Week 11, 2025 Shopping Centres Update: Location Analytics Perspective

Week 11, 2025 Shopping Centres Update: location analytics Perspective

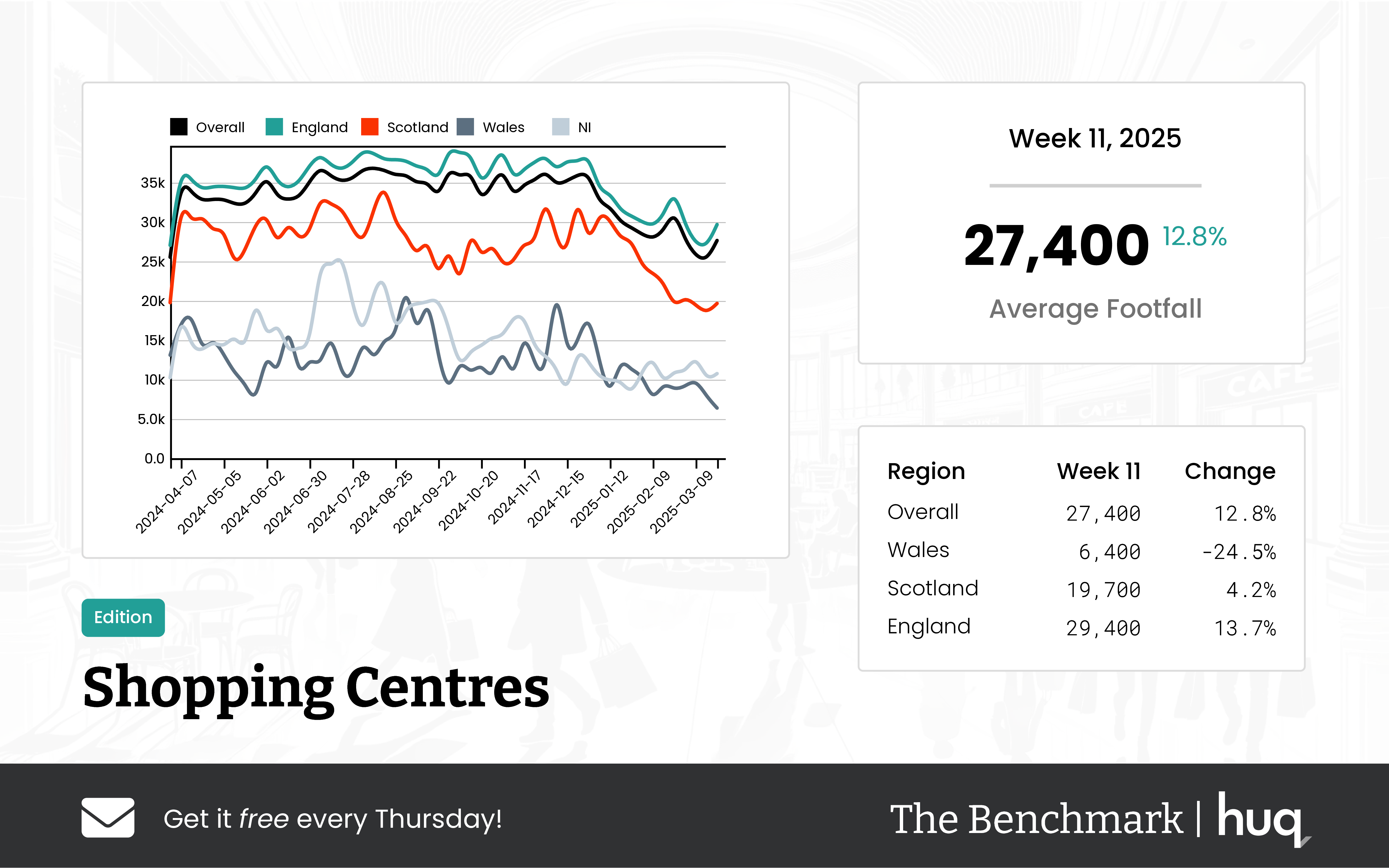

UK shopping centres saw a 12.8% weekly footfall increase despite a 6.7% annual decline, signalling a cautious short‐term recovery amid subdued longer‐term trends, while consumer dwell time insights underscore evolving shopper behaviour.

Share on LinkedIn

UK shopping centres recorded an average daily footfall of 27,400 during week 11, marking a moderate week on week rise of 12.8%. Despite this short‐term uptick, a year on year decline of 6.7% hints at underlying challenges that continue to affect overall visitor numbers.

Retailers are taking note of a significant change in shopper engagement: the average dwell time across venues stood at 113 minutes per visit—a weekly increase of 3.7% and an impressive year on year improvement of 17.7%. This trend suggests that even as overall visits have seen a slight dip over the year, consumers are spending more time in store, possibly engaging more deeply with in-store experiences.

A regional breakdown of the data provides further insights. In Wales, shopping centres experienced an average daily footfall of 6,400. The region saw declines both weekly and on a yearly basis, and the average duration of a visit was 90 minutes, reflecting lower levels of consumer engagement relative to other regions.

In contrast, Scotland’s centres posted an average daily footfall of 19,700, with modest increases of 4.2% week on week and 3.6% year on year. Shoppers in Scotland enjoyed a longer average dwell time of 121 minutes per visit, benefiting from a notable weekly uplift despite more moderate historical gains.

England leads the pack, boasting the highest average daily footfall at 29,400. Although England experienced a yearly decline of 5.3%, a healthy weekly increase of 13.7% underscores a dynamic retail landscape. With an average dwell time of 114 minutes per visit, the region also recorded a slight weekly increase and a strong year on year improvement in customer engagement.

Industry voices have commented on these trends. Joe Capocci, spokesperson for Huq Industries, noted, "The notable decline in footfall in Wales, coupled with observations from recent retail industry news, underscores the evolving dynamics of consumer engagement." These remarks echo a broader sentiment that, while short‐term recoveries are visible through increased dwell times and weekly boosts, long‐term challenges persist.

As the UK retail environment continues to evolve, these insights from location analytics provide a critical window into shifting consumer behaviour—helping retailers strategize and adapt in a competitive market landscape.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 11 2025 Major Retail Centres: Robust Performance & Location Analytics Insights

Week 11 2025 Major Retail Centres: Robust Performance & Location Analytics Insights

Positive retail performance across UK centres shows weekly gains of up to 8% and strong location analytics with emerging footfall trends, highlighting steady consumer engagement.

