UK Local Retail Centres – Week 13 Performance Update 2025: location analytics insights

UK Local Retail Centres – Week 13 Performance Update 2025: location analytics insights

UK local retail centres show mixed performance in week 13 of 2025 with a 5% rise in daily footfall and 5.4% longer dwell time, reflecting evolving location intelligence trends.

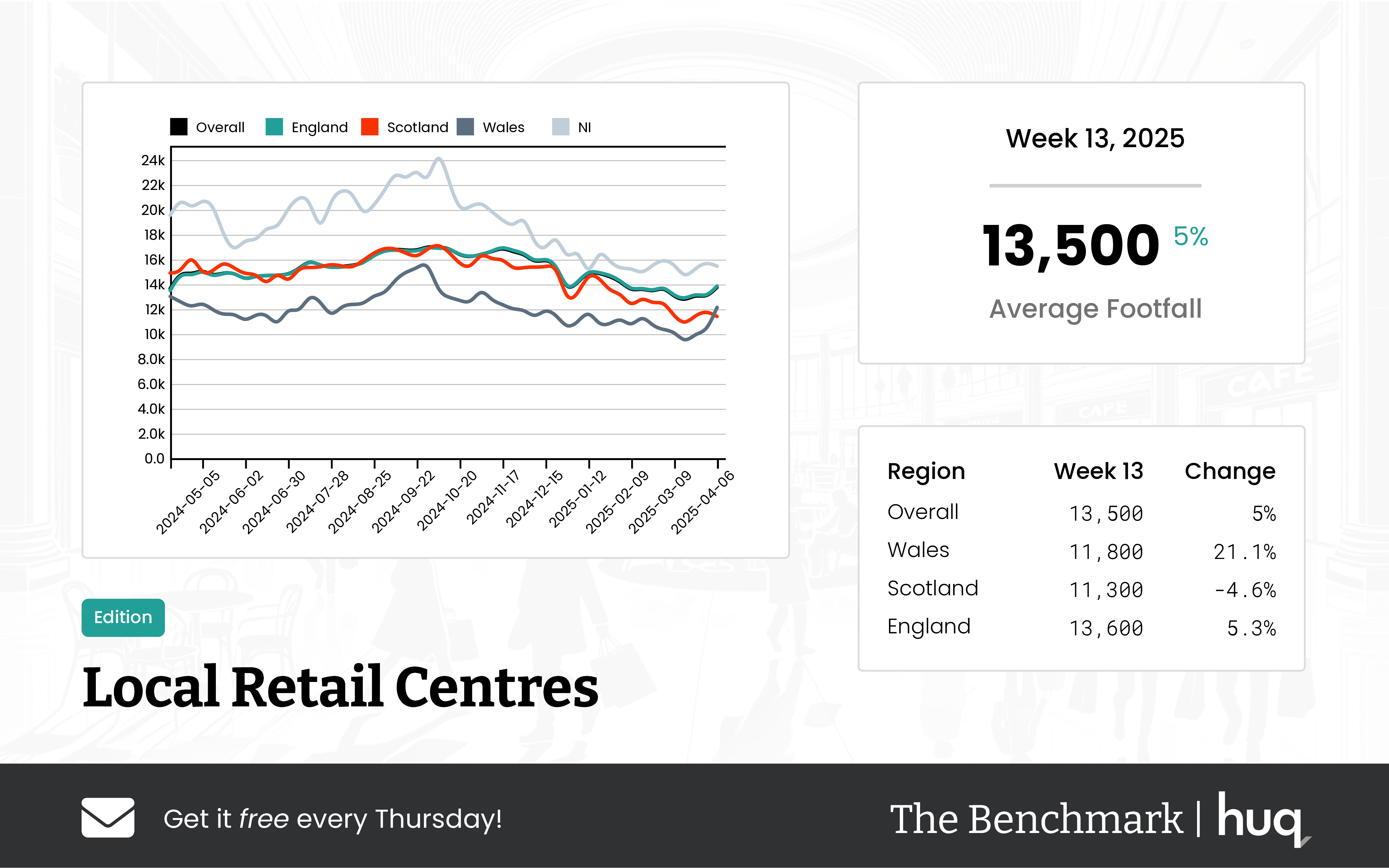

Recent data for the week ending 6 April 2025 highlights a mixed bag of short-term gains and longer term challenges across UK local retail centres, underpinned by strong location analytics. Centres recorded an average daily footfall of 13,500, marking a modest 5% improvement compared with last week, although overall footfall remains lower than the previous year with a 6.6% decline. Visitors spent an average of 98 minutes at these centres, with dwell time rising by 5.4% on a week-on-week basis and showing a sharp year-on-year increase, offering valuable location intelligence.

Regional Breakdown

Wales

In Wales, local centres welcomed an average of 11,800 daily visitors. This region experienced a sharp increase in footfall compared with the previous week, despite a moderate decline of 6.3% against last year’s figures. Visitors spent an average of 91 minutes per visit, with dwell time showing a sharp weekly increase; these trends offer location intelligence.

Scotland

In Scotland, centres recorded an average of 11,300 daily visitors. Footfall fell modestly over the week and compared less favourably with the same period last year while visit duration stood at 80 minutes, reflecting a moderate week-on-week decline despite a small year-on-year rise. These figures contribute to a growing sense of location intelligence in UK retail performance.

England

In England, local retail centres recorded a healthy average daily footfall of 13,600 with a 5.3% increase over the week, although their yearly performance softened by the same margin. The average visit duration was 99 minutes, showing positive progress both week-on-week and over the longer term. Such trends further reinforce location intelligence emerging from regional performance.

Industry Comment

Commenting on these findings, Joe Capocci, Huq Industries spokesperson, stated: “Our most striking change in footfall was observed in Wales, a trend that resonates with industry developments seen in recent retail news such as the ghost shopping centre story.”

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of physical commerce with our flagship lighthouse platform.

Looking for intelligence on specific locations? Explore the lighthouse platform.

Week 12 Weekly Wrap: Retail Insights with Location Analytics

Week 12 Weekly Wrap: Retail Insights with Location Analytics

Retail parks show a 4.2% weekly boost, signalling resilient location analytics trends as retailers harness location intelligence for strategic recovery.

Introduction to the Week

The latest figures reveal a complicated recovery in the UK retail scene, where metrics such as retail footfall and dwell times provide a window into evolving customer behaviours. Early analyses utilise location analytics to map out which centre types are gaining traction. Emerging insights indicate that shoppers are generally spending more time in retail environments, despite ongoing annual declines in visitor numbers.

Retail Parks: Steady if Slim Gains

Retail parks experienced a modest improvement with a 4.2% weekly boost, reaching an average of 16,200 daily visitors alongside an increase in dwell times from 71 to 73 minutes. Although a 19% year‑on‑year decline is evident, these trends point to a more engaged customer base when footfall occurs. Further details can be explored in the UK Retail Parks – Week 11 2025 Performance Update: Footfall Data Insights and the UK Retail Parks – Week 12 Performance Update 2025: Footfall Retail Insights.

