UK Retail Parks – Week 9 2025 Footfall Performance Update

UK Retail Parks – Week 9 2025 Footfall Performance Update

UK retail parks see a modest 3% drop in average daily footfall, with visitors spending 1.4% more time on site. footfall retail trends indicate improved quality of visit.

Share on LinkedIn

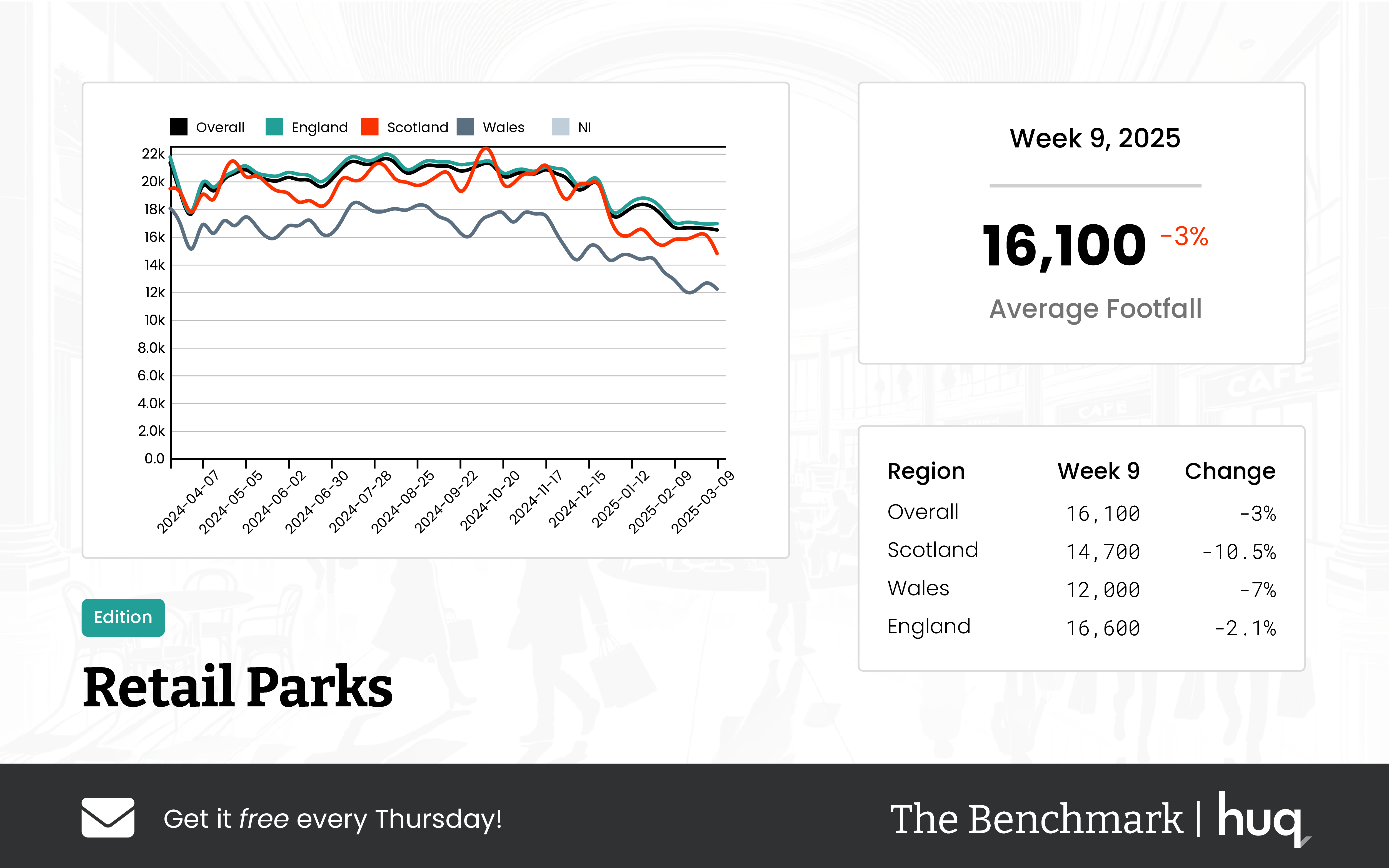

Huq Industries’ latest data reveals that UK retail parks experienced a slight overall drop in average daily footfall to 16,100 visitors, marking a 3% week-on-week decrease and a 19.1% decline year-on-year. Despite the reduced traffic, the data shows a positive trend: shoppers now spend more time at the parks, with the average visit duration rising to 74 minutes—a week-on-week gain of 1.4% and a 15.6% improvement from the same period last year.

A deeper look into regional performance shows notable variations. England’s retail parks recorded an average of 16,600 visitors daily, with only a minor 2.1% week-on-week drop and an 18% year-on-year decline, suggesting some resilience. Scotland, on the other hand, saw a lower average of 14,700 visitors and a more significant 10.5% drop over the week, accompanied by a notable annual decline. Wales recorded the lowest daily average at 12,000 visitors, along with a 7% weekly fall and a similar year-on-year decrease.

Dwell time trends suggest evolving consumer behavior, as shoppers are spending more time at retail parks. In Scotland, visitors now stay for an average of 81 minutes—an 8% week-on-week increase—while England and Wales report average visit durations of 73 and 66 minutes, respectively. This increased dwell time may be offsetting the decline in footfall by offering a better quality of visit, hinting at a shift from quantity to quality within the retail park experience.

Joe Capocci, Huq Industries Spokesperson, commented on these findings, stating, "Overall, the current trends suggest that while fewer consumers may be visiting, those who do are engaging more deeply, potentially paving the way for a reimagined retail experience in the UK."

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 9, 2025 High Streets & Town Centres: A location analytics Perspective

Week 9, 2025 High Streets & Town Centres: A location analytics Perspective

Week 9 data shows a modest overall decline in visitor numbers across high streets and town centres, with location analytics revealing subtle footfall trends amid a challenging retail landscape.