Share on LinkedIn

Overview

Data from The Benchmark

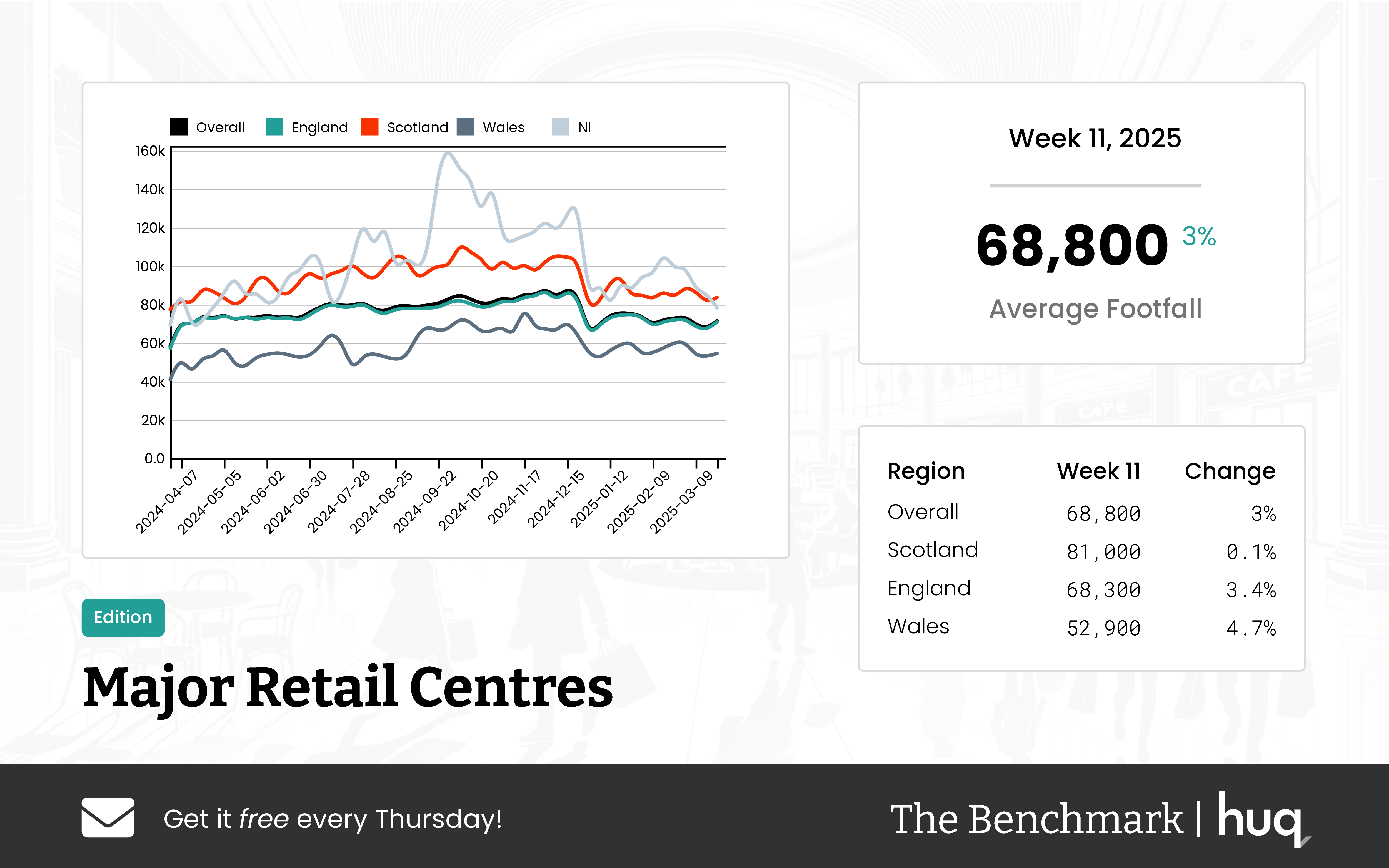

The latest update from The Benchmark reveals that footfall across UK Major Retail Centres remained robust during week 11, with an average of 68,800 daily visitors, a modest week‑on‑week gain and a moderate year‑on‑year increase. Alongside this, the average visit duration across all centres was 114 minutes; although visitors spent slightly less time per visit compared to the previous week, they enjoyed longer visits relative to the same period last year. This analysis, supported by location analytics and footfall trends as key visitor metrics, confirms stable retail performance and strong consumer engagement.

Regional Breakdown

In Scotland, the average daily footfall reached 81,000, with a marginal week‑on‑week change of 0.1% and a steady year‑on‑year improvement of 5.4%. Scottish visitors also recorded an average visit duration of 126 minutes, despite a slight decline in comparison to the previous week. These visitor metrics illustrate strong consumer engagement in the Scottish retail market.

Centres in England mirrored the overall trends with an average of 68,300 daily visitors, supported by a week‑on‑week gain of 3.4% and a positive year‑on‑year increase of 8.1%. The average visit duration in England was 114 minutes, reflecting balanced consumer engagement and robust retail performance. Conversely, centres in Wales recorded the lowest average daily footfall of 52,900; despite a healthy week‑on‑week gain of 4.7% and a sharp increase in visitor numbers over the year, visitors spent an average of only 85 minutes per visit, indicating a notable decline in dwell time.

Spokesperson Comment

Commenting on these insights, Joe Capocci, spokesperson for Huq Industries, stated: “The sharp increase in footfall in Wales alongside encouraging signals from recent industry headlines clearly underscores the resilience seen across UK retail centres.”