Shopping Centres: Increased Engagement

Shopping centres showcased a dynamic performance by attracting 27,400 daily visitors in Week 11, with dwell times reaching 113 minutes. This increase occurred despite a 6.7% year‑on‑year decline and was further followed by a slight weekly drop to 26,900 visitors in Week 12. For further illustration of these trends, visit the Week 11, 2025 Shopping Centres Update: Location Analytics Perspective and the Shopping Centres Week 12, 2025 Performance Update: Location Analytics Insights.

Major Retail Centres: Robust Performance

Major retail centres continue to demonstrate robust performance, with Week 11 reporting an impressive 68,800 daily visitors and dwell times of 114 minutes. Regional analyses reveal especially strong performance in Scotland, where centres drew 81,000 visitors and recorded dwell times of 126 minutes. This resilient pattern highlights the importance of harnessing both location analytics and location intelligence for informed decision making, as detailed in the Week 11 2025 Major Retail Centres: Robust Performance & Location Analytics Insights.

High Streets & Local Retail Centres: Cautious Recovery

High streets and town centres are witnessing a cautious recovery, with Week 11 averages of 28,100 visitors and roughly 96 minutes of dwell time before a slight decline in Week 12 to 27,600 visitors. Local retail centres also reflect evolving consumer habits despite a 10.2% year‑on‑year drop, sustaining dwell times at 93 minutes. These findings underline that regional trends vary considerably, with some areas in England showing minor declines while others in Wales and Scotland face steeper challenges; additional insights are provided in the UK High Streets & Town Centres – Week 11, 2025: Footfall Retail Trends and the UK High Streets & Town Centres – Week 12, 2025: Footfall Analytics Performance Update along with the Week 12, 2025 Local Retail Centres Footfall Performance Update.

Regional Trends: Divergent Patterns

Regional disparities have emerged prominently this week, with centres in Wales facing harsher conditions while those in Scotland and England record more stable numbers. The divergent regional trends force retailers to adapt strategies that take into account varying levels of retail footfall and dwell times. Retail stakeholders are increasingly utilising location intelligence to understand these differences, ensuring they optimise strategies based on robust regional data.

Expert Insights and Final Thoughts

Industry experts emphasise the significance of these retail trends as the sector continues its recovery. Joe Capocci from Huq Industries stated, "Understanding these shifts through location analytics and location intelligence is key to adapting strategies and ensuring that retail environments remain engaging and community‐oriented." His comment resonates strongly as retailers work to reconcile steady dwell times with softer footfall figures, adjusting approaches tailored to specific centre types and regional challenges.

The successive weekly updates provide not only a snapshot of current performance but also a roadmap for future adaptations in the retail sector. By balancing the gains in dwell times with overall declines in daily visitor numbers, businesses can refine their focus on enhancing customer experience. As developments continue to unfold, the interplay between regional trends and tactical insights remains critical for unlocking sustainable recovery in retail environments.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of physical commerce with our flagship lighthouse platform.

Looking for intelligence on specific locations? Explore the lighthouse platform.

UK Major Retail Centres – Week 12 Performance Update 2025: Footfall Data Insights

UK Major Retail Centres – Week 12 Performance Update 2025: Footfall Data Insights

Latest figures show a modest downturn across UK centres with a 1.2% weekly and 5.3% annual drop. Recent footfall data and footfall retail insights signal cautious consumer activity.

Overview

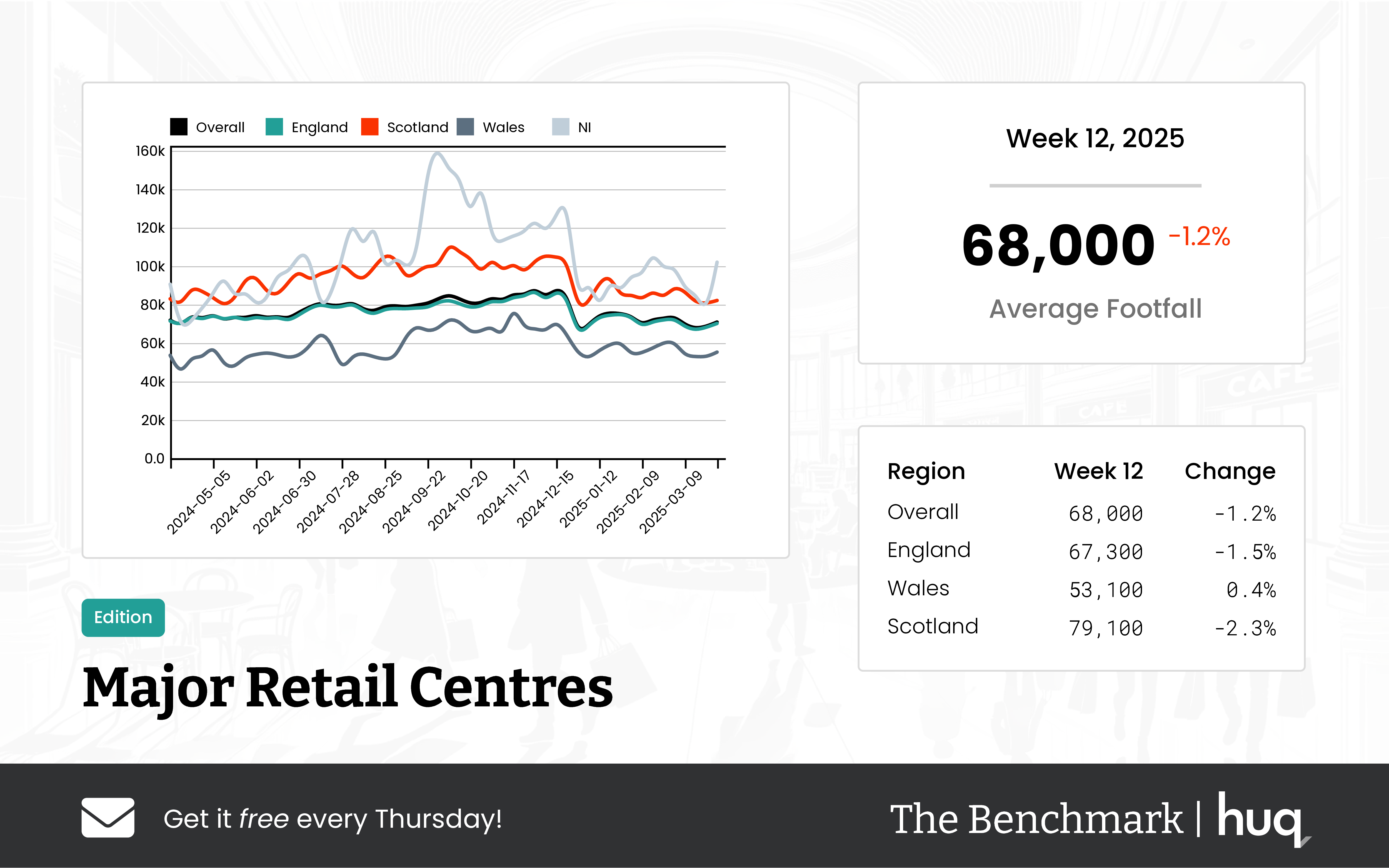

The latest weekly figures from The Benchmark, based on robust footfall data, reveal a modest downturn in overall footfall across UK Major Retail Centres. The average daily footfall stood at 68,000, marking a week-on-week decrease of 1.2% and a year-on-year decline of 5.3%. Average visit duration for the centres was recorded at 110 minutes, experiencing a 3.5% drop on a weekly basis and a more subtle annual dip of 0.9%.