Share on LinkedIn

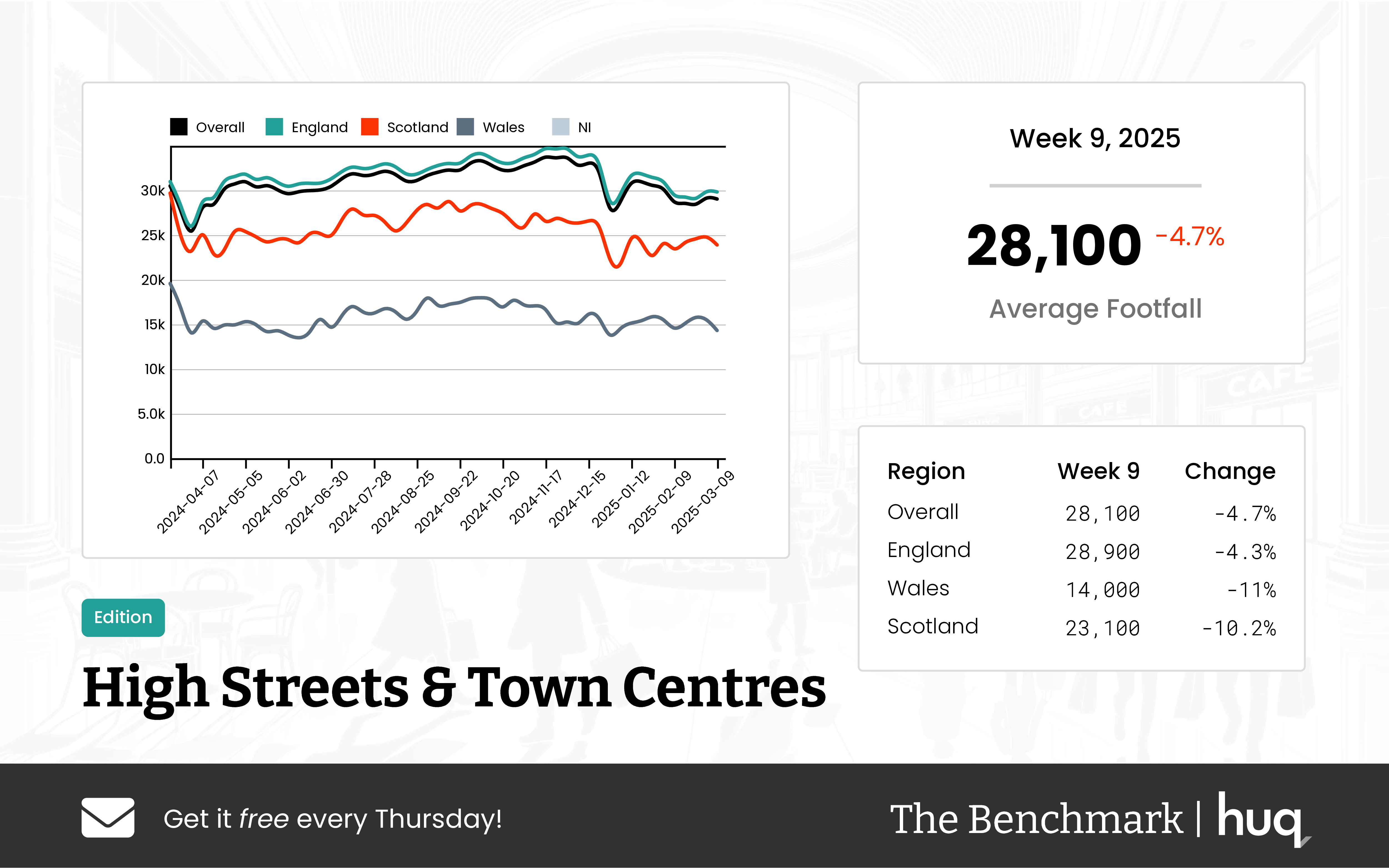

The latest figures from The Benchmark indicate a modest decline in daily footfall across UK High Streets and Town Centres during Week 9, 2025. Overall, visitor numbers have softened when compared to both the previous week and the same period last year, underscoring evolving retail performance amidst a challenging environment.

Regional analysis highlights clear distinctions across the UK. English centres are displaying resilience with less pronounced declines in daily footfall, in contrast to the more significant reductions seen in centres located in Wales and Scotland. These marked differences suggest that the retail environment in Wales and Scotland is facing tougher conditions.

Despite the downturn in overall footfall, dwell time data offers an interesting insight into consumer engagement. The average duration of visits remains robust throughout the regions. In Wales, there has been a modest rise in the time shoppers spend in centres, while Scotland has experienced a sharp increase in dwell time. This suggests deeper engagement by visitors in areas with declining footfall. Conversely, while English centres have seen a slight dip in visit duration on a week-on-week basis, their longer-term performance still holds positive indicators.

Joe Capocci, a spokesperson for Huq Industries, commented, "The most striking change observed in week nine is the notable decline in Welsh and Scottish footfall accompanied by a sharp increase in dwell time. This shows that although visitor numbers are down, engagement per visit is improving."

The evolving retail landscape highlights the need for retailers and high street centre managers to adapt quickly. As consumer engagement patterns shift despite lower footfall, the focus on enhanced in-store experiences and targeted marketing initiatives may well be the key to navigating this complex retail terrain.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 9, 2025 UK Shopping Centres Update: Insights from Location Analytics

Week 9, 2025 UK Shopping Centres Update: Insights from Location Analytics

Recent data reveal a subtle 5% dip in footfall alongside improved engagement. Location analytics highlight evolving footfall trends that shape the overall retail experience.

