UK Major Retail Centres – Week 19, 2025 Update: Shifting Trends and Insights from Location Analytics

UK Major Retail Centres – Week 19, 2025 Update: Shifting Trends and Insights from Location Analytics

Week 19 data reveals a modest weekly rise in footfall but overall year-on-year declines, while regional insights and location analytics highlight changing consumer behaviors.

Share on LinkedIn

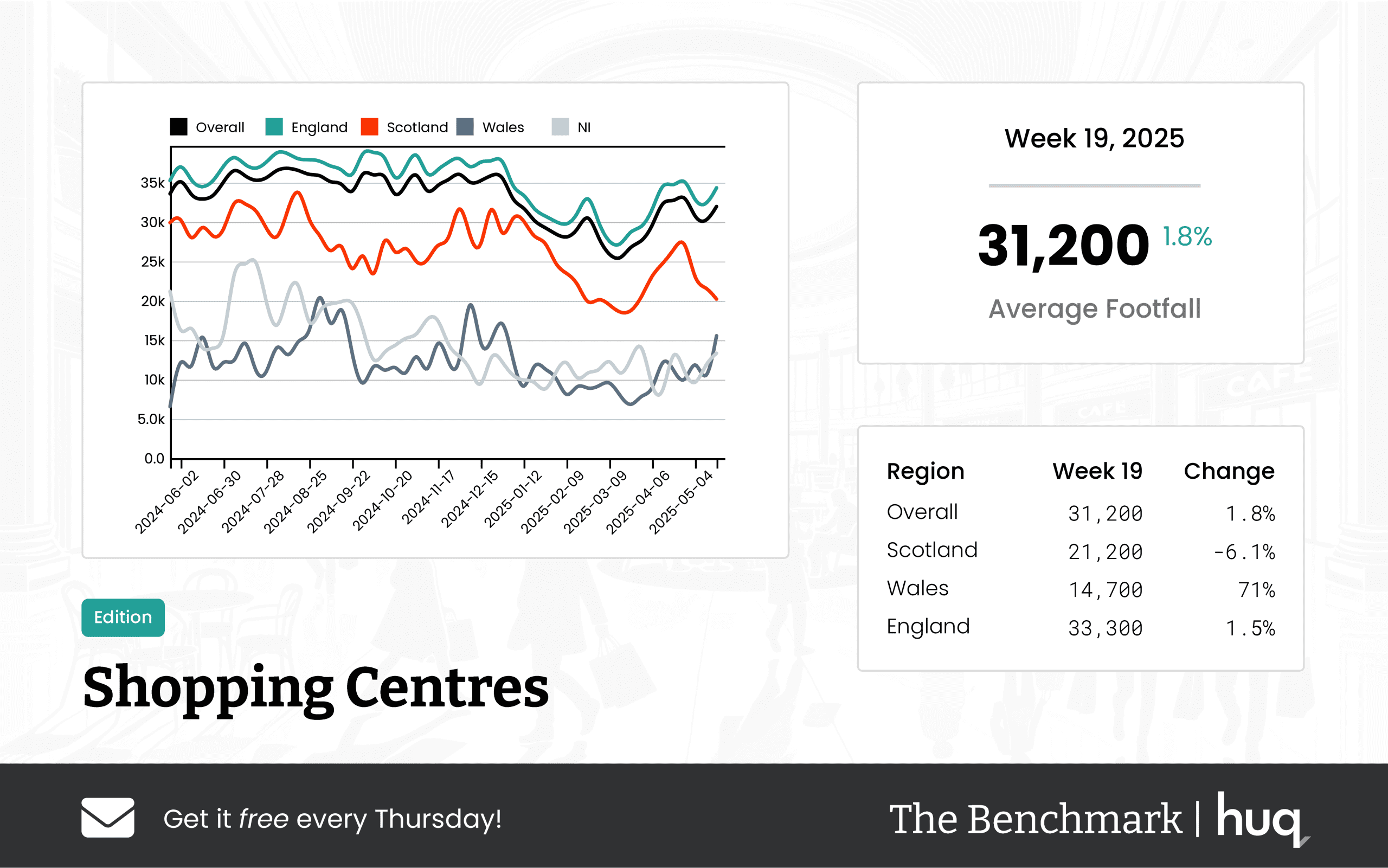

The latest figures from The Benchmark Tracker show that UK shopping centres welcomed an overall average daily footfall of 31,200 during the week ending 18 May 2025. Although this represents a modest weekly increase compared to the previous week, long‐term data reveals a decline relative to the same week last year. Notably, visitors spent an average of 120 minutes per visit—a small weekly uptick and a marked improvement from the previous year—highlighting emerging trends in shopper engagement derived from advanced location analytics.

In regional breakdowns, English centres led with an average daily footfall of 33,300. Despite a gentle week-on-week increase, the long-term trend shows softened footfall levels compared to the previous year, even though dwell times of about 122 minutes remain steady and display gradual improvement over time. In contrast, Scotland’s retail hubs attracted an average of 21,200 visitors daily. Not only did Scotland observe a modest decline in weekly footfall, but shoppers there also clocked an impressive average visit duration of 133 minutes, reflecting robust engagement within centre environments.

Wales presents a more varied picture; while the region recorded an average of 14,700 daily visitors with a notable sharp increase over the past week, the average visit duration stands at just 46 minutes—indicating a slight recent drop and a significant annual contraction.

Industry expert Joe Capocci from Huq Industries commented on the figures: "The sharp increase in Welsh footfall, alongside robust engagement in both Scotland and England, mirrors recent industry trends involving major store expansions and long-term retailer commitments. This underscores evolving consumer behaviour in our market."

These insights underscore the importance of location analytics in understanding and responding to changing consumer habits across different UK regions, revealing a complex interplay of short-term adjustments and long-term trends in the retail landscape.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 19 2025 Major Retail Centres: footfall retail Trends

Week 19 2025 Major Retail Centres: footfall retail Trends

UK major retail centres enjoyed a steady recovery in footfall retail, with a modest 1.7% weekly increase and 6.6% year‑on‑year growth, indicating positive footfall analytics across the country.

