Challenger Coffee Brand Site Selection Case Study

How a Challenger Coffee Brand Used Huq to Outperform the Competition with Site Selection

How a Challenger Coffee Brand Used Huq to Outperform the Competition

As a challenger brand in the highly competitive coffee market, a UK-based coffee chain needed to carve out its niche and outperform established competitors.

Client Overview

As a fast-growing challenger coffee brand, this UK-based chain was on a mission to expand its footprint while competing with well-established rivals. The company needed a smarter way to assess store performance, identify high-potential locations, and ensure that every new opening aligned with customer demand.

Traditional site selection methods—relying on assumptions and generic demographic data—were no longer sufficient in a rapidly evolving retail landscape.

Huq’s location intelligence platform provided the brand with unmatched visibility into consumer behaviour, enabling them to make confident, data-backed decisions to accelerate growth and beat the competition.

The Challenge

“To achieve their growth ambitions, the brand needed precise, real-time data to identify opportunities, optimise their network, and stay ahead of the competition.”

Winning Prime Locations

Identifying areas with untapped potential while avoiding oversaturated markets dominated by larger brands.

Outpacing Competitors

Gaining insights into customer behaviour and performance benchmarks to stand out.

Improving Underperforming Sites

Understanding why some locations lagged behind and taking targeted actions to improve profitability.

Huq's Solution

“Huq’s data has given us the competitive edge we needed to make smarter, faster decisions. With real-time insights into footfall, demographics, and competitor benchmarks, we’ve been able to optimise our store network, reduce expansion risks, and outperform larger rivals in key locations.”

Huq’s Lighthouse platform provided the challenger coffee brand with the data intelligence needed to punch above its weight.

To achieve their growth ambitions, the brand needed precise, real-time data to identify opportunities, optimise their network, and stay ahead of the competition.

Footfall Insights

Real-time data showing customer flows around existing and potential locations.

Competitor Benchmarking

Measuring performance against competitors, enabling the brand to spot and exploit gaps in the market.

Demographic Alignment

Deep insights into age, income, and spending patterns to ensure stores resonated with target customers.

How Huq's Solution Helped

Huq’s data empowered the coffee brand to disrupt the market and claim their share of success. Key outcomes included:

Beating Competitors in Prime Locations

By targeting areas with high potential and less competition, the brand secured sites that maximised footfall and revenue.

Optimising Underperforming Stores

Actionable insights allowed the brand to make quick, impactful changes to struggling locations, turning them into revenue drivers.

Gaining an Edge with Hyper-Targeted Marketing

TCampaigns tailored to local demographics outperformed competitors and attracted new customers.

Final comments

This challenger coffee brand needed to break through in a highly competitive market, ensuring that every store location was positioned for success. With Huq’s advanced footfall, demographic, and competitor benchmarking data, they gained the insights needed to strategically expand, optimise existing stores, and outperform larger rivals. By making data-backed decisions, the brand reduced expansion risk, improved store performance, and refined their competitive strategy with precision.

If your business is looking to gain a competitive edge and make smarter location-based decisions, Huq’s location intelligence solutions provide the clarity and confidence needed to succeed in a fast-moving market.

“Huq’s insights have given us the intelligence needed to confidently assess locations, outmanoeuvre competitors, and maximise the potential of our stores.”

Senior Expansion Manager

Is your business facing similar challenges?

Our experienced team can demonstrate how to use location intelligence and analytics to augment a wide range of use cases, including:

- Identifying locations for new stores

- Optimising your existing store portfolio

- Informing your pricing strategy

- Improving the effectiveness of marketing

- Benchmarking performance across locations

- Understanding competitor landscape

- Optimising opening hours

Ready to get started? Speak to one of our location experts

High Streets & Town Centres Footfall Report: Week 2, 2025

High Streets & Town Centres Footfall Report: Week Week 2, 2025, 2025

Huq's latest footfall data shows London's year-on-year increase, contrasting with declines in the North East and Wales.

Regional Footfall Trends

Huq Industries' latest footfall data, covering the week ending January 19, 2025, provides a comprehensive footfall report on over 2,700 retail centres across the UK. This footfall statistics reveal a nuanced landscape of consumer behaviour, with significant regional variations in footfall, dwell time, and weekday visitation.

In Scotland, a slight week-on-week decrease in footfall is observed, yet the average visit dwell time has increased, indicating that visitors are spending more time per visit. This trend is consistent in the East of England and the East Midlands, where dwell times have also seen an uptick. London, traditionally a retail hotspot, shows a notable year-on-year increase in footfall, contrasting sharply with the North East and Wales, where footfall has decreased significantly compared to the previous year.

Weekday Visitation Patterns

The South West and North West regions exhibit interesting patterns in weekday visitation, with slight increases suggesting a shift in consumer habits towards shopping during the week. This could be indicative of changing work patterns or consumer preferences in these areas.

Performance of Specific Retail Centres

Huq's location intelligence data highlights specific retail centres that are performing well or facing challenges. Newland Avenue in Yorkshire and the Humber and Poole Road in the South West are among the top performers with significant increases in visitation. Conversely, centres like Tiverton in the South West and Tamworth in the West Midlands have seen notable declines.

Market Outlook

Based on the direction of the latest footfall data and trends from the same period last year, it is likely that the coming four weeks will see continued growth in footfall in London, while regions like the North East and Wales may continue to experience declines. This forecast is crucial for retailers and commercial real-estate companies utilising location intelligence analytics to make informed site selection decisions.

Huq's detailed and region-specific footfall retail data is invaluable for understanding and adapting to the evolving market dynamics in the UK's retail sector. As one of the leading location intelligence companies, Huq provides essential insights that help businesses strategise effectively.

