Location Intelligence 101: A Guide for Real Estate

Pinpoint prime investments with data-driven decisions. We explain how location intelligence can unlock the keys to the right real estate – for investment and development that delivers.

In a market that is riddled with complexity – location intelligence helps real estate industry leaders gain vital competitive advantage and cut-through clarity. Huq understands this data more than anyone. Some of the challenges facing the real estate sector you’ll be familiar with include rising inflation and spiralling interest rates (now, thankfully coming down or at least stabilising), the long tail impact of Covid 19 on decentralisation, and – of course – regulatory factors.

Post-Covid working, as an example, has led to a substantial flow of people and resources away from dense urban areas and into suburbs and even further afield. As ‘the local’ is experiencing a revival, the business district and so its property market – particularly commercial – faces a decrease in demand. How then does a portfolio property investor / developer choose the optimum space to purchase?

As ever, location intelligence and live demographic data is key. Real estate data insights have traditionally focused on conventional metrics like occupancy rates, rental fees paid by tenants, and local market trends. More recently however, there’s a growing appreciation of the power of non-traditional variables – like the growth and positioning of local pop ups and stores (think the proliferation of indie coffee shops), localised online reviews (Google, Yell, Trusted Reviews, and app-based Swarm – that was once Foursquare). It also pays to explore any influx into an area of businesses, retail, and hospitality; the latter would not open up if it wasn’t confident there’d be people willing to part with cash for their croissants, carrot cake, or Calamari.

Consider Wimbledon town centre as a microcosm of this phenomenon. The impact of Covid acted as a fatal blow for numerous brands relying on casual foot traffic in this south-west London town, famed more for its tennis than its shopping scene. As a result, the town’s primary retail hub, Centre Court, transformed into a deserted mall marked by boarded doors and misty white windows. The Broadway high street also suffered terribly. However, thanks to astute analysis of localised intelligence, catchment demographics, and geospatial data, Romulus has made an extraordinary property development investment—giving rise to the ‘Wimbledon Quarter’. This revitalised space stands in stark contrast to the old mall, catering to an economically mobile and environmentally conscious demographic, offering a dynamic environment for individuals to ‘connect, engage, and thrive.

Traditional brand staples within generic retail parks face a greater risk of failure amid the substantial shift to online consumerism, causing nearby towns to experience decreased footfall. Instead, we’re witnessing the pull of unconventional businesses—a bespoke wall-climbing franchise, an indoor golf entertainment venue coupled with a light food enterprise, and a sizable seasonal pop-up area featuring a modest ice rink, crepe stands, and Christmas gift outlets. The changing landscape demands adaptation from retail chains, and this is where Huq steps in.

Only thorough yet user-friendly analysis of location data and demographics is crucial for making informed investments in property development. With such insights, we anticipate a further surge in housing development and alternative properties.

As the UK’s ageing population continues to grow, the landscape of housing for this demographic faces new challenges. With the possibility of multi-generational living arrangements and a strain on care facilities, there’s an urgent need to adapt accommodation options. The key to addressing these challenges lies in optimising real estate construction to cater to the evolving movements and needs of this population. Exploring this market presents a meaningful opportunity to develop top-tier real estate that fosters communities and offers support to individuals and families. Through prioritising dignity, independence, and affordable housing, we aim to create a nurturing environment for all. Only the real estate companies who have the data can best capture this arising new opportunity.

There are a myriad of ways Huq’s core location expertise could help identify successful investment strategies for property location optimisation, including:

- Investment – Harnessing visitor insights from specific areas aids in informed decision-making for selecting promising real estate sites and capitalising on property investment trends.

- Marketing – Utilise real estate market insights to target the appropriate stakeholders effectively.

- Competitive benchmarking – Assess your position within the market by leveraging location intelligence solutions and market intelligence.

- Housing and rentals – Attract tenants and discover suitable vacant units through comprehensive real estate market research.

We aim to minimise risk in site selection, real estate investment, and portfolio management by fostering repeatability and reliance on data. These crucial factors can be further enhanced by incorporating layers of location-based data, leveraging Huq’s expertise and cutting-edge tools as industry leaders.

Let’s look at some examples.