Share on LinkedIn

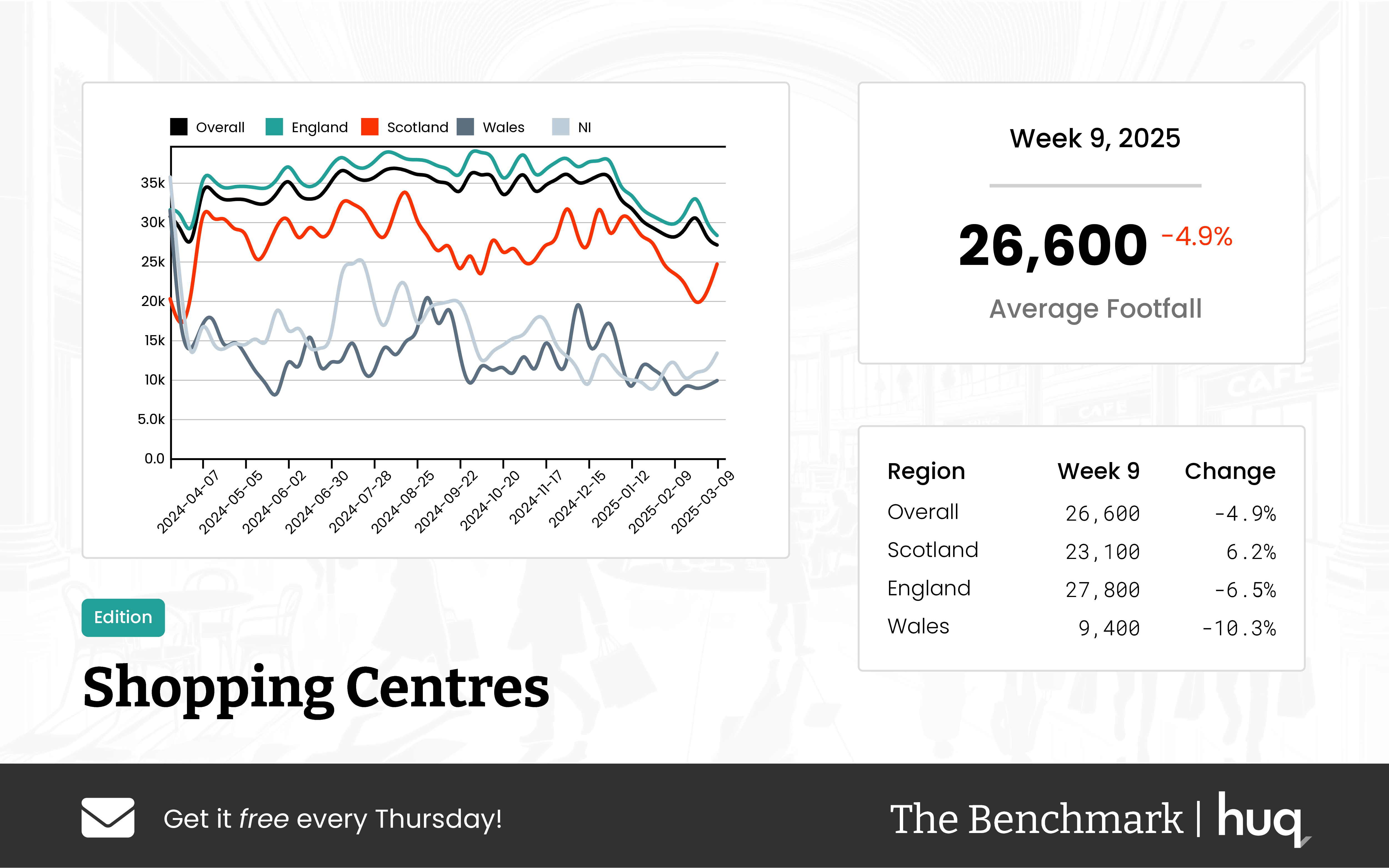

The latest update from The Benchmark leverages cutting-edge location analytics to provide refined insights into retail performance across UK shopping centres. For the week ending 2025-03-09, centres recorded an average daily footfall of 26,600—a slight 5% week-on-week dip and lower numbers compared with the previous year. Yet there’s a silver lining; overall visit duration improved, averaging 117 minutes per visit, underlining enhanced visitor engagement.

Scottish shopping centres stood out with an average of 23,100 visitors each day. While the weekly data indicated a modest increase, the year-over-year figures reveal a significant boost. The average dwell time in Scottish centres was recorded at 90 minutes per visit, albeit showing a slight softening compared with both the previous week and the past year.

In England, the average daily footfall reached 27,800. Despite this, centres experienced a weekly decline and overall footfall remains below last year’s figures. Notably, visit duration in English centres nudged upwards to an average of 120 minutes, bolstered by slight week-on-week improvements and a robust year-on-year growth in dwell time.

In contrast, Welsh centres recorded an average of just 9,400 visitors daily. Both weekly trends and year-on-year analysis indicate noticeable declines in visitor numbers. Although there was a slight uptick in visit duration to an average of 54 minutes, this figure still marks a considerable downturn compared with previous periods.

The evolving trends in dwell time, alongside improvements in overall visit duration, underscore a shift in the retail experience. Even as visitor numbers cooled, these metrics reflect a deeper engagement and a more qualitative shopping experience.

Joe Capocci, spokesperson for Huq Industries, commented on the data: "The sharp increase in Scottish footfall alongside observations in current retail industry developments underlines the need for agile strategies based on our latest data."

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 9 2025 Local Retail Centres Performance Update: Insights from location analytics

Week 9 2025 Local Retail Centres Performance Update: Insights from location analytics

Week 9 data shows a moderate decline in overall footfall alongside improved visit durations. Location analytics reveal a 4% drop and 1% uplift, reflecting evolving footfall trends.

Share on LinkedIn

Experts in location analytics have observed notable changes in retail centre statistics this week. Analysts highlight evolving footfall trends and shifts in visitor behaviour, while store developments continue to influence local market dynamics.

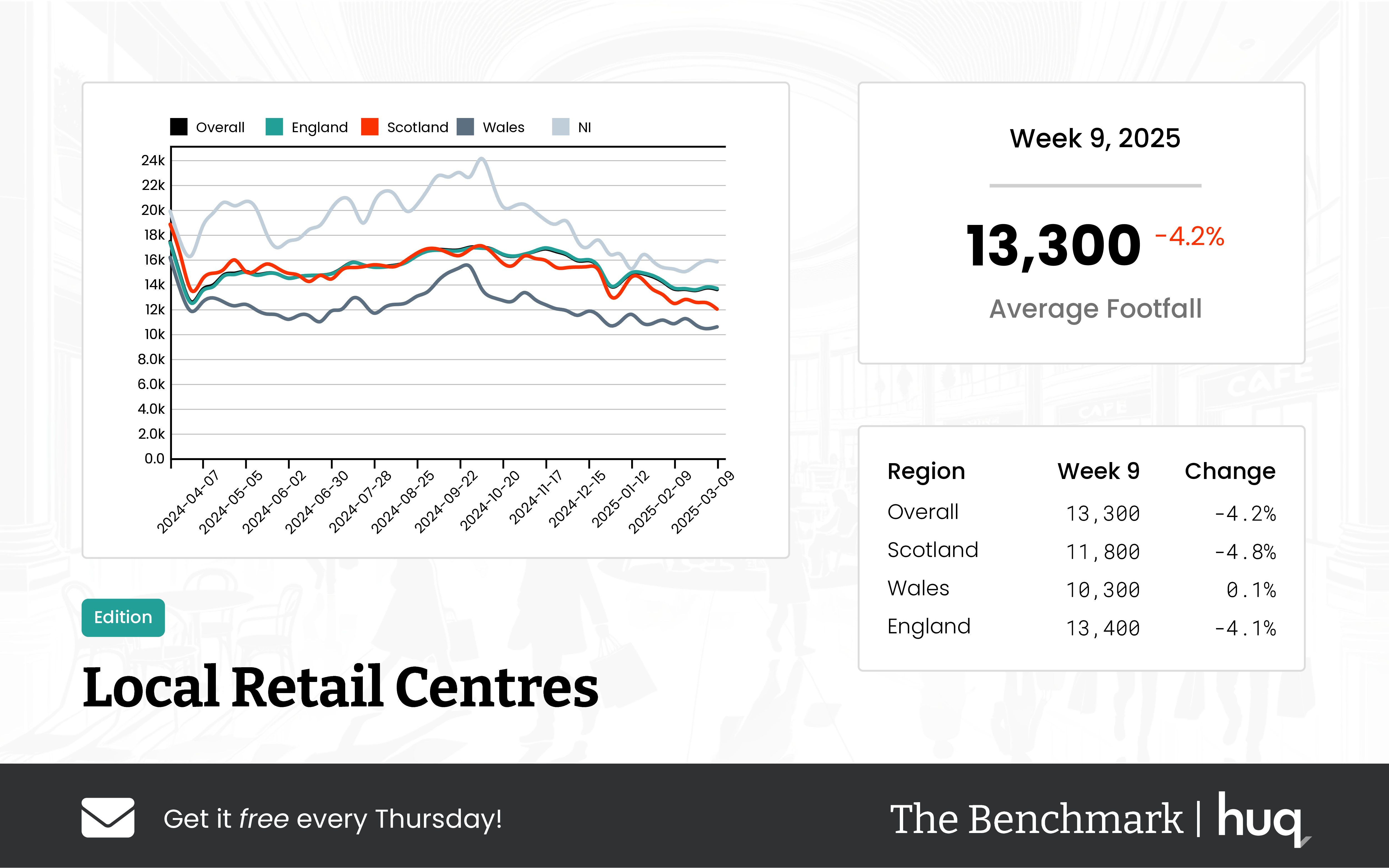

The latest data from The Benchmark reveals a mixed performance across UK Local Retail Centres during the week ending 2025-03-09. Overall, centres saw an average of 13,300 visitors daily, reflecting a moderate week-on-week decline of 4.2% and a year-on-year drop of 15.2%. While footfall numbers have dipped, the quality of visits appears to be on an upward trend as evidenced by the average visit duration, which increased to 94 minutes—up 1.1% from the previous week and showing a marked improvement compared with the same period last year.