Share on LinkedIn

UK Major Retail Centres – Week 19 Performance Update

Data from The Benchmark Tracker (Week Ending 18 May 2025)

Overall Performance:

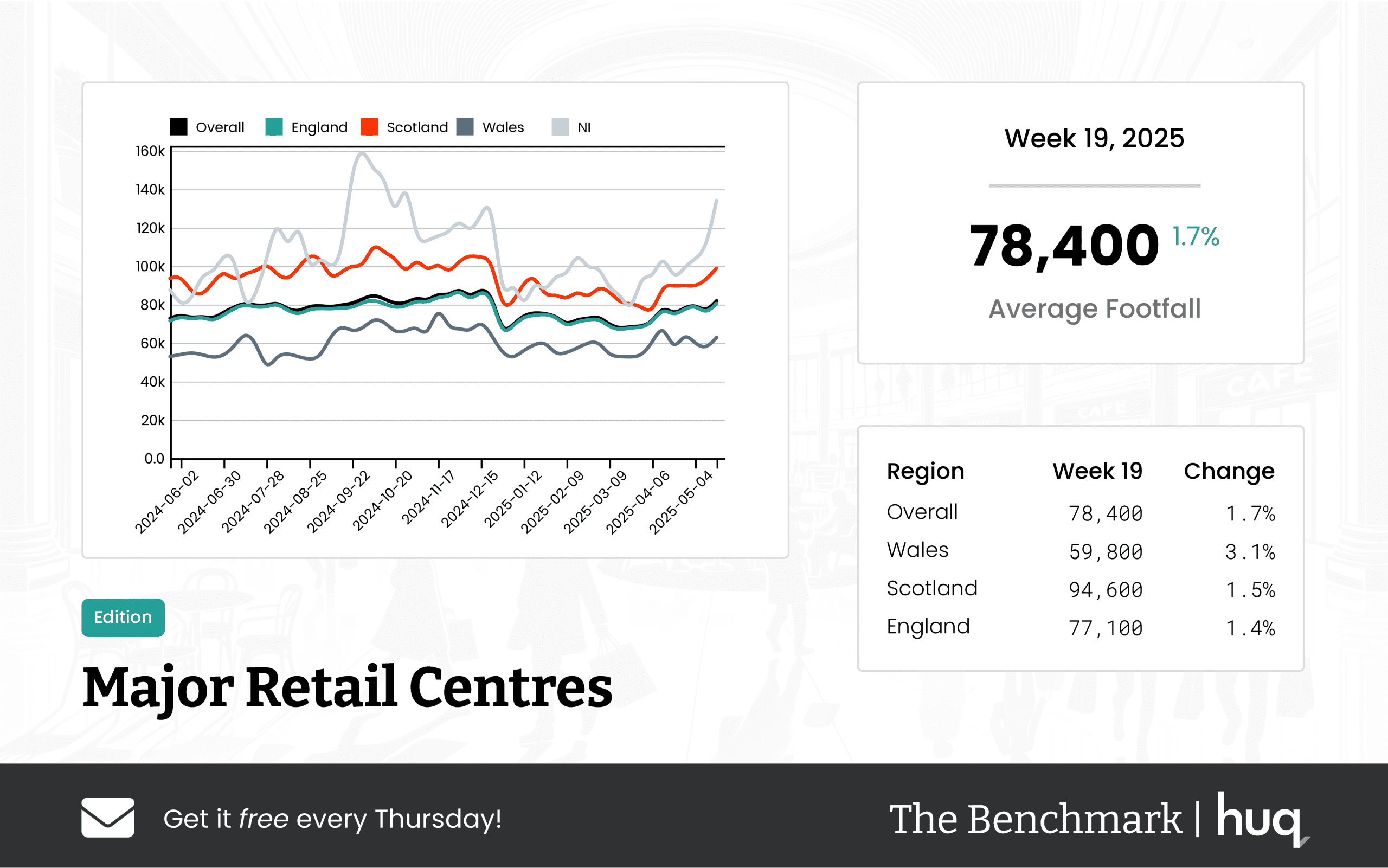

UK Major Retail Centres recorded an average daily footfall of 78,400 during the week ending 18 May 2025. This overall figure represents a moderate increase of 1.7% compared with the previous week and a 6.6% rise compared with the same week last year.

The consistent upward trend in footfall is a positive indication of growing consumer interest and a steady market recovery across the country. Analysis confirms that thorough footfall retail, detailed footfall analytics, comprehensive footfall statistics, and systematic footfall counting have all contributed to this promising performance.

Regional Analysis:

Regional variations were notable in the latest data. In Wales, retail centres saw an average daily footfall of 59,800, reflecting a weekly rise of 3.1% and a year‑on‑year growth of 14.6%. Scotland reported the highest daily footfall at 94,600, with modest improvements of 1.5% week‑on‑week and 8.6% compared to the previous year. Meanwhile in England, centres recorded a mean of 77,100 daily visitors, with weekly footfall up by 1.4% and a 5.5% increase from the same period last year. These differences highlight recovery patterns that vary by region, with some centres showing more dynamism in gaining momentum.

Dwell Time Insights:

The data also provided insights into dwell time, with the overall average visit duration increasing to 116 minutes. This marks a steady year‑on‑year increase of 5.5%, even though there was no change compared with the previous week. In Wales, visitors spent an average of 97 minutes per visit, showing a notable weekly gain, albeit with a slight year‑on‑year decline. Scotland maintained a strong performance with an average dwell time of 133 minutes, accompanied by an 8.1% weekly improvement and a significant annual increase. In England, visitors averaged 115 minutes, although there was a softening of 1.7% over the last week, the yearly performance still indicated modest improvement.

Industry Comment:

“Among the regional metrics, the most striking change in footfall was observed in Wales, and recent retail expansion news supports our view of a steadily recovering market,” noted Joe Capocci.

This detailed performance update not only highlights the encouraging revival of footfall in the UK major retail centres but also underscores the importance of continuous monitoring using advanced footfall analytics to better understand and predict consumer trends.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

UK Local Retail Centres – Week 19, 2025: Location Analytics Update

UK Local Retail Centres – Week 19, 2025: Location Analytics Update

UK Local Retail Centres saw a gradual recovery in Week 19 with footfall up 3.1% weekly and a 0.8% annual rise, demonstrating robust location analytics and evolving location intelligence trends.