Footfall

This data can identify what kinds of stores’ customers visit a given area or district. Are there out-of-the-way venues that are popular also, that could be reached by a close drive or transport? These are all decisions forming values.

Density

Better understanding behaviour and product popularity, gives retailers a strong hand to forecast demand, and therefore more accurately optimise supply – minimising stockouts and reducing overstock accordingly. Location data, and AI analysis can even help identify the busiest times and routes for last-mile delivery services. We imagine (for example) florists, and restaurants would benefit from this knowledge. This is the kind of intelligence that drives Amazon – but it’s yours at a fraction of the expense and hassle!

Dwell

How many people visit a business area? How long did they spend there? How does current foot traffic compare to last year or to 2021 and even before Covid? Which days are the most crowded? These are all key indicators for real estate investors that can support making sound, informed judgements – where premium investment is vital.

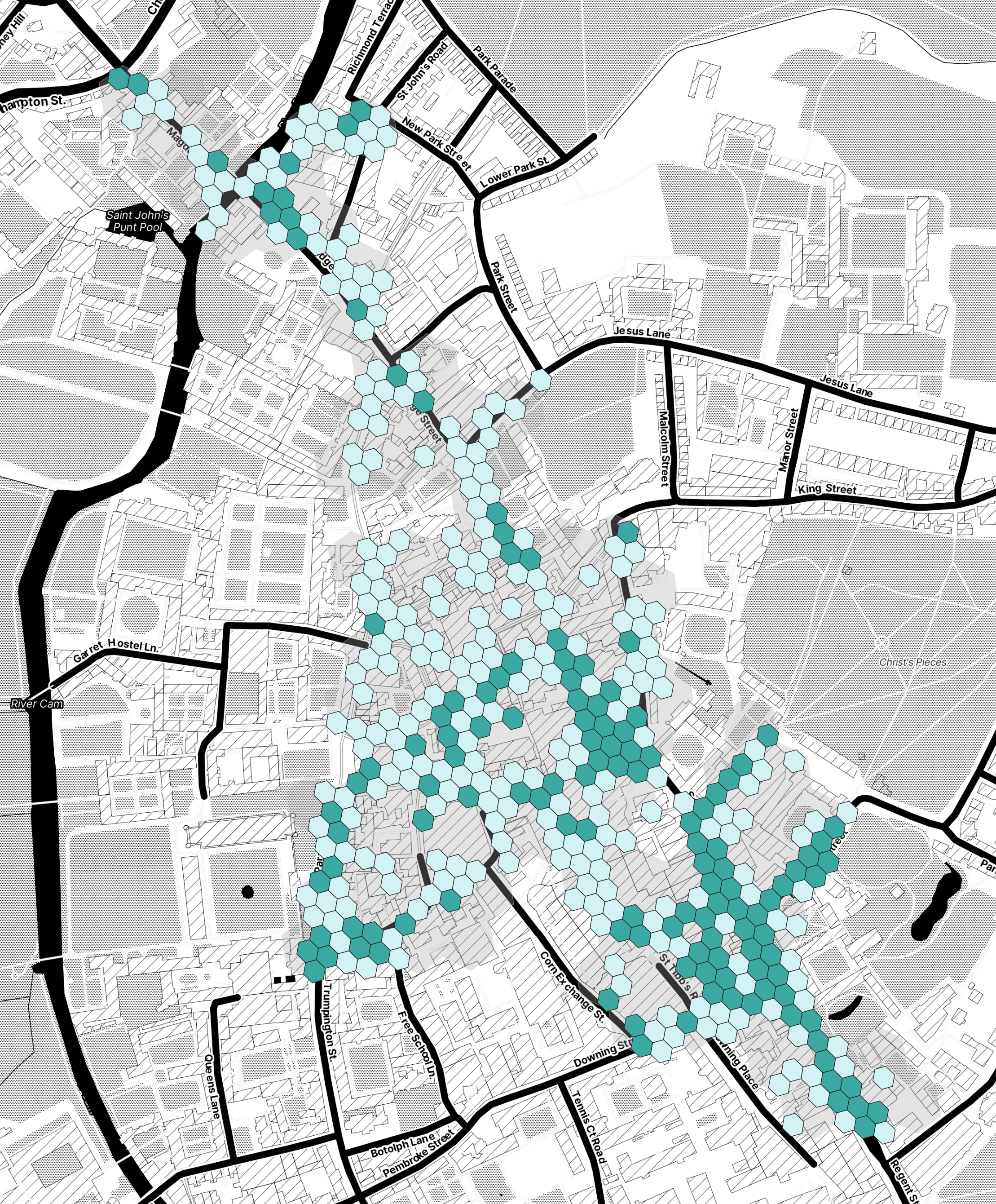

Catchment

By capturing geographic movement and – anonymised – demographic detail, developers and investors can see live and historic detail on demographic segmentation; aiding real estate market forecasting as to who these groups are and what they care about.