Regional Performance

In Scotland, centres recorded an average daily footfall of 11,800 visitors with a weekly decline of 4.8%. Although Scottish visit duration averaged 92 minutes with a week-on-week drop of 10.7%, the year-on-year data suggests a sharp increase in dwell time, indicating visitors are choosing to spend more time when they do visit.

Welsh centres attracted an average of 10,300 visitors per day. The week registered a marginal increase of 0.1% in footfall; however, the year-on-year figures suggest a notable decline. Dwell time in Wales averaged 99 minutes despite a modest weekly decrease of 5.7% and a 9.2% reduction over the same period last year.

In England, the picture is similar with a daily average of 13,400 visitors, representing a 4.1% decline on a week-on-week basis and a 14.1% decrease year on year. The average visit duration in English centres reached 93 minutes, enjoying a slight week-on-week uplift alongside a marked year-on-year improvement.

Industry Comment

Joe Capocci, spokesperson for Huq Industries, commented, "The most striking change in our data—a 15.2% year-on-year decline in overall footfall—is a clear signal of shifting consumer patterns."

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

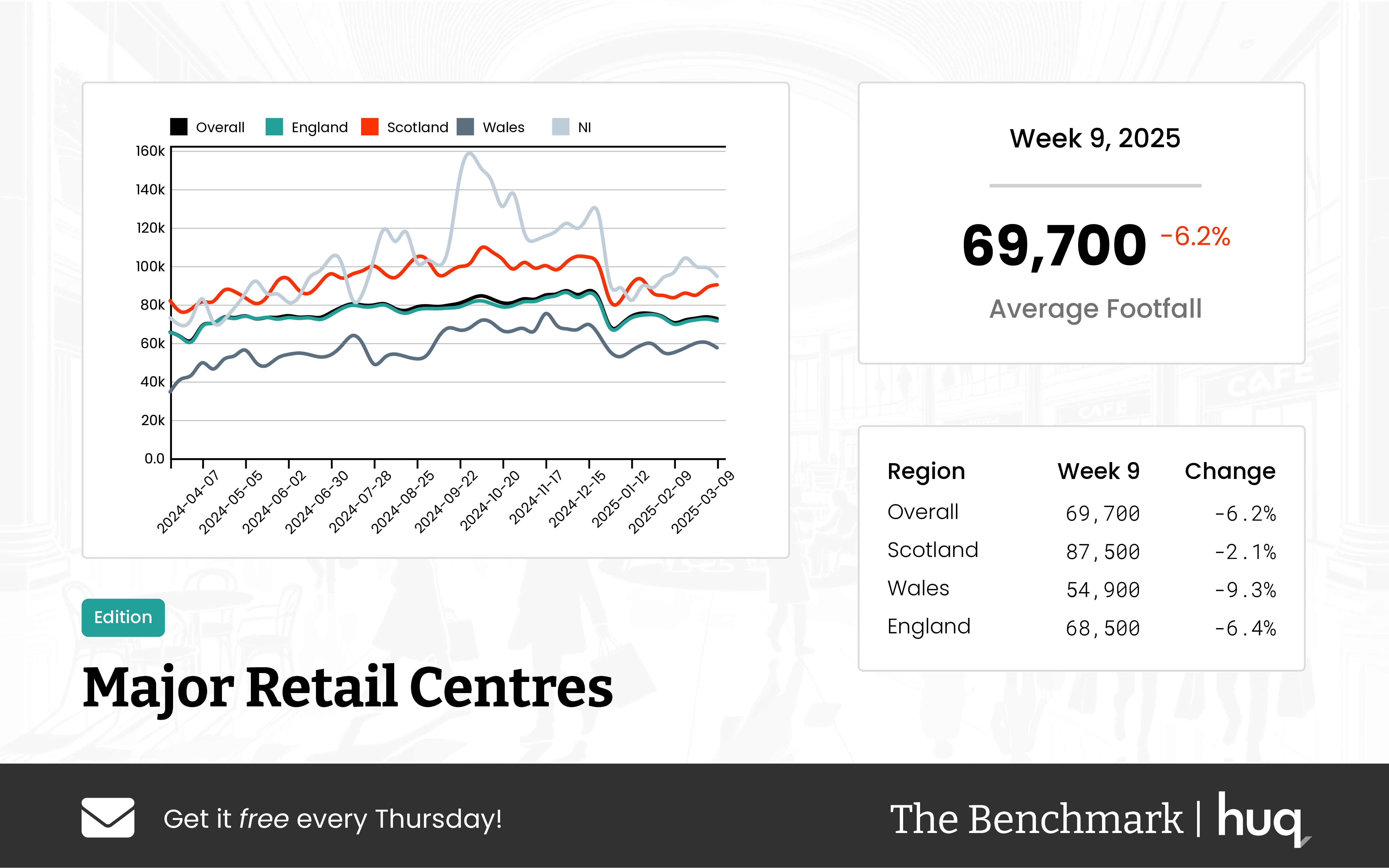

Week 9 2025 Major Retail Centres Performance Update: Location Analytics Insights

Week 9 2025 Major Retail Centres Performance Update: Location Analytics Insights

Overall footfall data reveal steady retail performance with a 6.2% drop week-on-week amid long-term growth. Discover location analytics insights.

Share on LinkedIn

The latest review from The Benchmark Tracker for week 9 shows mixed performance across the UK’s Major Retail Centres. Leveraging advanced location analytics, retail experts have uncovered trends that paint a picture of steady footfall and robust visitor metrics, despite a slight recent dip.

Overall Performance

Across all centres, the average daily footfall reached 69,700. Although this marks a moderate week-on-week decline of 6.2%, the long-term trend remains positive with a strong annual increase of 9.8%. This suggests that while current activity has softened somewhat, longer-term growth is continuing at a healthy pace.

Regional Breakdown

• In Scotland, centres welcomed an average of 87,500 visitors per day. Despite a small week-on-week decline of 2.1%, the region boasts an impressive annual growth of 13.8%, reflecting a resilient and engaged visitor base.

• In England, the average daily footfall was slightly lower at 68,500, with a week-on-week drop of 6.4%. However, there is an encouraging annual increase of 8.3%, signaling that recovery is underway.

• In Wales, retail centres experienced more significant short-term challenges, with a 9.3% decline bringing the daily average to 54,900 visitors. Nevertheless, long-term trends remain positive with clear growth observed over the year.