Regional Comparisons

England registered an average daily footfall of 67,300, following the overall trend with a weekly decline of 1.5% and a year-on-year reduction of 6%, underscoring evolving footfall retail trends. The duration of visits in England remained at 110 minutes, with a weekly dip of 3.5% while remaining steady compared to the previous year.

In Scotland, the average daily footfall was notably higher at 79,100, though it experienced a decline of 2.3% on a weekly basis and 5.9% year-on-year. Dwell time in Scotland was observed at 121 minutes, with a 4% softening in the week despite a year-on-year improvement of 14.2%, reflecting footfall analytics insights.

Wales presented a contrasting picture with a lower overall footfall of 53,100; however, it recorded a modest weekly gain of 0.4% and an annual improvement of 5.1%, aligning with encouraging footfall statistics. The average visit duration in Wales was 87 minutes, showing a weekly increase of 2.4% but a sharp decline when compared to the previous year.

Visitor Engagement

The dwell time figures, while secondary to footfall performance, provide a nuanced view of visitor engagement. Although the overall reduction in both footfall and dwell time suggests a cautious trading environment, the regional variations indicate a mixed performance landscape across the UK centres. Furthermore, detailed footfall counting highlights shifts in visitor behaviour.

Industry Comment

“Scotland’s notable footfall decline alongside Wales’s resilient performance, as highlighted in recent retail industry news, underscores evolving consumer behaviour in a challenging market,” said Joe Capocci, Huq Industries spokesperson.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of physical commerce with our flagship lighthouse platform.

Looking for intelligence on specific locations? Explore the lighthouse platform.

UK Retail Parks – Week 12 Performance Update 2025: Footfall Retail Insights

UK Retail Parks – Week 12 Performance Update 2025: Footfall Retail Insights

UK retail parks saw a modest week-on-week 0.8% boost in footfall, despite a 19.3% year-on-year decline. Recent trends from footfall analytics suggest evolving visitor habits.

Share on LinkedIn

Overall Performance

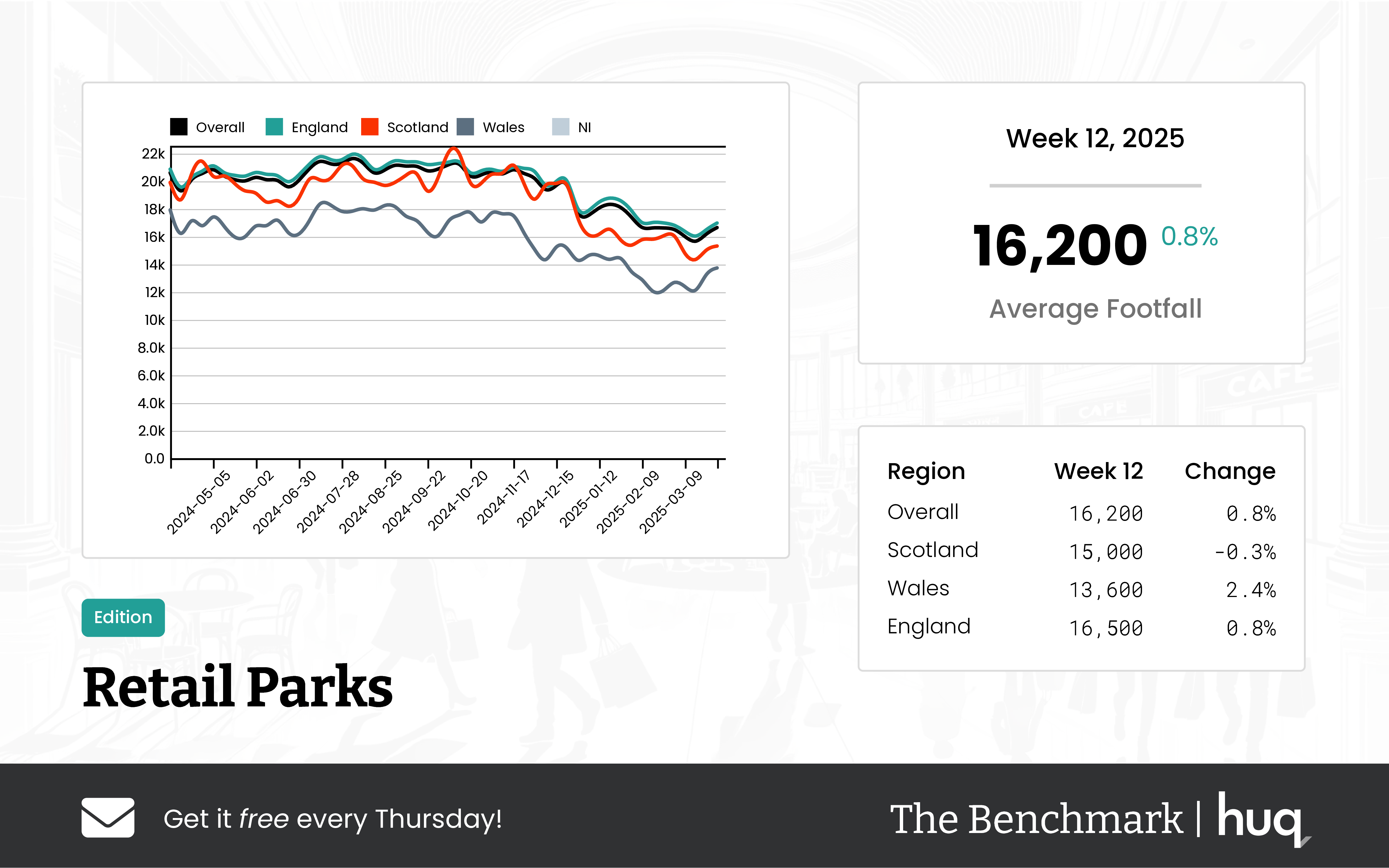

The latest data from The Benchmark provides an insightful overview of footfall activity across UK retail parks. The average daily visitor count now stands at 16,200, reflecting a modest weekly improvement of 0.8%. However, when compared with the same week last year, the overall footfall figures show a 19.3% decline, underlining the ongoing challenges in returning to historic performance levels.