Share on LinkedIn

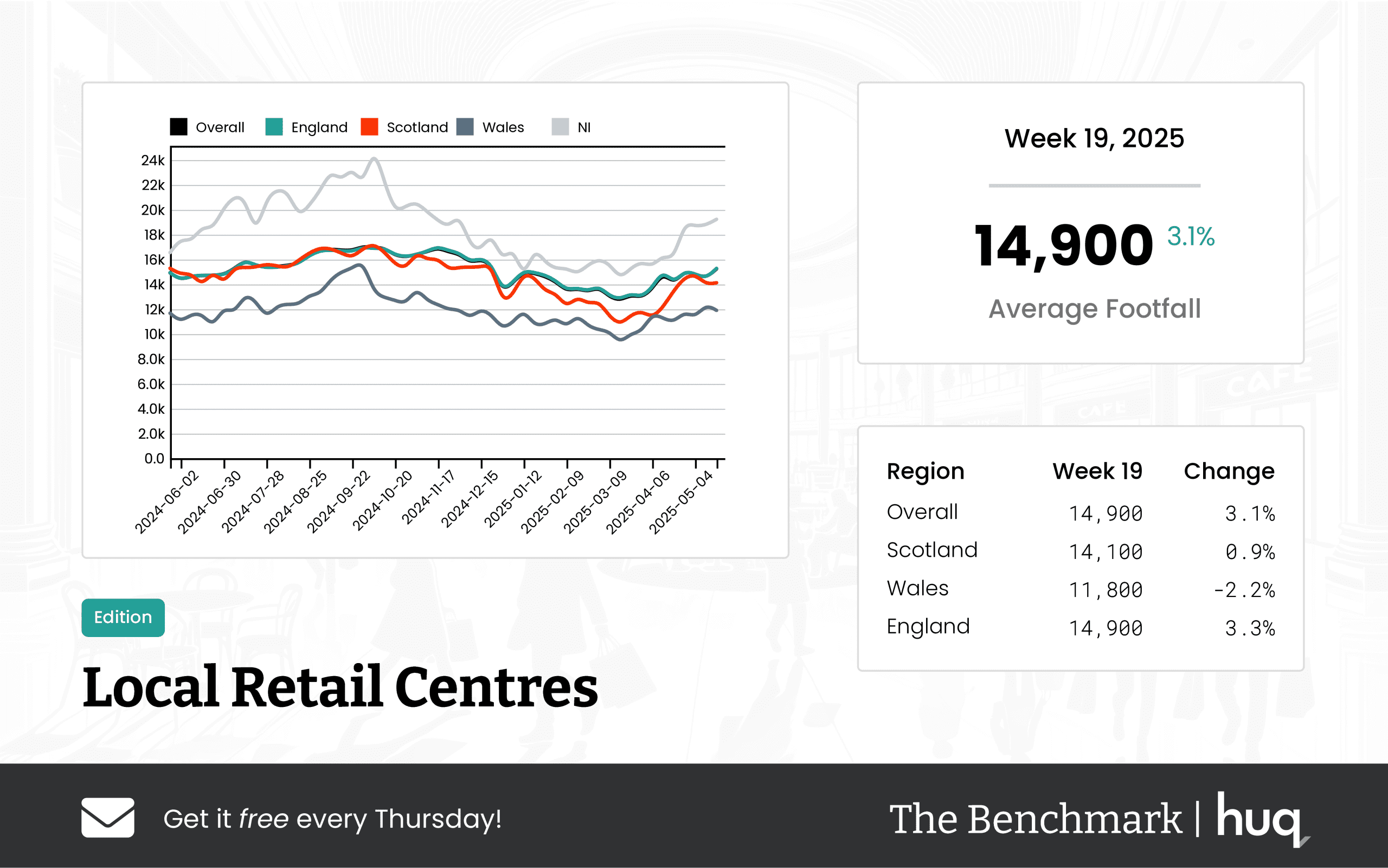

The latest figures from The Benchmark provide an update on footfall and dwell time performance across UK Local Retail Centres for Week 19. Incorporating location analytics into performance reviews has become essential. Overall, centres recorded an average daily footfall of 14,900, marking a 3.1% week-on-week improvement and a modest year-on-year increase of 0.8%. This gradual upward trend indicates that visitor numbers continue to slowly strengthen across the retail landscape.

Regional Performance

Examining regional performance reveals some variation. In England, centres maintained an average of 14,900 daily visitors with a week-on-week lift of 3.3% and an annual increase of 1.1%, suggesting that recent visits are slightly stronger relative to historical performance. Meanwhile, in Scotland, the average daily footfall stands at 14,100. Although there is a 0.9% weekly gain, the centres have experienced a year-over-year decline, reflecting a retreat compared to previous years despite emerging short-term recovery. In Wales, the situation is somewhat different; centres attract an average of 11,800 daily visitors, but figures show a 2.2% decrease on a weekly basis while the year-on-year change remains nearly static at 0.1%. This stability over the longer term contrasts with the recent drop in visitor numbers.

Dwell Time Update

Dwell time data paints a complementary picture. Across the UK, the average visit now lasts 100 minutes, registering a modest 1% increase from the previous week and a 19% annual boost. Scottish centres lead with an average dwell time of 110 minutes, even though there has been some recent softening, while Welsh centres report the lowest average at 86 minutes with recent declines noted in the data.

Industry experts highlight that emerging location intelligence trends are beginning to shape footfall metrics. Recent investments underscore the importance of location intelligence in driving regional performance, and analysts observe that a focus on location intelligence may support ongoing retail recovery. Continued monitoring reveals that advances in location intelligence are influencing centre strategies.

Joe Capocci, a spokesperson for Huq Industries, stated, "The strongest footfall improvement in England, observed alongside new retail expansion plans as reported in recent industry news, reflects the evolving dynamics of our retail environment."

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

UK Retail Parks – Week 19 Performance Update 2025: Insights Using Location Analytics

UK Retail Parks – Week 19 Performance Update 2025: Insights Using Location Analytics

UK retail parks saw a modest 1.4% weekly rise with a 7.6% year‑on‑year decline. Subtle shifts in location analytics and retail performance metrics signal evolving trends.