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

UK Retail Parks – Week 11 2025 Performance Update: Footfall Data Insights

UK Retail Parks – Week 11 2025 Performance Update: Footfall Data Insights

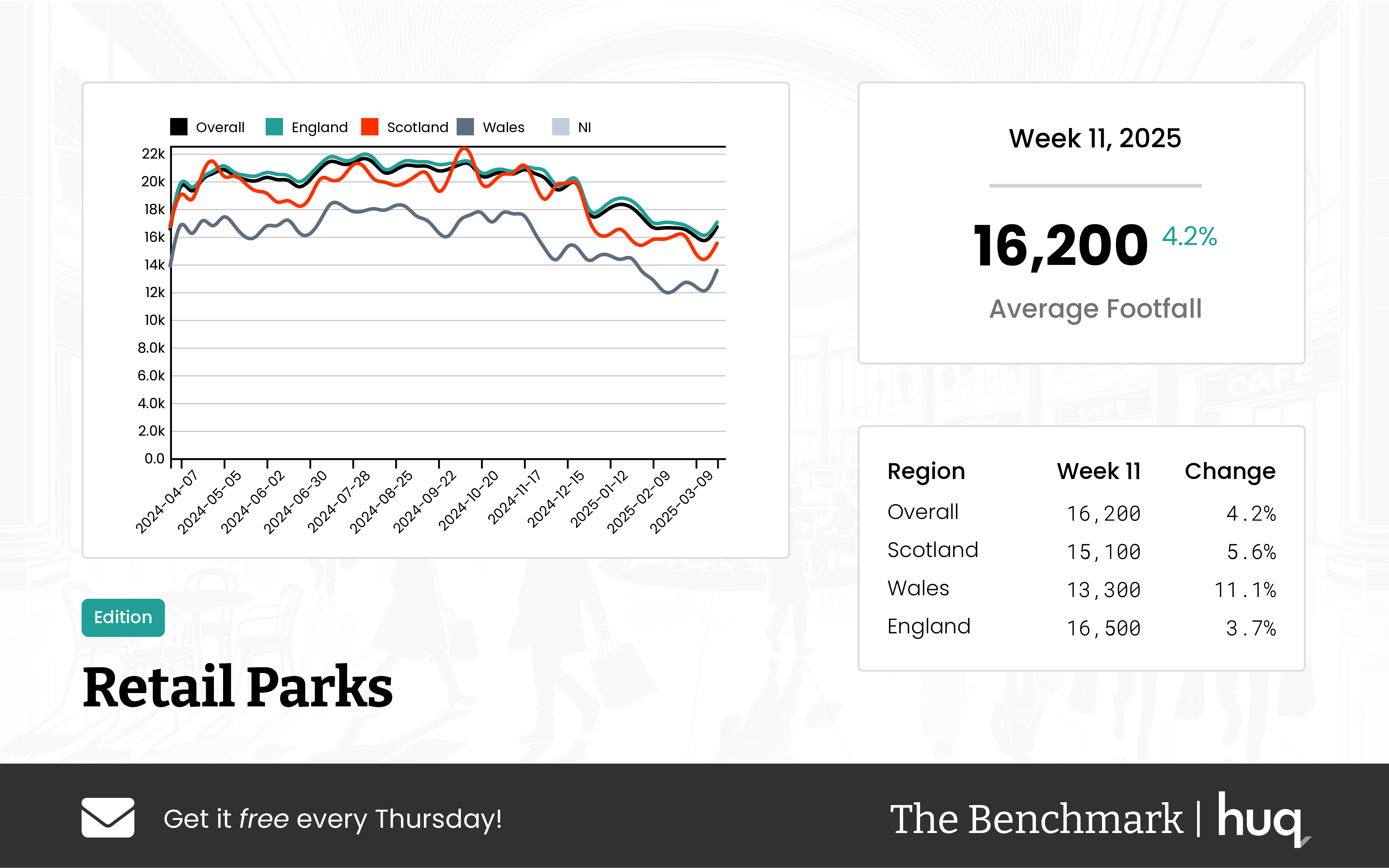

Overall footfall data shows a 4.2% week-on-week rise despite a 19% year-on-year decline. Increased visitor dwell times offer promising footfall analytics insights.

Share on LinkedIn

Overall Performance

According to recent footfall data, during the week ending 2025-03-23, overall average daily footfall in UK Retail Parks reached 16,200, marking a modest week-on-week rise of 4.2%. However, year-on-year figures indicate a 19% decline, reflecting ongoing challenges in drawing the same level of visitors compared to the previous period. Notably, analysis of visitor behaviour shows that those who do attend are engaging for longer, with the average visit duration now at 73 minutes—up 5.8% from the preceding week and 14.1% from the same period last year.

Regional Overview

In England, Retail Parks recorded an average daily footfall of 16,500, with a 3.7% increase from the previous week, although year-on-year performance depicts an 18.5% decline. Scotland’s parks achieved a weekly growth of 5.6% in average daily footfall, despite experiencing a notable decline on a yearly basis. In Wales, footfall exhibited a healthy week-on-week rise of 11.1%, yet the historical trend still points to a notable decline compared to the previous year. These regional variations underscore the nuanced landscape across the UK Retail Park market. These figures contribute to robust footfall retail insights and provide valuable footfall statistics for market evaluation.

Visitor Dwell Times

Visitor engagement has improved across the regions with overall dwell times trending upward. In England, the average dwell time increased to 72 minutes, registering a modest week-on-week growth of 4.3% and a 9.1% improvement compared to last year. Scotland’s Retail Parks observed an average duration of 78 minutes with a stronger week-on-week jump of 9.9% and a sharp increase in year-on-year performance. In Wales, the average visit extended to 79 minutes, supported by sharp increases in both week-on-week and year-on-year comparisons, further highlighting a trend towards longer visits even amid lower footfall numbers. These improvements in visitor engagement are further underlined by more refined footfall analytics insights, emphasizing the importance of continuous footfall measurement.

Industry Comment

Joe Capocci, spokesperson for Huq Industries, stated, “The healthy 11.1% week-on-week rise in Wales underscores a positive shift in visitor engagement, which is echoed by recent retail developments such as Lidl and Halfords gearing up to open.”

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 11 Weekly Wrap: UK Retail Trends & Location Analytics Insights

Week 11 Weekly Wrap: UK Retail Trends & Location Analytics Insights

Explore UK retail trends as dwell times in shopping centres climb by 14.1%. Gain insights on location analytics and dynamic retail performance.

Share on LinkedIn

Overview

UK retailers are adapting to evolving consumer behaviours with detailed improvements in visitor dwell time and footfall across various centre types, as shown in recent analyses. In Week 11, location analytics revealed that retail parks, major retail centres, shopping centres, and high streets & town centres experienced mixed trends. This weekly wrap examines these insights and guides retail stakeholders on actionable trends via comprehensive data and regional breakdowns.

Retail Parks Analysis

Retail parks reported promising weekly recoveries with Week 11 showing an average daily footfall of 16,200 visitors and a dwell time of 73 minutes, representing improvements of 4.2% and 5.8% weekly respectively. The report highlights that in England, daily visitors reached 16,500, while Scotland and Wales enjoyed weekly rises of 5.6% and 11.1%. For further details on these dynamics, see the Week 11 Retail Parks update and review Week 10 insights.

Major Retail Centres Insights

Major retail centres maintained robust performance in Week 11 with an overall daily visitor count of 68,800 and an average dwell time of 114 minutes. Regional differences were evident as Scotland led with 81,000 visitors and 126 minutes of dwell time, followed by England and Wales. These figures, outlined in the Week 11 Major Retail Centres update, are supported by a comparison with Week 10 data showing a modest dip that reinforces long‐term resilience.

In-depth on Shopping Centres

Shopping centres experienced strong weekly gains in Week 11 where average daily footfall rose to 27,400, marking a robust 12.8% increase. Dwell time also improved by 3.7% to reach 113 minutes despite an overall 6.7% annual decline. More granular data, including regional figures - with England centres leading at 29,400 visitors and Scotland and Wales following suit - can be found in the Week 11 Shopping Centres update, while Week 10 trends offer additional context.

High Streets & Local Retail Analysis

High streets and town centres saw a positive weekly surge, averaging 28,100 visitors in Week 11 with steady dwell times of 96 minutes despite minor annual dips. England experienced a slight peak, Scotland faced a small decline, and Wales witnessed substantial weekly gains despite lower overall numbers. Local retail centres experienced a 6.1% weekly increase, yet remain challenged by significant year-on-year declines, as detailed in the Week 11 update for local centres, underlining varied consumer engagement across regions.