Regional Breakdown

In England, retail parks averaged 16,500 visitors daily, benefitting from a 0.8% gain over the past week, counterbalanced by an 18.7% drop year-on-year. Scotland, meanwhile, registered an average of 15,000 daily visitors, despite a slight weekly dip of 0.3% coupled with a marked annual decline. Wales presented a contrasting trend with retail parks attracting an average of 13,600 visitors per day, highlighted by a healthier weekly increase of 2.4%, though still facing a 19.1% decline compared to the previous year.

Visitor Behaviour

Additional analysis from footfall analytics reveals that the average dwell time per visit has reached 71 minutes. While this marks a 2.7% decrease from last week, it is nevertheless a 12.7% improvement over the previous year's figures—a signal of both enhanced visit quality and evolving spending potential. Delving deeper, regional variations are evident:

• In Scotland, visitors now spend an average of 81 minutes per visit, which is a result of a 3.8% increase week-on-week and a 15.7% annual rise.

• In England, dwell times remain consistent with the overall average, despite experiencing a slight weekly decrease of 1.4% and recording a 14.5% improvement year-on-year.

• Conversely, in Wales, shorter visits averaging 63 minutes suggest a softening in dwell time relative to earlier periods.

Industry Perspective

Joe Capocci, spokesperson for Huq Industries, commented on the evolving retail landscape: "The pronounced year-on-year decline in footfall, notably seen in Scotland, underscores the challenging environment currently facing retail parks. This is further highlighted by recent developments in the sector, like the opening of an IKEA mini retail park store."

These trends provide vital insights for stakeholders aiming to navigate the shifting dynamics of UK retail parks and adapt strategies for improved visitor engagement.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

UK High Streets & Town Centres – Week 12, 2025: footfall analytics Performance Update

UK High Streets & Town Centres – Week 12, 2025: footfall analytics Performance Update

Footfall analytics indicate a modest 1.5% decline, with overall footfall data showing a drop amid evolving UK retail trends as visitors now spend 95 minutes on average.

Share on LinkedIn

Overview

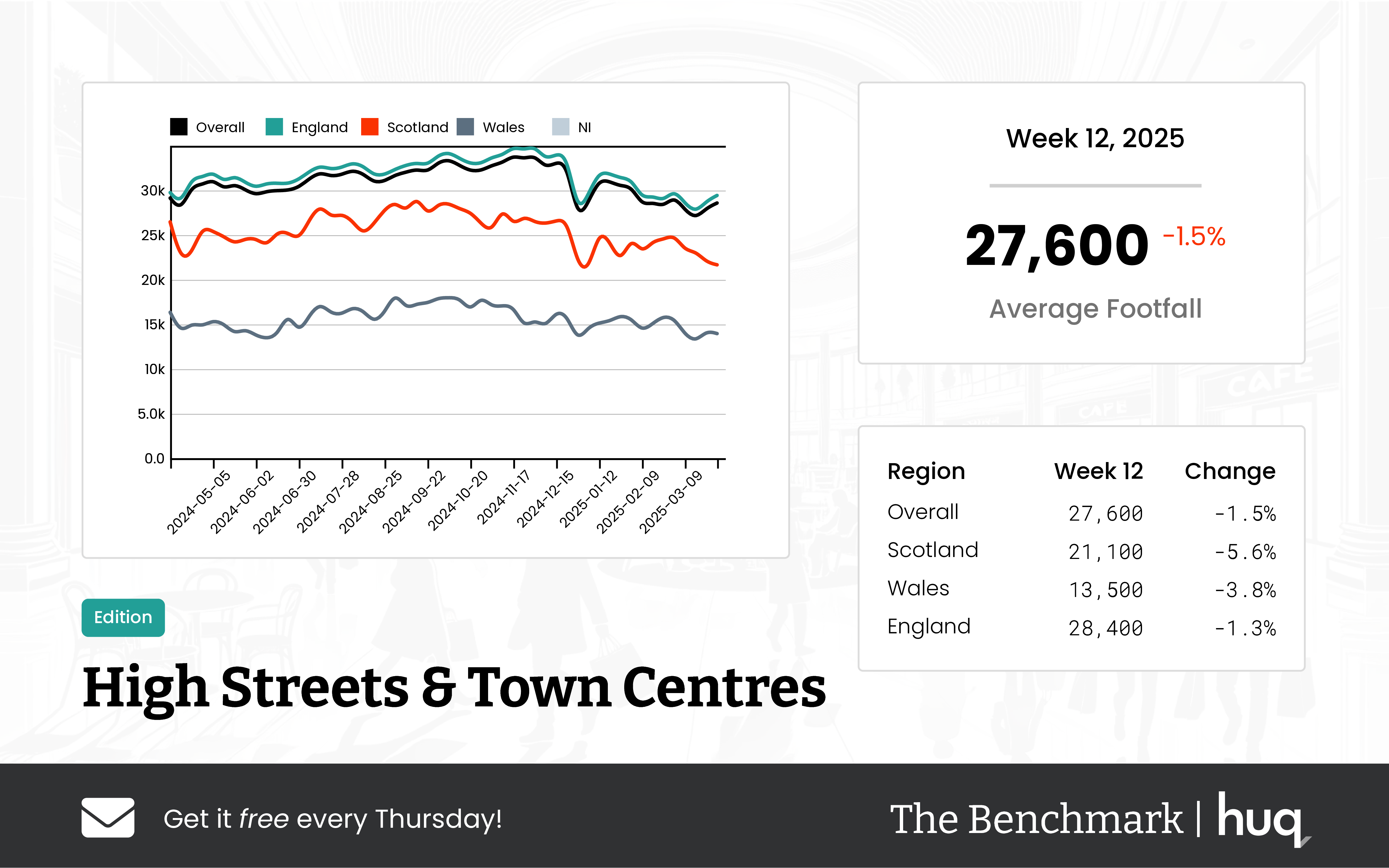

Data from The Benchmark for the week ending 30 March 2025 indicates modest declines in footfall across UK High Streets and Town Centres, according to footfall analytics. Nationally, average daily footfall was recorded at 27,600, marking a 1.5% reduction from the previous week and a 6.6% decline compared to the same period last year.

Despite these figures indicating fewer visitors overall, the duration of visits has improved, with the national average climbing to 95 minutes. This slight improvement in dwell time, alongside muted week on week variations, suggests that while fewer people are visiting, those who do are spending longer in store environments. These findings are further supported by robust footfall data.

Regional Breakdown

Regional analysis reveals distinct patterns across the UK. Centres in England have experienced a 1.3% drop in daily footfall from the previous week, arriving at an average of 28,400 visitors, with a comparable 6.3% decline over the year. In contrast, Scottish centres recorded lower attendance with an average of 21,100 visitors, declining by 5.6% week on week and 13.6% over the year.

