UK Retail Parks – Week 8 Performance Update 2025: Insights from location analytics

UK Retail Parks – Week 8 Performance Update 2025: Insights from location analytics

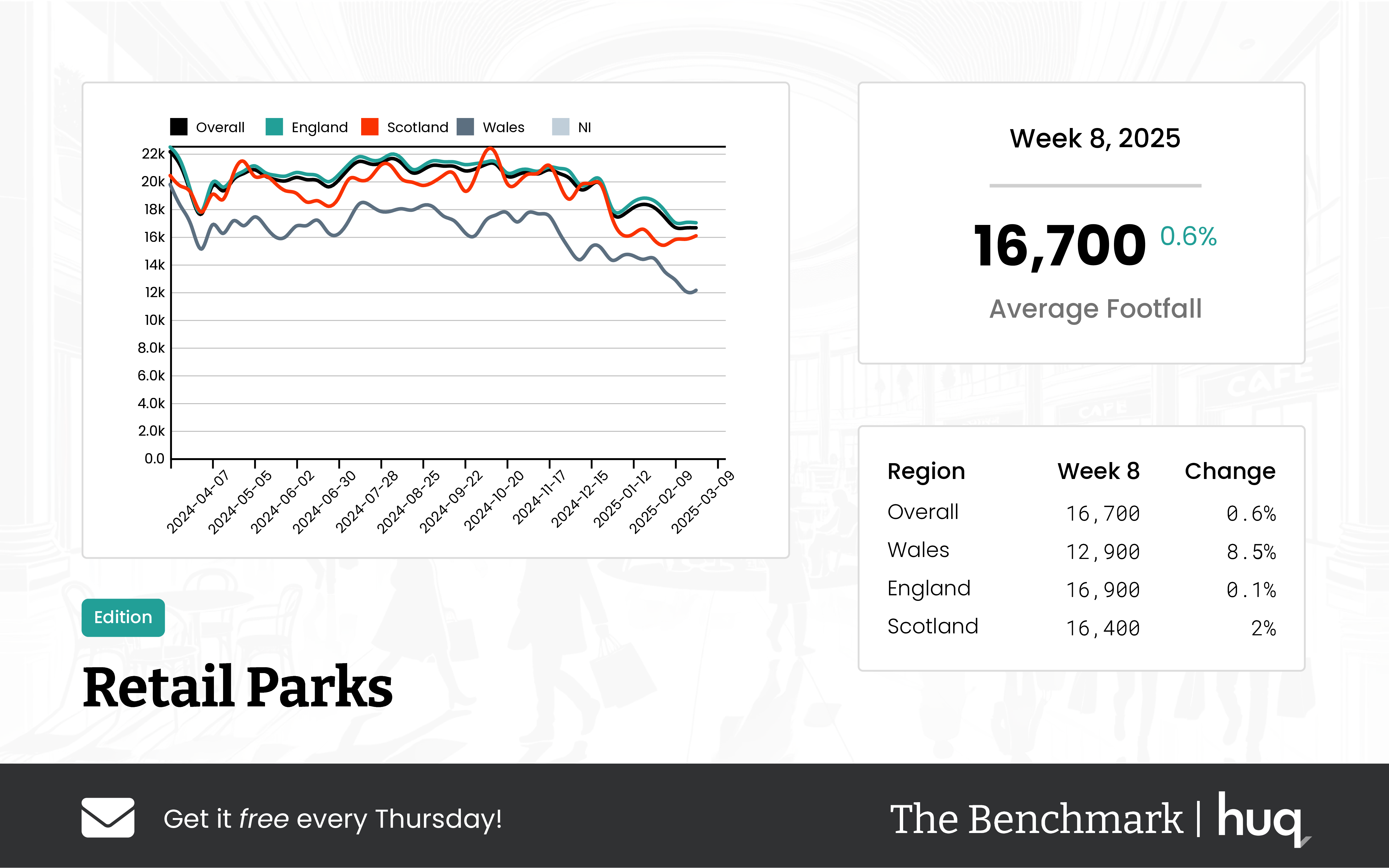

UK Retail Parks show a modest weekly increase (0.6%) but a yearly decline (16.5%). Dwell time improved by 14.1%, with shifts in footfall observed via location analytics.

Share on LinkedIn

Overall Performance

Recent data for UK retail parks indicate that, for the period ending 2025-03-02, locations across the country averaged 16,700 daily visits. Using location analytics, our analysis shows that consumer behaviour is shifting, with daily visits and footfall being closely monitored. The week on week change was modest at 0.6%, whereas the year on year performance shows a decline of 16.5%, reflecting ongoing challenges in the longer term.

Dwell time averaged 73 minutes per visit, with a weekly increase of 2.8% and an annual improvement of 14.1%, suggesting that visitors are spending more time at retail parks despite lower overall footfall.

Regional Breakdown

In England, retail parks recorded an average of 16,900 visits per day. The week on week change was minimal at 0.1%, with a year on year figure reflecting a decline of 16.2%. Visitors in England spent around 72 minutes per visit, experiencing a modest weekly gain of 1.4% and a year on year increase of 9.1%.