Share on LinkedIn

Overview

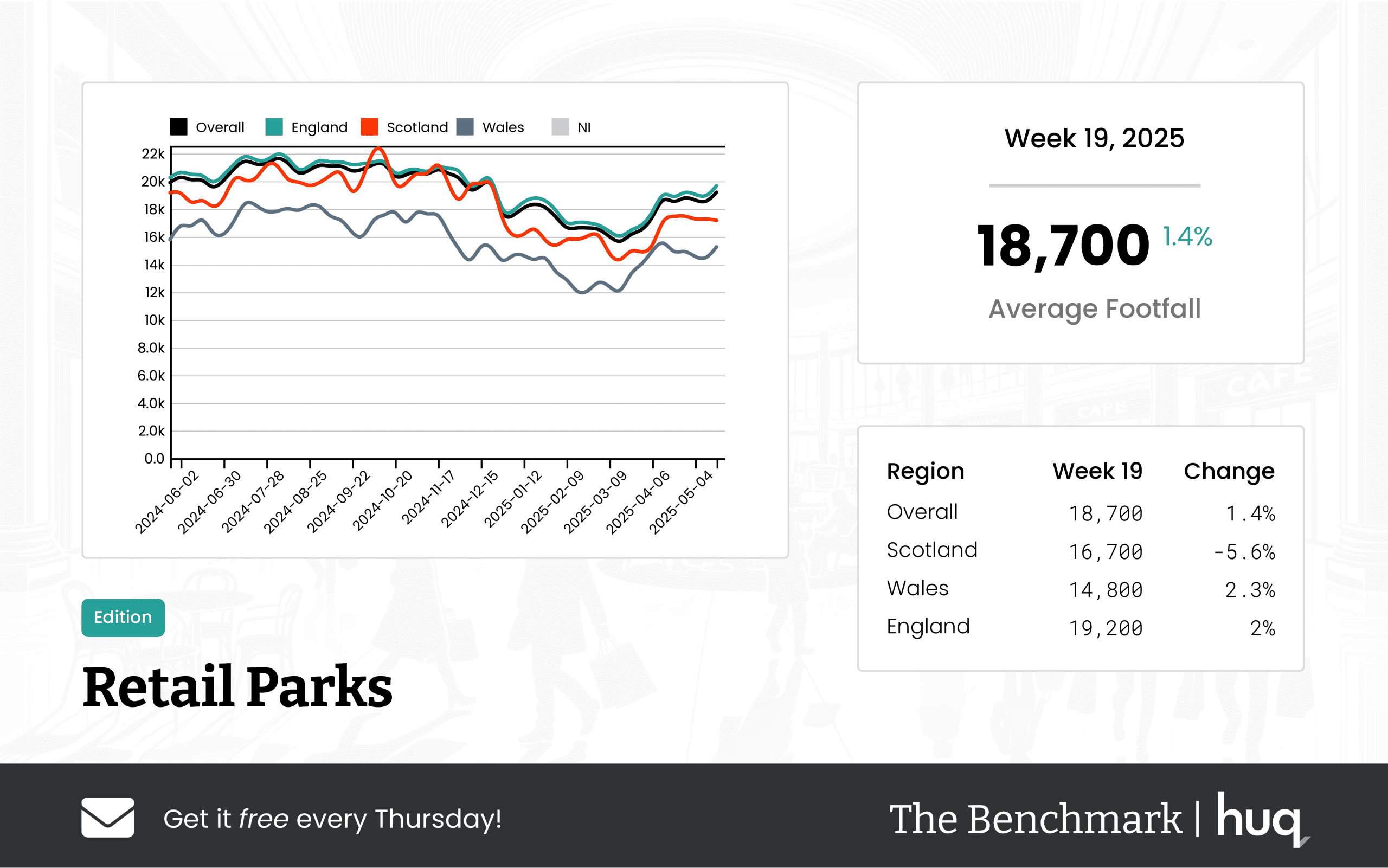

The latest results from The Benchmark reveal a mixed performance across UK retail parks. Location analytics indicate that the average daily footfall reached 18,700, marking a modest week‑on‑week increase of 1.4% but also a moderate year‑on‑year decline of 7.6%. While a slight recovery in visitor numbers signals potential short-term gains, the comparison with last year emphasizes a broader trend of subdued retail performance.

Regional Performance

A closer look at the region-specific data shows notable variations:

• In England, retail parks attracted an average of 19,200 visitors per day, with a stable weekly rise of 2% and a smaller year‑on‑year contraction of 6.7%.

• In Wales, although the average daily footfall was lower at 14,800, there was a positive weekly change of 2.3%, despite experiencing a larger year‑on‑year decline of 10.5%.

• Scotland reported an even lower average of 16,700 visitors per day, paired with a significant week‑on‑week softness of 5.6% and a steep year‑on‑year drop of 14.9%.

Dwell Time Analysis

Dwell time serves as a crucial secondary indicator of visitor engagement. Overall, visitors spent an average of 70 minutes per visit. When broken down by region:

• England saw a slight dip with an average of 69 minutes per visit and a weekly softness of 4.2%.

• Scotland observed a modest improvement with an average of 71 minutes per visit and a 4.4% weekly rise.

• Wales experienced a significant improvement, with dwell times reaching an average of 76 minutes per visit consistently, underscoring increased visitor engagement despite lower footfall figures.

Industry Insight

Joe Capocci, spokesperson for Huq Industries, noted, "The striking weekly softness in Scotland’s footfall, alongside the supportive retail developments noted recently, underscores the importance of monitoring these evolving trends." His comments highlight the critical need for businesses to closely track both footfall and dwell time metrics as part of their broader retail performance strategies.

The insights derived from these analytics provide a snapshot of the dynamic landscape of UK retail parks. With ongoing regional disparities, understanding the interplay between footfall and dwell time will be crucial as retailers and stakeholders strategize responses to modest growth and underlying declines.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 18 Weekly Wrap: UK Retail Trends and Location Analytics Insights

Week 18 Weekly Wrap: UK Retail Trends and Location Analytics Insights

Discover a 7.6% annual rise at major centres and UK retail footfall trends with top location analytics and footfall trends insights.

Share on LinkedIn

The latest weekly data on UK retail performance reveals some fascinating trends across various centre types. By leveraging location analytics and detailed data analysis, experts are shedding new light on consumer behaviour and regional performance. In this article, we take an in-depth look at the week’s retail trends.

Major Retail Centres Stand Strong

Major retail centres continue to hold their ground with robust improvements in visitor numbers. A recent review shows that average daily footfall edged up from 69,800 in Week 13 to 77,300 in Week 16, representing a steady 7.6% annual rise. For further details, readers can consult the comprehensive analysis in the Week 17 Weekly Wrap: UK Retail Trends and Location Analytics Insights.