Perspective from Industry Expert

Joe Capocci, the Huq Industries spokesperson, remarked, "The current trends underscore the potential of refined location intelligence techniques. With strategic data analysis, retailers can better understand variations and make informed decisions to enhance visitor experience." His comments highlight the importance of leveraging data insights, especially when improvements such as the 14.1% dwell time increase in some regions signal enhanced engagement despite softer footfall in others.

Concluding Thoughts

The latest data from Week 11 emphasises diverse performance levels within the UK retail landscape. While retail parks and shopping centres are making notable weekly strides, major retail centres and high streets are exhibiting mixed trends that necessitate nuanced strategies. Stakeholders are encouraged to delve into these detailed location analytics to adapt their approaches and capitalise on emerging consumer behaviour trends. This comprehensive weekly wrap provides valuable insights that can steer future retail planning.

Retail performance metrics continue to evolve, and with detailed location intelligence, retail managers can seize opportunities for growth. The trends presented here are a reminder that even modest improvements in metrics such as a 14.1% increase in dwell time can lead to significant changes in consumer engagement. By examining these trends and responding proactively, the industry can look forward to a dynamic and resilient retail environment.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 10, 2025 Local Retail Centres – Footfall Statistics Update

Week 10, 2025 Local Retail Centres – Footfall Statistics Update

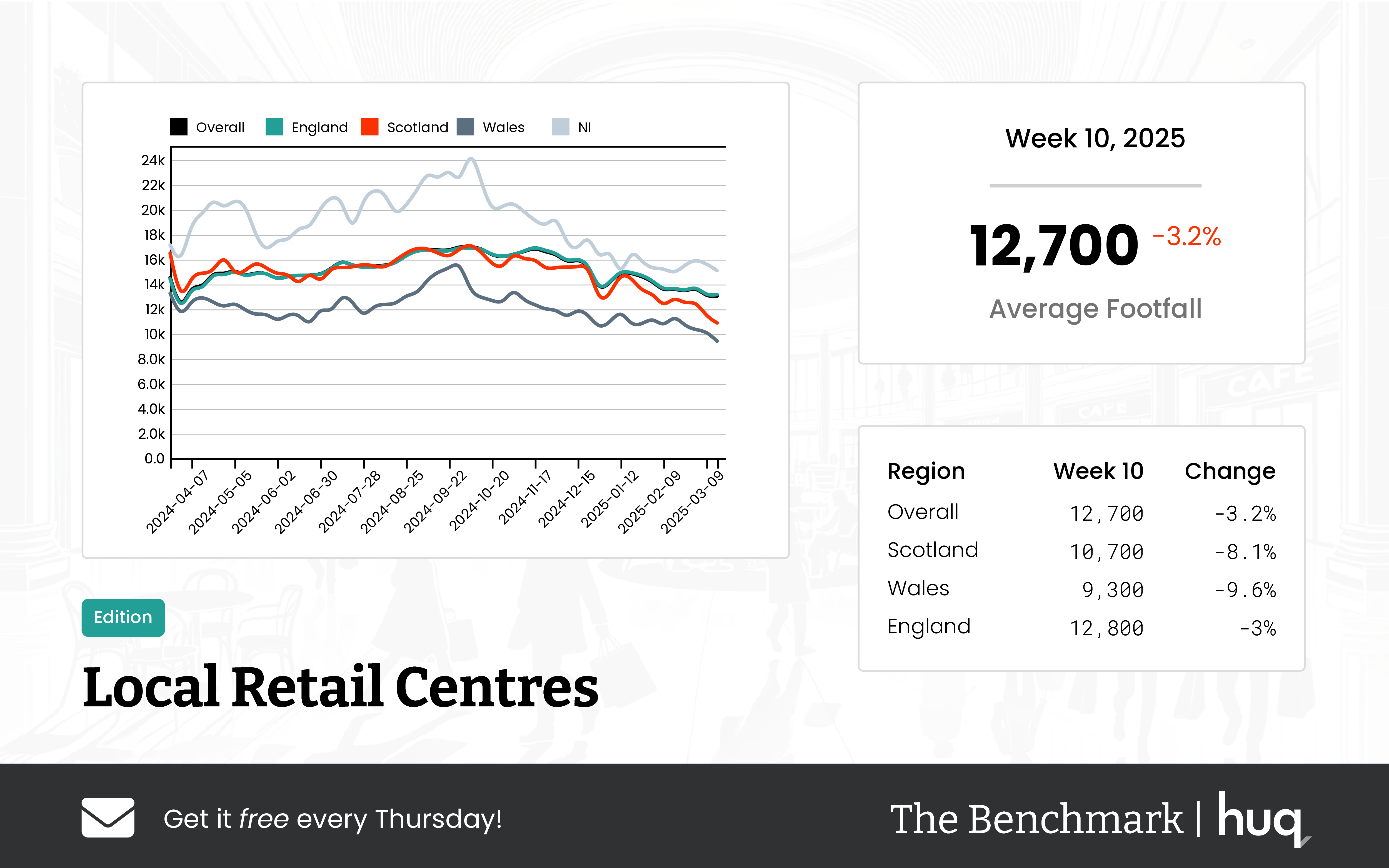

UK Local Retail Centres saw a modest decline in footfall data with daily visits dipping slightly while dwell times rose; footfall analytics reveal evolving visitor engagement trends.

Share on LinkedIn

Overall Performance

The latest figures from footfall data provided by The Benchmark show that UK Local Retail Centres experienced an average of 12,700 visits per day during Week 10, 2025. This represents a modest decline on a week-on-week basis as well as a lower overall performance compared to the same period last year. While fewer visitors are coming through the doors, those who do are spending more time on site, suggesting increased engagement as detailed by the footfall analytics.

Regional Performance

A deeper dive into the regional breakdown reveals significant differences. In England, retail centres recorded an average daily footfall of 12,800, marking only a slight dip over the week. However, Scotland’s centres took a more noticeable hit with an average of 10,700 visits per day—a decline nearly three times greater than that observed in England. Wales’s centres posted an average of 9,300 visits, mirroring Scotland’s challenges. Over longer-term comparisons, the decline in England has been relatively modest, whereas both Scotland and Wales have seen more pronounced long-term falls, underscoring region-specific challenges in footfall trends.

Dwell Time Trends

In tandem with the decline in visitor numbers, dwell time metrics provide additional insights into visitor engagement. Overall, the average visit duration increased modestly to 95 minutes in Week 10, 2025. Retail centres in England and Scotland enjoyed an uplift in dwell times, indicating that visitors are staying longer despite reduced footfall. In contrast, centres in Wales recorded a shorter average visit duration for the period. Compared to the previous year, the overall dwell time has witnessed a significant increase in England and Scotland, hinting at evolving visitor behavior and engagement patterns.

Industry Insights

Joe Capocci, a spokesperson for Huq Industries, commented on the situation: "While the marked footfall decline in Scotland and Wales is the most striking change, recent retail industry news adds weight to our observations." His statement suggests that broader industry trends could be influencing these regional discrepancies and reinforces the importance of adapting to new consumer behaviors.