Scottish retail parks experienced an average of 16,400 visits, with a 2% weekly increase and a year on year decline of 14.2%. The average dwell time in Scotland was the highest overall at 75 minutes, showing weekly growth and a notable annual improvement.

Wales presents a different profile, where despite achieving an average of 12,900 daily visits and the strongest week on week gain of 8.5%, the year on year performance still reflects a notable decline. Dwell time in Wales averaged 71 minutes with modest weekly progress and a sharp increase on an annual basis.

Comment

Joe Capocci, Huq Industries Spokesperson, stated, "The noticeable weekly improvement in Wales, alongside recent retail industry updates on park developments, underscores a subtle shift in consumer behaviour that retailers must carefully monitor."

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 8 Weekly Wrap: Unpacking UK Footfall Trends in Retail

Week 8 Weekly Wrap: Unpacking UK Footfall Trends in Retail

UK retail sees a 4.8% rise on high streets as footfall analytics reveal a rebound in visitor dwell time. Discover the trends!

Share on LinkedIn

UK retail continues to evolve as various store formats adjust to shifting consumer behaviours. In this weekly wrap, we delve into comprehensive footfall statistics and footfall data that show distinct regional and format-specific trends. The analysis provides insight into a modest recovery in some sectors and challenges in others, ensuring our readers understand the dynamic landscape of footfall retail.

Shopping Centres in Focus

UK shopping centres faced a downturn this week, with daily visitors down by 12.4% on a week‑on‑week basis. According to the Shopping Centres Footfall Update, mainland centres in England witnessed a sharper decline while Scotland enjoyed a 12.6% weekly increase in footfall. Despite a mixed scenario, the overall average dwell time of 116 minutes indicates that visitor engagement remains high in these venues, contributing solid footfall analytics insights.

High Streets and Town Centres Rebound

High streets and town centres showed a promising recovery as footfall data revealed a 4.8% weekly increase. The UK High Streets & Town Centres Rebound report highlights that these traditional retail spaces now attract 29,500 daily visitors with dwell times extending to 96 minutes. This recovery offers hope for retailers and enhances our understanding of footfall retail destiny during challenging times.

Major Retail Centres Surge

Major retail centres continue to demonstrate strength with a daily average of 74,300 visitors. Insights in the UK Major Retail Centres Performance update show robust results and steady growth, particularly in Scotland, which recorded 89,300 daily visitors. The impressive footfall statistics in these centres underline their significance within the competitive retail market.

Local Retail Centres Dynamics

Local retail centres attracted 13,900 visitors on average, as detailed by the Local Retail Centres Footfall Data. The data reveals that while England and Scotland posted comparable footfall numbers, Scotland enjoyed elevated dwell times, suggesting deeper visitor engagement even with slightly reduced numbers. These observations enhance our understanding of footfall analytics by showcasing the varied performance across different UK regions.

Retail Parks: Mixed Performance

Retail parks are showing a mixed performance, with daily footfall figures reaching 16,700 but marked with a significant year‑on‑year fall. The Retail Parks update notes that dwell times improved to 73 minutes, providing a glimmer of hope amid a challenging retail environment. With modest weekly increases in some regions, their performance in footfall retail remains a critical point for future strategy.

Expert Insights and Future Prospects

Joe Capocci, Huq Industries Spokesperson, commented, "We are encouraged by the positive signs on high streets and major retail centres, which reflect resilience in the market despite the pressures on shopping centres and retail parks."

Regional Spotlight and Consumer Behaviour Shifts

Regional variations highlight that areas like Scotland are redefining performance standards with notable improvements in dwell time. While England’s centres face sharper declines, Scottish centres display vigour through higher engagement levels and consistent footfall statistics. Such contrasts underscore the importance of leveraging footfall data to tailor approaches that resonate with local consumer behaviours.

Concluding Thoughts on Footfall Trends

In conclusion, this week’s review of footfall retail trends paints a vivid picture of a market that is both responsive and adaptive. While traditional sectors show a revival and strong engagement, shopping centres and retail parks must strategise to counter footfall declines. The evolving data in footfall analytics not only tracks recovery – it also informs future investments to bolster customer dwell time and overall retail performance.

The detailed performance insights across retail formats this week encourage agile decision-making. Continued monitoring of footfall statistics will equip stakeholders with essential tools for success in an ever-changing market. With both recovery and challenge present in the data, strategic adjustments remain paramount in the landscape of UK retail.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 7, 2025 Local Retail Centres: Footfall Trends and Retail Insights

Week 7, 2025 Local Retail Centres: Footfall Trends and Retail Insights

UK Local Retail Centres see a 1.7% decline in footfall with a promising 17% dwell time rise, as footfall analytics reveal regional shifts.

Overview

UK Local Retail Centres recorded an average of 13,500 visitors daily (footfall) during the week ending 2025‑02‑23. While the latest week on week figures show a modest decline of 1.7%, the year on year performance continues to reveal a notable drop. The centres have maintained relatively stable short‑term traffic; however, long‑term challenges persist in this complex footfall retail environment.

