UK Retail Parks – Week 22 Performance Update 2025: location analytics Insights

UK Retail Parks – Week 22 Performance Update 2025: location analytics Insights

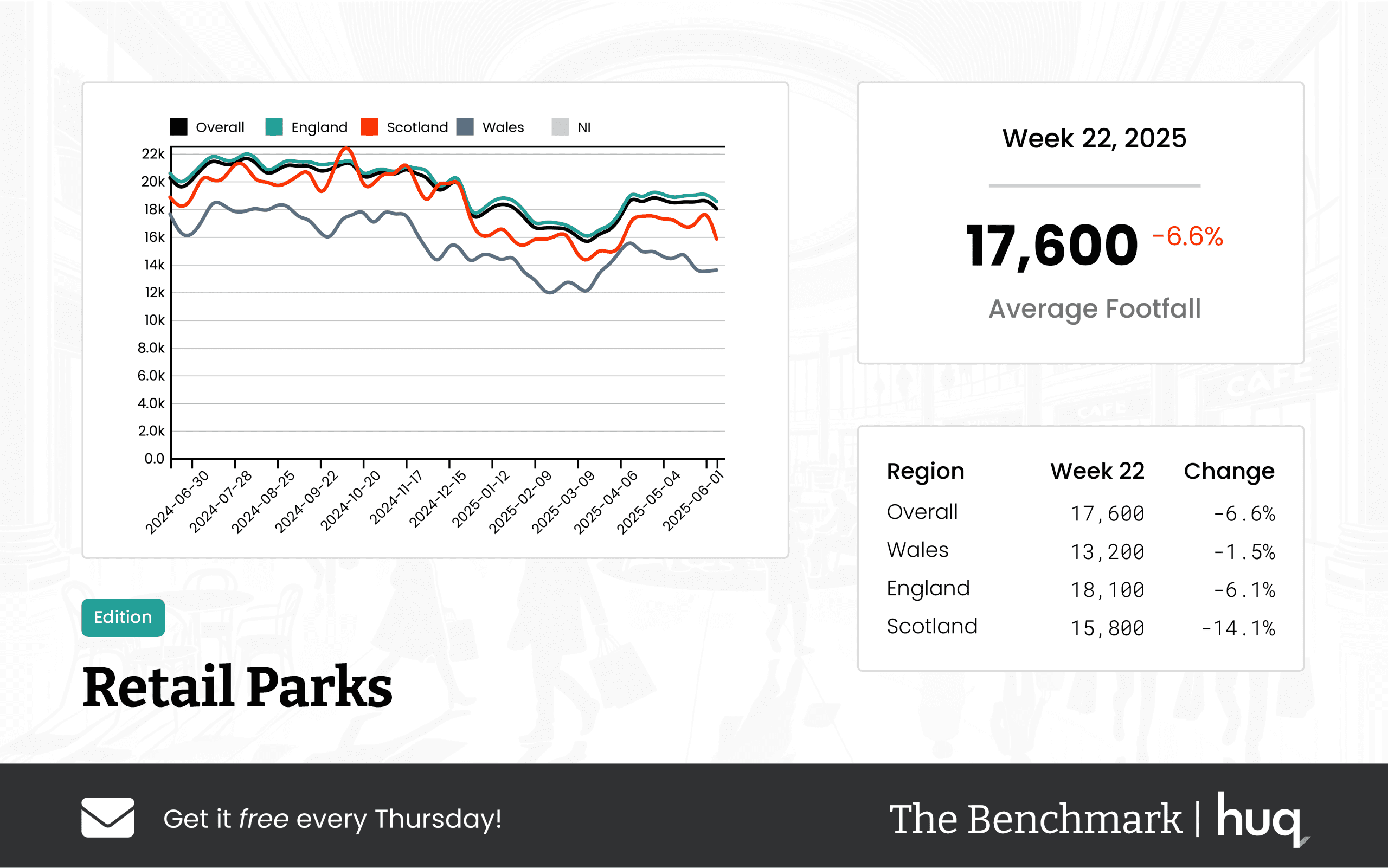

UK retail parks experienced a 6.6% footfall decline overall, while improved engagement was noted through location analytics and retail park trends.

Share on LinkedIn

The latest data from The Benchmark Monitor indicate that UK retail parks recorded an average daily footfall of 17,600 for the latest full week – a moderate decline of 6.6% from the previous week and an 11.5% drop compared with the same week last year. With refined location analytics provided by Huq Industries, stakeholders can now assess current trends more thoroughly, focusing on evolving customer engagement alongside solid footfall analysis.

In England, the retail parks recorded an average daily footfall of 18,100, marking a 6.1% decline compared with the previous week and a 10.8% reduction year-on-year. Wales showed steadier performance, with an average of 13,200 daily visitors declining only marginally by 1.5% on a week-on-week basis, though year-on-year figures indicate a notable drop. Meanwhile, Scotland’s retail parks experienced a sharper decline with an average daily footfall of 15,800, falling by 14.1% from the previous week and a 14.5% decrease compared to last year. These regional differences confirm key retail park trends and emphasize the value of targeted location analytics.

Beyond footfall, dwell time metrics provide additional insight into evolving visitor behavior. Although fewer visitors are frequenting these parks, those who do are staying longer. The overall average dwell time is now 77 minutes per visit – an 8.5% improvement from the previous week – and has seen a substantial annual increase. Specifically, England leads with an average visit duration of 79 minutes, a 9.7% week-on-week gain, while visitors in Wales maintain a consistent 77-minute duration. In contrast, Scotland's retail parks have seen lower dwell times, averaging only 60 minutes per visit with both weekly and annual declines, further highlighting divergent regional trends.

Joe Capocci, a spokesperson from Huq Industries, noted, "The data underscores the most striking change – a sharp 14.1% decline in Scotland’s footfall – while extended dwell times in England suggest visitors are engaging more meaningfully. This sentiment is echoed by recent retail park incidents, reinforcing the need for continuous monitoring and analytical insights."

The integration of location analytics provides a richer understanding of customer patterns, and while overall footfall may be dipping, the increased visitor engagement offers hope for turning these trends around in future cycles. Stakeholders are urged to keep a close eye on these evolving metrics to better tailor their strategies in an increasingly competitive retail environment.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

UK High Streets & Town Centres – Week 22, 2025 Performance Update: Insights from Location Analytics

UK High Streets & Town Centres – Week 22, 2025 Performance Update: Insights from Location Analytics

UK update shows robust visitor numbers using location analytics with 3.6% annual growth and slight weekly dips. Regional insights point to overall stability.

