Town Centres

High streets and town centres have shown resilience from an annual perspective even when weekly figures reflect minimal drops. With an average of 34,200 daily visitors and a 0.7% week-on-week decline, the overall annual footfall still grew by 4.6%, indicating stronger long-term consumer engagement. Regions such as Wales and Scotland are witnessing varied patterns, underscoring the role of both location analytics and location intelligence in painting a clear picture of ongoing changes. Readers can explore detailed performance data in the UK High Streets & Town Centres – Week 39, 2025 Performance Update.

Major and Local Retail Centres in Focus

Major retail centres continue to outperform with high footfall numbers and sustained annual growth. Week 38 data showed an average daily footfall of 90,900 with a 9.9% annual improvement and an average visit duration of 119 minutes. In contrast, local retail centres are showing more modest improvements with a national weekly increase of 3.9% in visitors, which was further bolstered in regions like Scotland and Wales. Retail centres of both types are reaping the benefits of granular footfall data gathered via sophisticated location analytics. See the Week 39 2025 Major Retail Centres – Footfall Retail Performance Update and the Week 38, 2025 Local Retail Centres: Footfall Retail Insights for further information.

Expert Insights and Consumer Engagement

Joe Capocci, spokesperson for Huq Industries, stated, "The varying performance across segments highlights that even modest improvements represent real consumer shifts." His comment underlines the significance of embracing precise analytics to fine-tune retail strategies. As retailers strive to adapt, utilising both location analytics and location intelligence remains pivotal to understanding consumer engagement and footfall data.

Observations on Emerging Retail Patterns

The latest trends demonstrate that even small percentage increases in footfall and shifts in dwell times can signal broader changes in UK retail engagements. Consumer engagement appears to be rising despite fluctuating weekly numbers, offering a more positive long-term outlook. In particular, notable improvements in regional metrics point to optimised in-store experiences, bolstered by detailed location analytics.

Looking Ahead

Retail analysts believe that integrating advanced location intelligence can further streamline strategies across shopping centres, retail parks, high streets, and more. The data suggests a continuing evolution in UK retail patterns, with focus shifting toward enhancing consumer experiences both on-site and digitally. As retail sectors adjust to these trends, the interplay between footfall data and shopper behaviour will remain a vital metric in understanding market dynamics.

Conclusion

This weekly wrap provides a comprehensive snapshot of UK retail trends as seen through the lens of detailed location analytics. With further emphasis on data-driven decisions and location intelligence, retailers appear well-positioned to meet the evolving demands of today's consumers. As we look ahead, the ability to interpret these trends accurately will be key to optimising in-store experiences and driving sustained growth.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.