Regional Performance

A closer examination of regional performance reveals some interesting nuances. In England, the centres performed in line with the national average, experiencing the same 1.7% dip. In contrast, retail centres in Wales recorded an average of 10,700 visitors per day with a 7% weekly decline and a notable annual fall, while Scotland’s centres averaged around 13,000 visitors daily with a small weekly increase of 1%. Northern Ireland leads with the highest daily footfall at 14,900 visitors, despite a modest weekly decline and annual decrease. These insights are further supported by detailed footfall analytics.

Dwell Time Insights

The dwell time metric offers a critical second dimension to consumer behaviour analysis. Overall, visitors spent approximately 94 minutes per visit; centres in England recorded an identical average. Centres in Wales saw a marginally longer visit at 96 minutes on average, while Scotland has experienced a sharp increase in its annual average visit duration despite a slight weekly improvement. Northern Ireland stands out where visitors now spend an average of 117 minutes per visit – buoyed by a robust 17% weekly increase, according to emerging footfall statistics.

Retail News

The latest retail news provides additional context to these performance trends. Recent developments include the national closure of 23 Quiz stores and a well‐known fashion retailer’s plan to axe 35 stores, as reported by Yahoo News UK and Daily Mail respectively. Amid these closures, rejuvenation is visible with a Cheltenham location preparing for the opening of an M&S Centrum Foodhall, as shared through Yahoo News UK. Such divergent news underlines the varied landscape confronting high street and local centre operators, as highlighted by comprehensive footfall analytics.

Economic Context

The broader economic context further compounds these challenges. Economic indicators for the UK reveal that consumer confidence continues to wane and that rising wages are not translating into proportional consumer spending. These sentiments are echoed by several reliable sources and have ramifications for overall footfall retail performance.

Weather Impacts and Final Thoughts

Recent weather conditions have also influenced performance. Parts of northern England experienced rare freezing rain combined with snow and sleet over the past weekend, while heavy snowfall and downpours affected travel and retail activities earlier in the week. These weather events likely contributed to some of the footfall challenges noted, particularly in the regions most impacted.

Joe Capocci, Huq Industries spokesperson, commented, "We are encouraged by the relative stability in weekly footfall figures despite the ongoing longer-term challenges. The increase in dwell times in regions such as Northern Ireland is particularly promising, as it indicates that visitors are engaging more with their surroundings once they arrive. At the same time, the notable annual declines remind us that external economic pressures and shifting consumer preferences continue to affect overall performance. Our ongoing analysis aims to provide deeper insight into these trends to assist our industry partners in navigating the current market conditions."

In conclusion, while UK Local Retail Centres have demonstrated a measure of short-term stability in visitor numbers, the broader backdrop of annual declines, mixed regional performance and evolving consumer behaviour indicates that the recovery path remains complex. The Benchmark will continue to monitor these trends closely and deliver further insights using comprehensive footfall data.

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 7, 2025 UK Shopping Centres Performance – A Deep Dive with Location Analytics

Week 7, 2025 UK Shopping Centres Performance – A Deep Dive with Location Analytics

UK Shopping Centres' Location Analytics show a week‑on‑week uplift and modest year‑on‑year gains, drawing 32,200 daily visitors.

Performance Overview

UK Shopping Centres demonstrated an overall uplifting trend during the week ending 23 February 2025 with an average daily footfall of 32,200 visitors. This performance marks a week‑on‑week uplift as well as a moderate year‑on‑year improvement, suggesting that shoppers are returning in greater numbers to the nation’s retail environments using proven Location Analytics.

Detailed Performance Trends

A closer look at the week‑on‑week and year‑on‑year comparisons reveals that centres are enjoying a generally positive trajectory even as some key indicators such as dwell time have experienced a slight dip over the week. The average visit duration across UK centres was recorded at 121 minutes. While recent figures suggest a small decline in weekly dwell time, the long‑term trend points to a sharp increase in visitor engagement when compared year‑on‑year.

Regional Variations

When dissected regionally, there are notable variations. Centres in England led the pack with an average daily footfall of 34,800, as both week‑on‑week and year‑on-year growth remained clearly positive with nearly 123 minutes of dwell time supporting enhanced visitor engagement. In contrast, Northern Ireland’s centres welcomed 12,100 visitors on an average day, with an impressive 245-minute average visit duration.

Challenges in Scotland and Wales

Scottish centres recorded an average daily footfall of 20,000, with recent data indicating a modest softening and an average dwell time of 83 minutes, marking declines over both short‑term and longer‑term periods. Similarly, centres in Wales experienced an average of 7,400 visitors daily. The weekly trend shows a noticeable downturn in footfall, and even though the dwell time remains at 68 minutes, recent weekly figures have softened, despite a sharp year‑on‑year increase.

Operational Changes in Retail

The retail landscape has been subject to significant operational changes that could be influencing footfall figures. Recent retail news has highlighted both closures and new openings, adding further nuance to the data. For example, reports detailed a closure at a high street fashion chain in Peterborough and several recent closures at a major Sheffield centre, while a global sports brand exited a prominent Scots centre.