Share on LinkedIn

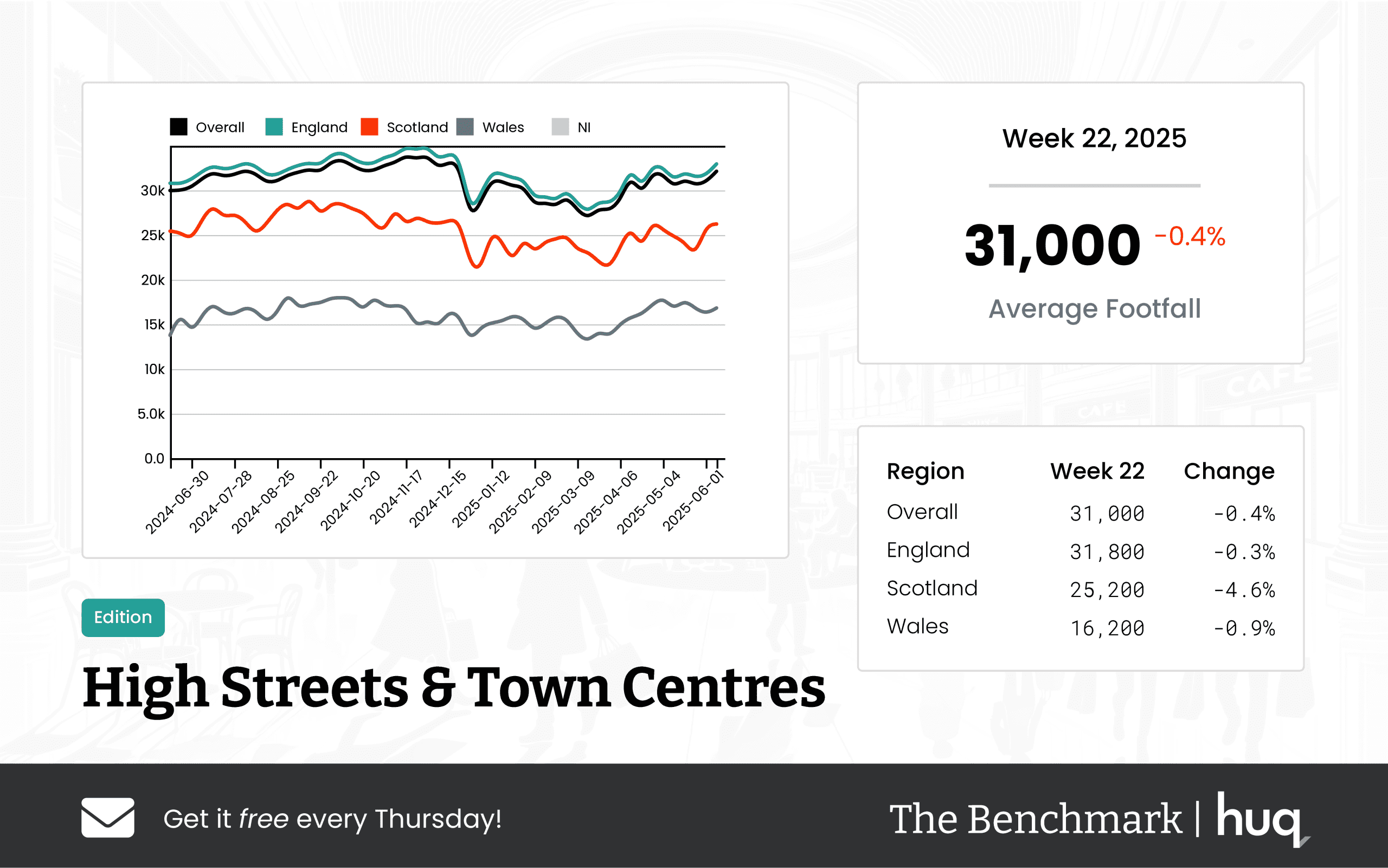

In the latest performance update, UK High Streets and Town Centres reported an average daily footfall of 31,000, highlighting a modest week‐on‐week footfall decline of 0.4% against a solid year‐on‐year growth of 3.6%. While weekly numbers show a slight softening, the annual figures reveal a healthy long-term trend in visitor numbers.

Regional insights provide a nuanced view of the overall performance:

• England: With an average daily footfall of 31,800, England experienced a marginal weekly decline of 0.3% but maintained a strong annual increase of 3.4%. This stability in Visitor levels reflects a resilient market in the region.

• Scotland: Scotland recorded an average of 25,200 daily visitors, with a more noticeable week‐on‐week dip of 4.6%. However, the annual performance remains positive with a 2.2% increase, suggesting continued recovery and improvement over the long haul.

• Wales: With lower overall numbers at 16,200 daily visitors, Wales saw a slight weekly decline of 0.9% yet exhibited an impressive 13.4% year‐on‐year improvement, underscoring a buoyant trend in visitor activity over time.

Visitor engagement has also seen positive movements. The average dwell time across sites increased to 98 minutes, up 3.2% from the previous week and 11.4% compared to the same period last year. While England led this trend with an average dwell time of 99 minutes (a 4.2% week‐on‐week and 13.8% year‐on‐year increase), Scotland's dwell time reached 98 minutes, up by 2.1% week‐on‐week and 10.1% year‐on‐year. Wales, however, reported a decline in the average duration of visits in both weekly and annual comparisons.

Industry spokesperson Joe Capocci of Huq Industries commented on the evolving retail landscape by noting, "The notable weekly softness in Scotland’s footfall, which is mirrored by patterns in recent retail industry news such as the developments in Watford, underscores the importance of monitoring these subtle shifts while overall performance remains encouraging." His remarks emphasize the need for stakeholders to remain attentive to emerging trends within a generally positive market backdrop.

This performance update provides valuable insights for retailers, urban planners, and industry analysts as they strategize for continued growth and adaptation in a dynamic retail environment.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

UK Shopping Centres – Week 22 Performance Update 2025: Footfall Retail Trends

UK Shopping Centres – Week 22 Performance Update 2025: Footfall Retail Trends

Week 22 UK shopping centres show a slight overall footfall decline with improved engagement as average dwell time reached 118 minutes. Footfall analytics hint at evolving consumer behaviour.

