UK Major Retail Centres – Week 24 2025 Performance Update: Location Analytics Insights

UK Major Retail Centres experienced a modest week-on-week increase of 0.8% and a year-on-year rise of 2.4%. This performance update highlights significant location analytics insights across the UK, with detailed regional breakdowns and dwell time trends that reveal evolving market dynamics.

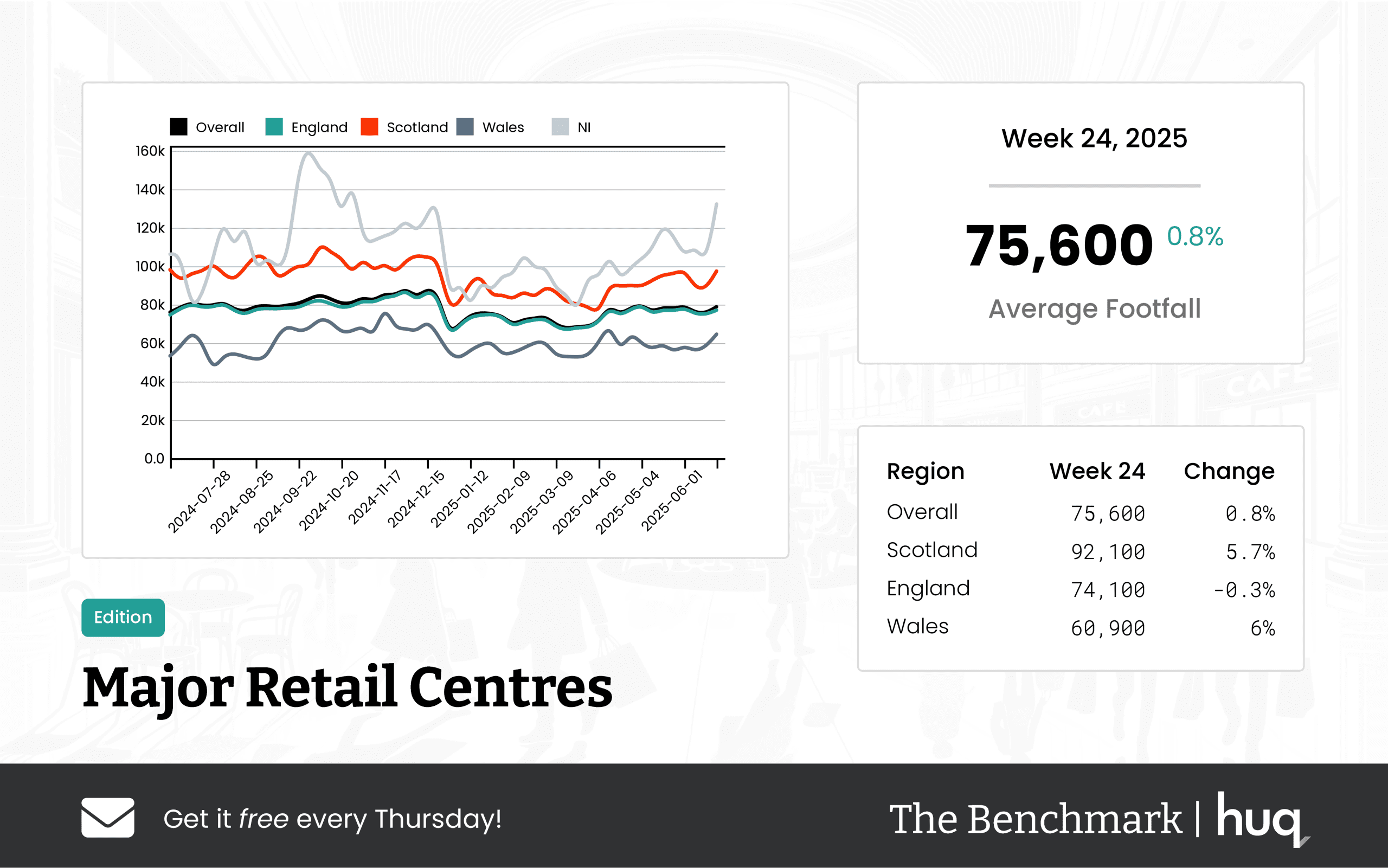

UK Major Retail Centres continued to demonstrate resilient performance during the week ending 22 June 2025, recording an average of 75,600 daily visits. The overall figures represent a modest week-on-week increase of 0.8%, paired with a year-on-year growth of 2.4%. These results underline a stable retail environment, underpinned by comprehensive location analytics and location intelligence that offer deeper insights into market trends.

The regional breakdown indicates interesting variations across the UK. Scotland led the market with an impressive average daily footfall of 92,100, showing a robust week-on-week rise of 5.7%, while mirroring the overall yearly stability at 2.4%. In contrast, England experienced a slight dip to 74,100 daily visits, with a marginal week-on-week decline of 0.3%, albeit with a modest year-on-year growth of 1.6%. Wales had a standout performance, with 60,900 daily visitors marking a strong recovery by showing a 6% week-on-week increase and a significant 13.9% year-on-year improvement.

Visitor engagement, as measured by dwell time, provides an additional layer of insight. Across the board, shoppers spent an average of 114 minutes per visit. Although there was a slight week-on-week reduction of 2.6%, the year-on-year dwell time saw a healthy increase of 7.5%, indicating a gradual yet positive trend in shopper engagement. Regional nuances in dwell time were also observed: in Scotland, the average visit duration was 109 minutes (down 10.7% over the week but up 13.5% year-on-year), in England the mean duration was 115 minutes (a slight 1.7% decrease over the week, rising by 7.5% year-on-year), and in Wales the 98-minute average had a 6% week-on-week improvement but a decline year-on-year.

Industry commentary highlights these evolving dynamics. Joe Capocci, spokesperson for Huq Industries, noted that the most striking change was seen in Scotland’s rebound, an observation reinforced by recent developments such as the opening of a US retailer in Glasgow. This comment supports the view that both traditional metrics and advanced location intelligence are crucial in understanding the market’s evolution.

The integration of location analytics with location intelligence continues to validate market performance and provides retail centres with a robust framework to navigate future trends in consumer behaviour and market dynamics.

Media: For all media and press enquiries, please contact [email protected]

About Huq Industries

Huq Industries is the leading provider of location intelligence across the UK, Europe, and the Middle East, specialising in delivering high-quality data insights on footfall, consumer behaviour, and retail performance. By leveraging advanced analytics and an expansive data network, Huq Industries enables retailers and analysts to understand and respond to market trends effectively, ensuring they are well-equipped to navigate the changing landscape of high street and town centre commerce.