Conclusion

As UK Local Retail Centres navigate these changing dynamics, the data underscores a shift in visitor behavior—fewer overall visitors, but an increase in the time they spend in-store. These trends may have significant implications for retail strategies and future planning as centres adapt to maintain engagement and drive business performance.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

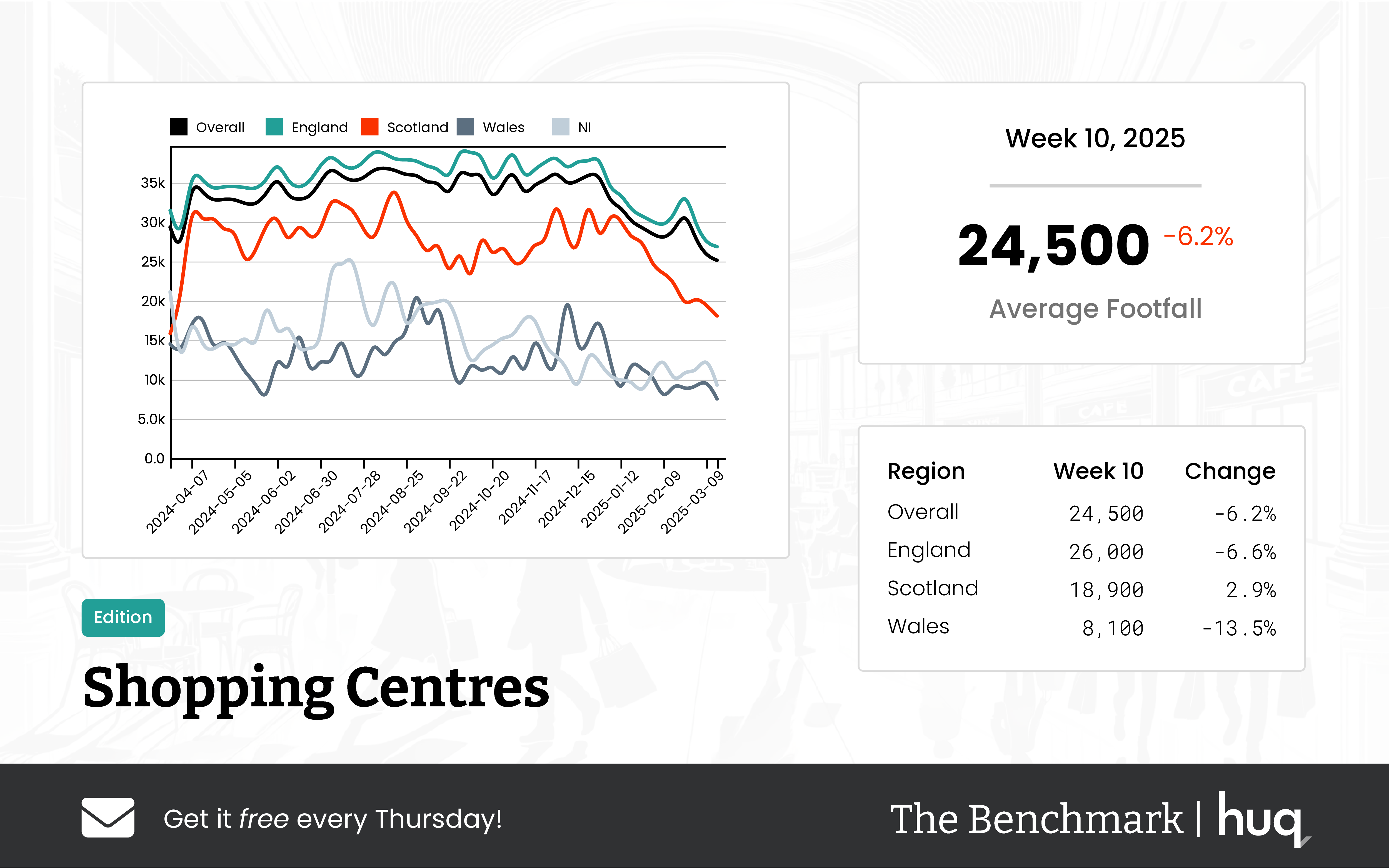

UK Shopping Centres – Week 10 Performance Update 2025: Location Analytics

UK Shopping Centres – Week 10 Performance Update 2025: Location Analytics

UK shopping centres experienced a modest contraction with a 6.2% week decline and a 16.6% year reduction. Robust location analytics and footfall data indicate mixed trends.

Share on LinkedIn

Overview

Recent data from The Benchmark, combined with detailed location analytics, provides a comprehensive briefing on the performance of UK shopping centres for week 10. The overall average daily footfall was reported at 24,500 visitors, reflecting a week on week decline of 6.2% and a year on year reduction of 16.6%. While these figures suggest a modest contraction compared to previous periods, a closer look at regional performance reveals a more varied picture.

Regional Performance

In England, shopping centres attracted an average of 26,000 visitors per day. This region experienced a week on week decline of 6.6% and a year on year reduction of 16.1%. In contrast, Scotland saw average daily footfall figures of 18,900, with a modest week on week increase of 2.9% and a nearly flat performance on a year on year basis, decreasing marginally by 0.7%. Welsh centres, however, faced tougher conditions with an average daily footfall of just 8,100. This region saw a significant week on week drop of 13.5% along with a notable decline in its year on year performance.

Visitor Dwell Time

Visitor engagement in terms of dwell time further underscores these mixed trends. Across all regions, the average visit duration was 109 minutes. This marked a 6.8% drop over the week, though there was a 13.5% improvement when compared to the previous year. In England specifically, shoppers spent an average of 112 minutes per visit—mirroring the overall trend while also indicating a sharp year on year increase in dwell time.

Scotland, on the other hand, showed lower engagement levels with an average visit duration of just 77 minutes, accompanied by a week on week drop of 14.4% and a significant annual decline. Conversely, Welsh shopping centres maintained high engagement levels, with visitors spending an average of 125 minutes per visit—a figure that saw impressive increases on both a weekly and yearly basis.

Comments from Industry

Joe Capocci highlighted these trends, noting, "Scotland’s modest uplift in footfall stands out amidst a broader decline, a trend supported by recent industry observations from retail centres facing challenges." His statement underscores that while some regions remain resilient, others are still grappling with the effects of contracted visitor numbers.