Share on LinkedIn

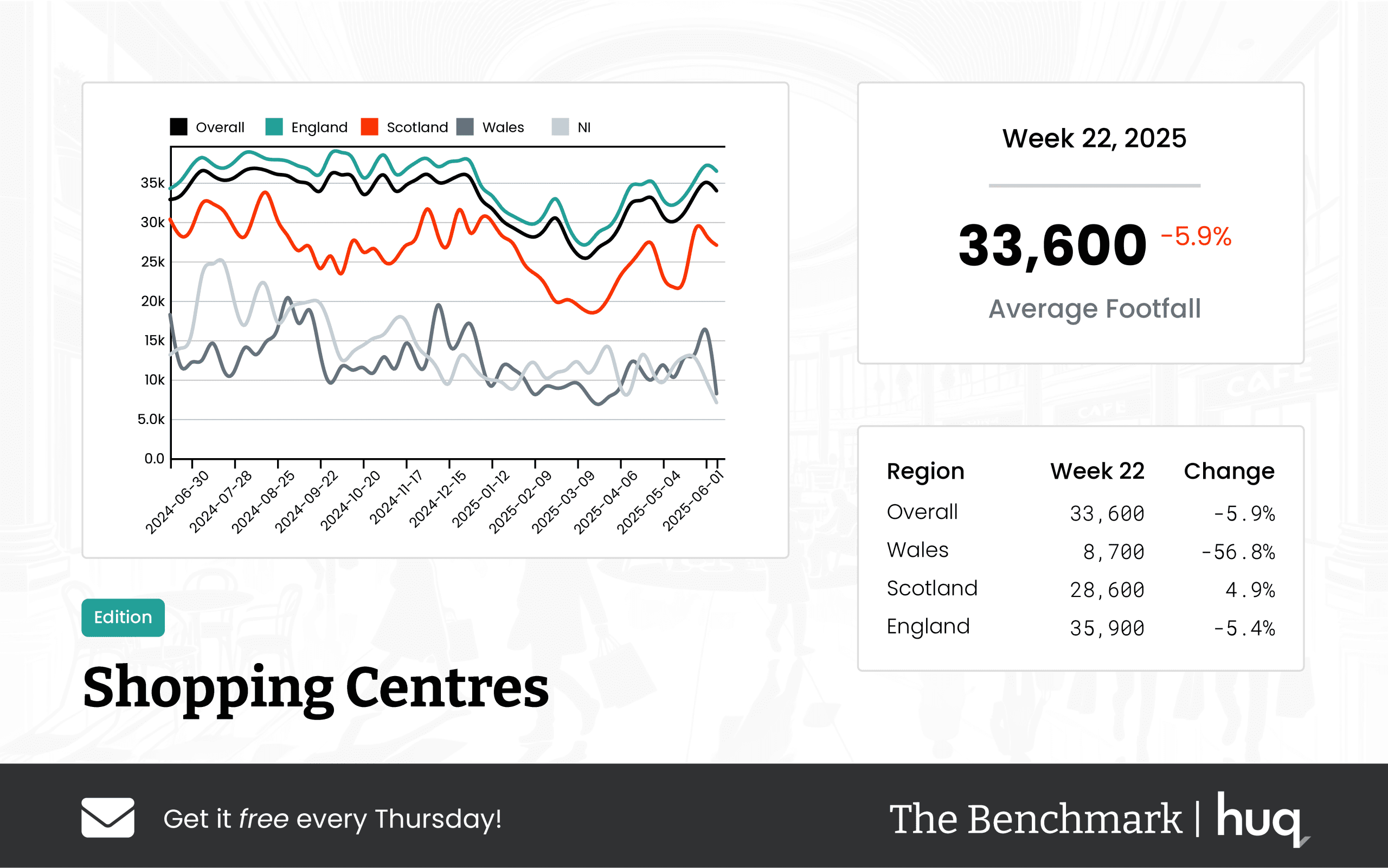

UK shopping centres recorded modest shifts in performance for the week ending June 8, 2025. The latest figures reveal a slight softening in overall visitation, with an average daily footfall of 33,600. While this represents a modest decline compared to both previous week and corresponding period last year, enhanced engagement through longer dwell times of 118 minutes suggests that fewer visitors are spending more time interacting with the retail environment.

In the regional breakdown, centers in England maintained robust performance with an average daily footfall of 35,900. Although there was a small decrease week‐on‐week, numbers have improved relative to the same period last year. Meanwhile, Scotland's centres attracted 28,600 visitors on average per day, marking a modest increase from the previous week despite a slight year‑on‑year softness; dwell time has notably increased from 107 minutes to a new high, enhancing overall customer experience.

Wales presents a slightly more divergent picture. With an average daily footfall of 8,700, visitor numbers have declined both week‑on‑week and compared to the previous year. However, a significant positive is the region’s dwell time spike to 162 minutes, signaling that while the number of visitors is lower, those who do visit are engaging more deeply with the retail space.

Industry insider Joe Capocci of Huq Industries contextualizes these trends by noting, "The notable decline in footfall in Wales, alongside recent retail industry news highlighting market activity in Manchester, clearly underscores the shifting dynamics within UK shopping centres." His comment aligns with the emerging narrative that while overall visitation might be softening, the quality of the shopping experience, as measured by dwell time, is on an upward trajectory.

This update not only reflects the current state of play in UK shopping centres but also underscores the importance of robust footfall analytics and dwell time tracking as key indicators of evolving consumer behaviour. Retailers and centre operators will continue to monitor these trends closely to adjust strategies in an ever-changing market.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 22, 2025 Local Retail Centres – Footfall Update

Week 22, 2025 Local Retail Centres – Footfall Update

Overall footfall dipped by 1.5% last week while dwell time improved by 2.1%, indicating a shift in consumer engagement at Local Retail Centres across the UK.