Dwell Time Metrics

Complementing the visitation figures, dwell time — the duration consumers spend in these retail environments — underscores the quality of these visits. Overall, consumers are now spending an average of 116 minutes per visit, marking an increase of 4.5% from the previous week and a 16% improvement compared to last year.

Scotland leads again with an impressive average of 129 minutes per visit, while centres in England and Wales recorded averages of 115 and 100 minutes respectively, demonstrating varied consumer engagement across regions.

Joe Capocci, a spokesperson for Huq Industries, commented on the dynamic nature of the current market: "The contrast between Scotland’s modest decline and the sharper dip observed in Wales underscores the disparity in footfall performance across UK regions."

These insights from location analytics provide a clear snapshot of retail performance across the UK’s major centres. While short-term dips are evident, persistent long-term growth, coupled with sustained consumer engagement, signal a robust outlook for the retail sector.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 9 Weekly Wrap: UK Retail Trends with Location Analytics

Week 9 Weekly Wrap: UK Retail Trends with Location Analytics

UK retail centres see a 5% drop in footfall with rising dwell times. Discover key location analytics and location intelligence shifts.

Share on LinkedIn

An Overview of a Shifting Retail Landscape

In the latest review of the UK retail scene, we see a delicate balance between lower footfall and increased consumer engagement. Recent data from retail parks, high streets, shopping centres, local retail centres, and major retail centres indicate that location analytics is at the forefront of understanding these trends. With evidence that dwell times are rising even as visitor numbers decline, change is in the air across the sector.

Retail Parks: Regional Variations and Steady Declines

Retail parks have experienced a modest drop with average daily visitors falling by 3% to 16,100. The performance is not uniform across the UK: England’s retail parks averaged 16,600 visitors while Scotland saw 14,700 visitors and Wales lagged at 12,000. Despite these declines, the data offers important insights for brands using location intelligence to target marketing efforts.

High Streets & Town Centres: Reduced Footfall, Greater Engagement

Footfall at high streets and town centres has declined, yet consumer engagement appears to be on the rise. English centres have shown relatively stable performance compared to sharper drops in Welsh and Scottish areas as reported by High Streets & Town Centres. Increased dwell times have been noted, particularly in Wales, where shoppers appear to be spending more time exploring their surroundings. This suggests that while fewer people visit, those who do stay longer, underlining the power of location intelligence in understanding customer behaviour.

Shopping Centres: A Tale of Contrasting Regional Figures

Data from shopping centres reveals that the average daily footfall has declined by 5% to 26,600 visitors. English centres, recording 27,800 visitors, experienced improved engagement, with dwell times reaching 120 minutes per visit. In contrast, Scottish centres attracted 23,100 visitors with shorter dwell periods and Welsh centres only 9,400 visitors. These figures provide valuable signals for businesses looking to optimise their strategies through location analytics, especially in regions with declining numbers but rising on-site engagement.

Local Retail Centres and Their Localised Impact

Local retail centres have reported an average of 13,300 visitors daily, marking a 4.2% drop week-on-week and a 15.2% drop year-on-year according to Local Retail Centres. Despite these declines, average dwell time rose modestly to 94 minutes. Scrutiny of the numbers shows that English centres lead with 13,400 visitors, while Scottish and Welsh centres follow with 11,800 and 10,300 visitors respectively. Such regional performance data assists stakeholders in refining their operations with the help of enhanced location intelligence tools.

Major Retail Centres: Long-Term Growth Amid Short-Term Declines

A striking feature comes from major retail centres where there is evidence of long-term growth despite a 6.2% weekly decline to 69,700 daily visitors. The year-on-year trend reveals a robust 9.8% increase in footfall coupled with improved dwell times, now rising to 116 minutes overall. Scottish centres stand out with 87,500 visitors and a notable 129 minute average visit, setting a benchmark against English and Welsh centres. This juxtaposition of short-term declines and long-term growth illustrates the potential impact of refined location analytics in planning for future expansion.

The Shift in Consumer Engagement

A recurring theme in these figures is the consistent increase in dwell time across all centre types. Consumers are now spending more time on-site, an indicator that location intelligence is being used to decipher deeper customer engagement. This trend suggests that retailers are shifting focus from the quantity of visits to the quality of consumer interactions. Increased engagement might just be compensating for softer footfall, making every visit more valuable than before.

Huq Industries Comment

Joe Capocci, Huq Industries spokesperson, noted, "Our evolving understanding of location analytics is crucial as we adapt retail strategies. The increased dwell times across most centre types are a clear signal that shoppers are valuing their in-store experiences over simply passing through."

Looking Ahead: Strategic Implications for Retailers

The various trends represented by these regional data points offer a blueprint for future retail strategies. Embracing enhanced location analytics and utilising robust location intelligence systems will be key in realigning with evolving consumer behaviour. Retailers now have the opportunity to transform challenges into strategic advantages, ensuring their spaces are designed to capture consumer interest and drive deeper engagement.

Concluding Thoughts on a Dynamic Marketplace

As retail centres adapt and evolve, the focus moves from mere visitor numbers to customer engagement measured through dwell time. With tools like location analytics and location intelligence, retailers are equipped to fine-tune their strategies and meet shifting consumer demands. Emerging trends, as highlighted this week, will undoubtedly serve as a guide for businesses aiming to thrive amidst dynamic economic conditions.

This comprehensive review provides fundamental insights that will shape the next wave of retail strategy. Stakeholders are encouraged to analyse these trends closely to better understand the changing dynamics of their local markets.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