So how does it work?

We are a dedicated and experienced team who first work to identify your needs, and will recommend the right Huq tools to get the intelligence you need. Huq works directly with you to ensure alignment with your Board, your business objectives, and aspirations. And our user-friendly and tailorable dashboard software lets you see the detail in the data and help join the dots.

You can rely on us to provide a supportive environment to make game-changing decisions, as we did with Aviva Investors.

As Jonathan Bayfield Head of UK Real Estate Research at Aviva Investors told us, Huq data “helps [Aviva] to make better investment decisions and allows us to appropriately manage risk on behalf of our investor clients.

“[For instance] Huq’s mobility data allows us to measure footfall, almost in real time, by submarket and by region.”

We are trusted by over 300 partners, including Aviva Investors, Colliers, CBRE, Cushman & Wakefield, not to mention major retailers, news institutions, and over 100 government bodies and university research teams.

Decision making is only as good as the data you put into it, and we’ve looked at how footfall, density, catchment, and dwell all add up to provide a real-time picture of a destination, and a place to call home.

We would love to engage our world class location intelligence suite, to help you make the right decisions when it comes to strategic and – ultimately profitable – property investment. We welcome the chance to support your real estate strategy, empowering you with the accuracy and reliability of real-time insights that will make the future come alive with possibility. Visit Real Estate – Huq Industries to book a demo, we’d love to talk and show you around.

For Impact

Retailers must be increasingly demonstrative of Environmental, Social and Governance (ESG) commitments, and transparent to an ever-demanding consumer and colleague base. New and existing customers smell, see, and sense any deviation from authenticity. And they let retailers know their disapproval through their purchase power, spending with social conscience.

So, our advice? Make the high-level business decisions easier with the right location, footfall, dwell and density, and catchment intelligence. Leaving you more time to concentrate on product, people, and planet.

Consider us a colleague and cheerleader – keen to see you put your best foot forward and stride on armed with the toolkit to take on the rest.

We would love to work with you – today – on your retail strategy, informing your leadership team with the insights that mean you can do what you do best. We’ll help you optimise and grow your customer base, and you can ensure colleagues are supported and driven by your company’s success. So, make the right decisions with data as unique as your offering. Visit Retail – Huq Industries to book a demo, call us with your questions, and we look forward to meeting you.

223Bn

£AUM

900+

Employees

12

Countries

Huq's mobility data helps us to make better investment decisions and allows us to appropriately manage risk on behalf of our investor clients

Jonathan Bayfield, Head of UK Real Estate Research at Aviva Investors

How to leverage footfall and boost instore Black Friday sales

How to leverage footfall and boost instore Black Friday sales

From a term first coined in the 1960s in the United States, Black Friday continues to be an ever-exceeding growth date for the retail industry, with in-store and online retailers one-upping each other; beginning the so-called sales period earlier and stretching discounts out for far longer than its one-day origin story. The worst kept secret for consumers is that Black Friday prices aren’t necessarily the optimum time to get the best deals, but the period does undoubtedly drive purchases – and physical footfall – into a frenzy.

It’s the latter point that we’re interested in here at Huq, because it makes us consider what we can learn about footfall traffic trends, and therefore how we can help retailers and the real estate sector innovate to encourage consumers to yield their purchasing power across towns, retail parks, and high streets.

As we’ve mentioned in our previous 101 Guide to location intelligence, there are limitations to traditional approaches to estimating footfall traffic at stores and shopping centres; data which provides an incomplete picture of the scale of traffic, density and dwell time, and the potential for making data-driven retail decisions.