As location analytics, footfall data, and dwell time metrics become more integral to understanding consumer behavior, stakeholders must keep a close eye on these varying trends to inform future strategies.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

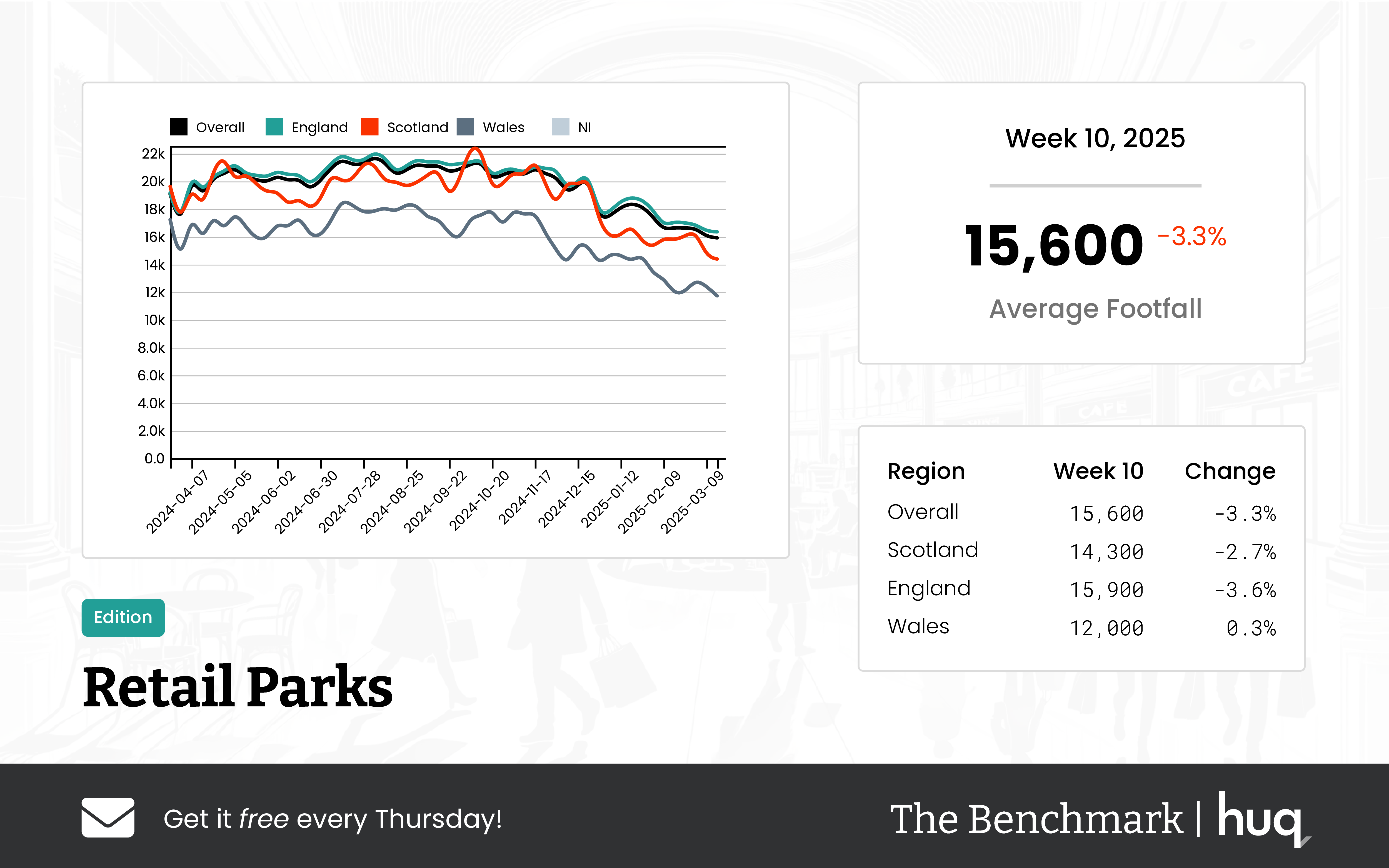

Week 10, 2025 Retail Parks Performance Update: footfall Trends in Focus

Week 10, 2025 Retail Parks Performance Update: footfall Trends in Focus

UK Retail Parks experienced a 3.3% decline in overall footfall, underscoring a challenging environment. Recent footfall data reveals shifts that require careful strategy.

Share on LinkedIn

UK Retail Parks recorded an average daily attendance of 15,600 during the latest full week, marking a 3.3% week-on-week decline along with a notable year-on-year downturn. This overall drop in visitor numbers signals a need for retail park managers and decision-makers to leverage footfall data, analytics, and trends more effectively.

A deeper dive into regional performance reveals varied outcomes. Scottish Retail Parks saw an average of 14,300 visitors daily, with a weekly drop of 2.7% and a significant year-on-year decline. In contrast, England’s retail parks attracted about 15,900 visitors per day despite a steeper 3.6% weekly drop. Wales, while facing a softened annual performance, demonstrated a degree of resilience with an average of 12,000 daily visitors and a slight weekly increase of 0.3%.

Visitor engagement also provided additional insight into retail performance. Across the UK, the average visit lasted 69 minutes—down 6.8% during the week but showing modest annual improvement. Scottish Retail Parks experienced a notable weekly dip in dwell time of 12.3% despite a marked year-on-year uptick, while English Retail Parks recorded a five and a half percent decrease with overall annual gains. In Wales, visitors spent an average of 61 minutes per visit, accompanied by a 7.6% weekly reduction yet moderate annual improvement.

Commenting on the trends, Joe Capocci, spokesperson for Huq Industries, noted, "While the sustained decline in overall footfall—contrasted by Wales’ slight rebound—provides insight into evolving visitor habits, recent retail industry news on funding and new retail park developments further underscore the necessity to skilfully adapt strategies."