Economic Pressures and Weather Impacts

Economic factors continue to exert pressure on the retail sector. Recent reports indicate that consumer confidence remains subdued due to rising costs, while debates continue over whether rising wages will boost spending. Additionally, weather conditions played a role during the analysed week; parts of the UK experienced unusual patterns including freezing rain, snow in northern England, and heavy downpours, which temporarily affected travel and shopping centre performance.

Industry Insights and Future Outlook

Joe Capocci, spokesperson for Huq Industries, observed, “While the data reflects a generally positive trend across UK shopping centres, these figures highlight the importance of understanding regional factors and external influences such as economic conditions and adverse weather.” He added that stakeholders must remain well‑informed with clear, actionable insights. Despite some challenges and regional disparities, the overall picture for UK Shopping Centres remains encouraging as centres work to boost engagement and dwell time.

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 7 2025 Major Retail Centres Footfall Data

Week 7 2025 Major Retail Centres Footfall Data

UK Major Retail Centres footfall retail data shows a modest 1.6% rise, drawing shoppers back to high streets.

UK Major Retail Centres have recorded a steady rise in footfall, as revealed by detailed footfall analytics for the week ending 23 February 2025, with an overall average daily figure of 72,900. The data indicates a modest week‐on‐week increase of 1.6% and an 11% increase compared with the same week last year, reflecting a cautiously optimistic recovery as shoppers return to high streets.

Regional Breakdown

Breaking the footfall statistics down regionally, centres in England observed an average daily footfall of 72,300, registering a healthy week‐on‐week rise of 2.4% alongside a nearly similar year‐on‐year improvement of 9.7%. In Wales, the daily average stands at 61,200, with a positive weekly lift of 10.3% and a sharp increase compared to the previous year. Meanwhile, centres in Northern Ireland recorded a higher daily average of 96,700 with a recent decline of 10.4%, although year‐on‐year performance shows a sharp increase in shoppers, and Scottish centres, averaging 82,200 visitors per day, experienced a modest week‐on‐week decline of 5.8% with a solid year‐on‐year increase of 7.8%.

Consumer Dwell Times

Alongside footfall, dwell time data further underscore evolving consumer behaviours. Across all centres, visitors spent an average of 112 minutes per visit. In England, the duration remained steady at 112 minutes, recording incremental week‐on‐week and year‐on‐year increases of 1.8% and 10.9% respectively.

Centres in Wales recorded an average visit duration of 99 minutes, with a week‐on‐week increase of 15.1%, despite softer annual performance. Northern Ireland centres averaged 100 minutes per visit, though both the latest week’s duration and the year‐on‐year trend exhibit a slight decline. Scottish centres demonstrated resilience with an average visit time of 124 minutes; even though the previous week saw a 9.5% decrease, the annual trend shows a sharp increase.

Retail Industry Developments

Recent retail industry developments provide further context to these footfall retail trends, with a huge fashion brand set to open a new Birmingham store at The Fort shopping centre as reported by MSN, marking a significant shift in that market sector. Concurrently, a major fashion retailer has announced plans to axe 35 stores in the coming days, while a report from Yahoo News UK warns of potential job cuts at a high street chain in Greater Manchester. Further disruptions have been flagged by store closures with chains such as Iceland and Superdry, indicating that the sector is recalibrating amidst evolving consumer and economic dynamics.

Economic and Weather Conditions

UK economic indicators add to the overall picture, with consumer confidence dipping to new lows as rising costs continue to bite, according to Grocery Gazette. Discussions are ongoing on whether rising wages will translate into increased consumer spending, as featured in Retail Week, while additional data from Investment Week, Investing.com UK, and Business Matters highlight subdued retail sales and ongoing challenges within major shopping hubs. Weather conditions played a role too, with parts of northern England experiencing freezing rain and snow, as noted by Manchester Evening News, and with substantial snowfall posing challenges reported by Birmingham Live.

Expert Comment & Conclusion

Joe Capocci, spokesperson for Huq Industries, commented, "The latest data reflects a cautious uplift in consumer activity as observed in footfall counting across major retail centres in the UK." Although regional variances continue to emerge, these results provide encouraging signals as retailers adjust to a landscape shaped by economic pressures and evolving consumer habits. In conclusion, the recent footfall and dwell time data illustrate a mixed yet generally positive picture for UK retail centres, with regional insights amid economic and weather challenges demonstrating promising signs as shoppers begin to return.

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 7, 2025: High Streets & Town Centres Footfall Data Reveal Modest Dip & In-Store Engagement Rise

Week 7, 2025: High Streets & Town Centres Footfall Data Reveal Modest Dip & In-Store Engagement Rise

Week 7, 2025 footfall data shows a modest 5% dip year on year, but footfall analytics reveal a 15% increase in dwell times on high streets.