Share on LinkedIn

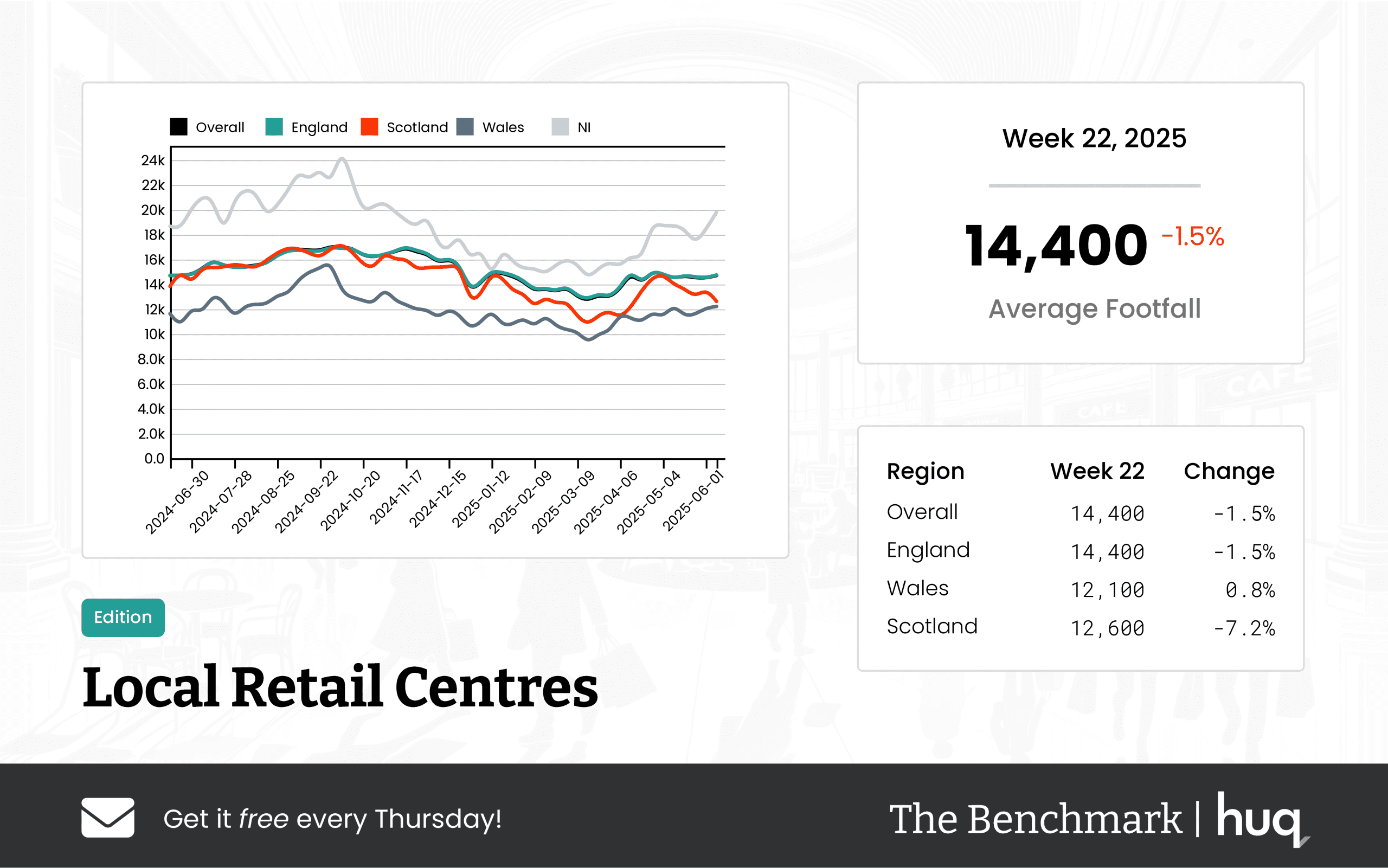

The latest figures from The Benchmark reveal a modest softening in overall footfall across UK Local Retail Centres, with an average of 14,400 daily visitors recorded for the week ending 2025‑06‑08. This represents a 1.5% decline from the previous week and a 2% drop compared to the same period last year.

Despite the downturn in visitor numbers, the average dwell time on site improved significantly, increasing to 97 minutes per visit – a 2.1% rise from the previous week and an impressive 18.3% year-on-year hike. These numbers suggest that while foot traffic is reduced, those who visit are spending more time engaging with the retail space.

A detailed regional breakdown provides additional insights. In England, retail centres maintained an average of 14,400 daily visitors, alongside a parallel 1.5% weekly decline and a slight 1.8% year-on-year reduction. However, English centres saw the average visit duration rise by 3.2% weekly, reaching 96 minutes, coupled with an 18.5% improvement compared to the previous year.

Wales presented a contrasting performance, with an average of 12,100 daily visitors, marking a modest week-on-week increase of 0.8% and a solid 6.4% uplift compared to last year. Dwell time in Wales was notably higher, averaging 130 minutes per visit. Scottish Local Retail Centres, however, experienced greater challenges; despite an average of 12,600 daily visitors, the region saw a steeper 7.2% weekly drop and a 13.3% annual decline, with an average visit duration of 91 minutes, evidencing a decrease in week-on-week performance despite a mild year-on-year recovery.

The data further underscores evolving consumer behaviour in retail settings. Detailed footfall analytics support these trends by highlighting enduring shifts in visitor patterns while also correlating with recent industry changes. Joe Capocci from Huq Industries commented on the regional disparities, particularly noting the significant declines in Scotland. He linked these changes to broader developments, such as recent investment announcements in Northern Ireland, which may be impacting regional retail dynamics.

Overall, while fewer people are visiting Local Retail Centres, the increased engagement during visits suggests a pivot towards quality over quantity in consumer interactions. This nuanced trend calls for ongoing monitoring as retail strategies adjust to shifting consumer habits.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 21 Weekly Wrap: UK Retail Trends and Insights Through Location Analytics

Week 21 Weekly Wrap: UK Retail Trends and Insights Through Location Analytics

UK retail centres show robust recovery, with shopping centres up 9.1% footfall in Week 21. Discover insights via location analytics & location intelligence.

Share on LinkedIn

The UK retail sector continues its steady recovery, as illustrated by diverse data points collected from numerous retail centre types. In this Weekly Wrap, advanced location analytics reveal impressive footfall trends and evolving consumer engagement patterns across major centres, local centres, shopping centres, retail parks and high streets. Importantly, this analysis also highlights how location intelligence plays a vital role in retail performance and dwell time insights.