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

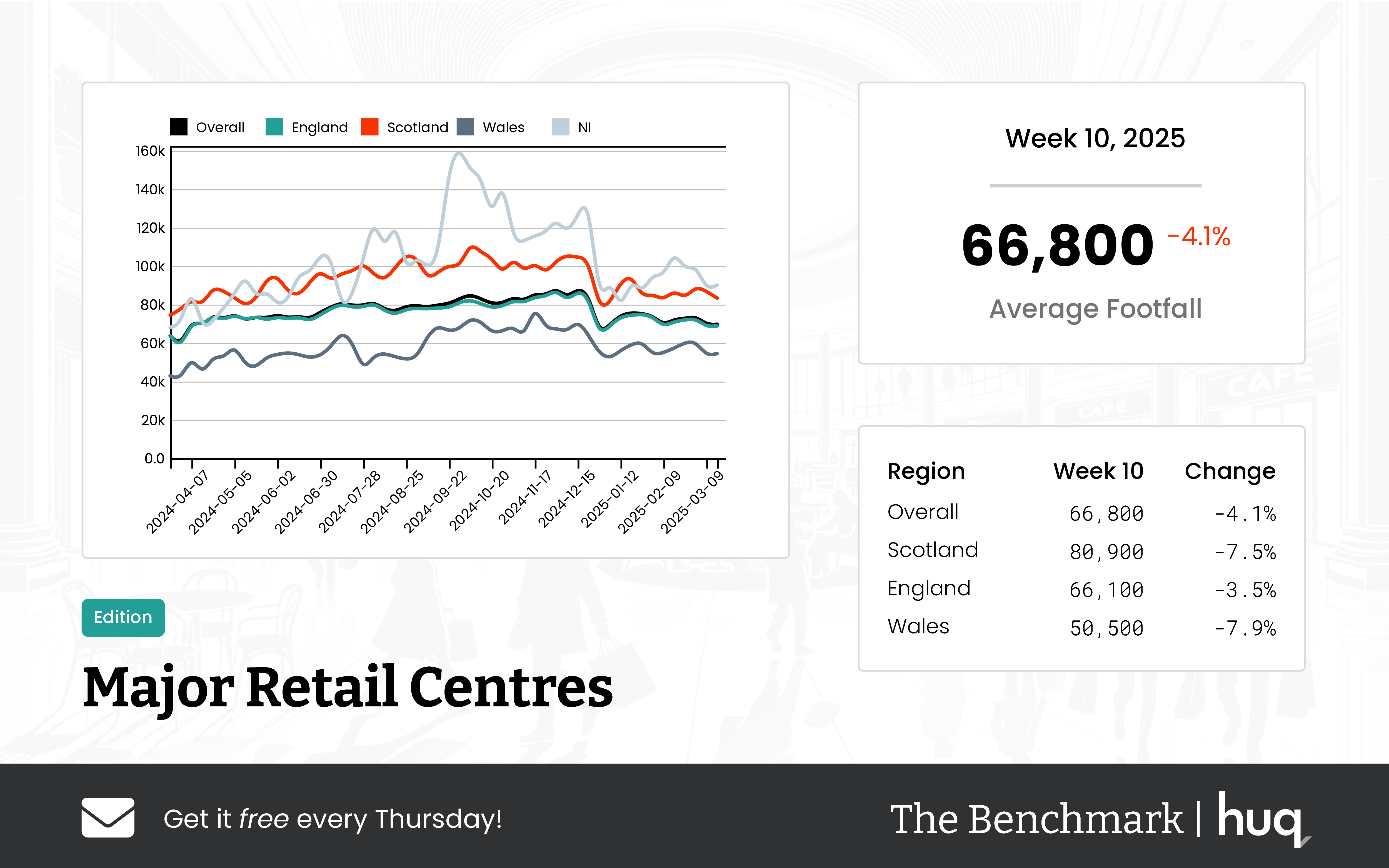

UK Major Retail Centres – Week 10 Performance Update: 2025 Footfall Data Insights

UK Major Retail Centres – Week 10 Performance Update: 2025 Footfall Data Insights

Week 10 shows a modest week-on-week dip yet long‐term resilience in footfall data, reinforced by consistent footfall analytics and improving trends.

Share on LinkedIn

The latest figures from The Benchmark reveal mixed trends across UK Major Retail Centres for the week ending 2025-03-16. Average daily footfall across these centres was measured at 66,800—a modest decrease compared to the previous week—yet the year-on-year comparison shows an encouraging upward trend, underscoring the longer term recovery in visitor numbers.

A closer examination by region indicates nuanced performances:

• In England, centres witnessed an average daily footfall of 66,100. While the week experienced a slight decline, the year-on-year data remains positive, highlighting steady engagement.

• Scottish centres, meanwhile, posted a higher daily average of 80,900. Even though there was a deeper short-term decline, the robust year-on-year improvement signals resilience amidst recent challenges.

• Welsh centres saw an average daily footfall of 50,500, with modest week-on-week softening; however, these centres recorded a sharp improvement compared to historical figures.

Visitor engagement metrics further complement the footfall insights. Overall visitor dwell time stood at 116 minutes per visit, maintaining a stable week-on-week performance while showing a clear improvement over the previous year. Scottish centres led with an average dwell time of 131 minutes per visit, posting both a modest week-on-week increase and a substantial year-on-year boost. Meanwhile, English centres averaged 115 minutes and Welsh centres, despite recording the lowest at 101 minutes, showed meaningful gains both in the short term and longer term.

The strategic use of precise footfall counting methods, robust analytics, and detailed statistics underpins the reported figures. These methodology insights ensure that the trends not only reflect current performance but also a continued recovery over time.

Industry expert Joe Capocci, spokesperson for Huq Industries, emphasised the standout performance in Welsh centres, stating, "The most striking change was seen in Welsh centres with their sharp increase in footfall, a trend that resonates with aspects of recent retail industry news."

This update highlights both the challenges and the ongoing recovery within the retail sector, providing stakeholders with critical insights into emerging trends and long-term performance drivers.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