High Streets and Town Centres Rebound

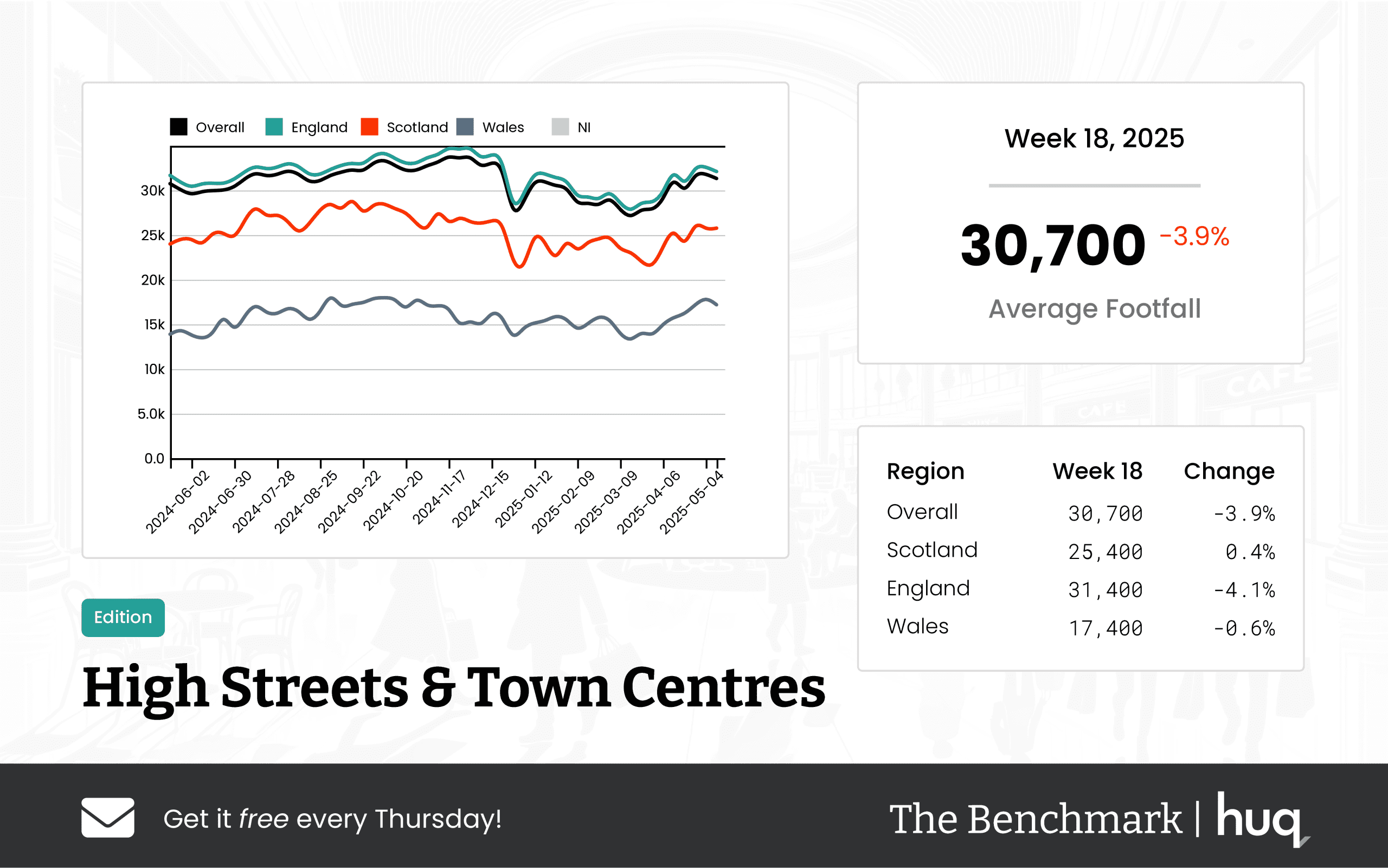

High streets and town centres are beginning to bounce back despite minor weekly drops. Recent updates indicate that high streets accrued around 30,700 visitors on average with slight weekly variances, while other snapshots show an average of 32,000 visitors – marking a weekly gain of 1.9% and an annual improvement of 5.7%. More detailed insights are available from the UK High Streets & Town Centres – Week 18, 2025 Performance Update and the Week 17, 2025 High Streets & Town Centres Update.

Local Retail Centres: A Mixed Bag

Local retail centres have shown a mixed performance across the UK. Some updates report a small 1.5% decline to around 14,600 daily visitors while others note stability with a modest 1.6% annual rise in local centre figures. Regional differences are stark, with Welsh centres experiencing improvements even as parts of England maintain steady traffic. Additional details can be found in the UK Local Retail Centres – Week 18, 2025 Performance Update with Location Analytics and the Week 17 2025 Footfall Update: UK Local Retail Centres.