Introduction

UK High Streets and Town Centres continue to tell an evolving story as the latest footfall data for Week 7, 2025, reveals a mixed picture characterised by a modest dip in overall daily visits alongside an improvement in the quality of customer engagement. Average daily footfall across these prime retail locations stands at 28,300, representing a slight weekly decline and remaining lower than figures recorded a year ago. Interestingly, while fewer visitors are setting foot on these streets, those who do are spending more time in store—a development signalling improved in-store engagement over the same period last year.

Regional Analysis

At a regional level, England displays a broadly similar trend to the national average. With an overall average of 28,900 daily visitors, the English high streets experienced a minor week-on-week dip, yet customers now spend approximately 96 minutes per visit. This improvement, as shown by footfall analytics, is encouraging compared to last year.

In Scotland, although the average daily footfall registers at 24,500—a figure somewhat lower than in England—a modest weekly uplift provided a brief counterpoint to overall subdued year-on-year performance. The average dwell time has eased to 78 minutes, suggesting a slight softening in engagement. These insights from footfall data offer further clarity on local retail dynamics.

Meanwhile, Wales presents a distinct scenario with an average daily footfall of 16,000. Visitors in Wales invest more time in each shopping trip, spending an average of 102 minutes despite year-on-year figures indicating softer performance. These footfall statistics highlight the varied performance across regions.

Economic and Weather Influences

These nuanced trends are unfolding amid wider uncertainty in the retail sector. Recent industry news highlights ongoing challenges for high street retailers as several major chains undergo significant restructures. Economic caution is compounded by adverse weather conditions—with parts of northern England experiencing rare freezing rain, snow, and sleet, and an Atlantic storm bringing substantial snowfall and heavy downpours that have affected footfall counting efforts.

Industry Restructures and Retail Challenges

Recent developments have seen critical shifts within the industry. A rescue deal has saved 42 Quiz stores from closure, while another well-known fashion brand is expected to shutter 35 stores, marking a significant setback for high streets. Additional closures, including those affecting WHSmith, emphasise the pressures on retail—a narrative underscored by recent footfall data and footfall analytics.

Economic Context and Consumer Behaviour

The broader UK economic landscape provides further context for these trends. Consumer confidence has plummeted due to rising costs and increasing concerns over energy and NIC expenses. Although some reports suggest rising wages might boost spending, the overall sentiment remains one of restraint, as reflected in sluggish retail sales and supported by recent footfall analytics.

Conclusion

Joe Capocci, spokesperson for Huq Industries, commented, "While the overall footfall figures suggest a challenging week for high street retailers, we are encouraged by the increase in dwell times which indicates that shoppers who do visit are engaging more deeply with the retail environment." In conclusion, the Week 7, 2025 data shows a slight downturn in overall footfall across UK High Streets and Town Centres, but increased visit duration provides a silver lining. Stakeholders may find comfort in improved customer engagement as a factor that could mitigate some retail pressures. Moving forward, the retail industry will be closely watching both economic trends and weather-related disruptions to better predict and respond to future footfall patterns.

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 7, 2025 Retail Parks: Steady Footfall Amid Regional Variations

Week 7, 2025 Retail Parks: Steady Footfall Amid Regional Variations

UK Retail Parks Week 7, 2025 show steady footfall with Scotland up 5.2% week-on-week. Footfall data reveals stability amidst evolving retail trends.

UK retail parks maintained a steady pace during Week 7, 2025, with average daily footfall holding at 16,700 visitors. Although short‐term figures have shown little variation from the previous period, the long‐term view indicates a notable decline compared with the same period last year. This measured performance points to both stability in the short term and lingering challenges over the longer timeframe that are affecting the retail sector overall. Reliable footfall analytics confirm these observations.

Regional Breakdown

Breaking down the regional data, retail parks in England continue to draw an average of 17,000 visitors per day. Despite a slight softening in week on week performance and a notable decline over the year, the figures remain resilient amid persistent market pressures and competitive footfall retail conditions. In Wales, the daily average stands at 12,000 visitors. Here, the market enjoyed a modest weekly uptick of 2%, even though the year on year trend reveals a notable decline.

Meanwhile, Scotland’s retail parks recorded approximately 16,300 visitors per day and experienced a clear week on week increase of 5.2%. The pace of change in Scotland appears more robust, while the year on year decline remains more moderate when compared to the other regions. These footfall data findings highlight regional variations that are key for understanding overall footfall statistics.

Dwell Time Insights

Turning to dwell time – a secondary metric offering insight into visitor engagement quality – the overall figure remained at 71 minutes per visit, with a small weekly improvement and moderate yearly increase. In England, the average visit duration held consistently at 71 minutes, recording steady improvements over both short and longer timeframes. In contrast, retail parks in Wales experienced a slightly lower average visit duration at 69 minutes with a week on week decrease, although over the year the figures lift more sharply.

Scotland once again stands out with an average visit duration of 73 minutes, benefiting from a notable recent rise and a sharp year on year increase. This enhanced experience for visitors supports the narrative behind current footfall retail trends.

Retail Industry Adjustments

This data should be considered in the context of ongoing retail industry adjustments. Several recent news stories reported closures of well-known retailers that traditionally operate from retail park locations. For instance, an article from Metro detailed the closure of an Iceland store in Derby, a move that comes as part of a wider trend in store closures across the country. Similarly, Daily Express reported on closures at outlets associated with WHSmith, New Look and Homebase.