Welsh centres saw the lowest numbers at 13,500 daily visitors, experiencing a 3.8% week on week drop and an 11% decline compared to last year. These footfall statistics highlight evolving regional consumer behaviours and contribute significantly to footfall retail insights.

Dwell Time Insights

Quality of visits has shown an overall improvement. Although the average visit duration fell slightly by 1% on a week on week basis, the year on year increase of 6.7% underscores an enhanced visitor experience. In England, dwell times were maintained from the previous week and improved by 9.1% compared to last year.

Scottish centres reported steady performance over the week while experiencing a sharp increase over the year, whereas Welsh centres noted a marked reduction in the time visitors spend per visit. Recent footfall counting metrics further corroborate these dwelling trends.

Industry Comment

“Overall results, with the most striking decline in Scotland’s footfall alongside recent retail headlines such as the WH Smith sale, affirm that our data provides essential insight into evolving consumer behaviour,” said Joe Capocci, Huq Industries spokesperson.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

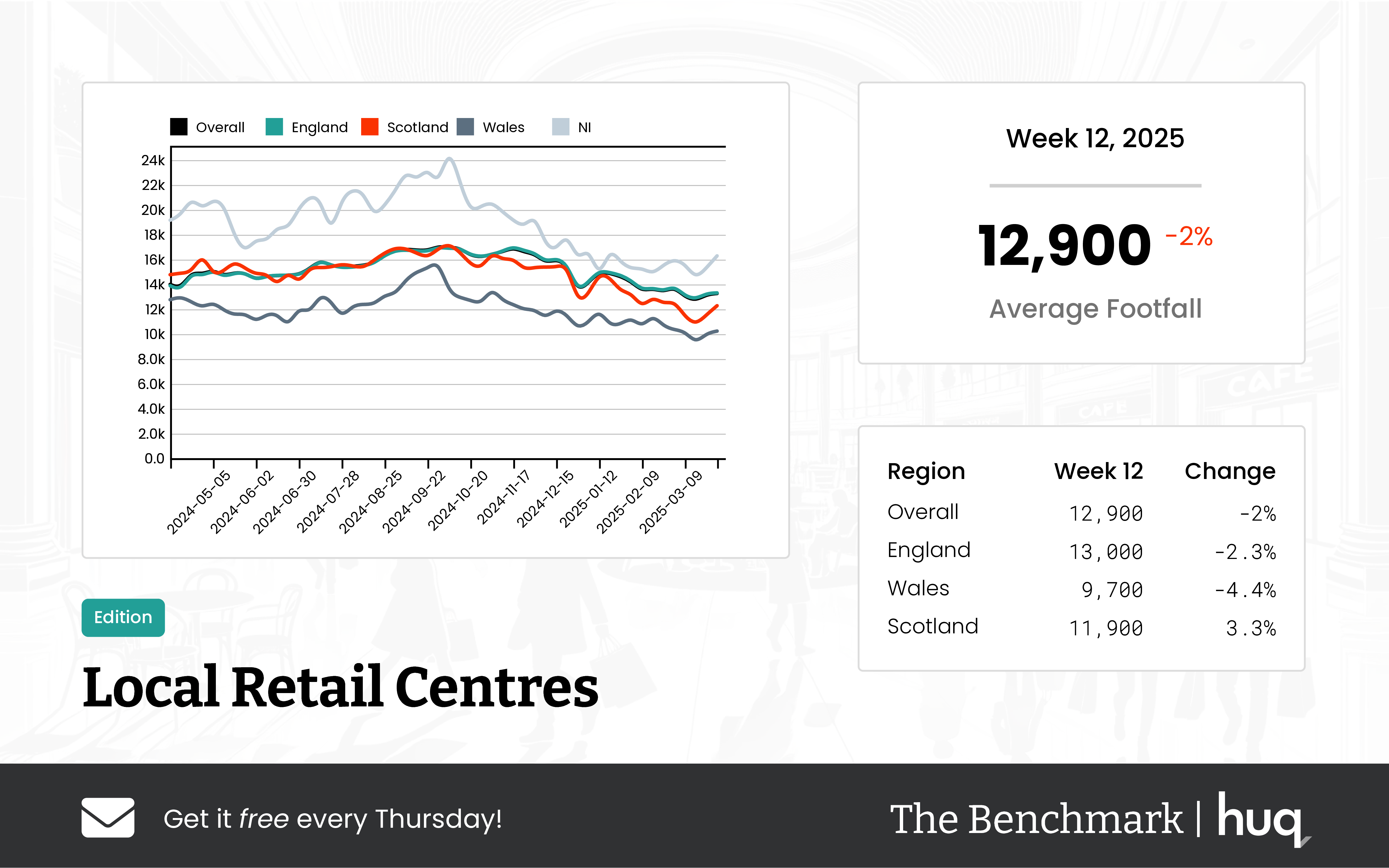

Week 12, 2025 Local Retail Centres Footfall Performance Update

Week 12, 2025 Local Retail Centres Footfall Performance Update

UK Local Retail Centres saw a 2% dip in daily visitor numbers. Robust footfall trends and footfall analytics reveal an overall soft performance from last week.

Share on LinkedIn

Overall Performance:

UK Local Retail Centres recorded an average of 12,900 daily visitors during Week 12, 2025, marking a 2% decline from the previous week and a notable 10.2% drop compared to the same period last year. This overall soft performance reflects a dynamic retail environment where even minor shifts in footfall can be significant.

Regional Breakdown:

In England, the centres saw an average of 13,000 visitors per day, experiencing a 2.3% decrease week on week and a 9.2% decline year on year. In contrast, Scotland’s performance was somewhat more encouraging, with an average daily footfall of 11,900—a 3.3% increase over the past week, despite softer comparisons with the previous year. Meanwhile, Wales faced tougher conditions, with an average of 9,700 daily visitors, registering a 4.4% weekly decline alongside a substantial year on year drop.

Visitor Engagement:

Visitor behavioural data revealed that the average dwell time at local retail centres remained steady at 93 minutes per visit, identical to last week’s figures. Notably, this duration represents a significant 14.8% year on year increase. England’s centres maintained an average visit duration of 94 minutes, buoyed by a 17.5% increase compared to the previous year. Scottish centres also saw improvements, with dwell times rising by 5.9% week on week and by 16.9% year on year. In contrast, Welsh centres experienced a decrease, with average dwell times falling to 64 minutes, highlighting a marked reduction relative to historical performance.