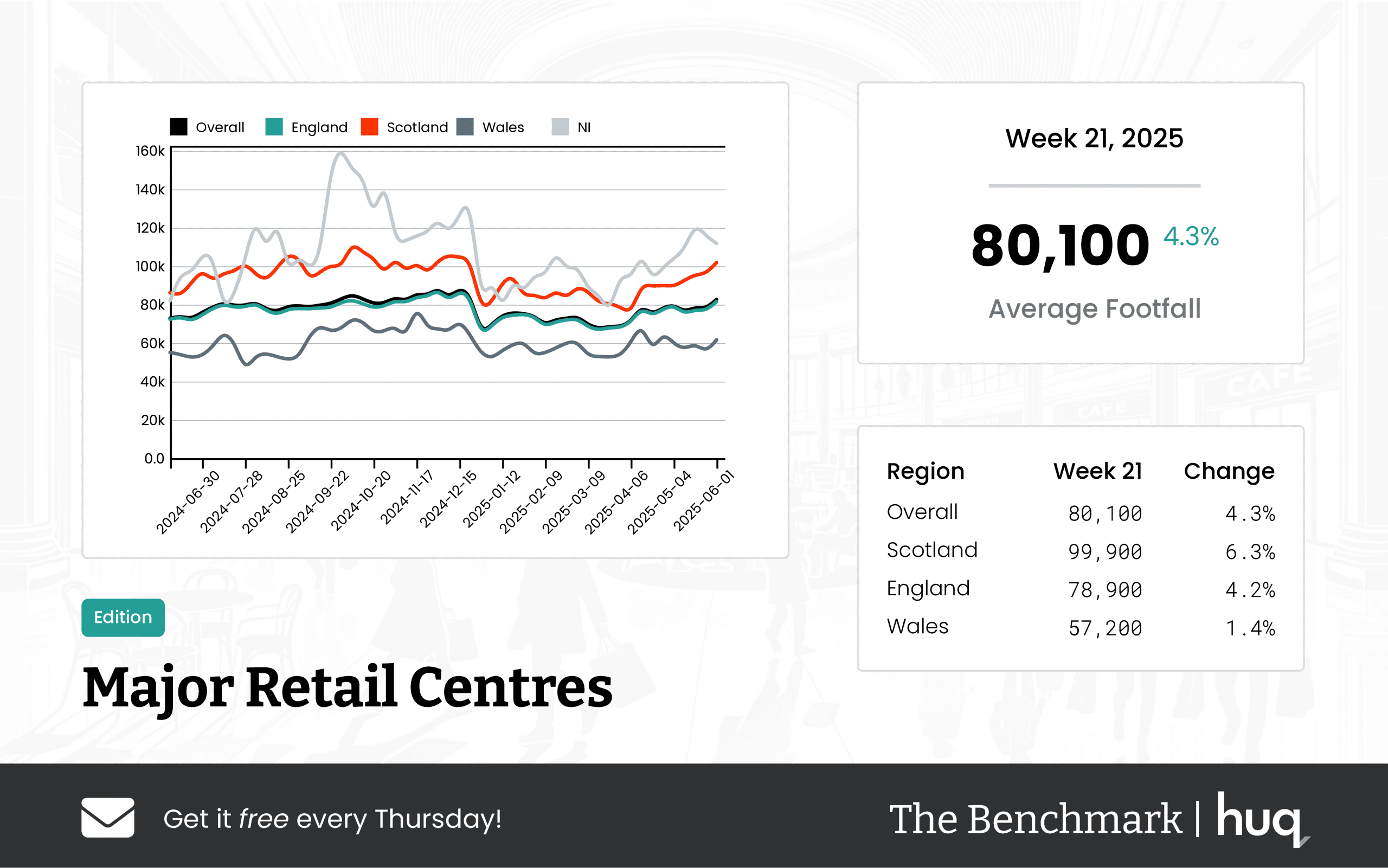

Major Retail Centres

Major retail centres have demonstrated robust recovery over recent weeks. In Week 19, centres saw a 7.6% annual rise with an average daily footfall of 78,400 visitors. Week 21 figures further support this trend, with centres posting around 80,100 daily visitors and consistent dwell times of approximately 119 minutes, reinforcing the sector’s upward trajectory.

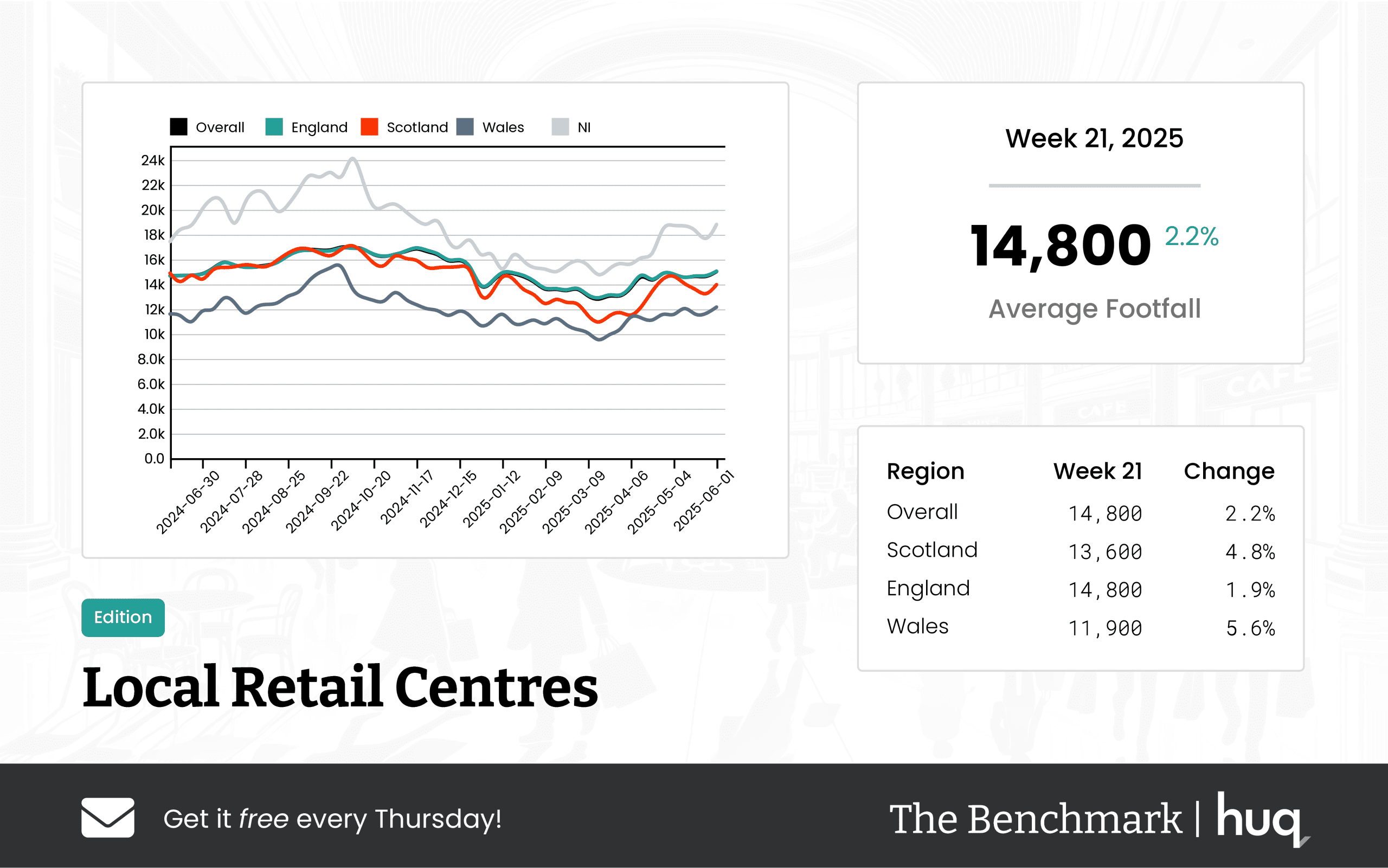

Local Retail Centres

Local retail centres are contributing to the overall recovery with modest yet steady improvements. Week 21 data reports an average of 14,800 daily visitors and a 2.2% weekly increase, as detailed in the UK Local Retail Centres – Week 21 2025 Footfall Analytics Performance Update. Similarly, a Week 19 update recorded 14,900 visitors with a weekly gain of 3.1%, indicating positive footfall trends and prudent consumer engagement.