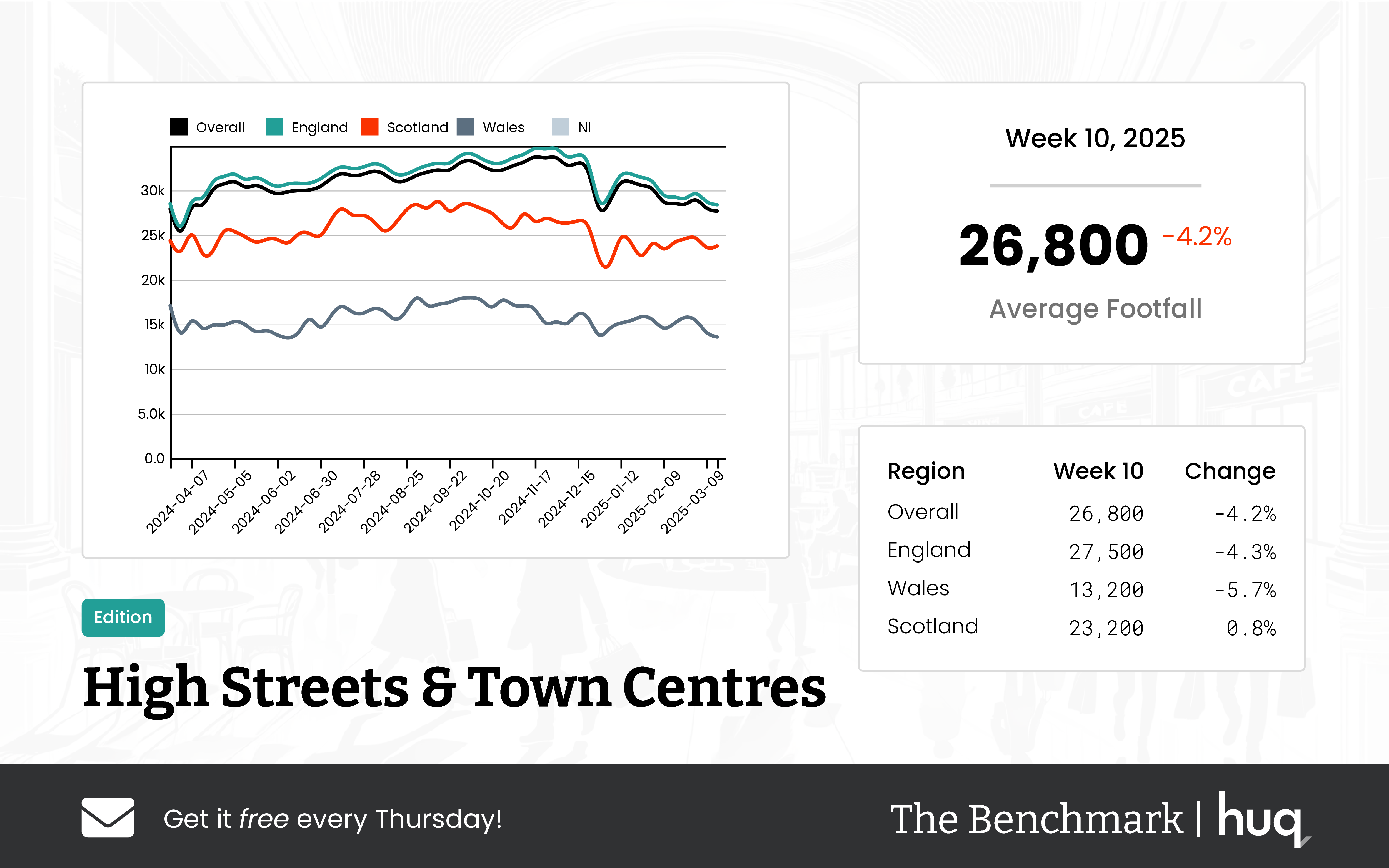

UK High Streets & Town Centres – Week 10 2025 Footfall Trends Update

UK High Streets & Town Centres – Week 10 2025 Footfall Trends Update

During the week ending 2025-03-16, UK High Streets & Town Centres experienced a 4.2% weekly and 6.3% yearly decline in footfall retail, while overall footfall trends indicate visitors spent 96 minutes on average.

Share on LinkedIn

During the week ending 2025-03-16, UK High Streets and Town Centres recorded an average of 26,800 visits per day. Although this reflects a modest week-on-week decline of 4.2% and a year-on-year reduction of 6.3%, detailed insights reveal a more nuanced retail landscape.

Overall, the footfall figures point towards significant strategic adjustments in retail environments. Despite the lower number of visitors, dwell time—a key indicator of customer engagement—has shown resilience, with the average visit lasting 96 minutes. This marks a slight weekly rise of 1.1% and signifies an improvement compared to the previous year, suggesting that while fewer shoppers are stepping through the doors, those who do are engaging more deeply with the retail space.

Regional Insights:

In England, the story is one of subtle decline with an average daily footfall of 27,500. This region experienced a decline of 4.3% from the previous week and a 5.7% drop compared to the same period last year.

Scotland presents a mixed picture: while the average daily visitors stand at 23,200—a figure which increased slightly by 0.8% week-on-week—the comparison with the last year shows a significant drop of 12.6%. Certain pinpoint sites in both England and Scotland even registered modest gains over the preceding week, highlighting areas of potential growth.

Meanwhile, Wales experienced a more pronounced impact with an average daily footfall of 13,200, declining by 5.7% from the previous week. However, the region's visitor engagement tells an interesting story as dwell time surged to an average of 113 minutes per visit, marking a strong week-on-week rise of 14.1% and a significant year-on-year improvement.

Scottish centres also recorded noteworthy customer engagement, with dwell times averaging 106 minutes and displaying a marked increase compared to the previous year. These trends suggest that while visitor numbers might be subdued in certain areas, the overall quality of the customer experience is strengthening.

Industry Comment:

Joe Capocci, spokesperson for Huq Industries, noted, "These metrics – a notable decline in footfall in areas such as Wales and a sharp increase in visitor dwell time – echo insights from recent retail industry news, underscoring the need for carefully adapted strategies."

This week's analysis highlights the evolving dynamics of the retail environment across the UK, emphasizing the importance of adaptability and strategic insight in maintaining strong customer engagement even amidst challenging footfall trends.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 10 Weekly Wrap: Retail Trends and Location Analytics Update

Week 10 Weekly Wrap: Retail Trends and Location Analytics Update

Week 10 analysis shows a 6.2% drop in shopping centres' footfall. Explore how location analytics and location intelligence reveal evolving shopper trends.

Share on LinkedIn

Introduction

In Week 10, retail performance tests the resilience of locations across the UK. Early data shows that shifts in footfall and longer dwell times were common trends, offering important insights via location analytics. Retail centre insights and evolving consumer behaviour are evident from the updated statistics and detailed regional breakdowns.

Local Retail Centres

Local Retail Centres have experienced a modest decline in visits, with an overall average of 12,700 daily visits. Reports indicate that England sees 12,800 visits while Scotland and Wales have experienced sharper declines. Despite reduced numbers, dwell times increased to 95 minutes, suggesting that consumer engagement has strengthened; more details are available in the Local Retail Centres update.

Shopping Centres

Shopping Centres recorded an average of 24,500 daily visits. The performance update shows a 6.2% week-on-week decline with England and Wales being particularly affected, even as Scottish centres saw a marginal weekly increase. Dwell times averaged 109 minutes, reflecting a noticeable 6.8% weekly drop but a strong 13.5% yearly improvement; further insights can be found in the Shopping Centres performance update.

Retail Parks

Retail Parks demonstrated a moderate repression in footfall with an average of 15,600 visits per day, alongside minor regional declines. Variation is evident with Scottish Retail Parks posting a 2.7% weekly drop and English parks showing a steeper decline. Notably, Welsh parks even experienced a slight increase, and dwell time figures played out a 6.8% drop overall; complete details are noted in the Retail Parks performance update.

Major Retail Centres

Major Retail Centres remain a robust segment with an impressive daily average of 66,800 visits. Both England and Scotland face short-term declines, though Scotland recorded higher activity, while Wales showed strong annual recovery. Dwell time trends are positive with an overall average of 116 minutes; this trend exemplifies retail centre insights, as more details are provided in the Major Retail Centres update.

High Streets & Town Centres

High Streets and Town Centres saw an average footfall of 26,800 visits with mixed regional performance. English centres experienced modest drops, while Scottish sites enjoy a slight weekly increase despite an annual decline. Welsh centres maintained impressive engagement with dwell times of 113 minutes, as reported in the High Streets & Town Centres update.

Expert Insights and Market Reflection

The analysis points towards a market where footfall performance is contracting, yet dwell time trends show increasing engagement. "Contracting footfall coupled with increased dwell time shows that visitors are making thoughtful visits," said Joe Capocci, Huq Industries Spokesperson.

Conclusion

Week 10 reveals that UK retail is in a phase of transformation. Despite challenges like a 6.2% dip in footfall at shopping centres, the increasing visit durations indicate a shift towards quality visits over quantity. Retail stakeholders are now better equipped to leverage location intelligence, optimise strategies, and respond to changing consumer behaviour across different regions.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.