Industry Comment:

Joe Capocci, spokesperson for Huq Industries, commented on the trends: "The notable decline in footfall observed in Wales alongside Scotland's rebound, as echoed in recent footfall statistics, underlines the evolving market dynamics." This industry insight underscores the complexities of regional performance and the importance of continuous monitoring in a fluctuating market.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

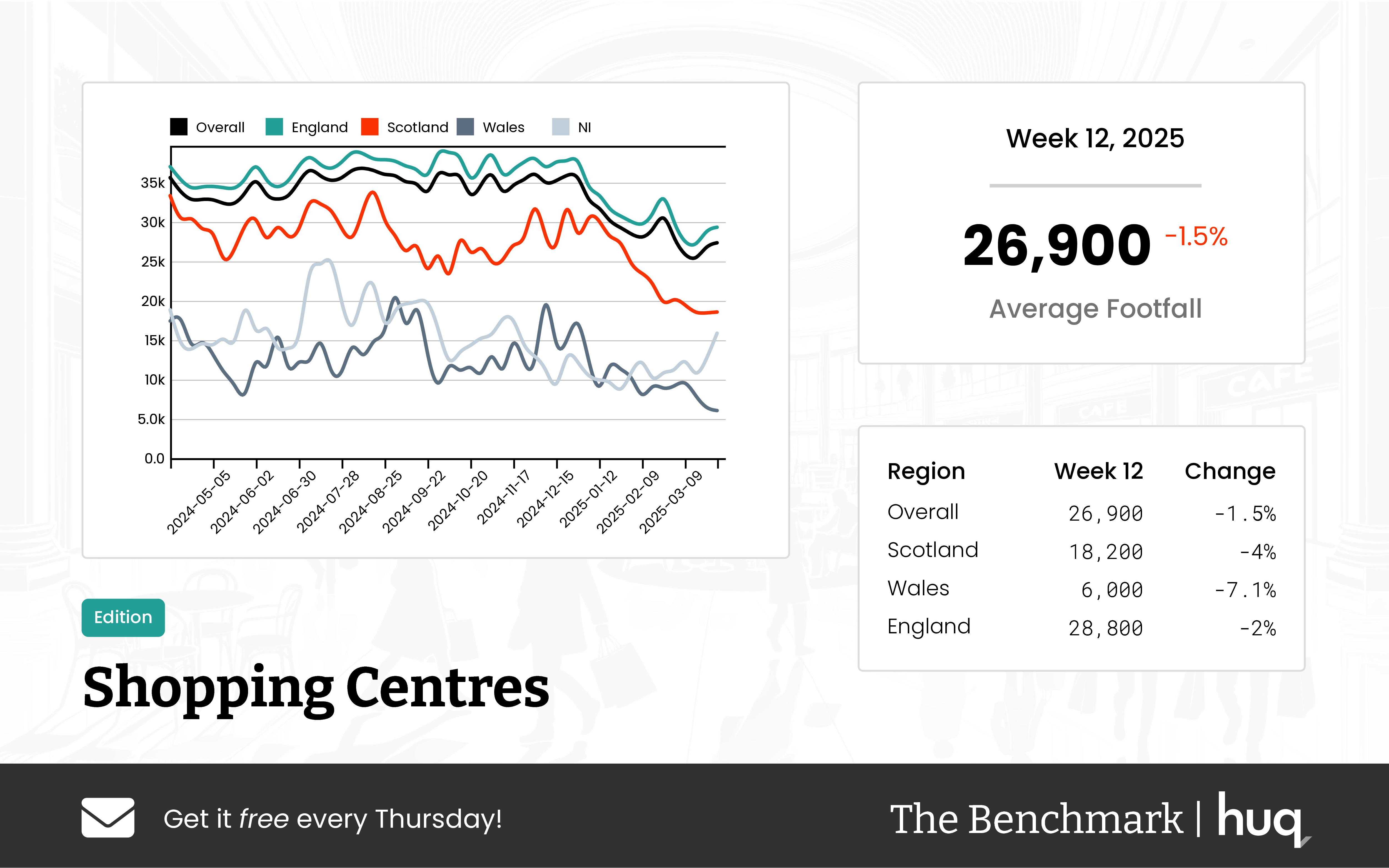

Shopping Centres Week 12, 2025 Performance Update: Location Analytics Insights

Shopping Centres Week 12, 2025 Performance Update: Location Analytics Insights

Week 12 update reveals mixed trends with a –1.5% weekly dip and modest dwell time uplift. Location analytics insights underscore robust footfall trends.

Overall Performance

UK Shopping Centres experienced mixed visitation trends over the week ending 30 March 2025, as revealed by location analytics that underscore current retail performance. Average daily footfall across all centres was 26,900, reflecting a slight weekly dip of –1.5% and a year-on-year decline of –19.8%. At the same time, visitors are spending more time on-site, with an average visit duration reaching 115 minutes—a modest weekly lift of 1.8% that signals a healthier level of engagement.

Regional Performance

In England, centres recorded an average daily footfall of 28,800 with a minor week-to-week decrease of –2% and a year-on-year drop of –17.9%, suggesting that while numbers have eased, there remains some resilience in visitor traffic. Scottish centres saw an average of 18,200 daily visitors accompanied by a weekly change of –4% and a notable year-on-year decline, pointing to relatively tougher trading conditions. Wales recorded the lowest overall average, with 6,000 daily visitors and a weekly decrease of –7.1%, compounded by a significant year-on-year fall that highlights the challenges faced in maintaining visitor numbers and footfall trends.

Dwell Time Analysis

In England, the average visit lasted 113 minutes, with only a slight softening of –0.9% on a week-on-week basis, while year-on-year performance improved by 14.1%. Scottish centres reported an average dwell time of 107 minutes, experiencing a significant week-on-week fall of –11.6% but a sharp improvement in their year-on-year figures. In contrast, centres in Wales displayed an average visit duration of just 26 minutes, with both weekly and yearly comparisons indicating notable declines in visitor engagement.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 11 Weekly Wrap: Robust Footfall Retail Analytics Across the UK

Week 11 Weekly Wrap: Robust Footfall Retail Analytics Across the UK

Discover how footfall retail trends show a 4.2% rise in retail parks, boosting footfall analytics and footfall data insights.

Share on LinkedIn

Overview of Week 11 Trends

In Week 11, the UK retail scene is buzzing with activity as footfall increases across multiple centre types. The latest footfall data reveal dynamic changes and a notable shift in visitor engagement across key retail outlets. Early indicators pinpoint retail parks and shopping centres as standout performers, with emerging footfall statistics and enhanced dwell times setting the stage for more resilient footfall retail performance.

Retail Parks Surge and Insights

Retail parks experienced a promising boost with an average of 16,200 daily visitors and dwell times rising to 73 minutes in Week 11. Compared to Week 10 figures, which reported 15,600 visitors, these parks now display a subtle yet significant improvement. The detailed Retail Parks Week 11 update provides further insight into regional gains and the upward movement in footfall analytics.

Major Retail Centres Performance

Major retail centres averaged 68,800 daily visitors alongside dwell times of 114 minutes in Week 11. Regions such as Scotland saw impressive numbers with 81,000 visitors, while England and Wales recorded steadier figures. More context on evolving footfall statistics in these centres is available in the Major Retail Centres Week 11 update.