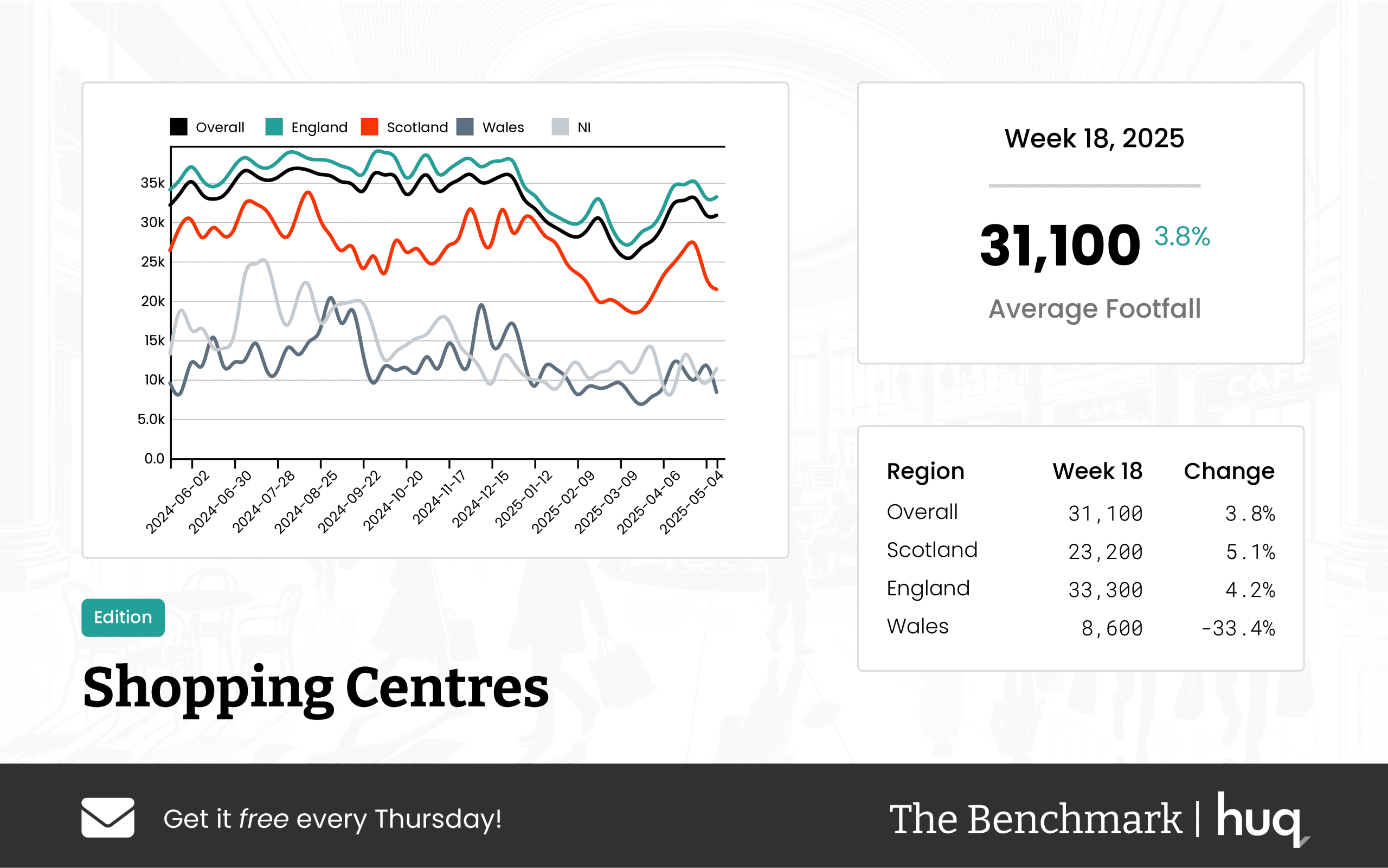

Shopping Centres Show Mixed Signals

Performance in shopping centres is proving to be somewhat inconsistent. While one Week 18 update notes a 3.8% rise in average daily footfall to 31,100 visitors, another Week 17 report flagged a slight 9% drop with about 30,300 visitors. Examination of dwell times, however, reveals that visitors continue to spend over 117 minutes per visit on average, offering positive news for retail managers. Readers looking for a more detailed breakdown should visit the UK Shopping Centres – Week 18 2025 Footfall Retail Performance Update and the UK Shopping Centres – Week 17 Performance Update 2025: Footfall Insights.

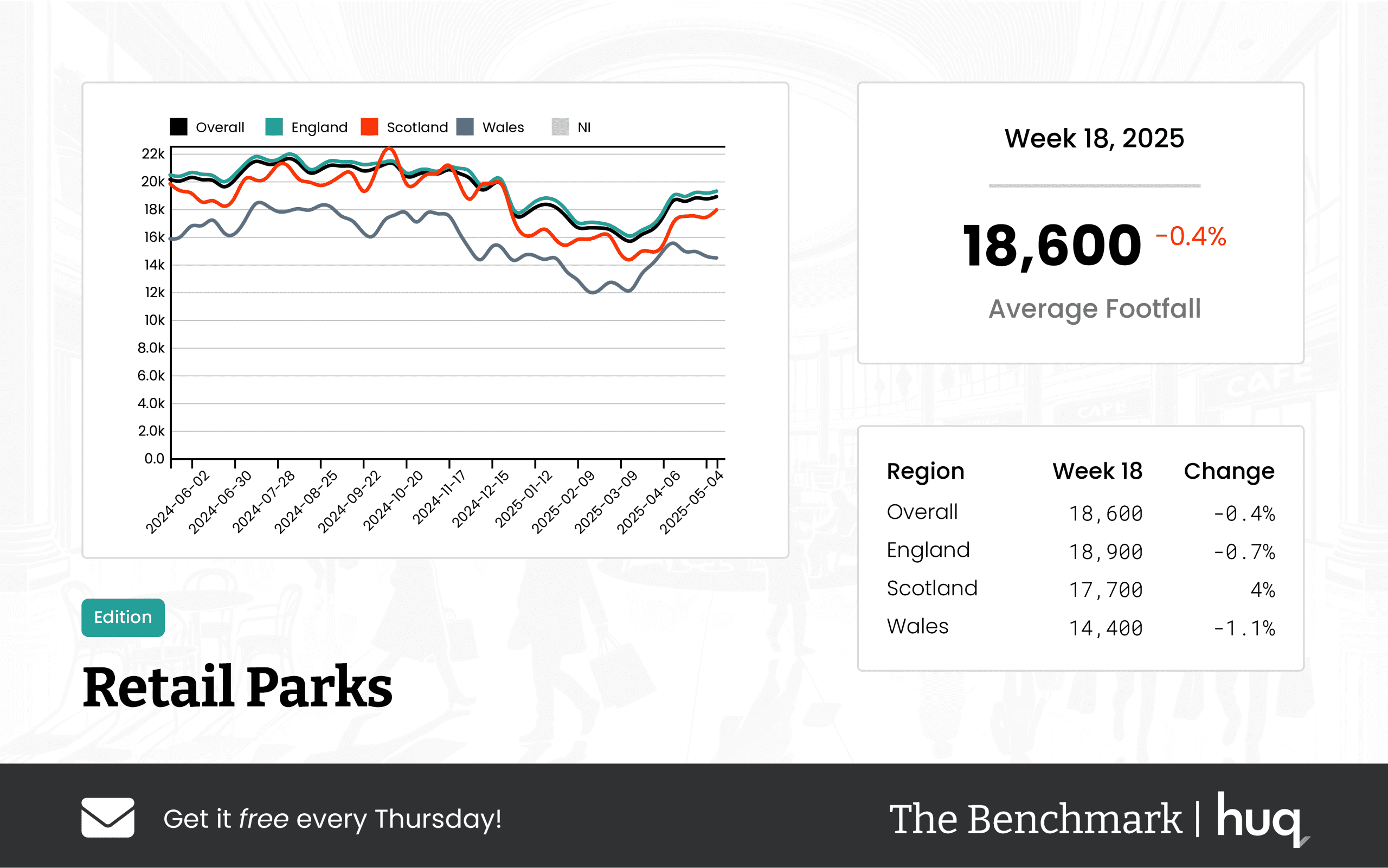

Retail Parks: Unsettled Performance

The data for retail parks presents a more unsettled picture. Week 18 figures displayed an average daily footfall of 18,600 visitors accompanied by a slight decline in dwell time as it fell to 71 minutes. In contrast, Week 17 measurements recorded a very similar daily visitor count but slightly improved dwell times. Regional differences are clear, with areas in Scotland and Wales performing differently, details of which can be explored in the UK Retail Parks – Week 18 2025 Performance Update: Footfall Analytics Insights and the Week 17, 2025 Retail Parks Performance Update: Location Analytics Insights.

Regional Nuances and Expert Insights

Regional variations play a significant role in shaping retail performance trends. English centres tend to show steady or improved figures, whereas some Scottish hubs observed a modest percentage decline and Welsh centres reported marked upswings. Joe Capocci, Huq Industries Spokesperson, noted that "the granular insights provided by detailed location analytics are essential for understanding varied regional consumer behaviours and tailoring strategies accordingly." More expansive context can be gathered from the Week 16 Weekly Wrap: Footfall Trends Across UK Retail.

Adapting with Location Intelligence

In a market characterised by dynamic shifts, UK retailers must adapt their strategies using advanced location intelligence and innovative data analysis techniques. Emerging trends across major centres, high streets, local centres, shopping centres, and retail parks illustrate the need for regional customisation. Retailers are increasingly realising that the integration of location analytics, footfall trends, UK retail performance, and consumer engagement data can unlock powerful insights and help them stay ahead in a competitive landscape.