Other coverage by The Sun highlighted the news of a prominent health store announcing plans for shutdown. These operational changes may be contributing factors to the observed footfall trends as shoppers adjust their routines in response to evolving service offerings.

Economic and Weather Impacts

Recent UK economic news also hints at a cautious consumer mood. An article from Grocery Gazette notes that consumer confidence has reached a new low, with rising costs weighing on household budgeting decisions. This contrasts with discussions in Retail Week, which suggest that while wages are rising, the benefits of these increases have yet to fully translate into consumer spending. Adding further complexity to the economic picture, Investing.com UK recently indicated that retail sales are falling more than initially forecast, supporting the narrative of a restrained consumer market.

Weather conditions over the period have contributed additional context to the retail performance. Reports from Manchester Evening News and Birmingham Live detail episodes of freezing rain, snow, and heavy downpours. Such conditions have likely impacted travel and discretionary shopping, especially in more northerly areas, adding an extra layer of challenge for retail park managers. The changing weather has undoubtedly affected footfall statistics and overall consumer patterns.

Industry Commentary and Conclusion

Joe Capocci, spokesperson for Huq Industries, commented on the latest figures: “While we continue to see overall stability week on week, the underlying long‐term decline highlights a gradual change in consumer behaviour. The regional disparities, especially the performance in Scotland, underscore the importance of regional dynamics in the retail market. We remain committed to delivering high‐quality location intelligence to help our clients navigate these challenges.”

In conclusion, the latest data for Week 7, 2025 underlines stable yet evolving consumer patterns in UK retail parks. With overall footfall levels remaining steady despite underlying yearly declines, and with notable variations emerging across England, Wales, and Scotland, this period reflects both continuity and change. Coupled with insights from the retail industry, economic and weather news, the sector faces challenges but also opportunities as it adapts to shifting consumer patterns and external pressures.

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 7 Weekly Wrap: UK Footfall Trends Revealed

Week 7 Weekly Wrap: UK Footfall Trends Revealed

UK retail footfall data highlights a 17% increase in dwell time in Northern Ireland amid challenging winter weather, signalling resilient consumer engagement in a shifting market.

Introduction

This week's analysis of UK retail shows fluctuating footfall trends across various centre types. In particular, recent footfall data reveals mixed short-term movements alongside encouraging engagement statistics. The report, based on detailed footfall analytics, offers clear insights into the evolving retail scene.

Regional Performance in Local Retail Centres

Local retail centres recorded an average of 13,500 daily visitors with a modest decline, though regional trends varied. England experienced a 1.7% dip, while Wales saw a steeper 7% drop. Read more details on how footfall statistics and regional performance continue to shift.

Insights from UK Shopping Centres

UK shopping centres maintained robust performance, drawing an average of 32,200 daily visitors. Their footfall retail figures reveal slight week-on-week upticks, while dwell times remain high, especially in Northern Ireland where visitors spent an impressive 245 minutes on average. Detailed footfall data provides further clarity on these trends and reinforces the importance of in-store engagement.

Major Retail Centres on the Rise

Major retail centres are showing promising momentum with an average of 72,900 daily visitors. Regional data highlights England’s steadiness and Wales’s healthy weekly lift, despite Northern Ireland experiencing a temporary decline. For further insights into footfall counting approaches and trends, please see the comprehensive analysis here.

High Streets and Town Centres: A Mixed Bag

High streets and town centres recorded an average of 28,300 visitors per day against last year’s higher figures. Despite a short-term drop in footfall, increased dwell times suggest that shoppers are engaging more deeply. Read more details on how footfall analytics are assisting retailers to understand these underlying shifts.

Performance at Retail Parks

Retail parks have drawn a consistent 16,700 daily visitors, even as annual comparisons reveal subdued growth. Regional nuances show steady performance with England and Scotland supporting the overall trend. For a deeper look at the footfall statistics within retail parks, refer to this comprehensive overview.

Economic Pressures and Weather Impacts

The overall retail scene is subject to operational changes, cautious consumer sentiment, and severe winter weather. Freezing rain, snow, and sleet have disrupted commuting patterns, while economic challenges compound these pressures. Such dynamics underscore the need for agile responses when assessing footfall data across sectors.

Industry Voices and Expert Commentary

Joe Capocci, Huq Industries spokesperson, stated, "Our footfall counting methods help retailers interpret nuanced shifts in consumer behaviour during challenging weather conditions and economic uncertainty. Retailers must embrace detailed footfall analytics to adjust strategies dynamically." His insights reinforce the imperative for retailers to respond proactively to both market disruptions and positive engagement trends.

Concluding Thoughts

As Week 7 unfolds, the retail landscape offers a complex yet informative picture. Observations from major centres such as UK shopping centres and high streets underline the importance of balancing footfall retail numbers with qualitative engagement measures. Overall, further analysis of reliable footfall data will be crucial for brands and partners seeking to thrive in a competitive and ever-changing market.