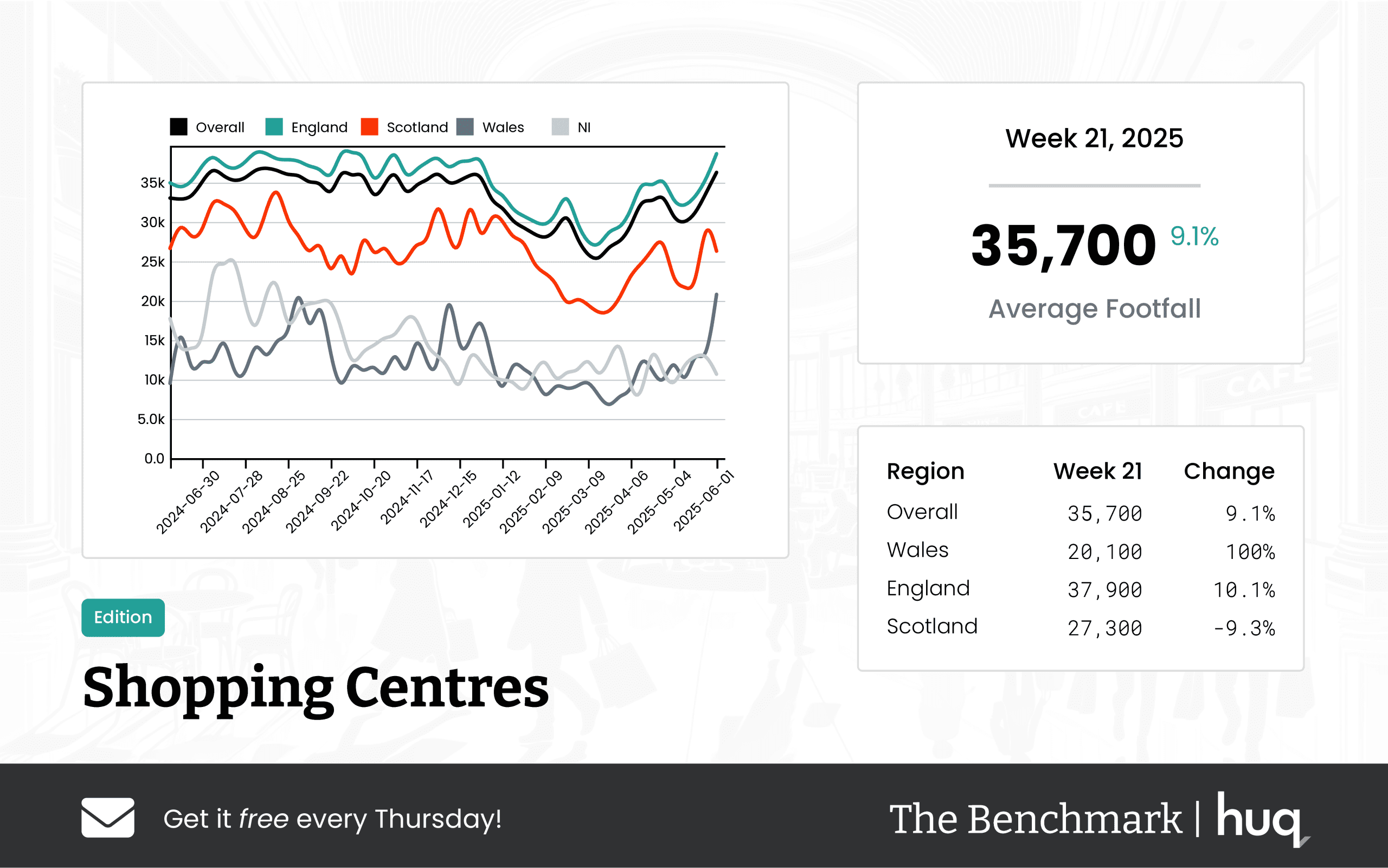

Shopping Centres

Shopping centres have shown a distinct rebound with notable weekly improvements. In Week 21, average daily visitor numbers reached 35,700, an increase of 9.1% week‑on‑week and 6.1% year‑on‑year, as confirmed in the UK Shopping Centres – Week 21, 2025 Performance Update featuring Location Analytics. Regional variations are evident, with English centres recording higher footfall and longer dwell times, underscoring shifting retail performance across the board.

Retail Parks

Retail parks have delivered mixed results during this period. The Week 19 update noted an average daily footfall of 18,700, with a modest weekly rise of 1.4% but a significant year‑on‑year decline of 7.6% UK Retail Parks – Week 19 Performance Update 2025. Regional disparities indicate that while centres in England have experienced slight gains, areas in Wales and Scotland are facing challenges with decreased overall visitor numbers.

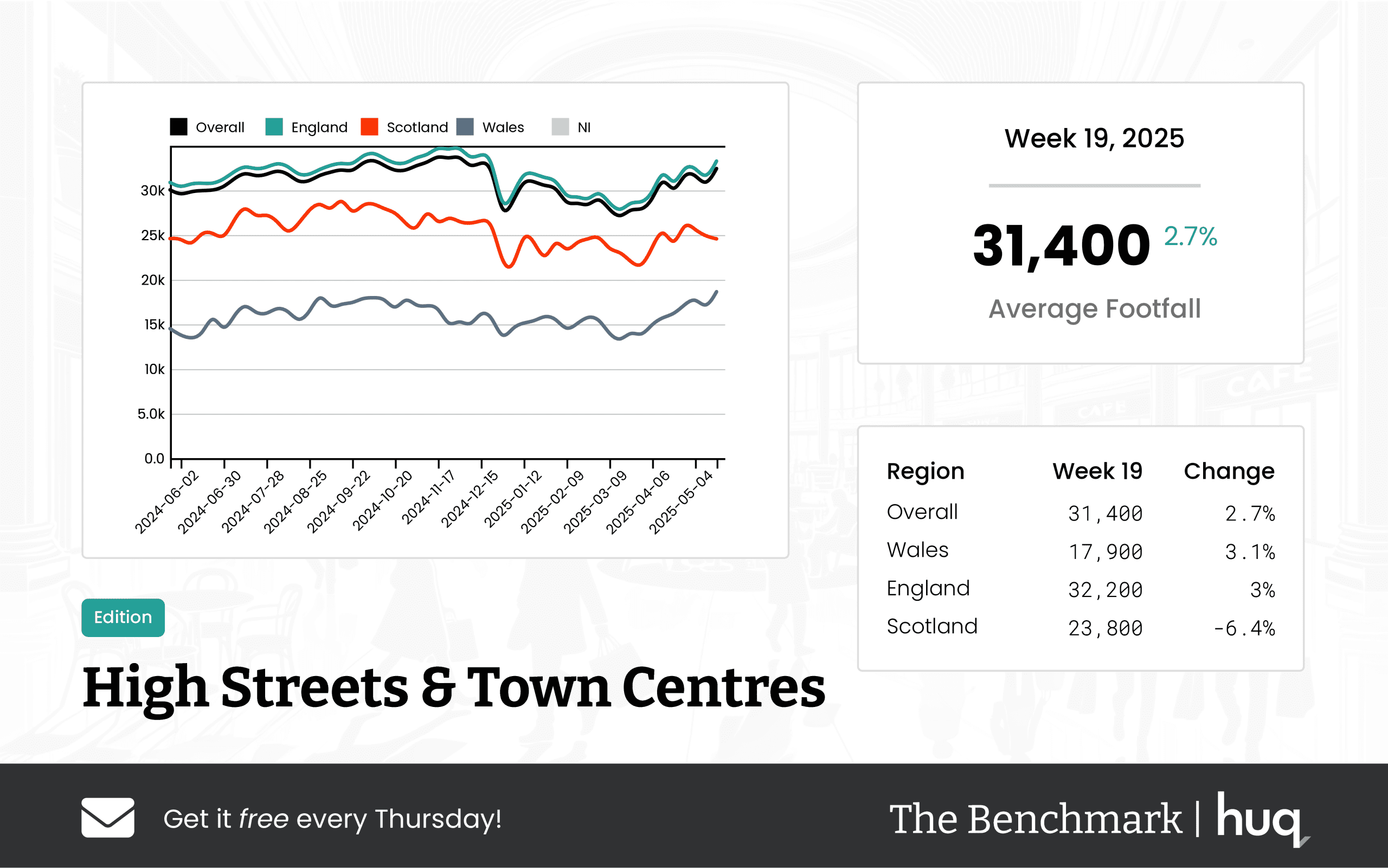

High Streets & Town Centres

High Streets and Town Centres continue to maintain consistent performance despite some regional discrepancies. Week 19 figures reveal an overall average of 31,400 daily visitors and a dwell time near 96 minutes, as explained in the UK High Streets & Town Centres – Week 19 2025 Footfall Retail Performance Update. English centres particularly shine with 32,200 visitors and slightly longer engagements, affirming the stability of these retail spaces.