The week’s performance data illustrates how a blend of growth in some areas and slight downturns in others create a complex picture. Tailored strategies based on robust location intelligence allow retailers to address local challenges while capitalising on strengths. As the market continues evolving, constant monitoring using detailed analytics remains crucial for long-term success and sustainable growth.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

UK Local Retail Centres – Week 18, 2025 Performance Update with Location Analytics

UK Local Retail Centres – Week 18, 2025 Performance Update with Location Analytics

UK local retail centres saw a modest 1.5% decline overall, reflecting subtle shifts. Location analytics and location intelligence insights highlight smoothing trends.

Share on LinkedIn

The latest figures for Week 18, 2025 provide a nuanced snapshot of footfall and engagement metrics across UK local retail centres, drawing heavily on advanced location analytics to better understand prevailing trends.

Overall Performance

Across the board, UK Local Retail Centres recorded an average daily footfall of 14,600, which represents a modest decline of 1.5% compared to the previous week. This figure is also 1.1% lower compared to the corresponding period last year, suggesting that while retail traffic remains relatively robust, emerging patterns are indicative of subtle shifts in consumer behavior. Location intelligence plays a critical role in deciphering this data, providing brands with the insights needed to adjust and strategize effectively.

Regional Overview

Diving into the regional statistics, distinct differences emerge:

• England: Centres in England have maintained an average of 14,600 daily visitors. Despite minor week-on-week declines, these figures are only slightly lower year over year, highlighting a stable performance.

• Scotland: The Scottish region experienced a sharper contraction, with local centres drawing an average of 14,100 daily visitors. This downtrend, when compared to the previous week and last year, signals potential challenges in the region’s retail engagement.

• Wales: In a contrasting narrative, Welsh retail centres recorded an average of 12,100 daily visitors, showcasing a significant 6.2% increase from the previous week and a 2.7% improvement from a year ago. This upward swing is an encouraging sign and underscores the diversity in regional performance across the UK.

Engagement Metrics

In addition to footfall, engagement metrics, particularly dwell time, offer further insights. Nationwide, visitors spent an average of 99 minutes per visit in centre environments. This figure reflects a slight 1% improvement week-on-week and an impressive 17.9% increase compared to last year.

Additional details include:

• England: Visitors spent an average of 98 minutes per visit. Although there was a minor weekly decline, the overall year-on-year improvement marks a positive trend in customer engagement.

• Scotland: Centres in Scotland saw visitors committing longer stays, with an average visit lasting 120 minutes. This substantial increase suggests heightened consumer engagement where indoor experience improvements may be taking hold.

• Wales: Average dwell times in Wales were recorded at 94 minutes, with a strong week-on-week improvement, even as annual figures showed a modest softening.

Final Analysis

Location intelligence is emerging as a powerful tool in retail strategy. It not only provides granular insights into consumer movement and behavior but also equips retail brands with the foresight to adapt to regional variances effectively. As echoed by Joe Capocci, spokesperson for Huq Industries, while the overall modest decline contrasts with Wales' significant weekly improvement, the differing regional performances call for a strategic review of the existing operational and revitalization plans for local shopping centres.

By integrating location analytics into performance updates, retailers can expect to achieve a deeper understanding of market dynamics, keeping them ahead in a rapidly changing retail landscape.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

UK Shopping Centres – Week 18 2025 footfall retail Performance Update

UK Shopping Centres – Week 18 2025 footfall retail Performance Update

UK Shopping Centres saw a modest 3.8% weekly rise in footfall, with subtle changes in visitor behaviour. Key footfall analytics highlight evolving trends in the retail landscape.

Share on LinkedIn

Overall Performance

The latest week’s footfall data for UK Shopping Centres indicates a mixed picture for visitor activity. Centres recorded a modest week-on-week increase of 3.8% in average daily footfall, reaching 31,100 visitors per day, though still 6.8% lower than the same week last year. Notably, although the average dwell time saw a slight decline of 1.7%, settling at 117 minutes, it remains 19.4% higher on an annual basis.

Regional Analysis

In England, shopping centres continue to perform robustly, with an average daily footfall of 33,300. Despite being down by 5.6% year-on-year, the week-on-week performance improved by 4.2% and dwell times also showed a favorable 2.5% increase compared to last week. Scotland’s centres experienced stronger week-on-week performance with a 5.1% uplift, averaging 23,200 visitors daily, although overall year-on-year trends remain negative. Dwell time in Scottish centres was recorded at 75 minutes, showing minor weekly softness and minimal annual change. In contrast, Welsh centres lagged behind, with an average of 8,600 daily visitors and experiencing a significant decline in both weekly and annual footfall figures. The dwell time in Wales was particularly low at 49 minutes, with marked drops noted in weekly performance and over the longer term.

Industry Comment

Joe Capocci from Huq Industries commented on the trends, stating, "We observed the sharp decline in footfall in Welsh centres, an insight further supported by recent retail industry news developments." This comment underscores the challenges faced by Welsh centres and the shifting landscape in visitor behaviours across the UK.

The data highlights the evolving retail environment across the UK, with regional disparities and changes in visitor habits representing both opportunities and challenges for the retail sector.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

UK Retail Parks – Week 18 2025 Performance Update: Footfall Analytics Insights

UK Retail Parks – Week 18 2025 Performance Update: Footfall Analytics Insights

Mixed trends reveal a 0.4% decline in overall footfall with 18,600 daily visitors and a 2.7% drop in dwell time, supported by robust footfall data across the UK.

Share on LinkedIn

Overall Footfall Performance

The latest figures for UK Retail Parks reveal mixed results for the period, with overall average daily footfall recorded at 18,600 – a slight week on week decline of 0.4% and an annual drop of 8.4%. Footfall analytics confirms these trends, with recent data and retail indicators underlining the market changes.

Regional Variations

The data reveals regional differences across the UK. In England, retail parks saw an average of 18,900 visitors per day, experiencing a modest week on week decline of 0.7% and an annual drop of 8%, reflecting a cautious downturn in visitor numbers. In contrast, Scotland posted a differing weekly trend with a 4% increase in footfall, although the year on year figure fell by 9.6%. Wales presents a more subdued profile, with an average of 14,400 daily visitors marking a 1.1% weekly reduction and a notably sharper annual decline of 13.2%.

Dwell Time and Visit Quality

The overall average dwell time for shoppers was 71 minutes per visit – a 2.7% decrease compared to the previous week, yet showing a marked year on year improvement of 10.9% in visit duration. In England, visitors spent an average of 72 minutes per visit, experiencing a 1.4% weekly dip accompanied by an annual improvement of 14.3%. Meanwhile, Scotland’s parks recorded an average dwell time of 68 minutes, though with an 18.1% decrease over the week and a 5.6% reduction year on year. Wales recorded the lowest engagement, with visitors spending 60 minutes per visit and experiencing a consistent decrease of 3.2% both on a weekly and annual basis.