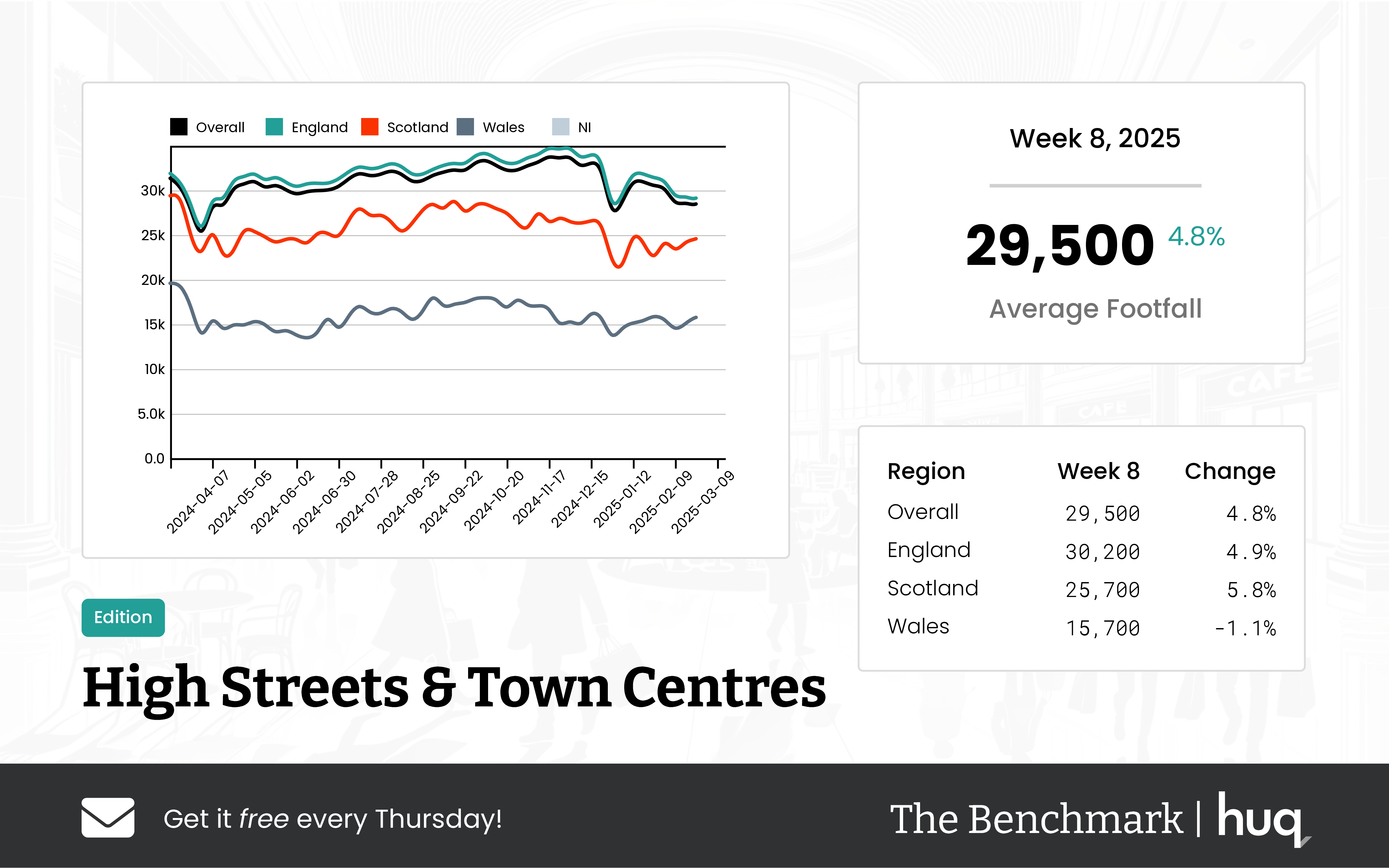

Week 8, 2025 Footfall Retail Update: UK High Streets & Town Centres Rebound

Week 8, 2025 Footfall Retail Update: UK High Streets & Town Centres Rebound

Footfall data shows a solid recovery with a 5% rise overall and improved visitor engagement. Retail footfall analytics support growing consumer confidence.

Share on LinkedIn

Overview

The latest data from The Benchmark reveals a steady rebound in UK High Streets and Town Centres during Week 8, 2025. Overall daily footfall reached 29,500, marking a 4.8% increase compared to the previous week and a 3.2% improvement on the same week last year. Visitor engagement has also deepened, with the average dwell time rising to 96 minutes—up 1.1% over the previous week and showing an 18.5% year‑on‑year increase. These results highlight the gradual return of consumer confidence to traditional retail spaces and support strong footfall retail analytics.

Regional Performance

In England, performance remained notably strong as average daily footfall climbed to 30,200, registering a 4.9% week‑on‑week increase alongside a 3.7% year‑on‑year rise. Dwell times remained at a consistent 96 minutes, reinforcing the appeal of bustling town centres. In Scotland, although footfall data recorded an average daily footfall of 25,700, the week‑on‑week figure improved by 5.8% despite a modest year‑on‑year decline of 3.1%. More significantly, dwell time in Scotland showed a sharp increase on weekly and annual comparisons, suggesting that visitors are engaging more deeply during each trip. Conversely, Wales experienced softer activity with an average daily footfall of 15,700, alongside a week‑on‑week decline and an 8.7% drop year‑on‑year, but maintaining an average visit duration of 97 minutes. These footfall statistics emphasise varied performance across regions.

Industry Comment

Retail specialists are increasingly relying on footfall counting for more accurate consumer analyses. “This week’s data, particularly Scotland’s robust increase in footfall and corresponding rise in engagement, aligns with evolving retail trends reported in recent industry news,” said Joe Capocci, spokesperson for Huq Industries.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