Strong Figures in Shopping Centres

The shopping centres sector reported a significant 12.8% increase, reaching 27,400 visitors per day with dwell times of 113 minutes. This improvement stands in contrast with Week 10 when a decline was observed, indicating a promising rebound in shopper engagement. Comprehensive analysis in the Detailed Shopping Centres data for Week 11 sheds light on these impressive footfall retail outcomes and the role of increased footfall statistics.

High Streets and Town Centres Dynamics

High streets and town centres recorded an average of 28,100 daily visitors with a modest overall improvement. Regional contrasts are evident as England enjoyed minor gains while Scotland saw reduced visitor numbers but slightly longer dwell times. Further information can be found in the High Streets & Town Centres update, which explains emerging trends in footfall counting and strategic retail adjustments.

Local Retail Centres: A Closer Look

Local retail centres reached 13,300 daily visitors with a strong weekly gain of 6.1% despite facing a YoY decline. Regional breakdowns identify Wales and Scotland as rising markets, even as average dwell times slightly dipped. Explore more detailed footfall analytics for these centres in the Local Retail Centres Week 11 update.

Expert Insights and Overall Analysis

Joe Capocci, Huq Industries Spokesperson, remarked, "The upward trends in footfall and longer dwell times are a strong signal that customers are engaging more deeply across all retail environments." He emphasised that substantial improvements in footfall statistics present opportunities for retailers to optimise customer interactions and better capitalise on emerging behavioural trends. This analysis demonstrates that even in face of variable visitor numbers, the enhanced time spent in stores underscores a positive shift in consumer habits.

Looking Ahead

Analysis of Week 10 alongside Week 11 reveals that improved dwell times are bolstering overall footfall retail performance, despite some isolated declines in major centres. Retail businesses can confidently leverage these measurable improvements to adjust their strategies. The nuanced insights and detailed metrics across retail parks, shopping centres, high streets, and local centres continue to inform stakeholders and paint a comprehensive picture of evolving consumer dynamics.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

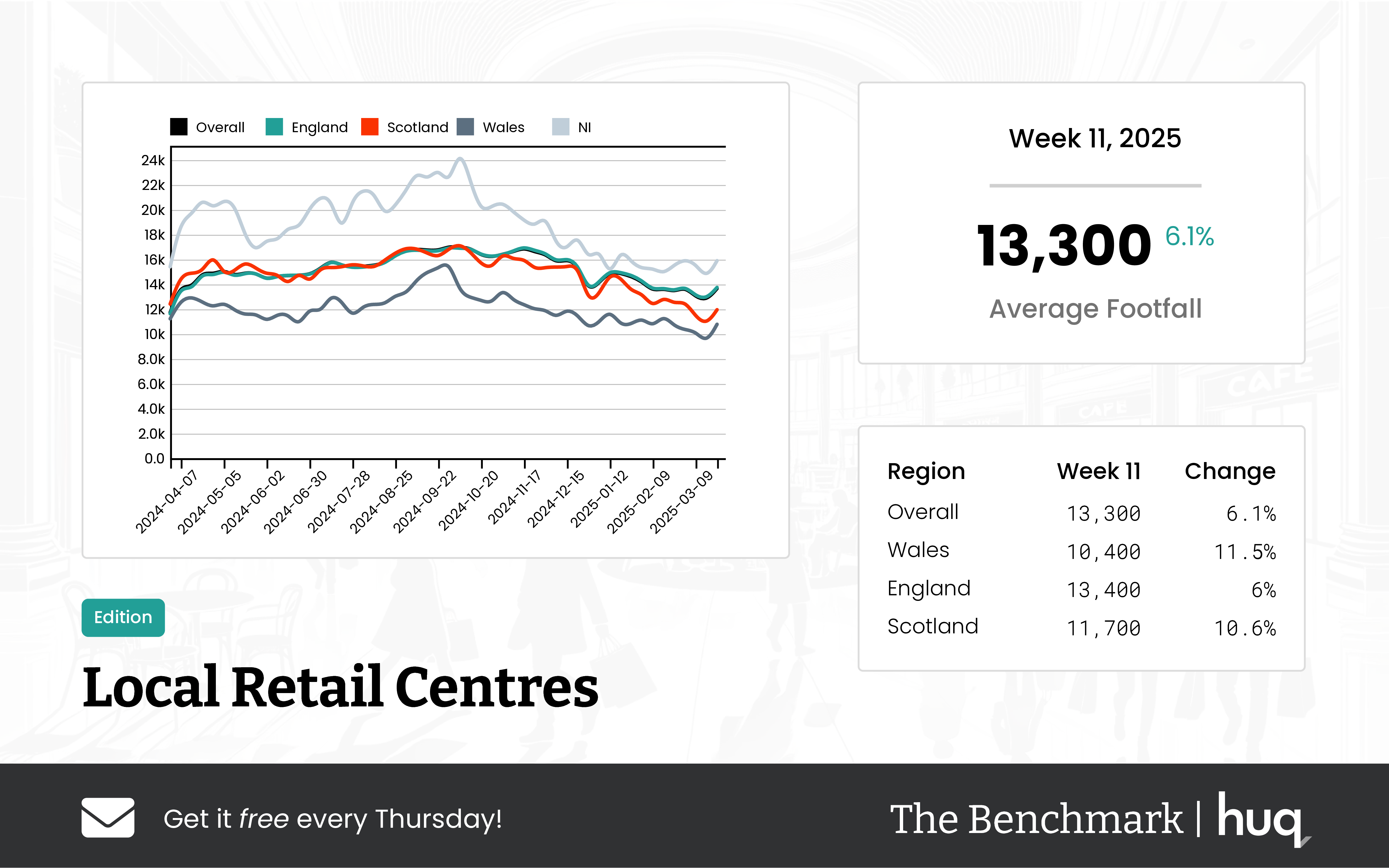

UK Local Retail Centres – Week 11 2025: Footfall Retail Performance Update

UK Local Retail Centres – Week 11 2025: Footfall Retail Performance Update

UK local retail centres saw steady gains this week with a 6.1% rise in average daily footfall retail. The modest increase, supported by encouraging footfall analytics, points to evolving consumer trends.

Share on LinkedIn

The latest data from The Benchmark highlights a slight week-on-week improvement in UK local retail centres, which recorded an average daily footfall of 13,300 for the week ending March 23, 2025. This represents a 6.1% increase over the previous week, despite a 14.9% decline compared to the same time last year. Shoppers are now spending an average of 93 minutes per visit, though this represents a slight softening of dwell time by 2.1% over one week, despite a strong long-term trend of increased time spent in centres.