Spokesperson Commentary

Joe Capocci, spokesperson for Huq Industries, commented: "The modest weekly boost in Scotland’s footfall stands out amid overall market softening, a detail that aligns with current retail industry developments such as Sandbrook Park's expansion and other structural changes."

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

UK High Streets & Town Centres – Week 18, 2025 Performance Update: Insights from Location Analytics

UK High Streets & Town Centres – Week 18, 2025 Performance Update: Insights from Location Analytics

Week 18 data shows modest decline with 30,700 daily footfall overall, yet a 1.1% y-o-y rise. Location analytics reveal resilient footfall trends in UK retail centres.

Share on LinkedIn

The latest update from The Benchmark harnesses the power of location analytics to present a balanced picture of UK High Streets and Town Centres performance during Week 18. While overall activity recorded a mean daily footfall of 30,700—a minor decline compared to the previous week—the year-on-year figures are encouraging with a 1.1% increase, underscoring longer-term resilience in visitor behaviour and retail recovery.

In regional performance, Scotland emerged with a daily footfall of 25,400, demonstrating a slight week-on-week gain and a stronger annual improvement than the overall UK trend. England, on the other hand, reported a higher average daily count of 31,400 but experienced a decline relative to the previous week, with only modest long-term improvement. Wales presented a unique scenario where a sharp increase in daily footfall points to robust long-term recovery, despite minimal weekly changes.

Dwell time metrics add another layer of insight into visit quality. Across the UK, visitors spent an average of 98 minutes per visit, reflecting a slight contraction week-over-week but benefiting from a healthy year-on-year increase. England mirrored these trends, recording nearly identical visit durations with steady improvement over time. However, Scotland and Wales saw reductions in average visit lengths; Scotland experienced declines both on a weekly and annual basis, while Wales maintained lower dwell times compared to the previous year during this period.

Industry voices have taken note of the data trends, and Joe Capocci from Huq Industries remarked, "The data reveals the most striking change in Wales, where a sharp increase in daily footfall is evident, a trend subtly echoed in recent retail industry news." This industry comment underscores the shifting dynamics across regions and sets the stage for further analysis in the evolving retail landscape across the UK.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 17 Weekly Wrap: UK Retail Trends and Location Analytics Insights

Week 17 Weekly Wrap: UK Retail Trends and Location Analytics Insights

Discover a 7.6% annual rise in major retail centre footfall and learn more about UK retail trends with location analytics and location intelligence.

Share on LinkedIn

The latest UK retail data reveals shifting dynamics across various centre types, giving us valuable insights into consumer engagement and regional performance. In this Weekly Wrap, we explore trends from major retail centres to high streets, utilising advanced location analytics to drive understanding. Notably, major retail centres saw a 7.6% annual rise in footfall, underscoring their resilience in a highly competitive market.

Major Retail Centres

Major retail centres remain a cornerstone of UK retail performance. Recent data shows daily footfall rising from 69,800 in Week 13 to 77,300 in Week 16, with average dwell times clustering around 115 minutes per visit. For more detailed figures, readers can refer to the Week 16 Weekly Wrap: Footfall Trends Across UK Retail, which highlights the steady customer engagement across Scotland, Wales and England.

Local Retail Centres

Local retail centres have delivered mixed results, reflecting the diverse expectations of regional shoppers. Some areas experienced a 9.8% week‑on‑week increase, which translated into a 5.4% annual improvement with roughly 15,200 daily visitors. More comprehensive insights are available in the Week 16, 2025 Local Retail Centres Report: UK Location Analytics Insights and the Week 17 2025 Footfall Update: UK Local Retail Centres.

High Streets & Town Centres

High Streets and Town Centres are showing signs of recovery with encouraging visitor trends. Average daily footfall reached 32,000, marking a 1.9% week‑on‑week and 5.7% year‑on‑year increase, while visitors spent approximately 100 minutes per visit. The regional breakdown is fascinating with English centres outperforming their Welsh and Scottish counterparts, as detailed in both the Week 17, 2025 High Streets & Town Centres Update: Insights from Location Analytics and the Week 16 2025 High Streets & Town Centres Report: Insights from Footfall Retail Data.

Shopping Centres

The shopping centre segment presents a more nuanced picture where robust dwell times contrast with a slight decline in footfall. One report details a 9% drop in visitor numbers, with the overall average reaching 30,300 daily visitors and a commendable dwell time of about 119 minutes. Readers looking for a deeper dive may explore the UK Shopping Centres – Week 17 Performance Update 2025: Footfall Insights and the Week 16 2025 Shopping Centres: Footfall Data Insights.

Retail Parks

Retail parks have maintained overall stability despite some regional variations. An average daily visitor count stands at 18,700 with a modest week‑on‑week increase, while dwell times average at around 73 minutes. For instance, Scottish retail parks enjoyed slightly higher engagement at 83 minutes compared to their Welsh counterparts at 62 minutes, as shown in the Week 17, 2025 Retail Parks Performance Update: Location Analytics Insights.

Regional Nuances

The weekly trends highlight the importance of regional differences in understanding footfall data and consumer behaviour. While English centres often lead in visitor counts, nuanced variations in Wales and Scotland reveal opportunities for targeted strategies. This emphasises the need for both location analytics and location intelligence to tailor efforts across different UK regions, ensuring that all retail segments remain competitive in evolving market conditions.

Expert Insights

“Retail trends continue to evolve, and our use of advanced location analytics and location intelligence helps us identify precise regional shifts,” said Joe Capocci, Huq Industries Spokesperson. His comments reinforce how detailed footfall data is informing broader strategies. Retailers are increasingly leveraging these insights to refine their approaches across different centre types.

Looking Ahead

The current trends signal a vibrant future for UK retail, underpinned by both steady increases in major retail centres and mixed performances in local markets. As the competitive landscape shifts, embracing both data-driven insights and contextual analysis will be paramount. Retailers need to remain agile, employing weekly retail trends and footfall data to drive strategic adjustments.

Final Thoughts

In summary, the analysed data demonstrates that while major retail centres and high streets are on an upward trajectory, segments like shopping centres and retail parks display varied performance. Using detailed location analytics, UK retailers can pinpoint areas of opportunity and overcrowded challenges alike. The mixture of increasing footfall, improved dwell times, and regional differences presents a dynamic market that demands continual attention and adjustment, laying the groundwork for a strong retail future.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.