Partner with Huq

Track consumer footfall and spend dynamics across your store network using Huq data and compare to your own sales data. Gain insights into crucial questions such as 'are we out-performing the market', 'where our similar locations for new store growth', and 'how healthy is this retail centre'.

If you are interested in basing your location insights to actual consumer behaviour then please connect with our team.

Harnessing Daypart Footfall Data for Local Economic Insights

Harnessing Daypart Footfall Data for Local Economic Insights

Daypart footfall data has become an indispensable asset for local governments and Business Improvement Districts (BIDs) looking to understand how and when people interact with their spaces. n this post, we’ll explore how Huq’s platform leverages daypart footfall insights to help local authorities and BIDs maximise the effectiveness of their town centres, high streets, and retail areas.

Community-Level Analysis

Gain a clearer understanding of how residents and visitors interact with local centres.

Allocating Investment

Guide public investment decisions by identifying areas that would benefit most.

Benchmarking

Combine footfall data with local business and service usage metrics to understand the impact of local initiatives.

Urban Planning

Footfall data provides an evidence-based foundation for long-term planning.

What is Daypart Footfall?

Daypart footfall data captures visitor numbers by time of day, providing a nuanced view of how foot traffic fluctuates from morning to night. This information is especially valuable for understanding daily engagement patterns across locations, from retail centres to town squares and high streets. Tracking when people engage with a space helps local authorities tailor resources and services to align with community behaviour, driving both economic activity and public satisfaction.

Using Daypart Data to Monitor Place Performance

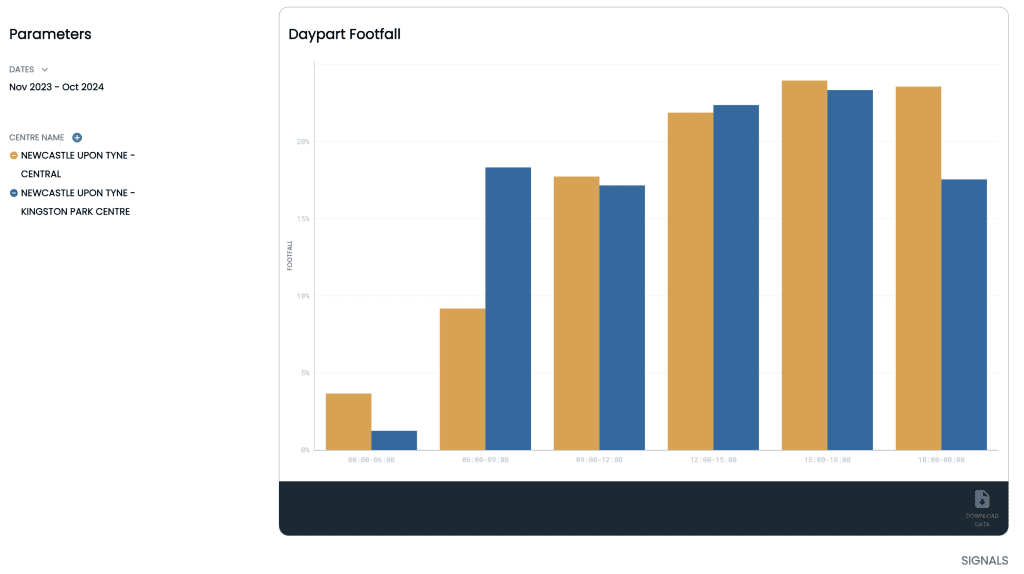

Consider Newcastle City Centre: tracking daypart footfall over a year shows visitor trends from early morning to late at night. In this example, Newcastle sees the majority of its footfall in the afternoon and maintains strong evening and nighttime activity, largely due to its vibrant nightlife. Daypart data shows not only when people visit, but also offers insights into what may be driving engagement at certain times.

Comparing different locations within a region, such as Newcastle City Centre and Kingston Park Retail Centre, further highlights each area’s strengths. Kingston Park, for instance, might attract higher morning footfall, while the city centre sees greater nighttime traffic. This level of detail allows councils to adapt their strategies to support each location’s unique role in the local economy.

Informing Decisions with Daypart Footfall

Daypart data also helps local governments plan resources and policies more effectively. High morning activity in retail centres could encourage adjustments to parking, transport, and business operating hours, while robust evening footfall in city centres might support investment in nighttime safety measures and public transport options. By having this real-time information at their fingertips, local authorities can develop targeted interventions that respond to each area’s specific needs.

Moreover, the ability to track trends over multiple years—thanks to Huq’s dataset spanning back to January 2019—enables councils to measure the impact of past projects and forecast future needs. Comparing current daypart trends with those from previous years also provides context for understanding recovery from challenges like the COVID-19 pandemic and helps guide the implementation of regeneration strategies.

Why Daypart Footfall Data is Essential for Thriving Local Economies

Daypart footfall data goes beyond simply tracking numbers; it offers a powerful, detailed view of community engagement, helping local authorities and BIDs to make data-driven decisions that enhance place performance. By understanding visitor behaviour throughout the day, councils can better support local businesses, improve public services, and strengthen the appeal of public spaces. Ultimately, this data is key to building vibrant, inclusive communities that meet the evolving needs of residents and visitors alike.

Footfall

Provides a baseline ahead of interventions to then monitor impact, as well as understand the health and vitality of a retail centre.

Secure Funding

Then prove the quality of your work with the changes in data to secure funding for future development.

Is your team facing similar challenges?

Our experienced team can demonstrate how to use location intelligence and analytics to augment a wide range of use cases, including:

- Identifying areas for community-focused investments

- Optimising the use of public spaces and facilities

- Informing local economic development strategies

- Enhancing the effectiveness of community engagement initiatives

- Benchmarking performance across districts and town centres

- Understanding the local business landscape and visitor demographics

- Optimising event timing and public service hours