Regional breakdowns further underscore the evolving retail dynamics. In England, the centres experienced an average of 13,400 visitors daily with a similar 6% weekly growth and an average visit duration of 94 minutes, even though the annual comparison shows a 13.8% decline. Welsh retail hubs performed notably well with an 11.5% gain, drawing in 10,400 daily visitors. Meanwhile, Scottish centres also saw robust footfall with 11,700 daily visitors and a 10.6% increase week-on-week; however, they recorded the shortest dwell times at 85 minutes, a figure that softened by 10.5% even amidst a year-on-year boost in footfall.

Industry insights reflect the significance of these trends. Joe Capocci of Huq Industries noted "The striking weekly improvements in Wales and highlighted evolving consumer trends significantly impacting local retail spaces."

Overall, while the year-on-year figures may appear challenging, the week-on-week growth suggests optimism and points to an evolving landscape where local retail centres are gradually regaining momentum with increasing visitor engagement.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

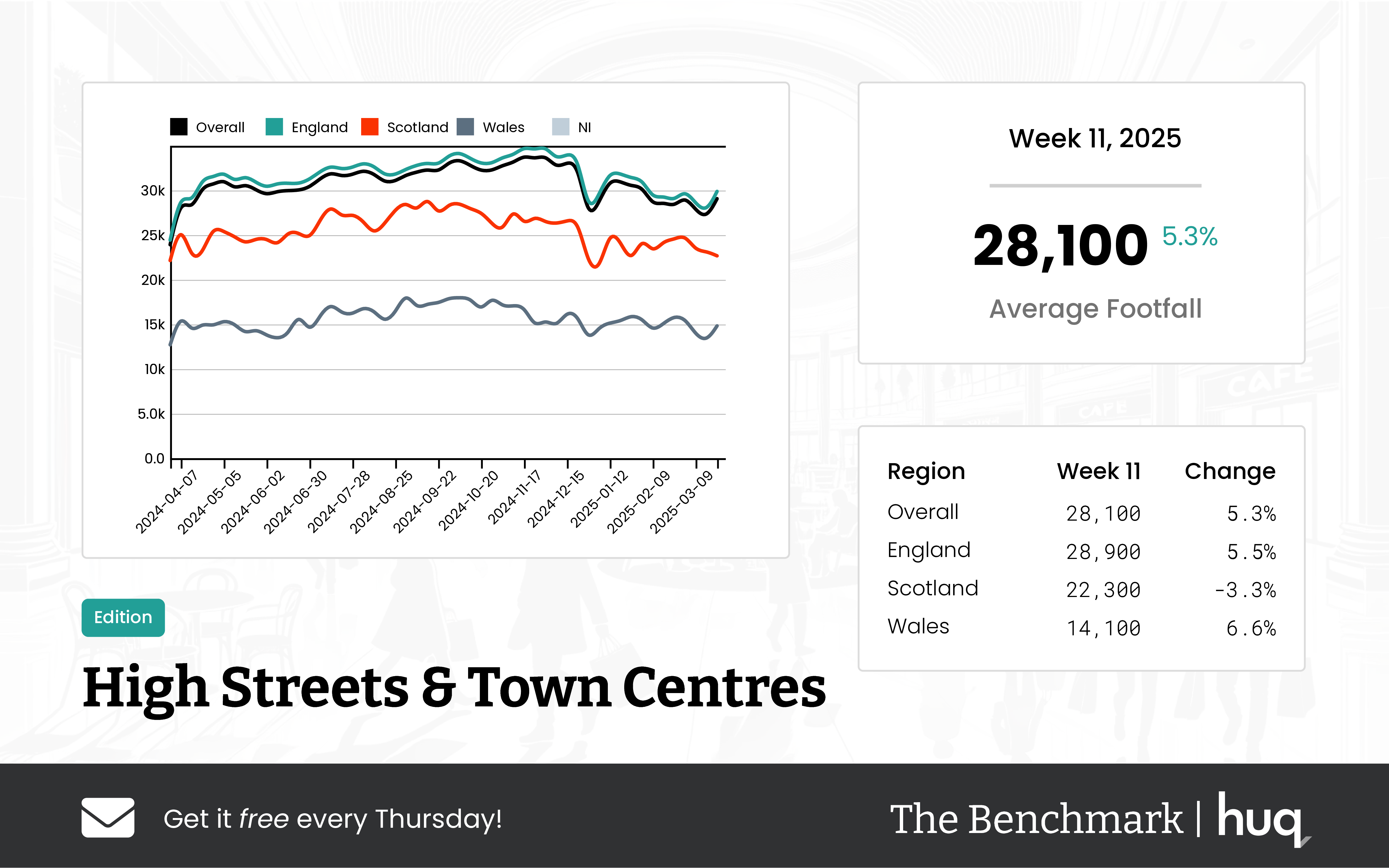

UK High Streets & Town Centres – Week 11, 2025: Footfall Retail Trends

UK High Streets & Town Centres – Week 11, 2025: Footfall Retail Trends

Cautious recovery as footfall data shows a 5.3% weekly rise and a 1.7% annual drop, reflecting steady footfall analytics in UK retail centres.

Share on LinkedIn

UK high streets and town centres are seeing cautious signs of recovery. The most recent figures from The Benchmark show an overall average daily footfall of 28,100 in the latest week, reflecting a 5.3% increase on a week-on-week basis, even though there is a 1.7% decrease compared to the same week last year. This mixed trend highlights a resilient yet stabilizing market, where short-term upticks contrast with slightly weaker long-term performance.

In England, the picture looks fairly positive with an average of 28,900 daily visitors, a 5.5% week-on-week increase, and only a minimal 0.9% year-on-year decline. This suggests that although the market has its challenges, recent recovery efforts seem to be paying off.

The situation in Scotland tells a different story. Here, high streets and town centres averaged just 22,300 daily visitors. This is coupled with a 3.3% reduction over the week and a significant year-on-year decline of 15.9%, pointing to more turbulent times in that region.

Wales has also recorded notable shifts, with an average of 14,100 daily visitors. The week-on-week performance was promising with a 6.6% increase, but the year-on-year comparison shows an 18.3% decline, painting a picture of a market under stress despite short-term gains.

Dwell time measurements, which provide insights into visit quality, remained steady overall at an average of 96 minutes per visit for the latest week. While this duration is consistent with the previous week's data, it represents an 18.5% improvement compared to last year. In England, dwell time trends closely mirror these overall patterns.

Scotland's visitors spent slightly more time on average, clocking in at 100 minutes per visit. Despite a week-on-week dip of 5.7% in dwell time, there has been a marked increase over a longer period. Wales again presents a mixed scenario: although the average visit duration remained at 96 minutes, there was a notable week-on-week decline of 15%, even as the year-on-year figure shows a moderate recovery of 14.3%.

Joe Capocci, spokesperson for Huq Industries, summed up the situation by highlighting the profound challenges facing the industry, especially in Wales: "The most striking change in our results is the notable decline in footfall across Wales, and recent industry news further underscores the importance of monitoring these trends."

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.