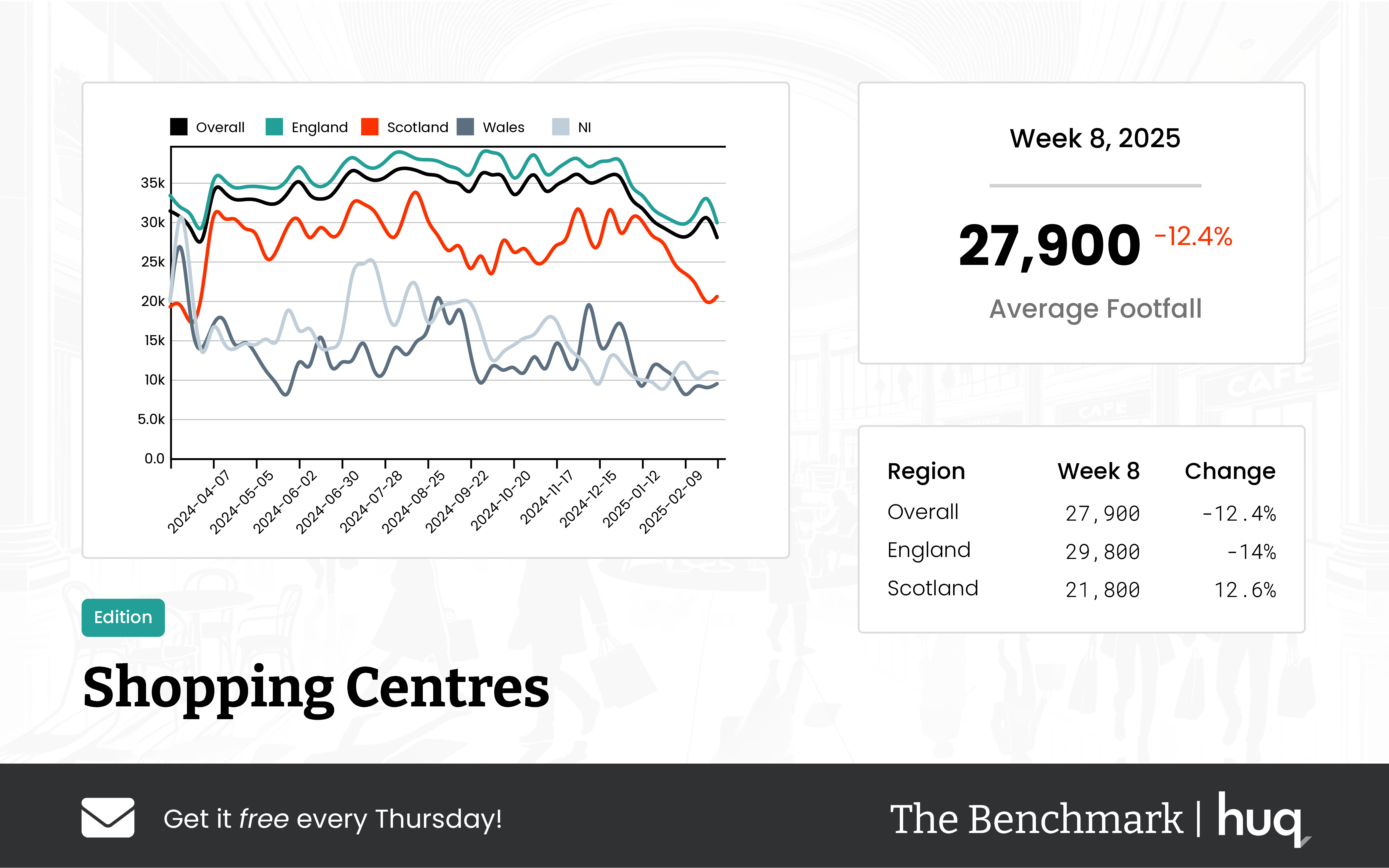

Week 8, 2025 Shopping Centres Footfall Update: Insights from Location Analytics

Week 8, 2025 Shopping Centres Footfall Update: Insights from Location Analytics

UK shopping centres recorded a 12.4% week-on-week decline with 27,900 daily visitors, reflecting evolving location analytics and emerging footfall trends.

Share on LinkedIn

Overall Performance

During the latest reporting period, UK shopping centres saw an average of 27,900 daily visitors. This figure reflects a moderate week-on-week decline of 12.4% and a year-on-year drop of 4.8%, illustrating the challenges posed by shifting consumer behaviors and evolving location analytics.

Regional Insights

In England, shopping centres experienced a slightly higher average of 29,800 daily visitors, although with a sharper 14% week-on-week decline and a 4% reduction compared to the same period last year. By contrast, Scottish centres benefitted from a notable upturn, recording 21,800 daily visitors with a week-on-week increase of 12.6% and a year-on-year improvement of 14.3%. These regional differences highlight varying consumer trends across the UK market.

Dwell Time Overview

Visitor engagement, as measured by dwell time, showed an overall average of 116 minutes per visit, despite a 4.1% week-on-week softening. In England, the average visit duration was slightly higher at 117 minutes, while Scottish centres saw 109 minutes. In Wales, however, centres continue to face challenges, with an average visit duration of only 46 minutes, signaling a decline in engagement levels.

Industry Comment

“Scotland’s standout improvement in footfall amid a challenging retail backdrop, as noted in recent industry news, clearly illustrates the evolving market dynamics,” commented Joe Capocci, a spokesperson for Huq Industries.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

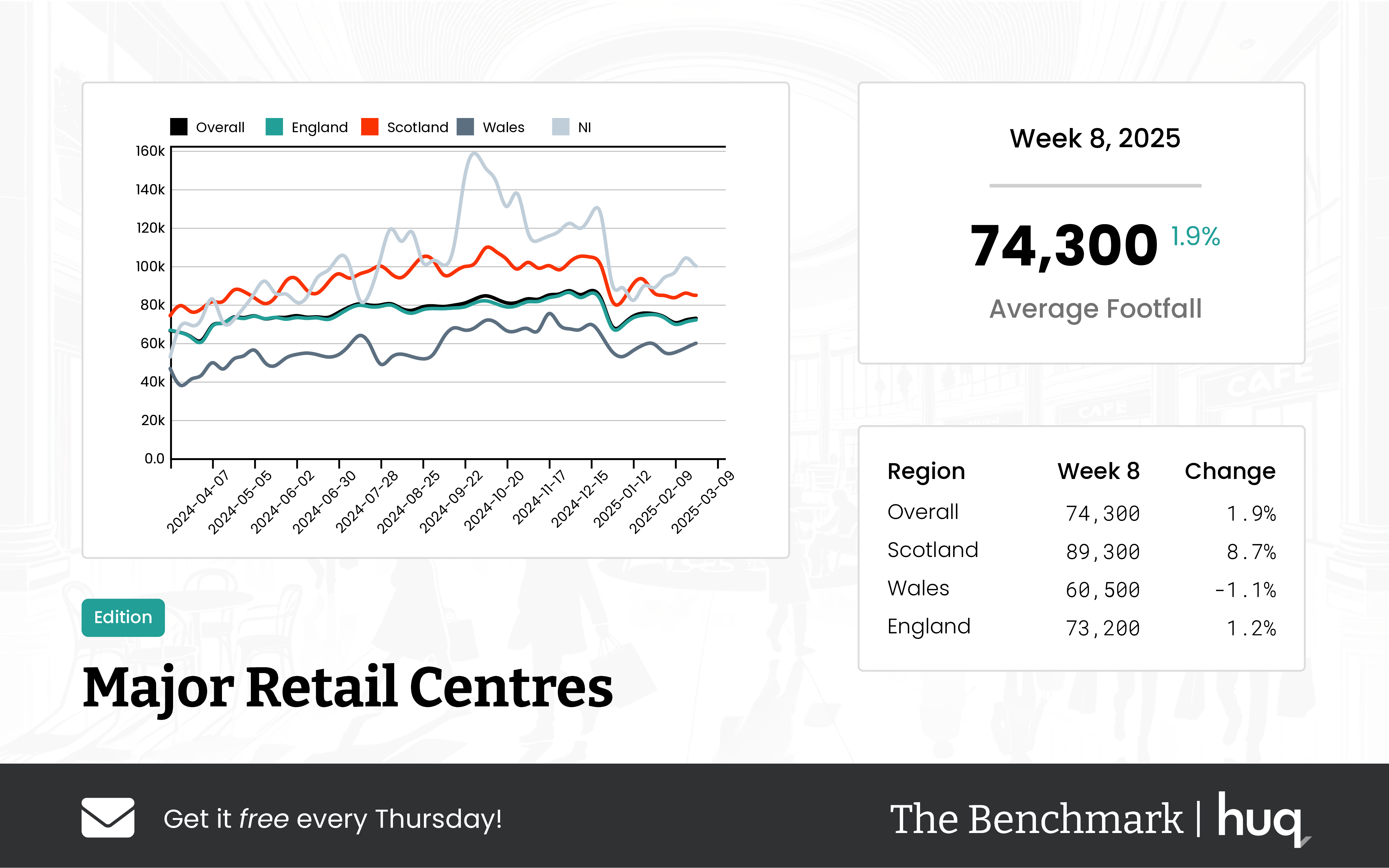

Week 8 2025 Footfall Retail Update: UK Major Retail Centres Performance

Week 8 2025 Footfall Retail Update: UK Major Retail Centres Performance

For week 8, 2025, UK Major Retail Centres show steady growth with modest rises in key numbers. Footfall retail figures and footfall analytics reinforce the overall positive trend.

Share on LinkedIn

Overview

The latest weekly figures from The Benchmark reveal an overall robust performance across UK Major Retail Centres for Week 8, 2025. Centres recorded an average daily footfall of 74,300, showing a modest increase compared to the previous week and a considerable improvement over the same period last year. The average visit duration reached 111 minutes, indicating enhanced shopper engagement and reinforcing the strength of footfall retail.