Expert Commentary

Joe Capocci, Huq Industries Spokesperson, emphasised that enhanced location analytics have enabled retailers to understand footfall trends and improve consumer engagement. He stated, "Our commitment to leveraging cutting‐edge location intelligence is driving significant benefits in both footfall and dwell time, offering retailers real-time insights to adapt to changing consumer behaviours." His observations underline the importance of data-driven strategies in evolving the UK retail landscape.

Concluding Thoughts

The data analysed this week paints a complex yet optimistic picture for UK retail. Advances in location analytics and location intelligence continue to inform robust performance improvements, even though each centre type faces its own unique challenges. As retail environments adapt to shifting consumer patterns, strategic application of these analytics remains crucial in driving footfall, managing dwell times and ultimately enhancing retail performance.

This week’s trends reflect a balanced recovery across various retail centres, and ongoing monitoring remains essential. The interplay between consumer engagement and detailed location-based insights sets the stage for continued evolution in the industry. Retailers who embrace these empowered analytics are well-positioned to navigate an increasingly competitive marketplace.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 21, 2025 Major Retail Centres Performance Update – Leveraging Location Analytics

Week 21, 2025 Major Retail Centres Performance Update – Leveraging Location Analytics

UK retail centres are on a steady recovery path with an average footfall close to 80,100 daily. Insights from location analytics and location intelligence highlight modest improvements and healthy consumer trends.

Share on LinkedIn

In the most recent update, UK Major Retail Centres continue to show signs of recovery and resilience. The benchmark figures for week 21, 2025, reveal that the overall average daily footfall sits at approximately 80,100, representing a moderate rise from the previous week and consistent year‑on‑year improvements.

A closer look at regional performance highlights some variations across the UK:

• Scotland leads with an impressive average daily footfall of nearly 99,900, showing both robust weekly gains and significant annual improvements.

• England follows with an average of 78,900 daily visitors. The steady week‑on‑week gains and solid annual trends reflect a healthy retail market.

• Wales, while recording a lower average daily footfall of around 57,200, still exhibits cautious yet optimistic recovery, with recent data showing a modest positive trend.

Visitor engagement, measured by average dwell time, further underscores the positive trend. Across the UK, consumers spend roughly 119 minutes per visit. Although there is a slight week‑on‑week softening, especially in Scotland and England, the overall annual performance remains strong. More specifically, Scotland’s centres enjoy an average of 124 minutes per visit compared to England’s 120 minutes, while Wales shows dynamic but mixed trends with an average of 98 minutes, where recent weekly increases contrast with longer‑term declines.

The industry commentary from Joe Capocci of Huq Industries highlights these trends by drawing a connection to broader market movements, such as the recent activity in the Manchester shopping centre stake news. This comment underscores the importance of location analytics and intelligence, which continue to play a pivotal role in interpreting consumer behaviour and retail performance in a shifting market landscape.

Leveraging these robust insights, stakeholders can better understand footfall trends and visitor engagement, empowering them to make informed decisions in this dynamic retail environment.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

UK Shopping Centres – Week 21, 2025 Performance Update featuring Location Analytics

UK Shopping Centres – Week 21, 2025 Performance Update featuring Location Analytics

UK shopping centres show a steady recovery with overall footfall rising by 9% week-on-week and 6% year-on-year – a trend that aligns with location analytics and location intelligence insights.

Share on LinkedIn

UK shopping centres are reporting a positive rebound with an impressive uptick in both weekly and annual footfall statistics. The latest data for the week ending June 1, 2025, indicates an average daily footfall of 35,700 – a 9.1% increase compared to the previous week and a 6.1% year-on-year rise. This steady growth is lending strong support to the overall optimism in the retail market, a scenario that is being continually refined and confirmed by robust location analytics insights.

Overall Footfall Performance

The report underscores a healthy recovery across the market, with improved visitor trends reaffirming the credibility of location intelligence. These insights are not only optimizing operational strategies for shopping centres but are also providing key demographics and temporal data that guide future investments.

Regional Insights

Diving deeper, the regional performance reveals distinct variations:

• Wales: Centres in Wales recorded an impressive average of 20,100 visitors per day. However, while the week-on-week visitor numbers showed a sharp increase, the average visit duration traditionally reported at 61 minutes experienced a decline, signaling a need for strategies focused on enhancing shopper engagement.

• England: Centres in England are in a phase of stable growth. With an average daily footfall of 37,900 and gains of 10.1% week-on-week and 6.9% year-on-year, the region is demonstrating consistent market performance. The robust average dwell time of 118 minutes serves as an encouraging metric, even in the face of minor short-term softening.

• Scotland: Conversely, Scotland’s performance highlighted some challenges. With an average daily footfall of 27,300, the centre’s footfall figures have weakened both in the recent week and compared to last year. Moreover, the local dwell time of 90 minutes saw a notable decline during the week, although it shows a modest annual recovery. These insights suggest that targeted tactical interventions may be necessary to reverse the downward trend in visitor engagement.

Industry Comment

Joe Capocci, spokesperson for Huq Industries, commented on the performance update, stating, "The sharp increase in footfall seen in Wales, supported by recent retail industry news, underscores an evolving and resilient market." This comment, together with detailed location intelligence data, reflects the dynamic challenges and opportunities present in the current retail environment.

Conclusion

The UK's retail landscape appears resilient, with shopping centres harnessing the power of advanced location intelligence to drive performance improvements and strategic decisions. As footfall rates and visitor engagement continue to evolve, the application of detailed location analytics is proving indispensable in shaping a more responsive and customer-centric retail environment.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

UK Local Retail Centres – Week 21 2025 Footfall Analytics Performance Update

UK Local Retail Centres – Week 21 2025 Footfall Analytics Performance Update

Week 21 2025 footfall in UK Local Retail Centres increased modestly by 2.2% week‑on‑week with 0.6% annual growth, according to fresh footfall retail insights.

Share on LinkedIn

Overall Footfall Performance

The latest figures from The Benchmark offer a detailed picture of visitation trends across UK Local Retail Centres. During week 21, centres recorded an average daily footfall of 14,800, reflecting a modest week‑on‑week increase of 2.2% and an annual improvement of 0.6%.