Huq’s unique first-hand and third-party authoritative data, presents a near exhaustive intersectional array of geospatial intelligence, which – in turn – can help retailers and real estate investors to forecast, plan, and deliver.

So how did Black Friday perform in 2023?

Paul Martin, UK Head of Retail at KPMG summarised this week, that Black Friday saw retail sales “grow by over 4% in November [which gave] a much-needed boost both [to] the high street and online.” But he warns that while “household appliances, footwear and furniture” saw sales growth – toys, computing and baby equipment products are still in negative sales figures.

Helen Dickinson OBE, CEO of the British Retail Consortium concurred that growth overall “remained far below current inflation” – suggesting volumes are down. The turn in the weather fuelled purchases of coats, hooded blankets and hot water bottles for sure, but consumers appear to be pivoting to cosy nights in rather than big nights out on the whole.

Meanwhile Huq’s proprietary data suggests that the intensity of average physical footfall across our 20 defined top-performing shopping areas, jumped from 180.6k to 250.5k in the same period from 2022 to 2023. The overall total change in footfall from 2022 to 2023 across our top performing retail environments was +27.9% during the Black Friday period. Within this, of course, hides a wealth of hugely rich demographic data that we can break down according to individual hot spots and our clients’ requirements – but this snapshot would indicate that footfall at least was greater this year’s Black Friday.

We carry our own caveats of course, in so far as our measurement for purposes here is comparing apples and avocados, as some retail centres are much larger than others. Our general assessment however is that our footfall, density and dwell data is likely greater because retailers have decided to use Black Friday for much longer sales periods, therefore attracting consumers throughout the entire week (and sometimes further). Moreover, when we explore our own historic data capture, we see that 2019 – across our same 20 shopping destinations – carried as high an average of footfall traffic as 396.5k over the same time period.

We deduce from our geospatial data that the ‘great decentralisation’ that has spread across the UK post-Covid, means that consumers simply aren’t physically shopping in the same areas and in the same numbers as they were before the pandemic. But the boost from 2022 to 2023 shows promise for the future.

Let’s look at what our location intelligence – which can be pinpointed to an individual store location with incredible accuracy – can support, when it comes to helping retail brands and real estate developers. When we get as narrow as possible in terms of which brands and product themes are attracting and retaining consumers, we can help strategic planners, communicators and marketers possess confidence in retail growth planning, location selection, and even influence inventory management tactics.

How Huq can unleash Black Friday’s potential

For global and multi-location retailers, it’s vital to explore the data to uncover your customer behaviours, and troubleshoot which strategies succeeded and what may have fallen short. Which stores thrived, which merely survived, and what could you reposition ahead of 2024’s Black Friday period to attract and retain consumers? Only by looking at the data and conducting the right evaluation can we set the future up for success.

For outlets and areas which didn’t perform so well during 2023’s Black Friday period, or experienced inconsistent patterns across different locations, our location data will give a strong indication of customer trends, and what drives them to visit, spend, shop and socialise. We improve when we kick the weakest tyres after all.

Retail store performance metrics will indicate whether less-dense footfall areas need to be repurposed or may similarly support the development of enhanced shopper experiences, targeted promotions, and individualised marketing. Benchmark, adjust, and improve – that’s a mantra that retailers will appreciate.

And because Huq provides granular understanding of customer base and catchment areas, for real estate developers, this location intelligence can support property purchases and portfolio decisions.

Finally, we would suggest you watch your rivals. Insights are truly valuable when contextualised. By examining how your competitors performed you can reverse engineer the strategies that contributed to their successes – or failures.

To round up then, we have the broad analysis of retail performance for Black Friday 2022, and by twinning these trends insights with Huq’s unrivalled location data, we can begin to make highly informed and strategic decisions in retail growth and contraction planning, and investment strategies.

The transformative potential of geospatial intelligence for retailers and real estate stakeholders is only just being untapped. We would encourage industry leaders to embrace these technologies to stay ahead, maximise the post-Black Friday momentum, and grow consumer retention and loyalty, in an ever-evolving retail landscape – and a challenging spending environment.

3400

Stores

38

Countries

$12.5Bn

Annual sales

Huq’s catchment insights allows JD to more accurately assess the impact of the wider retail catchment on the sales potential of new store opportunities

Alastair Browne, JD Group Head of Site Research & Strategic Insight