Regional Breakdown

Regional differences emerged from the footfall data. Scotland led the pack with an average of 89,300 daily visitors, demonstrating solid week-on-week progress and a healthy upward trend on an annual basis. England’s centres followed with an average of 73,200 visitors per day, while centres in Wales experienced a softer week at 60,500 daily visitors, even as annual comparisons show a strong recovery.

Dwell Time Analysis

A detailed examination through footfall analytics revealed that visit durations varied by region. Scottish centres reported an average visit duration of 115 minutes, albeit with a more pronounced recent drop, whereas centres in Wales saw shoppers spending around 96 minutes per visit and England maintained the overall 111-minute average. Despite minor short-term dips, these footfall statistics and careful footfall counting underscore a long-term trend of increased consumer engagement.

“Scotland’s standout performance in footfall, noted as the most striking change in our recent data and supported by observations in Retail Industry News, confirms our view of a resilient retail sector,” said Joe Capocci, Huq Industries Spokesperson.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

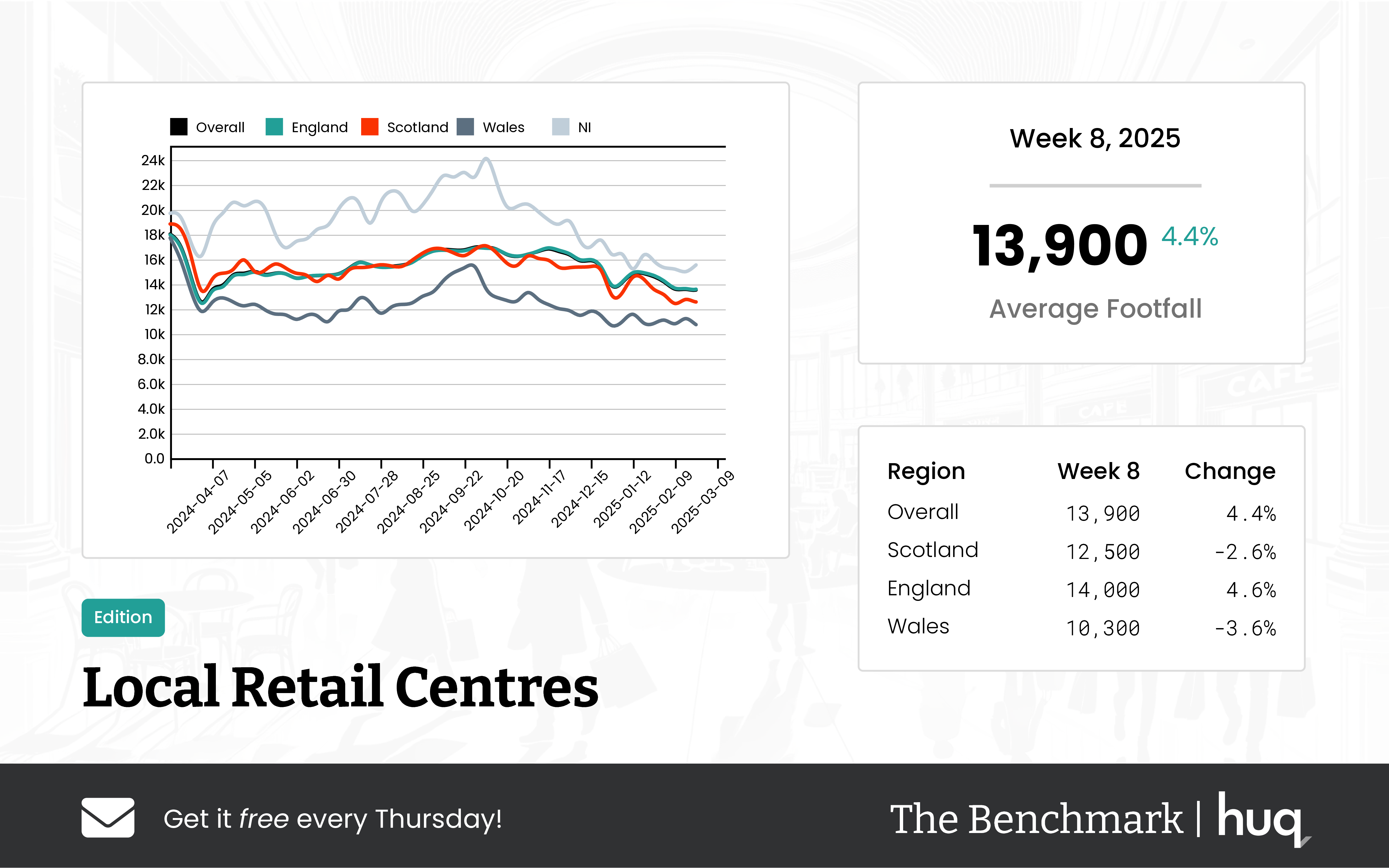

Week 8 2025 Local Retail Centres: Insights from Footfall Data

Week 8 2025 Local Retail Centres: Insights from Footfall Data

For the week ending 2025‑03‑02, overall footfall data shows modest improvement with an average of 13,900 daily visitors and dwell time at 93 minutes. Footfall analytics capture subtle changes versus last year.

Share on LinkedIn

For the week ending 2025‑03‑02, the footfall data across UK local retail centres averaged 13,900 visitors per day. This overall performance reflects a modest improvement over the previous week, although it remains subdued compared to last year’s figures. The average dwell time across centres was 93 minutes, showing a slight week‐on‐week drop even as the long‐term trend indicates a substantial increase in the duration of visits.

Regional Breakdown

In England, centres recorded the highest daily average of 14,000 visitors. Although there was a moderate week‐on‐week increase of 4.6%, a gentle decline is observed on a year‐on‐year basis. The average dwell time in England was 92 minutes, with a modest drop over the week but a sharp long‐term rise that points to solid visitor engagement despite softer recent performance.

Scotland’s centres averaged 12,500 visitors per day. This region experienced a small decline over the week, alongside a notable annual decrease in footfall. However, visitor engagement remains high in Scotland, with an average dwell time of 103 minutes, marking a positive weekly change of 19.8% and a sharp increase on an annual basis.

Centres in Wales reported the lowest daily average at 10,300 visitors, with a weekly trend that mirrors a broader softening in long‐term footfall. Despite this, dwell time in Wales was the highest among the regions at 105 minutes, showing a moderate week‐on‐week increase and only a slight softening compared to the previous year.

Key Metrics and Industry Insights

Comprehensive footfall analytics and rigorous footfall counting practices were undertaken to ensure the reliability of these statistics. According to Joe Capocci, a spokesperson for Huq Industries, “These data indicate a striking decline in Scotland’s footfall, and recent retail industry news underlines the importance of tracking these evolving trends.”

Overall, these insights provide a nuanced picture of current trends in local retail centre performance across the UK, highlighting regional differences and evolving patterns in visitor engagement.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.