The overall average dwell time was recorded at 95 minutes. Although visits were 5% shorter compared to the previous week, the dwell time metric enjoyed a notable annual improvement, increasing by 15.9% compared to the same period last year.

Regional Comparisons

In Scotland, centres reported an average daily footfall of 13,600 with a robust week‑on‑week rise of 4.8%. However, the year‑on‑year performance showed a decline. Scottish visitors maintained an average visit duration of 109 minutes, which, while steady from the weekly average, represented a sharp increase compared to last year.

In England, the footfall was aligned with the overall average at 14,800. The region experienced a moderate week‑on‑week gain of 1.9% and a slight annual improvement of 0.9%. The average visit duration in England was 93 minutes, showing a 7% decrease from the previous week, yet still marking a solid annual increase of 14.8%.

Welsh centres, despite recording a lower average daily footfall of 11,900, experienced the most noteworthy rebound. With a 5.6% week‑on‑week increase and a 5.2% annual improvement, Welsh centres also boasted the longest dwell times, with visitors spending approximately 119 minutes per visit.

Additional Analysis

A closer look at the available data—including footfall numbers, retail footfall statistics, and counts—reinforces these observed trends, highlighting nuanced differences across regions.

Industry Insight

Joe Capocci, spokesperson for Huq Industries, commented: "The data highlights a striking week‑on‑week rebound in Welsh footfall, and recent Northern Ireland retail developments further support the resilience and dynamism we are observing in the market."

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

Week 19 Weekly Wrap: UK Retail Trends and Location Analytics Insights

Week 19 Weekly Wrap: UK Retail Trends and Location Analytics Insights

UK retail centres saw a 7.6% footfall rise in Week 19, signalling robust dynamics in location analytics and advanced location intelligence.

Share on LinkedIn

An Overview of UK Retail Performance

UK retail trends this week showcase diverse performance metrics across multiple centre types, as detailed through location analytics and other key measures. The data reveals contrasting trends among major retail centres, shopping centres, retail parks, local centres, and high streets. This article explores these insights and highlights emerging shifts that are reshaping the UK retail landscape.

Robust Growth in Major Retail Centres

Footfall trends in major retail centres have shown a strong recovery. Notably, Week 19 saw an average of 78,400 daily visitors, with English centres recording 77,100, Scotland 94,600, and Wales 59,800. The detailed analysis from Week 19 Major Retail Centres update demonstrates a 7.6% annual footfall increase, reinforcing the strength of these centres.

Diverse Performance in Shopping Centres

The recent review of UK shopping centres presents mixed signals. While there was a modest 3.8% weekly increase to 31,100 daily visitors across these locations, the sector still lags by 6.8% compared to the previous year. Detailed regional metrics, such as a 4.2% improvement in England and a 5.1% rise in Scotland, are outlined in the UK Shopping Centres update. This analysis adds to our understanding of how retail performance continues to evolve.

Mixed Trends in Retail Parks

Retail parks are displaying a complex picture. The Week 19 update reported an increase of 1.4% with 18,700 daily visitors, although there remains a 7.6% YoY decline. Minor shifts were noted in Week 18 as well, with 18,600 daily visitors and slightly reduced dwell times. For further insights, please review the UK Retail Parks – Week 19 Performance Update 2025 alongside other updates from this segment.

Resilient Recovery in Local Retail Centres

Local retail centres are slowly regaining momentum. Week 19 figures indicate an average of 14,900 daily visitors and a significant 19% YoY boost in dwell time. Regional differences are evident; while England exhibits steady growth with a 3.3% weekly lift, Scotland and Wales have varying trends that warrant further consideration. Insights are available in the UK Local Retail Centres update, which sheds light on subtle recovery patterns across areas.

High Streets & Town Centres: A Beacon of Stability

High streets and town centres continue to demonstrate resilience despite volatile economic conditions. Week 19 recorded an average of 31,400 daily visitors with an overall modest improvement. In England, for example, 32,200 visitors were recorded, while Scotland and Wales reveal variations in both footfall and visit duration. The analysis provided in the UK High Streets & Town Centres update gives an in‑depth look at these stabilising trends.

Expert Perspectives and Future Outlook

Joe Capocci, Huq Industries Spokesperson, remarked, "Our ongoing analysis highlights that embracing location analytics is key for retailers. The granular insights provided enable businesses to adapt swiftly to dynamic market conditions." His comments encapsulate the value of advanced data and location intelligence in navigating competing challenges. The emphasis on strategic planning is expected to further enhance retail performance in the coming months.

Navigating the Changing Retail Landscape

Underlying these trends is a broader narrative shaped by evolving consumer behaviour and economic shifts. Retailers who harness location analytics and location intelligence are better equipped to pinpoint opportunities and transform footfall trends. The varying performance across centre types underlines the need for targeted strategies that respond to daily visitor patterns and regional dynamics.

Conclusion

The current week encapsulates both encouraging recoveries and ongoing challenges within the UK retail environment. Major retail centres are leading the pack, while shopping centres and retail parks prompt careful monitoring. The insights derived from location analytics and related metrics continue to guide retailers towards more responsive and impactful decisions. As local centres and high streets stabilise, the future holds promise for those embracing detailed analysis. Collectively, these trends signal that informed decision-making through sophisticated location intelligence is essential for the sector's sustained growth.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.

UK High Streets & Town Centres – Week 19 2025 Footfall Retail Performance Update

UK High Streets & Town Centres – Week 19 2025 Footfall Retail Performance Update

UK High Streets & Town Centres showcase steady growth with robust visitor engagement. Comprehensive footfall analytics confirm resilience and consistent footfall retail performance.

Share on LinkedIn

Across the UK, the Benchmark footfall retail data confirms that High Streets and Town Centres continue to attract steady visitor numbers. The overall average daily footfall reached 31,400, with modest week-on-week growth and a slight year-on-year rise. An average visit duration of 96 minutes, though experiencing a small dip compared to the previous week, reinforces the notion of consistent shopper engagement.

In England, performance remains stable with an average of 32,200 daily visitors and consistent dwell times of 97 minutes. The regular week-on-week and year-on-year growth figures suggest that local shoppers are keeping interest alive in these bustling urban spaces.

Wales shows a different picture: whilst the daily visitor count is lower at 17,900, there has been a significant year-on-year increase. However, with visitors spending an average of 88 minutes on site, there is evidence suggesting a need for improved footfall counting and engagement measures to enhance the shopping experience further.

Scotland, on the other hand, recorded an average daily footfall of 23,800, showing a decline compared to the previous week. The shorter average visit duration of 81 minutes points towards a potential need for renewed strategic initiatives to rejuvenate shopper spending time in the high streets and town centres.

Joe Capocci, spokesperson for Huq Industries, remarked, "The sharp increase in Welsh footfall alongside the recent retail industry news underscores shifting visitor dynamics across the nation."

Overall, these insights underscore the ongoing resilience and subtle shifts in visitor behavior across the UK, highlighting opportunities for localized improvements in customer engagement and experience while celebrating the consistent performance of these key retail destinations.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.