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 6, 2025 Local Retail Centres Footfall Report & Analysis

Week 6, 2025 Local Retail Centres Footfall Report & Analysis

Week 6, 2025 sees UK Local Retail Centres report a modest 3.7% week-on-week footfall data improvement amid cautious recovery.

Overview

UK Local Retail Centres experienced steady activity during Week 6, 2025, with overall footfall averaging 13,900 daily visits. The latest figures from Huq Industries illustrate a modest week on week increase of 3.7% and a 19.2% decline when compared to the same period last year. While this marked week on week improvement suggests an ongoing recovery, the long‐term comparison indicates that visitor numbers still trail behind previous levels.

To ensure our analysis is comprehensive, we have integrated robust footfall data to provide in-depth footfall retail insights. Detailed footfall statistics and precise footfall counting methods support the findings throughout this report.

Regional Performance

Examining the performance across regions reveals some interesting contrasts. England’s centres maintained the overall average at 13,900 daily visitors, registering a week on week boost of 3.6% alongside a year on year decline of 18.1%. In Scotland, with an average daily footfall of 12,900, centres reported a slightly higher weekly increase of 5.5% although they experienced a notable decline compared to last year. Wales’ centres, averaging 11,700 daily visitors, stood out with the most pronounced recent weekly uplift of 11.7%, balanced against a similarly notable longer-term reduction in visitation. Northern Ireland’s centres led in terms of volume at 15,300 average daily visits but exhibited only a marginal week on week improvement of 0.9% while also enduring a notable year on year drop. These regional differences underscore varying local market dynamics and consumer responses within the broader UK retail landscape.

Dwell Time Trends

Dwell time data adds further nuance to the performance narrative. The average visit duration across all centres increased to 94 minutes, representing a week on week growth of 1.1% and a sharp increase when compared to the corresponding period last year. In England, a slight softening in dwell time by 1.1% was observed on a weekly basis; however, the annual figures show a marked improvement, suggesting that while consumers might be spending marginally less time in a given week compared to the previous one, they are engaging more deeply overall relative to last year. Conversely, centres in Scotland experienced a healthy weekly boost in dwell time of 13.7%, implying growing consumer engagement, whilst in Wales there was a decrease of 12.8% in average visit length, indicating that a change in consumer behaviour might be at play. Northern Ireland’s centres also displayed a robust improvement in visit duration on a weekly basis, albeit with only a modest change in the year on year comparison.

Retail Developments

Recent developments in the retail sector further contextualise these findings. For instance, a report from the Daily Express highlighted that New Look is set to close its town centre shop, a move that could affect local footfall patterns as retailers adjust to market challenges (Daily Express). In a contrasting development from Birmingham, a popular fashion brand has unveiled its new Bullring store following the closure of a previous well-regarded unit, as reported by Yahoo News UK (Yahoo News UK). Other industry headlines, such as the one from The Sun concerning the closure of a high street store, and another from MSN discussing a major store opening with ambitious plans at The Fort shopping centre, both point to an evolving retail environment where changes in store footprints are influencing local retail dynamics. Additionally, WHSmith’s confirmation of a closure at one of its city centre locations, as detailed by the Daily Express (Daily Express), further illustrates the shifting retail landscape.

Economic Indicators

Economic indicators complement the footfall data, suggesting a mixed sentiment in consumer spending. For example, FashionUnited UK reported that January storms boosted online and non‐essential spending, potentially mitigating some of the declines found in physical store visits (FashionUnited UK). Similarly, Retail Week discussed the impact of rising wages, questioning whether increased incomes will translate into more robust consumer spending in the near future (Retail Week). Other economic reports, such as those from Investing.com UK and EDP24, have also noted cautious consumer behaviour and measured growth in retail sales, a sentiment echoed in the positive albeit tentative remarks about the UK’s economic revival in The Irish News (The Irish News).

Weather Impact

Weather conditions during the week may also have played a part in the observed retail performance. Reports from The Mirror indicated that the UK experienced a deep freeze with temperatures dropping as low as -3°C, followed by snow in several regions (The Mirror). The rarity of freezing rain, as forecasted by Metro.co.uk, further reminds us that challenging weather conditions can have a tangible impact on footfall and shopping behaviours (Metro.co.uk).

Industry Perspectives

Joe Capocci, Huq Industries spokesperson, remarked, "The latest data reflects a cautious yet discernible recovery in consumer footfall activity. Although regional variations remain evident and some sites are still below their performance levels from last year, we are observing increasing visit durations that point towards enhanced customer engagement. Retailers and local centres alike will benefit from understanding these nuanced shifts as they continue to adapt to both evolving consumer behaviours and external factors such as weather conditions and economic pressures."

Conclusion

In conclusion, while Week 6, 2025 has shown encouraging week on week improvements in both footfall and dwell times within UK Local Retail Centres, overall recovery remains tempered by significant year on year declines. The interplay of regional differences, evolving retail industry strategies and the impact of current economic and weather conditions suggest that local centres are navigating a complex landscape. Retailers and stakeholders must continue to monitor these trends closely to adjust strategies in a dynamic environment.

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in high-quality data insights on footfall, consumer behaviour, and retail performance. Traditional analytics show how stores are performing, but Huq goes further—uncovering why. By leveraging advanced analytics and an extensive location data network, Huq Industries helps retailers and analysts understand the real drivers of success, predict future trends, and make data-driven decisions to optimise store performance in an evolving high street and town centre landscape.

Week 6, 2025 Major Retail Centres: Robust Insights from Location Analytics

Week 6, 2025 Major Retail Centres: Robust Insights from Location Analytics

UK Major Retail Centres report modest, sub-20% improvements in footfall and dwell time – a signal of resilient UK retail and evolving consumer spending.

The latest data from Huq Industries shows that UK Major Retail Centres are experiencing modest improvements in visitor footfall and dwell time for the week ending 2025‑02‑16. Using advanced Location Analytics, the overall average daily footfall now stands at 71,000, reflecting gradual enhancements compared to the previous week and marked year‐on‐year improvements in UK retail trends and footfall data insights. Visitor engagement remains robust with the average visit lasting 111 minutes, even though there has been a slight softening in this score on a weekly basis.

Regional Breakdown

Breaking the figures down by region, Scotland continues to outperform with a robust daily average of 85,100 visitors. Scottish retail centres have seen steady week on week increases in footfall and a healthy year‐on‐year improvement. Visitors in Scotland also spend more time in centres, with an average of 137 minutes per visit. This substantial improvement in dwell time highlights the region’s growing engagement with the retail environment. In contrast, Welsh retail centres report a daily average of 56,100 visitors. Although there has been a modest uplift in footfall and a sharp increase over the year, visitor dwell time in Wales is comparatively lower at 86 minutes per visit, and the year‐on‐year figures indicate a notable decline in the length of visits.

Northern Ireland and England Trends

Northern Ireland is another standout with retail centres attracting 109,300 daily visitors. The region has experienced both a healthy week on week boost and a sharp increase over the previous year. Notably, the average visit duration in Northern Ireland is among the highest at 140 minutes, despite a slight softening in this metric on a weekly basis. England’s figures are consistent with the overall trends, recording a daily footfall of 70,000 with modest week on week and annual increases, and an average visit duration of 110 minutes per visit. These insights into consumer engagement and dwell time further enhance our understanding of the UK retail industry.

Recent Retail News and Economic Sentiment

Recent retail news has provided additional context for these figures. For instance, a huge fashion brand is set to open a new store at The Fort shopping centre in Birmingham, replacing the old Wilko outlet that closed three years ago, signalling a reinvestment in high street retail MSN. In another development, Starbucks recently announced the opening of a new state-of-the-art store in a Livingston shopping centre, which is expected to generate 20 new jobs and enhance the local retail landscape further The Herald. Additionally, changes in the retail roster continue in other regions with examples such as Sports Direct in Nottingham transitioning to a new branch and a closing down sale in York’s Coppergate Shopping Centre, all reflecting broader dynamics in consumer spending and regional retail trends Yahoo News UK Yahoo News UK.

Economic sentiments are currently mixed within the industry. Recent reporting has suggested that while January saw a boost in online and non‐essential spending driven by adverse weather events, retailers have been cautiously optimistic about the period ahead. According to a report by FashionUnited UK, the severe weather conditions earlier in the month contributed to a shift in consumer spending patterns. However, other voices in the industry remain circumspect. For example, Retail Week has warned that while wages are rising, the effect on consumer spending remains uncertain. Meanwhile, conflicting data from Investing.com UK suggests a more subdued retail sales environment, indicating that consumer appetite may be tempered despite the year‐on‐year improvements in footfall.

Weather Impact and Final Thoughts

Weather too has played its part in shaping retail outcomes this week. The UK experienced a deep freeze with temperatures dipping as low as -3°C, and forecasts from the Met Office warned of possible freezing rain in some regions. These harsh conditions, as reported by The Mirror and Metro.co.uk, have likely contributed to the increased dwell time seen in several regions as shoppers took extra care navigating the wintery conditions.

Joe Capocci, Huq Industries spokesperson, remarked, "The consistency in the improvements of both footfall and visit duration across most regions reinforces the resilience of UK retail. Our data reflects subtle but positive shifts, even when external factors like inclement weather and evolving consumer sentiment complicate the picture."

In conclusion, the latest footfall data from Huq Industries offers cautious optimism for UK retail centres across major regions. While overall visitor numbers and engagement metrics continue their steady climb, regional variations highlight areas where further attention may be needed. Coupled with evolving retail strategies and shifting consumer fortunes influenced by economic and weather-related factors, the industry continues to adapt in a challenging environment.

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in high-quality data insights on footfall, consumer behaviour, and retail performance. Traditional analytics show how stores are performing, but Huq goes further—uncovering why. By leveraging advanced analytics and an extensive location data network, Huq Industries helps retailers and analysts understand the real drivers of success, predict future trends, and make data-driven decisions to optimise store performance in an evolving high street and town centre landscape.